It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date this review was generated may also be an important factor to consider, as the information may have changed since then. Therefore, readers are advised to always check the updated information directly with the company before making any decision or action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should take precedence. However, we recommend that you open the official website for further consultation.

Pros and cons of INFINOX

Pros:

Wide variety of financial instruments, including currency pairs, stocks, commodities, indices, and futures.

Cons:

What kind of broker is INFINOX?

INFINOX is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly with the market, INFINOX acts as an intermediary and assumes the opposite position to that of its clients. As such, it can offer faster order execution speeds, tighter spreads, and greater flexibility in terms of leverage offering. However, this also means that INFINOX has a certain conflict of interest with its clients, since their profits come from the difference between the purchase and sale price of the assets, which could lead them to make decisions that are not necessarily the better for your customers. It is important that traders are aware of this dynamic when trading with INFINOX or any other MM broker.

General Information and INFINOX Regulation

INFINOX is an online broker founded in 2009 in London, UK. The company offers a variety of financial instruments, including currency pairs, stocks, commodities, indices, and futures. INFINOX also offers two types of accounts, STP and ECN, and a number of educational resources to help its clients improve their trading skills. The company is regulated by the UK Financial Conduct Authority (FCA) and has a 24/5 customer support team.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering easy and well-organized information. If you're interested, read on.

Market instruments

INFINOX offers its clients a wide variety of financial instruments to trade, including currency pairs, stocks, commodities, indices and futures. This allows traders to have access to a wide variety of markets and trading opportunities. With the ability to diversify their portfolios and reduce risk, clients can take advantage of the wide range of instruments offered by the broker. Furthermore, traders can access global markets and take advantage of opportunities in different markets. However, the availability of some instruments may be restricted depending on the geographic location of the client and the quality of prices and liquidity of the different instruments may affect the execution of orders.

Spreads and commissions to trade with INFINOX

INFINOX is proud to offer one of the most competitive spreads on the market. However, the specific spreads for each instrument vary, and some of them may be higher compared to other brokers. INFINOX does not charge fees for deposits or withdrawals, which can be beneficial for traders who trade frequently. In addition, clients have the option to trade micro lots, allowing them greater control over their risk exposure. Although it is important to note that INFINOX charges an inactivity fee if the account remains without operations for more than 180 days. It is also important to note that overnight swaps can be higher than other brokers, which can affect those traders who hold positions open for long periods of time.

Trading accounts available at INFINOX

INFINOX offers its clients two account types, STP and ECN, which differ in spreads and commissions. The STP account is commission free, but has higher spreads that start at 0.9 pips. On the other hand, the ECN account has lower spreads, which start at 0.2 pips, but commissions start at $3.00. Both accounts have a minimum lot size of 0.01 and options of different base currencies. However, the minimum deposit required to open an account is not disclosed.

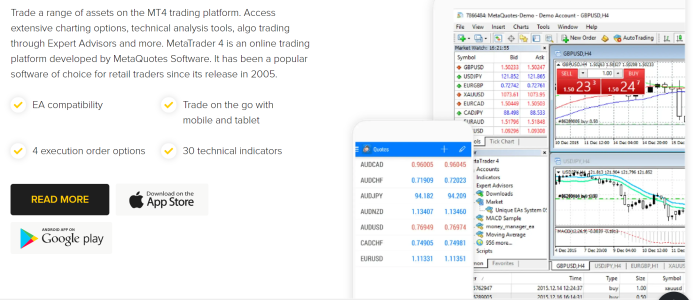

Trading platform(s) offered by INFINOX

INFINOX offers its clients the ability to trade on the MetaTrader4 and MetaTrader5 trading platforms. MetaTrader4 is a widely used trading platform that is well known to most of the traders, while MetaTrader5 is a more advanced platform that offers more tools and features than MetaTrader4. Both platforms offer a wide range of technical analysis tools and allow traders to customize their trading experience. INFINOX offers support for both platforms, allowing traders to choose the platform that best suits their needs. However, it is important to note that MetaTrader5 has not yet reached the same popularity as MetaTrader4, which means that there are fewer resources available online to learn how to use it. Overall, INFINOX offers its clients a good selection of high-quality trading platforms to choose from.

Here is a MetaTrader 4 video tutorial on its official YouTube channel.

A maximum leverage of INFINOX

INFINOX offers a maximum leverage of 1:30, which means that traders can trade larger positions with less capital. This feature is advantageous for experienced traders who are looking to maximize their profits and have good risk management and capital management.

However, leverage can also increase the risk of further losses if it is not used properly. Also, the maximum leverage offered by INFINOX may be limited compared to other brokers. Therefore, it is important that beginning investors carefully consider their investment objectives and risk tolerance before using leverage.

It is worth mentioning that the 1:400 leverage is only available for professional clients.

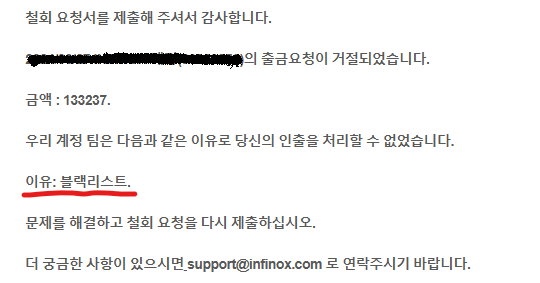

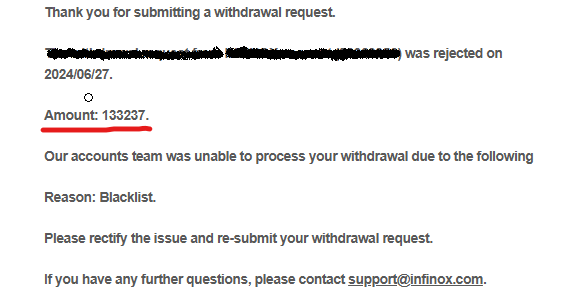

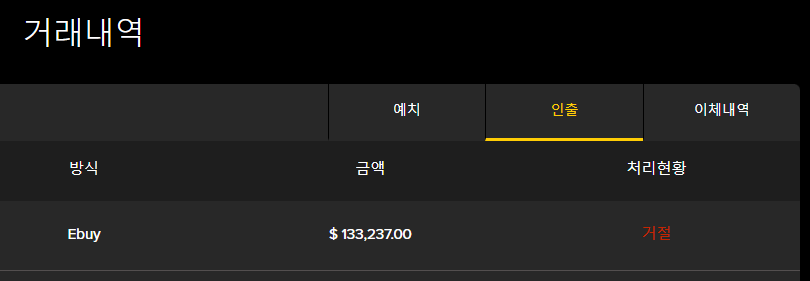

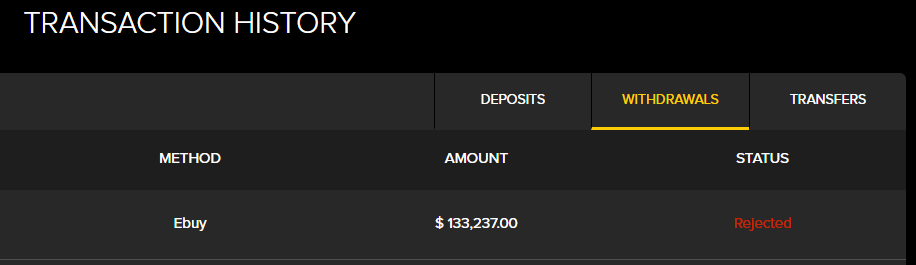

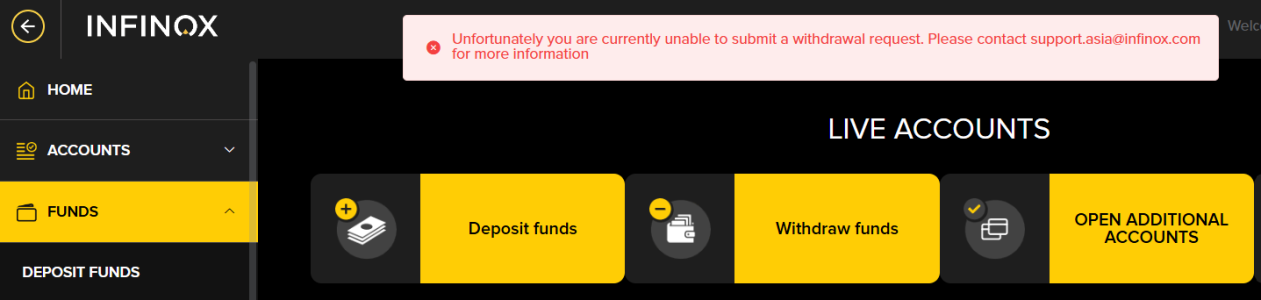

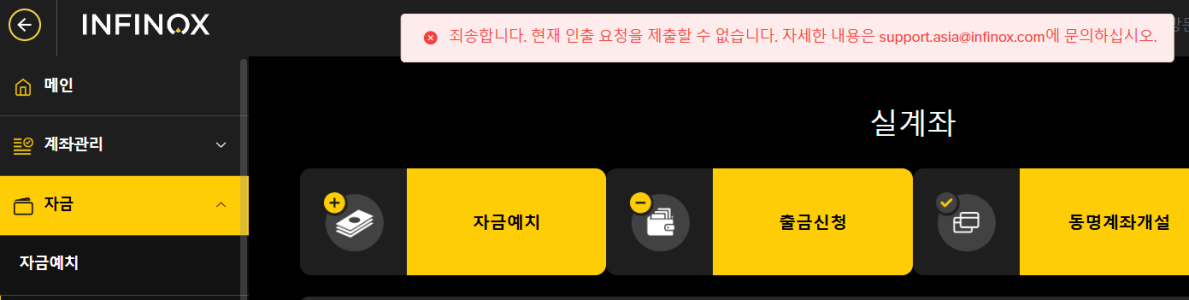

Deposit and Withdrawal: methods and fees

INFINOX offers several options for deposits and withdrawals, which is beneficial for its clients. Deposits can be made with debit or credit cards, digital wallets and bank transfers. The minimum deposit required is 50 GBP or its equivalent in the base currency of the account, which is reasonably low compared to other brokers. In addition, the processing of deposits and withdrawals is fast, allowing clients to quickly access their funds. However, INFINOX does not accept cash or checks as deposit methods, nor does it accept American Express or Diners cards, which could be a disadvantage for some customers. In addition, there may be additional charges from the payment provider, although this is not the direct responsibility of INFINOX.

Education at INFINOX

INFINOX offers a wide variety of educational resources for its clients, including research, courses, economic calendar, press and webinars, among others. The availability of a large number of resources can be an advantage for traders who want to learn and improve their trading skills. However, some resources may be too advanced for beginning traders and the quality and relevance of the educational materials may vary. Also, it can be overwhelming for some traders to navigate and select the right resources. In general, INFINOX offers a good number of free educational resources for its customers.

INFINOX customer service

INFINOX offers good customer service through various communication channels, including email, telephone and social networks. Their support team is available 24/5 and they also have an FAQ section for quick answers to common queries. However, they do not offer multi-language support and there is no 24/7 live support. Also, there is no specified maximum response time for queries, which could be a disadvantage for customers who need immediate assistance. In general, INFINOX offers satisfactory customer service with a good level of availability and various communication channels.

