Score

Finova trade

United States|1-2 years|

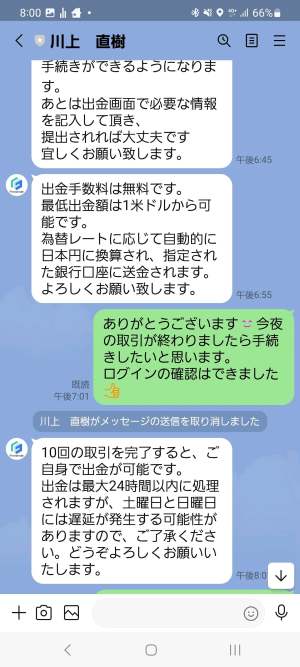

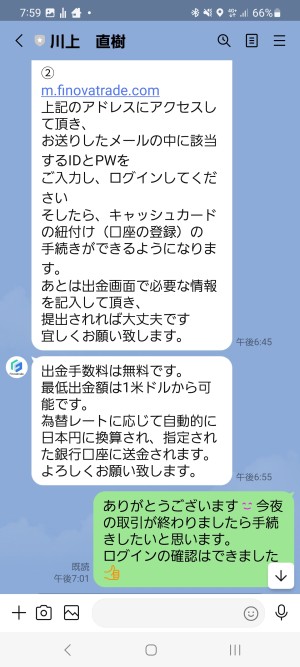

United States|1-2 years| https://www.finovatrade.com/en

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Finova trade

Finova trade

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The United StatesNFA regulation (license number: 0557508) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Finova trade also viewed..

XM

FXCM

AUS GLOBAL

Exness

Finova trade · Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | Finova Trade |

| Regulation | Unauthorized with NFA (United States) |

| Minimum Deposit | $250 (Standard Account) |

| Maximum Leverage | Up to 1:100 (VIP Account - for indices) |

| Spreads | Starting from 0 pips (Zero Spread Account for select forex instruments) |

| Trading Platforms | Tradingweb (PC and Mobile) |

| Tradable Assets | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Account Types | Standard, Zero Spread, VIP, Islamic, Demo |

| Demo Account | Available (with $10,000 in virtual funds) |

| Islamic Account | Available (Compliance with Sharia law, no overnight fees or swaps) |

| Customer Support | Email support@finovatrade.com |

| Payment Methods | Bank Wire Transfer, Credit/Debit Cards (Visa, Mastercard), Skrill, Neteller, FasaPay, UnionPay, Cryptocurrency (BTC, ETH, LTC) |

| Educational Tools | No |

Overview

Finova Trade, a registered company in the United States, raises concerns due to its unauthorized status with the National Futures Association (NFA), indicating a lack of essential regulatory approval and potential risks for traders. While the broker offers various account types and payment methods, the absence of educational resources leaves traders at a disadvantage. Customer support, relying solely on email contact, appears passive and unresponsive, raising concerns about service quality. Overall, Finova Trade's regulatory ambiguity, limited educational support, and potentially subpar customer service demand cautious consideration from prospective traders.

Regulation

Finova Trade currently holds an “Unauthorized” status with the National Futures Association (NFA) in the United States, indicating that it lacks the necessary regulatory approval to provide financial services. Under the classification of a “Common Financial Service License,” this institution, identified as FINOVA TRADE with License No. 0557508, operates without disclosing its email address. Unfortunately, the effective date of this status is not provided. The label “No Sharing” suggests restricted public disclosure of its license details. This status serves as a cautionary signal, implying non-compliance with NFA regulations and the need for careful consideration when engaging with Finova Trade in any financial transactions.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments: Offers a range of financial instruments, including forex, commodities, indices, shares, and cryptocurrencies. | Regulatory Concerns: Holds an “Unauthorized” status with the NFA, raising questions about regulatory compliance. |

| Multiple Account Types: Provides a variety of account options, catering to different trader preferences and strategies. | Limited Educational Resources: Lacks educational materials, potentially disadvantaging traders seeking knowledge. |

| Competitive Spreads: Offers tight spreads starting from 0 pips on certain accounts. | Passive Customer Support: Customer support communication comes across as passive, requiring proactive engagement. |

| Choice of Trading Platforms: Access to the Tradingweb platform for both PC and mobile trading. | Lack of Transparency: Limited information on commission rates and spread details for specific accounts. |

| No Deposit/Withdrawal Fees: Does not charge fees for deposits or withdrawals. |

FinovaTrade presents a mixed picture for potential traders. While it offers a diverse range of market instruments, multiple account types, and competitive spreads, significant concerns arise due to its regulatory status. The broker's “Unauthorized” classification by the NFA raises doubts about regulatory compliance and legitimacy. Moreover, the absence of educational resources leaves traders without essential tools for skill development. Customer support appears passive, and transparency regarding commissions and spreads could be improved. Traders should exercise caution and carefully weigh these factors when considering FinovaTrade as their broker of choice.

Market Instruments

Forex Straight Pairs:

Market Instruments: Forex straight pairs, also known as major currency pairs, are some of the most traded instruments in the foreign exchange (Forex) market. They consist of two major currencies from different countries, like EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). These pairs are characterized by high liquidity and are often used as benchmarks in Forex trading.

Forex Cross Pairs:

Market Instruments: Forex cross pairs, also called minor currency pairs, consist of two currencies that do not include the US Dollar. Examples include EUR/GBP (Euro/British Pound) or AUD/JPY (Australian Dollar/Japanese Yen). Cross pairs can provide trading opportunities based on the relative strength of these currencies.

Gold:

Market Instruments: Gold is a precious metal traded in various forms, including spot (physical delivery), futures contracts (standardized contracts for future delivery), and exchange-traded funds (ETFs) that track the price of gold. Additionally, gold can be traded through options contracts and as a commodity in the commodities market.

Silver:

Market Instruments: Similar to gold, silver is traded as a physical asset (bullion), in futures contracts, and through ETFs that aim to replicate its price movements. It is also a commodity available for trading in the commodities market.

Index:

Market Instruments: Stock market indices, such as the S&P 500 or Dow Jones Industrial Average, represent a basket of stocks that collectively measure the performance of a particular stock market. Investors can trade index futures, options, and ETFs that track these indices to gain exposure to the overall market's performance.

Crude Oil:

Futures Contracts: Standardized contracts for the future delivery of crude oil. Examples include West Texas Intermediate (WTI) and Brent crude oil futures.

Options Contracts: Derivative contracts that give the holder the right, but not the obligation, to buy or sell crude oil futures at a predetermined price.

Exchange-Traded Funds (ETFs): ETFs that track the price of crude oil and can be traded on stock exchanges.

Physical Market: Crude oil can also be traded physically, with buyers and sellers agreeing to deliver or receive the actual commodity.

Market Instruments: Crude oil is a widely traded commodity with various market instruments. These include:

Each of these market instruments provides investors and traders with various ways to participate in the respective financial markets, whether through physical ownership, derivatives trading, or investment vehicles like ETFs. The choice of instrument depends on an individual's investment goals, risk tolerance, and market expertise.

Account Types

Finova trade offers a range of account types, each tailored to meet specific trader requirements and preferences:

Standard Account:

Minimum Deposit: $250

Spreads: Starting from 2.2 pips

Assets: Trading available in forex, commodities, indices, shares, and cryptocurrencies.

Suitable For: Traders seeking a basic account for various asset classes.

Zero Spread Account:

Minimum Deposit: $1000

Spreads: Offers raw spreads starting from 0 pips, particularly attractive for traders looking for the tightest spreads.

Assets: Primarily focused on select forex instruments.

Suitable For: Traders who prioritize low spreads in their trading strategies.

VIP Account:

Minimum Deposit: $50,000

Spreads: Lower spreads starting from 0 pips.

Features: Includes a dedicated account manager and access to VIP trading signals and webinars.

Suitable For: High-volume traders or those who value personalized services and advanced features.

Islamic Account:

Minimum Deposit: $1000

Compliance: Designed to comply with Sharia law, with no overnight fees or swaps.

Suitable For: Traders who adhere to Islamic finance principles and require swap-free trading options.

Demo Account:

Funds: Provides a free demo account with $10,000 in virtual funds.

Purpose: Ideal for practice and familiarization with the trading platform, such as the popular MT4 platform.

Suitable For: Beginners and traders looking to test strategies without real financial risk.

In summary, Finovatrade.com offers a comprehensive selection of account types to accommodate traders with varying deposit sizes, trading strategies, and specific needs. These accounts differ in terms of minimum deposit requirements, spreads, and additional features, ensuring that traders can select the account that aligns best with their individual trading objectives. Whether it's minimizing spreads, accessing VIP services, adhering to Islamic finance principles, or practicing in a risk-free environment, Finovatrade.com aims to cater to a diverse range of trader preferences.

Leverage

FinovaTrade offers a maximum leverage of up to 1:100 for trading indices through their VIP account. This high leverage allows traders to potentially amplify their positions in the indices market. However, it's important to use leverage judiciously due to its potential to increase both profits and losses. Different leverage levels apply to other asset classes, with forex having a maximum of up to 1:30 for regular accounts, while shares and cryptocurrencies typically have lower leverage due to their specific market characteristics and risks.

Spreads & Commissions

Spreads:

Standard Account: Spreads start from 2.2 pips.

