User comment

0

CommentsWrite a review

No comment yet

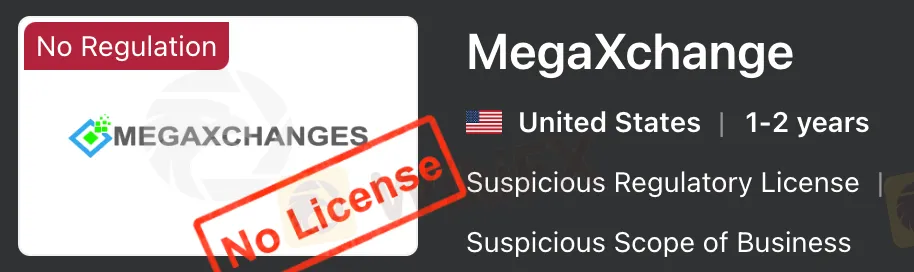

United States|1-2 years|

United States|1-2 years| https://megaxchanges.org/

Website

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

| MegaXchange | Basic Information |

| Company Name | MegaXchange |

| Founded | 2021 |

| Headquarters | United States |

| Regulations | Not regulated |

| Tradable Assets | Cryptocurrencies, Forex, Shares, Indices, ETFs |

| Account Types | STARTER, BASIC, PRO, EXECUTIVE |

| Minimum Deposit | $500 (STARTER Account) |

| Maximum Leverage | 1:500 (Forex) |

| Spreads | Variable, starting from 0.5 pips (Forex) |

| Commission | $2.5 per $100,000 traded (Forex), variable for other assets |

| Deposit Methods | Cards, Bank Transfer, E-wallets, Cryptocurrencies |

| Trading Platforms | Desktop, Android, iOS |

| Customer Support | Live Chat, Email |

| Education Resources | Market Analysis, Webinars, Trader Tools |

| Bonus Offerings | None |

MegaXchange, launched in 2021, is a modern financial trading platform headquartered in the United States. Positioned as a comprehensive trading solution, the platform boasts an array of diverse trading instruments, catering to both cryptocurrency enthusiasts and traditional traders alike. From the ever-evolving realm of cryptocurrencies like Bitcoin and Ethereum to the age-old Forex market, MegaXchange seeks to offer a one-stop hub for trading enthusiasts. However, what truly distinguishes the platform is its intuitive trading platforms, available for both desktop and mobile users, ensuring seamless trade executions and real-time market monitoring. Though promising in its offerings, MegaXchange operates without any recognized regulatory oversight, casting a shadow of concern over its otherwise impressive suite of services.

MegaXchange is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like MegaXchange carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

MegaXchange presents itself as an enticing platform for traders due to its offering of a diverse array of trading instruments, comprehensive trading platforms tailored for different user needs, and a variety of account types that cater to traders with varying preferences. Additionally, the broker's rich educational resources can be invaluable for both novice and experienced traders. However, there are undeniable drawbacks; the most glaring being its lack of regulation. This raises legitimate concerns about the safety of traders' funds and the overall credibility of the platform. Additionally, the lack of transparency in its fee structure can be off-putting for some traders. Furthermore, the limited information provided on the website might make potential users hesitant, as it can be seen as a lack of transparency and clarity.

| Pros | Cons |

|

|

|

|

|

|

|

|

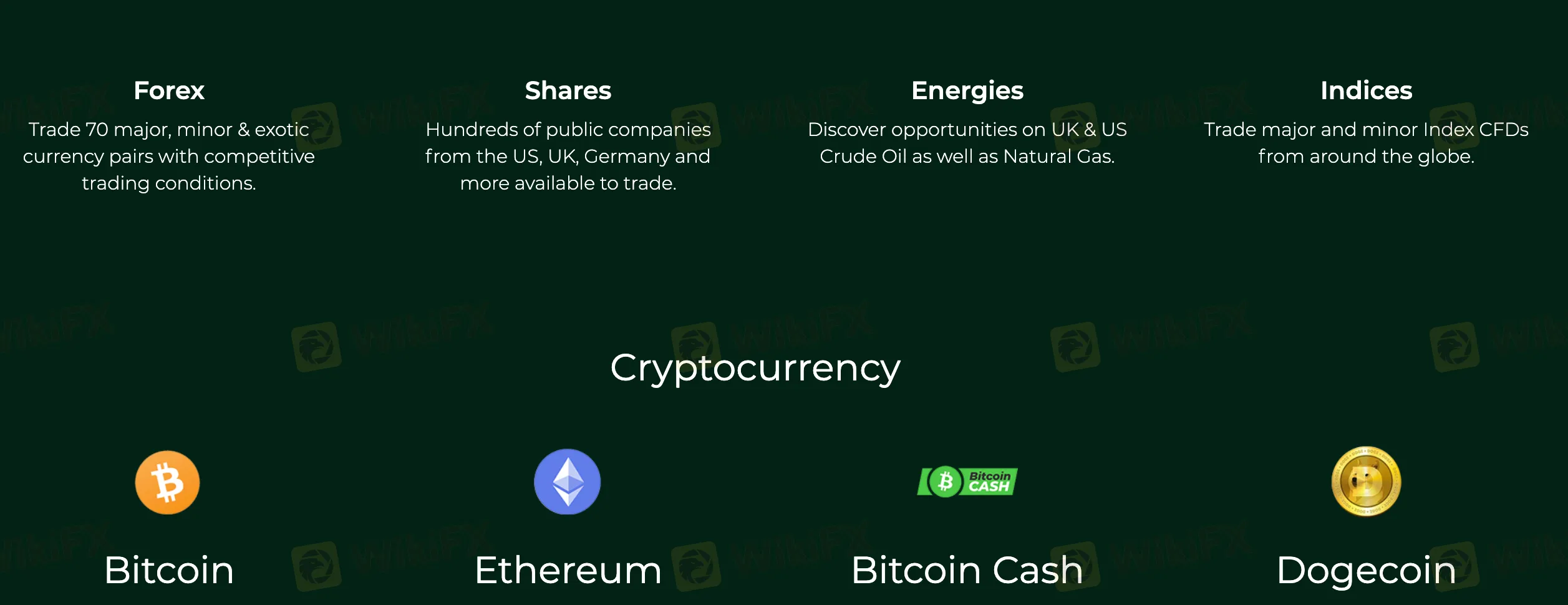

MegaXchange offers a diverse range of trading instruments to cater to the preferences and strategies of traders. These instruments encompass various asset classes, including:

1. Cryptocurrencies: MegaXchange allows traders to explore the dynamic world of cryptocurrencies. This includes popular options like Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Dogecoin (DOGE). Cryptocurrencies offer unique opportunities for traders to speculate on the price movements of digital assets with significant market volatility.

2. Forex: MegaXchange provides access to the forex market, offering 70 major, minor, and exotic currency pairs. Forex trading allows traders to engage in the global currency exchange market, capitalizing on fluctuations in exchange rates.

3. Shares: MegaXchange grants access to hundreds of publicly traded companies from various regions, including the US, UK, Germany, and more. Trading shares enables investors to participate in the equity markets and potentially benefit from company-specific news and trends.

4. Indices: Traders can explore major and minor index CFDs from around the world through MegaXchange. Index trading allows traders to speculate on the performance of entire stock market indices, providing a broader perspective on market movements.

5. ETFs (Exchange-Traded Funds): While not explicitly described in the provided information, ETFs are typically investment funds that hold a diversified portfolio of assets such as stocks, bonds, or commodities. ETF trading allows for diversification and exposure to multiple assets within a single investment.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | MegaXchange | IC Markets | FxPro | RoboForex |

| Forex | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| CFD | No | Yes | Yes | Yes |

| indexes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes |

| ETF | Yes | No | No | Yes |

| Options | No | No | Yes | No |

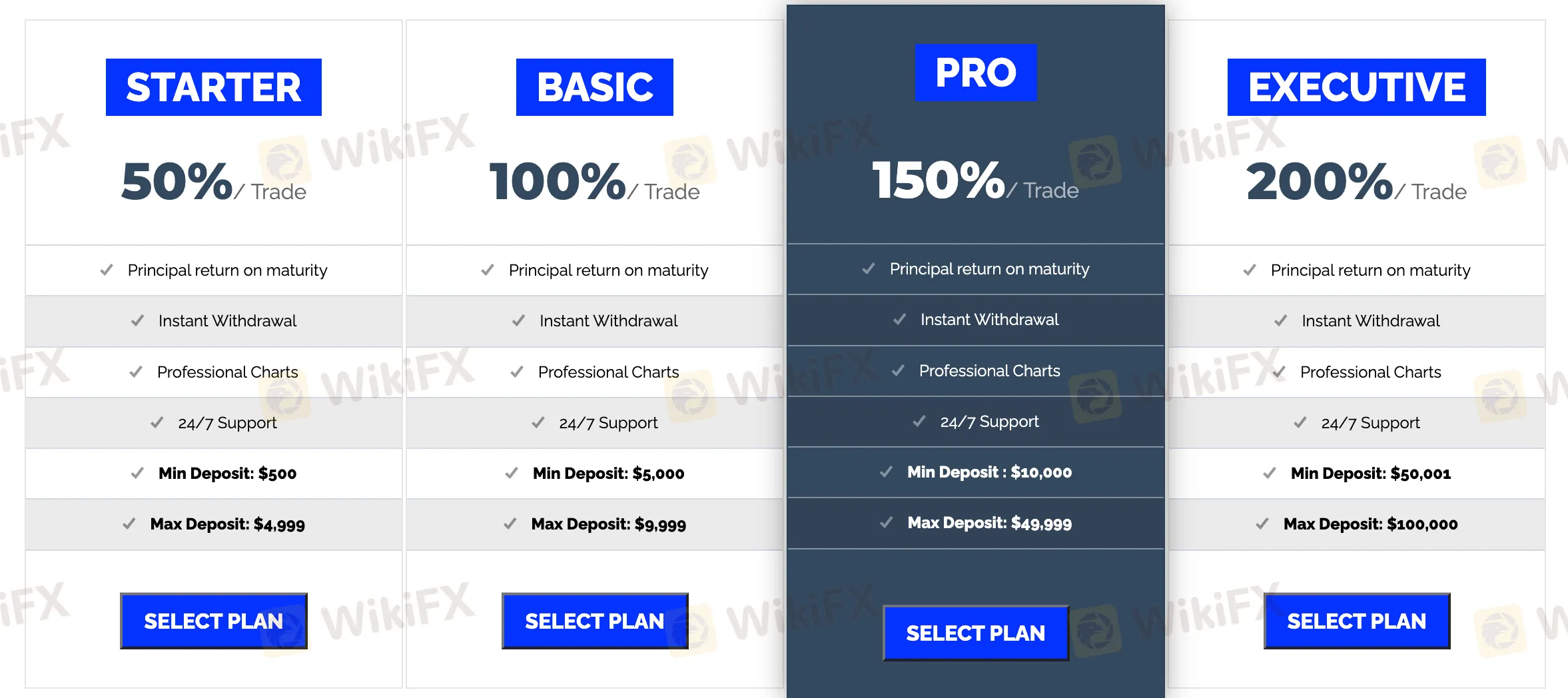

MegaXchange offers a variety of account types designed to accommodate traders with different preferences and investment levels:

1. STARTER: This account type requires a minimum deposit of $500 and caters to traders looking to start with a modest investment. Traders can benefit from a 50% return per trade, principal return on maturity, instant withdrawal options, access to professional charts, and 24/7 customer support.

2. BASIC: The BASIC account is suitable for traders who are willing to deposit a minimum of $5,000. With a 100% return per trade, principal return on maturity, instant withdrawals, professional charting tools, and around-the-clock customer support, this account type offers an upgraded trading experience.

3. PRO: For traders with a more substantial investment, the PRO account requires a minimum deposit of $10,000. It offers a higher return of 150% per trade, principal return on maturity, instant withdrawal capabilities, access to professional charts, and 24/7 customer support.

4. EXECUTIVE: The EXECUTIVE account is designed for seasoned traders and requires a minimum deposit of $50,001. It provides an impressive 200% return per trade, principal return on maturity, instant withdrawal options, professional charting tools, and continuous 24/7 customer support.

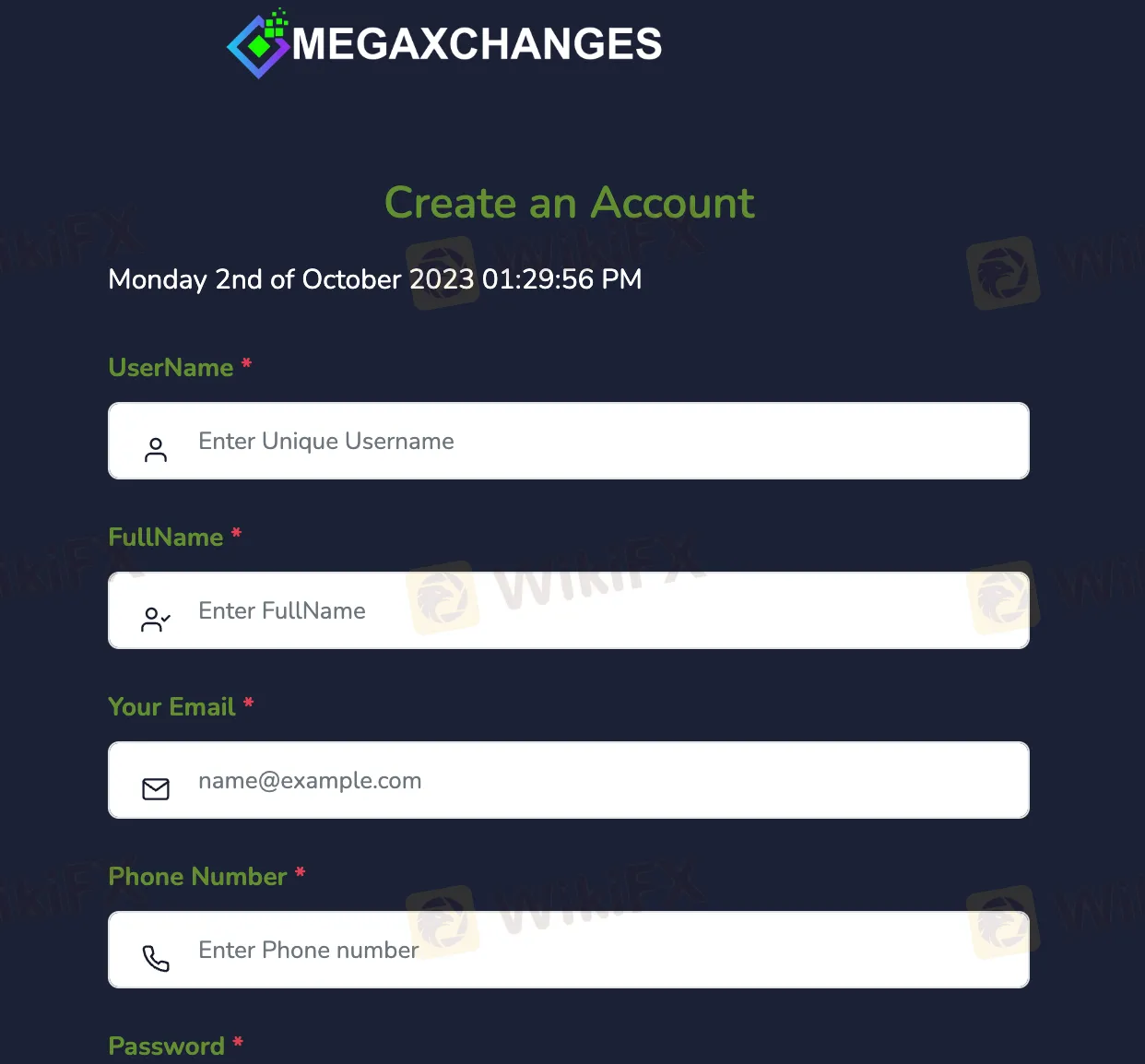

To open an account with MegaXchange, follow these steps.

Visit the MegaXchange website. Look for the “SIGN UP” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

MegaXchange offers leverage on various trading instruments across different asset classes. Here's a breakdown of the leverage options:

Cryptocurrencies: When trading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Dogecoin (DOGE), MegaXchange provides a leverage of 1:10. This leverage allows traders to potentially magnify their positions and exposure in the highly volatile cryptocurrency market.

Forex: In the Forex market, MegaXchange offers leverage of up to 1:500 on currency pairs like AUD/CAD, AUD/CHF, AUD/JPY, and others. This level of leverage provides traders with the ability to control larger positions with a relatively smaller amount of capital, but it also increases the potential for both profits and losses.

Shares: MegaXchange offers leverage on shares of various companies. For example, the leverage for 3I GROUP shares is 1:10, while for 58.COM shares, it's 1:20. Leverage on shares allows traders to amplify their exposure to individual stocks.

Indices: MegaXchange provides leverage on major indices like the Australia 200, Europe 50, Germany 30, and others, with a leverage of 1:200. This enables traders to access a broader range of market opportunities and potentially increase their trading positions.

ETFs: When trading Exchange-Traded Funds (ETFs), MegaXchange offers leverage options, such as 1:10 on IBOXX USD HIGH YIELD ETF and 1:10 on LATIN AMERICA 40 ETF. Leverage on ETFs can enhance trading flexibility.

It's important to note that while leverage can magnify potential profits, it also increases the risk of substantial losses. Traders should use leverage judiciously and have a clear risk management strategy in place when trading with leverage on MegaXchange.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | MegaXchange | IG | AvaTrade | IC Markets |

| Maximum Leverage | 1:500 | 1:200 | 1:400 | 1:500 |

MegaXchange offers a range of spreads and commissions depending on the specific trading instrument and market conditions. Here's a brief overview:

Cryptocurrencies: While the platform doesn't mention specific spreads or commissions in the provided information, it's common in the cryptocurrency market to have variable spreads that can tighten or widen based on market liquidity and volatility. Traders should check the platform for real-time spreads and any associated commissions when trading cryptocurrencies.

Forex: For Forex trading, MegaXchange offers spreads that can vary depending on the currency pair being traded. The provided example mentions a commission of $2.5 per $100,000 traded for pairs like AUD/CAD, AUD/CHF, and AUD/JPY. These commissions are relatively low and can make Forex trading cost-effective, especially with the high leverage available.

Shares: When trading shares of public companies, MegaXchange may charge commissions in the form of a minimum commission per lot traded. For example, it mentions a commission of 0.01 USD per lot traded for shares like 3I GROUP and 58.COM. Traders should consider these commissions when calculating the overall cost of trading shares.

Indices: MegaXchange offers indices with zero commissions, as indicated by a commission of 0. Traders can benefit from competitive spreads when trading major indices from various regions, such as the Australia 200, Europe 50, and Germany 30.

ETFs: Similar to indices, MegaXchange provides ETF trading with commissions as low as 0.01 USD per lot traded. These commissions are typically reasonable, allowing traders to access a diversified range of ETFs with cost-effective trading conditions.

It's important for traders to review the specific spreads and commissions applicable to their chosen trading instruments and to be aware of any potential changes based on market conditions. While competitive spreads and low commissions can reduce trading costs, traders should also consider other factors like leverage and risk management when making trading decisions on MegaXchange.

MegaXchange offers a variety of deposit and withdrawal methods, including:

Credit/debit cards: Visa, Mastercard, Maestro, and American Express cards are accepted.

Bank wire transfer: Bank wire transfers are available for both deposits and withdrawals.

E-wallets: Skrill, Neteller, and WebMoney are accepted.

Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and Dogecoin are accepted.

The minimum deposit amount varies depending on the deposit method used. For credit/debit cards and e-wallets, the minimum deposit is $10. For bank wire transfers, the minimum deposit is $500. For cryptocurrencies, the minimum deposit is equivalent to $10 in the cryptocurrency of your choice.

The maximum withdrawal amount varies depending on the withdrawal method used. For credit/debit cards and e-wallets, the maximum withdrawal is $10,000 per day. For bank wire transfers, the maximum withdrawal is $50,000 per day. For cryptocurrencies, the maximum withdrawal is equivalent to $10,000 in the cryptocurrency of your choice.

Withdrawal processing times also vary depending on the withdrawal method used. For credit/debit cards and e-wallets, withdrawals are processed within 1-2 business days. For bank wire transfers, withdrawals are processed within 3-5 business days. For cryptocurrencies, withdrawals are processed within 24 hours.

MegaXchange charges a fee for all deposits and withdrawals. The fee amount varies depending on the deposit and withdrawal method used. For credit/debit cards and e-wallets, the fee is 2.5% of the deposit or withdrawal amount. For bank wire transfers, the fee is $25. For cryptocurrencies, the fee is 0.1%.

MegaXchange offers a versatile range of trading platforms to cater to traders' preferences and needs, ensuring a seamless trading experience:

Desktop: MegaXchange's desktop trading platform is designed for traders who prefer to conduct their trading activities on a computer. It provides a comprehensive and feature-rich trading environment, including advanced charting tools, technical analysis capabilities, access to historical quotes, and more. The desktop platform allows traders to execute their strategies with precision and flexibility.

Android: For traders on the go, MegaXchange offers an Android trading app that can be easily installed on Android smartphones and tablets. This mobile platform provides access to the financial markets, allowing traders to monitor their positions, execute trades, and stay updated on market developments, all from the convenience of their Android devices.

iOS: MegaXchange also offers a dedicated trading app for iOS devices, such as iPhones and iPads. The iOS app offers similar functionality to the Android app, enabling traders to manage their portfolios, analyze market data, and execute trades with ease while using their iOS devices.

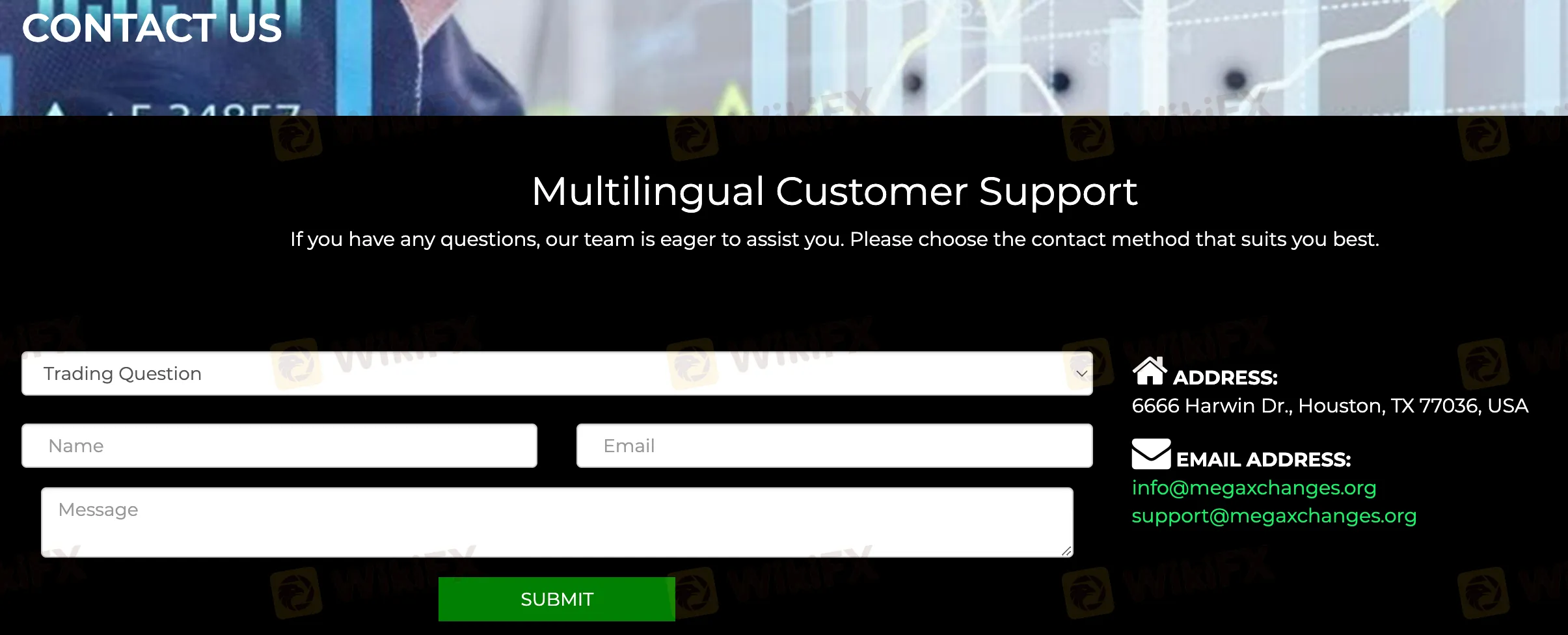

MegaXchange offers customer support options to assist traders with their inquiries and concerns:

Live Chat: MegaXchange provides a live chat feature that allows traders to engage with customer support representatives in real-time. This instant communication channel is valuable for addressing urgent questions, technical issues, or general assistance. Traders can receive prompt responses and guidance through the live chat function.

Email Support: Traders can also reach out to MegaXchange via email. The broker provides two email addresses, “info@megaxchanges.org” and “support@megaxchanges.org,” which traders can use to send inquiries, request information, or seek assistance. Email support offers a convenient way to communicate with the broker, especially for non-urgent matters or when detailed explanations are required.

Physical Address: MegaXchange lists its physical address as “6666 Harwin Dr., Houston, TX 77036, USA.” While this address is provided, it's important to note that traders typically use digital communication channels like live chat and email to contact customer support. The physical address may be more relevant for administrative or official correspondence.

MegaXchange offers a range of educational resources to support traders in their financial journey:

Exclusive Insights and Analysis: Traders can access valuable market insights and analysis from MegaXchange's team of experts. This includes daily market analysis sent directly to traders' inboxes, keeping them informed about significant market developments. Additionally, traders can stay up to date with the latest financial news and forecasts, helping them make informed trading decisions. Weekly webinars provide an interactive platform for learning and discussing various trading topics.

Premium Trader Tools: MegaXchange provides traders with premium tools designed to enhance their trading experience. These tools are available on multiple platforms, offering customized solutions to meet a variety of trading needs and styles. Whether traders are beginners or seasoned professionals, MegaXchange's trader tools can assist in technical analysis, risk management, and more. These resources are also offered in a variety of languages, making them accessible to a diverse global audience.

MegaXchange stands out as a contemporary trading platform in the financial arena, having diversified its trading instruments and offering user-friendly trading platforms for both desktop and mobile users. Its vast educational resources further aid traders in their financial endeavors. However, its unregulated status looms as a shadow over its offerings, making it imperative for potential traders to tread cautiously. The concerns over fund safety and the paucity of clear-cut information on the platform further underscore the need for a thorough evaluation before committing to this platform.

Q: Is Leadmax a regulated broker?

A: No, Leadmax is not regulated by any recognized financial regulatory authority.

Q: What are the primary trading instruments offered by MegaXchange?

A: MegaXchange offers a variety of trading instruments including Cryptocurrencies, Forex, Shares, Indices, and ETFs.

Q: What types of accounts does MegaXchange provide to traders?

A: MegaXchange offers different account types such as STARTER, BASIC, PRO, and EXECUTIVE.

Q: Are there any fees associated with deposits and withdrawals at MegaXchange?

A: Yes, MegaXchange charges fees for both deposits and withdrawals. The exact fee varies depending on the chosen method.

Q: How can traders contact MegaXchange's customer support?

A: Traders can reach out to MegaXchange's customer support via live chat or email. They also provide a physical address for official correspondence.

MegaXchange

MegaXchange

No Regulation

Platform registered country and region

United States

--

--

--

--

--

6666 Harwin Dr., Houston, TX 77036, USA

--

--

--

--

info@megaxchanges.org

Company Summary

User comment

0

CommentsWrite a review

No comment yet

start to write first comment