Score

CXM Trading

Saint Vincent and the Grenadines|5-10 years| Benchmark C|

Saint Vincent and the Grenadines|5-10 years| Benchmark C|https://www.cxmtrading.com/en/

Website

Rating Index

Benchmark

Benchmark

C

Average transaction speed (ms)

MT4/5

Full License

CXMTradingLtd-Demo

China

ChinaInfluence

C

Influence index NO.1

China 2.94

China 2.94Benchmark

Speed:C

Slippage:AAA

Cost:D

Disconnected:A

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

China

ChinaInfluence

Influence

C

Influence index NO.1

China 2.94

China 2.94Surpassed 25.82% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

CXM Trading LTD

CXM Trading

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

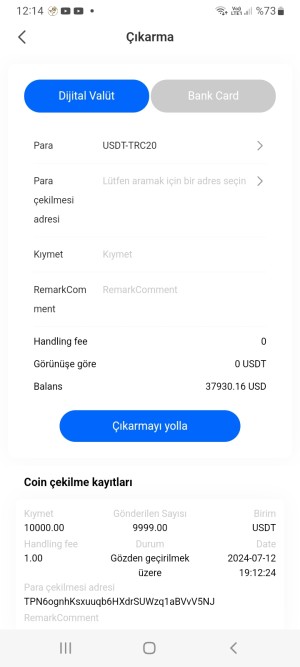

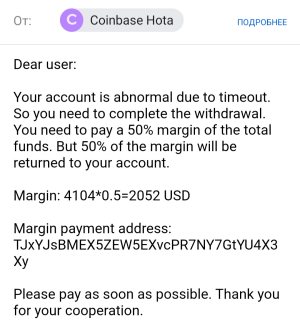

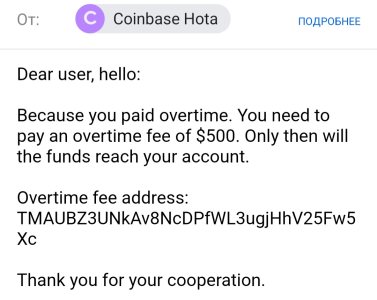

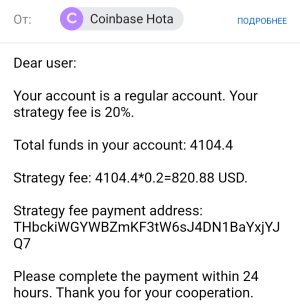

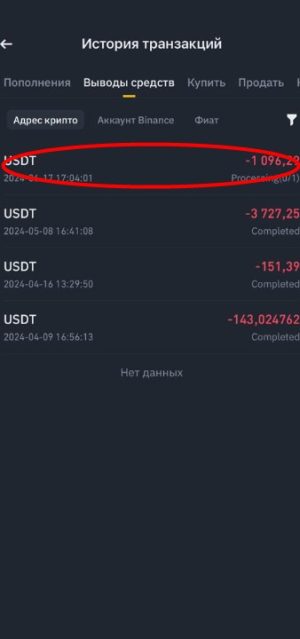

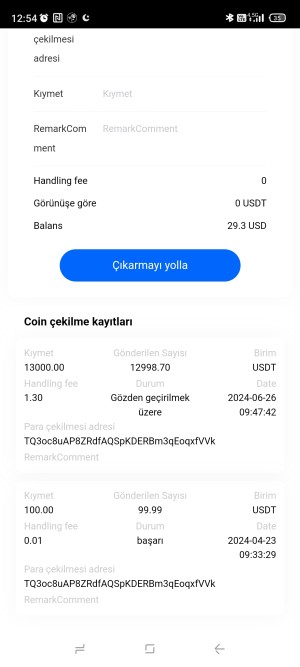

- The number of the complaints received by WikiFX have reached 15 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The Mauritius FSC regulation with license number: GB21026337 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | C |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | $50,000 |

| Minimum Spread | -- |

| Products | FX, Metals, CFDs, Cryptos |

| Currency | -- |

|---|---|

| Minimum Position | .01 lots FX |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | C |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $30,000 |

| Minimum Spread | -- |

| Products | FX, Metals, CFDs, Cryptos |

| Currency | -- |

|---|---|

| Minimum Position | .01 lots FX |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | C |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $5,000 |

| Minimum Spread | -- |

| Products | FX, Metals, CFDs, Cryptos |

| Currency | -- |

|---|---|

| Minimum Position | .01 lots FX |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | C |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $2,000 |

| Minimum Spread | -- |

| Products | FX, Metals, CFDs, Cryptos |

| Currency | -- |

|---|---|

| Minimum Position | .01 lots FX |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed CXM Trading also viewed..

XM

MiTRADE

J.P. Morgan

ATFX

Total Margin Trend

- VPS Region

- User

- Products

- Closing time

silicon valley

silicon valley- 385***

- GBPUSDc

- 07-26 21:18:15

silicon valley

silicon valley- 372***

- GBPUSDc

- 07-26 21:18:15

London

London- 494***

- GBPUSDc

- 07-26 19:16:07

Stop Out

0.76%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

CXM Trading · Company Summary

Note: It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Registered in | Saint Vincent and the Grenadines |

| Regulated by | FCA, FSC (Offshore) |

| Year(s) of establishment | 5-10 years |

| Trading Instruments | Forex pairs, stocks, cryptocurrencies, indices, metals, energies, indices |

| Minimum Initial Deposit | $500 |

| Maximum Leverage | 1:500 |

| EUR/USD Spread | Around 0.7 pips |

| Trading Platform | MT4 |

| Payment Method | Bank wire transfer, bitcoin, union pay, etc. |

| Customer Service | 24/5 contact form, email |

| Fraud Complaints Exposure | Yes |

CXM Trading Information

CXM trading is a forex and CFD broker offering a range of financial instruments including forex pairs, stocks, cryptocurrencies, indices, metals, and energies. The broker offers various types of accounts with different deposit requirements and leverage ratios, including a Cent account, Standard account, Premium account, ECN account, and FIX API account. The platform used by CXM trading is the popular MT4 platform, which allows for social trading. The broker offers several deposit and withdrawal methods, including bank wire, cryptocurrencies, stable cryptocurrencies, and Union Pay. Customer support is available 24/5 via email.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

What Type of Broker is CXM Trading?

| Advantages | Disadvantages |

| No Dealing Desk intervention | Possible higher spreads |

| Faster execution speed | No price manipulation |

| Lower risk of conflicts of interest | No control over the pricing |

| Transparency of trading conditions | Limited control over liquidity |

| Better trade execution |

STP stands for Straight Through Processing, which means that CXM Trading doesn't act as a market maker or take the other side of your trade. Instead, it uses advanced technology to connect your trades to the liquidity providers in the market, without any human intervention. This eliminates the possibility of any conflict of interest between the broker and the client, providing transparency and better execution speed. However, the spreads may be higher due to the lack of control over pricing, and the broker has limited control over liquidity, which may lead to a slippage during high volatility periods.

Pros & Cons

Pros:

- Wide range of instruments available for trading, including forex pairs, stocks, cryptocurrencies, indices, metals, and energies.

- Different types of accounts with varying minimum deposit requirements and maximum leverage options, providing flexibility to traders with different needs and preferences.

- Availability of the popular MetaTrader 4 (MT4) platform, as well as social trading features for more collaborative and interactive trading experiences.

- Multiple deposit and withdrawal options, including bank wire, cryptocurrencies, stable coins, and UnionPay, with minimal to no commission charges and relatively low minimum amounts.

- 24/5 email customer support available for any queries and concerns.

Cons:

- Limited educational resources, which may pose a challenge to novice traders who need more guidance and training.

- No live chat or phone support options, which may not be ideal for traders who prefer more direct and immediate assistance.

- High minimum deposit requirements for some of the more advanced account types, which may not be accessible to traders with limited capital.

Is CXM Trading Legit?

CXM Trading operates under robust regulatory frameworks with two distinct licenses. The brokerage holds a Straight Through Processing (STP) license (No. 612233) from the strict and reliable UK's Financial Conduct Authority (FCA), indicating high standards in transparency and operational fairness.

Additionally, CXM Trading has an offshore-regulated Retail Forex License (No. GB21026337) issued by the Financial Services Commission (FSC) in Mauritius. While offshore licenses are often viewed with a degree of caution, the regulation still indicates an adherence to certain financial regulations.

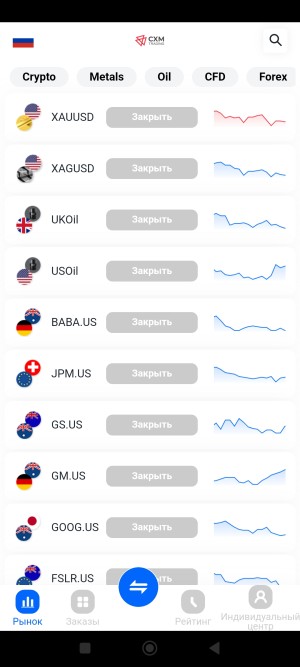

Market Instruments

CXM Trading offers a wide range of tradable instruments that include forex pairs, stocks, cryptocurrencies, indices, metals, and energies. The variety of tradable instruments offers traders the opportunity to diversify their portfolio, hedge against market volatility, and take advantage of multiple market opportunities.

Spreads & Commissions

CXM Trading provides detailed information about spreads, min and max trade size, lot size, margin and leverage in their trading specification form. Spreads on major currency pairs such as EURUSD are low, at around0.7 pips. However, the broker does not mention anything about commissions, making it difficult for traders to estimate their overall costs.

Account Types

All account types support trading in forex, metals, CFDs, and cryptocurrencies. The minimum lot size for all account types is 0.01 lots. The required minimum initial deposit amount varies significantly across account types, ranging from $500 for the CENT account to $50,000 for the FIX API account. The maximum leverage ratio available also differs by account type, from 1:500 for the ZERO account to 1:200 for the FIX API account.

| Account Type | ZERO | STANDARD | ECN | FIX API | CENT |

| Starting Deposit | $30,000 | $2,000 | $10,000 | $50,000 | $500 |

| Instruments | FX, Metals, CFDs, Cryptos | FX, Metals, CFDs, Cryptos | FX, Metals, CFDs, Cryptos | FX, Metals, CFDs, Cryptos | FX, Metals, CFDs, Cryptos |

| Min Lot | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Max Leverage | 1:500 | 1:1000 | 1:1000 | 1:200 | 1:1000 |

The ZERO and STANDARD accounts are suitable for beginners or traders with smaller volumes, as they have lower initial deposit requirements. The ECN and FIX API accounts are more geared towards experienced traders or those who need higher leverage ratios. The CENT account is suitable for traders who want to try out micro-trading with smaller amounts.

Leverage

CXM Trading offers a maximum leverage of 1:500 for most of its account types. This high leverage can be beneficial for traders who want to control larger positions with less capital and who have a sound risk management strategy in place. However, high leverage also comes with higher risks, as larger losses can be incurred if trades go against the trader. Traders need to exercise caution and ensure they have sufficient capital and risk management strategies in place to mitigate these risks. It is important to note that the FIX API account type offers a maximum leverage of 1:200, which may be more suitable for traders who prefer lower leverage.

Trading Platform

| Advantages | Disadvantages |

| MT4 platform available | No other platform options available |

| Social trading feature | Limited customization options |

| Advanced charting tools | No proprietary platform |

| User-friendly interface |

Trading Platform

CXM Trading offers only one platform option which is the popular MT4 platform. It offers advanced charting tools, user-friendly interface and a social trading feature. However, the company does not provide any proprietary platforms which may be a disadvantage to some traders. Also, the platform customization options are limited.

Deposit & Withdrawal: Methods and Fees

| Bank Wire | Currencies | Processing Time | Commission | Minimum amount |

| Deposit/Withdrawal | USD, EUR, GBP | 2-5 Business Days | None | Contact Account Executive for details |

| Crytos | Currencies | Processing Time | Commission | Minimum amount |

| Deposit | BTC, ETH , BCH | 1 Working Day | 1% | 500 USD equivalent |

| Withdrawal | 100 USD equivalent |

| Stable Cryptos | Currencies | Processing Time | Commission | Minimum amount |

| Deposit | USDT (Tether) | Instant | None | 500 USD equivalent |

| Withdrawal | 100 USD equivalent |

| Union Pay | Currencies | Processing Time | Commission | Minimum amount |

| Deposit | RMB | Instant | None | 500 USD equivalent |

| Withdrawal | 1-5 Business Days** | 100 USD equivalent |

CXM Trading offers a variety of deposit and withdrawal methods to its clients. For bank wire transfers, the processing time is 2-5 business days, with no commission charged for either deposits or withdrawals. For crypto deposits and withdrawals, the available currencies are BTC, ETH, BCH, and USDT, with processing times ranging from instant to 1 working day. However, crypto deposits and withdrawals have a 1% commission fee. Stablecryptos, such as USDT, have no commission and offer instant processing time for both deposits and withdrawals. Lastly, UnionPay allows for instant deposits in RMB, with no commission charged. However, withdrawal processing times can take 1-5 business days. It should be noted that there is a relatively high minimum deposit and withdrawal amount for all methods.

Social Trading

CXM Trading's social trading platform empowers you to either replicate the strategies of top-performing traders or attract followers to profit from your trading expertise.

Customer Service

CXM Trading provides its clients with 24/5 contact form andemail customer support. This means that clients can reach out to the support team via email at any time from Monday to Friday and receive a response within a reasonable timeframe. However, CXM Trading does not offer live chat or phone support, which can be a disadvantage for traders who prefer real-time assistance.

Conclusion

In conclusion, CXM trading is a forex and CFD broker that provides traders with a range of trading instruments, including forex pairs, stocks, cryptocurrencies, indices, metals, and energies. The broker offers several account types, including Cent, Standard, Premium, ECN, and FIX API accounts, each with varying minimum deposit requirements and leverage levels. CXM trading also provides a range of deposit and withdrawal options, including bankwire, cryptocurrencies, stablecryptocurrencies, and UnionPay.

However, the broker has limited educational resources. Overall, CXM trading may be suitable for experienced traders looking for a wide range of trading instruments and account types, but beginners may need to look elsewhere for more educational resources and robust customer support.

Frequently Asked Questions (FAQs)

- Is CXM Trading a regulated broker?

- Yes. It is regulated by FCA and offshore regulated by FSC.

- What types of trading accounts does CXM Trading offer?

- It offers five types of trading accounts, including Cent, Standard, Premium, ECN, and FIX API accounts.

- What trading platforms does CXM Trading support?

- It supports the popular trading platform MetaTrader 4 (MT4) and also offers social trading functionality.

- What financial instruments can I trade with CXM Trading?

- It offers a range of financial instruments to trade, including forex pairs, stocks, cryptocurrencies, indices, metals, and energies.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now