Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

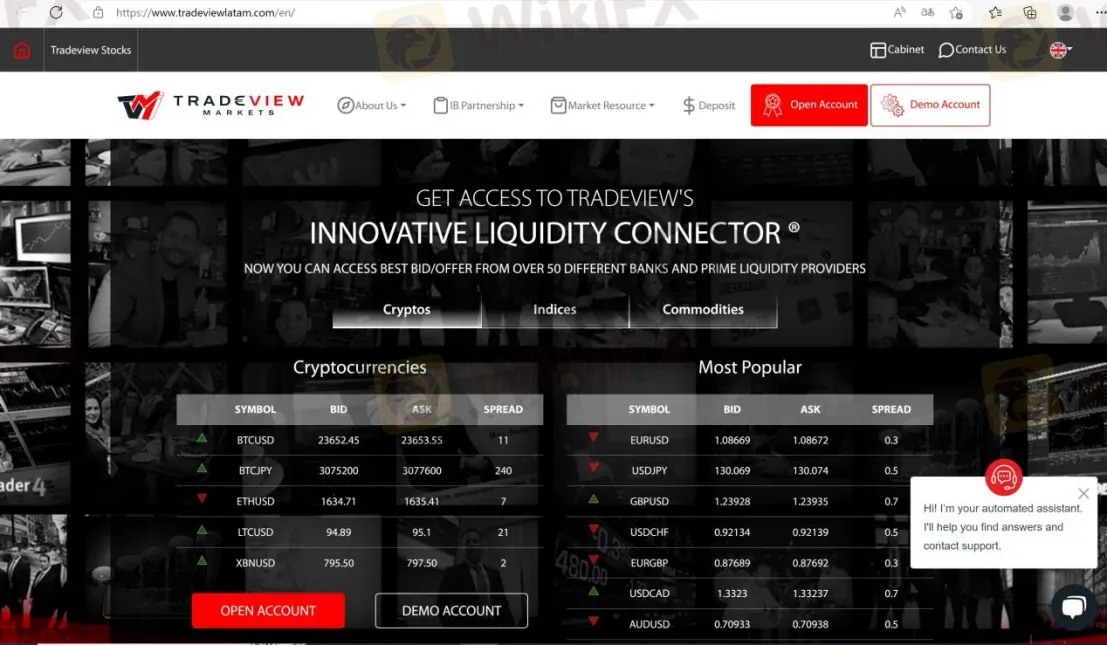

Tradeview is an online ECN broker based in the Cayman Islands, founded in 2004. Tradeview is a regulated brokerage firm operating in the Cayman Islands and regulated in Malaysia.The company offers Straight Through Processing (STP) and holds a full license for MT4/5, providing traders with access to various financial markets. Tradeview allows trading in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and XRP, as well as major stock market indices and commodities like gold, silver, and crude oil. The brokerage offers two trading account options: the X leverage account and the Innovative Liquidity Connector account, catering to different types of traders.

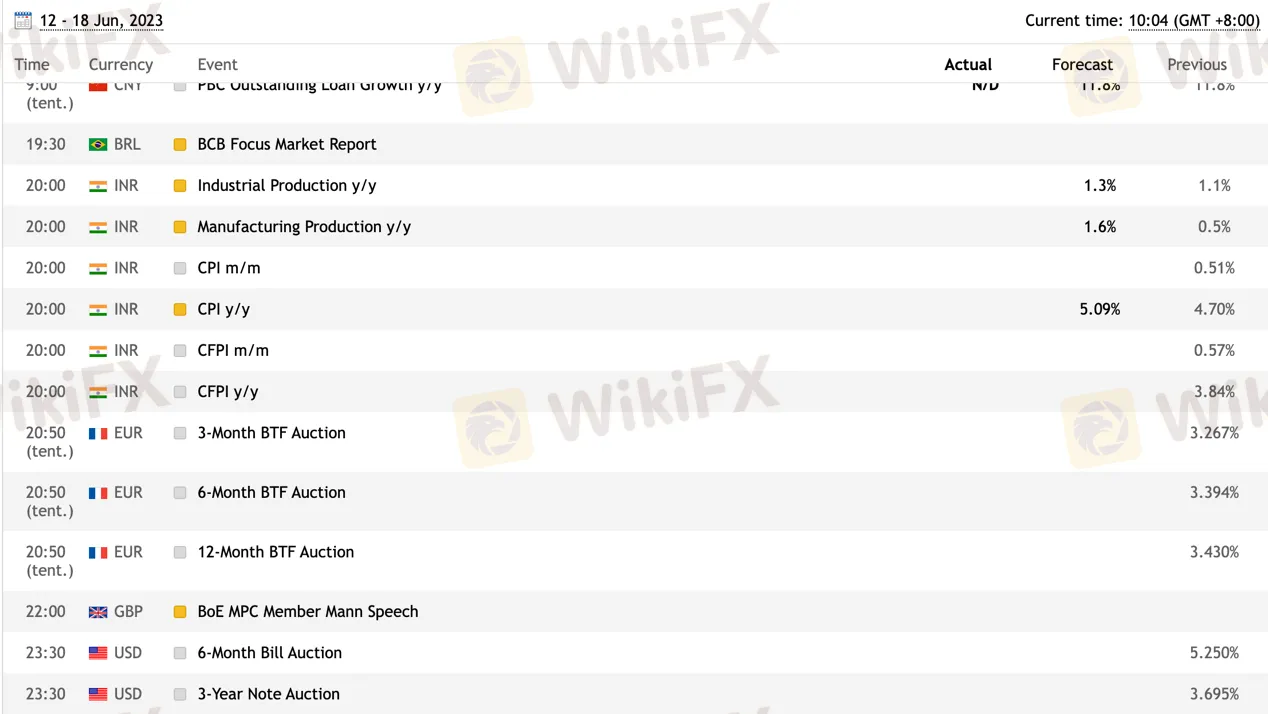

Tradeview supports multiple trading platforms, including Metatrader 4, Metatrader 5, cTrader, and Currenex. These platforms offer advanced features, charting capabilities, and a wide range of technical indicators. The company also provides a comprehensive trading platform, an economic calendar, and educational resources such as a glossary and financial blogs.

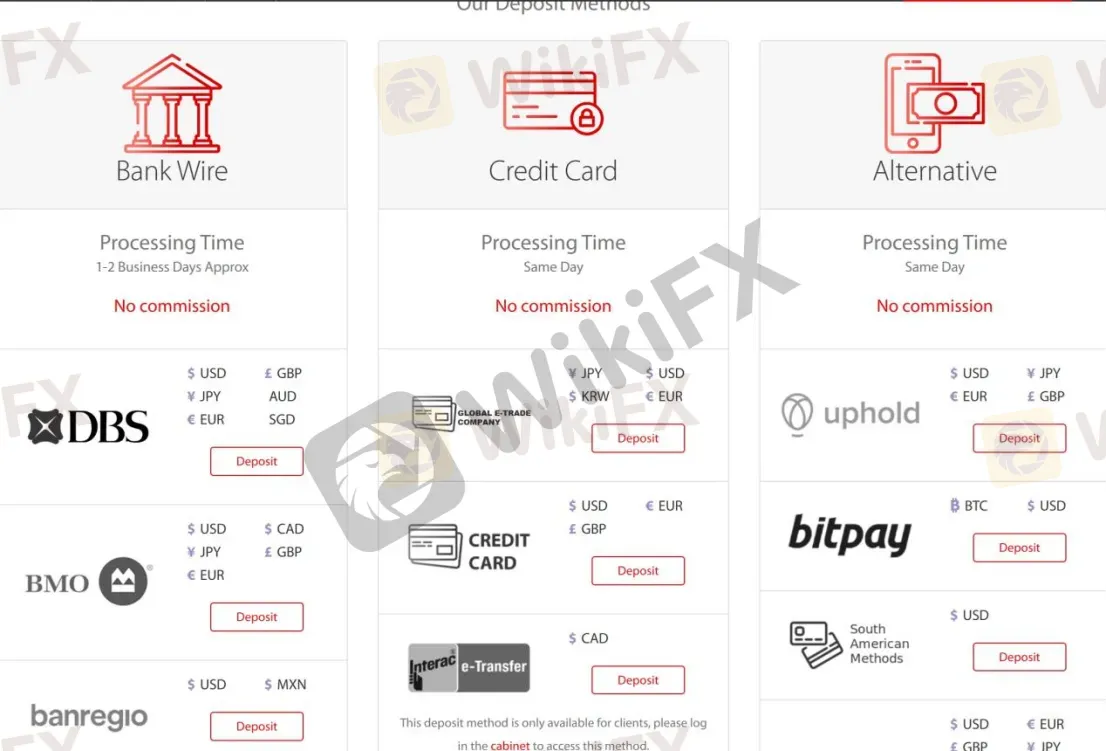

Tradeview offers various payment methods, including bank wire transfers, credit cards, and alternative options. However, there have been concerns raised by customers, including difficulties with fund withdrawals, server errors, suspicious trading practices, and lackluster customer support. Some users have also reported discrepancies in payment methods and fees.

Here is the home page of this brokers official site:

Pros and Cons

Tradeview, a regulated brokerage based in the Cayman Islands, offers a diverse range of market instruments, including cryptocurrencies, stock market indices, commodities, and currency pairs. However, there are some drawbacks to consider. The spread values for trading are not provided in the available information, and there is a lack of detailed information on leverage, margin requirements, trading hours, and specific contract specifications. Additionally, there is limited information on trading fees, commissions, and the features and advantages of certain account types and trading platforms. There have been concerns raised by customers regarding difficulties in withdrawing funds, server errors, abnormal trading practices, and poor customer support. These factors indicate a need for further research and caution before engaging with Tradeview as a trading platform.

Is Tradeview Legit?

Based on the information provided, Tradeview Ltd is regulated by the Cayman Islands Monetary Authority (CIMA) with license number 585163. However, the provided information indicates that Tradeview Ltd has exceeded its business scope regulated by CIMA and has received a risk alert from WikiFX. The alert suggests that Tradeview Ltd is operating with a license that does not cover its current business activities.

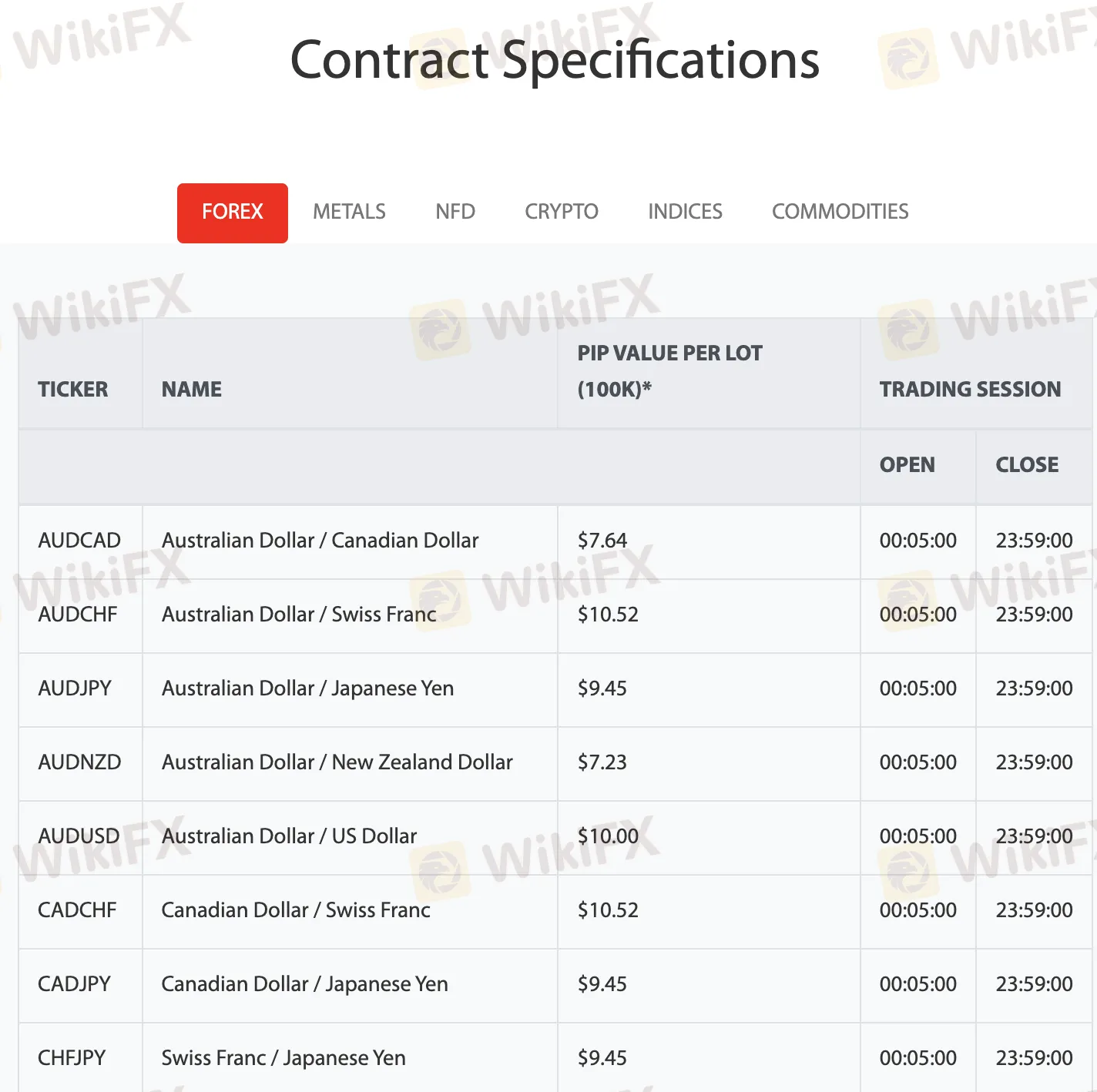

Market Instruments

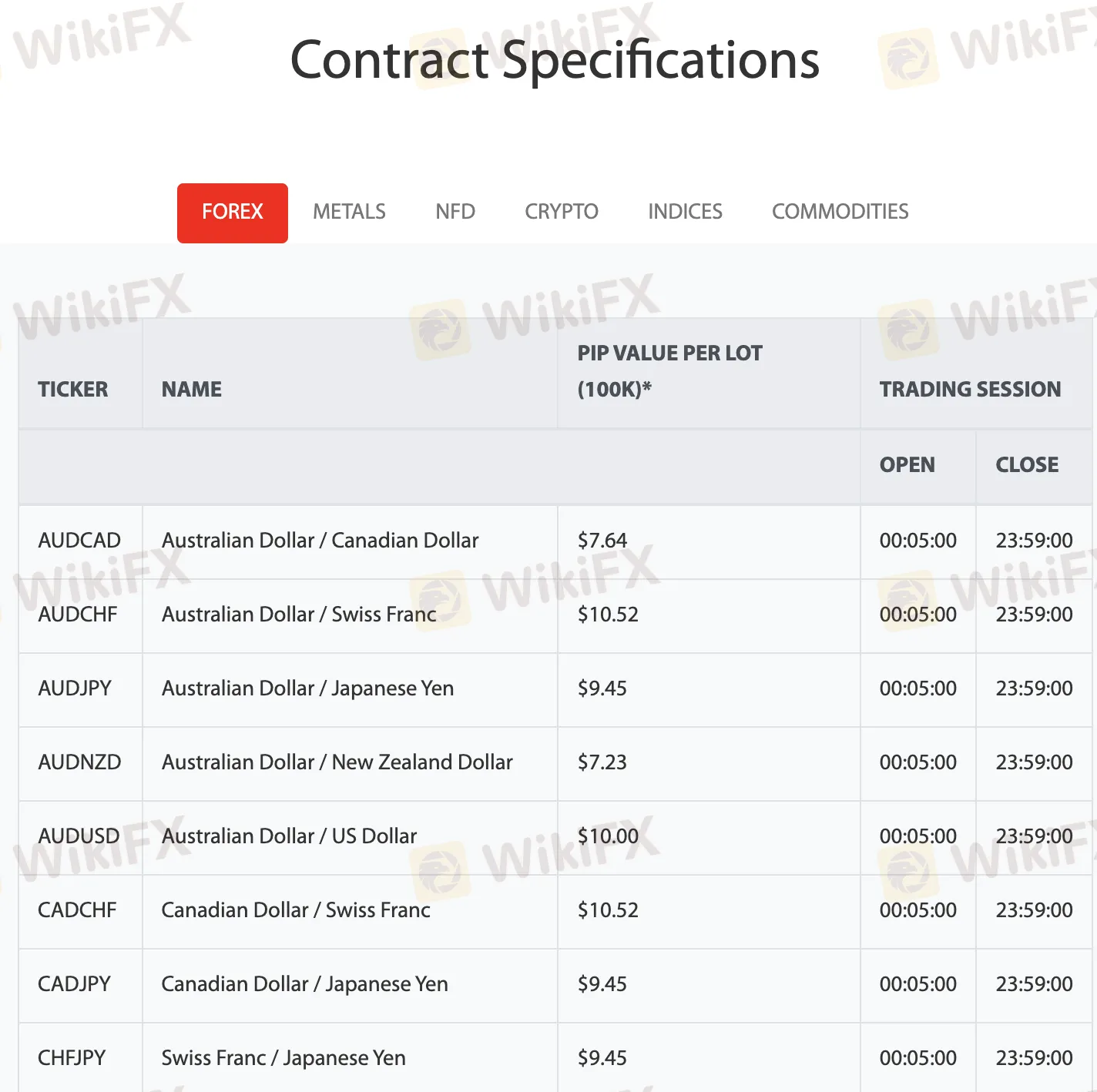

Tradeview currently offers investors trading in Forex, Indices CFDs, Commodities, and Cryptocurrencies like Litecoin, Bitcoin, Ethereum, Ripple and more.

Cryptos:

Tradeview offers several cryptocurrencies for trading, including BTCUSD (Bitcoin to US Dollar), BTCJPY (Bitcoin to Japanese Yen), ETHUSD (Ethereum to US Dollar), LTCUSD (Litecoin to US Dollar), and XBNUSD (XRP to US Dollar). These instruments allow traders to speculate on the price movements of various cryptocurrencies.

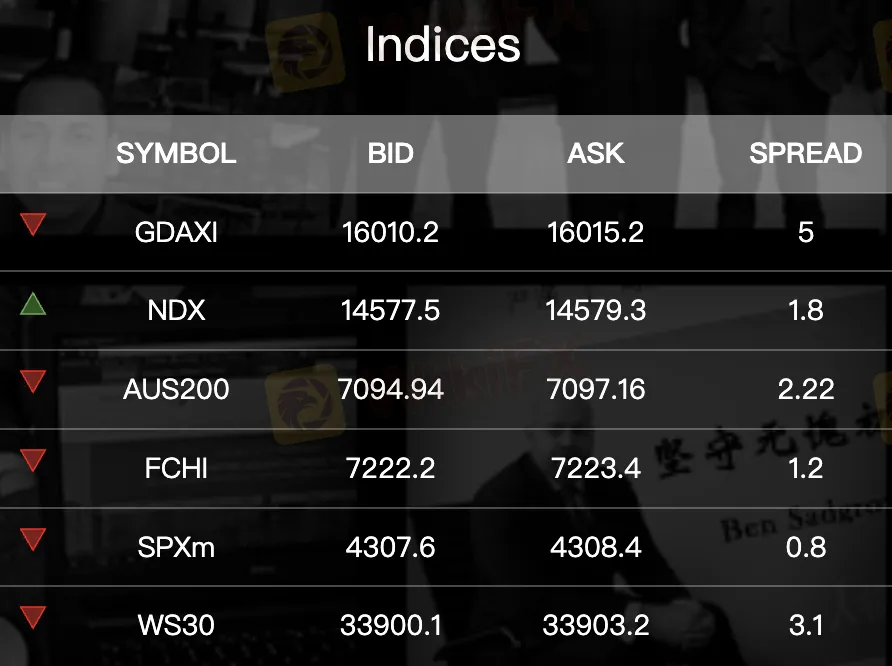

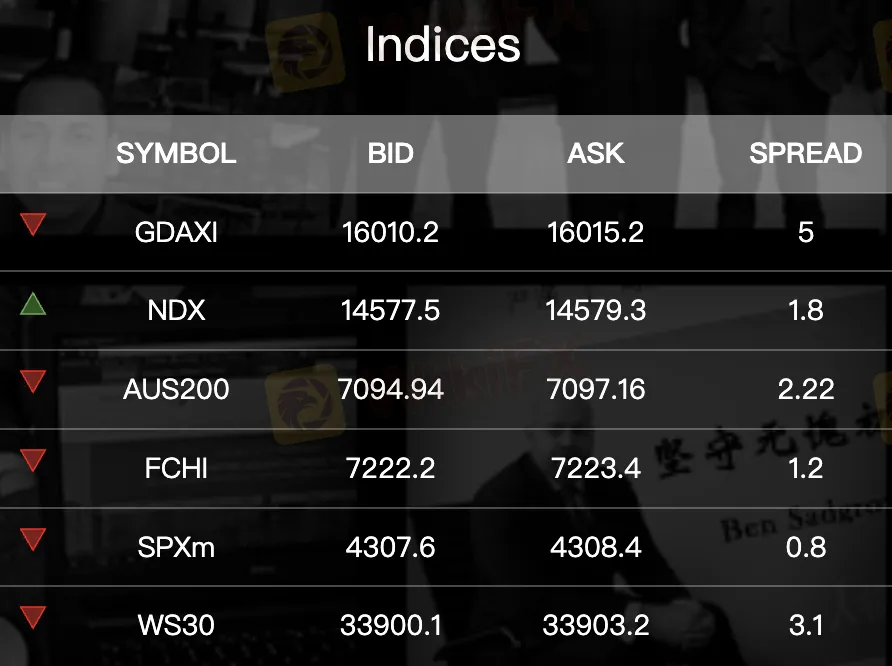

Indices:

Tradeview provides trading opportunities in different indices such as GDAXI (German DAX 30), NDX (NASDAQ 100), AUS200 (Australian 200), FCHI (French CAC 40), SPXm (S&P 500 mini), and WS30 (Dow Jones Industrial Average). Traders can take positions based on the performance of these stock market indices.

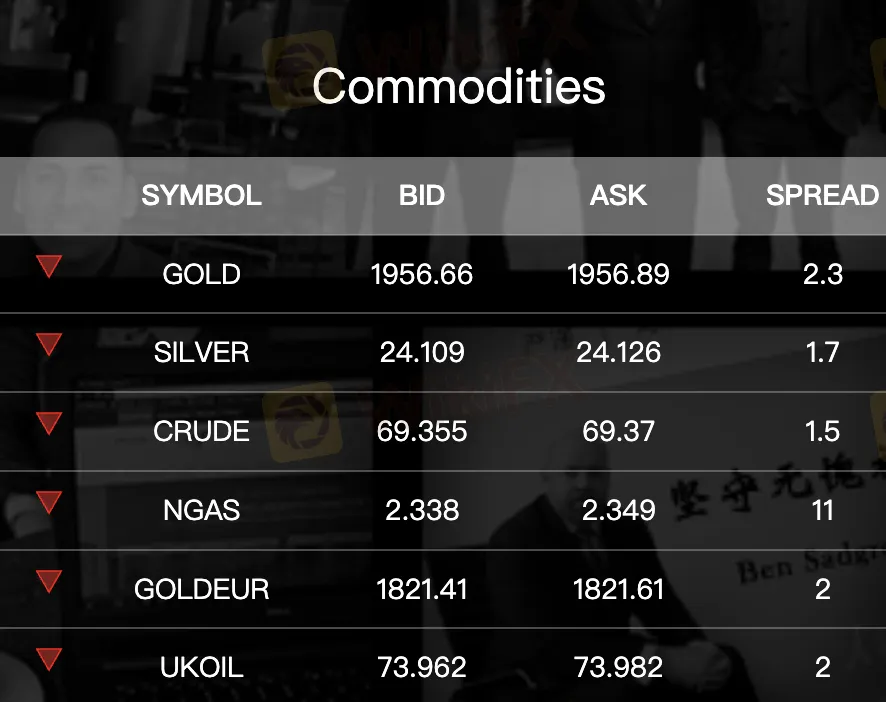

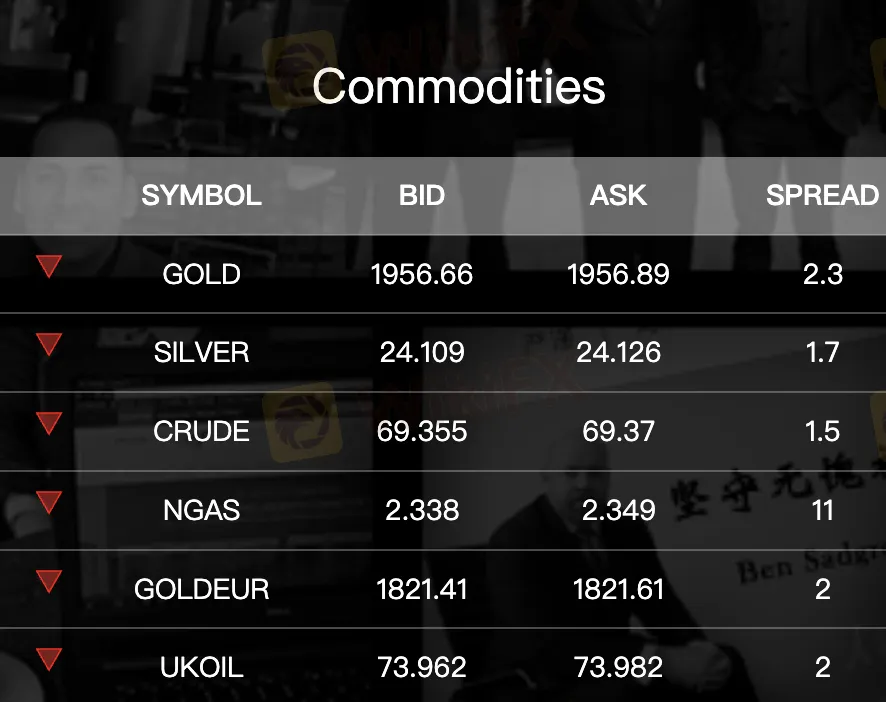

Commodities:

The commodities available for trading on Tradeview include GOLD (Gold), SILVER (Silver), CRUDE (Crude Oil), NGAS (Natural Gas), GOLDEUR (Gold to Euro), and UKOIL (UK Brent Crude Oil). Traders can speculate on the price fluctuations of these commodities

Pros and Cons

Account Types

There are two trading account options available at Tradeview: the X leverage account and the Innovative Liquidity Connector account. The minimum deposit to open an X leverage account is $100, which sounds quite reasonable for most regular traders to have a try.

Tradeview also offers a free live demo account where users can trade across MT4, MT5, cTrader and CurreneX platforms. Users can learn to trade in real-time, and practice trading strategies with technical indicators while avoiding money risks.

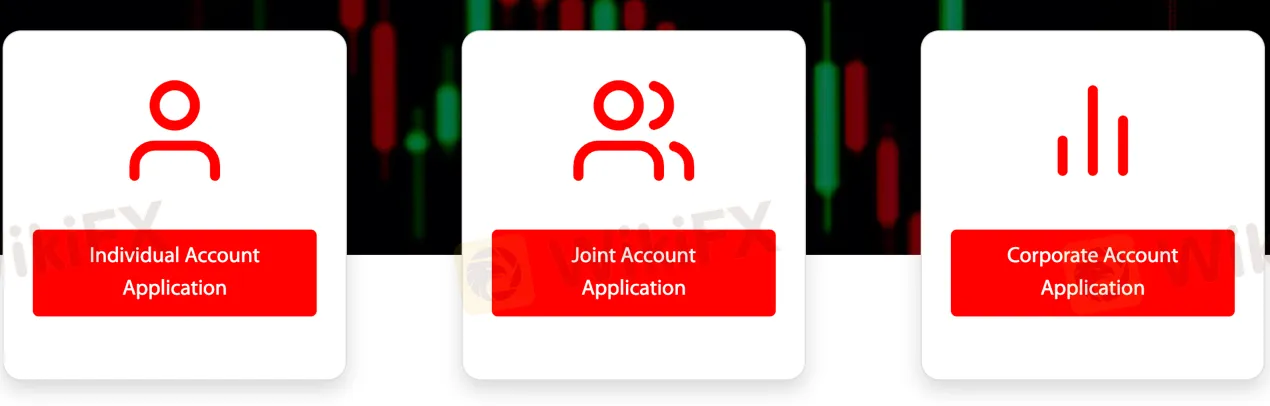

How to Open an Account?

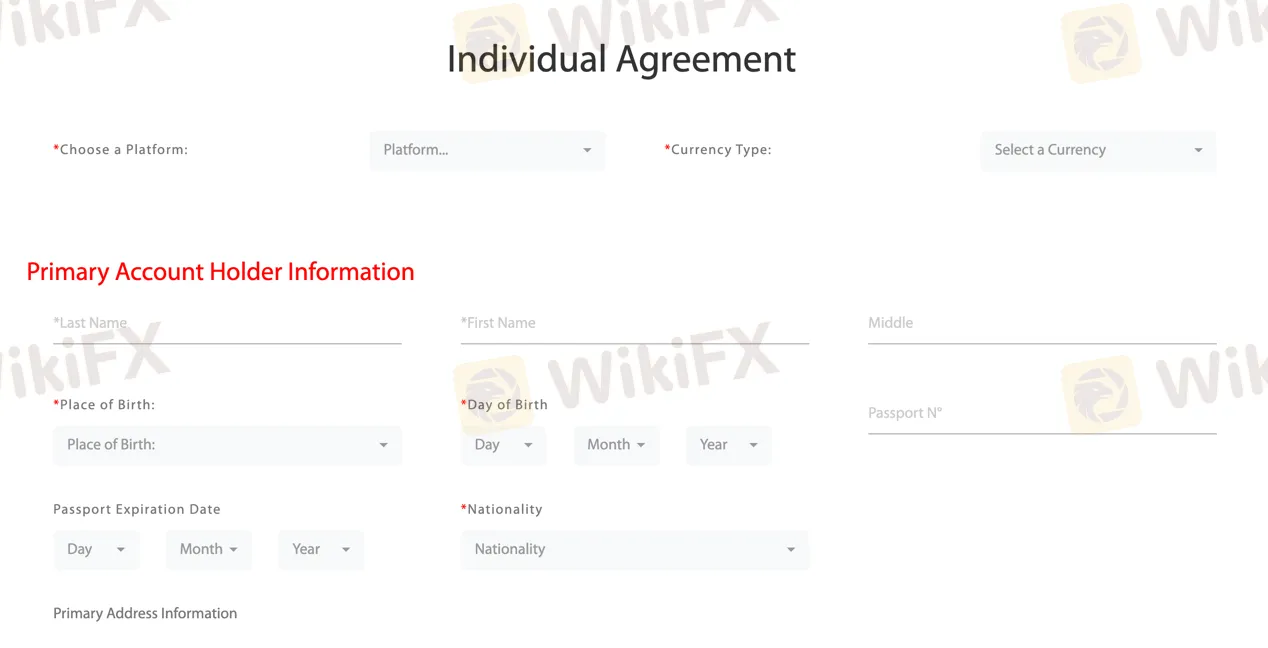

To open an account with Tradeview, follow these steps:

Go to the Tradeview website.

Look for the “Open Account” button on the homepage and click on it.

3. On the account types page, you will see different options. To start with a demo account, click on the “Demo Account” option. If you want to open a live trading account, proceed to the next step.

4. Select the type of account you want to open. Tradeview offers three options: “Individual Application,” “Joint Account Application,” and “Corporate Account Application.” Choose the one that suits your needs and click on it.

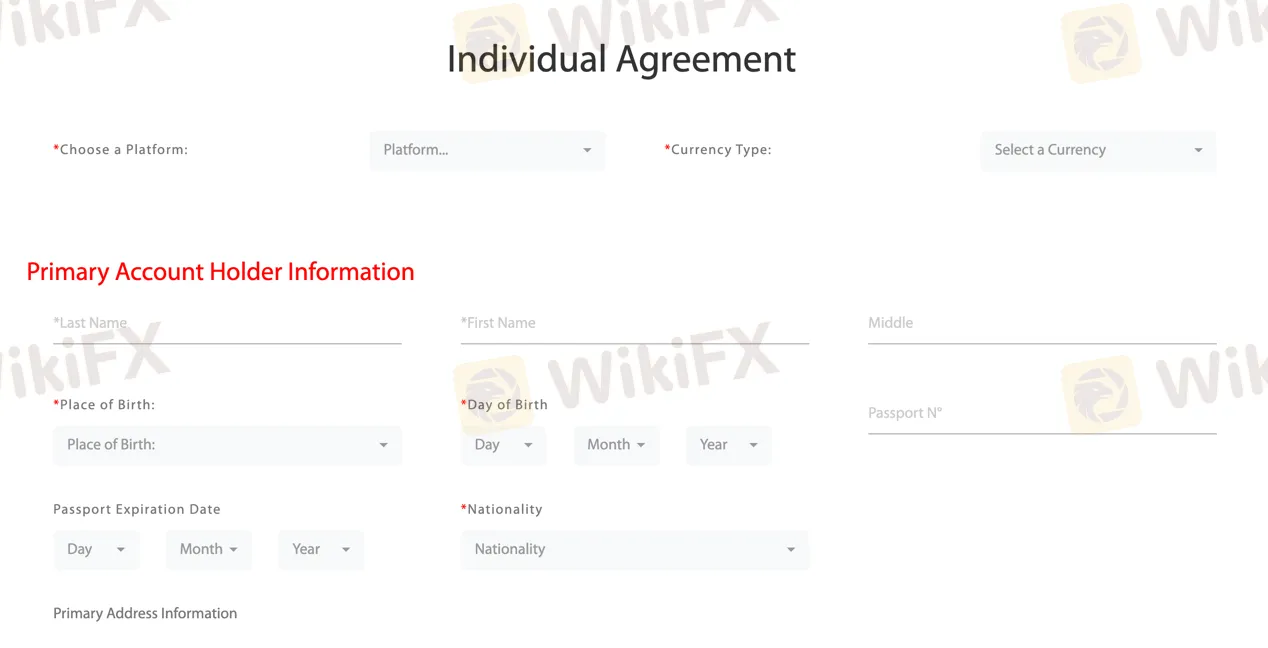

5. Fill out the basic information form. Provide accurate details such as your name, email address, phone number, country of residence, and desired account currency.

6. Next, you need to choose a trading platform. Tradeview offers several platforms, such as MT4, MT5, cTrader, and Currenex. Select the platform you prefer for trading.

7. Select the currency type for your account. You can choose between USD (United States Dollar) and EUR (Euro).

8. Proceed to fill in the primary account holder information. This includes personal details like your full name, date of birth, residential address, and occupation.

9. Read and review the Individual Agreement carefully. This document outlines the terms and conditions for opening and using an individual trading account with Tradeview. Make sure you understand and agree to the terms before proceeding.

10. Once you have completed all the required information, click on the “Submit” or “Open Account” button to submit your application.

After submitting your application, Tradeview may require additional documentation to verify your identity and address. This typically includes providing a copy of your identification documents (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement). Make sure to follow any instructions provided by Tradeview to complete the verification process.

Leverage

Leverage differs for each account. For ILC (Innovative Liquidity Connector) accounts, the maximum trading leverage is 1:100 while on X Leverage accounts, it is up to 1:400. The minimum trade size is 0.1 lots on the ILC account and 0.01 lots on the X leverage account.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

All spreads with Tradeview are a floating type and scaled with the asset class. For example, the EUR/USD spread is floating around 0.3 pips. There is no commission on the X Leverage account, while the Innovative Liquidity Connector account has to pay a commission of $5 per lot.

Trading Platform

Traders are free to choose from four different trading platforms, Metatrader4, Metatrader5, cTrader, and Currenex, depending on their trading experience and trading needs.

Tradeview offers four trading platforms to choose from: Metatrader 4, Metatrader 5, cTrader, and Currenex. These platforms provide traders with advanced tools and features to enhance their forex trading experience.

Metatrader 4 (MT4) is a widely recognized platform in the forex industry. It offers a user-friendly interface, extensive charting capabilities, and a wide range of technical indicators. Traders can execute trades, set up automated trading strategies, and access a vast marketplace of third-party plugins and expert advisors.

Metatrader 5 (MT5) is the successor to MT4 and offers enhanced features and functionality. It provides an improved trading environment, additional order types, advanced analytical tools, and more options for customization. MT5 also allows traders to access various financial markets, including cryptocurrencies.

cTrader is a powerful and innovative trading platform known for its advanced order execution capabilities and comprehensive charting tools. It provides direct market access (DMA) and enables traders to execute trades quickly. cTrader also offers a range of features such as depth of market (DOM), detachable charts, and customizable layouts.

Currenex is a platform designed specifically for institutional and professional traders. It offers deep liquidity, fast order execution, and advanced trading tools. Currenex provides access to a wide range of currency pairs and allows for high-volume trading.

Trading Tools

Tradeview offers two trading tools that provide valuable features and functionality for traders. These tools are designed to assist traders in making informed decisions and executing their trading strategies.