Conclusion

In conclusion, INFINOX is a Forex and CFD broker that offers its clients a wide variety of trading instruments, popular trading platforms, educational resources, and accessible customer service. Its pricing model varies depending on the type of account chosen, and its offer of competitive spreads and no commission on STP accounts may be attractive to some traders. However, it is important to note that the spreads can be higher compared to other brokers and the impact on trading costs must be taken into account. Also, the lack of transparency in some aspects, such as minimum deposit and margin requirements, can be a drawback for some clients. Overall, INFINOX seems to be a solid choice for those looking for a broker with a wide range of instruments and educational resources, but further research is recommended before making a decision.

Frecuently asked questions about INFINOX

Question: What is the minimum deposit required to open an account at INFINOX?

Answer: The minimum deposit is 50 GBP or the equivalent in the base currency of the account.

Question: What account types are available at INFINOX?

Answer: There are two account types available: STP and ECN. The STP account is commission free, but the spreads start at 0.9 pips. The ECN account has lower spreads, starting at 0.2 pips, but has commissions starting at $3.00.

Question: What deposit and withdrawal methods are accepted at INFINOX?

Answer: Deposits are accepted by debit or credit card, digital wallets and bank transfers. Withdrawals can be made by the same methods.

Question: What is the maximum leverage offered by INFINOX?

Answer: The maximum leverage offered is 1:30.

Question: What trading platforms are available at INFINOX?

Answer: Both MetaTrader4 and MetaTrader5 platforms are offered.

Question: How long does it take to process withdrawals at INFINOX?

Answer: Withdrawals are usually processed within 24 business hours.

Question: What is the email address and phone number for INFINOX customer service?

Answer: The email is support@infinox.co.uk and the phone number is +44 (0) 208 158 6060.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX