Company Summary

| amana Review Summary | |

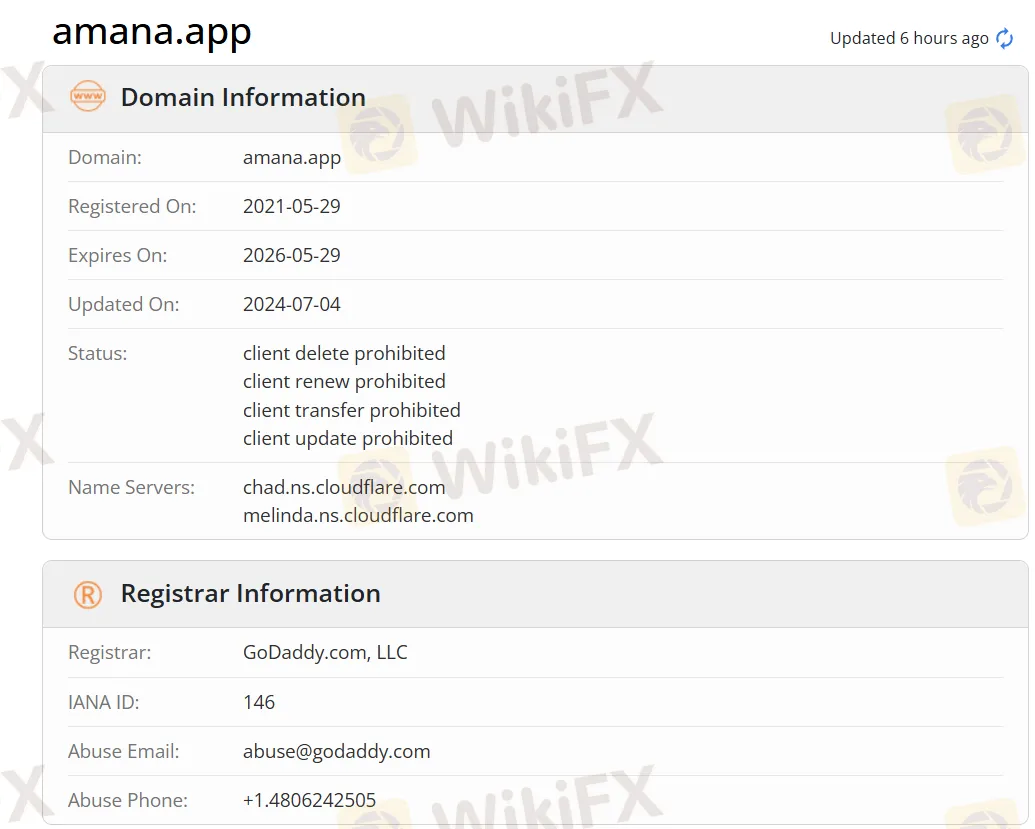

| Founded | 2021 |

| Registered Country/Region | United Arab Emirates |

| Regulation | DFSA, CMA, LFSA, BDL (Revoked), SCA (Exceeded), CYSEC/FCA (Suspicious Clone) |

| Market Instruments | 6,000+, Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, Metals |

| Demo Account | / |

| Leverage | Up to 1:100 |

| Spread | 70% Lower Spread |

| Trading Platform | amana App, amana Web, MT4, MT5 |

| Minimum Deposit | / |

| Customer Support | Live chat |

| Email: support@amana.app | |

| Social Media: Facebook, Twitter, Instagram, YouTube, LinkedIn, TikTok, Messenger, Telegram, WhatsApp | |

amana Information

Based in the United Arab Emirates, Amana is an online trading platform, offering 6,000+ tradable products, including Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, and Metals. It claims to offer leverage up to 1:100 and a spread 70% lower. This company holds multiple licenses from various authorities, while most of the licenses are effective, some of the licenses are revoked, exceeded, or suspected to be a fake clone.

Pros and Cons

| Pros | Cons |

| Various market offerings | Some licenses are exceeded, revoked or suspected to be a fake clone |

| No commissions | |

| MT4 and MT5 supported | |

| Three account types | |

| Various payment methods | |

| Live chat support |

Is amana Legit?

amana operates under various regulatory frameworks across different jurisdictions. However, when it comes to regulatory status, while most entities are regulated, some have had their licenses revoked or are flagged as “Suspicious Clone” by certain authorities.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Dubai Financial Services Authority (DFSA) | Regulated | Amana Financial Services (Dubai) Limited | Retail Forex License | F003269 |

| Capital Markets Authority LEBANON (CMA) | Regulated | Amana Capital SAL | Retail Forex License | 26 |

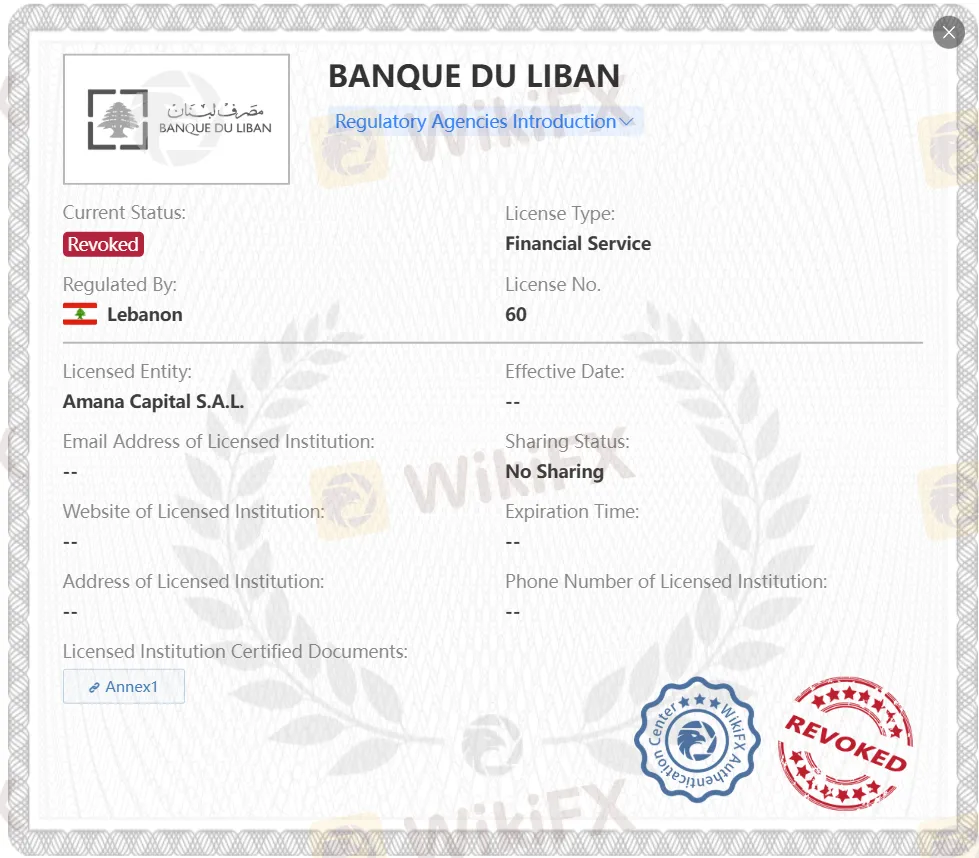

| BANQUE DU LIBAN (BDL) | Revoked | Amana Capital S.A.L. | Financial Service | 60 |

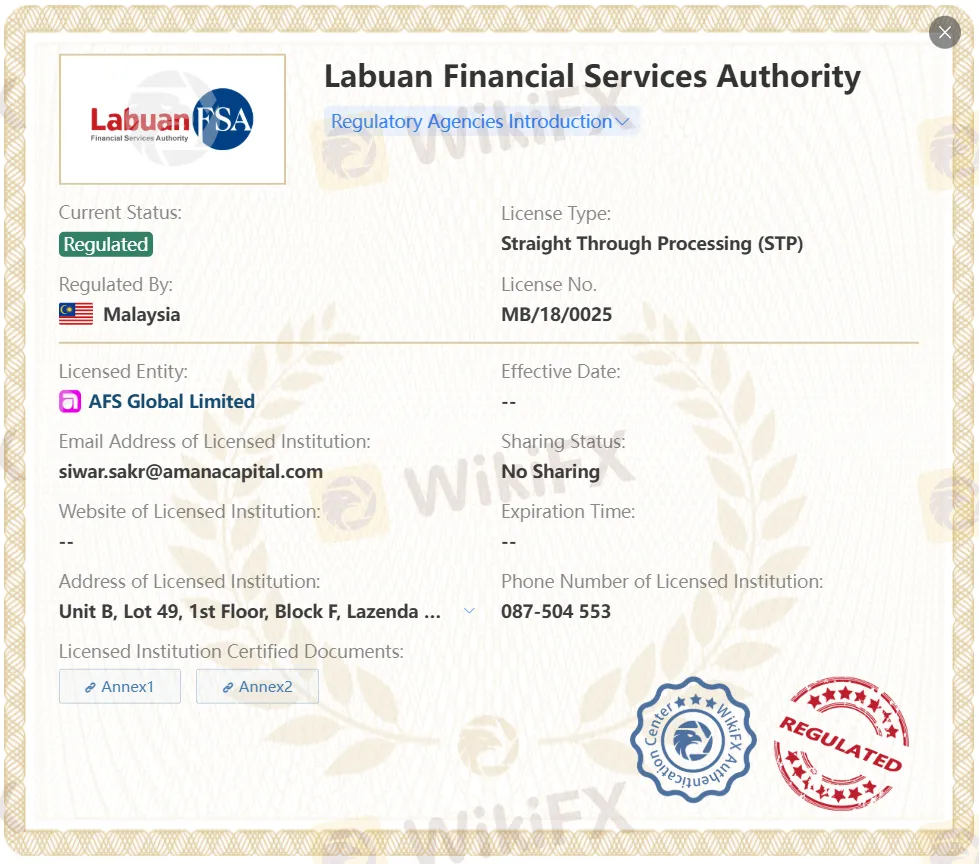

| Labuan Financial Services Authority (LFSA) | Regulated | AFS Global Limited | Straight Through Processing (STP) | MB/18/0025 |

| Securities and Commodities Authority (SCA) | Exceeded | Amana Mena Promotional Services L.L.C | Investment Advisory License | 20200000255 |

| Cyprus Securities and Exchange Commission (CySEC) | Suspicious Clone | Amana Capital Ltd | Market Maker (MM) | 155/11 |

| Financial Conduct Authority (FCA) | Suspicious Clone | Amana Financial Services UK Limited | Straight Through Processing (STP) | 605070 |

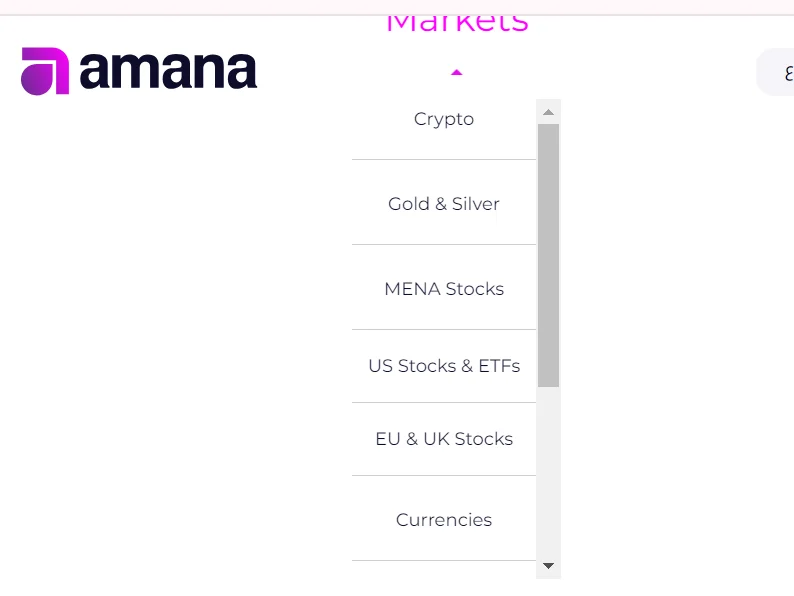

What Can I Trade on amana?

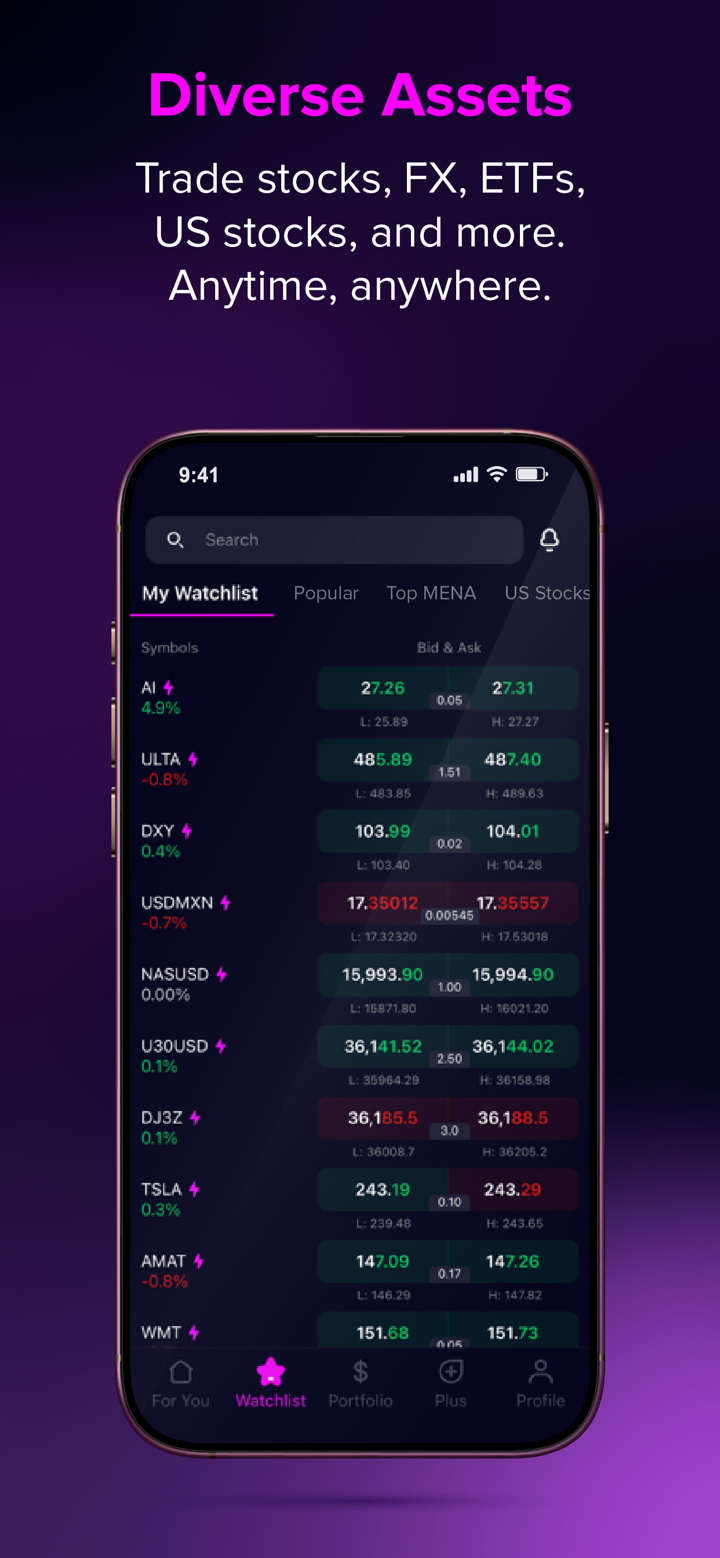

amana asserts to offer over 6,000 types of market instruments, including Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, and Metals.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| commodities | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| ETFs | ✔ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

Account Type

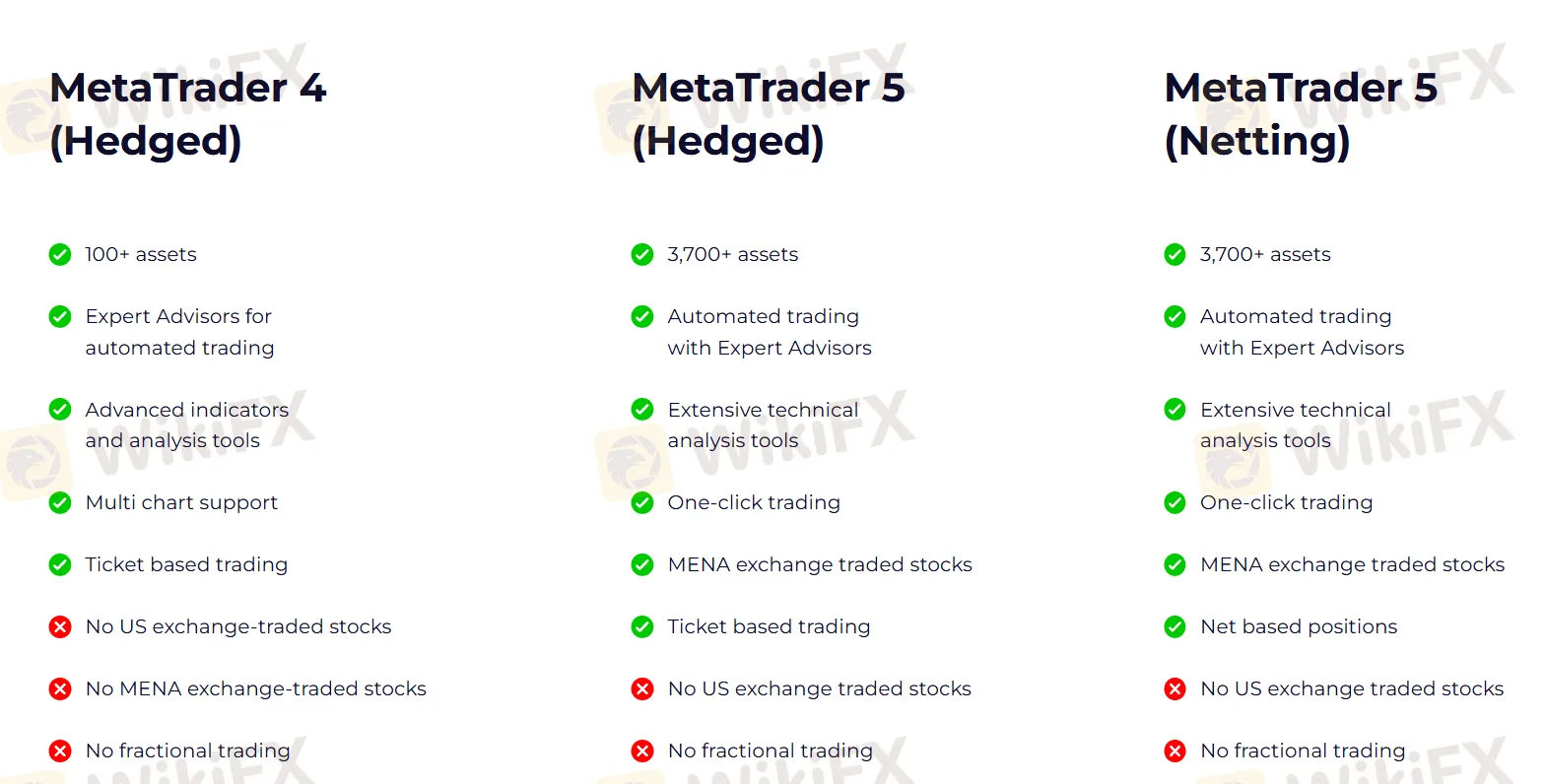

There are three types of car available on this platform, Meta Trader 4 (Hedged), Meta Trader 5 (Hedged), and Meta Trader 5 (Netting), each comes with different trading conditions.

| Account Type | MetaTrader 4 (Hedged) | MetaTrader 5 (Hedged) | MetaTrader 5 (Netting) |

| Trading Assets | 100+ assets | 3,700+ assets | 3,700+ assets |

| Expert Advisors for automated trading | ✔ | ✔ | ✔ |

| Advanced indicators and analysis tools | ✔ | ✔ | ✔ |

| Multi chart support | ✔ | ❌ | ❌ |

| One-click trading | ❌ | ✔ | ✔ |

| Ticket-based trading | ✔ | ✔ | ✔ |

| MENA exchange-traded stocks | ❌ | ✔ | ✔ |

| US exchange-traded stocks | ❌ | ❌ | ❌ |

| Fractional trading | ❌ | ❌ | ❌ |

| Net-based positions | ❌ | ❌ | ✔ |

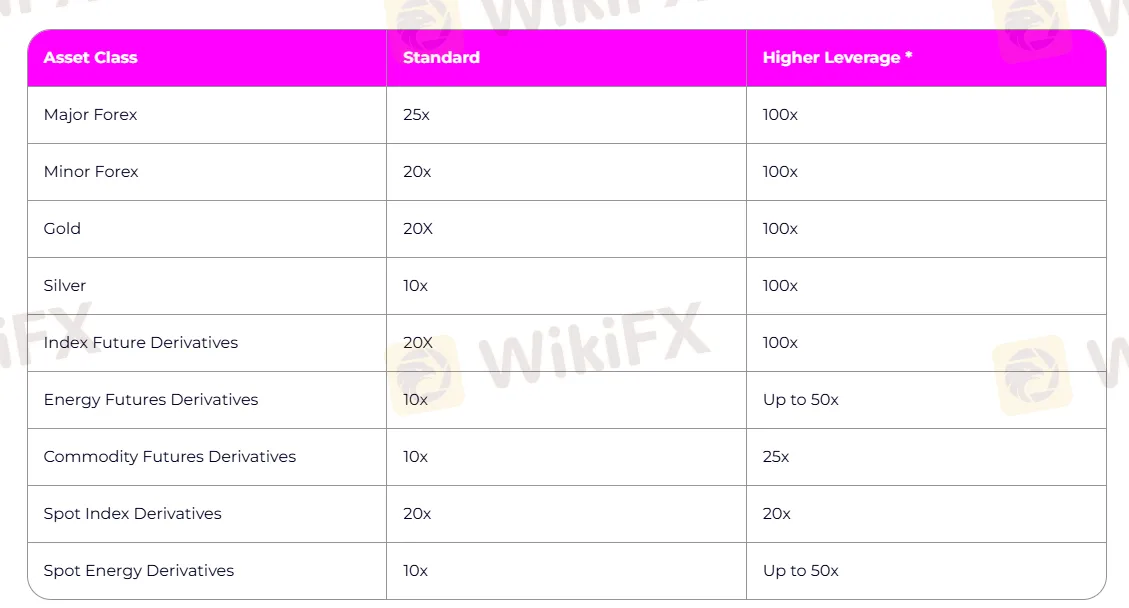

Leverage

Amana offers distinct leverages based on the asset class. 1:100 is the maximum leverage on this platform. Traders can contact the customer support team to request more leverage.

| Asset Classes | Standard Leverage | High Leverage |

| Major Forex | 25x | 100x |

| Minor Forex | 20x | |

| Gold | ||

| Silver | 10x | |

| Index Future Derivatives | 20x | |

| Energy Futures Derivatives | 10x | 50x |

| Commodity Futures Derivatives | 25x | |

| Spot Index Derivatives | 20x | 20x |

| Spot Energy Derivatives | 10x | 50x |

Fees

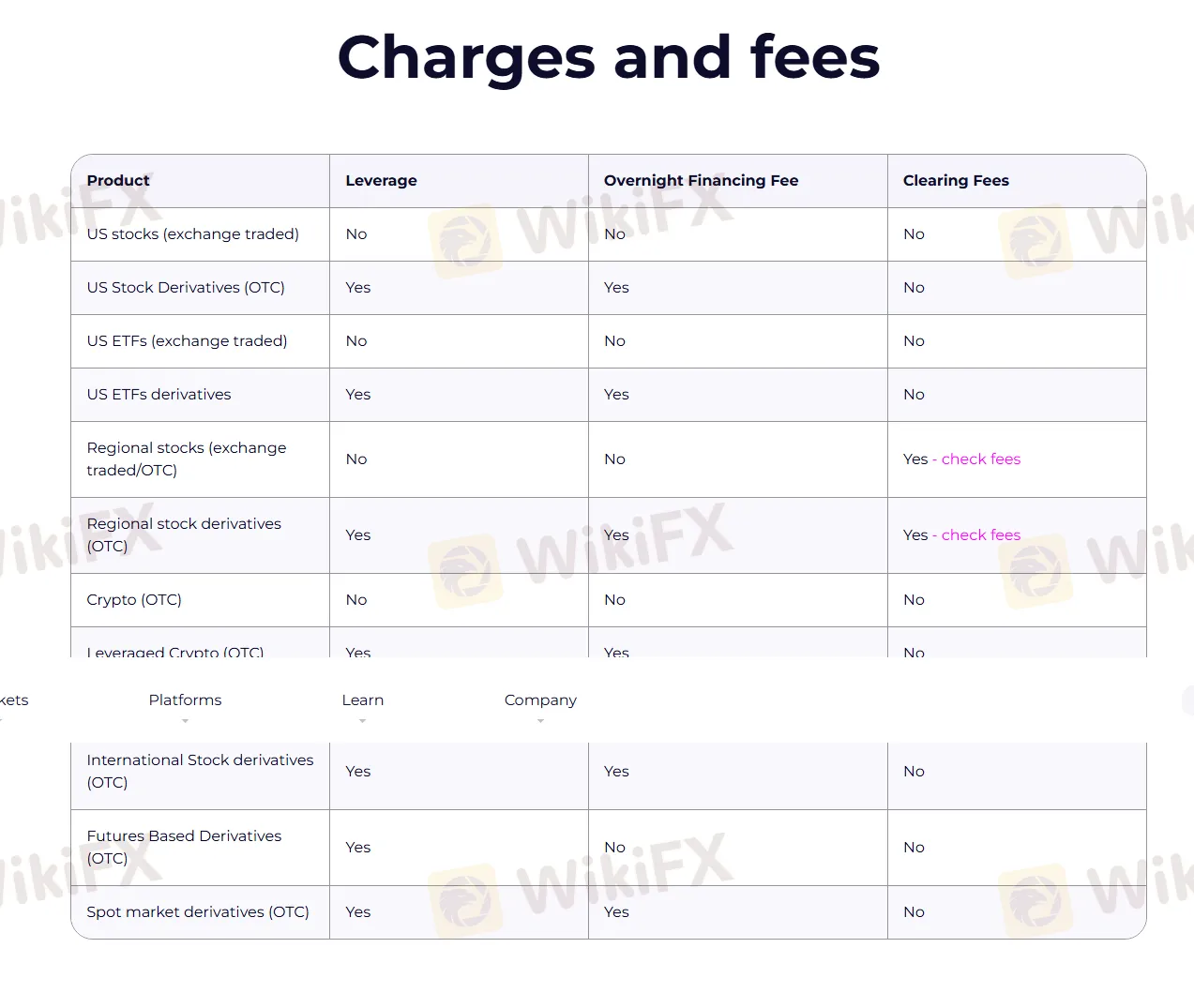

The spread on this platform is committed to being 70% lower. According to amana, traders are allowed to enjoy commission-free on all assets.

However, amana charges overnight financing fees on US Stock Derivatives (OTC), US ETFs derivatives, Regional stock Derivatives, Leveraged crypto, Forex Derivatives (OTC), International Stock derivatives (OTC), and Spot market derivatives (OTC).

Plus, amana charges a clearing fee on Regional stocks (exchange traded/OTC) and Regional stock derivatives (OTC).

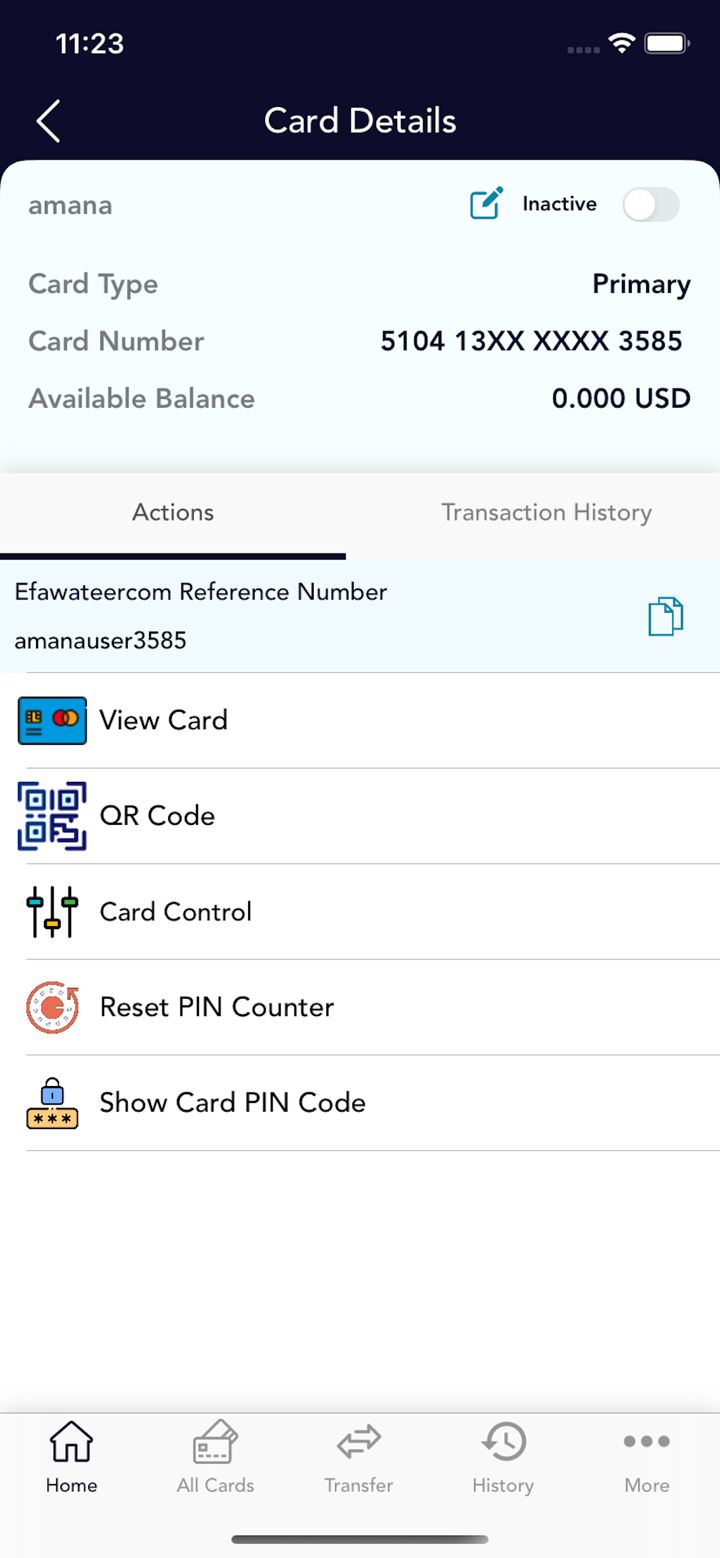

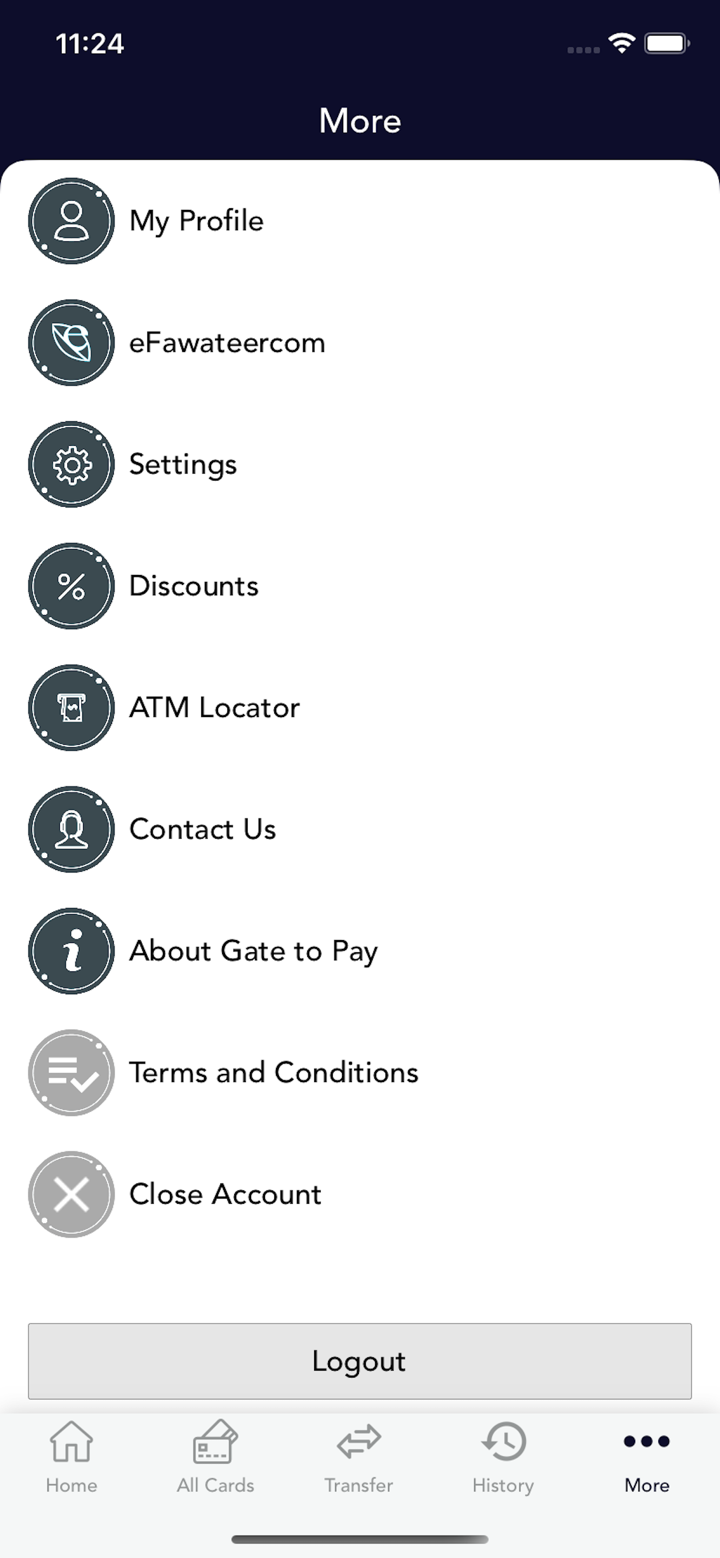

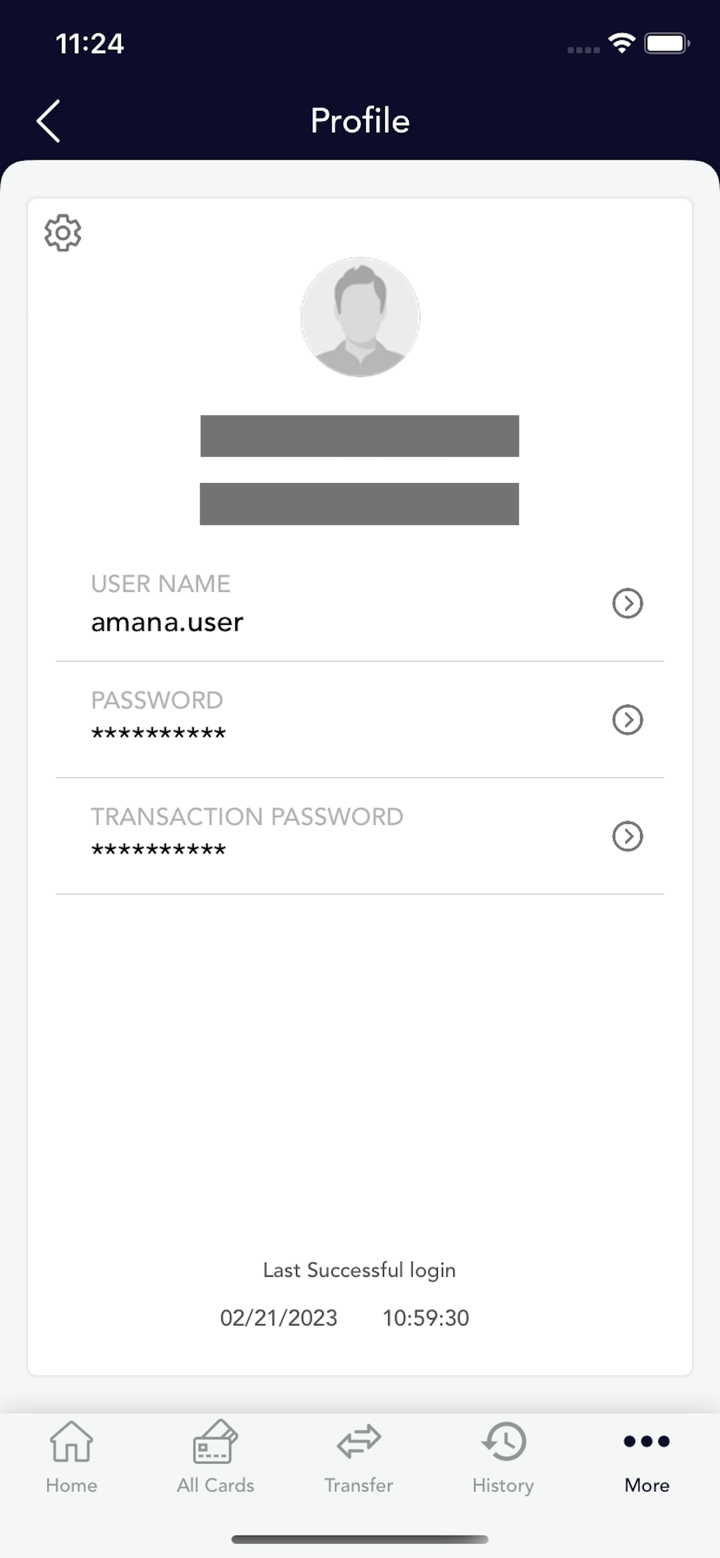

Trading Platform

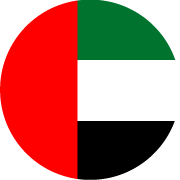

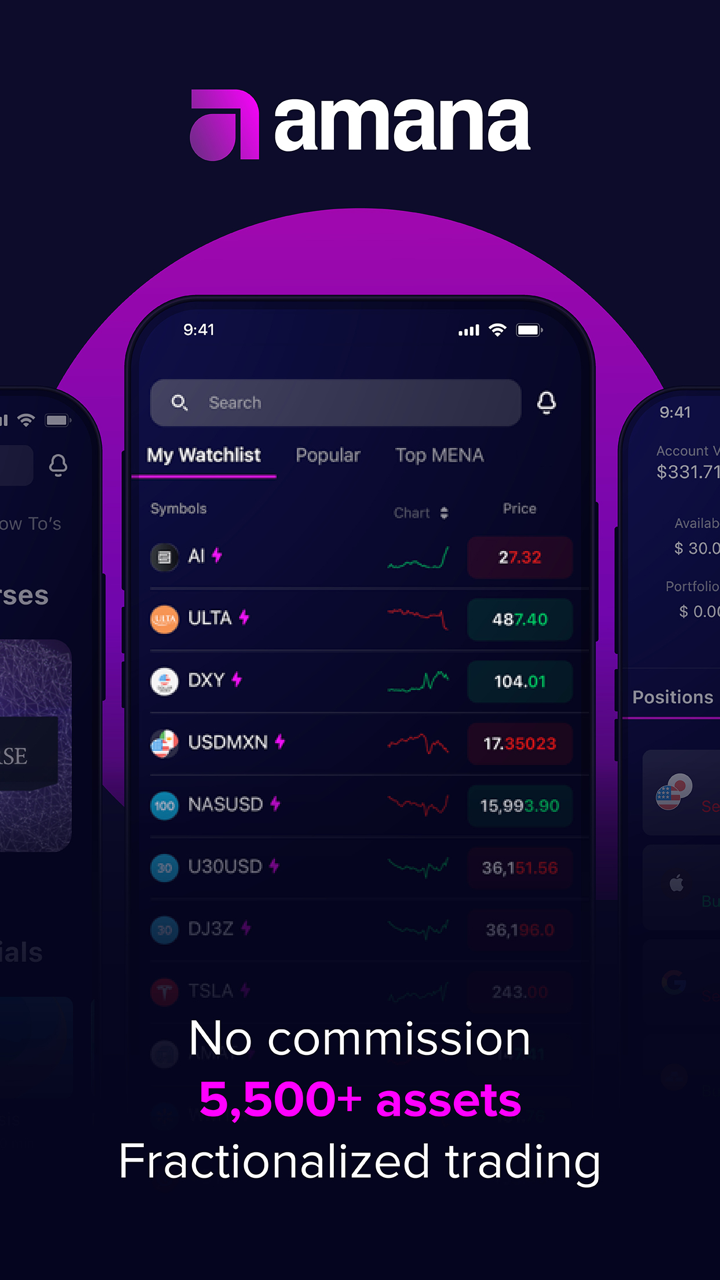

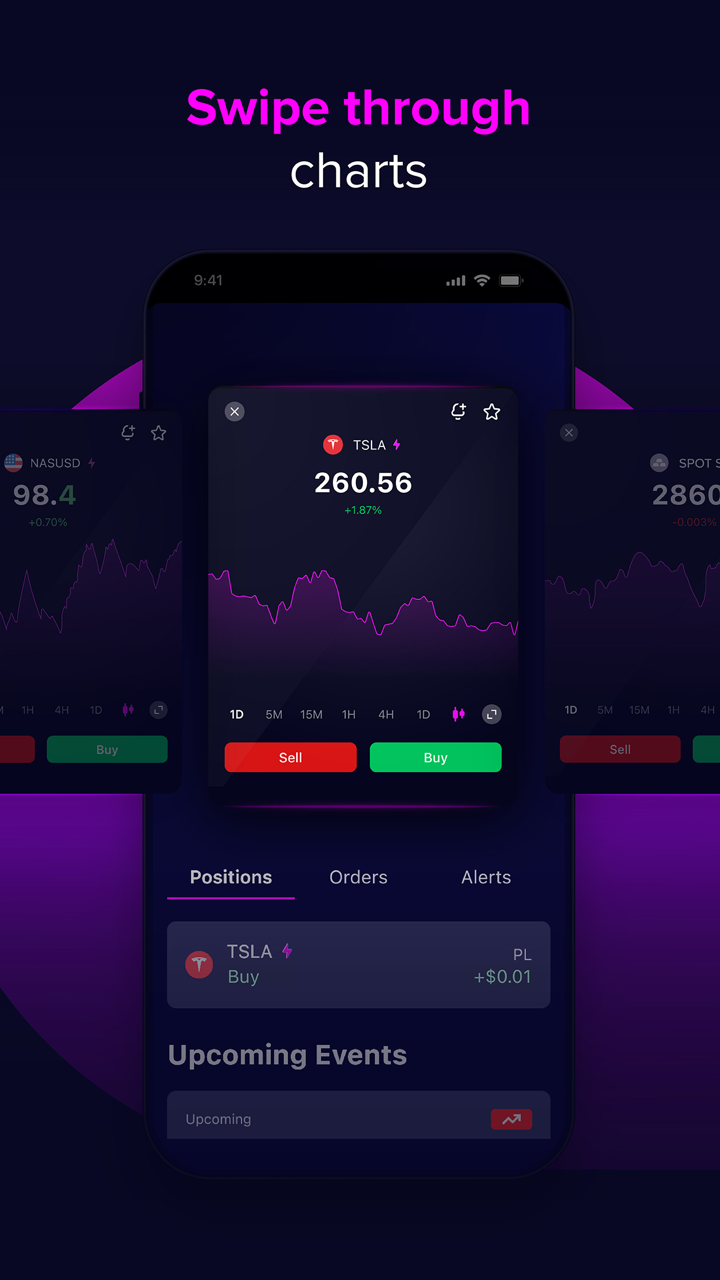

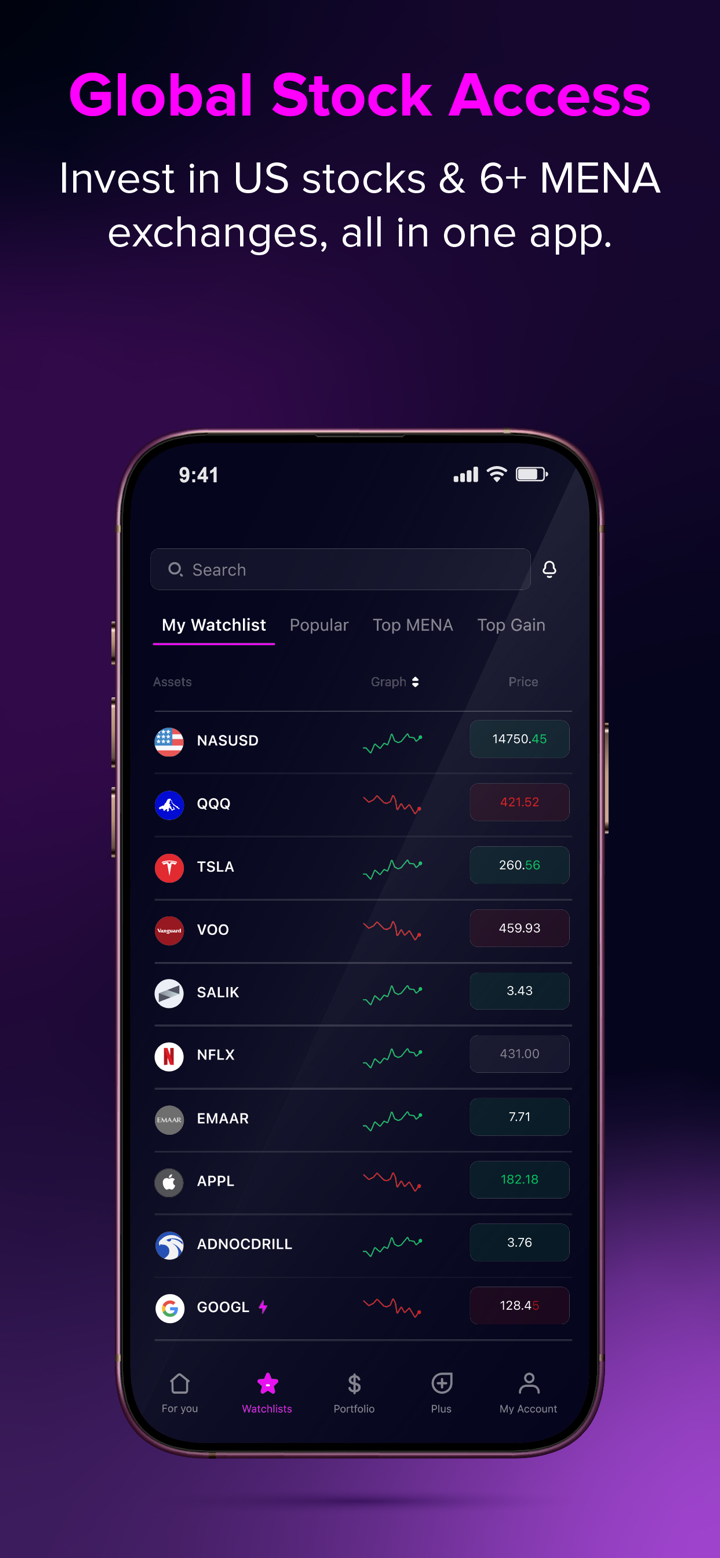

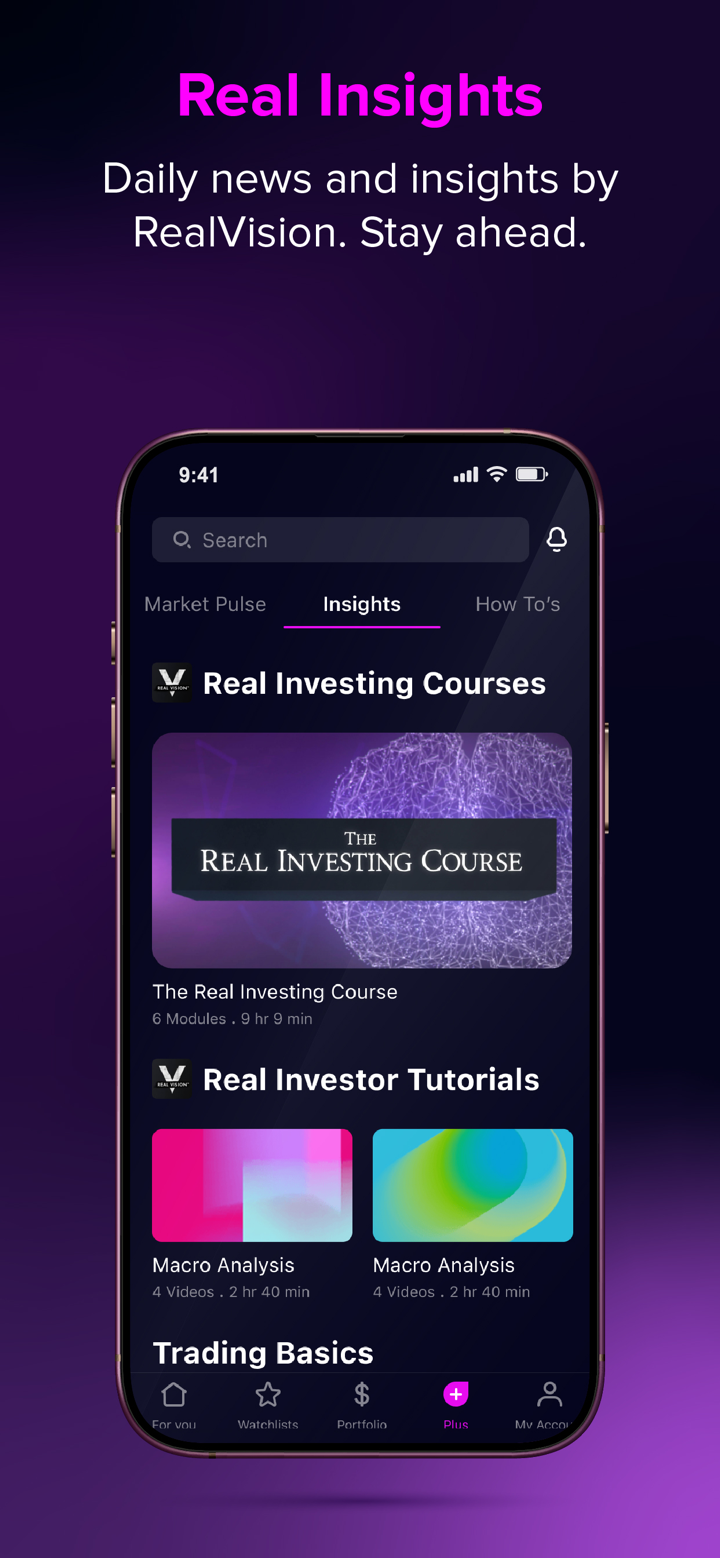

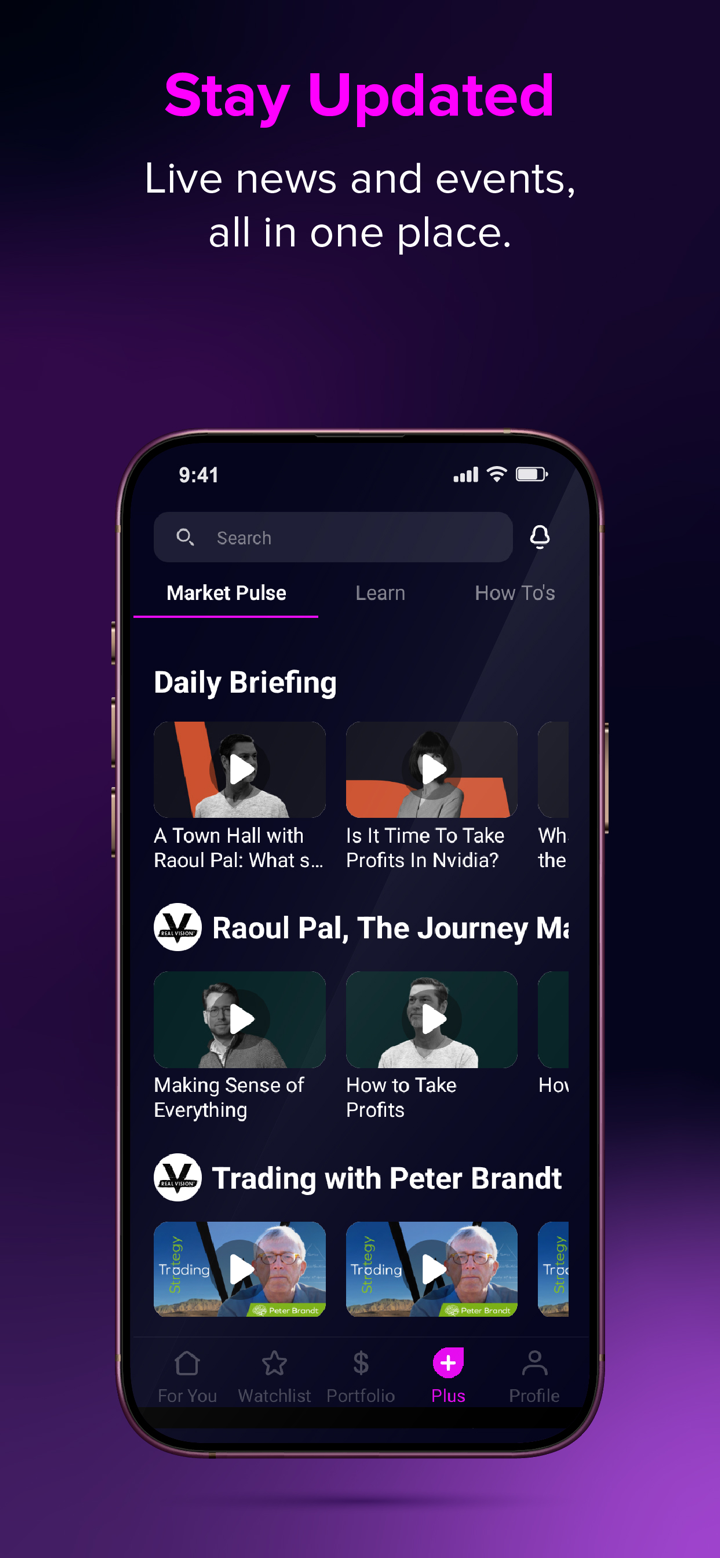

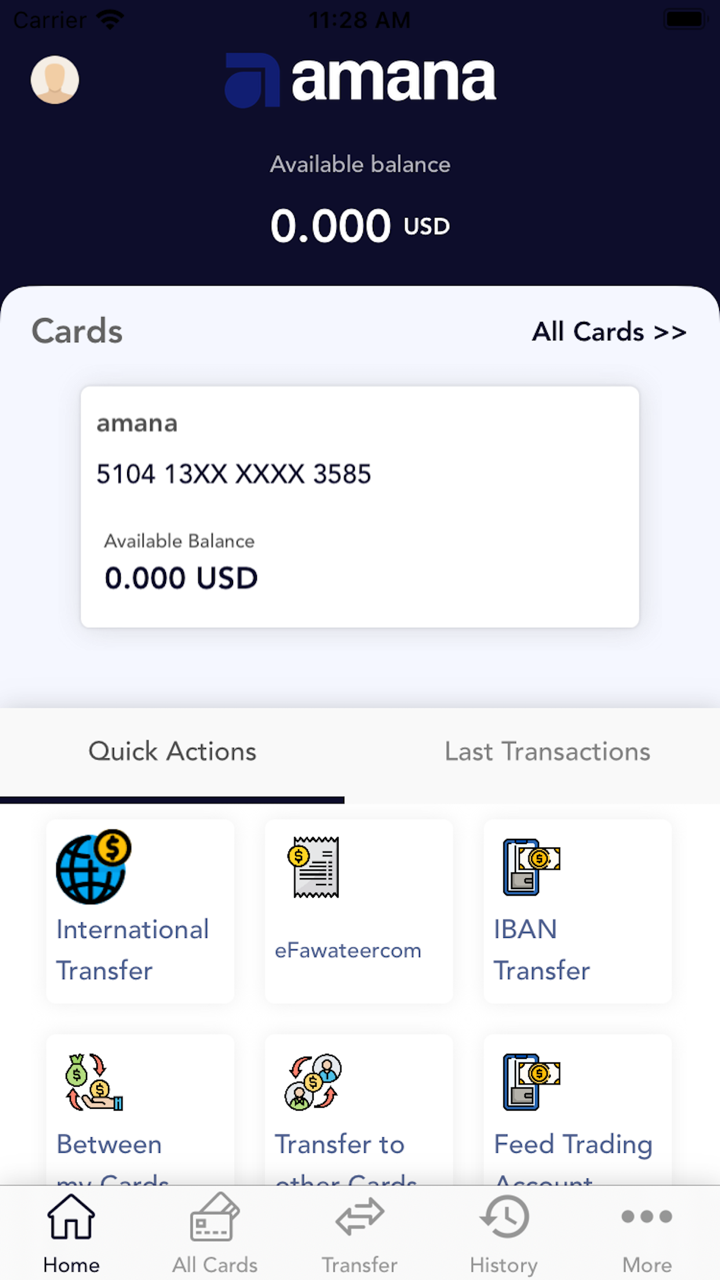

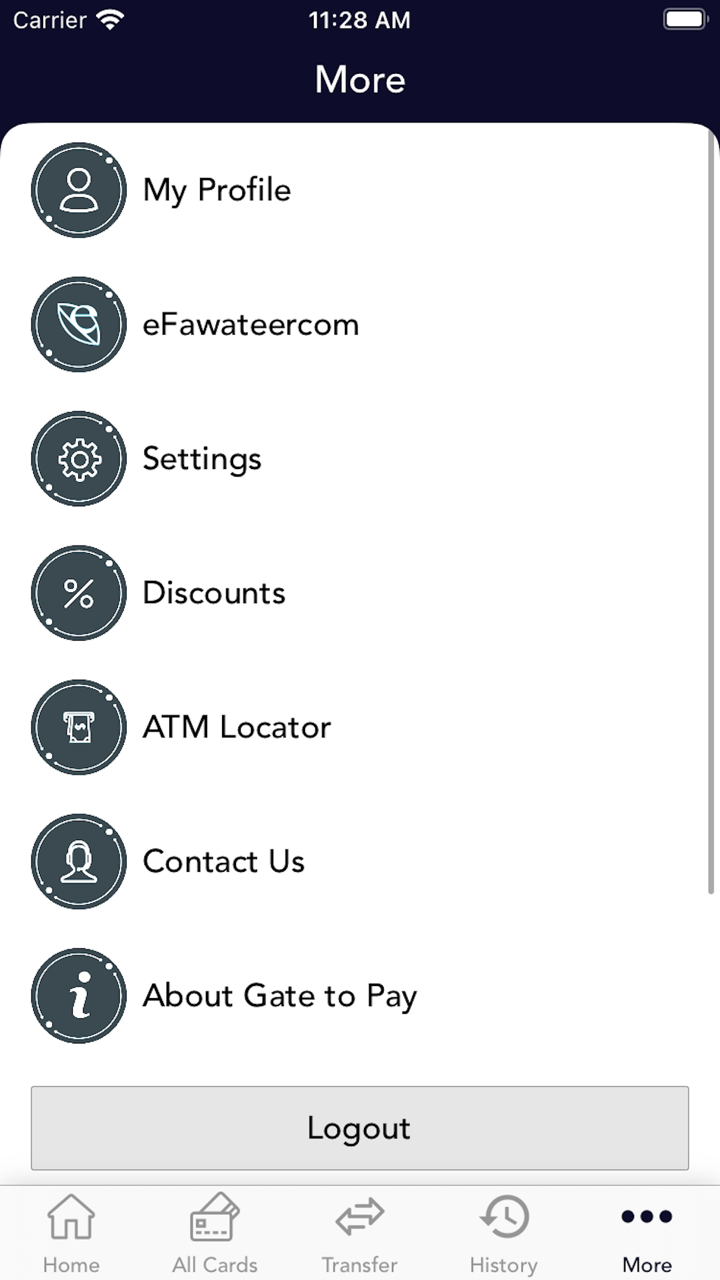

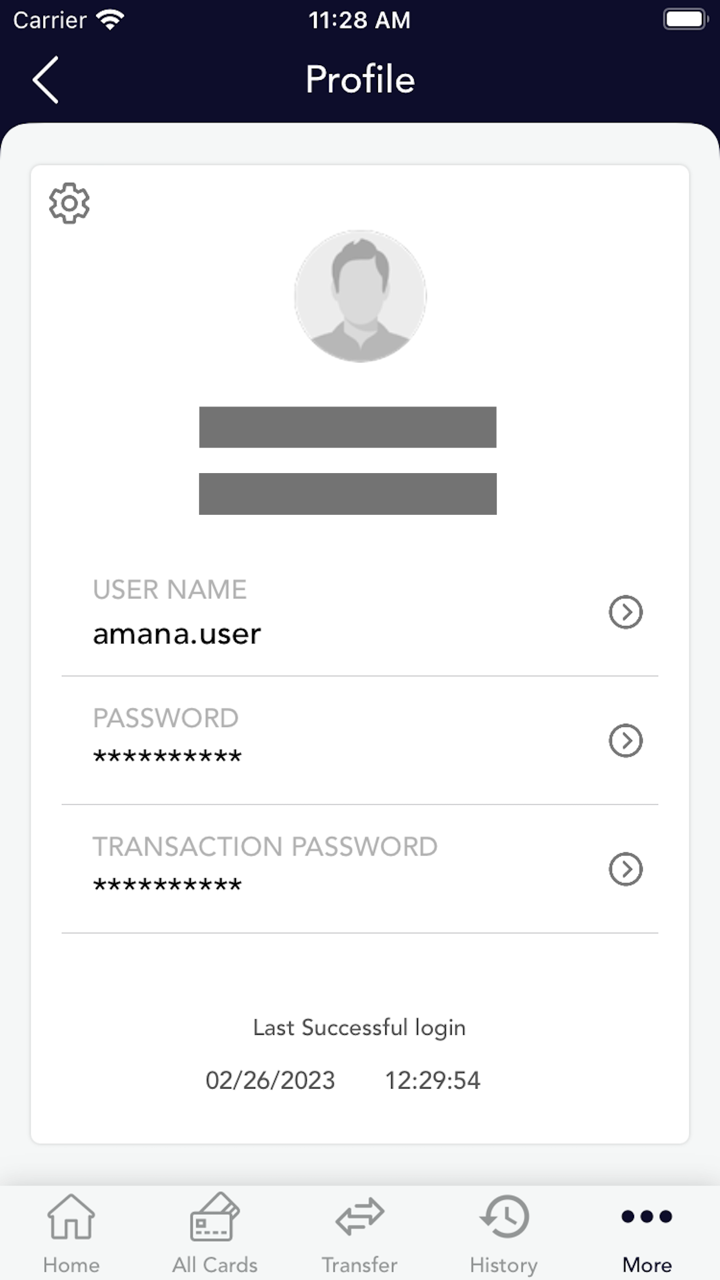

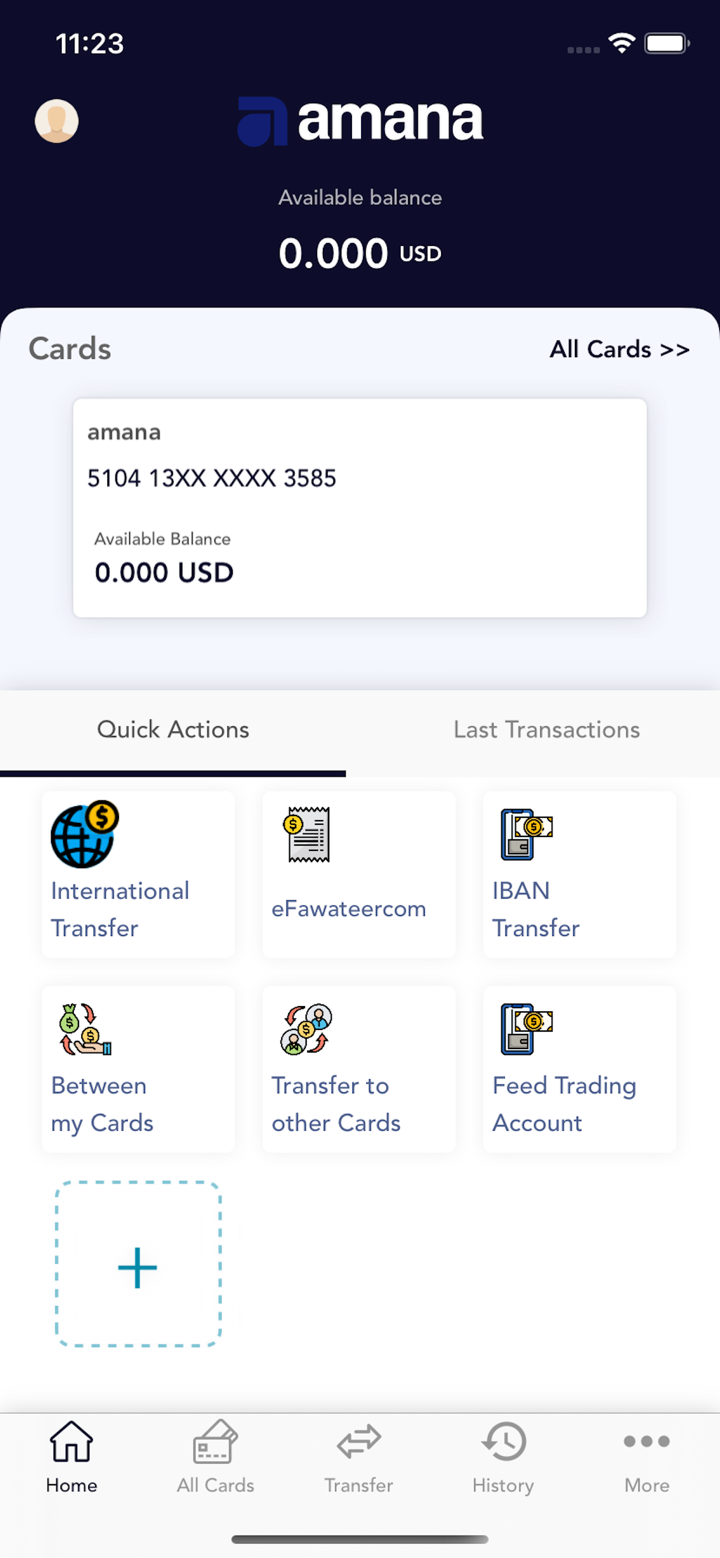

Traders on this platform get access to amana App, which is an all-in-one trading app that grants access to 5,500+ commission-free assets across global and regional markets. From stocks, cryptocurrencies, forex, metals, and indices to ETFs, commodities, and more.

In the meantime, amana also provides access to MT4 and MT5, which are popular trading platforms widely used for forex, CFDs, and other financial markets trading.

- MT4 is simpler and highly popular for forex trading.

- MT5 offers more advanced features, supports more markets, and is more flexible for algorithmic trading.

| Trading Platform | Supported | Available Devices | Suitable for |

| amana App | ✔ | Desktop, Mobile, Web | / |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

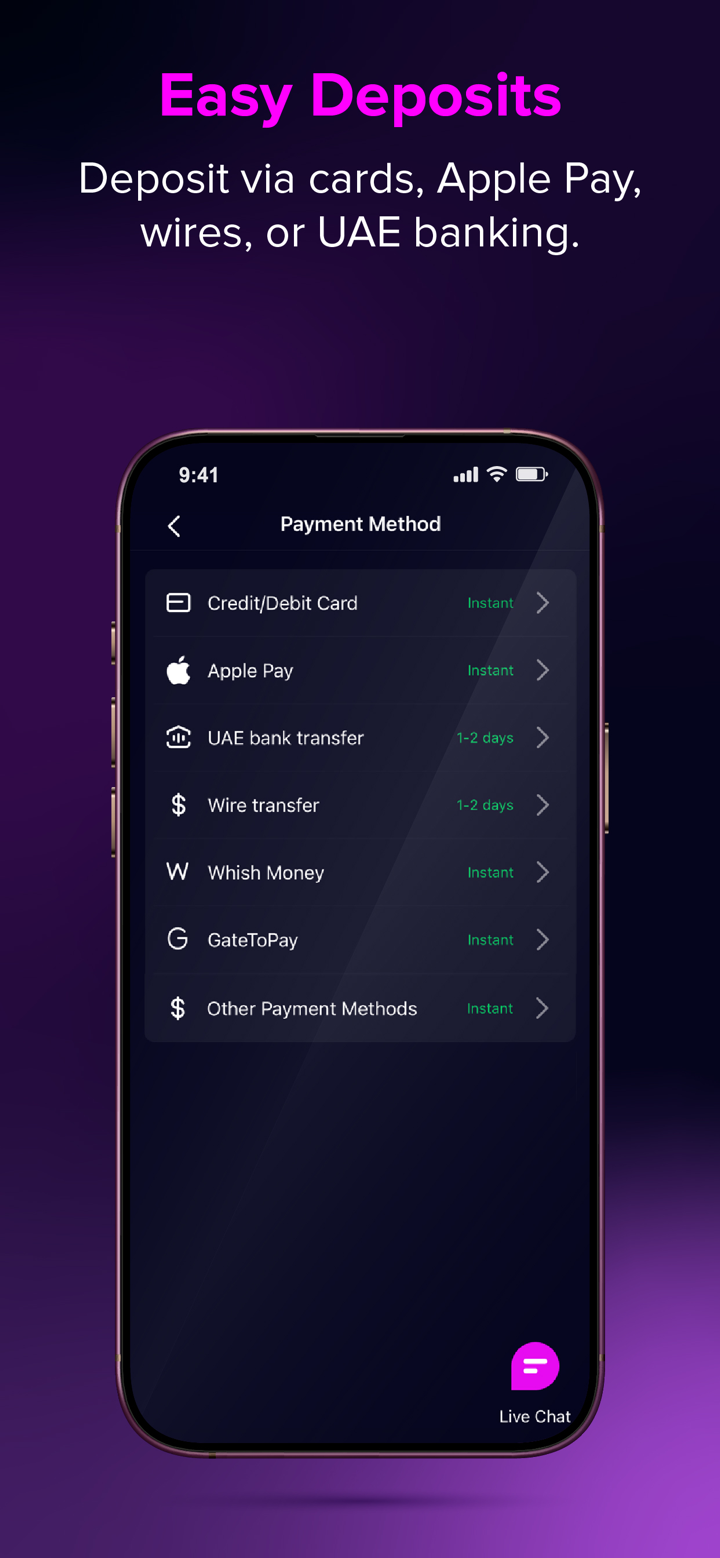

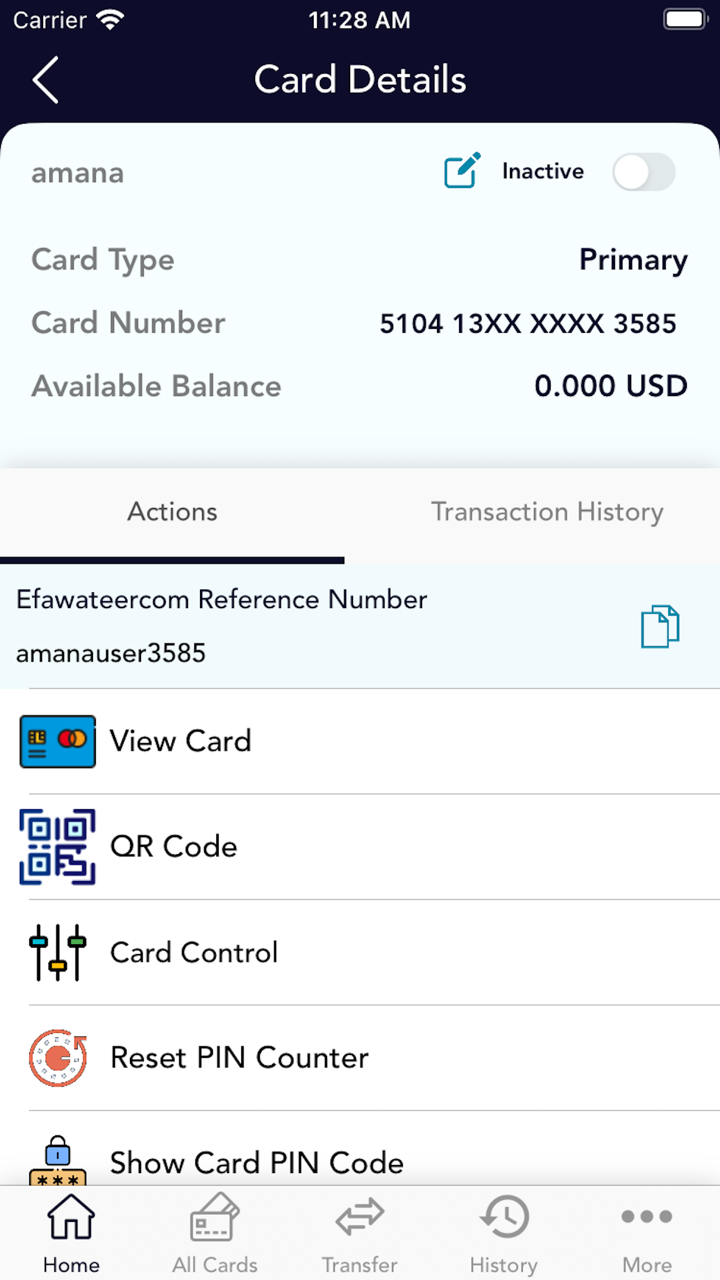

Deposit and Withdrawal

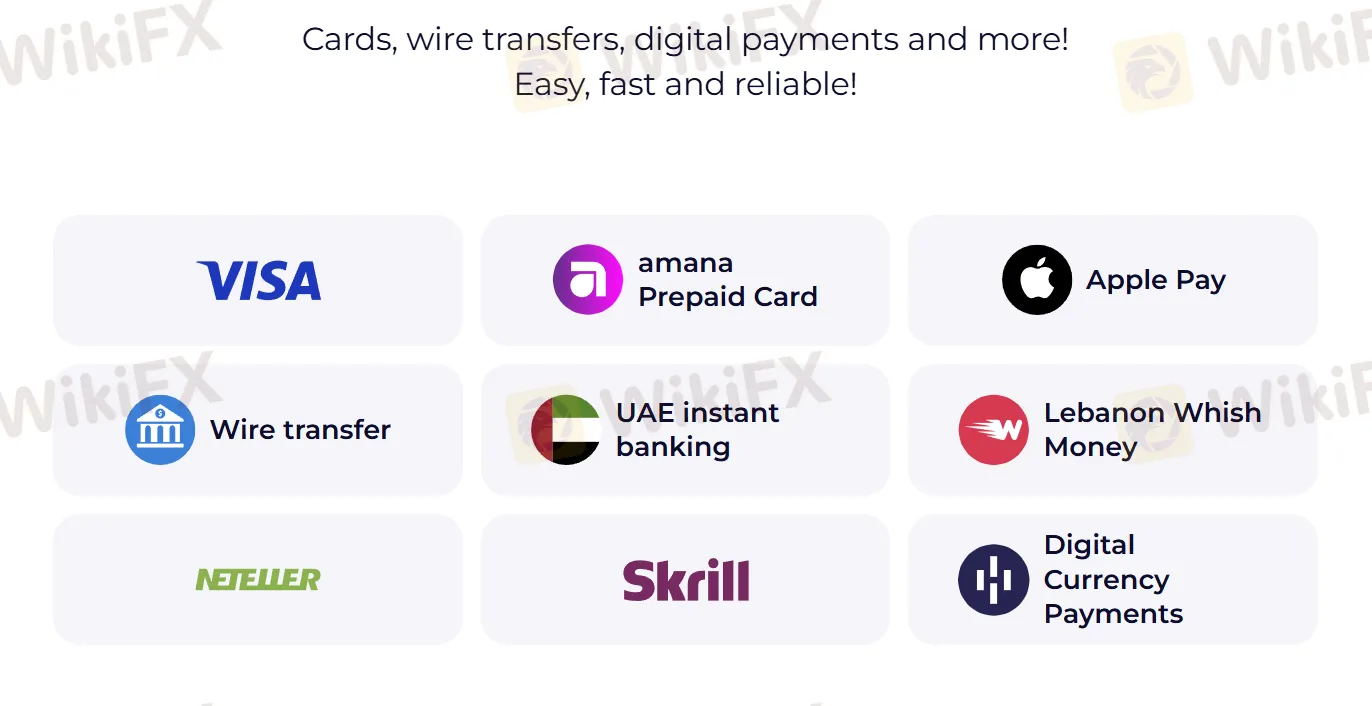

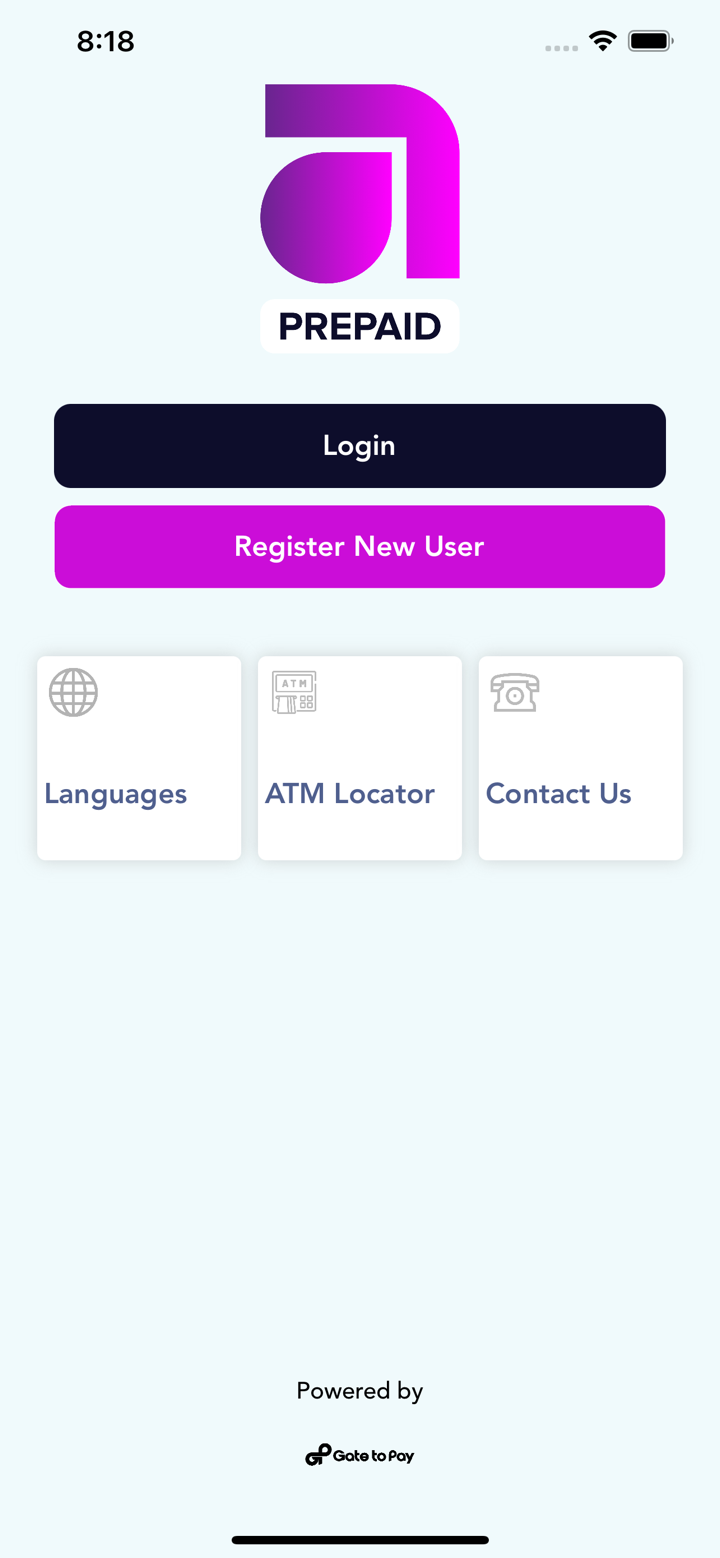

These are the payment options available on this platform: Visa, Mastercard, amana Prepaid Card, Apple Pay, Wire Transfer, UAE instant banking, Neteller, Whish Money (Lebanon), Skrill, and digital currencies.

Amana claims that traders can enjoy zero fees on all card deposits and withdrawals.

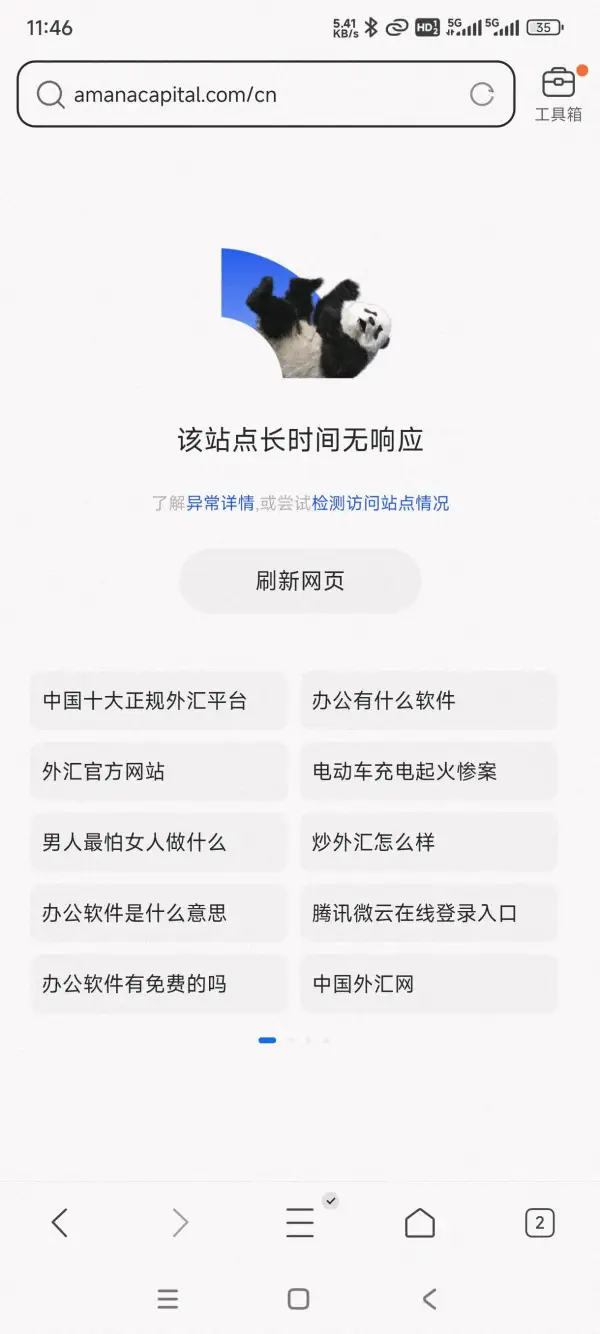

FX3524007946

Hong Kong

The official website cannot be opened using multiple browsers. This situation would not occur with a legitimate platform.

Exposure

十二1147

Hong Kong

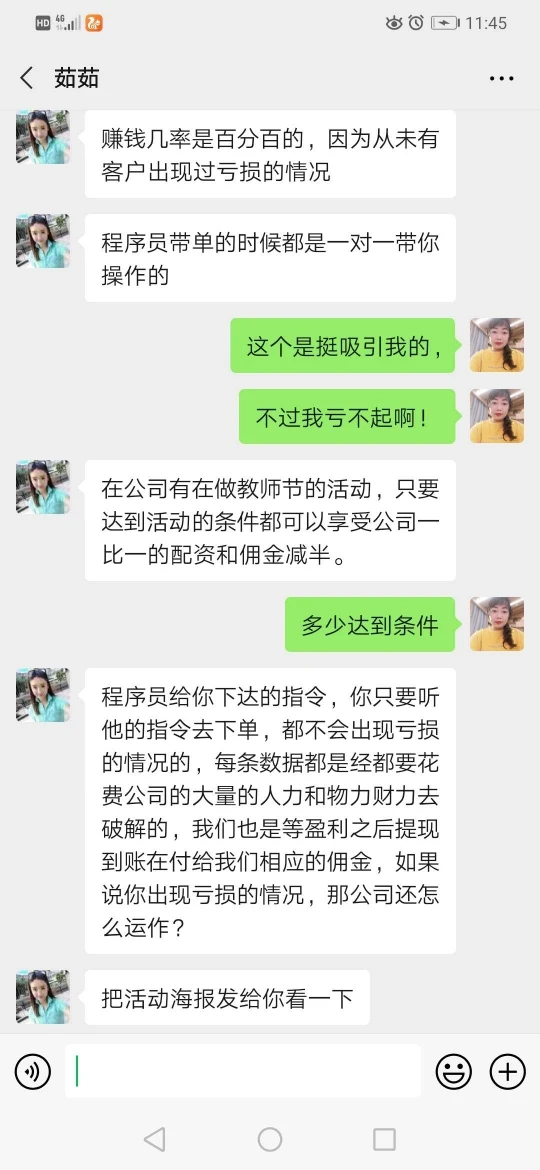

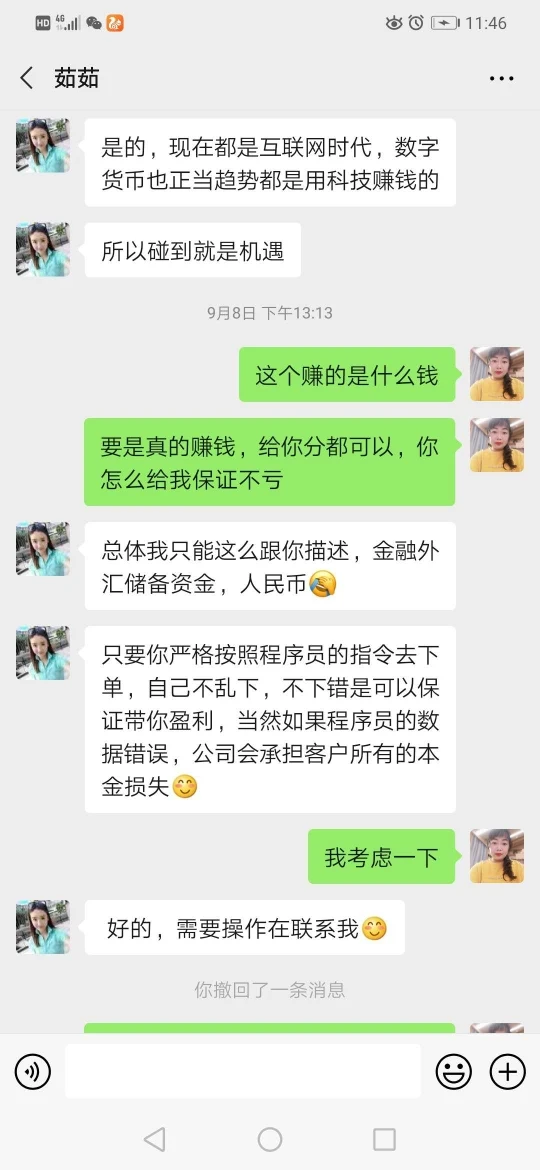

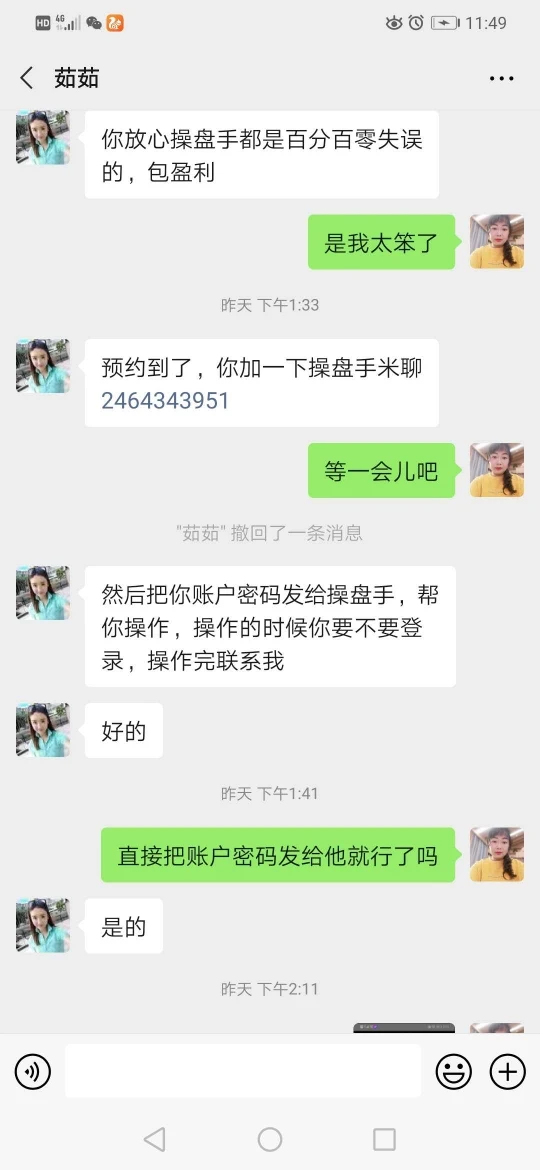

Trap you by high returns. Don't be cheated

Exposure

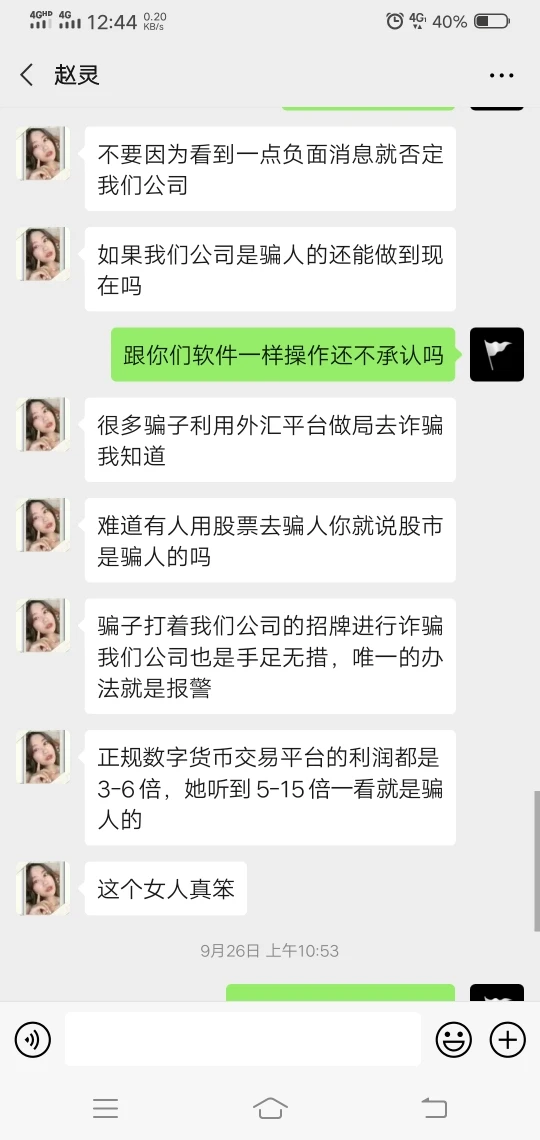

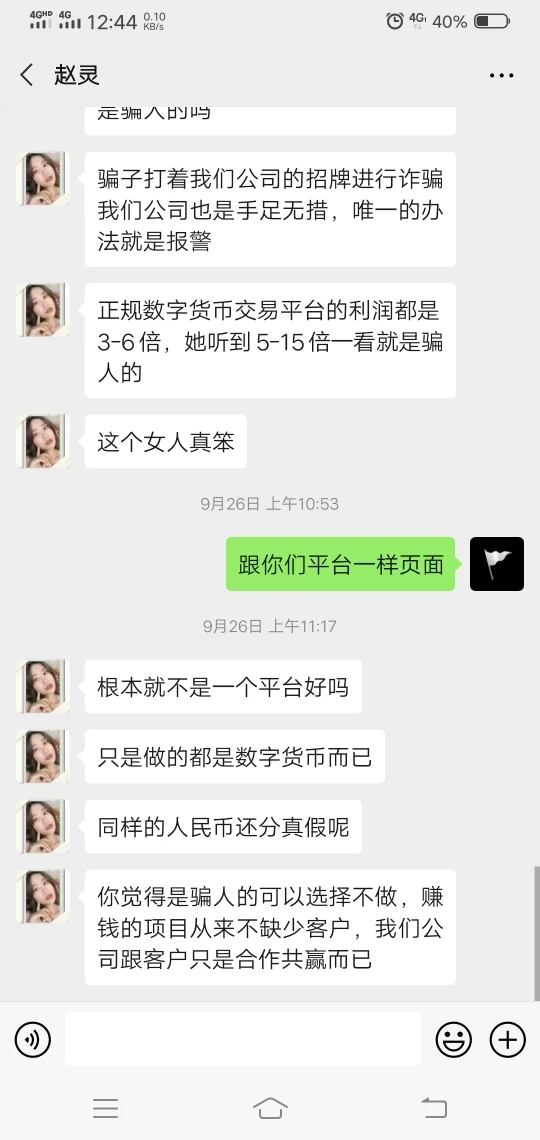

麻雪峰

Hong Kong

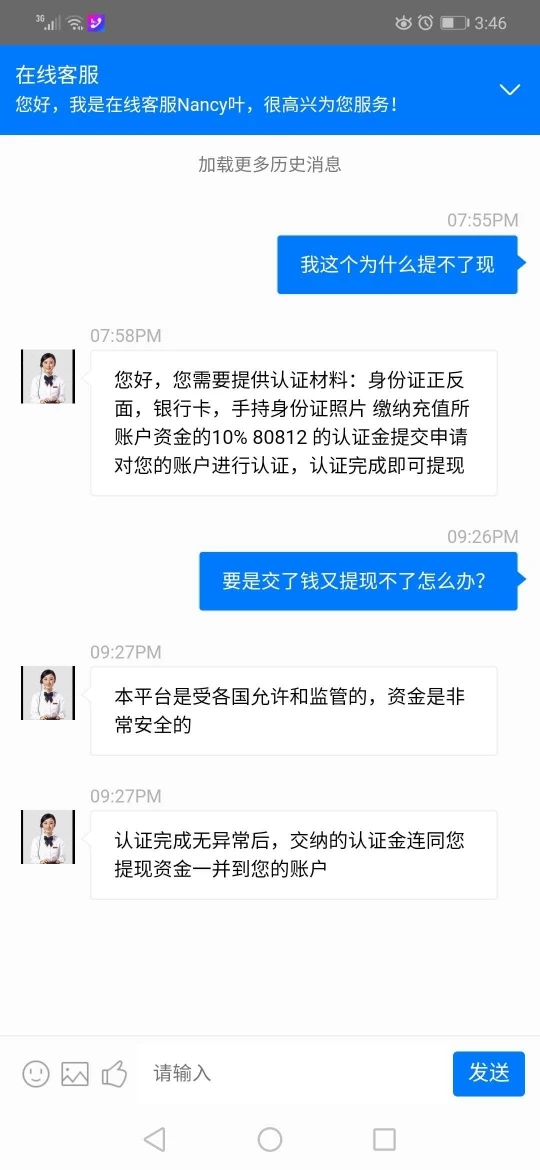

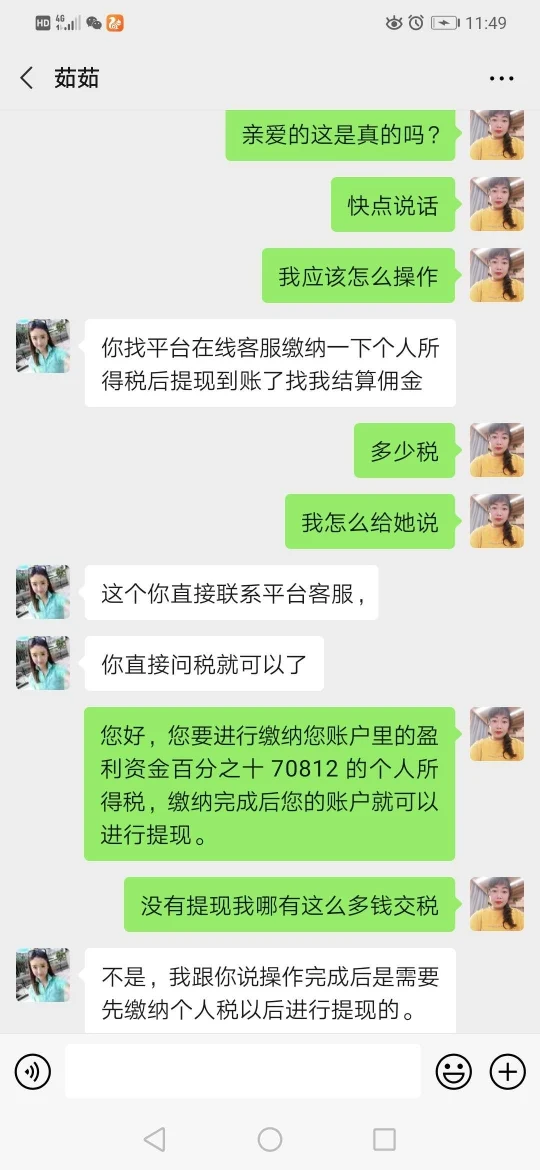

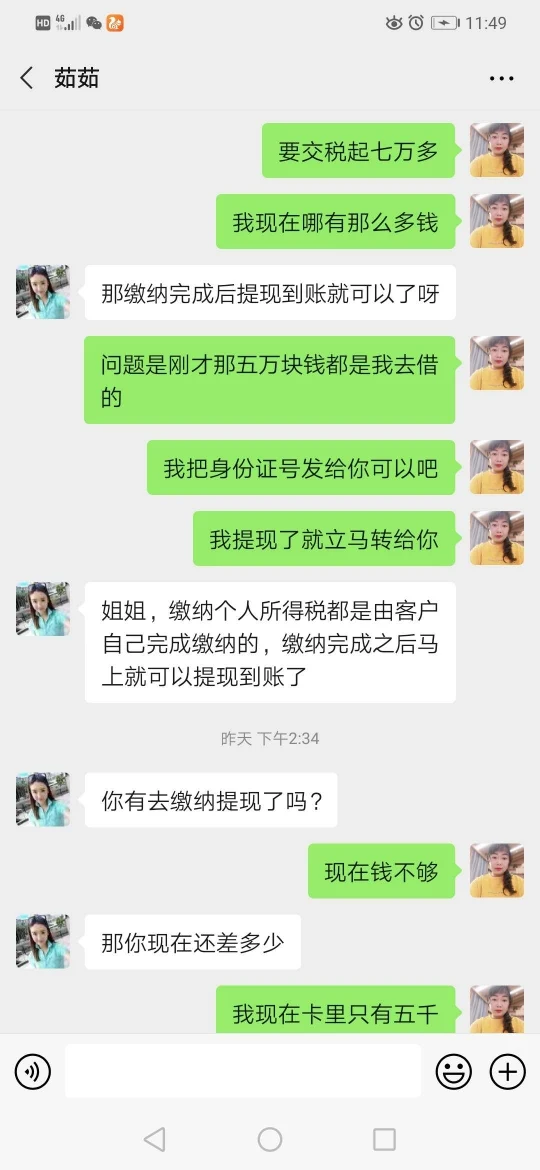

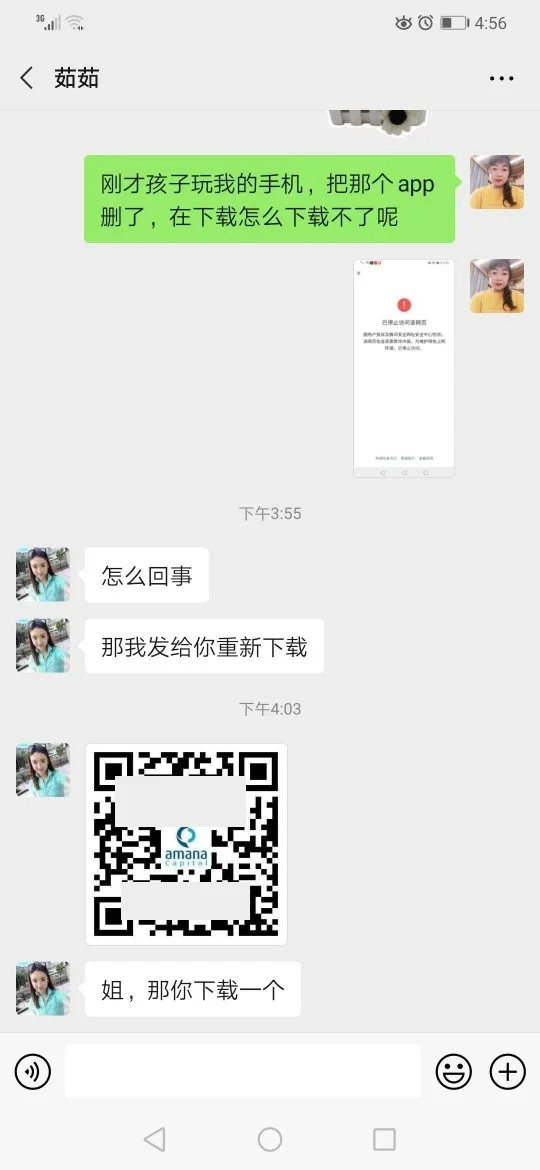

I knew a customer manager this September. She pushed me to opene an account. I opened an account on October 10. I deposited 30,000 on the same day and lost, just over 200 left. I deposited another 50,000 on the morning of October 11. A staff helped me to operate and there was ober 800,000 in the afternoon. But I can't withdraw. The customer service said I have to pay personal income tax. I transferred three times to three designation accounts, 70,812 in total. I was asked to pay over 70,000 as certification fund. Now I called the police for it's a fraud platform.

Exposure

Okanireo

Germany

Finally found a broker regulated by an authority! And they offer all the market tools I need. This is perfect!

Positive

Over again.

Argentina

My only issue is that. I am still not a rich man having traded with several thousand of USD. And secondly, nothing like reward or awards or something for clients over 10 years or pioneers like us in Nigeria. For withdrawal and the likes Amana Capital is great.

Positive

Alessandro Mancini

Italy

Trading signals and technical analysis are top-notch! The competitive spreads make it even better. More importantly, Amana Capital is trusted and regulated broker.

Positive

Mingyu

United Arab Emirates

I've been using the Amana app for trading and it's pretty solid. Love that I can trade stocks and crypto without commission. The app is straightforward and being regulated by several authorities gives me peace of mind. Just be careful with the leveraged trading options, especially in crypto—it's super volatile!

Positive

Sutii

United Arab Emirates

Amana Capital is an impressive platform. What stood out to me initially was the speed at which my orders were executed - it's efficient and reliable. I appreciate the transparency and forthright nature of the company as well, it really puts me at ease when trading. Also, the support staff deserve a shout out for their dedication and assistance. Whenever I've had questions or needed help, they've been there, providing thorough and helpful answers. All in all, my trading with Amana Capital has been a positive one so far and I look forward to seeing it continue in this vein.

Positive

FX1146475754

Taiwan

I saw that the staff of wikifx conducted a Tianyan site survey in the UK... This so-called foreign exchange broker registered in the UK has no physical office at all. Combined with the complaints on wikifx, it is undoubtedly a liar!

Neutral

FX1044735726

Spain

I have been trading with amana for months now and my withdrawals have been normal. But now I see many complaints against this broker in wikifx. Do I have to withdraw all my money? Well, I still have almost 3 thousand euros. If this broker scams me, can wikifx help me???

Positive

中航光电-李宏谦

Hong Kong

Amana capital seems to offer attractive trading environment, both MT4 and MT5 trading platform available, low spreads from 0.4 pips, low initial deposit of $50, it seems worthy having a try with it…😊😊

Positive

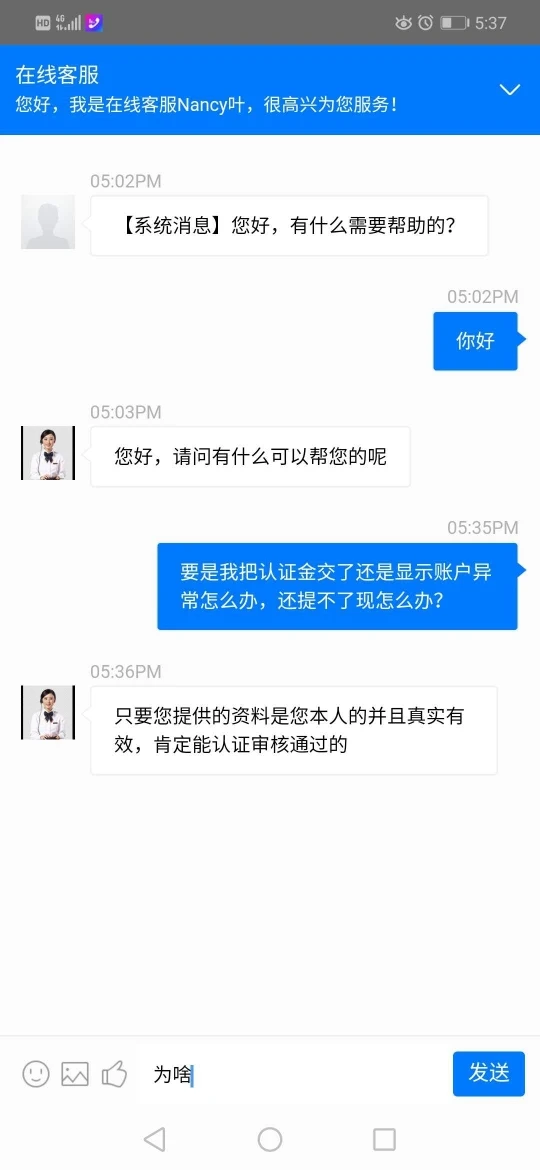

Eliza8558

Taiwan

I have successfully withdrawn twice before, and I want to withdraw all the amount for the third time, the account will be frozen, ask customer service, ask to deposit the same amount within the deadline, then you can withdraw, if not deposited, the amount will be deducted every day. Today, this app has been getting errors and changing the app download URL

Exposure

璇1094

Taiwan

If you apply for a withdrawal, you must also be upgraded to a gold member to be able to withdraw without running volumn requirement, but you can't withdraw part of the money after you have recharged it... It is also stipulated that you must recharge within the time limit, otherwise it will be deducted from the account until the deduction is exhausted.

Exposure

王建兵

Hong Kong

Now I can't withdraw funds and I deposited ¥600,000. What should I do

Exposure