No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

The WikiFX Score of this broker is reduced because of too many complaints!

Ring Financial

China | 5-10 years |

China | 5-10 years | Suspicious Regulatory License | Suspicious Scope of Business | High potential risk

https://ring-forex.com/

Website

Rating Index

Contact

+44 7846150132

https://ring-forex.com/

The WikiFX Score of this broker is reduced because of too many complaints!

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

3

Basic Information

Registered Region  China

China

China

China Operating Period

5-10 years

Company Name

Ring Forex Ltd

Customer Service Email Address

services@ring-forex.com

Contact Number

+447846150132

Company Website

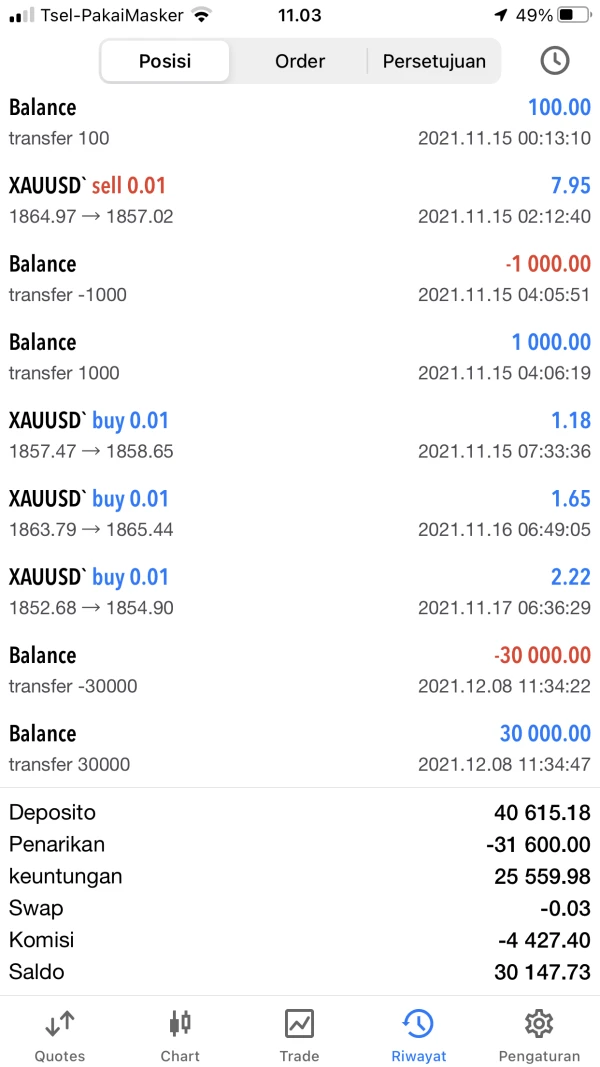

40

Account

Website

Comment

Account

- Environment--

- Currency--

- Maximum Leverage1:200

- SupportedEA

- Minimum Deposit$ 1,000

- Minimum Spread--

- Depositing Method--

- Withdrawal Method--

- Minimum Position0.01 lot

- Commission--

- ProductsForeign exchange, commodities, CFDs

Updated:

Users who viewed Ring Financial also viewed..

VT Markets

8.68

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

VT Markets

Score

8.68

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

FXCM

9.40

Score Above 20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

FXCM

Score

9.40

Above 20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

XM

9.10

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

XM

Score

9.10

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

GTCFX

9.23

Score ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

GTCFX

Score

9.23

ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

Official Website

Website

ring-forex.com

8.210.12.194Server LocationHong Kong

ICP registration--Most visited countries/areas--Domain Effective Date--Website--Company--

