Score

ICE

United States|5-10 years|

United States|5-10 years| https://www.theice.com/index

Website

Rating Index

Influence

Influence

A

Influence index NO.1

Italy 6.64

Italy 6.64Surpassed 13.68% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+1 770 738 2101

Other ways of contact

Broker Information

More

Intercontinental Exchange, Inc.

ICE

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed ICE also viewed..

XM

MultiBank Group

MiTRADE

Decode Global

ICE · Company Summary

| ICE Review Summary | |

| Founded | 5-10 years |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Services & Products | Exchanges & clearing houses, fixed income & data services, sustainable finance and so on |

| Customer Support | (24h) Phone, Twitter, Instagram |

What is ICE?

ICE (Intercontinental Exchange) is a leading provider of markets. One area of expertise for ICE is in the fixed income market. ICE also offers efficient trading technology with multiple protocols and solutions to meet trading and risk management needs. In addition, ICE recognizes the need for lenders to scale, increase efficiency, expand capacity, improve communications, and simplify the loan workflow experience.

It is worth noting that ICE has been operating for 5-10 years and is registered in the United States. However, it is important to be aware that ICE is currently unregulated.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros of ICE:

- Global Presence: ICE has a global reach, allowing traders from various regions to access its services and products.

- A Range of Services and Products: ICE offers a diverse set of financial market services and products including exchanges & clearing houses, fixed income & data services, sustainable finance and so on, providing traders with a wide array of options to choose from.

- Personalized Support: ICE provides personalized support with many phone lines for different services, which can be beneficial for traders who require tailored assistance.

Cons of ICE:

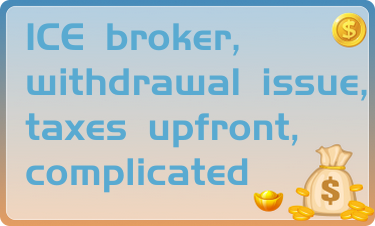

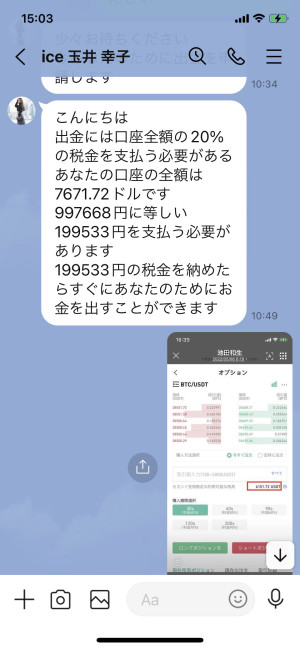

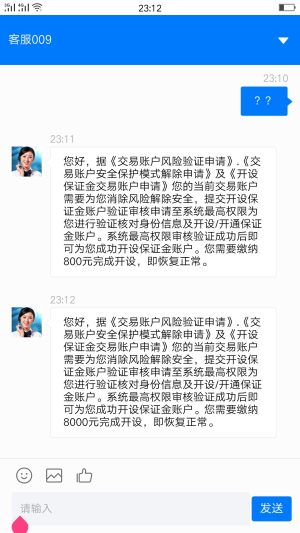

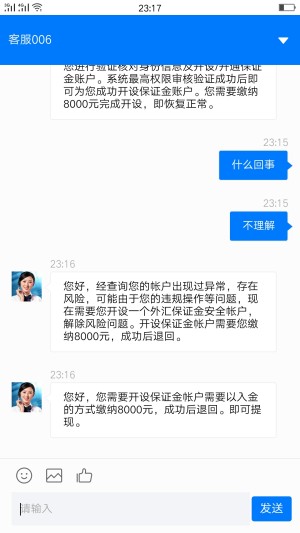

- Reports of Unable to Withdraw: There have been reports of difficulties related to withdrawing funds from ICE, indicating potential issues with the platform's financial processes.

- Unregulated: As an unregulated entity, ICE poses increased risks for traders due to the lack of oversight and consumer protection measures.

- Complex Fee Items: ICE's fee structure contains complex or difficult-to-understand items, potentially leading to confusion for traders.

- Unclear Trading Conditions: The trading conditions, including spreads, commissions, and swaps, are not transparent, which could make it challenging for traders to fully understand the costs and risks associated with their trades.

Is ICE Safe or Scam?

ICE currently has no valid regulation. This can lead to confusion and potential abuses, as there are no clear boundaries and limits on what ICE can and can not do. It also raises concerns about accountability and transparency, as ICE perate without sufficient checks and balances in place.

If you are considering investing with ICE, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Services & Products

ICE (Intercontinental Exchange) offers a wide range of services and products across various sectors of the financial industry.