Zero Spread Account: Offers raw spreads starting from 0 pips on specific forex instruments.

VIP Account: Provides lower spreads starting from 0 pips.

Islamic Account: Specific spread details not mentioned, but typically tailored for compliance with Sharia law.

Demo Account: Spreads are not applicable as demo accounts are for practice.

Commissions:

Standard Account: Commission details not provided; earnings often included in spreads.

Zero Spread Account: Possible trading commissions, but exact rates not specified.

VIP Account: May have trading commissions, but specific commission rates are not detailed.

Islamic Account: Commission details not mentioned, with a focus on avoiding overnight fees or swaps.

Demo Account: No commissions, as demo accounts are for practice and do not involve real-money trading.

In summary, FinovaTrade's spreads and commissions vary across different trading accounts, with specific commission rates not provided in the information. Traders should carefully review the terms and conditions of each account type to understand the spread structure and any associated commissions or fees. Both spreads and commissions are essential factors to consider when evaluating the overall cost of trading with the broker and aligning them with individual trading strategies and preferences.

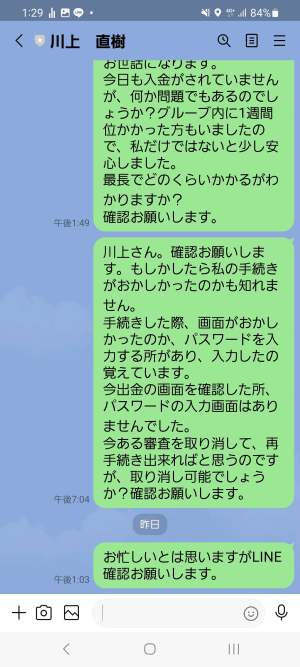

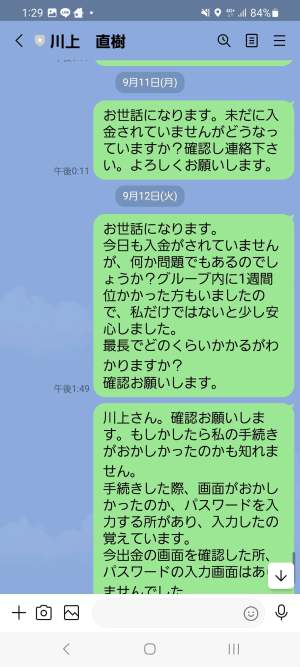

Deposit & Withdrawal

Deposit Methods:

Bank Wire Transfer: Allows for traditional bank transfers, which may take 1-7 business days to process.

Credit/Debit Cards (Visa, Mastercard): Provides instant deposit options for traders.

Skrill: An e-wallet option that is generally instant for depositing funds.

Neteller: Another e-wallet option known for its instant deposit processing.

FasaPay: An electronic payment system.

UnionPay: A payment method often used in Asia.

Cryptocurrency (BTC, ETH, LTC): Enables deposits using popular cryptocurrencies, with processing times depending on network confirmations.

Withdrawal Methods:

Bank Wire Transfer: Used for transferring funds back to a bank account.

Credit/Debit Cards (Visa, Mastercard): Allows withdrawals to the original card used for deposits.

Skrill: An e-wallet option for withdrawing funds.

Neteller: Similar to Skrill, offers e-wallet withdrawals.

FasaPay: Facilitates electronic payment withdrawals.

UnionPay: Enables withdrawals using the UnionPay method.

Cryptocurrency (BTC, ETH, LTC): Provides the option to withdraw in cryptocurrencies, with processing times dependent on network confirmations.

Key notes on deposits and withdrawals include:

FinovaTrade does not charge fees for deposits or withdrawals.

Bank transfers may take 1-7 business days, offering a secure but relatively slower option.

Credit/Debit card deposits are instant, but withdrawals may take 3-5 days.

E-wallets like Skrill and Neteller generally offer instant transactions.

Cryptocurrency deposits and withdrawals depend on network confirmations, which can vary in processing time.

It's worth noting that there are minimum deposit and withdrawal amounts based on the chosen payment method, and additional documentation may be required for processing withdrawals.

Overall, FinovaTrade provides traders with a convenient and varied selection of payment methods for both depositing funds into their trading accounts and withdrawing profits. The broker's commitment to fee-free transactions and multiple options enhances the flexibility and accessibility of financial transactions for its clients.

Trading Platforms

FinovaTrade offers its traders access to the Tradingweb trading platform, which is recognized as one of the most popular and powerful forex trading platforms in the financial industry. Here's a detailed description of the trading platforms provided by the broker:

Tradingweb PC:

Description: Tradingweb PC is hailed as the world's most popular online financial transaction terminal. It serves as an indispensable trading tool for investors participating in online financial markets.

Features: With Tradingweb PC, traders gain access to a comprehensive suite of features, including narrow spreads and state-of-the-art systems. The platform facilitates trading in over 90 forex and other CFD products directly, ensuring liquidity and a seamless trading experience.

User-Friendly: Tradingweb PC boasts an intuitive user interface and high levels of customization, allowing traders to tailor their trading strategies to their preferences.

Technical Analysis: The platform offers a wide range of charts and technical indicators to help traders stay informed about market trends and seize trading opportunities.

Expert Advisors (EA): Tradingweb PC supports the MQL language, enabling the creation and management of Expert Advisor Intelligent Trading Systems (EAs), making it easier for traders to handle multiple trades simultaneously.

Tradingweb Mobile:

Description: Tradingweb Mobile is a popular and convenient mobile trading platform that complements the desktop version.

Accessibility: Traders can access the mobile platform for free by downloading it from their device's app store. It is available for both iOS and Android devices.

User-Friendly: The mobile platform offers a user-friendly experience, allowing traders to execute trades on the go.

Installation: Users can easily install the platform by searching for “Tradingweb” in their app store or by following the provided download links.

Account Access: Traders can log in to the mobile platform using their existing account credentials, ensuring a seamless transition from the desktop platform to mobile trading.

In summary, FinovaTrade provides its clients with access to the Tradingweb trading platform, available for both PC and mobile devices. The PC version is renowned for its robust features, customization options, technical analysis tools, and support for Expert Advisors. The mobile platform offers traders the flexibility to manage their trades anytime, anywhere, making it a valuable complement to the desktop version. Overall, these platforms cater to the diverse needs and preferences of traders in the online financial markets.

Customer Support

FinovaTrade's customer support appears to be lacking in proactive engagement and information. While they provide an email address (support@finovatrade.com) for inquiries, the language used, such as “If you have any needs, please contact us” and “Feel free to send us your email,” gives the impression that they may not be particularly attentive or readily available to address customer concerns. The tone comes across as somewhat passive, suggesting that customers may need to take the initiative to reach out, and it leaves room for improvement in terms of responsiveness and proactive assistance.

Educational Resources

FinovaTrade's approach to educational resources is notably limited, as exemplified by the statement “Educational Resources: none.” This indicates that the broker does not provide any educational materials or resources to assist traders in enhancing their knowledge and skills within the financial markets.

In a critical light, the absence of educational support can be viewed as a substantial drawback, potentially leaving traders without the necessary tools to navigate the complexities of trading. Many reputable brokers prioritize trader education, offering a wealth of resources such as tutorials, webinars, articles, and videos to empower traders with a better understanding of market dynamics and effective trading strategies. The lack of such resources at FinovaTrade may place novice traders at a disadvantage, hindering their ability to make informed and confident trading decisions.

Summary

In summary, FinovaTrade presents a mixed picture for potential traders. The broker's regulatory status is a significant concern, as it holds an “Unauthorized” classification with the National Futures Association (NFA), indicating a lack of necessary regulatory approval. This raises red flags regarding the legitimacy and compliance of the broker.

While the broker offers a range of account types, including Standard, Zero Spread, VIP, Islamic, and Demo accounts, the absence of educational resources is a glaring shortcoming. Traders seeking guidance and educational materials to enhance their skills and knowledge are left wanting.

Additionally, the customer support provided appears to be passive and lacking in proactive engagement, potentially leaving traders with unaddressed concerns or queries.

While the trading platform, Tradingweb, offers some promising features and customization options, the overall experience is marred by regulatory uncertainties, limited educational support, and seemingly passive customer service. Traders should exercise caution and carefully evaluate these factors before considering FinovaTrade as their broker of choice.

FAQs

Q1: Is FinovaTrade a regulated broker?

A1: No, FinovaTrade currently holds an “Unauthorized” status with the National Futures Association (NFA) in the United States, indicating a lack of necessary regulatory approval.

Q2: What are the account types offered by FinovaTrade?

A2: FinovaTrade offers a range of account types, including Standard, Zero Spread, VIP, Islamic, and Demo accounts, each tailored to meet specific trader requirements.

Q3: Are there educational resources available for traders on FinovaTrade?

A3: Unfortunately, FinovaTrade does not offer any educational materials or resources for traders to enhance their knowledge and skills in the financial markets.

Q4: What is the maximum leverage offered by FinovaTrade?

A4: The maximum leverage varies by asset class and account type, with the highest leverage of up to 1:100 available for trading indices through the VIP account.

Q5: How can I contact FinovaTrade's customer support?

A5: You can contact FinovaTrade's customer support by emailing them at support@finovatrade.com. However, the tone of their customer support communication appears to be somewhat passive and may require proactive engagement on your part.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now