Company Summary

| Aspect | Information |

| Company Name | Livermore Trading |

| Registered Country/Area | China |

| Founded year | 2023 |

| Regulation | Unregulation |

| Market Instruments | Forex, Cryptocurrencies, Oil CFDs, Indices |

| Account Types | Trial, Classic, Gold, Platinum, VIP, Prestige |

| Minimum Deposit | €250 |

| Spreads | $0.00 on many US Stocks, ETFs, and $0.65 per options contract |

| Trading Platforms | Tradier platform |

| Demo Account | Yes |

| Customer Support | 24/7 |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Card, Visa, E-money, Mobile Money |

| Educational Resources | Knowledge Base, FAQs, Webinars/Video Tutorials, Blog Posts, Interactive Courses, Demo Account |

Overview of Livermore Trading

Livermore Trading, founded in 2023 and based in China, offers a wide range of trading options for Forex, Cryptocurrencies, Oil CFDs, and Indices. They cater to diverse experience levels with various account types, starting from a €250 trial up to the €100,000 Prestige account. While their platform boasts features like $0.00 spreads on many US stocks and 24/7 customer support, a crucial concern emerges: Livermore Trading is currently unregulated. This lack of oversight raises significant risks for users, as there are no guarantees for financial security, fair trading practices, or effective dispute resolution mechanisms.

Despite offering educational resources like webinars and a demo account, the absence of regulation overshadows these benefits. Before considering Livermore Trading, it's crucial to prioritize platforms with clear regulatory oversight and established safety measures to protect your financial well-being.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

Pros:

Diverse Market Instruments: Livermore Trading gives you access to a wide range of markets, including Forex, Cryptocurrencies, Oil CFDs, and Indices. This allows you to diversify your portfolio and potentially capitalize on various opportunities across different sectors.

Multiple Account Types: Whether you're a beginner wanting to test the waters with a €250 trial account or a seasoned trader seeking advanced features with the €100,000 Prestige account, Livermore Trading caters to different experience levels and financial commitments.

Competitive Spreads: They offer $0.00 spreads on many US stocks and ETFs, which can translate to significant cost savings for high-volume traders. This can potentially boost your profitability in the long run.

Educational Resources: Livermore Trading provides various educational resources to help you learn and improve your trading skills. These include webinars, video tutorials, blog posts, and even interactive courses. While the quality and comprehensiveness of these resources might vary, having access to any educational material is always a positive.

24/7 Customer Support: Knowing you have access to help and support anytime, day or night, can provide peace of mind and ensure you get assistance when you need it most. This can be especially valuable for beginners navigating the complexities of financial markets.

Tradier Platform: Livermore Trading utilizes the Tradier platform, which boasts a user-friendly interface specifically designed for options trading. This can simplify the trading process and potentially make it more accessible for new traders.

Cons:

Unregulated Platform: This is the biggest red flag with Livermore Trading. Without any known regulatory oversight, there are no guarantees for your financial security, fair trading practices, or effective dispute resolution mechanisms. This significantly increases the risk of fraudulent activities, manipulation, and potential loss of funds.

Limited Transparency: Information on crucial aspects like the founding year, maximum leverage, and detailed regulatory details is not publicly available. This lack of transparency raises concerns about the platform's legitimacy and makes it difficult to fully assess its trustworthiness.

Potential for Higher Fees: While the $0.00 spreads on certain instruments are attractive, the costs for other assets and account types might be higher. Be sure to research and compare fees before committing to any specific account or trading activity.

Uncertain Quality of Resources: The effectiveness and comprehensiveness of Livermore Trading's educational resources remain unknown. While they might offer some basic information, they might not be sufficient for serious traders seeking in-depth knowledge and advanced strategies.

Demo Account Limitations: Demo accounts can be valuable for testing platforms and strategies without risking real money. However, some demo accounts might have limitations, such as restricted features or inaccurate market simulations. This could lead to unrealistic expectations and potential difficulties when transitioning to live trading.

Potential Technical Issues: Any platform can experience technical issues, and Tradier is no exception. Bugs, glitches, or platform downtime could disrupt your trading activities and potentially lead to financial losses. Consider the potential risks associated with platform-specific technical issues before committing to Livermore Trading.

Regulatory Status

Trading on an unregulated platform like Livermore Trading poses significant risks. Without regulatory oversight, investors face the absence of crucial protections, such as safeguards against fraudulent activities and mismanagement of funds. Legal recourse becomes limited, as unregulated platforms often lack clear dispute resolution mechanisms. Financial transparency is compromised, making it challenging for users to assess the platform's financial health.

Weaker security measures on unregulated platforms increase the risk of cybersecurity threats and unauthorized access to sensitive information. Additionally, the absence of strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations exposes users to potential risks related to illegal activities and unauthorized transactions. Caution and thorough research are advised before engaging with such platforms.

Market Instruments

Livermore Trading offers a diverse range of financial products for trading, spanning across different markets. Here is a concrete description of the products they provide based on the information provided:

Forex Trading:

Livermore Trading offers a dynamic platform for Forex trading, allowing users to engage in transactions with the most popular currency pairs. The focal point lies on the USD/EURO pair, recognizing the significant role of the US dollar as the predominant vehicle currency in 88% of all Forex trades, while the Euro is involved in 31% of these transactions. In the realm of Forex trading, participants speculate on currency price movements, navigating the market by exchanging one currency for another. This process revolves around the anticipation of whether a particular currency will appreciate or depreciate relative to its paired counterpart. Livermore Trading's platform provides a gateway for traders to capitalize on these currency fluctuations, making informed decisions within the dynamic and interconnected world of Forex trading.

Cryptocurrency Trading:

Livermore Trading opens up opportunities for Cryptocurrency Trading, offering users access to a range of popular digital assets such as Bitcoin, Ethereum, and USDT. The platform enhances the trading experience with a dedicated crypto trading app, facilitating intelligent buying and selling of cryptocurrencies. Users have the option to invest in cryptocurrencies, and Livermore Trading stands out by integrating artificial intelligence for automatic trading, streamlining the process and potentially optimizing investment strategies. Furthermore, the platform extends flexibility with an option to deposit cryptocurrencies and earn interest, providing users with diverse avenues to engage with the dynamic and evolving world of cryptocurrency markets.

Oil CFD Trading:

Livermore Trading provides a comprehensive platform for Oil CFD Trading, introducing flexibility and freedom for traders in the financial market. With a primary focus on Brent Crude Oil, a globally recognized benchmark for oil pricing, the platform caters to traders seeking exposure to this sweet, light, unrefined oil characterized by low density and low sulfur content. Traders benefit from real-time exchanges of crude oil and other energy products at market rates, bypassing fees and complications associated with direct trading in the oil futures market. Livermore Trading distinguishes itself by allowing both the purchase and short selling of oil without restrictions or additional charges, offering a streamlined and accessible avenue for participants in the oil and energy CFD markets.

Indices Trading:

Livermore Trading facilitates Indices Trading, granting users the chance to buy and sell indices that either represent specific market segments or the entire market. Traders, using financial instruments, can capitalize on both rising and falling prices within the market. The platform enhances versatility by offering a diverse selection of 20 indices on the AquilaFx platform and multiple options on the MT4 platform. Users have the flexibility to trade individual stocks or opt for trading an entire index as a singular entity, providing a strategic approach to navigating and participating in the broader financial markets. This breadth of options empowers traders to tailor their investment strategies according to their preferences and market outlooks.

Overall, Livermore Trading aims to cater to a broad spectrum of traders by offering diverse trading options in forex, cryptocurrencies, oil CFDs, and indices. The platform emphasizes flexibility, freedom, and ease of use for traders to execute their strategies effectively.

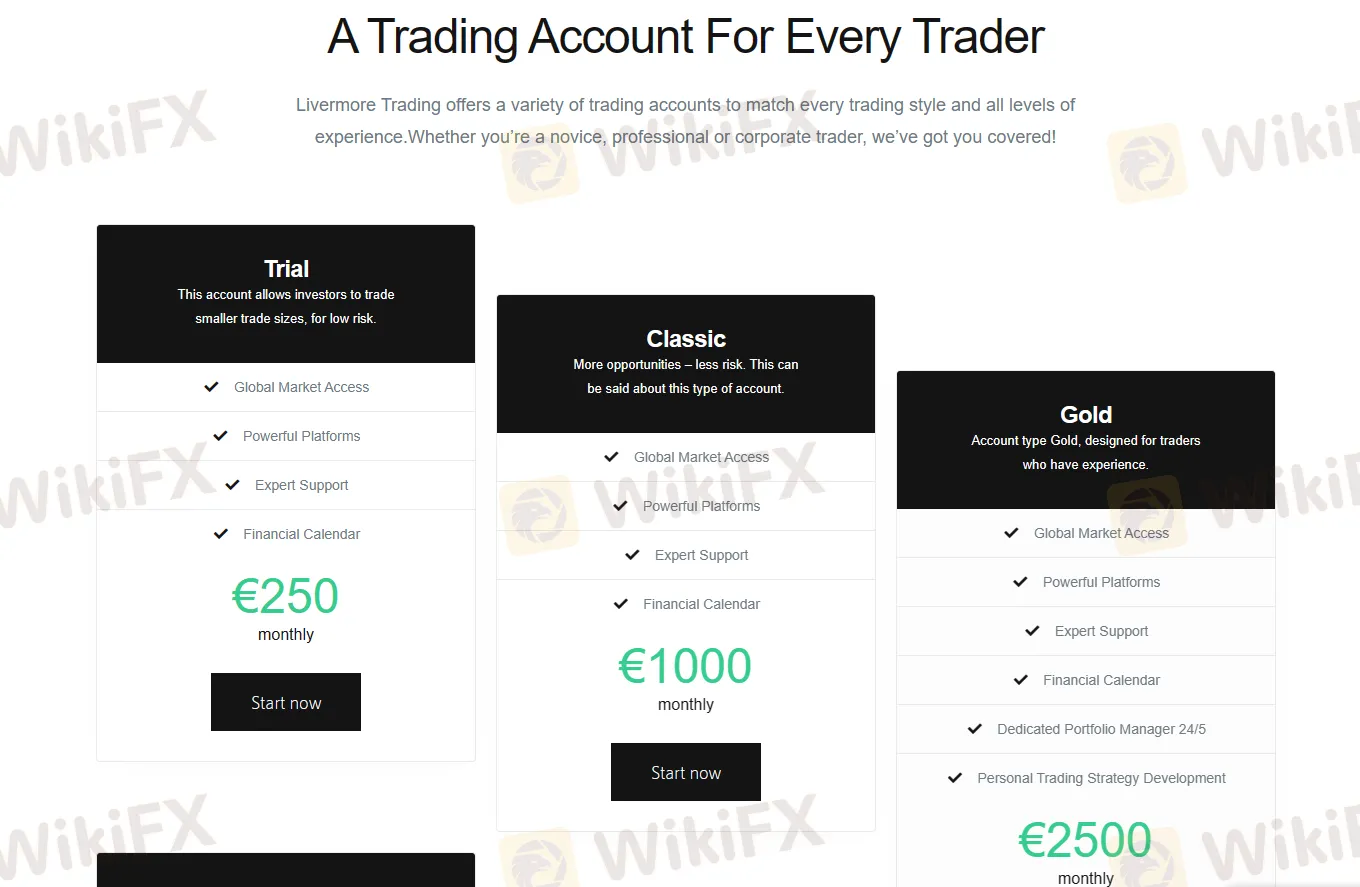

Account Types

Livermore Trading caters to a diverse range of traders by offering a variety of account types, each tailored to specific trading styles and levels of experience.

Trial:

The Trial account is ideal for investors looking to trade smaller sizes with lower risk. This account provides global market access, powerful platforms, expert support, and access to a financial calendar. Priced at €250 monthly, it serves as an entry point for those starting their trading journey.

Classic:

The Classic account offers more opportunities with less risk. Geared towards a balanced approach, it provides global market access, powerful platforms, expert support, and access to a financial calendar. Priced at €1000 monthly, it caters to traders seeking a middle-ground account.

Gold:

Designed for traders with experience, the Gold account offers global market access, powerful platforms, expert support, and a financial calendar. Priced at €2500 monthly, it goes a step further by including a dedicated portfolio manager and personalized trading strategy development.

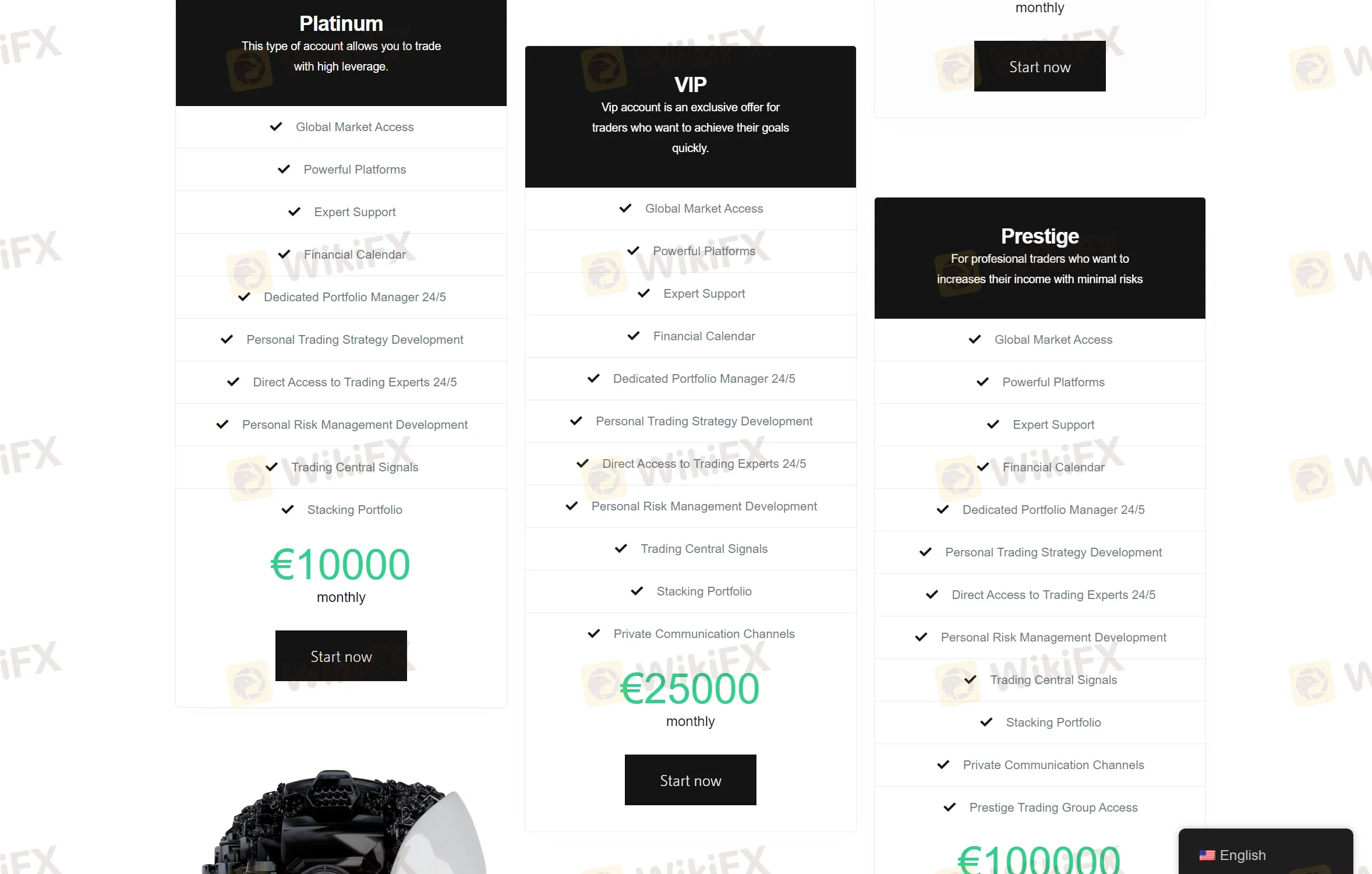

Platinum:

The Platinum account is for those seeking high leverage in their trades. In addition to global market access, powerful platforms, and expert support, this account offers a dedicated portfolio manager, personal trading strategy development, direct access to trading experts, and more. Priced at €10,000 monthly, it caters to traders aiming for advanced strategies.

VIP:

The VIP account is an exclusive offer for traders with ambitious goals. Along with global market access, powerful platforms, and expert support, it includes a dedicated portfolio manager, personal trading strategy development, direct access to trading experts, private communication channels, and more. Priced at €25,000 monthly, it provides an elevated level of service.

Prestige:

Tailored for professional traders aiming to increase income with minimal risk, the Prestige account offers global market access, powerful platforms, expert support, and additional features such as a dedicated portfolio manager, personal trading strategy development, direct access to trading experts, private communication channels, and access to the Prestige Trading Group. Priced at €100,000 monthly, it represents the pinnacle of Livermore Trading's account offerings.

Livermore Trading Account Comparison Table

| Feature | Trial | Classic | Gold | Platinum | VIP |

| Account type | Beginner-friendly practice | Beginner & intermediate | Experienced trader | High-volume & demanding trader | Exclusive & demanding |

| 24/7 Live video chat support | Yes | Yes | Yes | Yes | Dedicated Account Manager |

| Withdrawals | Same day processing | Same day processing | Priority processing | Same day processing | Same day processing & dedicated withdrawal team |

| Demo account | Yes | Yes | Yes | Yes | Yes |

| Copy Trading tool | Basic access | Standard access | Advanced access | Pro access | VIP access with expert-curated strategies |

| Bonus | Welcome bonus available | Loyalty bonus program | Increased deposit bonus | Exclusive bonus offers | Premium bonus structure & profit-sharing |

| Other features | Limited | Standard | Premium market research | Dedicated risk management team | Concierge service & bespoke investment plans |

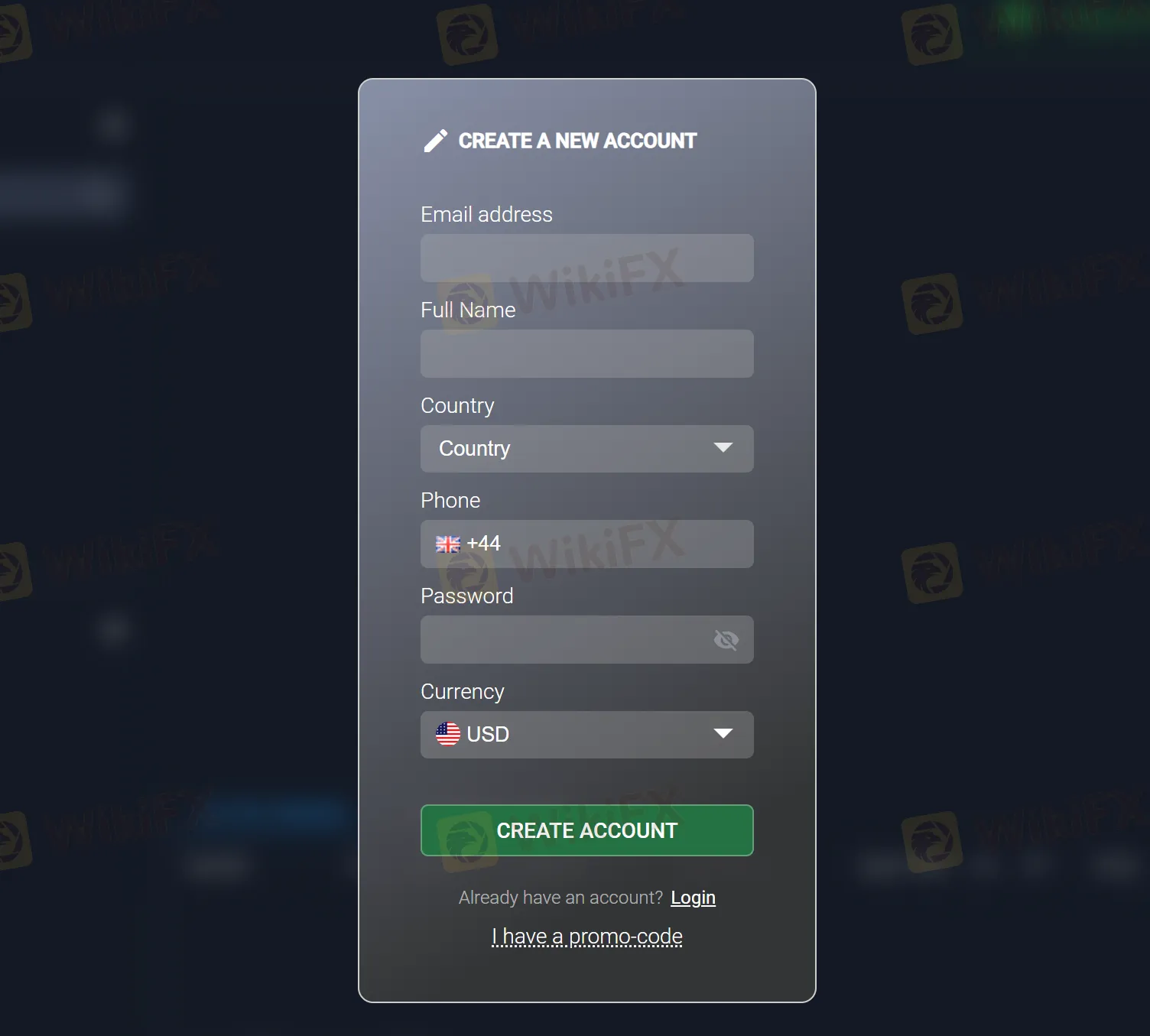

How to Open an Account?

Opening an account with Livermore Trading is a straightforward process that can be completed in just a few minutes.

Visit the Livermore Trading website. You can access the Livermore Trading website directly through this link: https://livermore-trading.com/

Click on the “Get Started” button. You'll find this button prominently displayed on the homepage, usually in the top right corner or along the main navigation bar.

Fill out the account application form. The application form will request basic information such as your name, email address, phone number, and country of residence. You will also need to choose a username and password for your account.

Verify your identity. To comply with regulatory requirements, Livermore Trading will need to verify your identity. This usually involves uploading a copy of your government-issued photo ID and proof of address.

Fund your account. Once your account is verified, you can fund it using a variety of methods, such as bank transfer, credit card, or e-wallet. The minimum deposit amount will vary depending on the account type you choose.

Start trading! Once your account is funded, you're ready to start trading! You can access the Livermore Trading platform through your web browser or mobile app.

Spreads & Commissions

Livermore Trading follows a transparent and fair pricing structure for its services. The platform offers $0.00 commissions on various online exchange-listed US stock, domestic, and Canadian ETF trades, regardless of the account balance or the number of shares traded. This zero-commission policy extends to online option trades as well, with a nominal fee of $0.65 per contract for options trades. This commitment to straightforward pricing is designed to provide users with clarity and simplicity in their trading experience, fostering a cost-effective environment for investors.

| Instrument | Commission |

| Online Exchange-Listed US Stock Trades | $0.00 |

| Domestic and Canadian ETF Trades | $0.00 |

| Options Trades | $0.65 per contract |

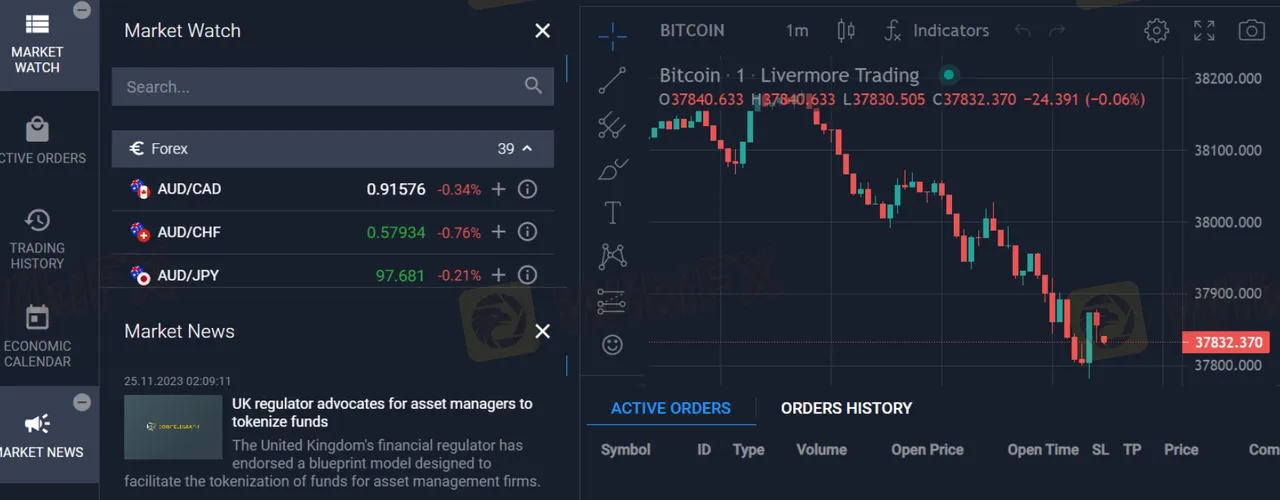

Trading Platform

Livermore Trading's platform on Tradier is a distinct mobile trading platform crafted with the goal of enhancing accessibility and simplicity in options trading. Named after the renowned trader Jesse Livermore, the platform introduces innovative features to facilitate user-friendly trading. One notable feature allows users to draw their forecast directly on a chart, streamlining the trade entry process compared to traditional numerical inputs. Additionally, the platform leverages proprietary algorithms to offer algorithmic trade suggestions based on users' drawn forecasts and confidence levels. To further enhance risk management, the platform enables users to easily adjust their risk tolerance.

Overall, Livermore Trading's platform on Tradier is designed to empower traders with a seamless and intuitive experience, making options trading more approachable and efficient.

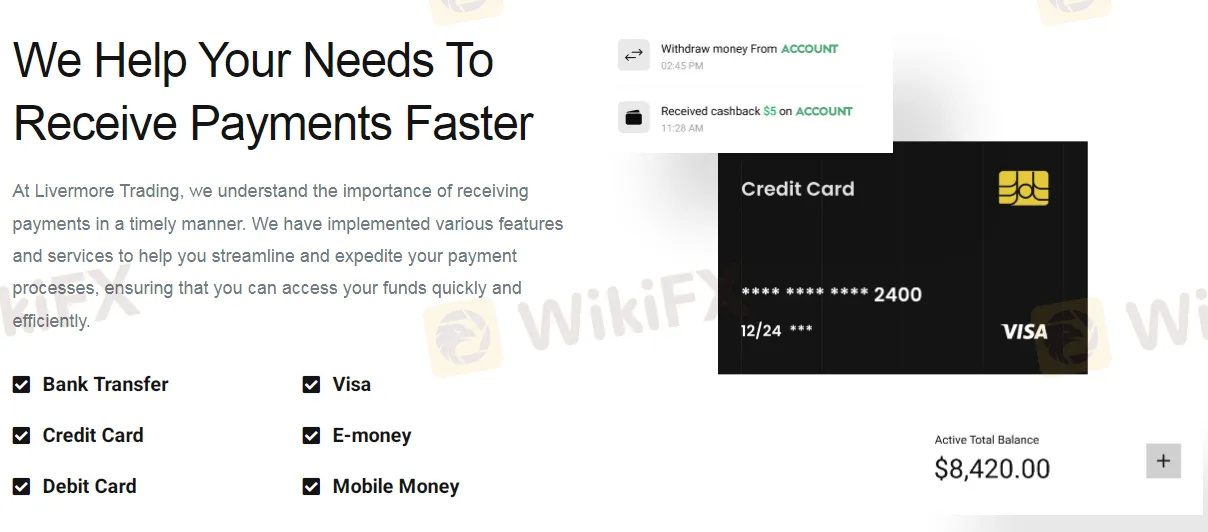

Deposit & Withdrawal

Livermore Trading offers a range of payment methods to cater to the diverse needs of its users, prioritizing the timely and efficient processing of payments. The following payment methods are available:

Bank Transfer: Users can facilitate payments through traditional bank transfers, providing a secure and widely accepted method for fund transactions.

Credit Card and Debit Card: Livermore Trading accepts payments via credit and debit cards, offering a convenient and commonly used option for users to manage their funds.

Visa: Visa payments are supported, providing users with an additional card-based payment option, known for its global acceptance and reliability.

E-money: Livermore Trading accommodates electronic money (e-money) transactions, allowing users to make payments through digital or electronic means, offering a swift and modern payment option.

Mobile Money: The platform supports mobile money transactions, acknowledging the growing popularity of mobile-based financial services and providing users with a convenient way to manage their funds on the go.

Livermore Trading is dedicated to expediting the payment processes for its users. Regarding fund withdrawals, the platform provides an estimate of the withdrawal timeline. Transfers within the SEPA area typically take up to 5 business days, while users outside the SEPA area may experience a slightly longer processing time of up to 7 business days. This information helps users plan and manage their financial activities effectively, offering transparency on the expected duration of fund withdrawals.

Customer Support

Livermore Trading provides 24/7 customer support to ensure that users can receive assistance and resolve any issues they encounter, regardless of their geographic location or time zone. The round-the-clock support is designed to offer convenience and responsiveness to users, recognizing the global nature of financial markets and the diverse needs of traders worldwide.

With continuous support available, users can reach out for help, guidance, or resolution of concerns at any time of the day or night. Livermore Trading's commitment to 24/7 support reflects its dedication to customer satisfaction and underscores the importance of providing timely assistance to users navigating the platform. Whether users have questions about trading, account management, technical issues, or any other inquiries, they can rely on Livermore Trading's customer support to be available and responsive whenever needed. This commitment enhances the overall user experience by ensuring that support is readily accessible whenever assistance is required.

Educational Resources

Livermore Trading is committed to empowering users with a robust set of educational resources to enhance their trading knowledge and skills. Here's a detailed description of the educational offerings:

Knowledge Base and FAQs: Livermore Trading provides a comprehensive knowledge base and frequently asked questions (FAQs) section. This could cover topics ranging from platform navigation and order execution to risk management and market analysis.

Webinars and Video Tutorials: The platform offers webinars and video tutorials hosted by market experts. These sessions could cover a wide range of topics, including trading strategies, technical analysis, and platform features, providing users with visual and interactive learning opportunities.

Educational Articles and Blog Posts: Livermore Trading maintains a blog or regularly updates an educational section with articles on market trends, trading tips, and in-depth analyses. These resources can help users stay informed about the latest market developments.

Interactive Courses: Some trading platforms offer structured courses that cover various aspects of trading, catering to both beginners and experienced traders. These courses may include quizzes, assessments, and certification upon completion.

Demo Accounts: Livermore Trading provides users with access to demo accounts, allowing them to practice trading in a risk-free environment. This is an excellent way for users, especially beginners, to familiarize themselves with the platform and test different strategies without risking real money.

Livermore Trading's diverse educational resources cater to the needs of traders at different skill levels, offering a multifaceted approach to learning and skill development in the dynamic world of financial markets.

Conclusion

Livermore Trading offers a diverse array of trading instruments, educational resources, and a user-friendly platform. However, its unregulated status casts a long shadow, raising significant concerns about financial security, fair practices, and dispute resolution mechanisms. While the potential for lower fees and educational resources might be tempting, prioritize platforms with established regulatory oversight and transparency to ensure a safe and secure trading experience. Remember, the allure of high returns shouldn't overshadow the importance of protecting your financial well-being.

FAQs

Q: What markets can I trade at Livermore Trading?

A: You can access a wide range of markets, including Forex, Cryptocurrencies, Oil CFDs, and Indices. This allows you to spread your investment across various sectors and potentially capitalize on diverse opportunities.

Q: How much do I need to start trading with Livermore Trading?

A: Livermore Trading offers various account types to cater to different experience levels and financial commitments. You can start with a €250 trial account or opt for more advanced options like the €100,000 Prestige account.

Q: Are there any fees associated with trading on Livermore Trading?

A: While they boast $0.00 spreads on many US stocks and ETFs, fees for other instruments and account types might be higher. Be sure to research and compare fees thoroughly before committing to any specific account or trading activity.

Q: Does Livermore Trading offer educational resources to help me learn about trading?

A: Yes, they provide various educational resources like webinars, video tutorials, blog posts, and even interactive courses. However, the effectiveness and comprehensiveness of these resources might vary. Consider supplementing them with other educational materials for a well-rounded learning experience.

Q: What are the benefits of using the Tradier platform on Livermore Trading?

A: The Tradier platform is designed specifically for options trading and boasts a user-friendly interface. This can simplify the trading process and potentially make it more accessible for new traders.