- Exchanges & Clearing Houses: ICE operates numerous exchanges and clearing houses globally, facilitating the trading and clearing of a wide range of financial instruments such as equities, futures, options, and commodities.

- Fixed Income & Data Services: ICE provides fixed income trading platforms and data services, offering market participants access to bond and other fixed income securities. They also provide data and analytics to help clients make informed investment decisions.

- Sustainable Finance: ICE offers services and data related to sustainable finance, including sustainability indices, environmental markets, and sustainability data. They aim to support environmentally conscious investing and contribute to the transition to a sustainable global economy.

- Mortgage Technology: ICE Mortgage Technology offers solutions and platforms that streamline and automate the mortgage industry. This includes mortgage data and analytics, as well as tools for managing the mortgage rate lock process.

- Benchmark Administration: ICE is involved in price benchmark administration, ensuring the accuracy and integrity of various financial benchmarks widely used in the industry.

- Climate Solutions & Energy Transition: In response to the growing focus on climate change, ICE offers solutions and products that enable market participants to engage in climate-related markets, such as carbon credits and renewable energy certificates.

It's important to note that this is just a brief introduction of their services and products. To learn the details, it is advisable to look through the official website.

Fees

Trading fees are charged by ICE for executing trades on the exchange. These fees vary based on the product and region in which trading takes place. For example, ICE Futures Europe charges a per-contract fee for trading futures, while ICE Futures U.S. charges a tiered fee based on the volume of trades. Clearing fees are also charged by ICE, and these fees cover the cost of processing and settling trades. Again, the fees charged for clearing depend on the product and region.

Traders can click: https://www.ice.com/fees to learn each fee items.Itis critical for traders to stay up-to-date with any changes to ICE fees, which will affect their profitability and overall trading strategy.

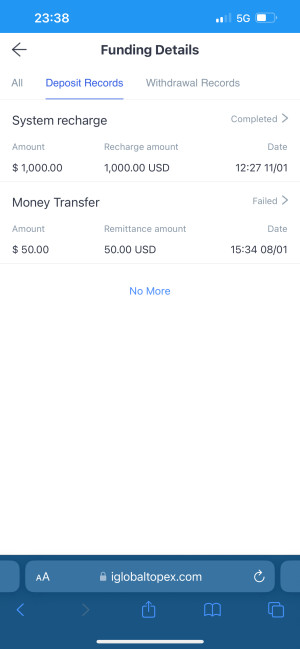

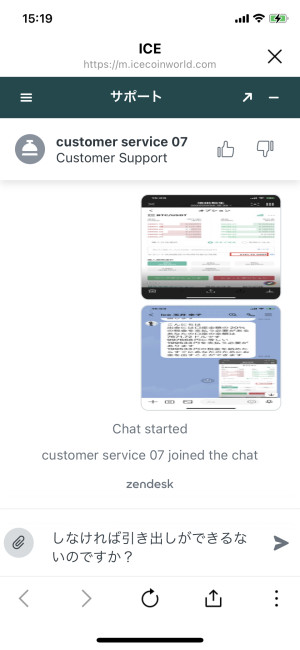

User Exposure on WikiFX

Visitors to our website can access reports of withdrawal difficulties. Traders are advised to thoroughly examine the accessible data and evaluate the risks linked to trading on an unregulated platform. Prior to engaging in trading activities, it is recommended to utilize our platform to gather relevant information. If you encounter fraudulent brokers or have been impacted by such entities, please notify us in the Exposure section. Your input is valued, and our team of specialists will make every effort to address the issue on your behalf.

Customer Service

ICE offers offers various service lines according to different services and function. Traders also can click: https://www.ice.com/contact to contact them in a specific purpose.

For example, customers can get in touch with customer service lines using the information provided below:

Telephone: +1 770 738 2101 or +1 312 945 5800

Moreover, clients could get in touch with this broker through the social media, such as Twitter and Instagram.

Conclusion

In brief, ICE is a global financial market operator that provides markets for investing, managing risk, and raising capital across major asset classes.

As for the safety of ICE, it is crucial to exercise caution as an unregulated entity. While ICE provides sophisticated technology and market solutions, it is generally advisable to conduct thorough due diligence and consider the potential risks before engaging in any financial activities.

Frequently Asked Questions (FAQs)

| Q 1: | Is ICE regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at ICE? |

| A 2: | You can contact via phone, +1 770 738 2101 or +1 312 945 5800, Twitter, Instagram and so on. |

| Q 3: | What services and products ICE provides? |

| A 3: | It provides exchanges & clearing houses, fixed income & data services, sustainable finance and so on. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now