Company Summary

| Palm Capital Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Bahamas |

| Regulation | SCB (Suspicious clone) |

| Market Instruments | Forex, metals, indices, and commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| EUR/USD Spread | Average 1.57 pips (Standard account) |

| Trading Platform | MT4 |

| Minimum Deposit | $100 |

| Customer Support | Contact form |

| Phone: +44 203 1502654 | |

| Email: info@palmglobalcapital.com | |

| OPERATIVE ADDRESS: #3 Bayside Executive Park West Bay Street and Blake Road P.O. Box CB-12407, Nassau, Bahamas Palm Global Capital Ltd. | |

Palm Capital Information

Palm Capital was founded in 1995 and is registered in the Bahamas. It offers trading in forex, metals, indices, and commodities with leverage up to 1:200 on most accounts. The broker supports MetaTrader 4 but not MetaTrader 5, provides a demo account, and various customer support options, but operates under a suspicious clone license.

Pros and Cons

| Pros | Cons |

| Various trading instruments | Suspicious clone regulation |

| Demo accounts available | Limited funding methods |

| MT4 platform |

Is Palm Capital Legit?

Palm Capital claims to be regulated by the Securities Commission of the Bahamas (SCB), but it is suspicious clone.

| Regulatory Authority | Regulated by | Current Status | Licensed Institution | Licensed Type | Licensed Number |

| The Securities Commission of the Bahamas (SCB) | Bahamas | Suspicious clone | Palm Global Capital Ltd | Retail Forex License | SIA-F191 |

What Can I Trade on Palm Capital?

Palm Capital offers four main trading instruments: forex, metals, indices, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

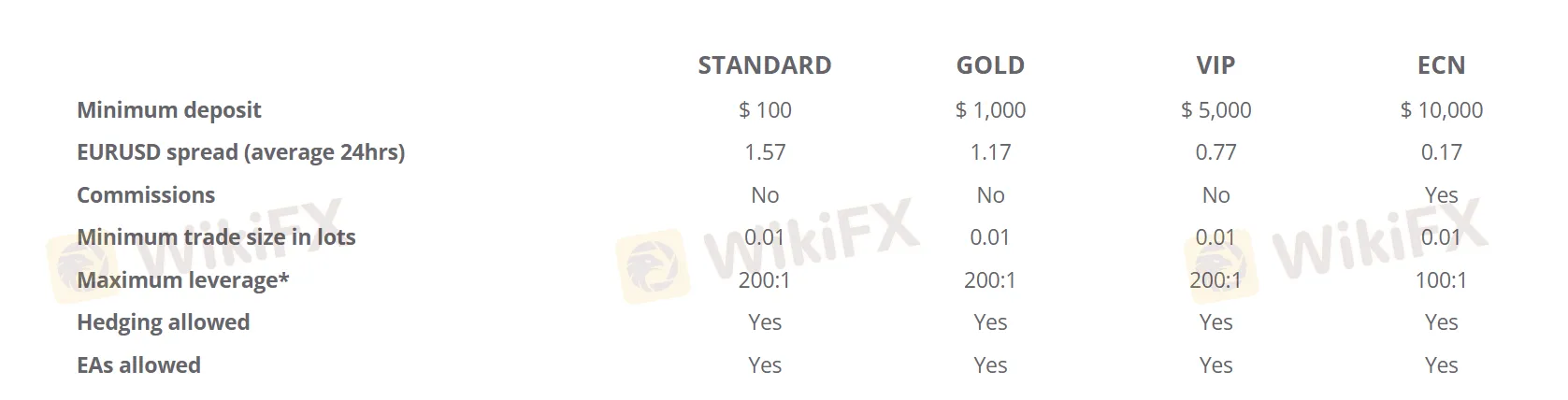

Account Type

Palm Capital offers four main account types: Standard, Gold, VIP, and ECN.

| Account Type | Minimum Deposit | Maximum Leverage | Average EUR/USD Spread | Commission | Minimum Trade Size |

| Standard | $100 | 1:200 | 1.57 | ❌ | 0.01 lots |

| Gold | $1,000 | 1.17 | ❌ | ||

| VIP | $5,000 | 0.77 | ❌ | ||

| ECN | $10,000 | 1:100 | 0.17 | ✔ |

Leverage

The maximum leverage at Palm Capital depends on the account type: the Standard, Gold, and VIP accounts offer up to 1:200 maximum leverage, while the ECN account provides a maximum leverage of 1:100. Note that higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

Trading Platform

Palm Capital supports the MetaTrader 4 platform but does not support MetaTrader 5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 | ✔ | Windows, macOS, iOS, Android | Beginners |

| MetaTrader 5 | ❌ | / | Experienced Traders |

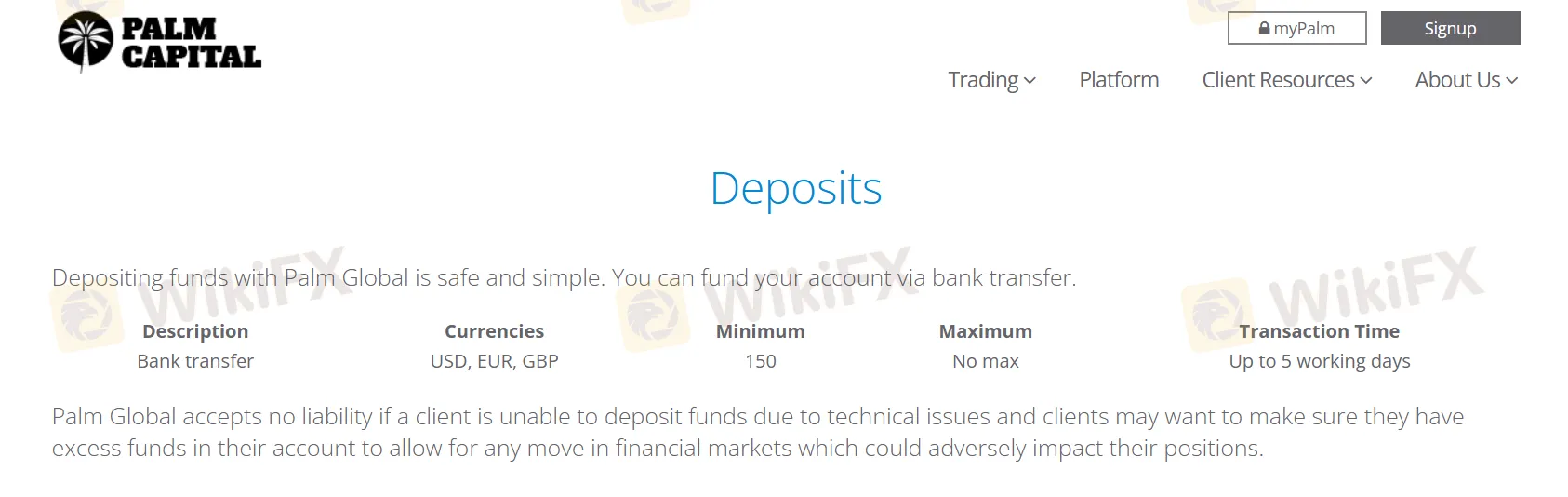

Deposit and Withdrawal

Palm Capital primarily processes deposits via bank transfers in USD, EUR, and GBP, with a minimum deposit of $150 and no maximum limit. Transactions can take up to 5 working days to process.

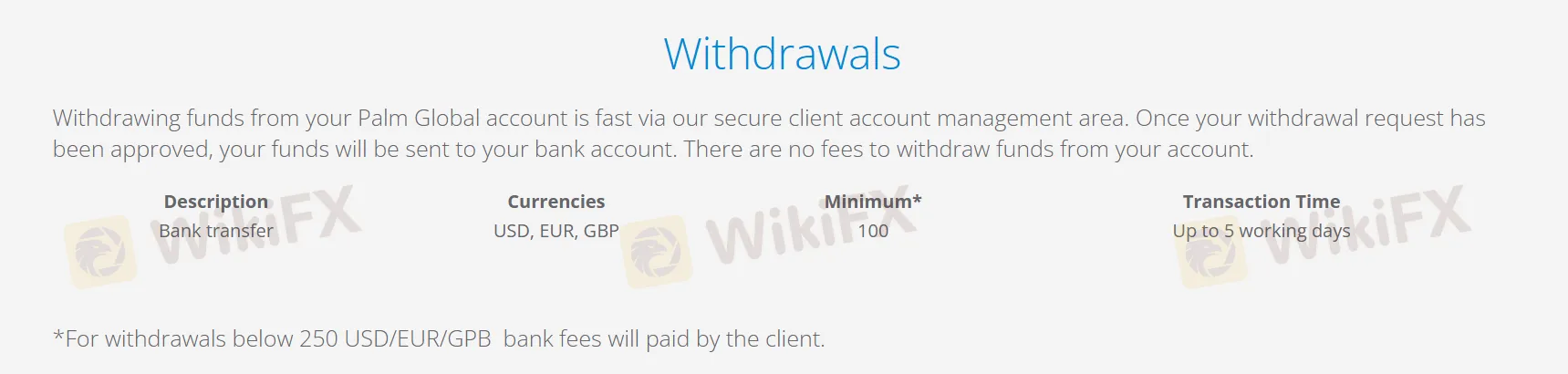

Withdrawals are also handled via bank transfer, with a minimum amount of $100. Palm Capital does not charge withdrawal fees, but clients are responsible for any bank fees on withdrawals below $250.