General Information of FX Corp

FX Corp is a regulated financial services provider offering a range of foreign exchange solutions to individuals and businesses. With its headquarters in Sydney, Australia, the company operates under the regulatory oversight of the Australia Securities & Investment Commission (ASIC).

For individuals, FX Corp facilitates international payment services for various purposes, including real estate transactions, luxury goods purchases, investments, inheritance management, overseas income handling, and mobile payments. Their goal is to provide efficient and secure solutions for conducting international transactions in these areas.

For businesses, FX Corp specializes in commercial foreign exchange services, catering to diverse industries. Whether it's a small online retailer or a growing global company, FX Corp aims to streamline payment processes and provide tailored solutions to meet their specific needs. The company's expert team works closely with businesses, enhancing their foreign exchange capabilities and offering valuable insights for successful expansion into new markets.

FX Corp offers a range of foreign exchange products to align with businesses' goals and requirements. These include spot contracts, which involve immediate purchase or sale of foreign exchange at prevailing rates, and forward exchange contracts (FECs), which allow businesses to lock in exchange rates for future dates to manage currency risk.

Customer support at FX Corp is available through phone communication, and their office in Sydney serves as a physical location for face-to-face interactions when needed.

While FX Corp is regulated and holds a license from ASIC, it's important for potential clients to consider the associated risk alert and conduct thorough research before engaging with the company.

Pros and Cons

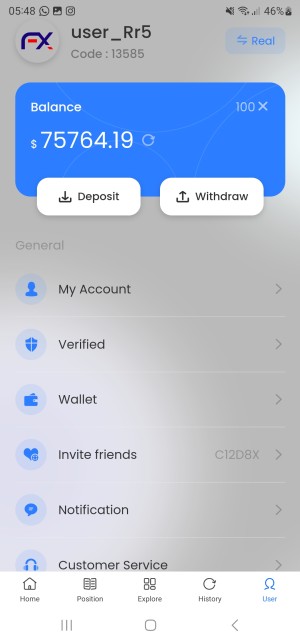

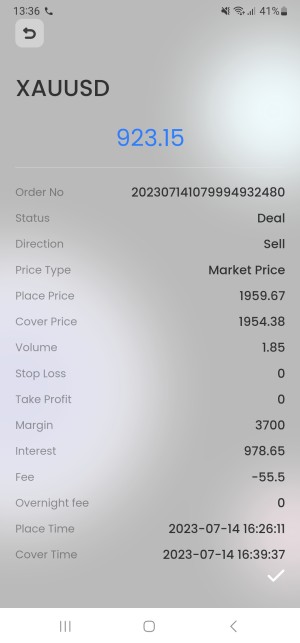

FX Corp, a regulated financial services provider based in Australia, offers international payment services and foreign exchange solutions to individuals and businesses. While the company has certain advantages, it's essential to consider the associated risks and drawbacks. One of the pros of FX Corp is its legitimacy as a regulated entity under the Australia Securities & Investment Commission (ASIC), providing a level of trust and compliance with industry regulations. Additionally, the company offers competitive exchange rates, low transaction fees, and convenient international money transfer services. However, there are some cons to consider. Firstly, there is a risk alert associated with FX Corp, indicating potential risks and a negative field survey review. Moreover, the available information suggests a lack of functional trading software. Traders should exercise caution, conduct thorough research, and consider alternative options before engaging with this broker.

Here is a table summarizing the pros and cons of FX Corp:

Is FX Corp Legit?

FX Corp Pty Ltd, also known as FX Corp, is a regulated entity. It is regulated by the Australia Securities & Investment Commission (ASIC) in Australia. The company holds a full license under the authority of ASIC with the license number 459050. The license was granted to FX Corp Pty Ltd on October 30, 2014.

The regulatory status confirms that FX Corp Pty Ltd operates under the regulations and oversight of ASIC, ensuring compliance with the applicable rules and regulations in the financial industry.

However, it is important to note that there is a risk alert associated with this broker. The risk alert indicates that the broker has received one negative field survey review, which raises concerns about potential risks and the possibility of a scam. Additionally, the current information suggests that the broker does not have a trading software.

Traders should exercise caution and conduct thorough research before engaging with this broker. It is advisable to assess the risks involved and consider alternative options based on the available information and personal circumstances.

How to open and Account?

To open an account with FX Corp, follow these steps:

1. Visit the FX Corp website and locate the “OPEN ACCOUNT” button.

2. Click on the button to initiate the account opening process.

3. You will be directed to a form that needs to be completed.

4. Fill in your personal details, including your name (first name and last name), company (if applicable), website (if applicable), email address, and phone number.

5. Optionally, you may provide additional comments or information relevant to your account opening.

6. If you wish to receive updates and information from FX Corp, you can choose to subscribe to their mailing list.

7. Once you have entered all the required information, review the details for accuracy.

8. Click on the submit or send button to complete the form.

9. A Relationship Manager from FX Corp will be in touch with you shortly to guide you through the remaining steps of the account opening process.

International Money Transfers

FX Corp's international transfer service is available in 60 currencies for over 80 international/regional locations worldwide, with payments to most countries/regions taking 1-2 business days. There are two most common payment networks in the global payments arena, the SWIFT and the Automated Clearing House (ACH), with the former requiring a $60 transaction fee.

Commercial

FX Corp offers commercial foreign exchange solutions for businesses operating in various industries, ranging from small online retailers to fast-growing global companies. They understand the challenges faced by businesses expanding geographically and aim to provide tailored and modernized payment processes to meet their needs.

To support businesses in achieving their goals, FX Corp operates at the forefront of the foreign exchange services landscape. They have extensive experience working with businesses in different industries, similar to the ones they serve. By leveraging their expertise, FX Corp can enhance and improve the existing setup of businesses, helping them optimize their foreign exchange capabilities.

FX Corp's dedicated relationship managers play a crucial role. These managers keep businesses updated on the latest developments in foreign exchange and ensure that their FX capabilities remain adaptable to changing market conditions. They offer insights, advice, and support that are critical for the success of businesses' expansion plans into new markets.

FX Corp Personal

FX Corp provides international payment services for individuals buying and selling real estate, buying and selling luxury goods, investments, inheritance, overseas income, mobile, etc. The personal services offered by FX Corp focus on providing international payment solutions for individuals. These services cater to various needs such as buying and selling real estate, buying and selling luxury goods, managing investments, handling inheritances, managing overseas income, and facilitating mobile payments. FX Corp aims to assist individuals in efficiently and securely conducting international transactions related to these areas.

FX Corp Products

FX Corp offers a range of foreign exchange products to align with businesses' specific goals and requirements. These products can be utilized simultaneously for different projects based on factors such as profit margin or time to completion. It is important for finance teams, who often face time constraints and pressure to meet reporting and accounting deadlines, to carefully consider FX transactions and products.

FX Corp specialists are available to assist finance teams in selecting suitable FX products while ensuring they can manage their other responsibilities effectively. By leveraging FX Corp's resources and experience, businesses can choose products that maximize their chances of success and minimize the impact of unfavorable currency movements.

Spot Contracts: One of the basic and commonly used FX products is the spot contract. Spot payments involve a binding obligation to buy or sell a specific amount of foreign exchange for fast delivery. These transactions are conducted at the prevailing live spot rate and typically settle within two business days.

Forward Exchange Contracts (FECs): FX Corp also offers forward foreign exchange contracts (FECs), which allow businesses to “lock in” an exchange rate for a specific date in the future. The forward rate for an FEC is calculated based on the current spot rate, time to maturity, and the interest rate differential between the two currencies involved. FECs provide businesses with greater certainty for forecasting costs or profits without the need to pre-purchase currency and deplete their cash flow. While a deposit may be required, the full payment of the contract amount is not necessary until the maturity date.

Customer Support

FX Corp provides customer support through various channels. The primary contact method is through phone, and customers can reach their customer support team at the phone number 02 8076 9535. This phone support allows customers to directly communicate with FX Corp's representatives to address their inquiries, concerns, or seek assistance regarding their services.

Additionally, FX Corp has a physical office located in Sydney, Australia. The office is situated at Level 14, 1 Castlereagh Street, Sydney, NSW, 2000. Customers can visit the office in person if they prefer face-to-face interactions or have specific needs that require an in-person meeting.

Conclusion:

In conclusion, FX Corp Pty Ltd offers international payment services and foreign exchange solutions to businesses and individuals. As a regulated entity, it operates under the oversight of the Australia Securities & Investment Commission (ASIC), providing a level of legitimacy. However, it is important to note the risk alert associated with this broker, indicating potential risks and a lack of functional trading software. While FX Corp offers competitive exchange rates, low transaction fees, and convenient international money transfer services, traders should exercise caution, conduct thorough research, and consider alternative options before engaging with this broker.

FAQs

Q: Is FX Corp a legitimate broker?

A: Yes, FX Corp is a regulated entity and holds a full license from the Australia Securities & Investment Commission (ASIC).

Q: How can I open an account with FX Corp?

A: To open an account, visit the FX Corp website and click on the “OPEN ACCOUNT” button. Fill out the required form with your personal details, and a Relationship Manager will contact you to guide you through the rest of the process.

Q: What international money transfer services does FX Corp offer?

A: FX Corp provides international money transfer services in 60 currencies to over 80 international and regional locations. They offer competitive exchange rates, low transaction fees, and the option to pay in local currency.

Q: What products does FX Corp offer for businesses?

A: FX Corp offers spot contracts and forward exchange contracts (FECs) as foreign exchange products for businesses. Spot contracts involve fast delivery of foreign exchange at the prevailing spot rate, while FECs allow businesses to lock in an exchange rate for future transactions.

Q: What services does FX Corp offer for individuals?

A: FX Corp provides international payment solutions for individuals, including services for buying and selling real estate, luxury goods, investments, handling inheritances, managing overseas income, and facilitating mobile payments.

Q: How can I contact FX Corp for customer support?

A: You can reach FX Corp's customer support team by phone at 02 8076 9535. They also have a physical office located at Level 14, 1 Castlereagh Street, Sydney, NSW, 2000.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX