Company Summary

| CVS Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Services | Investment Banking and Securities Finance Business |

| Demo Account | ❌ |

| Trading Platforms | China Vered Securities |

| Minimum Deposit | / |

| Customer Support | Phone: 852 3899-3900 |

| Email: info@veredsec.com | |

| Address: 24/F, China Taiping Tower,8 Sunning Road, Causeway Bay, Hong Kong | |

Founded in 2020, CVS (China Vered Securities), is a regulated financial institution based in Hong Kong. It provides services such as Investment Banking and Securities Finance Business via its China Vered Securities platform.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | Demo accounts unavailable |

| Various services | |

| Comprehensive contact channels | |

| Multiple supported devices for trading platforms |

Is CVS Legit?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| The Securities and Futures Commission (SFC) | China Vered Securities Limited | Dealing in futures contracts | BBK541 |

Services

CVS provides Investment Banking and Securities Finance Business for clients.

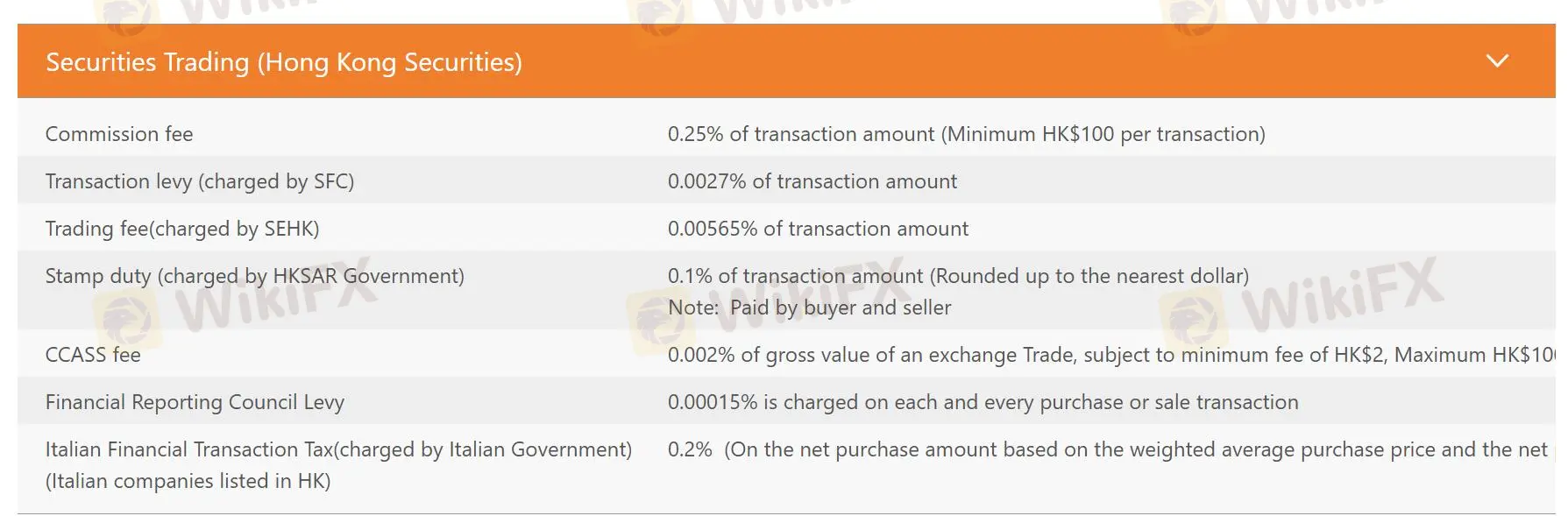

CVS Fees

CVS implements a commission fee about 0.25% of transaction amount (Minimum HK$100 per transaction). There are also other fees that you can find on the screenshot below.

Trading Platform

CVS offers China Vered Securities available through the Apple Trading app, Apple Security Code App, Android Trading App, Android Security Code APp, and Windows Download.

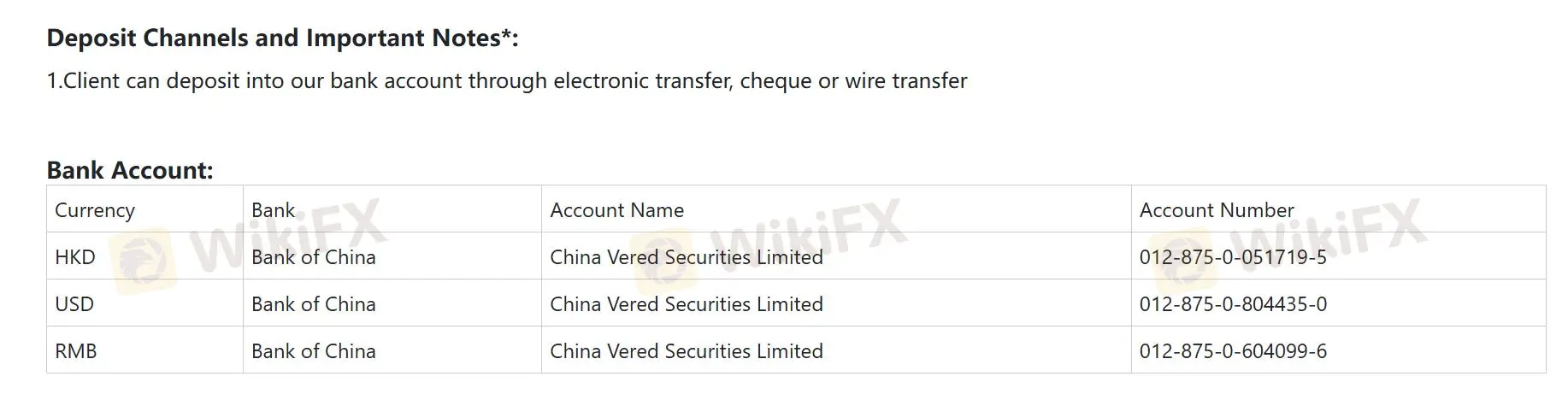

Deposit and Withdrawal

Deposit

| Currency | Bank | Account Name | Account Number |

| HKD | Bank of China | China Vered Securities Limited | 012-875-0-051719-5 |

| USD | Bank of China | China Vered Securities Limited | 012-875-0-804435-0 |

| RMB | Bank of China | China Vered Securities Limited | 012-875-0-604099-6 |

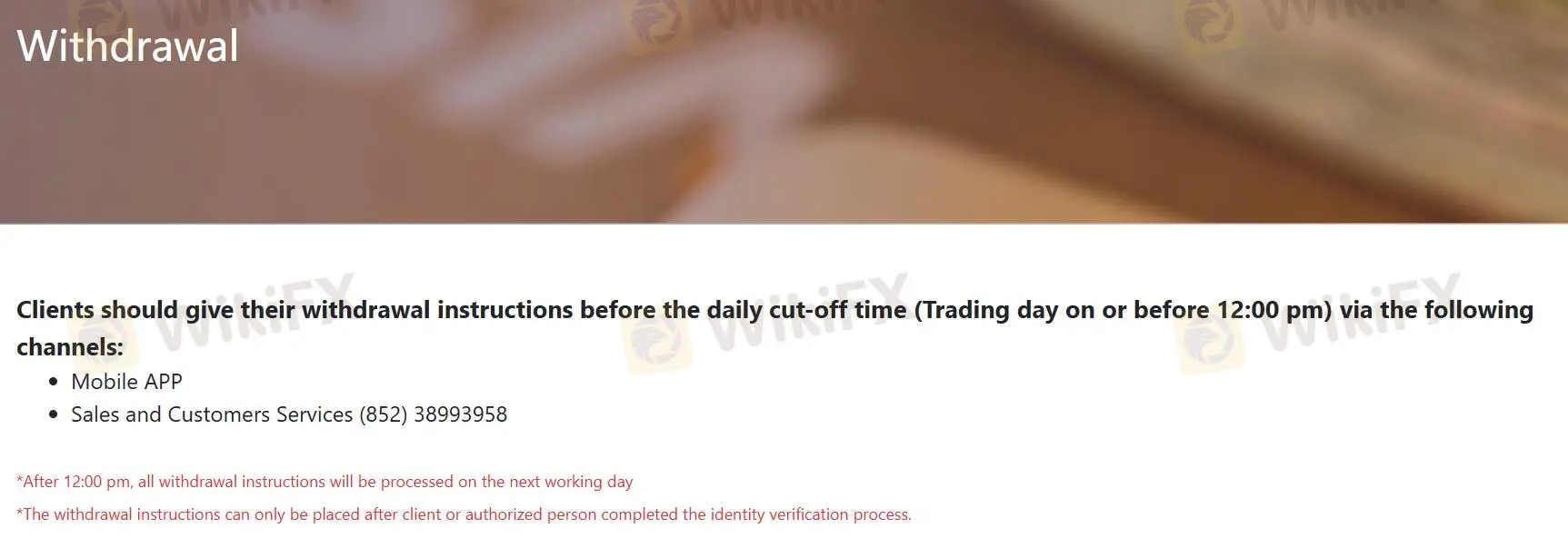

Withdrawal

Clients should give their withdrawal instructions before the daily cut-off time (Trading day on or before 12:00 pm) via Mobile APP or Sales and Customers Services: (852) 38993958.