Trading Platform: Tradeview provides a comprehensive trading platform that allows traders to access various financial markets and instruments. The platform offers a user-friendly interface with advanced charting capabilities, real-time market data, and a range of order types for executing trades. Traders can analyze price movements, monitor positions, and implement trading strategies directly from the platform. The trading platform is accessible on desktop computers, as well as mobile devices, enabling traders to stay connected to the markets at all times.

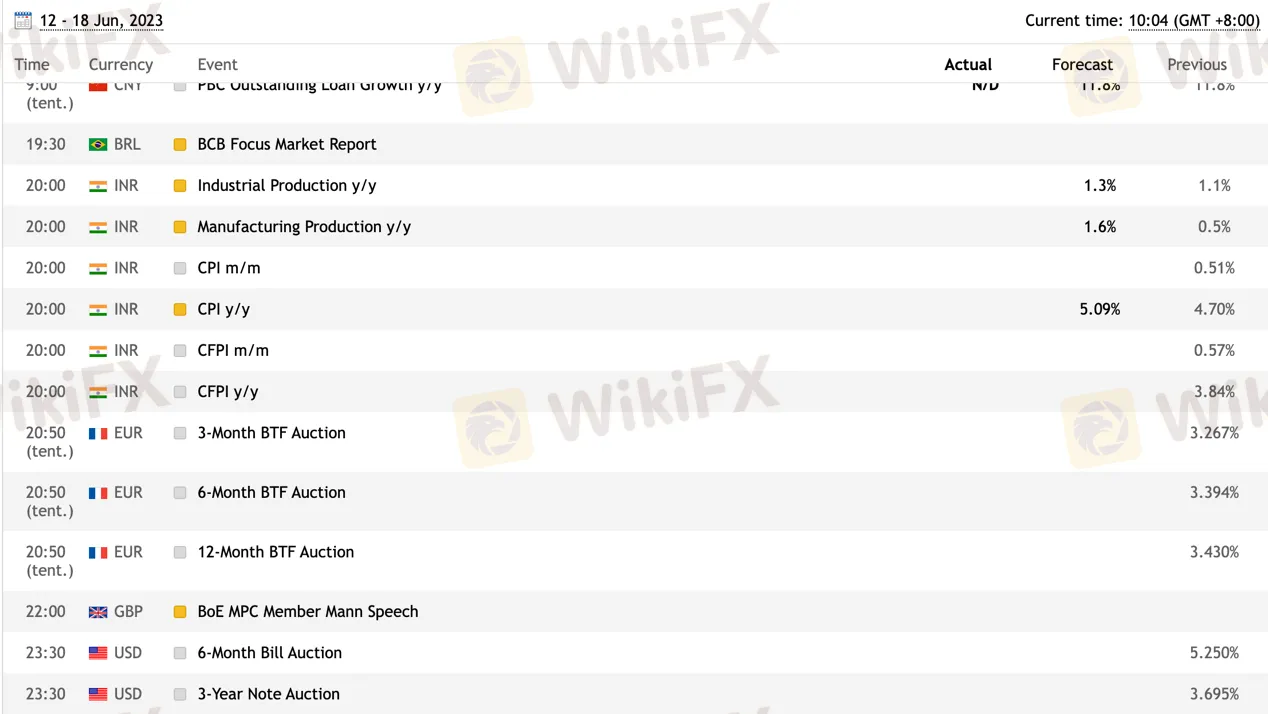

Economic Calendar: Tradeview offers an economic calendar, which is a vital tool for traders to stay updated on important economic events and their potential impact on the financial markets. The economic calendar provides a schedule of upcoming economic indicators, such as GDP releases, interest rate decisions, employment reports, and more. Traders can use this information to anticipate market movements, identify trading opportunities, and manage their risk accordingly. The economic calendar offered by Tradeview is comprehensive and provides relevant data for various regions and countries.

Pros and Cons

Trading Hour

Tradeview opens on Sunday at 5 pm EST and closes on Friday at 4:55 EST. Each market is subject to specific trading hours. Forex, Indices and commodities markets are open 24/5 from Monday to Friday. Trading hours for each market can also be viewed on MT4 and MT5 platforms.

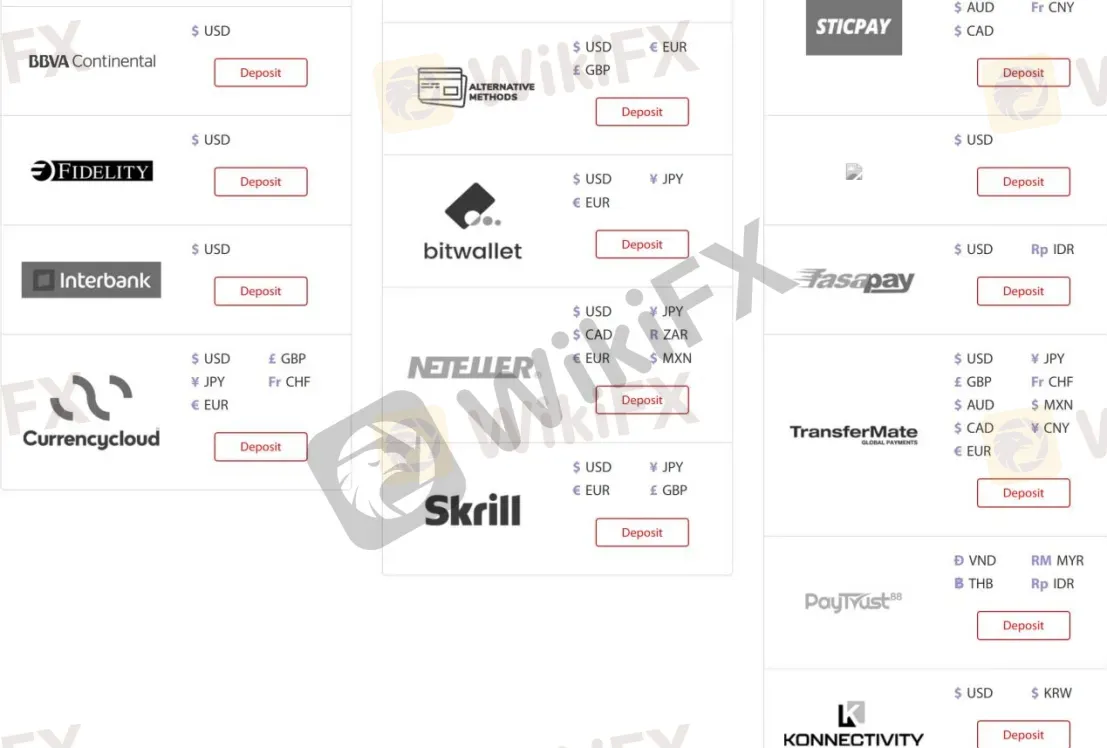

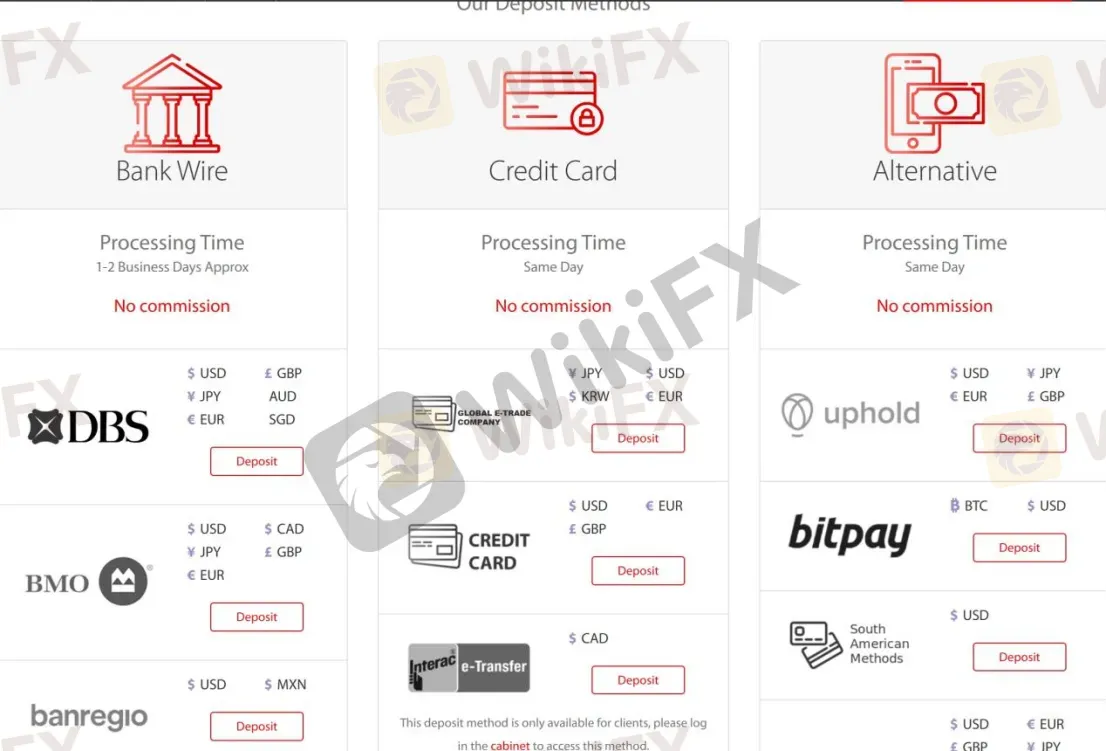

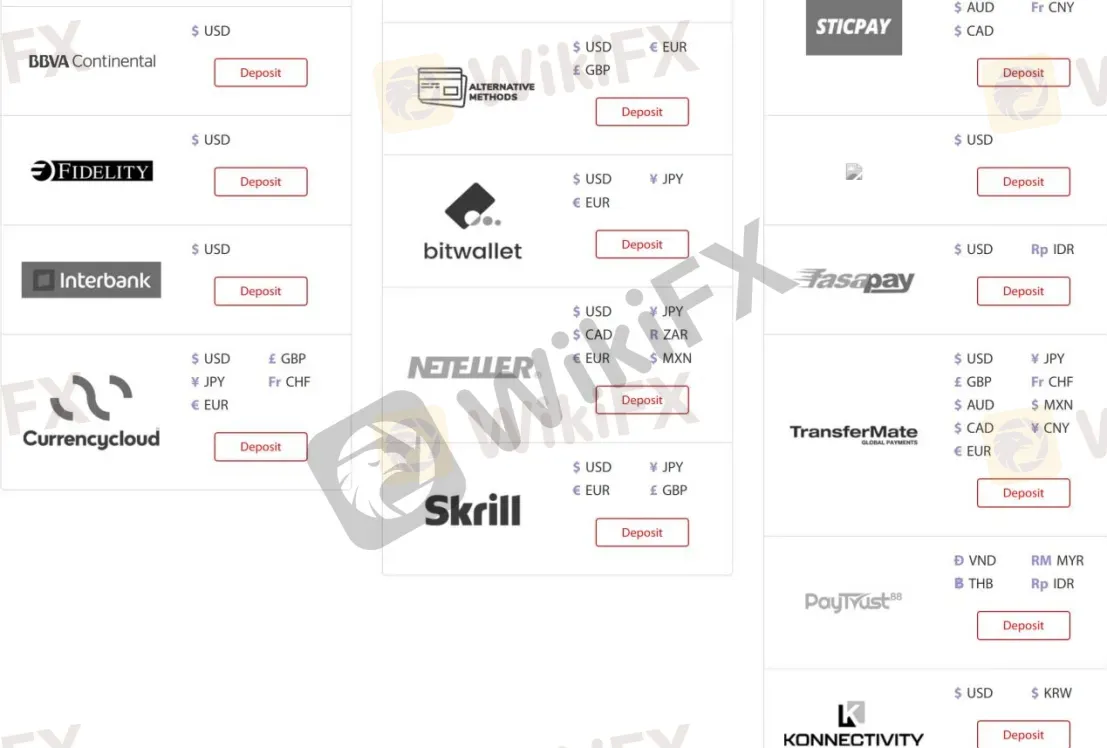

Deposit & Withdrawal

Tradeview supports bank wire transfers, credit cards, Skrill, Neteller, STICPAY, Fasapay, and many other deposit and withdrawal methods.

Note that losses can exceed the initial amount invested. Third-party payments will NOT be accepted. All deposits MUST be from the original account owner.

Withdrawals are only released via the same method in which the payment was originally submitted. Tradeview does not charge fees for withdrawals. However, a hefty $35 is charged with the bank wire option and a 1%-1.5% fee for Skrill and Neteller. To submit a request for withdrawals, users have to complete a form on the website with supporting documentation.

Educational Resources

Tradeview offers some educational materials in the form of a glossary list. They also have a website called Surf Up!, which is dedicated to educating about the FX market. The website is updated with daily news and regular financial blogs.

Trading Hours

Tradeview operates during specific trading hours, which are as follows: The trading week starts on Sunday at 5 pm EST and ends on Friday at 4:55 pm EST. The Forex, Indices, and commodities markets are open 24 hours a day, five days a week, from Monday to Friday. For more detailed trading hour information, users can refer to the MT4 and MT5 platforms provided by Tradeview.

Customer Support

Tradeview provides customer support services through various channels. Traders can reach out to their customer service desk 24/5 via instant web chat. Additionally, there is a 'contact us' form available for submitting inquiries, and the support team responds to these queries via email. For direct assistance, traders can contact Tradeview by telephone at the provided numbers. Tradeview is also active on popular social media platforms such as Facebook, Twitter, LinkedIn, and Instagram. Their physical address is located at 4th Floor Harbour Place, 103 South Church St, PO Box 1105.

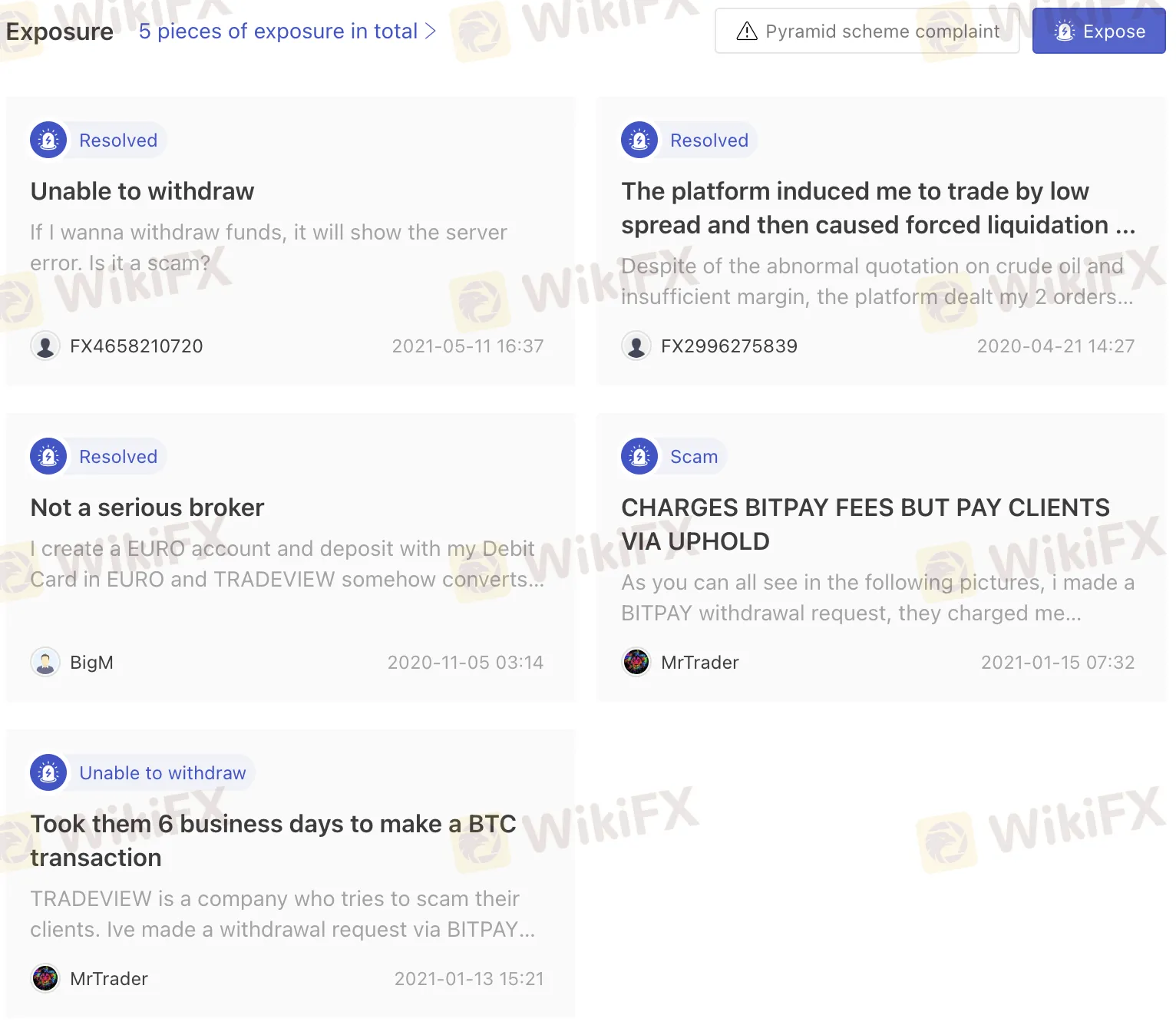

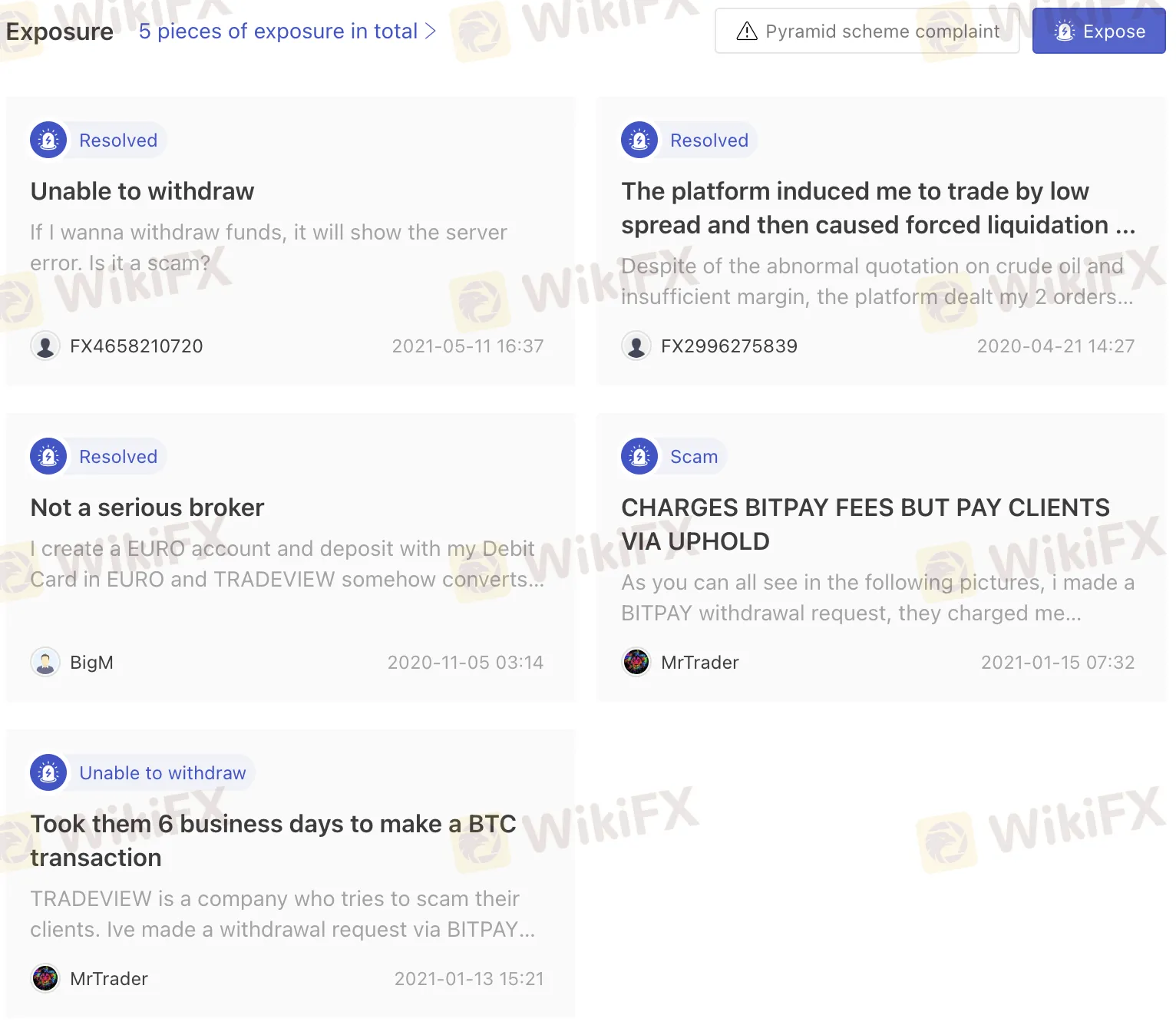

Reviews

The reviews on WikiFX about Tradeview suggest several concerns and issues raised by customers. One user reported difficulties in withdrawing funds, encountering server errors, and expressing suspicions about the legitimacy of the platform. Another user mentioned experiencing forced liquidation and losses due to abnormal quotations and insufficient margin. Additionally, a customer complained about the broker converting their EURO deposit to RUB without their knowledge and the lack of response from customer support. Another review accused Tradeview of charging BitPay fees but paying clients via Uphold, resulting in delayed transactions and potential losses. Finally, a customer claimed that Tradeview took several days to process their BTC transaction, charged BitPay fees despite using Uphold, and suggested the company intentionally delayed transactions when the Bitcoin price was rising. These reviews highlight concerns related to withdrawal issues, abnormal trading practices, poor customer support, and potential discrepancies in payment methods and fees.

Conclusion

In conclusion, Tradeview has both advantages and disadvantages to consider. On the positive side, Tradeview offers a diverse range of market instruments, including cryptocurrencies, stock market indices, and commodities, providing traders with various trading opportunities. They also offer multiple trading platforms, such as Metatrader 4, Metatrader 5, cTrader, and Currenex, each with its own set of features. Additionally, Tradeview provides educational resources to help users learn about the FX market. However, there are several concerns raised by customers, including difficulties with fund withdrawals, server errors, suspicions about the platform's legitimacy, forced liquidation, and potential discrepancies in payment methods and fees. It is important for potential traders to carefully evaluate these factors before deciding to engage with Tradeview.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX