Company Summary

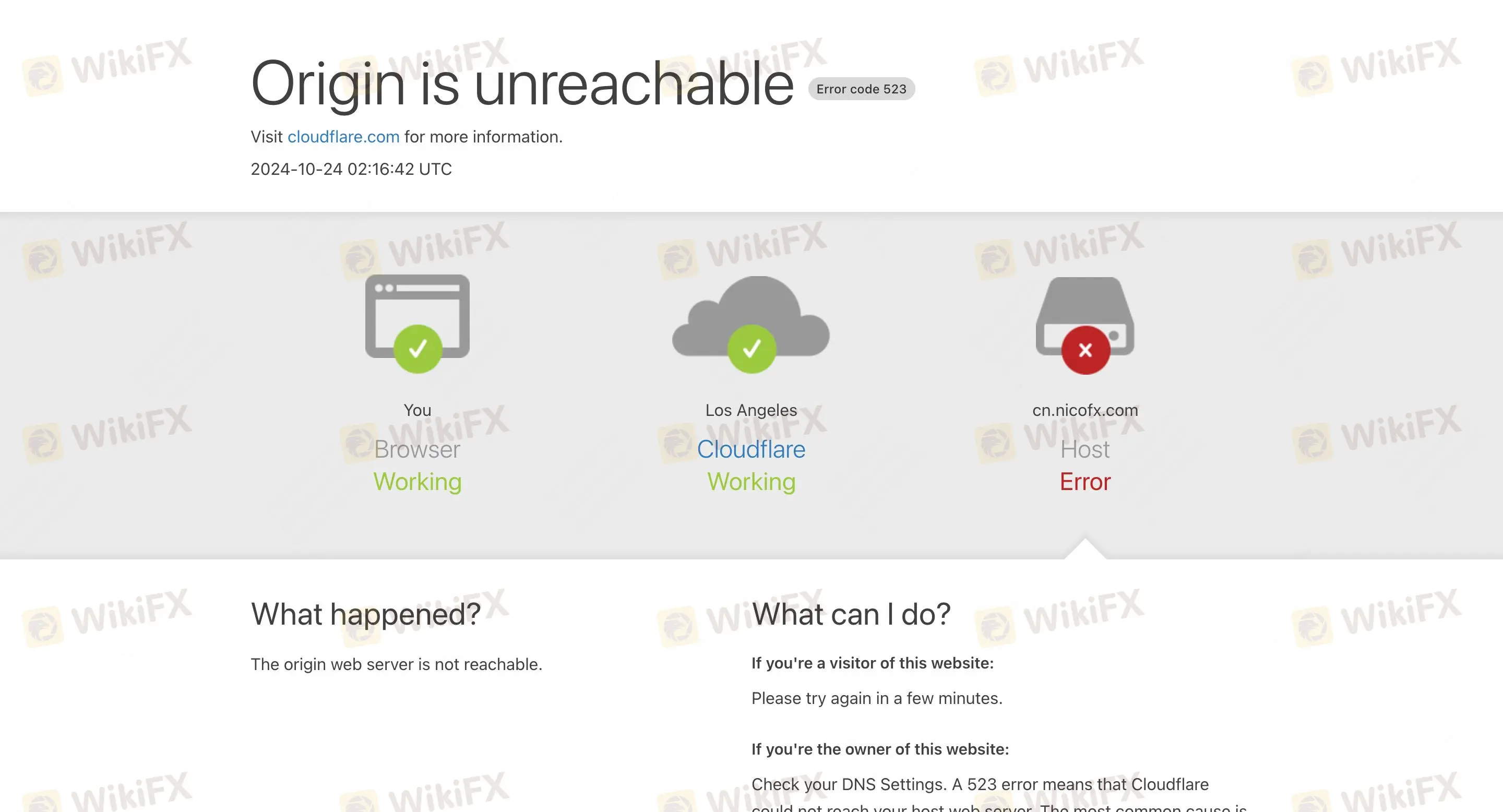

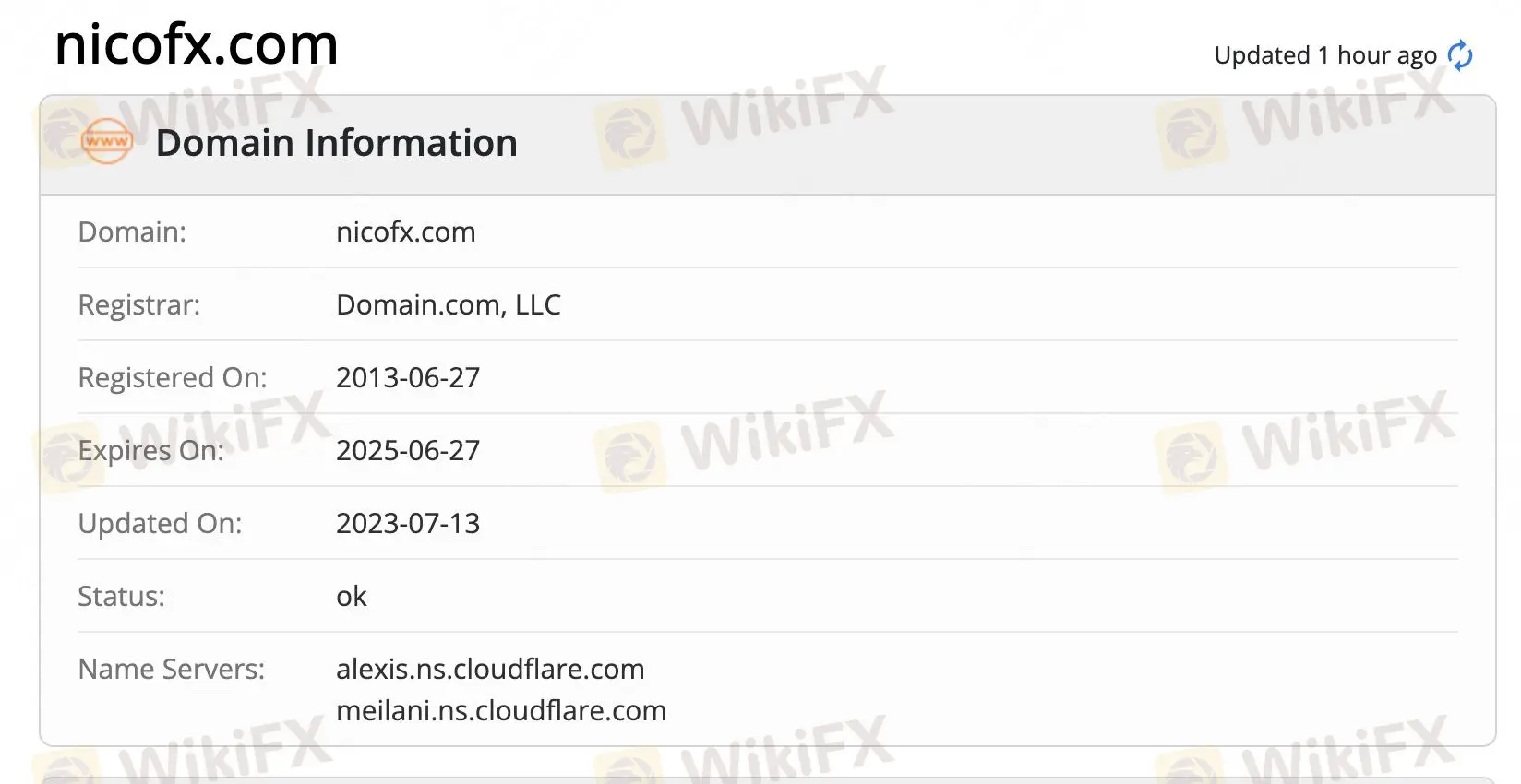

Note: NICOFXs official website: https://cn.nicofx.com/en/index.html is currently inaccessible normally.

| NICOFXReview Summary | |

| Founded | 2013 |

| Registered Country/Region | United Kingdom |

| Regulation | CySEC (Cyprus Securities and Exchange Commission) |

| Market Instruments | Precious metals (gold, silver, platinum, palladium), Forex currency pairs |

| Demo Account | ❌ |

| Leverage | Up to 1:30 |

| Spread | Variable spreads based on market conditions |

| Trading Platform | MT4 Margin WebTrader |

| Min Deposit | $100 |

| Customer Support | Phone: 35724020288 |

| Email: cn.support@nicofx.com | |

NICOFX Information

NICOFX, founded in 2013, is an established brokerage registered in the United Kingdom. The trading instruments it provides cover Precious metals and Forex. But currently its website is unreachable.

Pros and Cons

| Pros | Cons |

| Diversified trading products | Unreachable website |

| Support MT4 | Office in Cyprus Does Not Exist |

| 3 types of accounts |

Is NICOFX Legit?

It is clear that NICOFX is regulated by the Cyprus Securities and Exchange Commission (CySEC), holding a license of 226/14. (Regulated)

NICOFX is also regulated by Financial Conduct Authority (FCA) in United Kingdom, holding a license of 672844(Unsubscribed).

In Germany, NICOFX is regulated by Federal Financial Supervisory Authority. The license number is 142143 (Revoked).

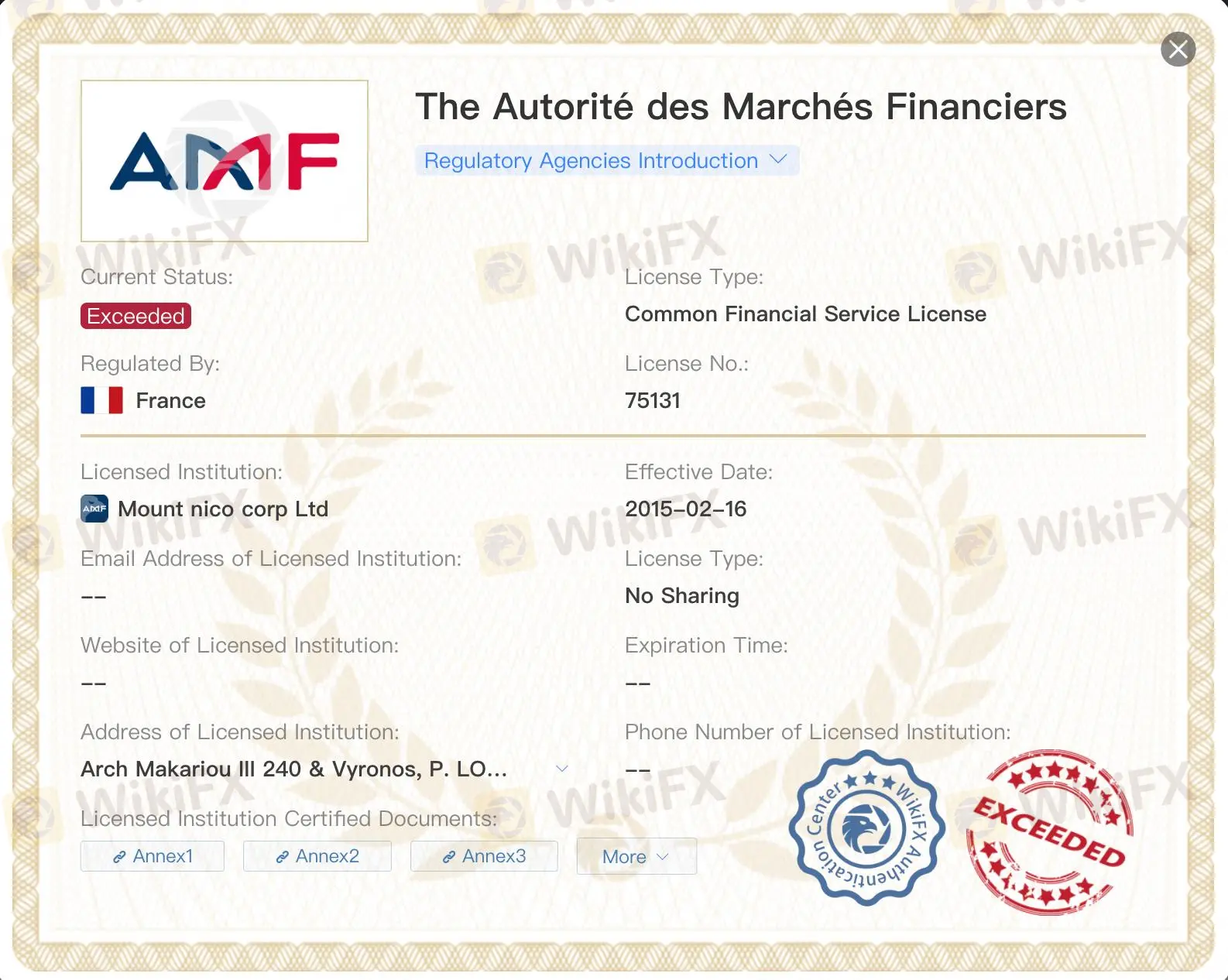

In France, NICOFX is regulated by The Autorité des Marchés Financiers (AMF). The license number is 75131 (Exceeded).

What Can I Trade on NicoFX?

NicoFX offers traders the opportunity to trade Precious metals (gold, silver, platinum, palladium), Forex currency pairs. However, Stocks, ETFs, funds and bonds are not accessible.

| Tradable Instruments | Supported |

| Precious metals | ✔ |

| Forex currency pairs | ✔ |

| Stocks | ❌ |

| ETFs | ❌ |

| Funds | ❌ |

| Bonds | ❌ |

Account Types

NicoFX offers three trading accounts: the Standard Account (minimum deposit of $100), the Premium Account (minimum deposit of $5,000), and the VIP (minimum deposit of $10,000).

| Account Types | Standard | Premium | VIP |

| Minimum Deposit | $100 | $5,000 | $10,000 |

| Max Leverage | 1:30 | 1:30 | 1:30 |

| Spread Type | Variable | Variable | Variable |

NicoFX Fees

NicoFX claims to offer low and variable spreads, but does not give specific information.

Trading Platform

NicoFX's trading platform is MT4 Margin WebTrader, which supports traders on the web and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 Margin WebTrader | ✔ | Web, Mobile | Beginner |

| MT5 | ❌ |

Deposit and Withdrawal

The broker supports four payment methods: VISA, bitcoin, mastercard and WIRE TRANSFER. In addition, its minimum deposit requirement is $5,000.

Deposit Options

| Deposit Options | Fees | Processing Time | Exchange Rate |

| Bank Transfer | No specific fee mentioned | 2-5 working days | current exchange rate |

| Union Pay | 1% | 1-4 working days | current exchange rate |

| Visa | 2.4% | Instant | current exchange rate |

| Mastercard | 2.4% | Instant | current exchange rate |

| Skrill | 3.85% | Instant | current exchange rate |

| JCB | 5.85% | Instant | current exchange rate |

| Amex | 5.85% | Instant | current exchange rate |

Withdrawal Options

| Withdrawal Options | Fees | Processing Time | Exchange Rate |

| Bank Transfer | $40 | 2-5 working days | current exchange rate |

| Union Pay | $20 | 1-4 working days | current exchange rate |

| Visa | 1% | 1 working day | current exchange rate |

| Mastercard | 1% | 1 working day | current exchange rate |

| Skrill | 1% | 1 working day | current exchange rate |

| JCB | 1% | 1 working day | current exchange rate |

| Amex | 1% | 1 working day | current exchange rate |