Company Summary

| ELAN FINANCIALReview Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Absconding by United Kingdom |

| Market Instruments | Forex (22 major currency pairs), Spot Gold, Spot Silver |

| Demo Account | Yes |

| Leverage | Up to 1:500 |

| Spread | Standard: Starting from 0.1 pips for EUR/USD,Islamic: Starting from 0.1 pips for EUR/USD,ECN: Starts from 0.0 pips |

| Trading Platform | MetaTrader 4 |

| Min Deposit | $100 |

| Customer Support | QQ: 800005651 |

| Email: info@99elon.com | |

ELAN FINANCIAL Information

ELAN FINANCIAL is based in the United Kingdom and was founded in 2003. This broker offers kinds of tradable assets, including real-time access to 22 major currency pairs and precious metals such as gold and silver. It also provides leverage up to 1:500 and two account types to choose.

Pros and Cons

| Pros | Cons |

| Offers various trading assets | Exceeded FCA regulations |

| Provides several account types for investors to choose | Limited Security Measures on Trading Platform |

| Offers a competitive leverage of 1:500 | |

| Provides MetaTrader 4 trading platform |

Is ELAN FINANCIAL Legit?

ELAN FINANCIAL is revoked. Its License number is No. 489701. Traders should be cautious and consider alternatives when trading.

What Can I Trade on ELAN FINANCIAL?

ELAN FINANCIAL offers kinds of trading assets to satisfy the different needs of different traders.

Foreign Exchange (Forex):

ELAN FINANCIAL provides 22 major currency pairs. This includes many trade currency pairs such as EUR/USD, USD/JPY, GBP/USD, AUD/USD, and NZD/USD, providing traders with different exposure to the global economy.

Spot Gold and Silver:

In addition to Forex, ELAN FINANCIAL offers precious metals, specifically gold and silver. This feature enables investors to engage in real-time transactions.

Account Types

ELAN FINANCIAL offers some account types tailored to satisfy users need.

Standard Account:

Standard account is suitable for traders looking for a balanced trading experience.

Islamic Account:

ELAN FINANCIAL meets traders need with its Islamic account. The Islamic account requires minimum deposit of $200.

ECN Account:

The ECN account provides leverage up to 1:200, with spreads starting from 0.0 pips. Unlike the Standard account, the ECN account charges no commissions. Also the minimum deposit requirement is $1,000, means its suitable for traders with more money to trade.

| Feature | Standard | Islamic | ECN |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:200 |

| Spreads | Starting from 0.1 pips for EUR/USD | Starting from 0.1 pips for EUR/USD | Starts from 0.0 pips |

| Commissions | $0.02 per side | None | None |

| Minimum Deposit | $100 | $200 | $1,000 |

| Demo Account | Yes, unlimited demo account available | Yes, unlimited demo account available | Yes, unlimited demo account available |

| Trading Tools | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

Leverage

The maximum leverage offered by ELAN FINANCIAL is up to 1:500.

This means traders can control positions in the market up to 500 times the amount of their trading capital.

ELAN FINANCIAL Spreads

In a standard account, traders can benefit from spreads of major currency pairs such as EUR/USD as low as 0.1 pips. In addition, the standard account charges a commission of $0.02 per.

In Islamic accounts, the spread of EUR/USD starts from 0.1 pips and no commission is charged.

In the ECN account, the spread of major currency pairs such as EUR/USD starts at 0.0 pips.

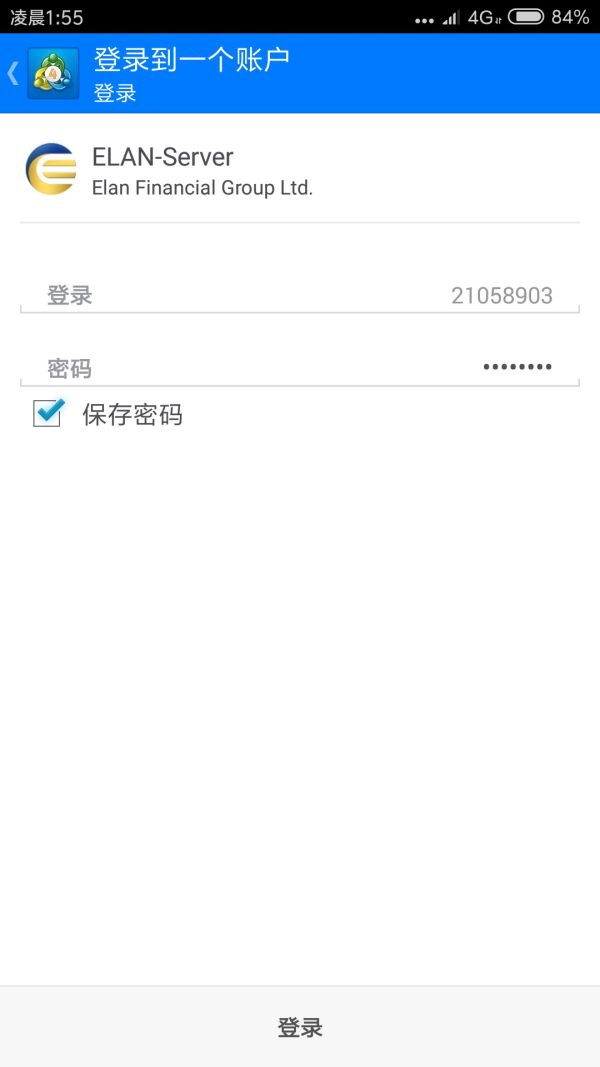

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what traders |

| MetaTrader 4 | ✔ | Windows, MAC, IOS, and Android | Investors of all experience levels |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

Deposit and Withdrawal

The minimum deposit amount required to open a trading account with ELAN FINANCIAL is $100 for standard accounts, $200 for Islamic accounts, and $1,000 for ECN accounts.

Customer Service

Users can reach out through QQ with the ID 800005651 or via email at info@99elon.com. However, the unreliability in response times and the limited avenues for support may frustrate users seeking assistance with urgent queries or concerns.

| Contact Options | Details |

| Phone | ❌ |

| info@99elon.com | |

| Support Ticket System | ❌ |

| Online Chat | ❌ |

| Social Media | QQ: 800005651 |

| Supported Language | English |

| Website Language | English |

| Physical Address | Not mentioned |

FX5789574411

Hong Kong

When I logged in ELAN FINANCIAL today,I found that the withdrawal was unavailable.I contacted them by QQ,no one responded,as well as the customer service line.

Exposure

FX3189879582

Hong Kong

ELAN FINANCIAL has absconded.Unable to withdraw.Is there any reliable Future platform?

Exposure

月是故乡明

Hong Kong

The customer service disappeared.I am so sad for having traded for more than 2 years.Does the credit exist in the society?

Exposure

FX1565211327

Nigeria

ELAN FINANCIAL has become non-operational for almost two months now, with no withdrawal options and no customer support available. Despite the platform's apparent issues, finding negative news online is surprisingly difficult. I'm unable to retrieve my funds, and there's no information or progress on the situation. It's a concerning experience with no clear resolution in sight.

Neutral

江山81617

Hong Kong

More than a year ago, ELAN FINANCIALI cheated me of nearly 300,000, which were partly saved from my salaries and partly lent from my credit cards, making me break the bank. But the platform is still on the run. I am so worried about my money. Those cheaters deserve a gruesome death.

Exposure

QIAO

Hong Kong

Their platform is down, but the website is still accessible. All their people is missing. How can I recover my loss?

Exposure

QIAO

Hong Kong

I found basically not much negative comments on the Internet about them. I can still access their website, but I just can’t withdraw.

Exposure

FX6589696176

Hong Kong

I’ve got all my family fortune in it. They won’t let us withdraw. My QQ number is 1004523945.

Exposure

月是故乡明

Hong Kong

Get them!

Exposure

良胤

Hong Kong

The withdrawal in ELAN FINANCIAL hasn’t been received yet.No one answers the service line.

Exposure

FX8079982023

Hong Kong

Innocents,don’t be cheated.No one deals with the deposit and withdrawal.So sad.

Exposure