Company Summary

| Artha Finance Capital Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Mauritius |

| Regulation | Unregulated |

| Market Instruments | Forex, Cryptocurrencies, Commodities, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 2.5 pips (Standard account) |

| Trading Platform | MT5 |

| Min Deposit | $100 |

| Customer Support | Tel: +230-4906000 |

| Email: contact@arthafx.com | |

| Social Media: Facebook, Instagram, Linkedin, Twitter | |

| Company Address: 1st Floor, Standard Chartered Tower, 19, Cybercity, Ebene, Mauritius | |

| Regional Restrictions | European Union, UK, Australia, Canada, United States, Cuba, Iraq, Myanmar, North Korea, Sudan |

Founded in 2023, Artha Finance Capital, is an unregulated broker registered in Mauritius, offering trading in Forex, Cryptocurrencies, Commodities, and Stocks with leverage up to 1:500 and spread from 25 pips on the Standard account through the MT5 platform. Demo accounts are available and the minimum deposit to open a live account is 100 USD.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Lack of regulation |

| Demo accounts | Regional restrictions |

| Multiple account types | Unknown payment methods |

| Commission-free accounts offered | |

| Flexible leverage ratios | |

| MT5 supported |

Is Artha Finance Capital Legit?

No, Artha Finance Capital operates without any regulation. Investing in this platform can be dangerous.

What Can I Trade on Artha Finance Capital?

| Trading Asset | Available |

| forex | ✔ |

| commodities | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| indices | ❌ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

Account Type/Leverage/Fees

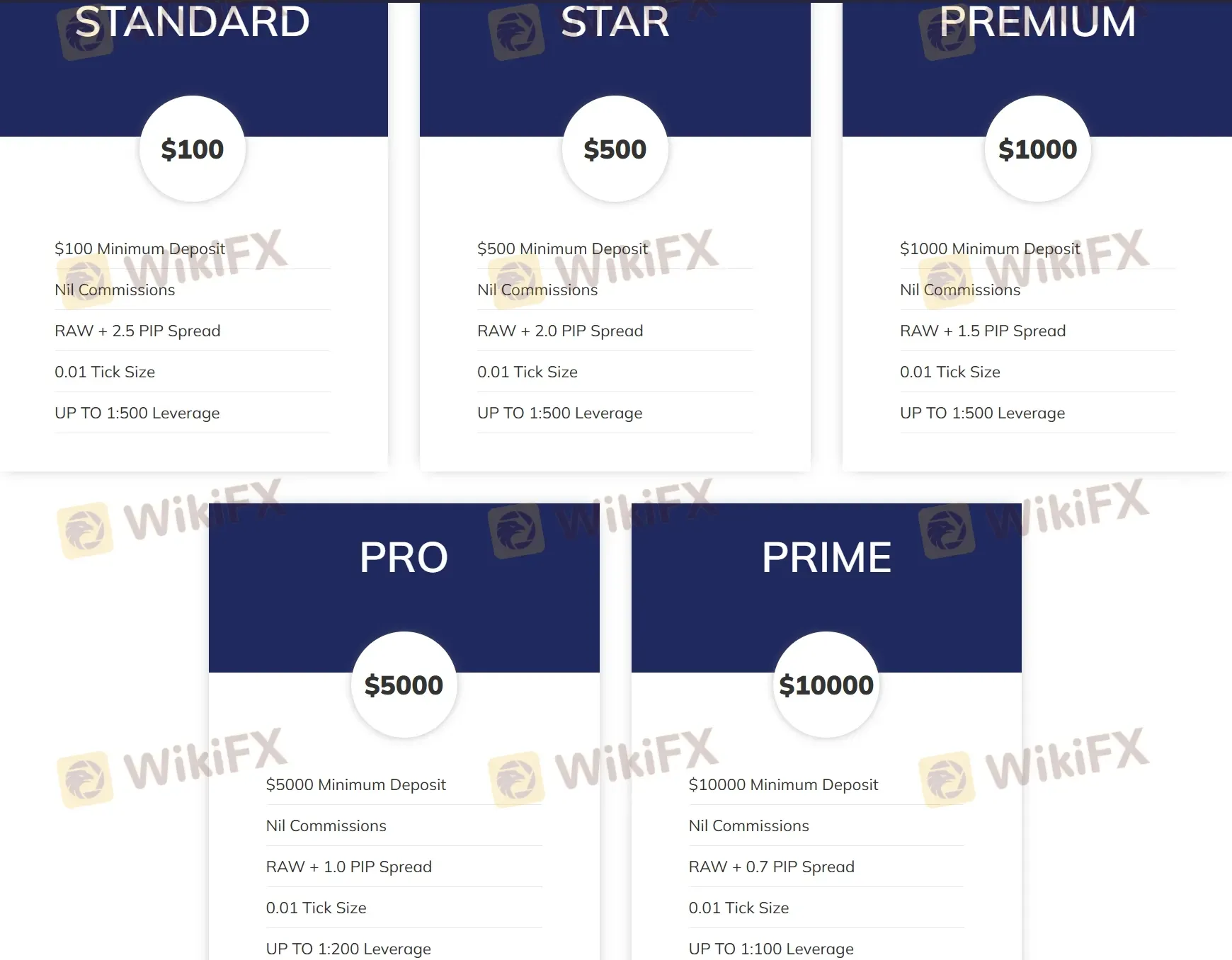

Artha Finance Capital provides a diverse range of account types tailored to meet the needs of different traders, from beginners to seasoned investors.

| Account Type | Min Deposit | Max Leverage | Spread | Commission |

| STANDARD | $100 | 1:500 | 2.5 pips | ❌ |

| STAR | $500 | 2.0 pips | ❌ | |

| PREMIUM | $1 000 | 1.5 pips | ❌ | |

| PRO | $5 000 | 1:200 | 1.0 pips | ❌ |

| PRIME | $10 000 | 1:100 | 0.7 pips | ❌ |

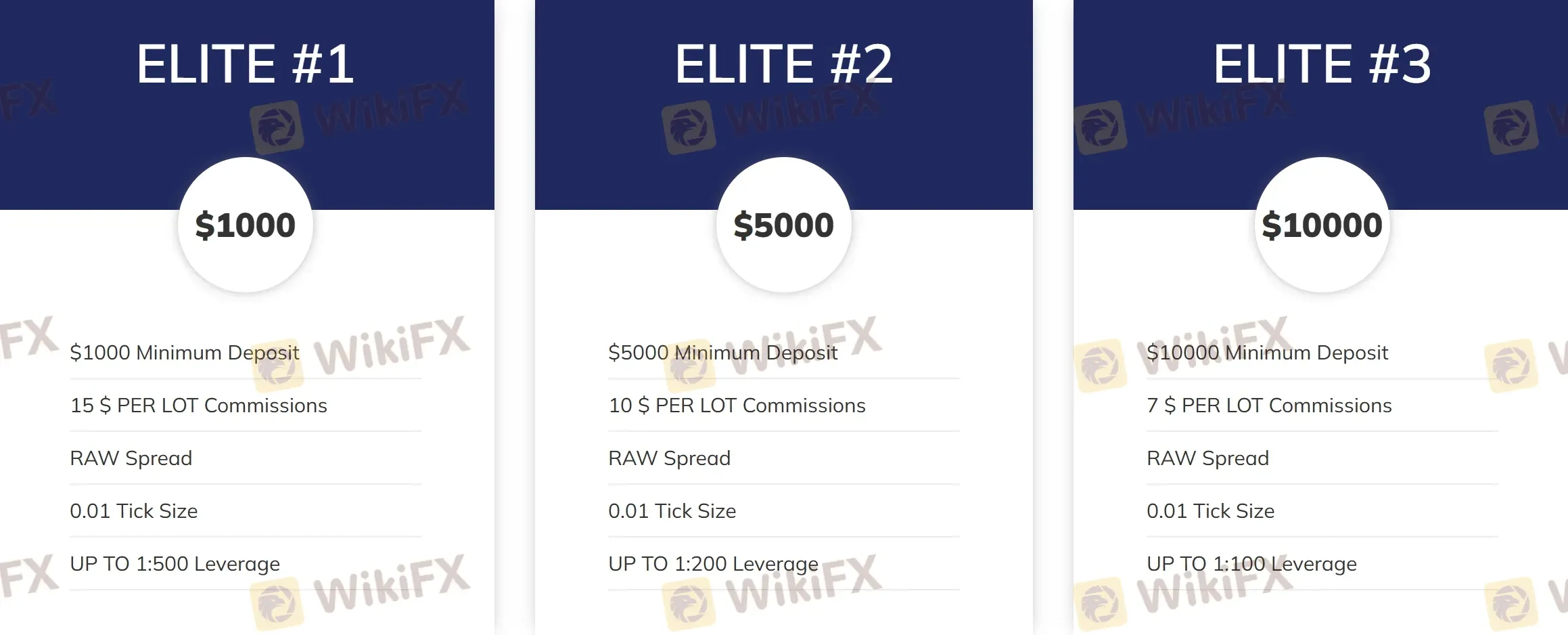

Additionally, Artha Finance Capital features an exclusive series of Elite accounts.

| Account Type | Min Deposit | Max Leverage | Spread | Commission |

| ELITE #1 | $1 000 | 1:500 | RAW | $15 per lot |

| ELITE #2 | $5 000 | 1:200 | RAW | $10 per lot |

| ELITE #3 | $10 000 | 1:100 | RAW | $7 per lot |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Android, iOS | Experienced traders |

| MT4 | ❌ | / | Beginners |