User Reviews40

Scroll down to view more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 40

Write a comment

40

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

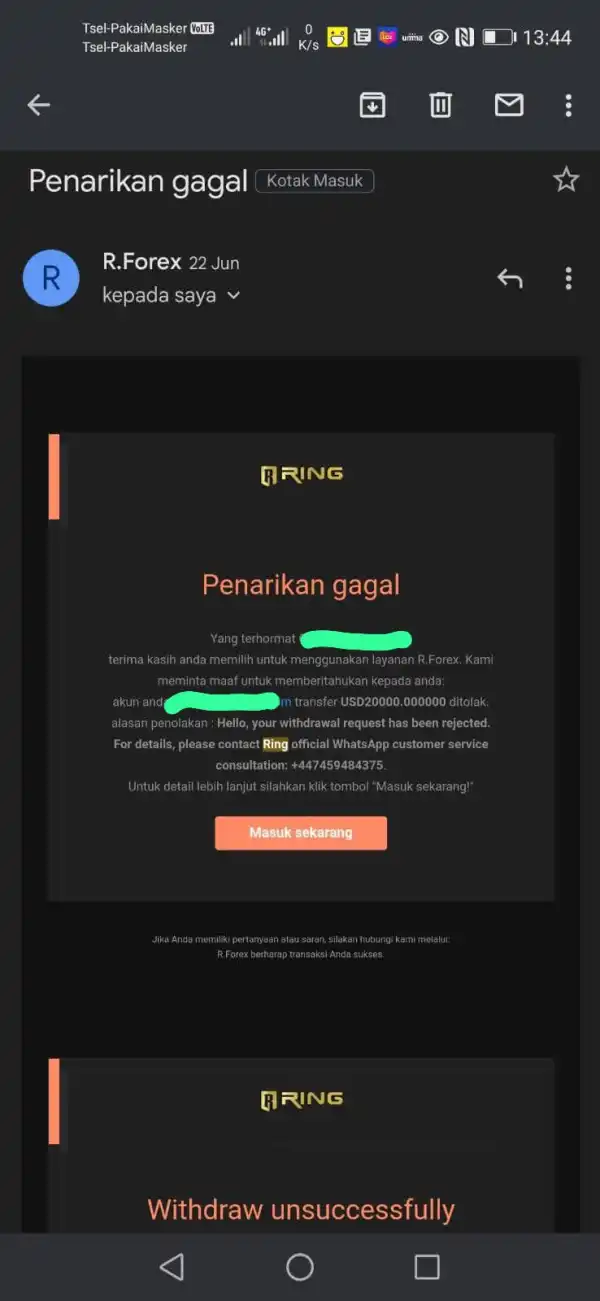

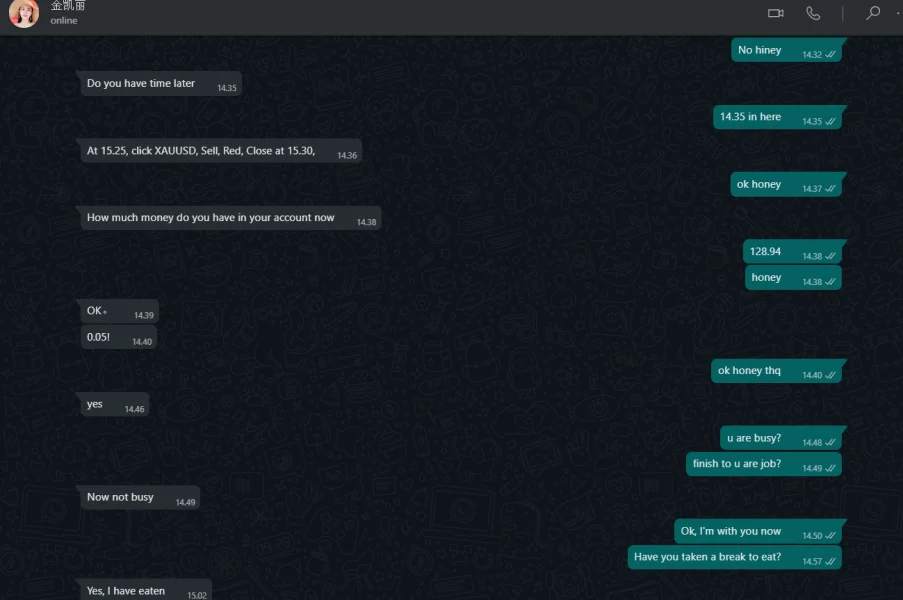

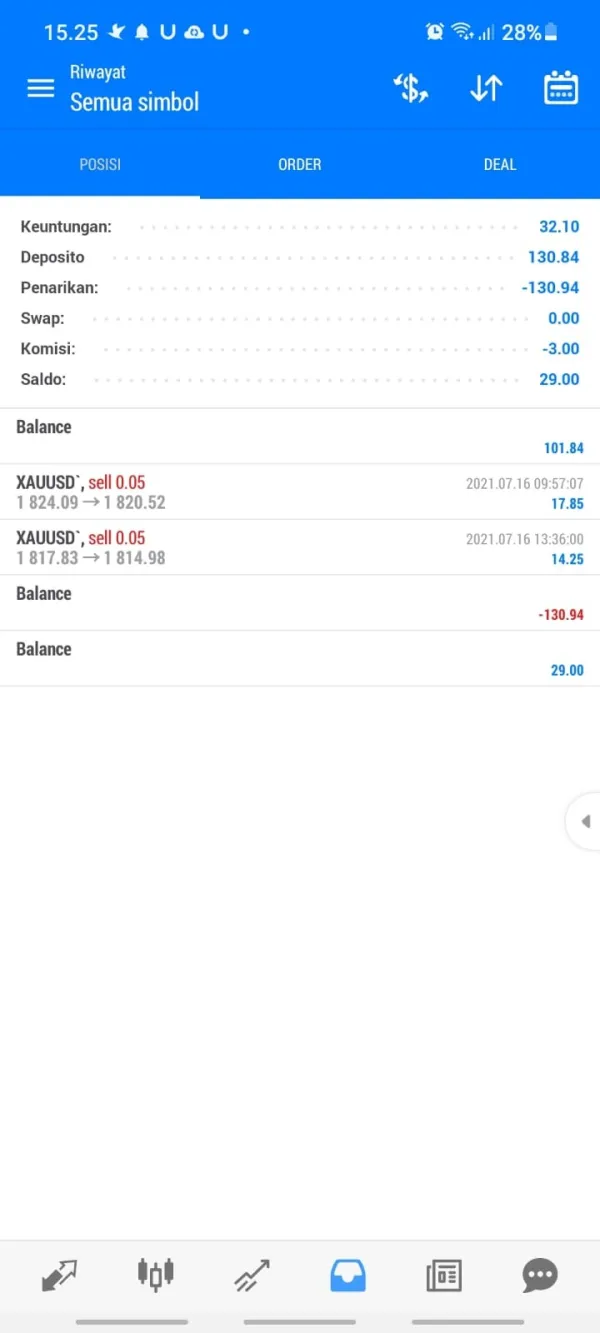

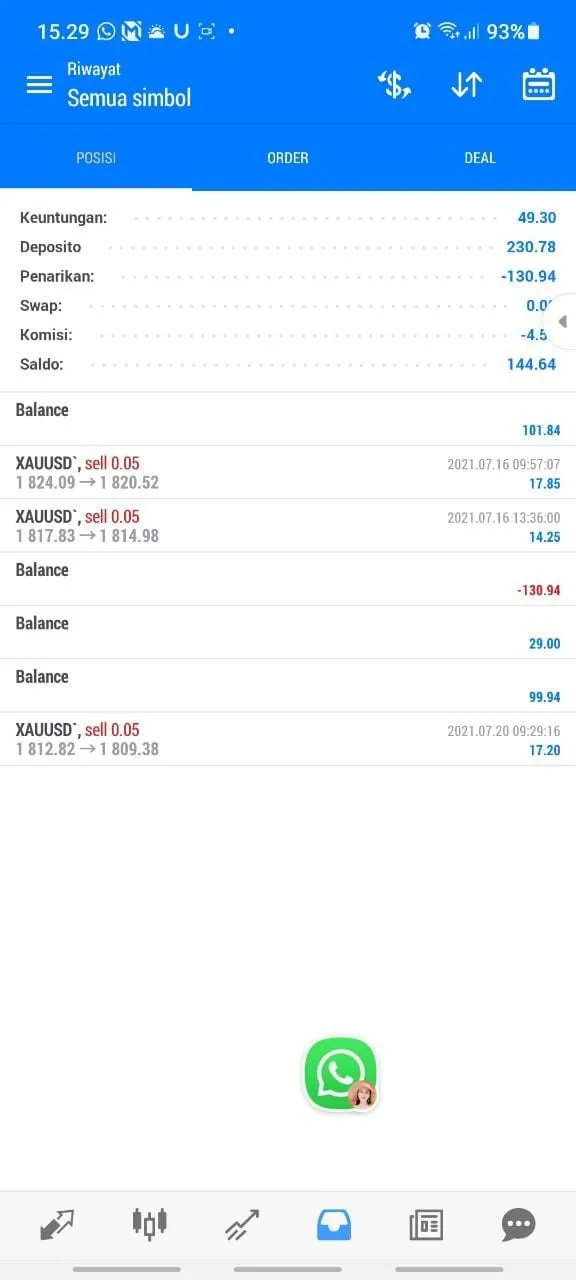

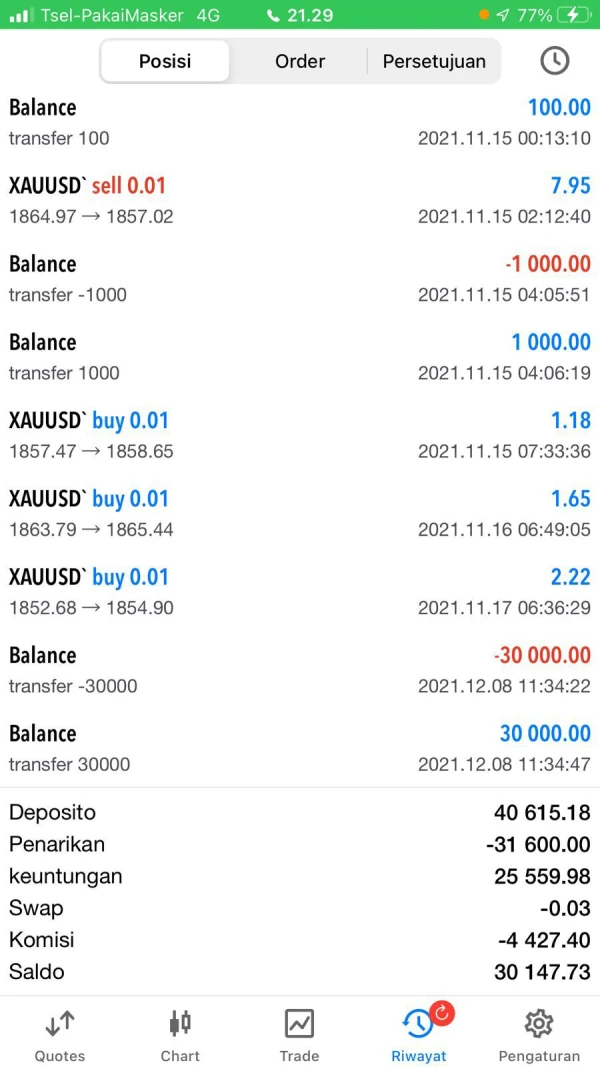

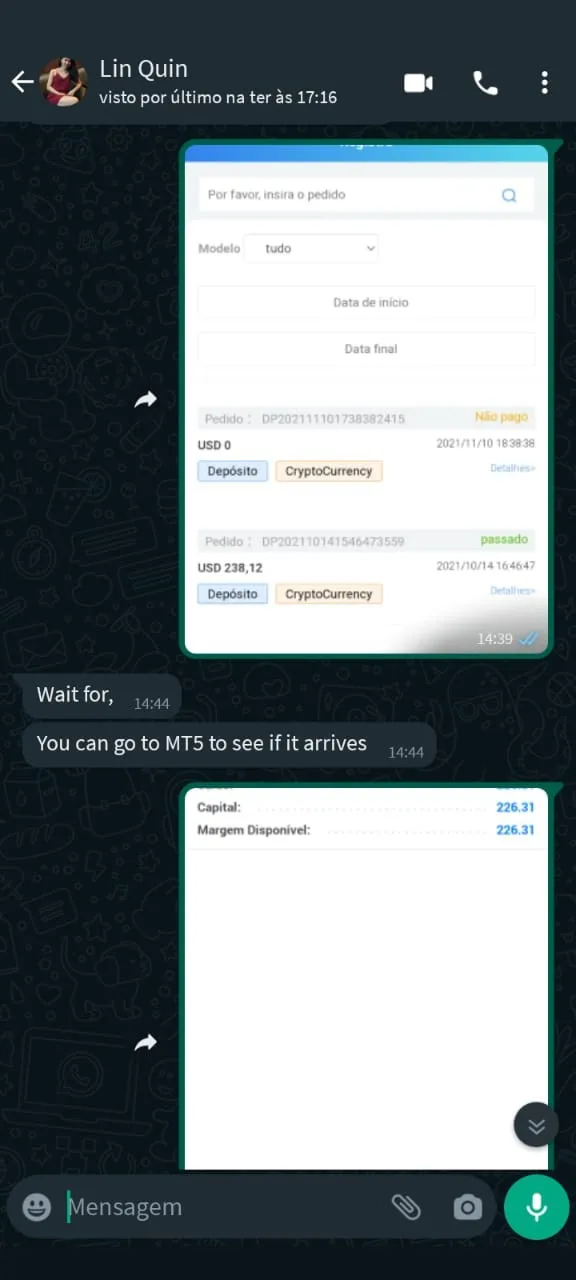

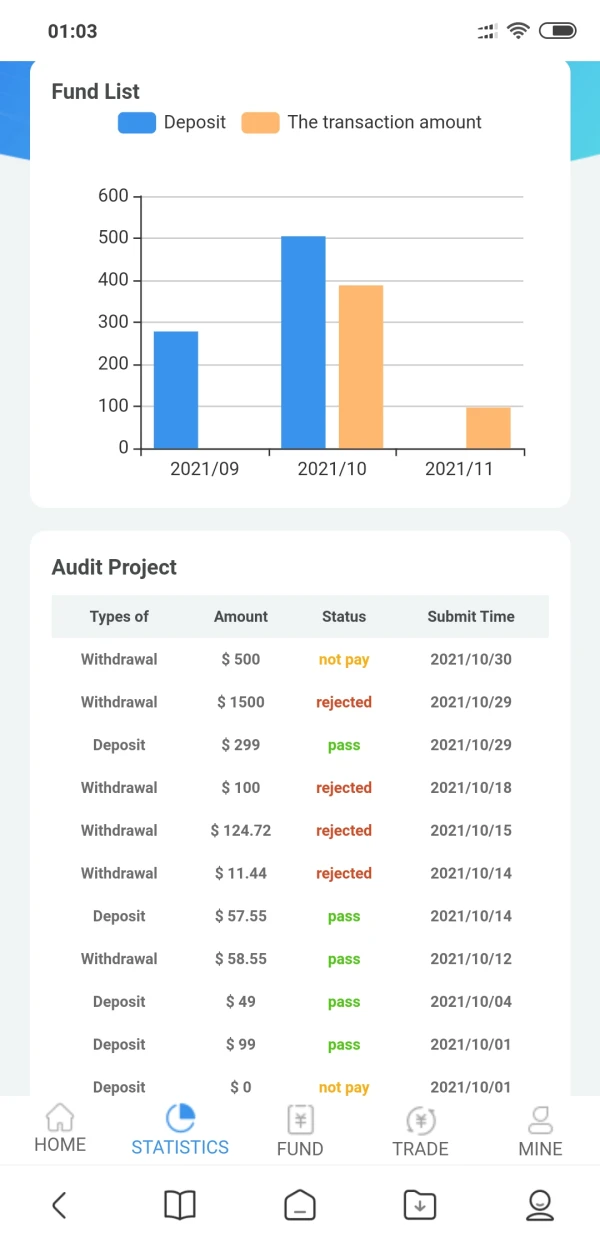

suki991

Indonesia

In the beginning, in 2021, I met an old friend with a Hong Kong girl and started dating with her. Her name is Kelly, asked her to enter the Ring, every transaction didn't matter. The money that came in was IDR 900,000,000 with a balance of IDR 3,150,000,000. At the end of the month I want to withdraw it, the account is blocked, the reason is asking for 20% tax. How can I get the money back to me?

Exposure

FX9623396722

Indonesia

My name is riky. I met a friend called Kelly Kim through Tinder. Before I used real account, I made sure that the demo account worked well for two attempts. I deposited $101, but was unable to withdraw. Then my account was blocked the next day.

Exposure

FX2928155622

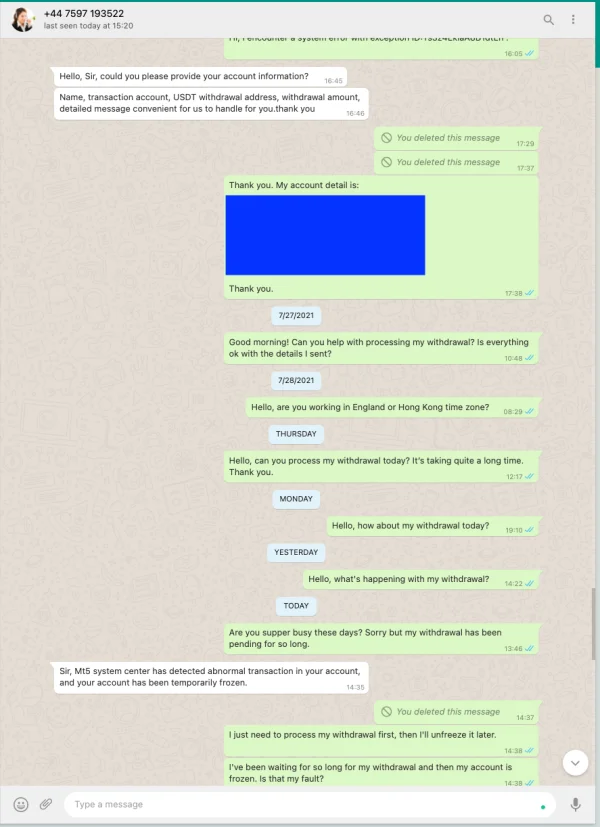

Finland

This is completely a fraud broker, I lost 2300 USD for it.ring-forex works by hunting in dating apps. Its women are very patient and skilled, they lure men to trust them, then they start talking about finance and promise everything and show all the benefits they got from ring-forex. Because they can manipulate the numbers in MT5, you will get a lot of money with a demo account. But when you start a real account, you may still win, BUT YOU CANNOT WITHDRAW. They will find all the reasons to not let you withdraw your balance, such as blaming you for abnormal transactions, blocking your account... Contact me if you need more details. If you know any international police that I can sue them, please tell me. Thanks!

Exposure

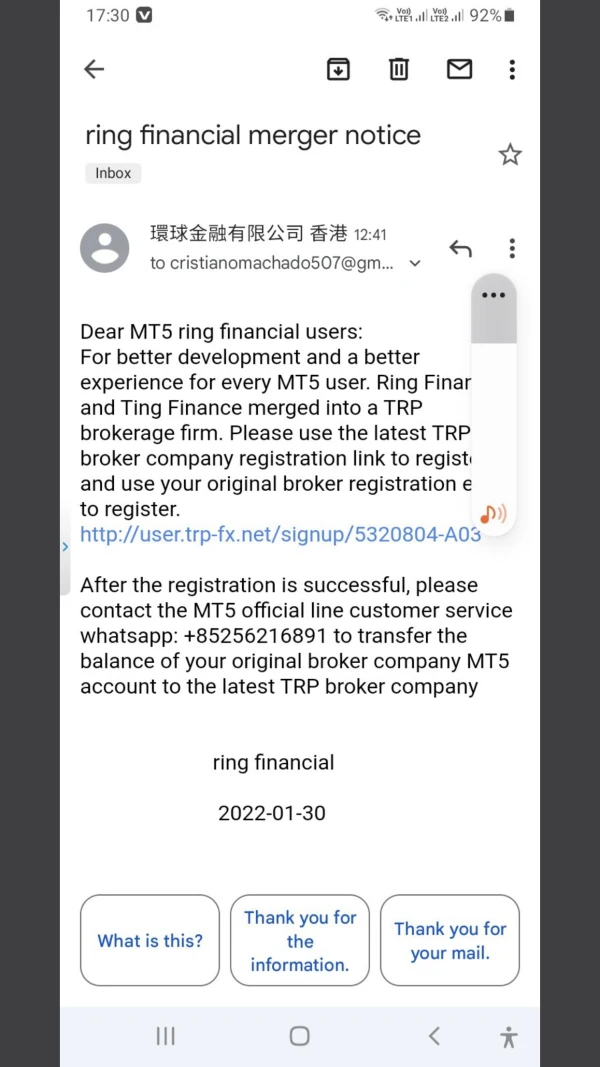

RFLS

Indonesia

They change their name to TRP. Never do transactions with them, they always cheat by changing names

Exposure

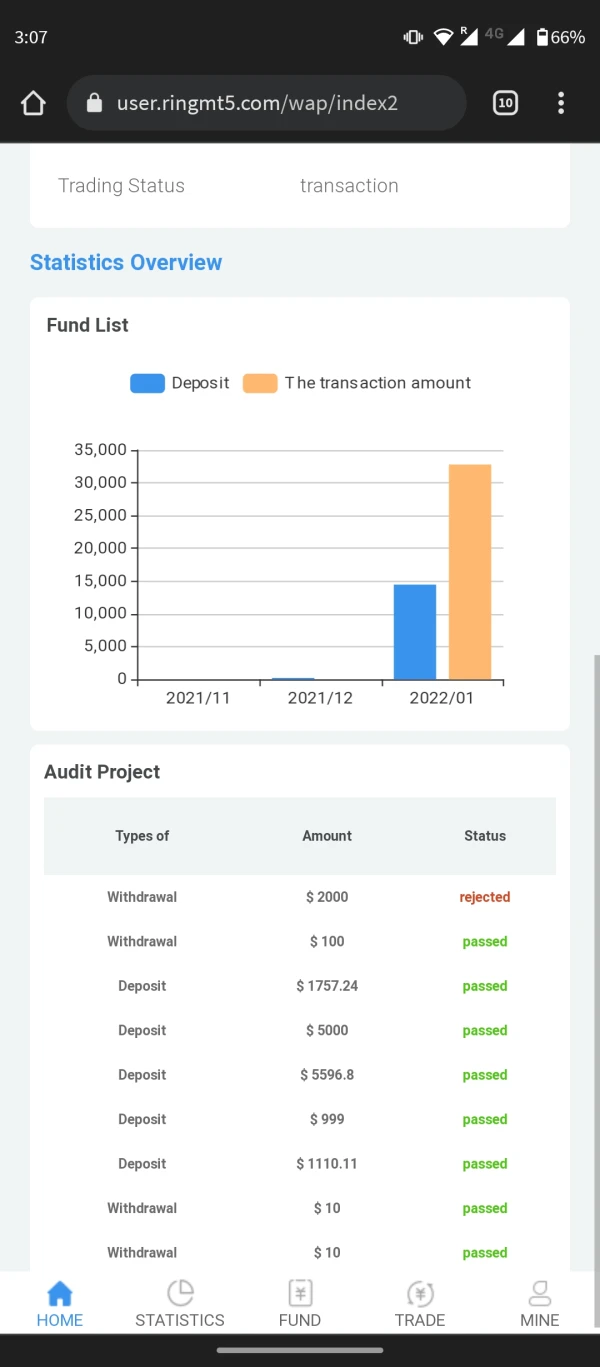

FX2184281673

India

This company is using scam artists from Hong Kong eg. Kelly who makes you invest more capital in your account. It allows small withdrawal initially like 100$ and when you need to withdraw more, they provide illogical reasons and reject your withdrawal by freezing your account. They ask you for more and more money to invest to make withdrawal possible which does not make sense. Please beware of such people and stay away from them. Don't fall for this trap.

Exposure

RFLS

Indonesia

No response and news from August 2021

Exposure

FX2123769171

Brazil

I was lucky that I had invested more. I really thought I was earning a lot, but I was losing what I had invested. I am youtuber from Brazil and I am influential on Instagram with more than 3 million followers. That showed why these types of people who do these things were willing to have a cheap life in big cutting-edge cities. People like that don't grow in life because their knowledge about life will be poorer and poorer. Today, I may have lost a little, but these people will lose a lot from now on. It is a tip

Exposure

budi hermawan

Indonesia

don't use and beware of this broker they used beauty women to increased your account after this your account is disabled and the company stolen money in your wallet she is a Thief beware guys

Exposure

budi hermawan

Indonesia

rings financial is scam application. beware of beautiful thief

Exposure

kuli receh

Indonesia

Even the victims of their deception, they still carry out extortion. They even doubt the credibility of Biance as the main funding channel of circular foreign exchange of their own choice. Then they will lead you to Amin, a fictional person like their agent, and then they will stop you.

Exposure

kuli receh

Indonesia

There is always a spread between 21.00 - 23.00 hours in the chart.

Exposure

kuli receh

Indonesia

Beware of this broker. Unable to withdraw.

Exposure

RFLS

Indonesia

They still ask for 30% of my total balance since they hold my balance from august 27th

Exposure

Arya

Indonesia

I can't withdraw my funds...my account and MT5 are blocked..please return my money

Exposure

hzk

Indonesia

They led users to transaction on Ring Financial Limited but rejected withdrawal. Stay away from it.

Exposure

FX1975281782

Indonesia

1. They find their prey by using female agents on dating apps (e.g: Tinder).2. The scam friends will play victims and try to make money as fast as possible then invites you using RING Financial limited.3. After several trades, she will ask you to increase the capital to get more money.4. She did this very smoothly and very patiently, even begging for mercy when she miscalculated the market and made us lose our assets.5. After several days, I tried to withdraw my money and contact the customer service.6. Customer service said if I need to pay 20% of my total balance because my profit has been reached 200%.7. 24 hours after they gave me that information, my account was frozen and I needed to pay an additional $500 to unfreeze the account.8. After paying 20% taxes my contact has been blocked from Ring Customer Service, and My account on MT5 is blocked and I can’t access it anymore. 9. In the end the customer service told me she is the same person with my scam friend and all my assets are gone.

Exposure

RFLS

Indonesia

My money was locked and they might take it away. There was only the number left in the system. I could only wait until it disappear.

Exposure

RFLS

Indonesia

Please return my money. They stole my investment.

Exposure

RFLS

Indonesia

They kept my balance for 2 months. Would it disappeared? Stay away from this broker.

Exposure

RFLS

Indonesia

They blocked customer service because of spams and rejected my withdrawal. It was the same broker like Ring FinancialLimited. Do not trust it.

Exposure

RFLS

Indonesia

They locked your investment on purpose without maintenance system. There was no system to store the investment. Do not rely on the online service which is a scam.

Exposure

RFLS

Indonesia

They have no customer service and closed all the social media. They cheated users and did not reply me from August 30, 2021. Because they asked for taxes and told me to wait for the review before withdrawal, my finally money lost.

Exposure

Hope Pray

Indonesia

Thief always command you to deposit , but you can't withdrawal ( She use that picture )

Exposure