Company Summary

| Quick ThinkMarkets Review Summary | |

| Founded in | 1999 |

| Registered in | Australia |

| Regulatory Status | ASIC, FSA, FCA, CySEC, FSA (Offshore) |

| Market Instruments | 4,000 CFDs on forex, indices, commodities, cryptocurrencies, stocks, ETFs, futures, gold |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Account Type | Standard, ThinkTrader, ThinkZero |

| Min Deposit | $50 |

| Max Leverage | 1:500 |

| EUR/USD Spread | Floating around 0.8 pips |

| Trading Platform | ThinkTrader, TradingView, MT4/5 |

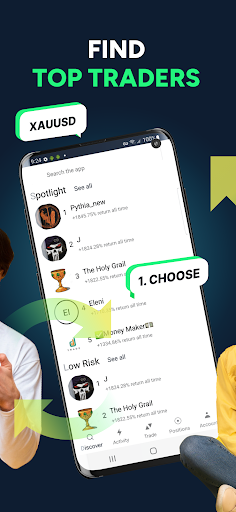

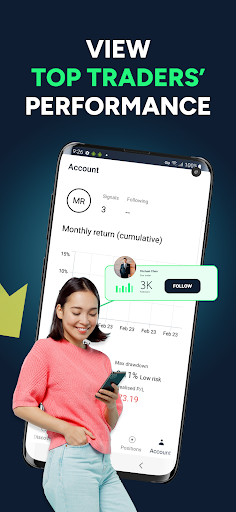

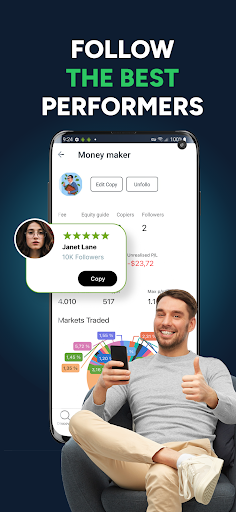

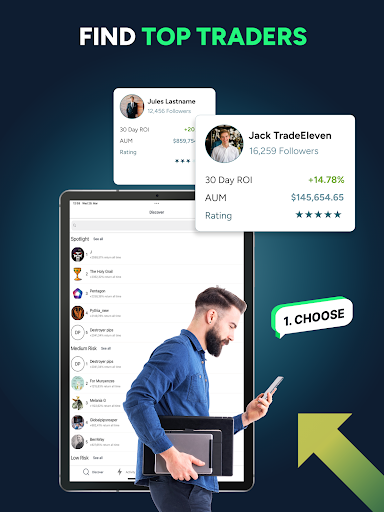

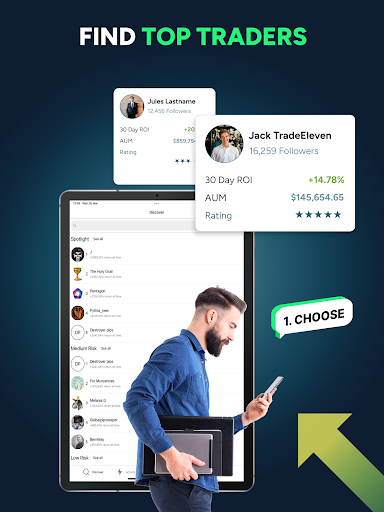

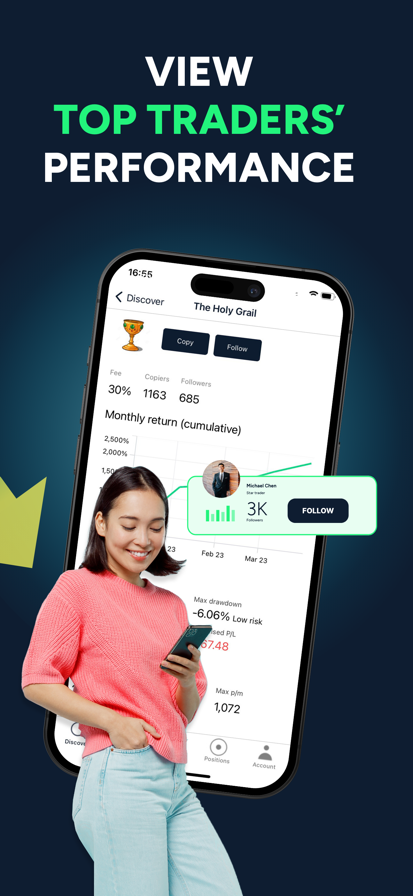

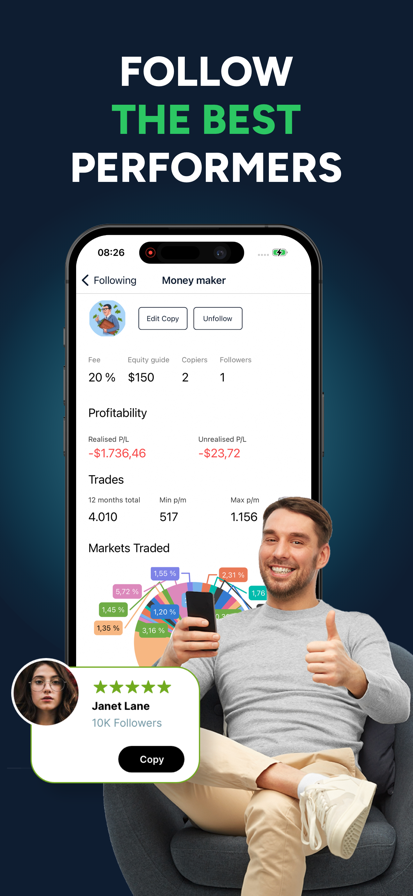

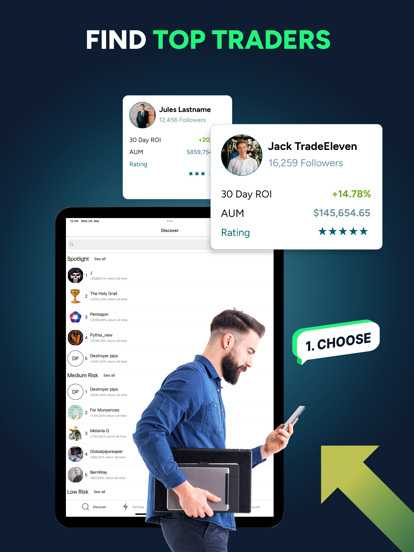

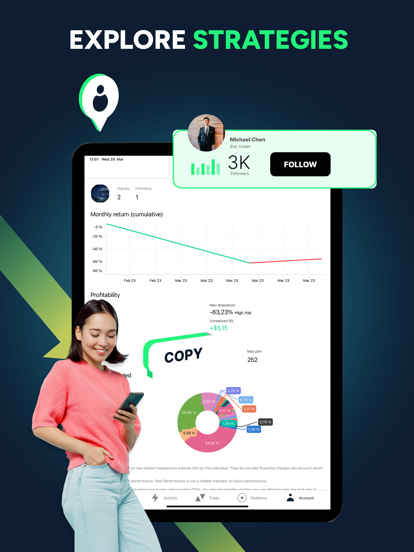

| Social/Copy Trading | ✅ |

| Payment Methods | Swift, cryptos, Visa, MasterCard, Apple Pay, Google Pay, Neteller, Skrill, UPI, Indian Net Banking, Mpesa, Mobile Money Ghana |

| Deposit & Withdrawal Fee | ❌ |

| Customer Support | 24/7 live chat, contact form |

| Tel: +44 203 514 2374 (UK), +248 4373952 (SY) | |

| Email: support@thinkmarkets.com | |

| Regional Restrictions | The United States, Canada, Bermuda the European Union, Australia, United Kingdom, Russia and Japan |

Founded in 1999, ThinkMarkets is a regulated broker registered in Australia, offering trading in 4,000 CFDs on forex, indices, commodities, cryptocurrencies, stocks, ETFs, futures, and gold with leverage up to 1:500 and spread floating from 0.0 pips via ThinkTrader, TradingView, and MT4/5 platforms. Demo accounts are available and the minimum deposit requirement to open a live account is only $50.

ThinkMarkets Pros and Cons

Pros:

- - It offers a wide variety of financial instruments for trading.

- - It has several trading platforms, including MetaTrader4, MetaTrader5, TradingView and ThinkTrader.

- - It offers a ThinkZero account with ultra-low spreads and high execution speed.

- - The customer service team is multilingual and available 24/7.

- - It has a wide range of educational resources (academy, glossary, videos) for traders.

- - It does not charge commissions for deposits or withdrawals.

Cons:

- - The minimum deposit for the ThinkZero account is $500, which may be an obstacle for some traders.

- - Educational resources may be too basic for advanced traders.

- - Clients from the United States, Canada, Bermuda the European Union, Australia, United Kingdom, Russia and Japan are not allowed.

Is ThinkMarkets Legit?

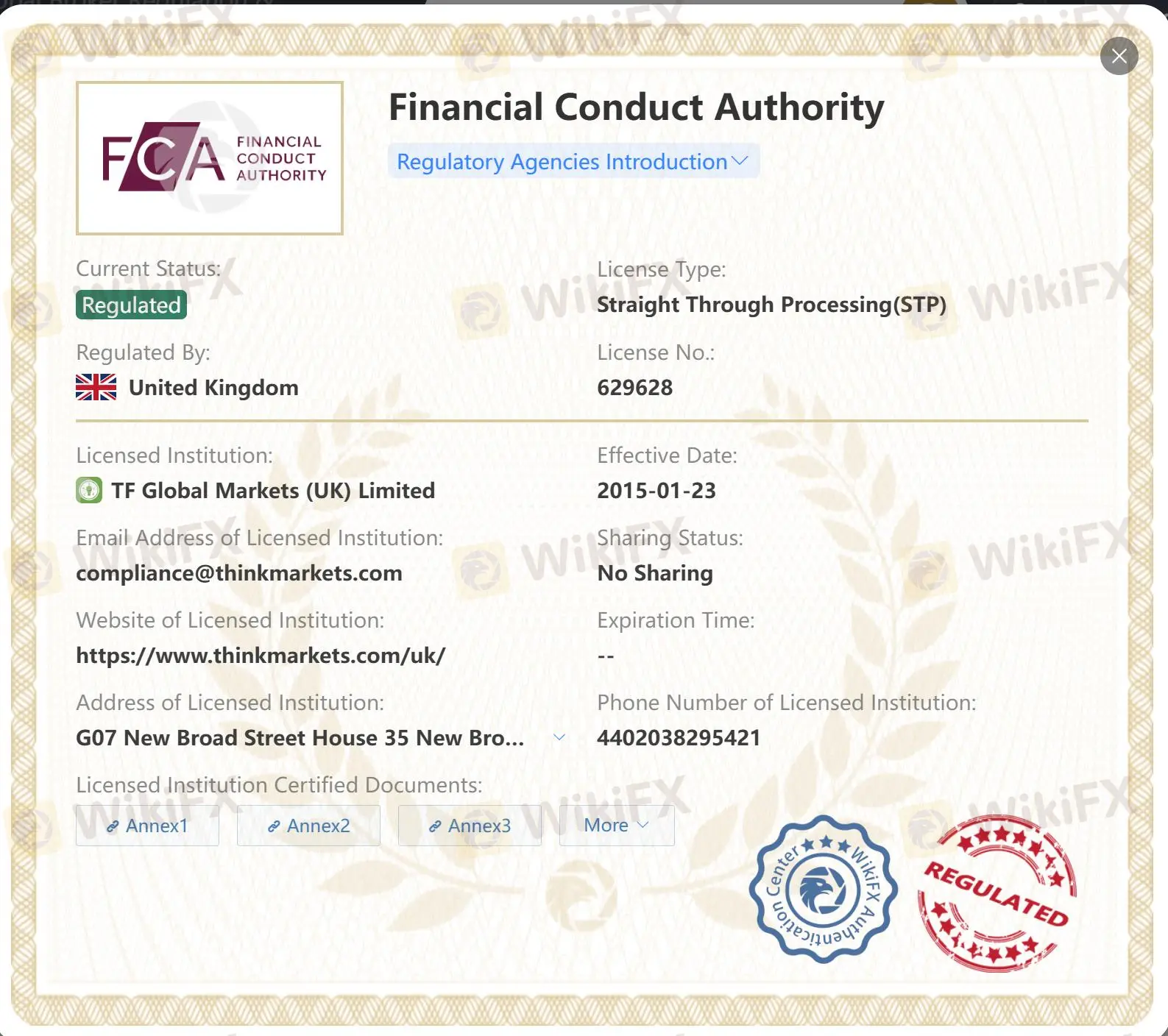

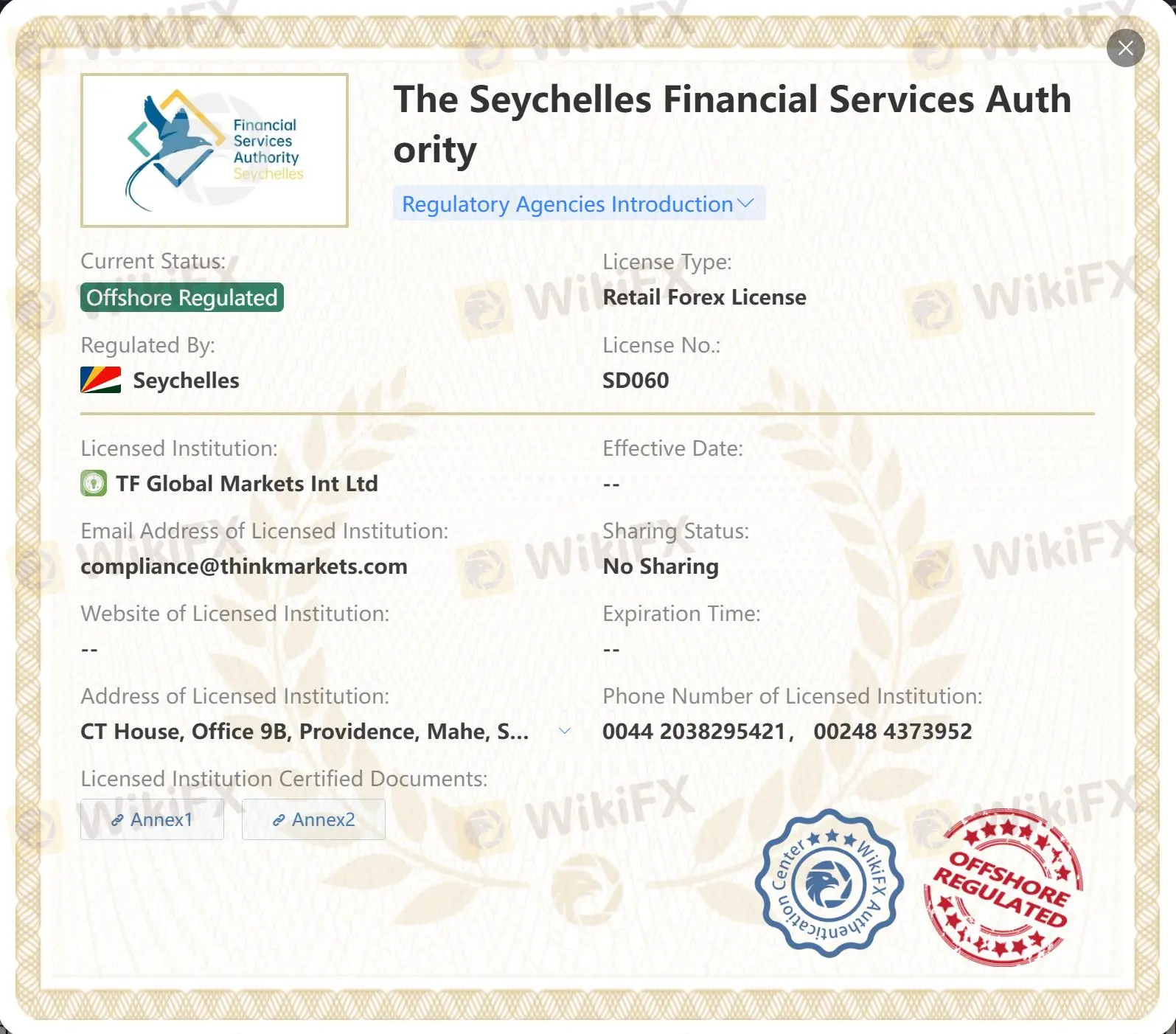

ThinkMarkets has multiple regulations, including Australia Securities & Investment Commission (ASIC), Financial Services Agency (FSA) in Japan, Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and offshore regulated by the Seychelles Financial Services Authority (FSA).

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| ASIC | Regulated | TF GLOBAL MARKETS (AUST) PTY LTD | Market Making (MM) | 424700 |

| FSA | Regulated | TF Global Markets Japan 株式会社 | Retail Forex License | 関東財務局長(金商)第250号 |

| FCA | Regulated | TF Global Markets (UK) Limited | Straight Through Processing (STP) | 629628 |

| CySEC | Regulated | TF Global Markets (Europe) Ltd (ex A-Conversio Capital Ltd) | Straight Through Processing (STP) | 215/13 |

| FSA | Offshore Regulated | TF Global Markets Int Ltd | Retail Forex License | SD060 |

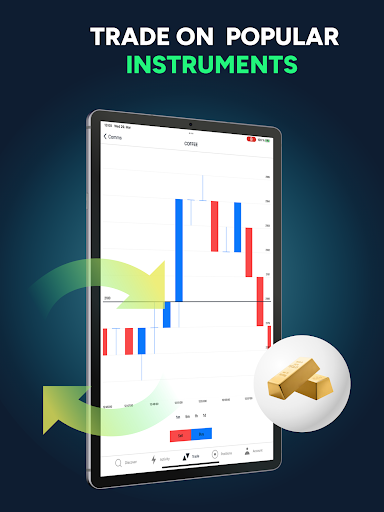

Market Instruments

ThinkMarkets offers 4,000 CFDs on forex, indices, commodities, cryptocurrencies, stocks, ETFs, futures, and gold.

| Trading Assets | Available |

| CFDs | ✔ |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Futures | ✔ |

| Gold | ✔ |

| Bonds | ❌ |

| Options | ❌ |

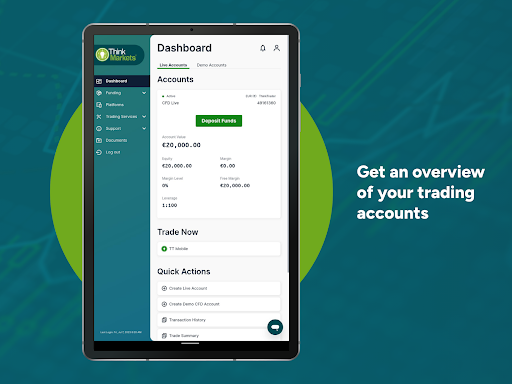

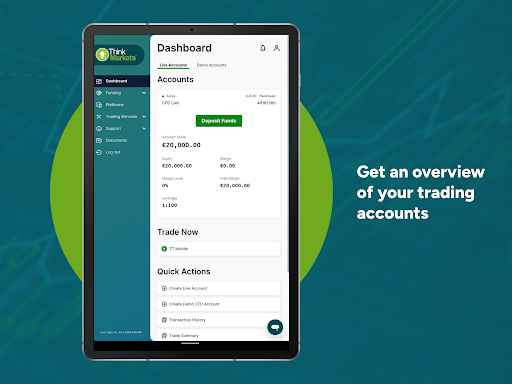

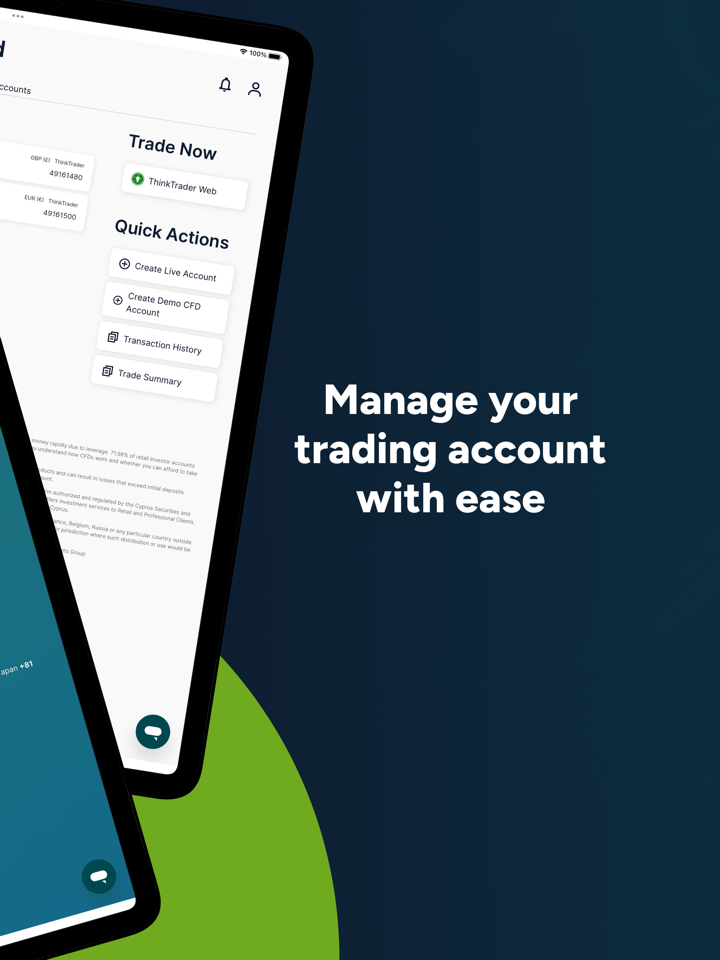

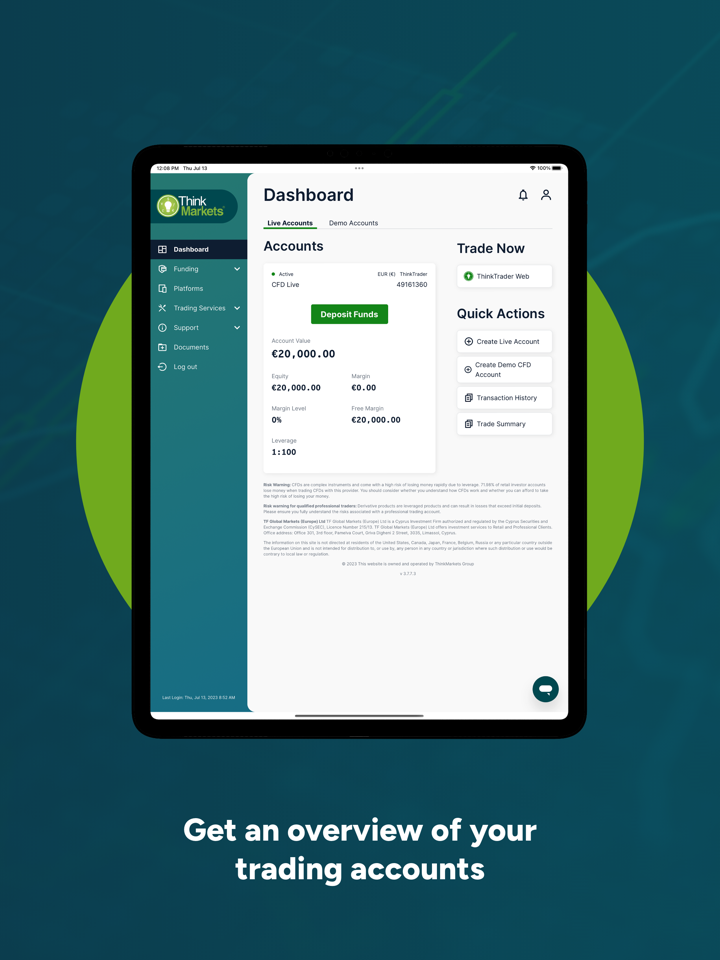

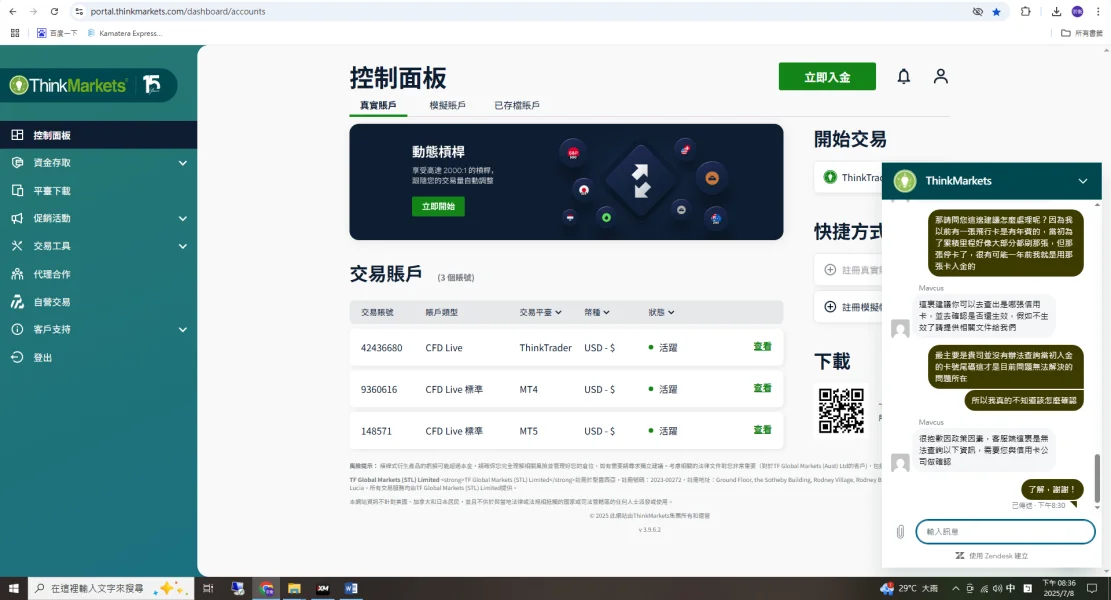

Trading Accounts

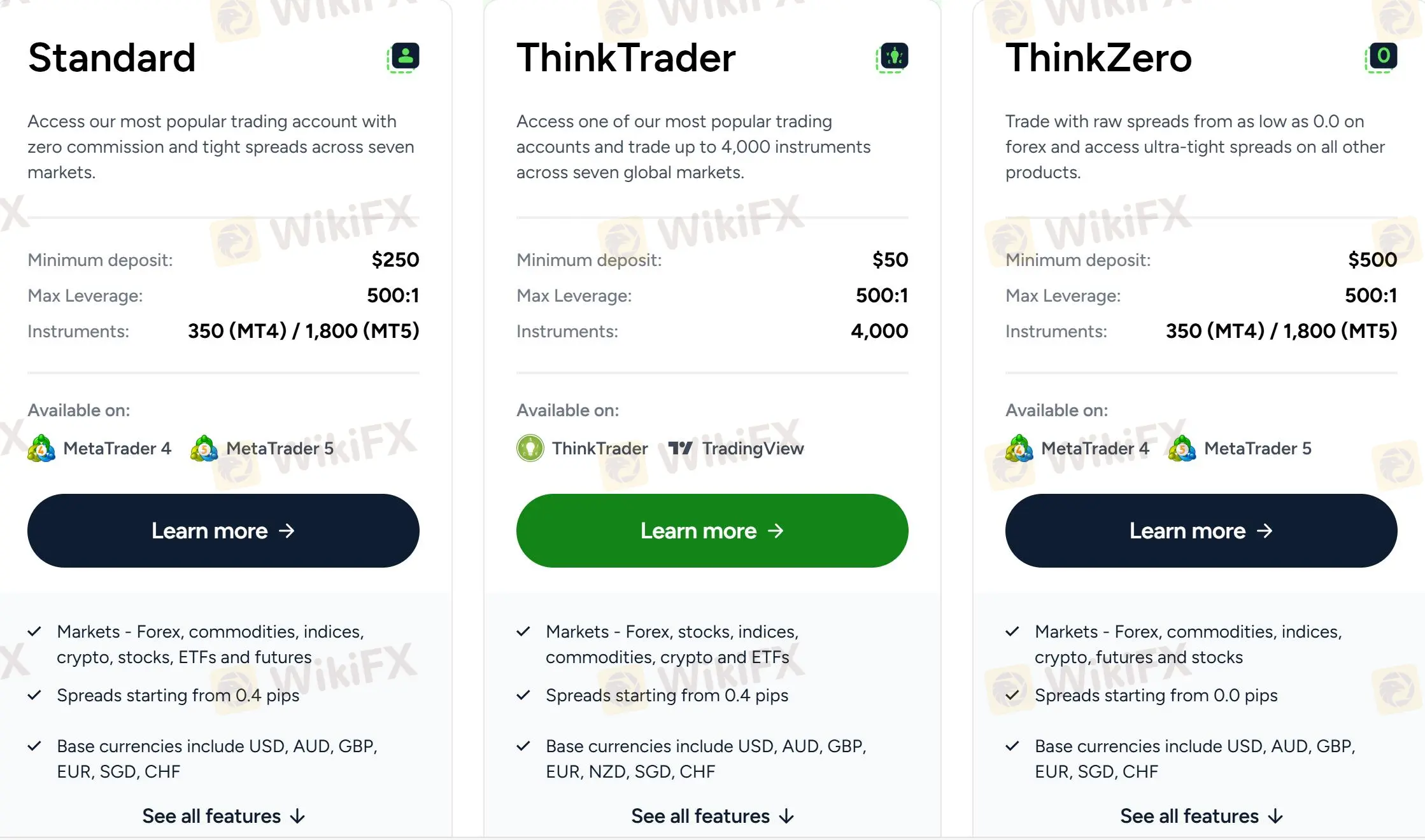

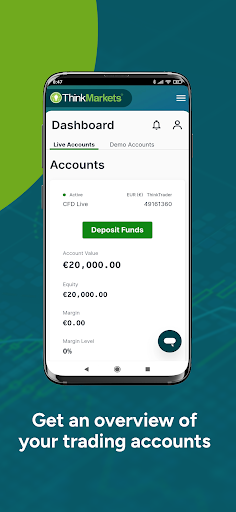

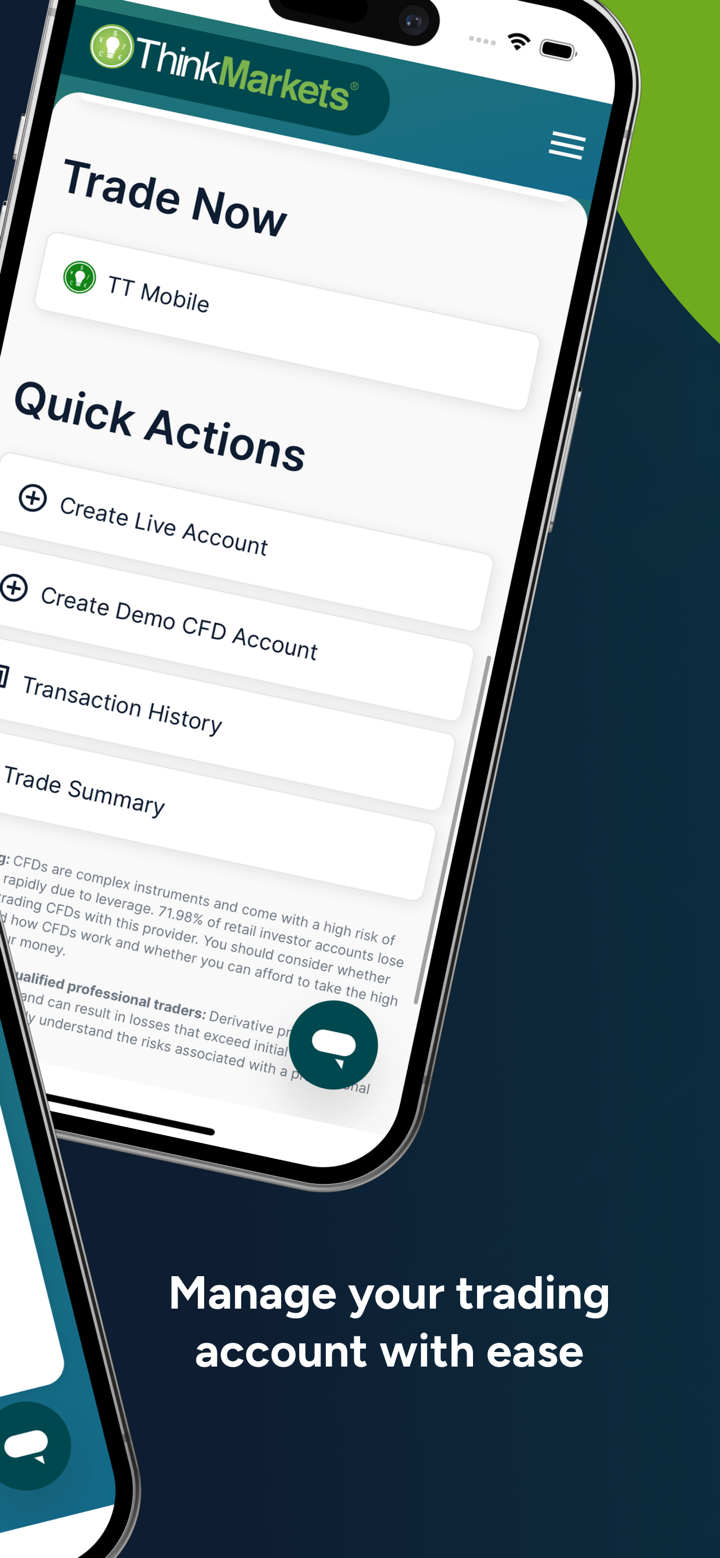

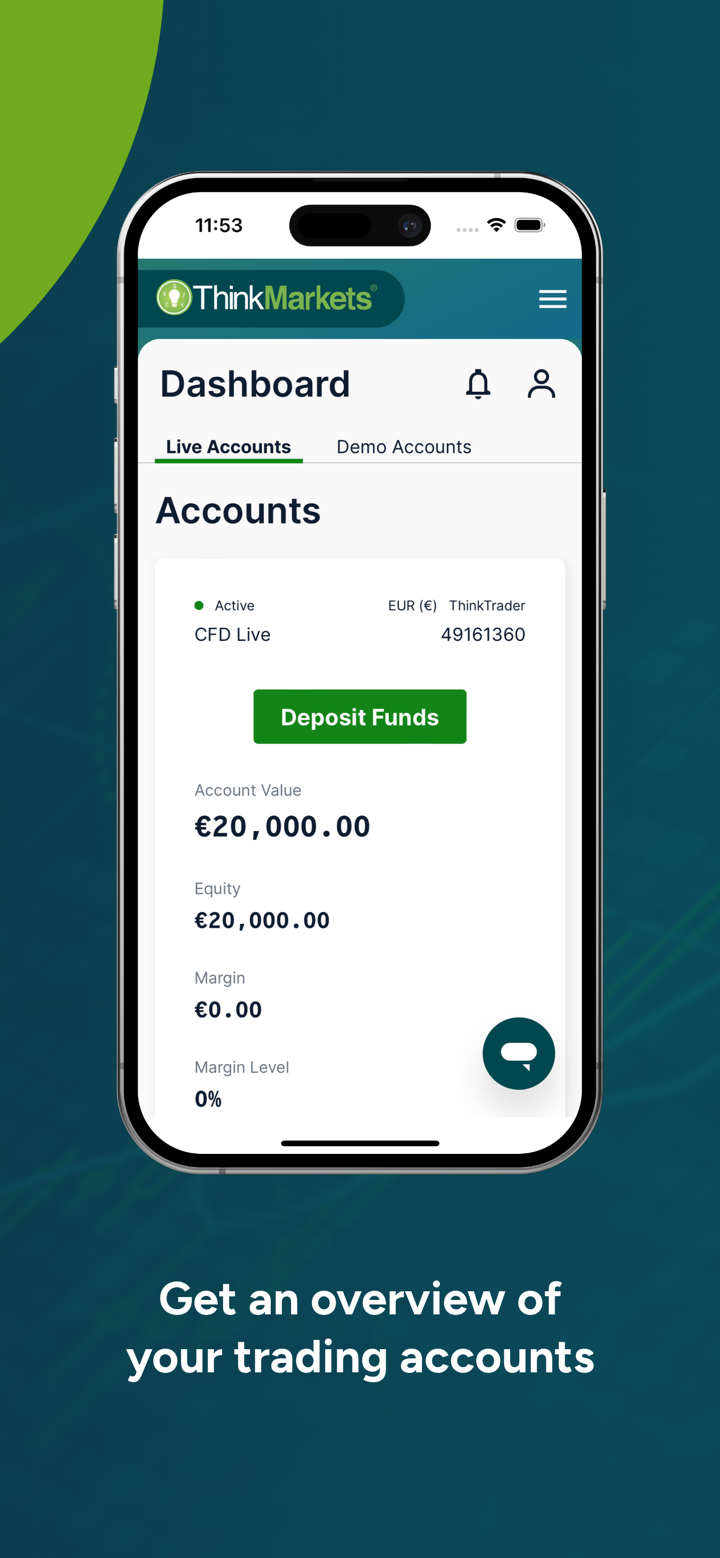

ThinkMarkets offers its clients three live account options: the Standard Account, the ThinkTrader Account, and the ThinkZero Account.

| Account Type | Tradable Assets | Base Currencies | Min Deposit | Spread | Trading Platforms |

| Standard | Forex, commodities, indices, crypto, stocks, ETFs and futures | USD, AUD, GBP, EUR, SGD, CHF | $250 | From 0.4 pips | MT4/5 |

| ThinkTrader | Forex, stocks, indices, commodities, crypto and ETFs | USD, AUD, GBP, EUR, NZD, SGD, CHF | $50 | ThinkTrader, TradingView | |

| ThinkZero | Forex, commodities, indices, crypto, futures and stocks | USD, AUD, GBP, EUR, SGD, CHF | $500 | From 0.0 pips | MT4/5 |

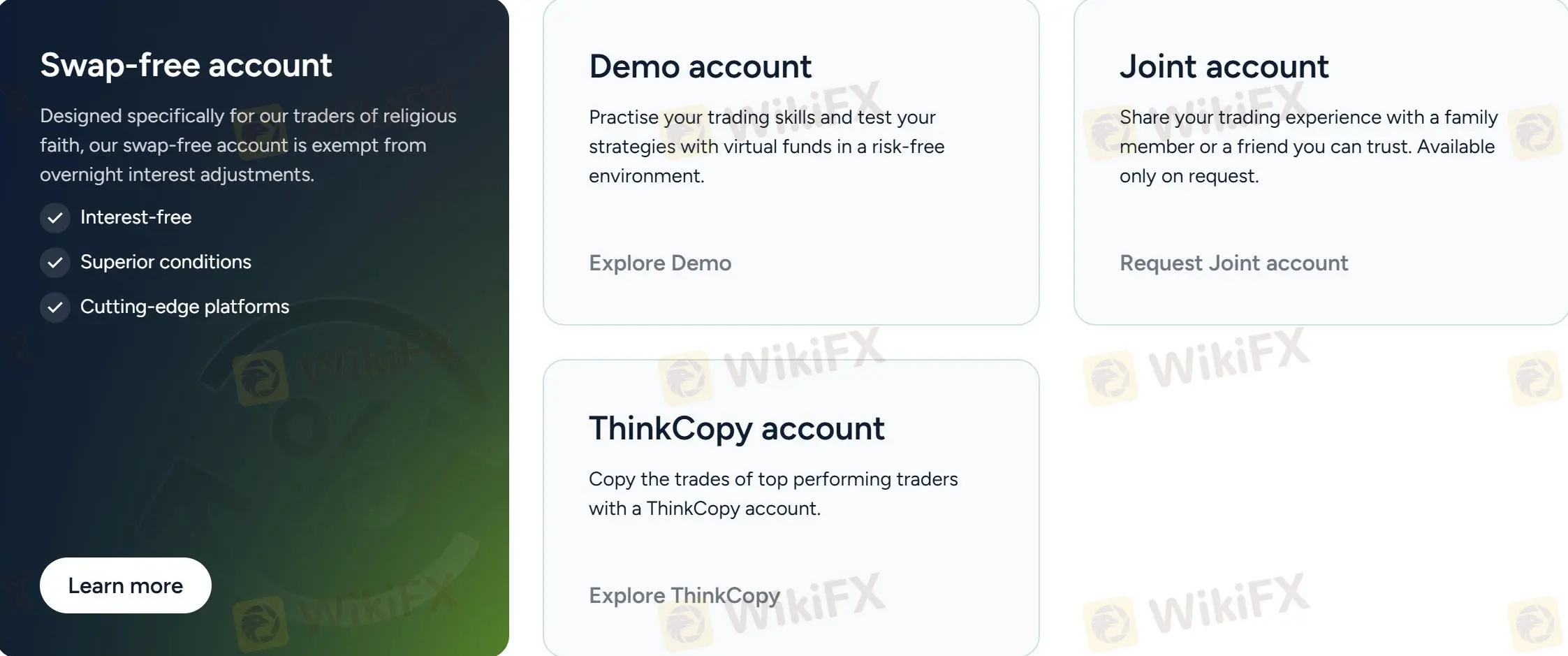

Besides, ThinkMarkets also offers the swap-free account, demo account, Joint account, and ThinkCopy account.

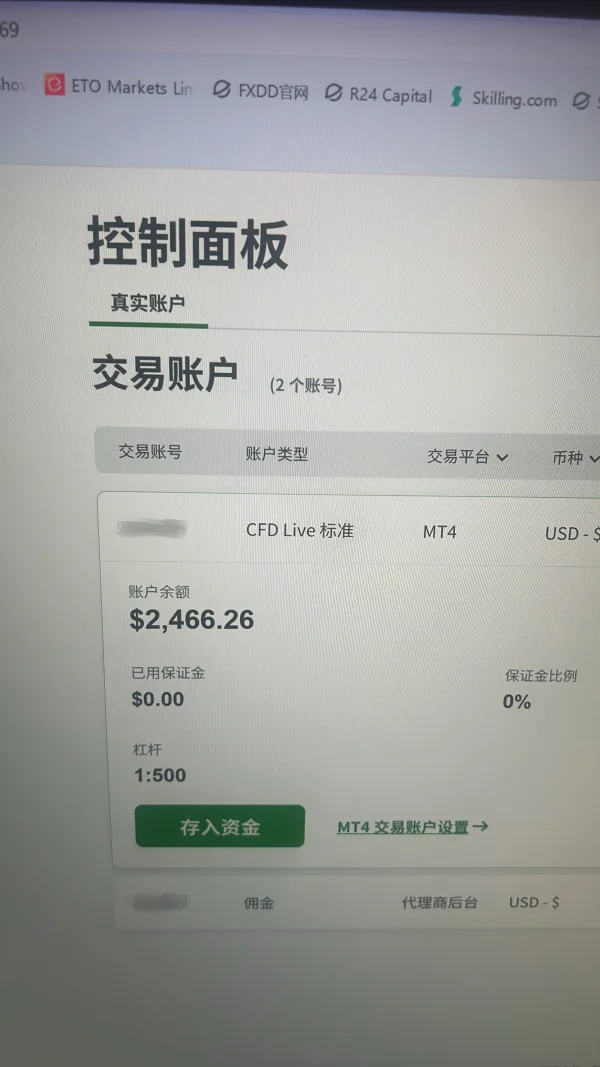

Leverage

Leverage is an important tool in forex trading, as it allows traders to increase their buying power and have access to greater trading opportunities. At ThinkMarkets, the maximum leverage offered is 1:500 for all account types, which means that traders can control a position up to 500 times the size of their account.

However, it is important to note that high leverage also carries a higher risk, as the potential losses are also multiplied by the same proportion. Therefore, it is important that traders understand the risks associated with high leverage and use appropriate risk management tools when trading with high levels of leverage.

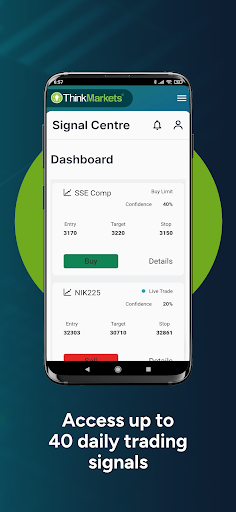

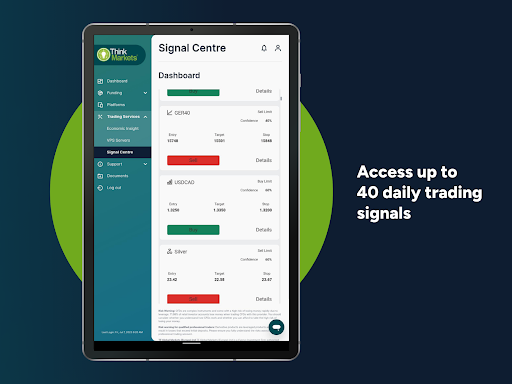

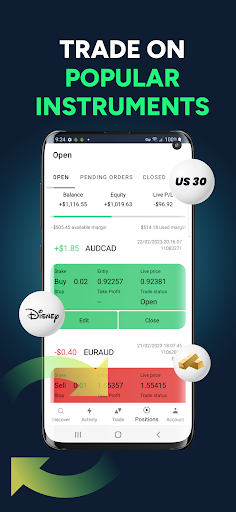

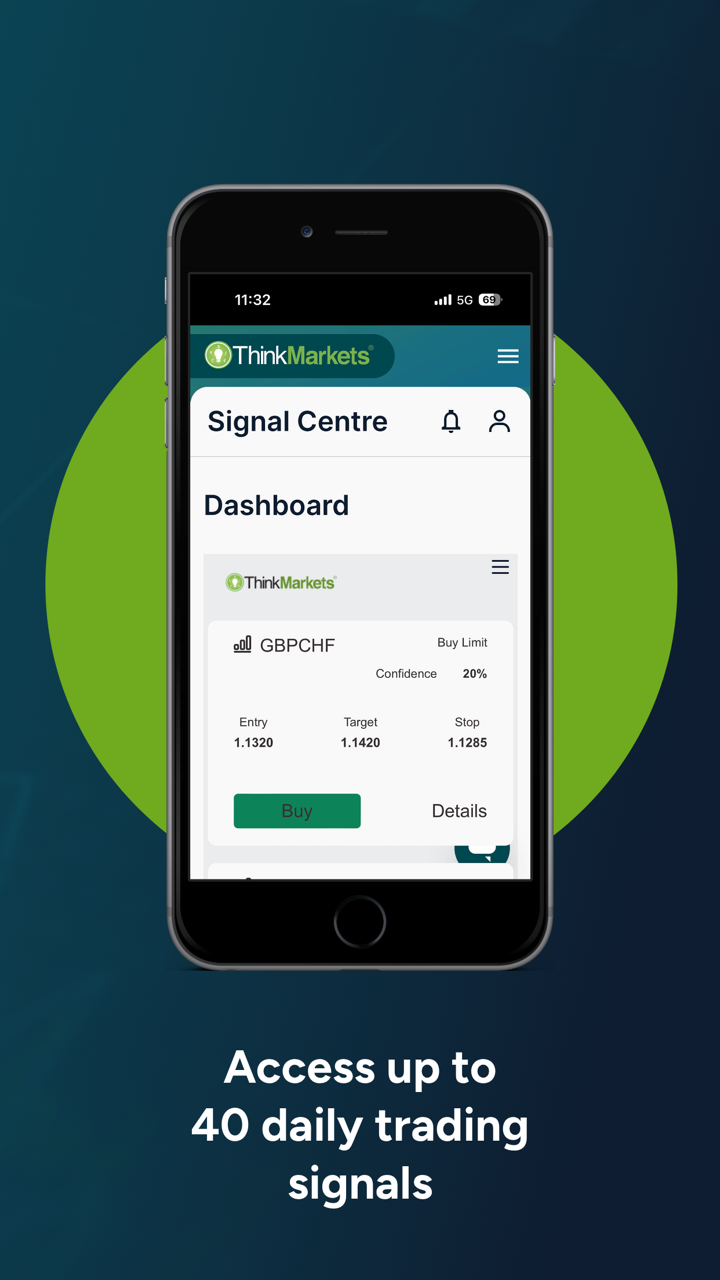

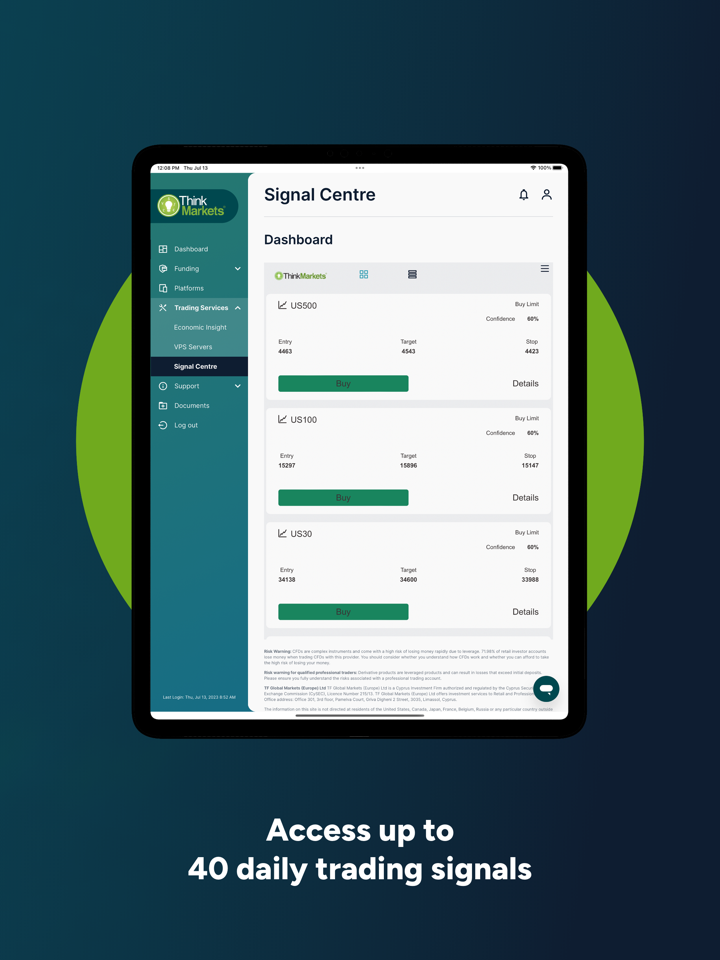

Trading Platform

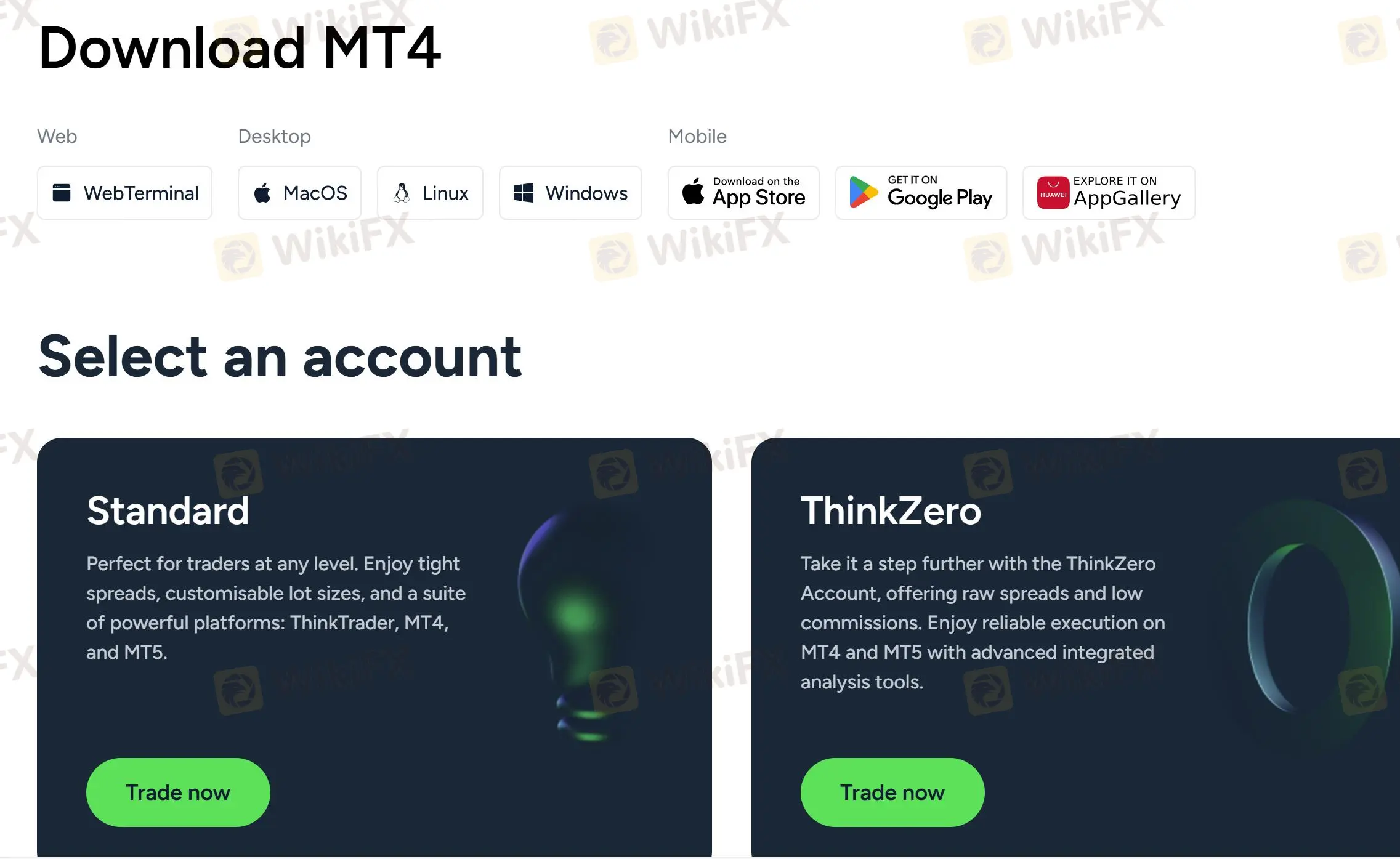

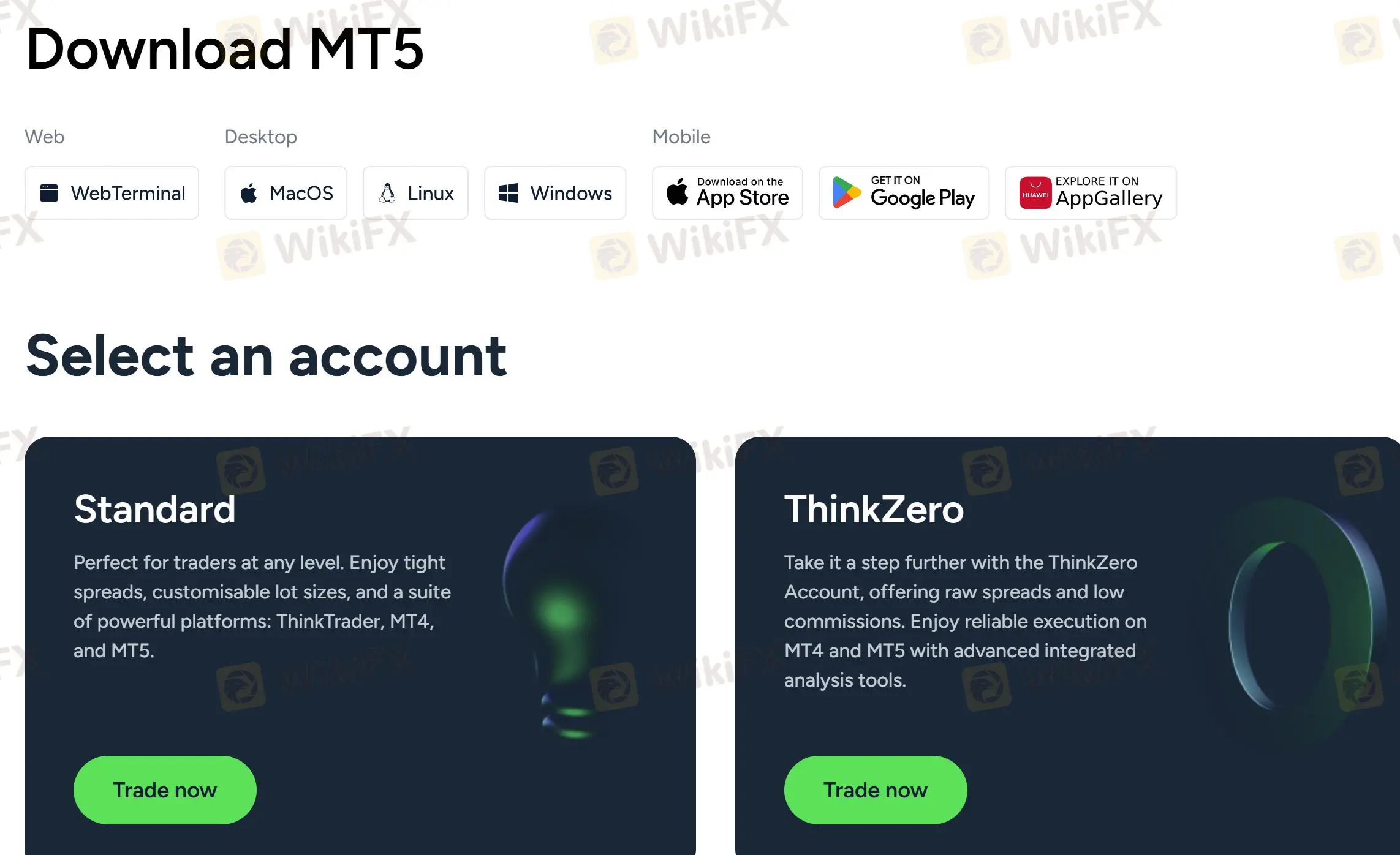

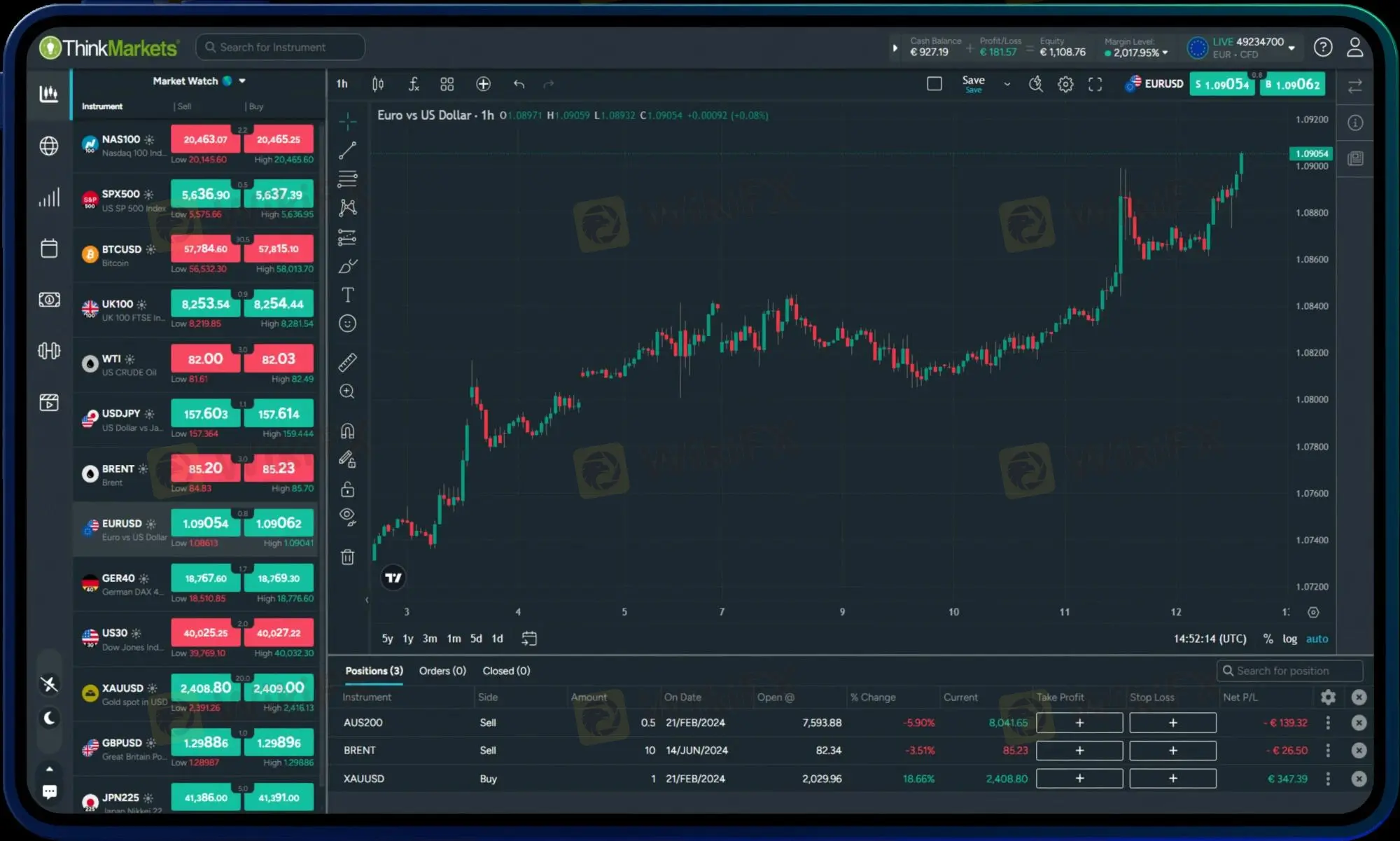

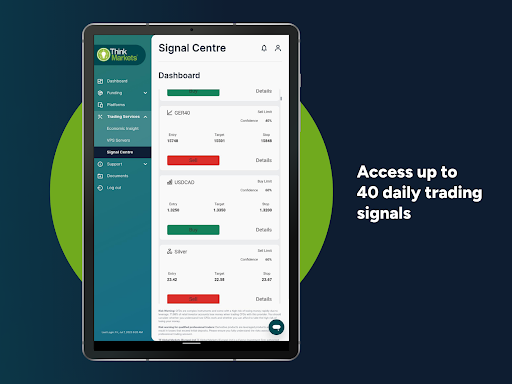

ThinkMarkets offers its clients four different trading platforms: MetaTrader4, MetaTrader5, TradingView and ThinkTrader.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, Desktop, Mobile | Beginners |

| MT5 | ✔ | Web, Desktop, Mobile | Experienced traders |

| TradingView | ✔ | Web, Desktop, Mobile | Beginners |

| ThinkTrader | ✔ | Web, Mobile | / |

MetaTrader4 is one of the most widely used trading platforms in the world and has earned a great reputation due to its ease of use and wide range of technical analysis tools and resources.

MetaTrader5 is the most advanced MetaTrader trading platform, with additional features such as the ability to trade futures and options.

TradingView is a premium business utility that offers a free demo of its trade charting platform. The app is simple for beginners and effective for technical analysis experts.

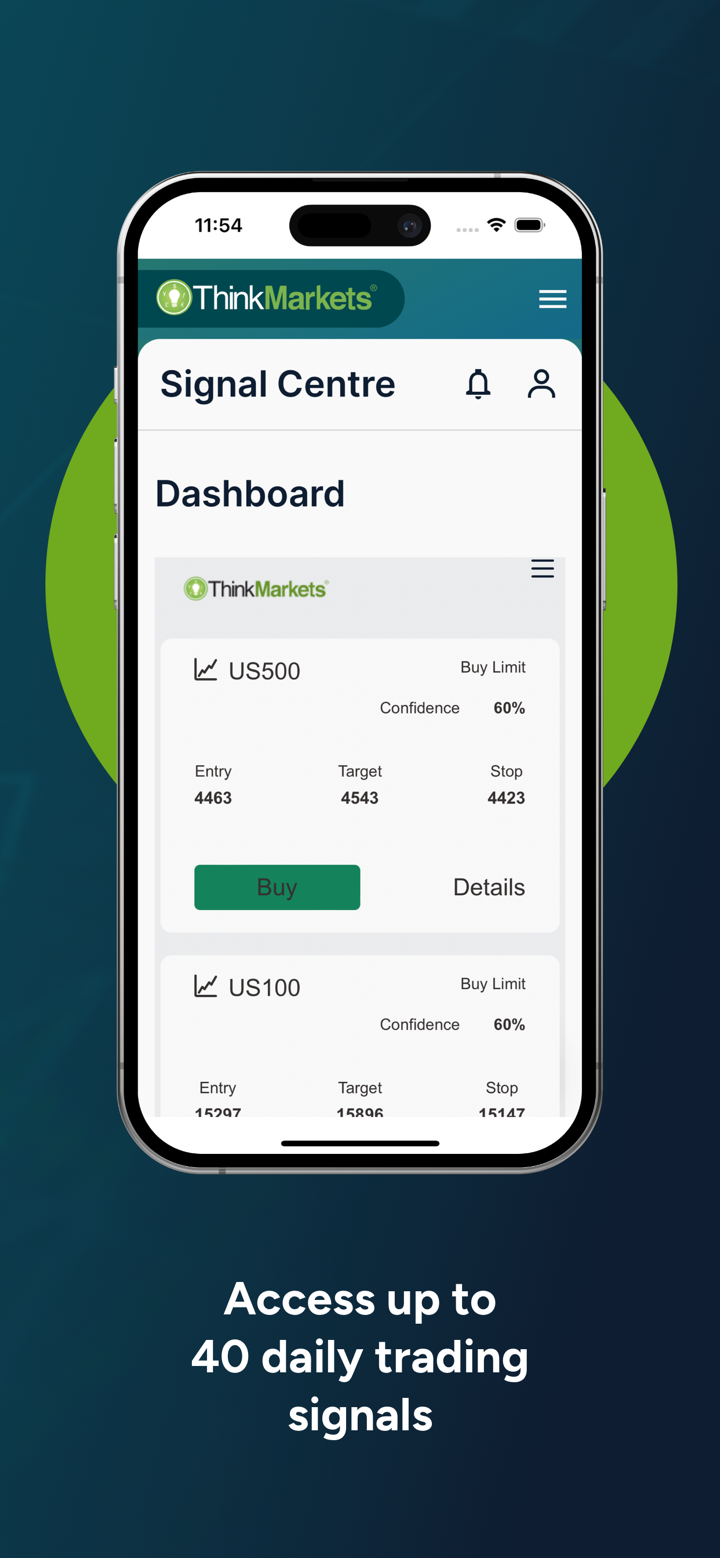

ThinkTrader is ThinkMarkets' proprietary trading platform, designed to provide a superior trading experience with advanced features, an intuitive interface and full customization.

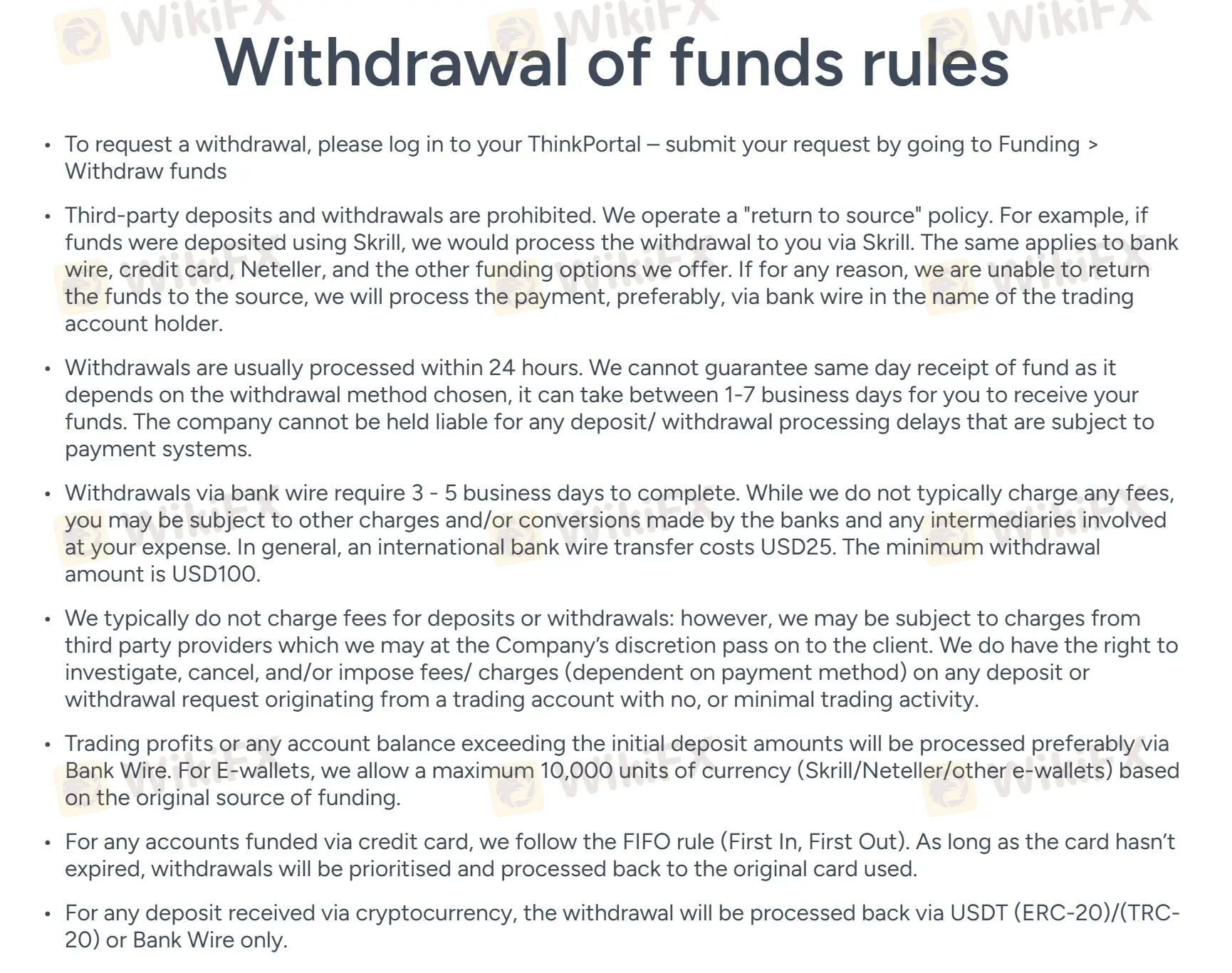

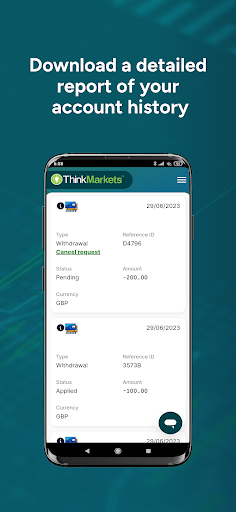

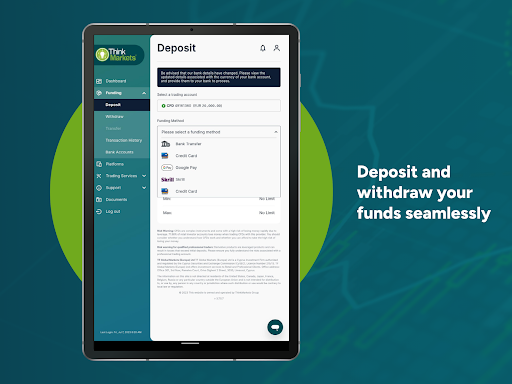

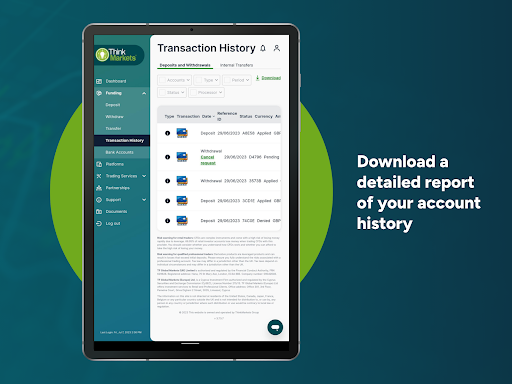

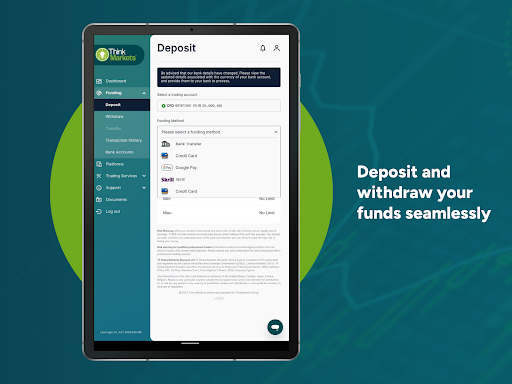

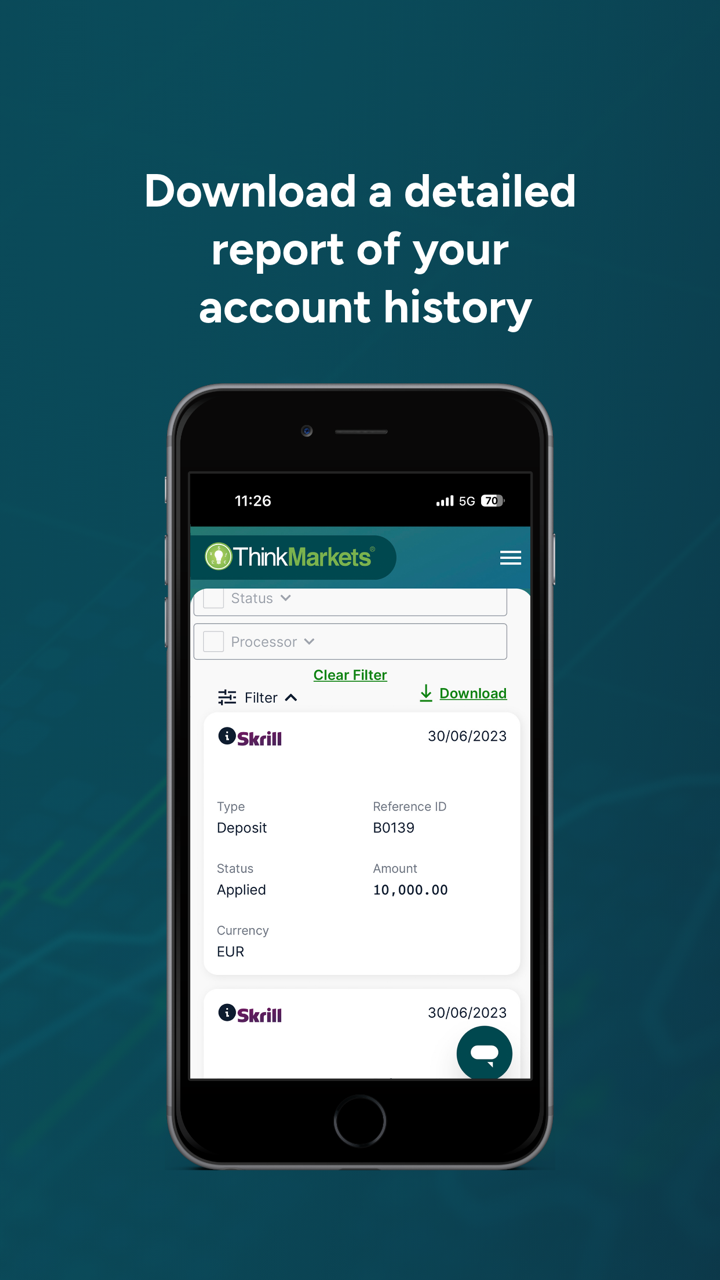

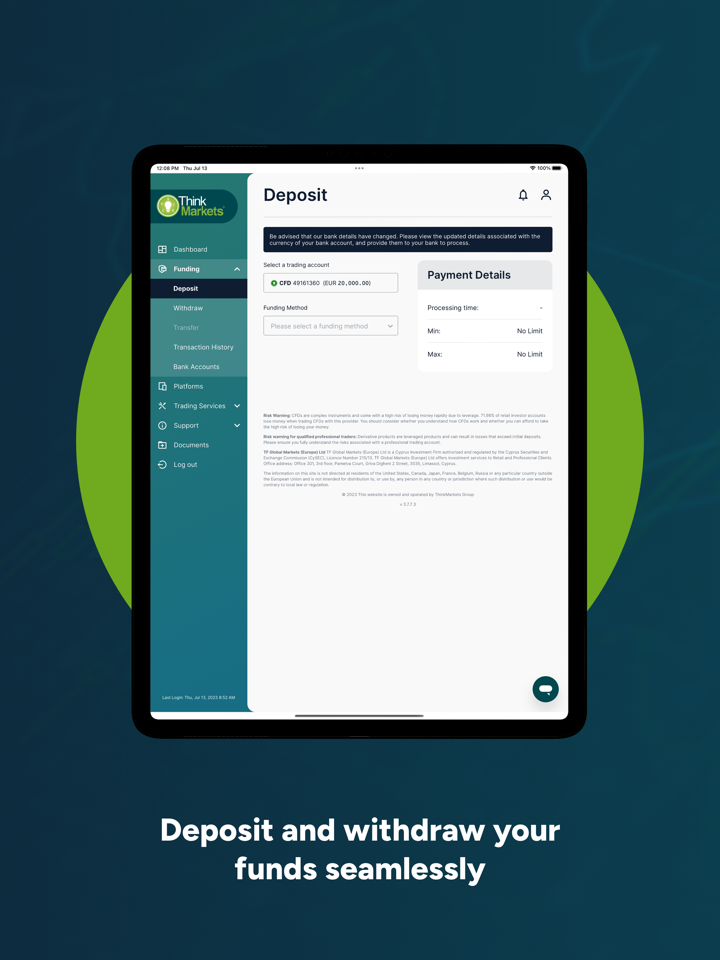

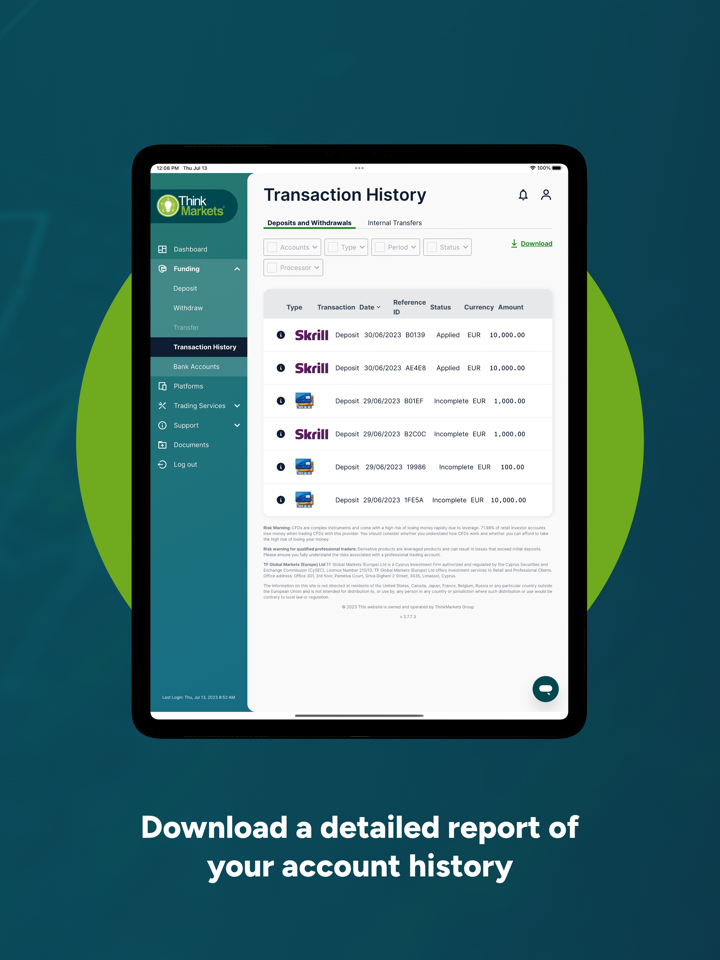

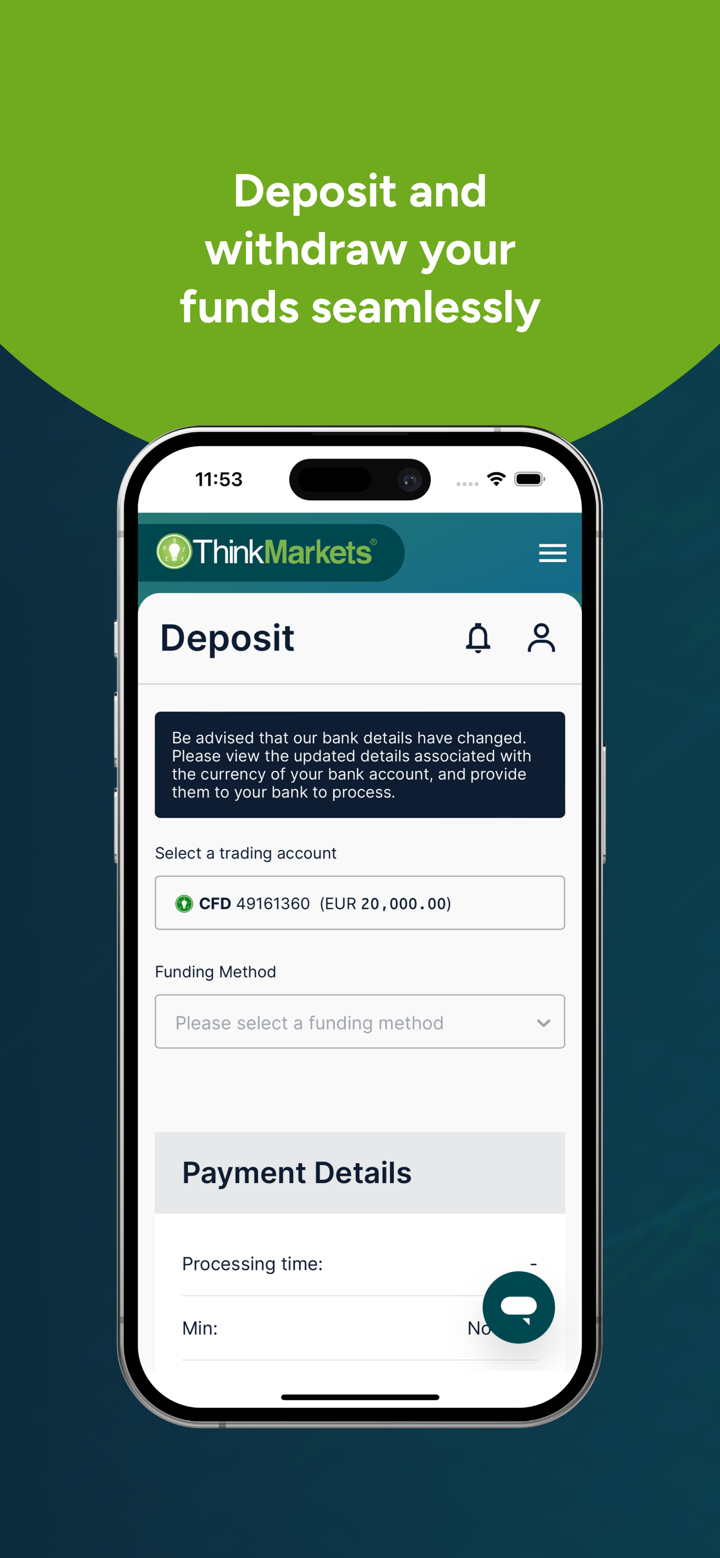

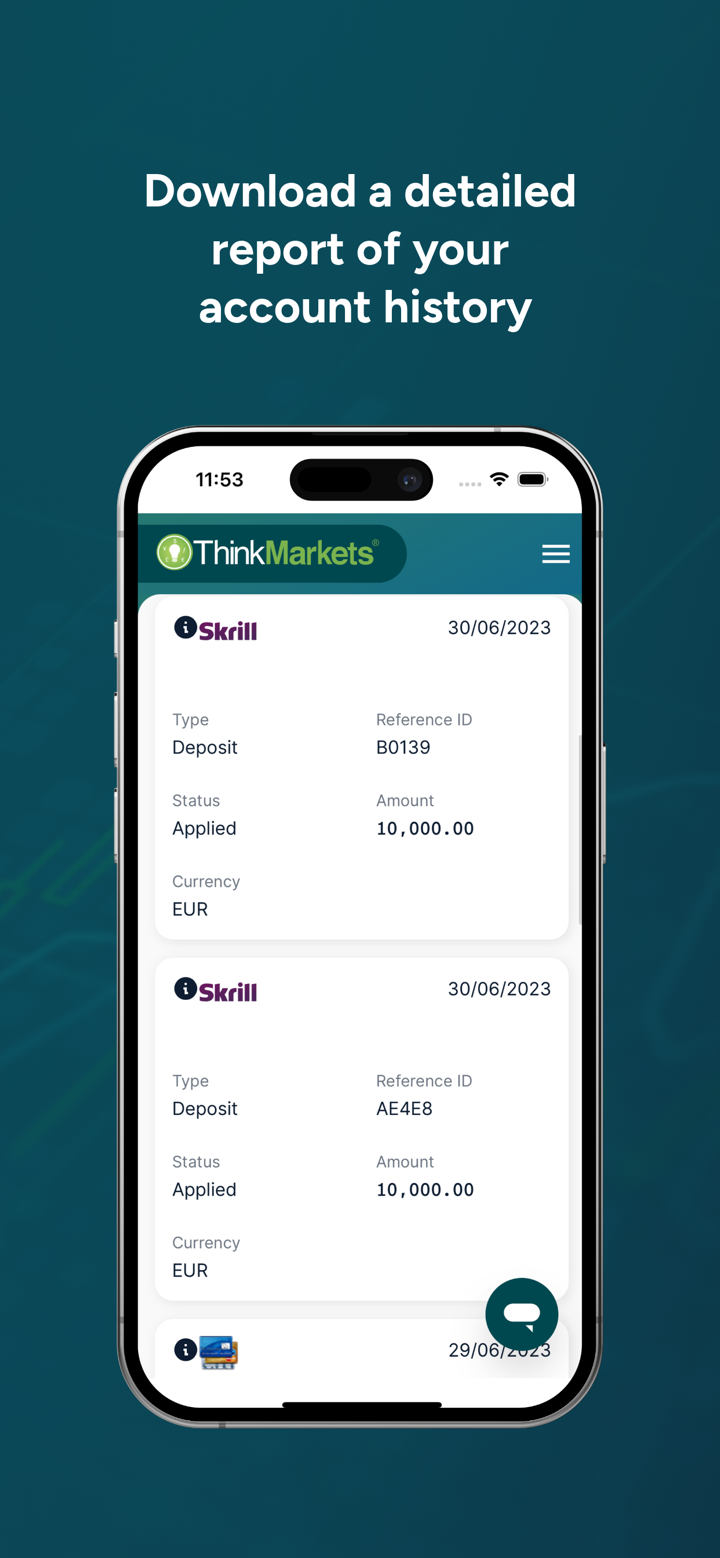

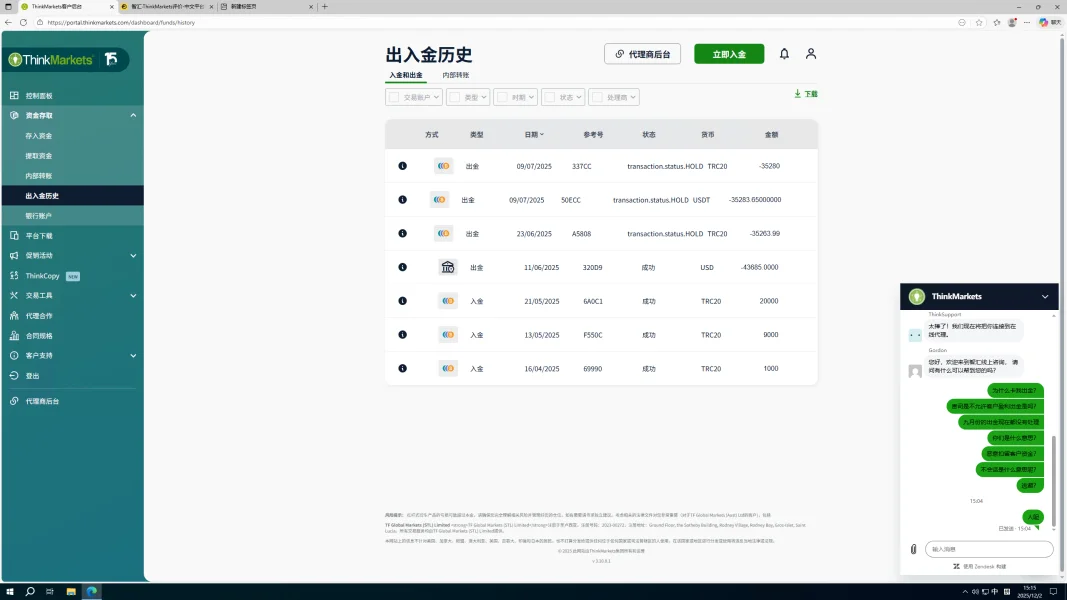

Deposit and Withdrawal: Methods and Fees

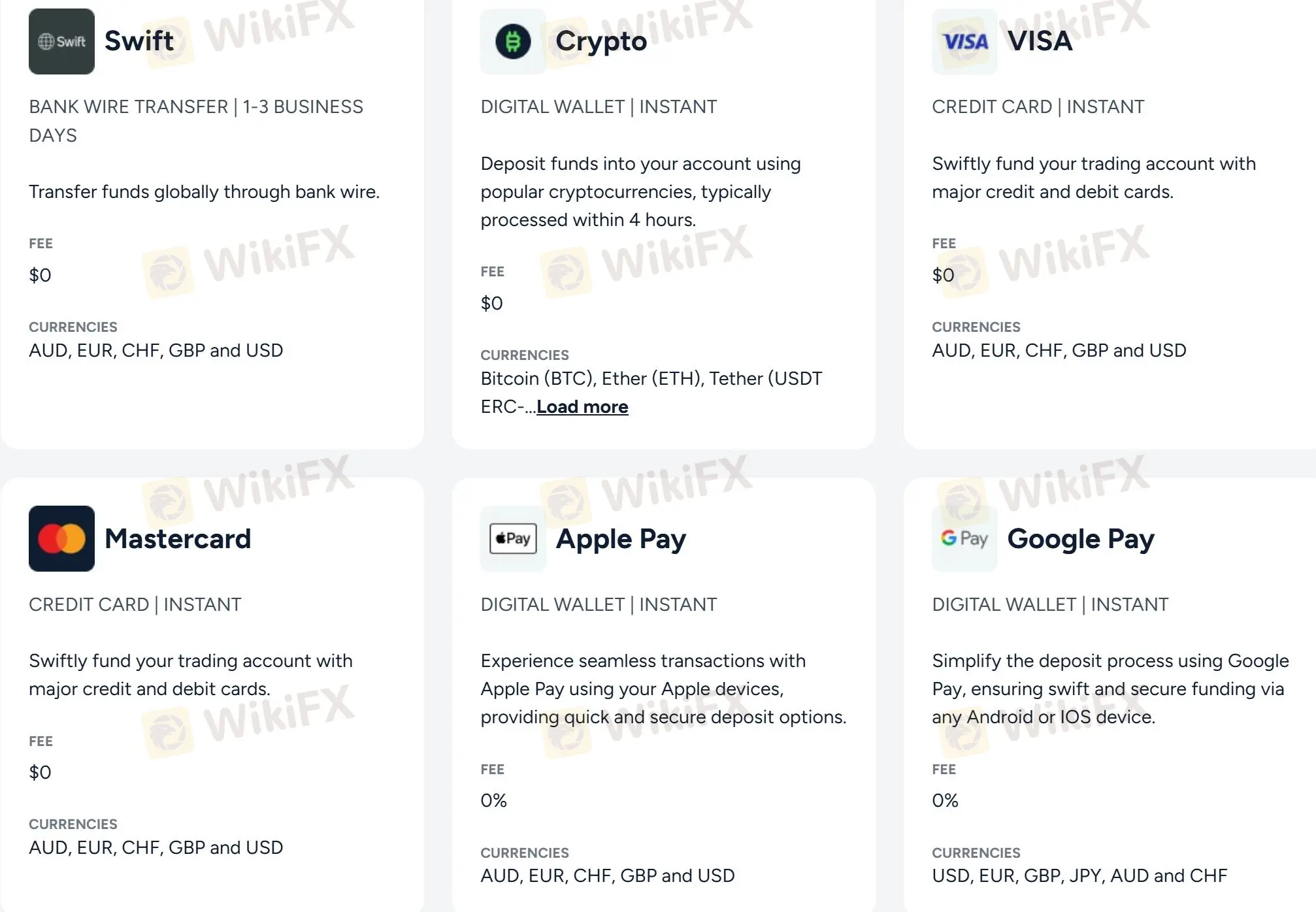

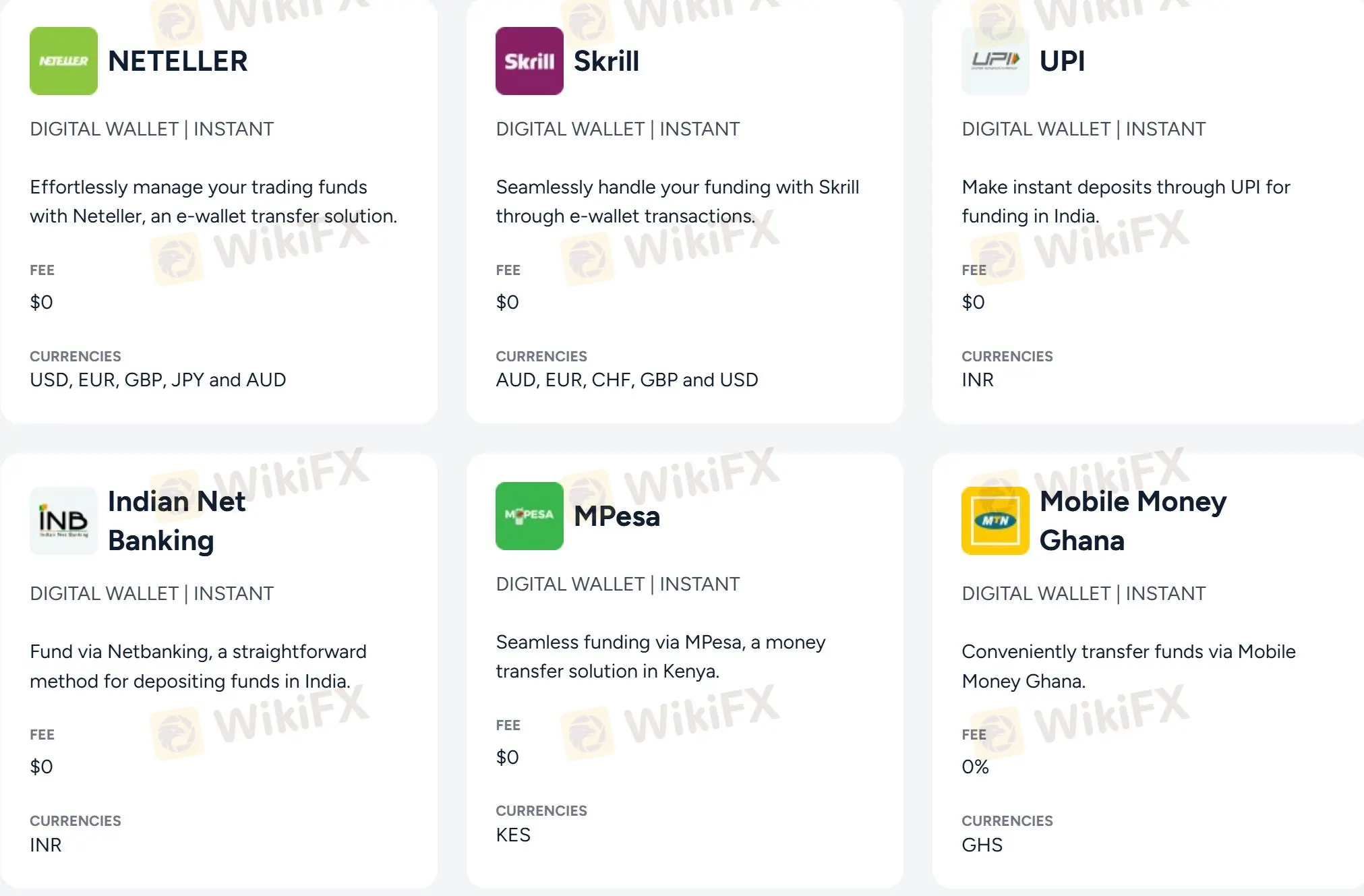

ThinkMarkets offers multiple deposit and withdrawal options for its clients, including Swift, cryptos, Visa, MasterCard, Apple Pay, Google Pay, Neteller, Skrill, UPI, Indian Net Banking, Mpesa, and Mobile Money Ghana.

| Payment Method | Accepted Currencies | Fee | Processing Time |

| Swift (Bank Wire Transfer) | AUD, EUR, CHF, GBP, USD | ❌ | 1-3 business days |

| Crypto | Bitcoin (BTC), Ether (ETH), Tether (USDT ERC-20 & TRC-20), Bitcoin Cash (BCH), Stellar (XLM), Litecoin (LTC), EOS (EOS), DASH (DASH), USDC (USDC ERC-20), XRP (XRP), Binance Coin (BUSD) | Instant | |

| Visa/MasterCard (Credit Card) | AUD, EUR, CHF, GBP, USD | ||

| Apple Pay | AUD, EUR, CHF, GBP, USD | ||

| Google Pay | USD, EUR, GBP, JPY, AUD, CHF | ||

| Neteller | USD, EUR, GBP, JPY, AUD | ||

| Skrill | AUD, EUR, CHF, GBP, USD | ||

| UPI | INR | ||

| Indian Net Banking | |||

| MPesa | KES | ||

| Mobile Money Ghana | GHS |

Conclusion

In summary, ThinkMarkets is a multi-regulated forex and CFD broker that offers a wide range of trading instruments with competitive spreads. The company also offers an advanced trading platform, 24-hour customer support and educational resources to help traders improve their trading skills and knowledge. If you are looking for a reliable and experienced broker in the market, ThinkMarkets is an excellent option to consider.

Frequently Asked Questions

What types of accounts does ThinkMarkets offer?

ThinkMarkets offers three types of accounts: the Standard account, the ThinkTrader account, and the ThinkZero account.

What payment methods are available for depositing and withdrawing funds into my account?

Available payment methods include Swift, cryptos, Visa, MasterCard, Apple Pay, Google Pay, Neteller, Skrill, UPI, Indian Net Banking, Mpesa, and Mobile Money Ghana.

What assets can I trade at ThinkMarkets?

ThinkMarkets offers a wide variety of financial instruments, including 4,000 CFDs on forex, indices, commodities, cryptocurrencies, stocks, ETFs, futures, and gold.

What is the maximum leverage offered by ThinkMarkets?

ThinkMarkets offers a maximum leverage of 1:500.

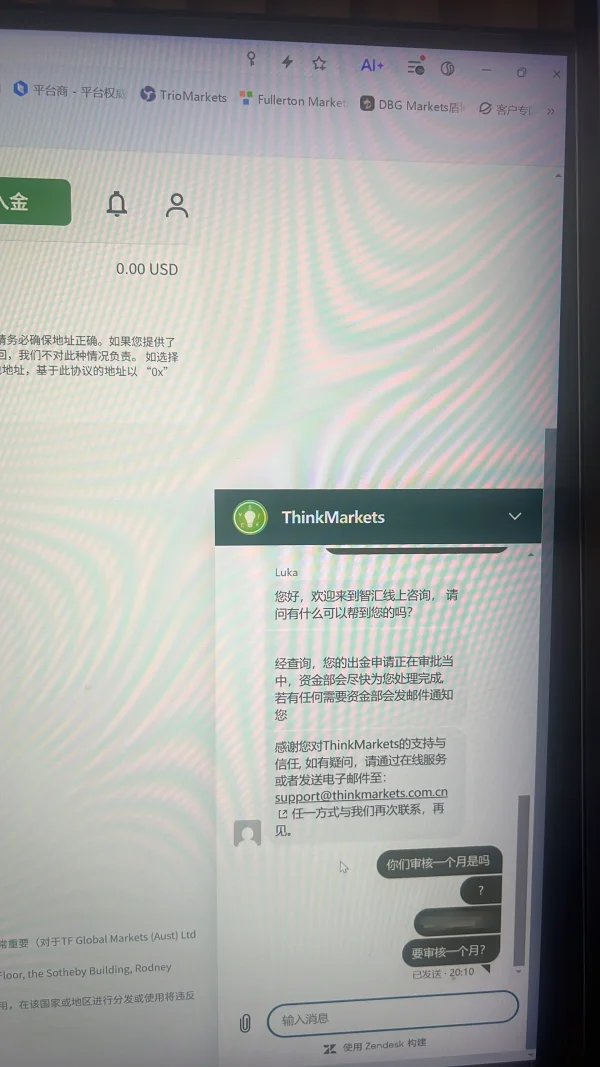

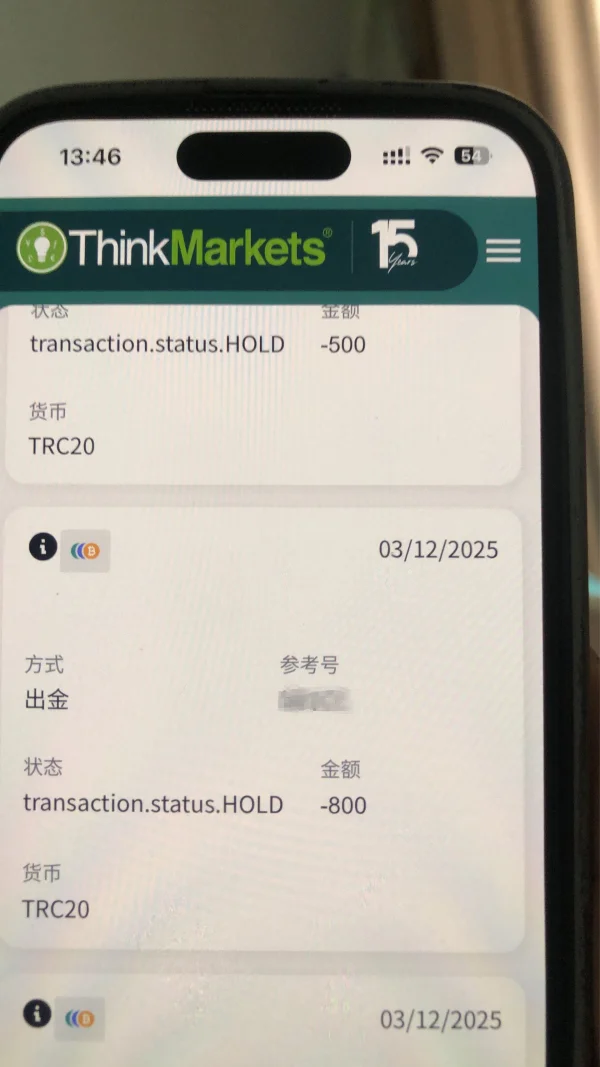

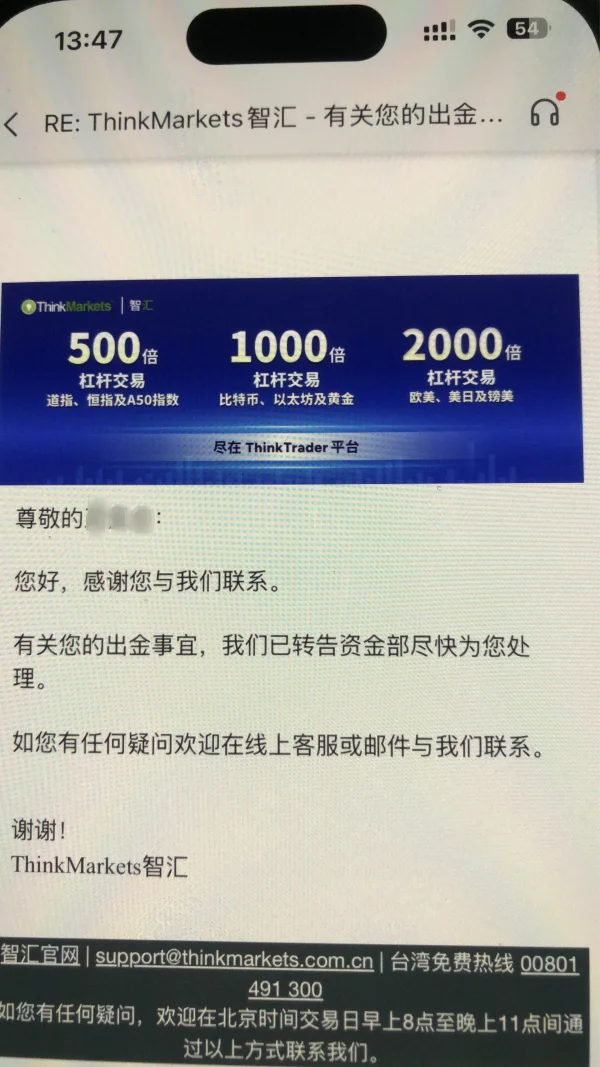

W80881

Hong Kong

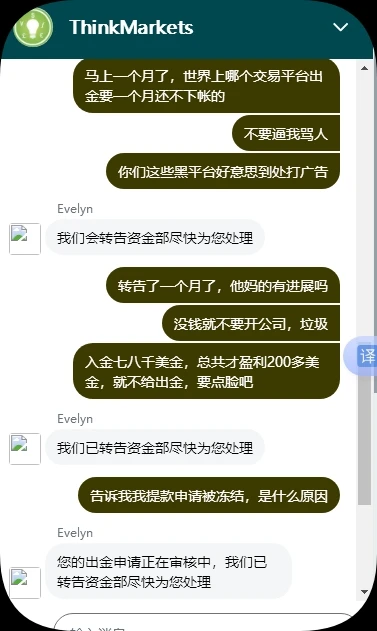

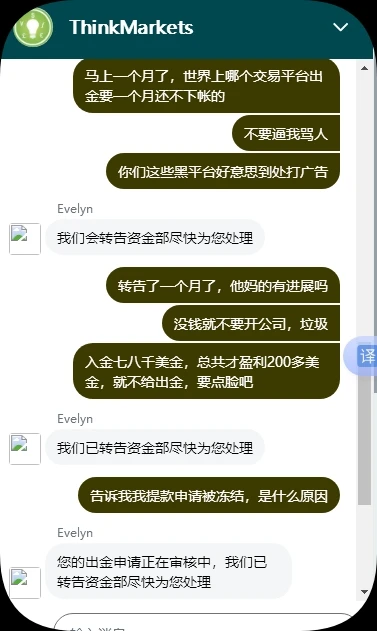

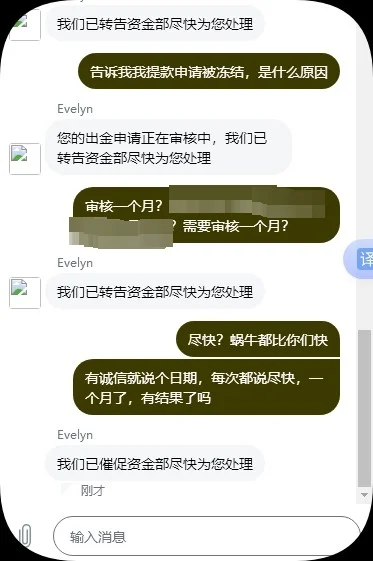

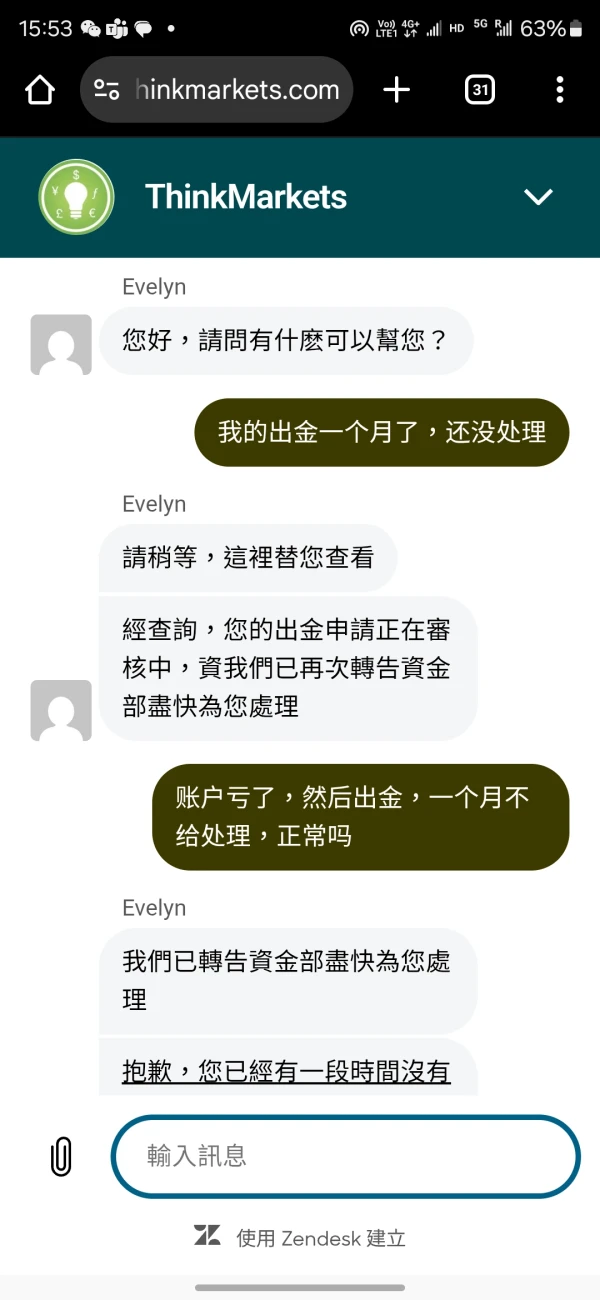

It's been a month and they still haven't processed my withdrawal request. Every time I ask, they just say it's being processed. What kind of withdrawal takes a month to review?

Exposure

FX7104043152

Hong Kong

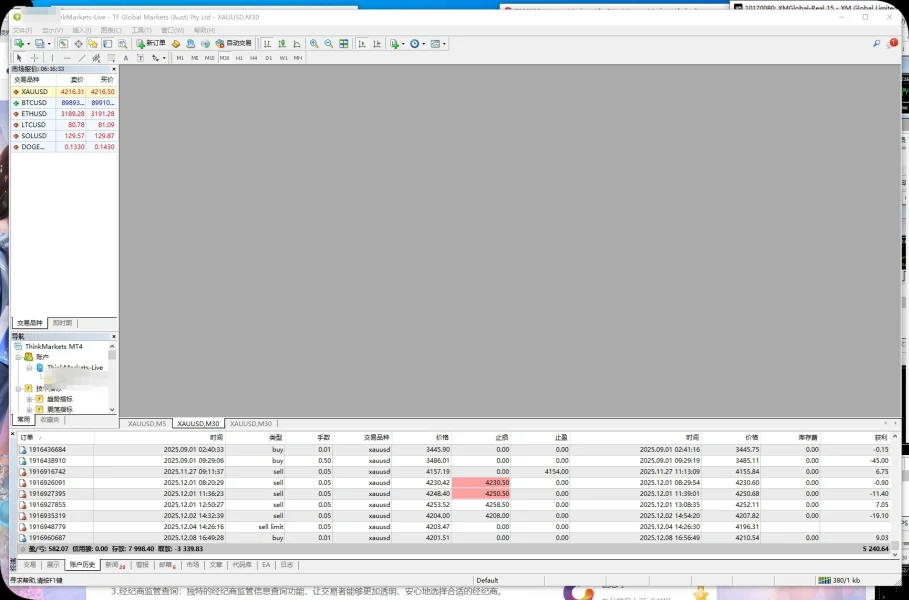

I opened a trading account with ThinkMarkets on April 23, 2025. I deposited a total of $7,998.40, withdrew $3,339.883 during the period, and my current account balance stands at $5,240.64. Since August 26, 2025, when I first requested a withdrawal, ThinkMarkets has consistently refused to process it. They have even frozen all my withdrawal requests directly within the user center. I have contacted their online customer service countless times during this period, but they have never provided a clear response or a definite timeline. They merely deflect responsibility by stating they have notified the finance department to handle it. It has now been four months since my initial withdrawal request on August 26. During this period, I proactively proposed withdrawing only my principal amount, yet the company continues to offer no response or resolution. Their actions clearly indicate an intent to fraudulently withhold my account funds.

Exposure

FX6295236062

Hong Kong

My withdrawal request has been pending for a week without processing. Customer service and email support only say to wait for the finance department's review. Since it's a direct deposit-to-withdrawal transaction, what exactly needs to be reviewed?

Exposure

肯尼

Taiwan

Due to the withdrawal design not being very user-friendly, other aspects such as deposit speed, customer service speed, and being regulated by the FCA are still considered good, so an overall rating of average is given. Description of the non-user-friendly withdrawal issue: The withdrawal method involves first refunding the principal to the original credit card used for deposit, which is fine. However, if that credit card is no longer available and another withdrawal method is desired, proof of the card closure must be provided. Over a year ago, I deposited $10, which was lost. This time, I deposited $50 and made a profit of $10. However, since I have forgotten which credit card I used for the $10 deposit over a year ago and whether it was closed, ThinkMarkets customer service stated that they cannot retrieve the credit card details used for deposit. This poses a problem because even if you have accumulated profits, you cannot withdraw them until the refund of the principal is processed first, as per ThinkMarkets' policy. Therefore, to withdraw the profits, you must recall which credit card was used for the $10 deposit over a year ago, contact the credit card company to request records of the deposit and proof of card closure, and submit this information to ThinkMarkets official. Only then can the $10 be processed through another withdrawal channel. After completing this process, the remaining profits can be withdrawn through another channel. This design is quite non-user-friendly. Note: Attached is a conversation record with ThinkMarkets official customer service for reference.

Neutral

FX2298508282

Hong Kong

In April-May of this year, I deposited 30,000 USD. On June 10, 2025, due to a one-sided market trend, my account generated profits. Shortly thereafter, I received an email from the ThinkMarkets platform claiming I had engaged in illegal activities and notifying me that they would adjust my account balance and close my account! Not only did they seize my entire profit of 43,685 USD, but my request to withdraw the principal 30,000 USD has been ignored for three months! Over these three months, I repeatedly contacted ThinkMarkets demanding my principal and profits, yet the platform has completely ignored me with no response whatsoever! I even filed a complaint with the regulator—they are a scam platform and are not subject to legitimate oversight. Everyone, please stay away from this platform!!!!

Exposure

FX3915666866

Pakistan

One of the best broker i have ever seen love support team easy deposit and witharwals, low spread.

Positive

riky946

Indonesia

This is one of the best brokers in my opinion, with low spreads and very fast withdrawal speeds making it my choice.

Positive

FX2746710442

Taiwan

I applied for withdrawal on September 3rd, but the platform doesn't process it. It's been delayed for a month. I don't know if this platform is delaying a lot of withdrawals, if someone has withdrawn successfully, could you please let me know?

Exposure

FX2746710442

Taiwan

My real experience on the ThinkMarkets platform: On August 29th, I deposited 200 USD, wanting to try trading. I found serious slippage and the experience was very poor, so on September 3rd, I applied to withdraw 188 USD. Little did I know that this was just the beginning of a nightmare! After applying for withdrawal, the customer service would only say 'processing', but the funds never arrived. To date, 22 days have passed, and not a penny of the 188 USD has arrived. I want to emphasize again: my trades are completely legal and compliant, with no violations. The platform keeps delaying and not processing, and in the end, they even blacklisted my principal! Facts have proven that ThinkMarkets has no intention of letting customers withdraw smoothly, the funds go in and can't come out. Everyone must be vigilant!

Exposure

FX2746710442

Taiwan

On August 29th, I deposited $200 into ThinkMarkets to test the platform, but encountered severe slippage and a poor experience. Consequently, I requested a withdrawal of $188 on September 3rd. Little did I know this was just the beginning of the nightmare—ThinkMarkets has no intention of processing withdrawals smoothly! After submitting the withdrawal request, customer service only responded with “processing,” and over seven days later, not a single cent of the $188 has been credited to my account. I must emphasize: all my trading activities were fully legal and compliant, with no violations whatsoever. Yet the platform has persistently delayed and refused to process my request, and ultimately even blocked my deposited funds! I urge everyone to be aware of the severe withdrawal risks associated with ThinkMarkets's platform. Please exercise extreme caution to avoid becoming a victim.

Exposure

FX6672253742

Hong Kong

When opening the account in 2016, they didn't mention any account management fees. Then, without any notice, they secretly deducted the fees and claimed they could modify the agreement at will. They even said that to get the management fees refunded, you'd need to deposit another $1,000. Isn't this just the usual trick used in scams?

Exposure

FX2877684858

Ghana

Hello FPA members, I am raising a serious issue with ThinkMarkets, a CFD brokerage regulated under FCA (UK), ASIC (Australia), CySEC (Cyprus), Withdrawal Request ID: 12D82 Method: Crypto Date Submitted: 15/08/2025 at 08:56 Status: Still pending after more than 5 days Here are the key issues: I provided all requested recordings, yet the withdrawal remains unprocessed. Whenever I contact support via live chat, I’m told the issue has been “forwarded to finance.” The finance team is completely unresponsive – I have sent countless emails to finance@thinkmarkets.com and received no reply. My account manager (Rivash Gudar) is also not communicating with me at all. This is not even about profits – my capital is not being addressed. This lack of transparency and refusal to process withdrawals raises serious compliance concerns under FCA client money rules (CASS) and equivalent obligations with ASIC, CySEC.

Exposure

FX1530032678

Hong Kong

I am a new user. After making a deposit on 6/25/2025, I wanted to request a withdrawal on 7/30/2025, but it has been delayed continuously. Customer service does not respond, emails go unanswered—this is absolutely a confirmed scam platform.

Exposure

等待的艺术122

United States

Withdrawals usually take 5 hours to process, deposits take 10 minutes. No issues in 3 years, just a slight slippage—perfectly normal.

Positive

Mohamed.abdelsalam

Egypt

Scammers and crooks, simple as that! From leverage manipulation in the spread to intentional lagging, they do it all I want to help all customers not to lose your money. manipulation on spread and the charts not move in APP thinktrader to lose money I will escalate the issue to all regulatory authorities FCA & FSA i recourd this issue To preserve my rights even after a while please dont use this platform

Exposure

Abdelrahmn Salah

Egypt

Stay away! Would not recommend. Full manipulated broker, ThinkMarkets, alert to all traders. On 18 DEC, when I traded, I opened the trade but it did not open and there appeared a message saying, 'please wait, order has been sent to server'. After a few moments, the trade opened with a huge loss of 100 PIP, and I lost my account along with losing 1014 dollars. I have already recorded this issue to protect your rights.

Exposure

FX1184866398

Hong Kong

Since applying for a withdrawal on April 26th this year, over $10,000 of my profits were directly deducted by this scam platform. I can't even withdraw my principal; all three attempts were delayed and denied. Customer service is ineffective, emails are not responded to, and they are completely uncontactable.

Exposure

FX1498997612

Taiwan

with account number 10154602, I refuse to let ThinkMarkets get away with their fraud! I don't care about my principal anymore—I'm here to expose this scam and prevent others from suffering like I have. There are countless victims out there who've lost their funds and profits, and it's time we stand together! ThinkMarkets treats their clients like absolute fools. They welcome losers but will do anything to prevent profitable clients from withdrawing their money. This is nothing less than a trap—a disgraceful scam! Since they BLOCKED my withdrawal last December, I've sent 11 emails over five months with ZERO replies. I’ve filed multiple complaints with regulators, submitting all evidence. They claimed on June 19 they were "still investigating," but there's been NO progress! Now, nine months later, I filed another complaint on September 11, and they responded the next day with more empty promises. It was only after I expos

Exposure

FX1498997612

Taiwan

I don't care about my principal anymore—I'm here to expose this platform and prevent others from becoming victims like me. Many individuals around me have lost their funds and profits, and it's time we stand together! ThinkMarkets treats clients like fools. They welcome losers but use every trick to prevent profitable clients from withdrawing their money. This is a classic scam—a trap for unsuspecting traders! Since they BLOCKED my withdrawal last December, I’ve sent 11 emails over five months, yet received ZERO replies. I filed multiple complaints with regulators, providing all necessary evidence. On June 19, they claimed they were "still investigating," but no progress has been made. Now, nine months later, after another complaint on September 11, they responded with more empty promises. they finally contacted me—not with genuine assistance but with THREATS! They demanded I delete my posts or risk losing my principal while they simp

Exposure

峄鸿

Hong Kong

I have been applying for withdrawal for four days on ThinkMarkets, but the platform refuses to process it. The customer service said they have urged the finance department, saying that fund security requires time to process. However, it has been four days and it still hasn't been processed.

Exposure

mohammed alawadi

Iraq

i was open trades and after some hours i saw that all my trades are sl in area price didnt reach !! thats made me upset and confused coz after it all my trades could hit tp i connect them about it they told me its new day spread ! is there spread more then 200 pips !!! and my account is Zero spread !!!

Exposure

FX2950523649

Hong Kong

I agreed to deposit $1000 with a promise of $150 monthly profit and a $200 monthly EA management fee. After more than two months, I incurred losses exceeding $100. Today, when I requested a withdrawal, it was unreasonably denied. I urge regulatory platforms to take strict action!

Exposure

Deccy

Pakistan

ThinkMarkets is awesome! They have a super low minimum initial deposit, making it easy for traders of all levels to get started. Plus, their customer support is top-notch - always friendly, knowledgeable, and quick to assist with any issues I've had.

Positive