Company Summary

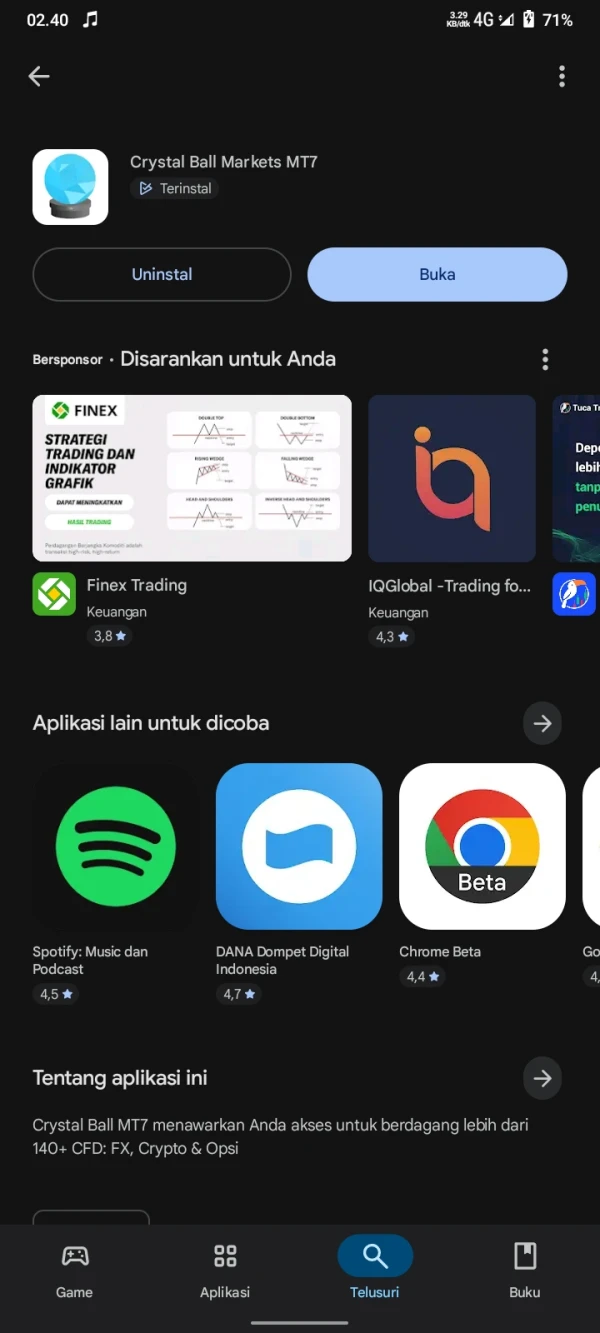

| Crystal Ball Markets Review Summary | |

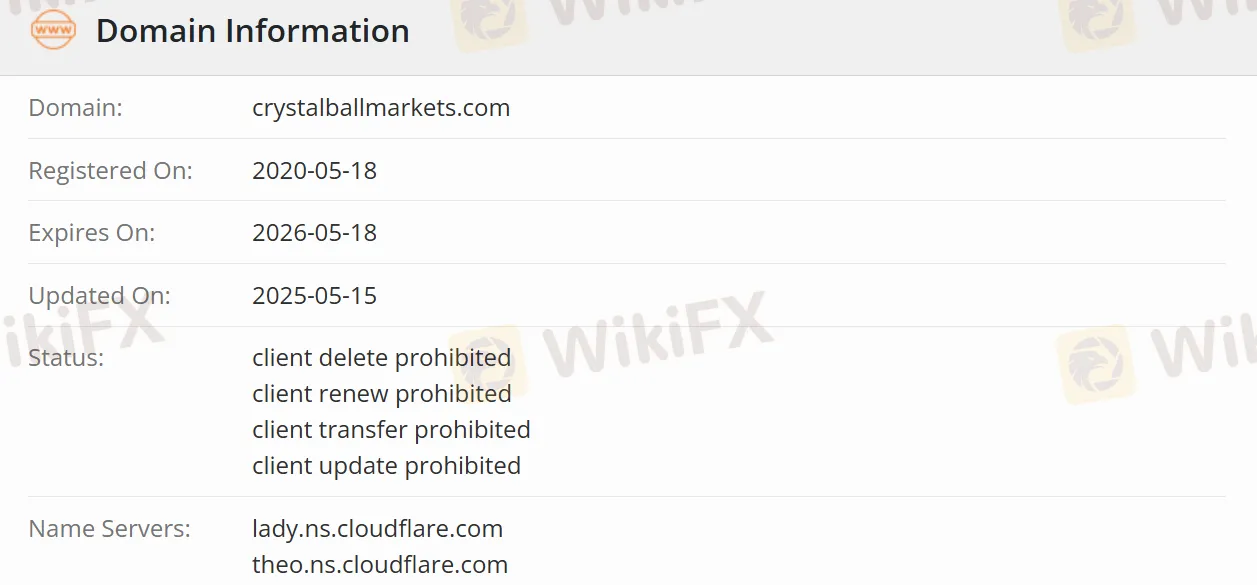

| Registered | 2020 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Currencies, Stocks, Energy, Indices, Agricultural Commodities, Metals, Cryptocurrencies, and Digital Options |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 1.2 pips(Standard) |

| Trading Platform | Mobius Trader 7 |

| Minimum Deposit | $50 |

| Customer Support | support@crystalballmarkets.com |

| +44 1244 94 1257 | |

| Live Chat | |

| Facebook, Instagram, LinkedIn, YouTube, TikTok, Twitter, Telegram, etc. | |

| Suite 305, Griffith Corporate Centre, Beachmont, Kingstown. St. Vincent and the Grenadines. | |

Crystal Ball Markets Information

Crystal Ball Markets is an online platform specializing in foreign exchange (FX) and contract for difference (CFD) trading, offering the Mobius Trader 7 trading platform. Additionally, the platform provides various types of trading accounts, allows trading of multiple financial instruments, and offers multiple deposit and withdrawal methods to facilitate fund management for traders.

Pros and Cons

| Pros | Cons |

| Over 160 trading instruments | Not regulated |

| Flexible account types | No trading bonuses |

| Spread as low as 0 pips (PRO ECN) | No demo account |

| 24/7 customer support | No MT4 or MT5 |

| No deposit and withdrawal fees |

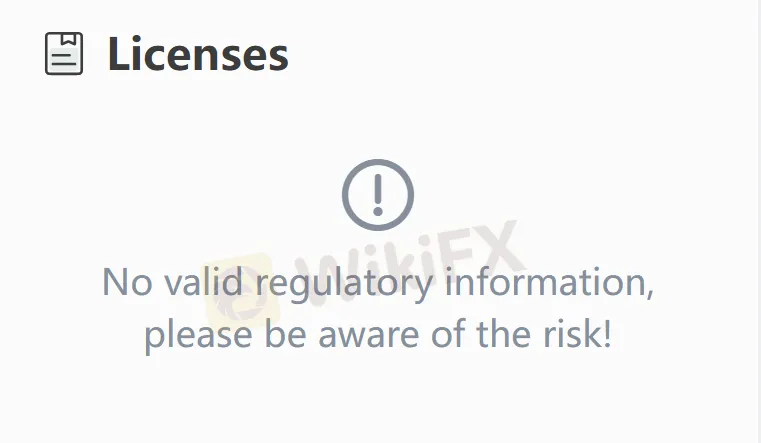

Is Crystal Ball Markets Legit?

Crystal Ball Markets is unregulated and has low security, even though it claims to comply with the regulations of the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) for foreign exchange and virtual currency transactions (MSB Number: M21983070).

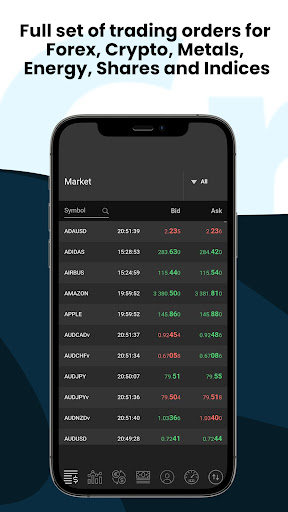

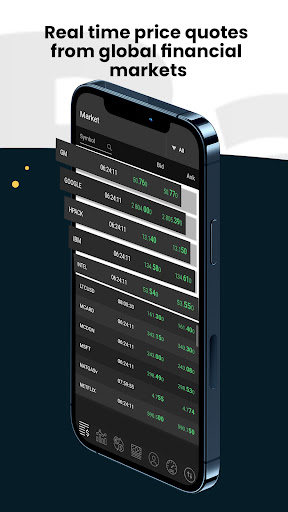

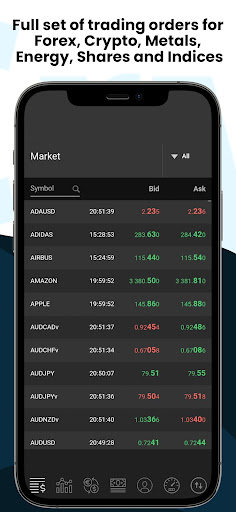

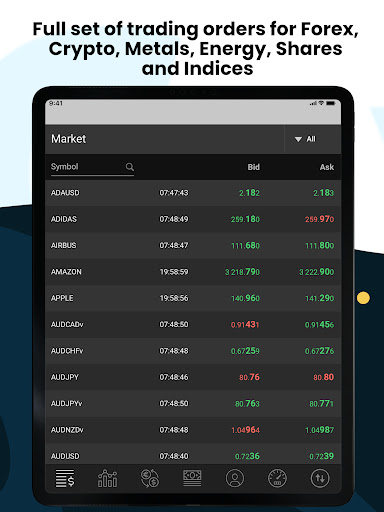

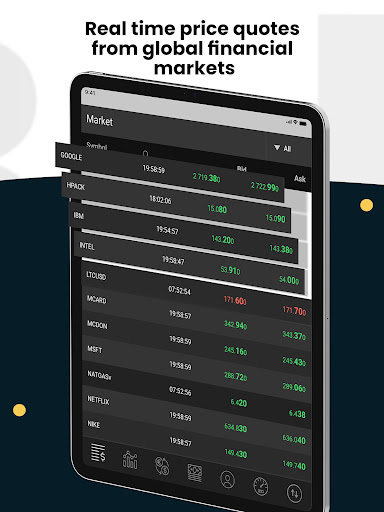

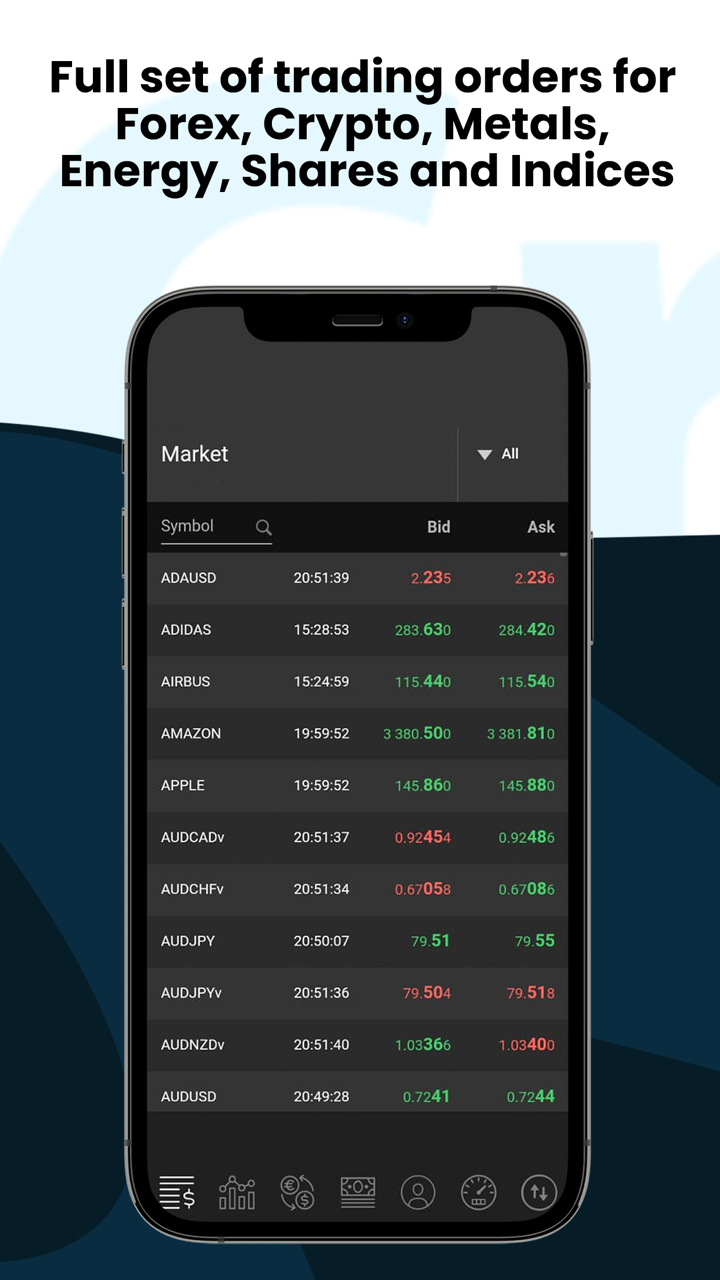

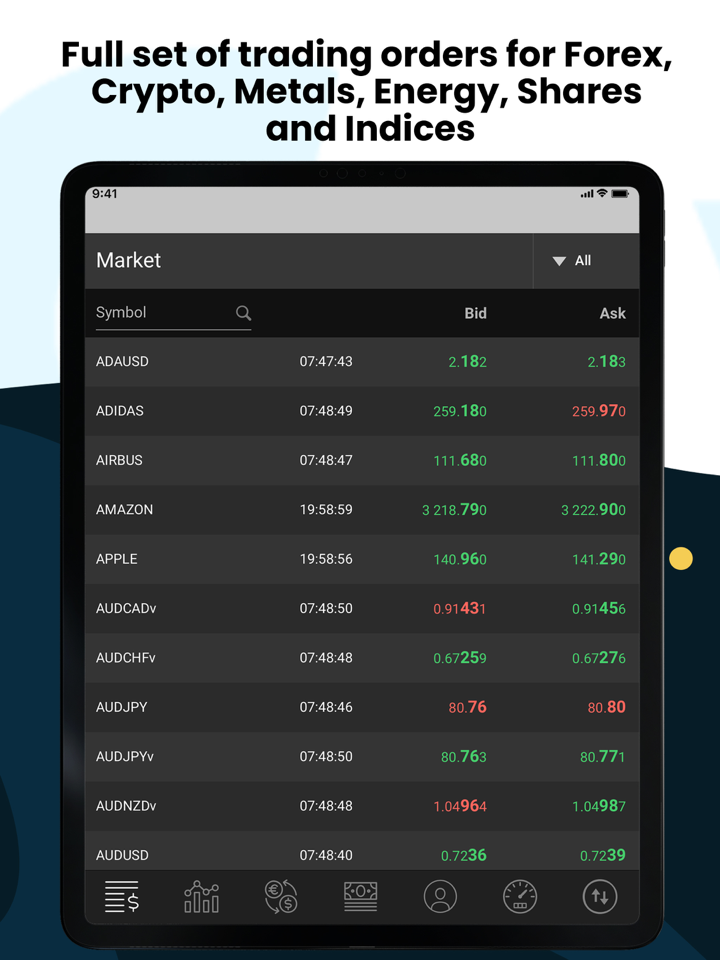

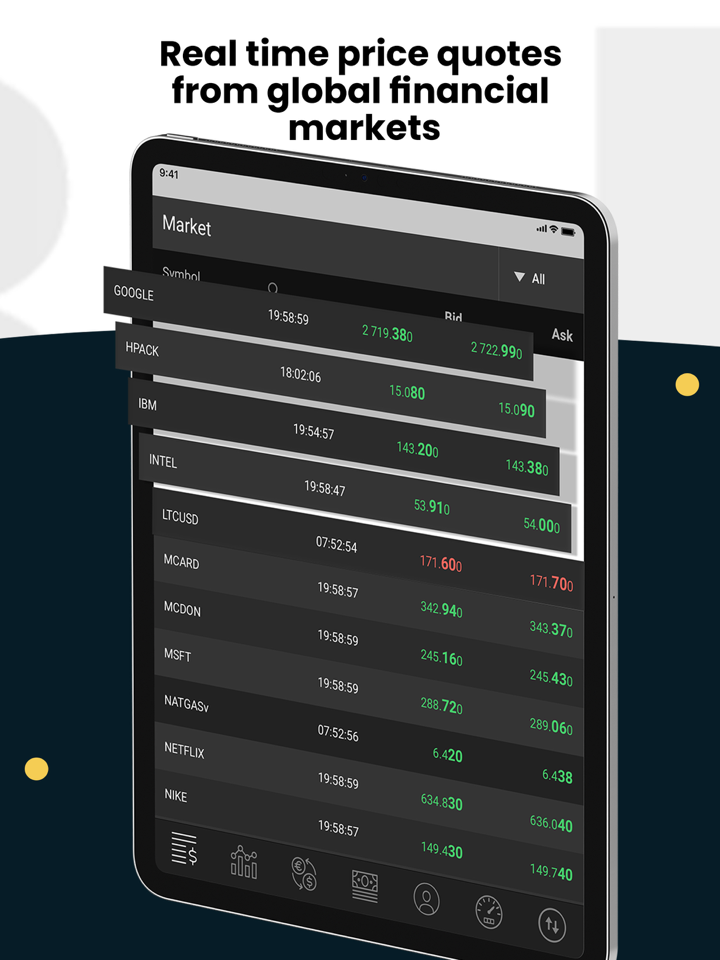

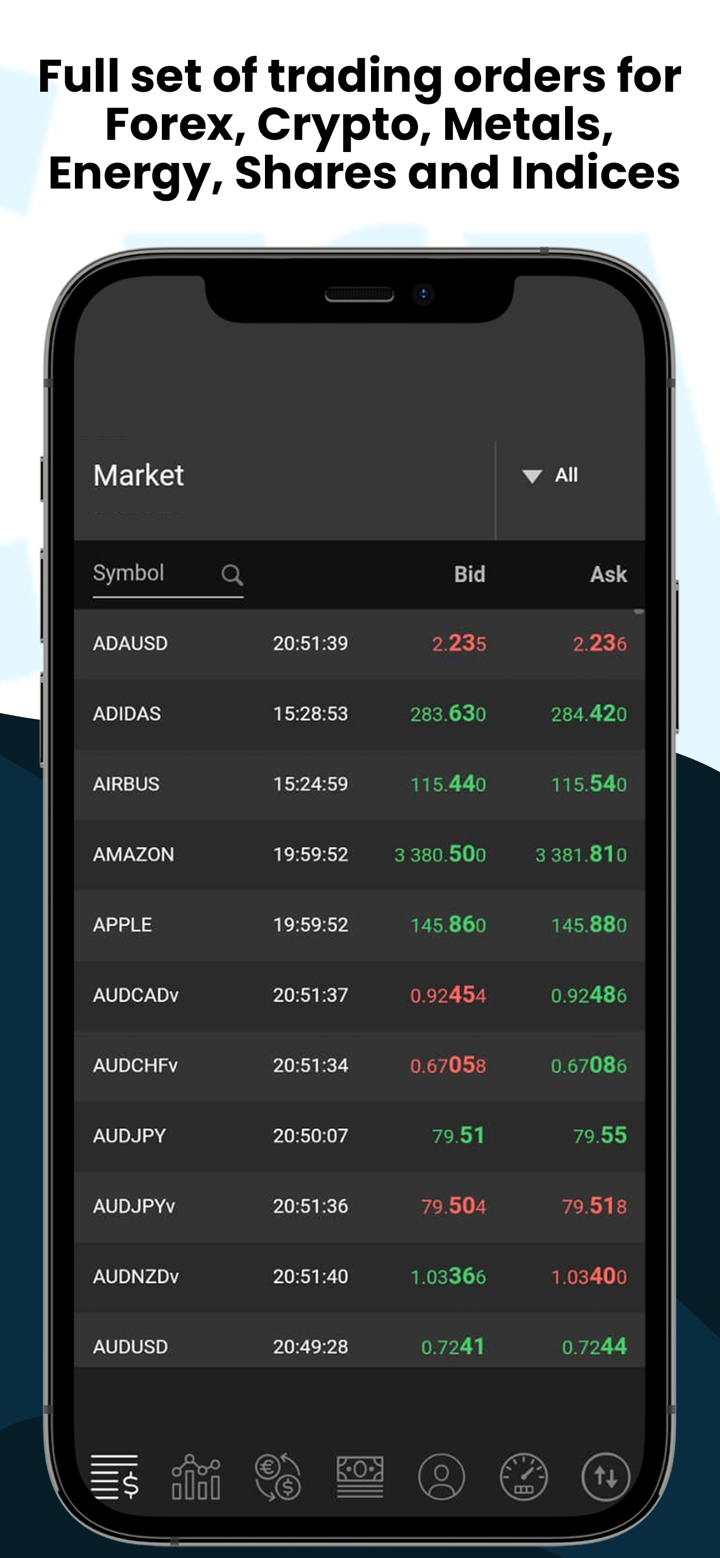

What Can I Trade in Crystal Ball Markets?

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Stocks/Shares | ✔ |

| Energy | ✔ |

| Indices | ✔ |

| Agricultural Commodities | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Digital Options | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

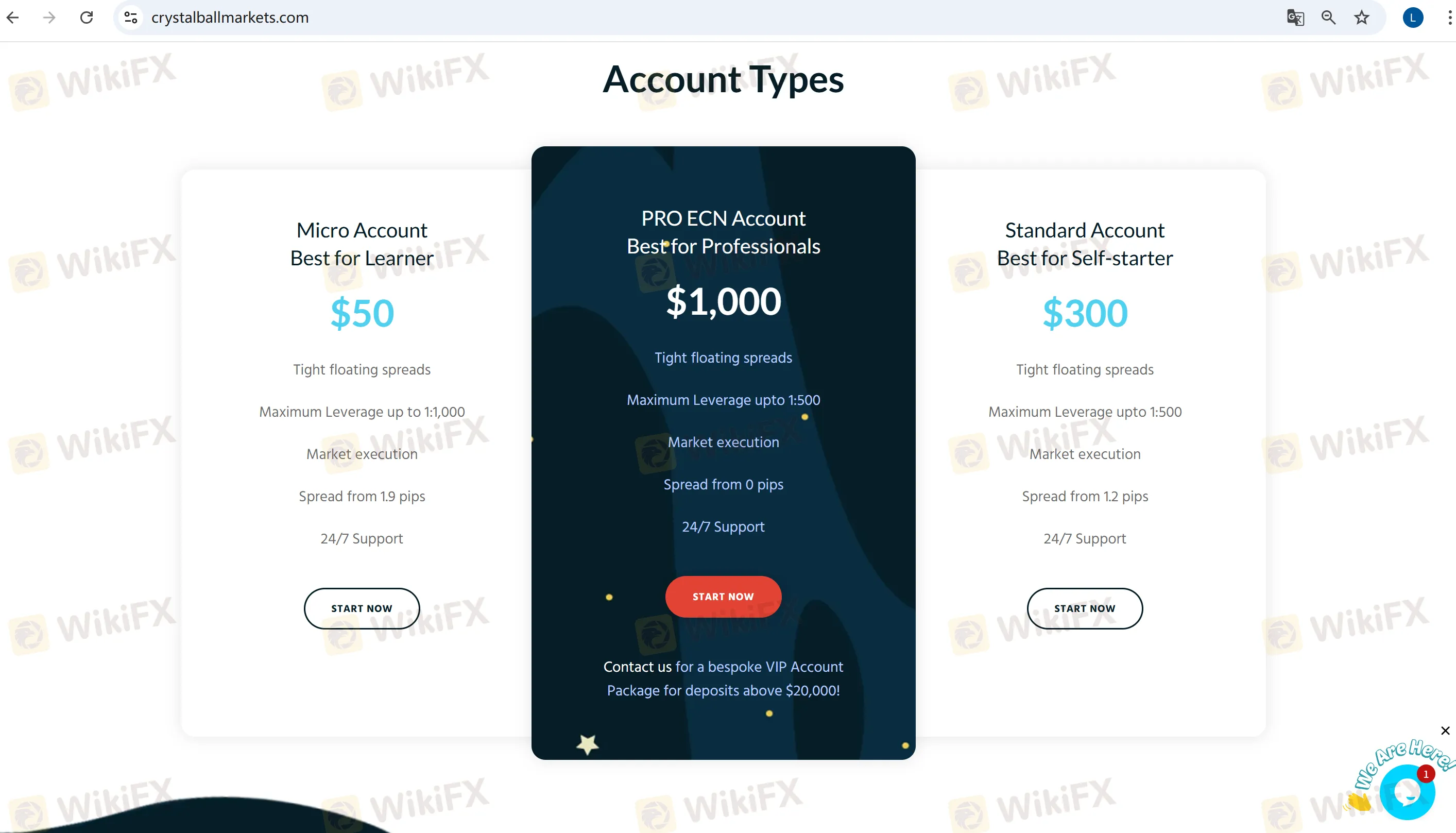

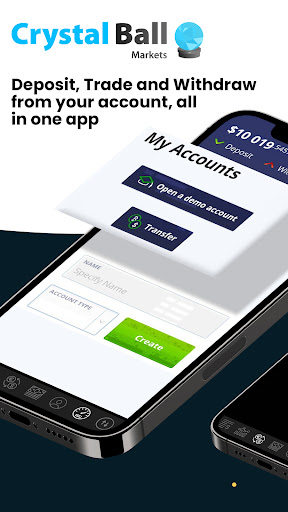

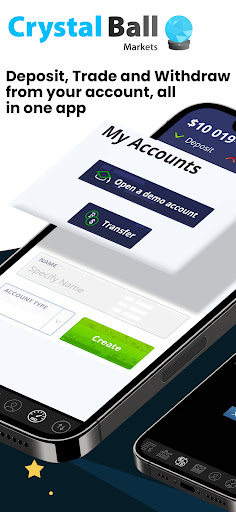

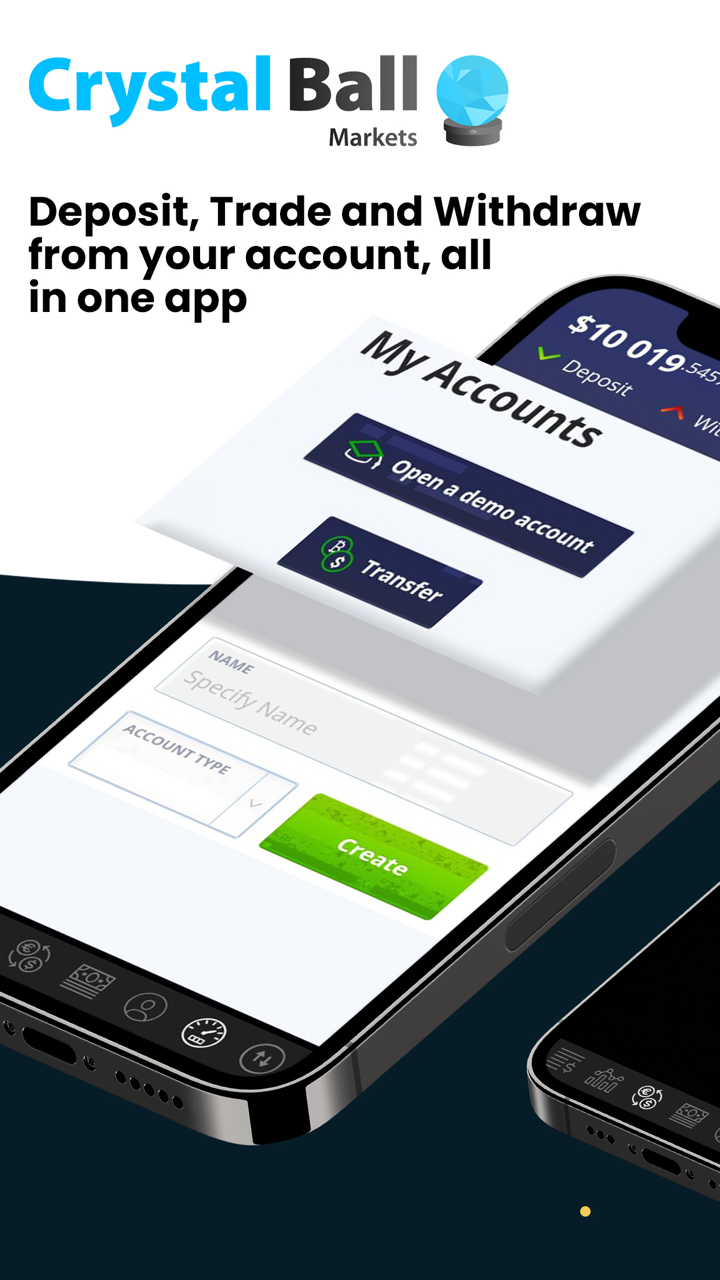

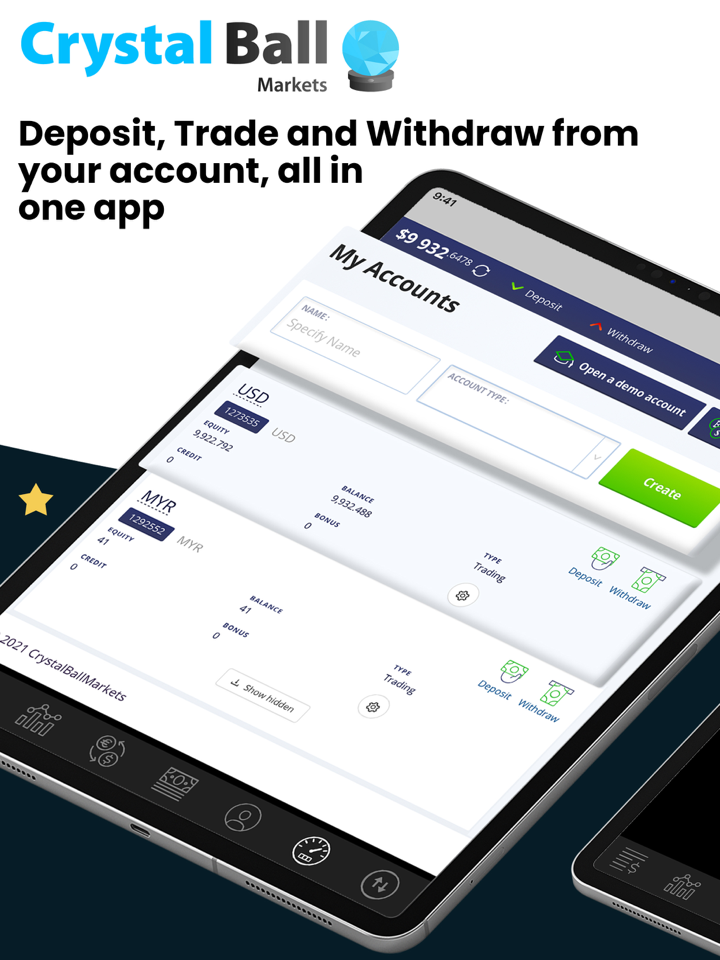

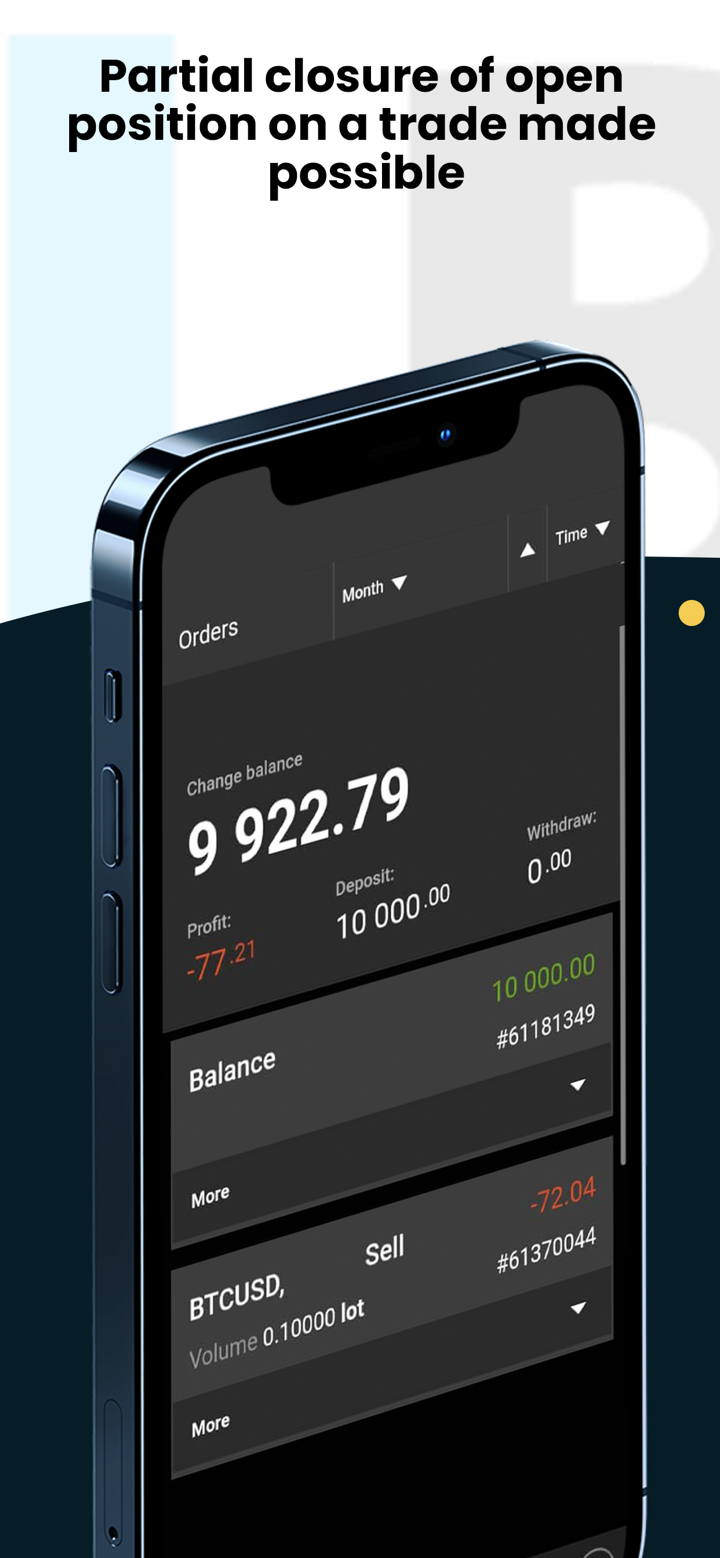

Account Type

The platform offers three types of trading accounts, including:

Micro Account, suitable for novice traders to get familiar with the market and practice strategies.

Standard Account, designed for experienced independent traders.

PRO ECN Account, specially created for professional traders, offering institutional-level liquidity and zero spread advantages.

| Account Type | Micro | PRO ECN | Standard |

| Minimum Deposit | $50 | $1,000 | $300 |

| Maximum Leverage | 1:1000 | 1:500 | 1:500 |

| Spreads | From 1.9 pips | From 0 pips | From 1.2 pips |

| Market execution | Yes | Yes | Yes |

| 24/7 Support | Yes | Yes | Yes |

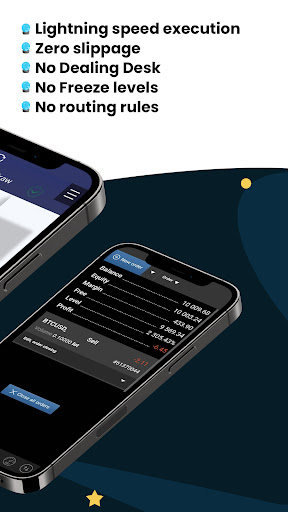

Leverage

The platform offers high leverage ratios, with the maximum leverage of 1:1000 for micro accounts and 1:500 for standard accounts and PRO ECN accounts.

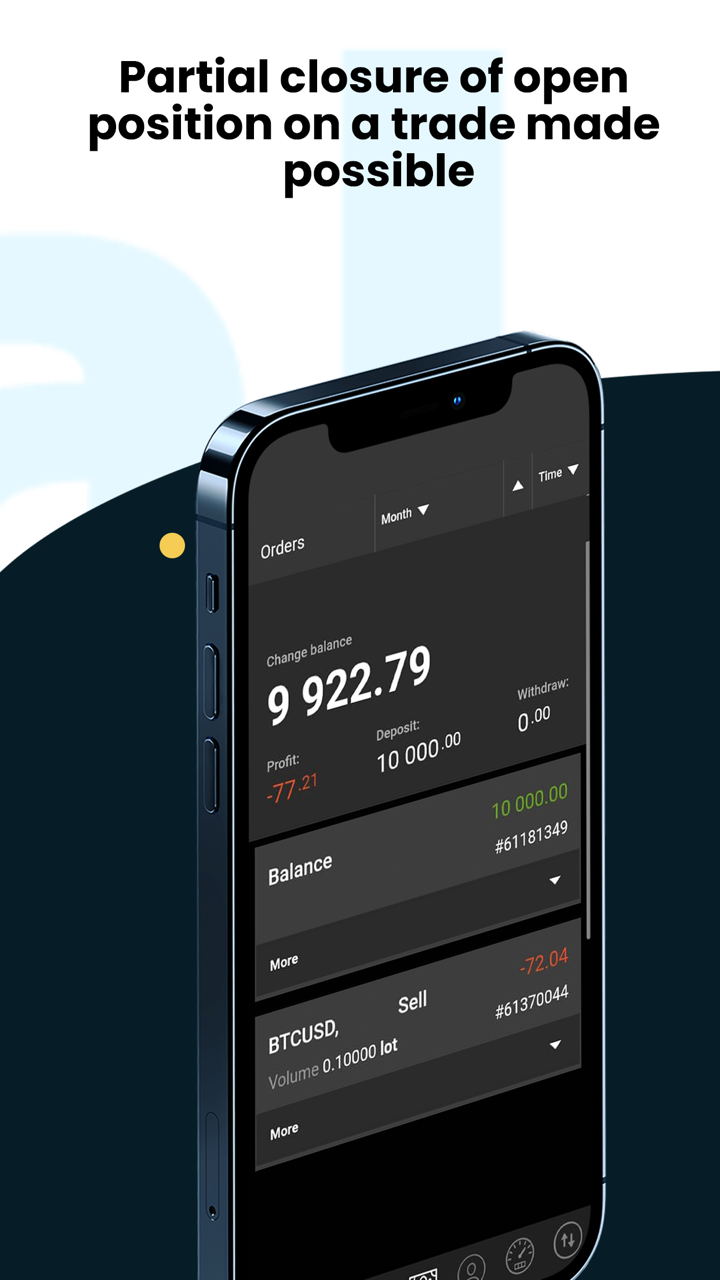

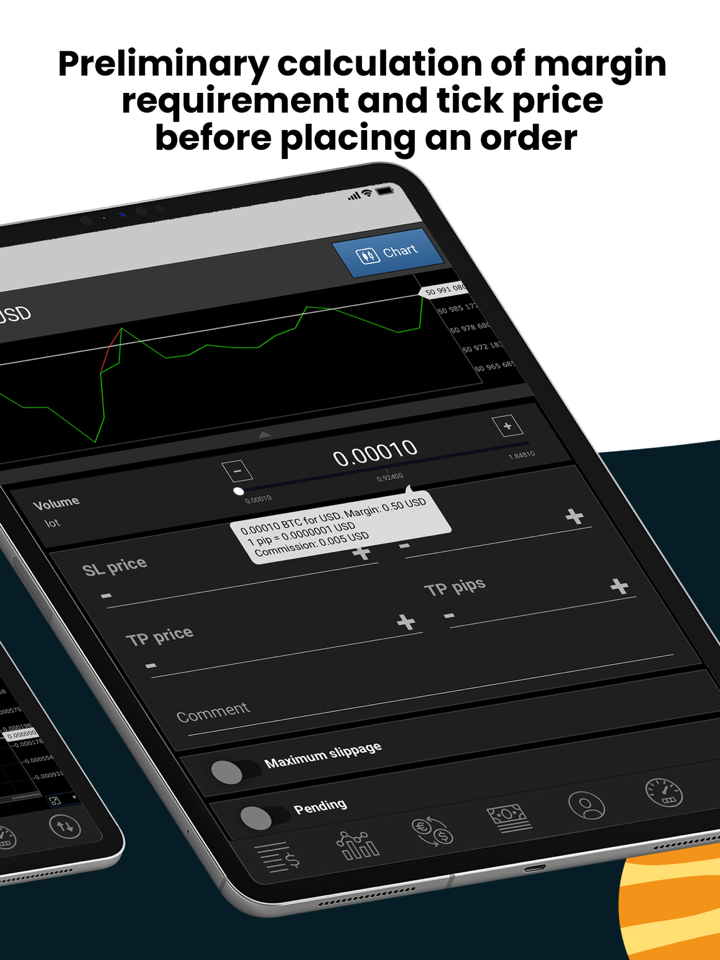

Crystal Ball Markets Fees

The spreads vary among different account types, ranging from 0 to 1.9 pips. The PRO ECN account offers a spread of 0 pips. If an account remains inactive for 12 consecutive months, it will be marked as dormant, and third-party fees may be charged for withdrawals after reactivation.

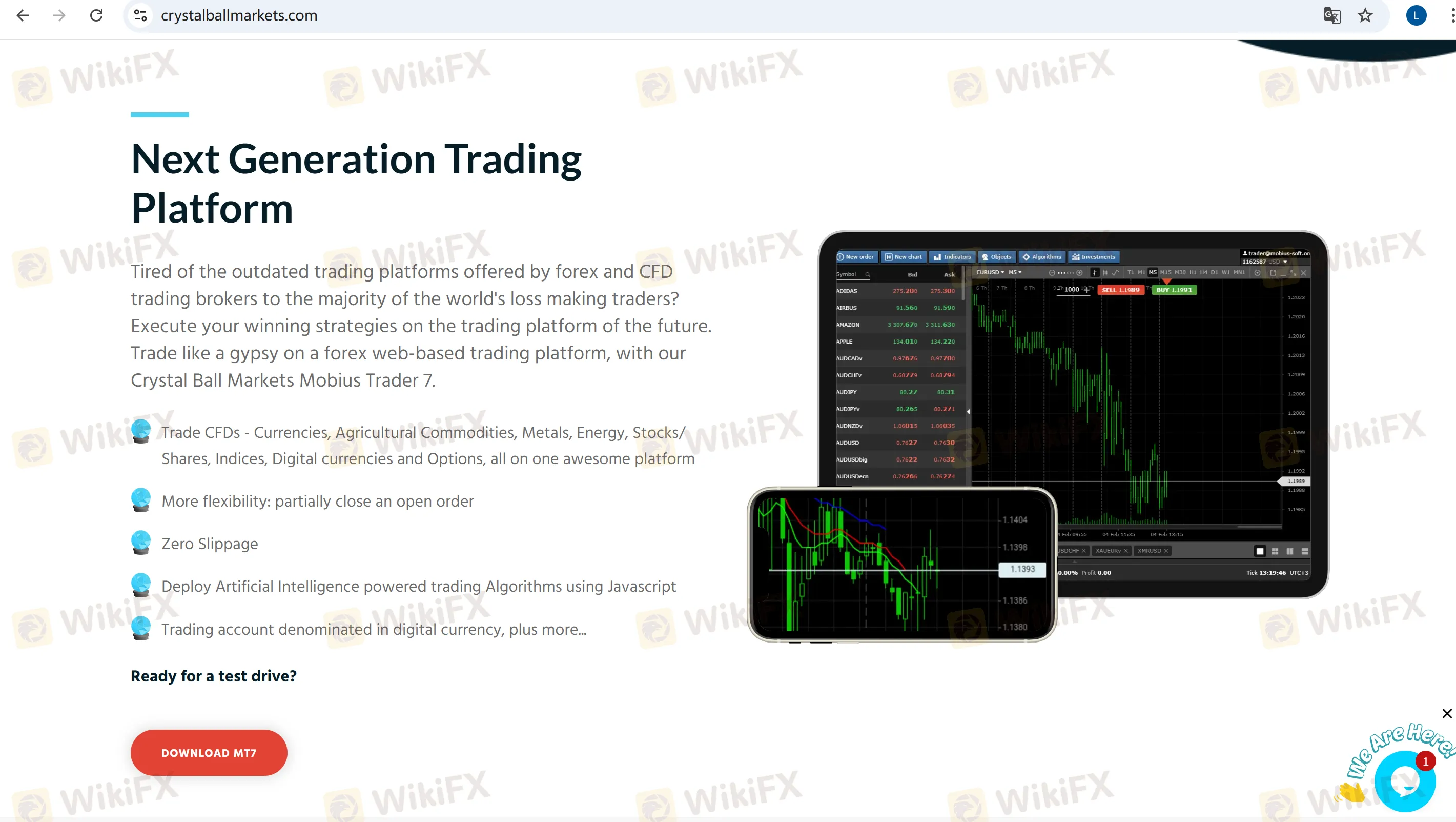

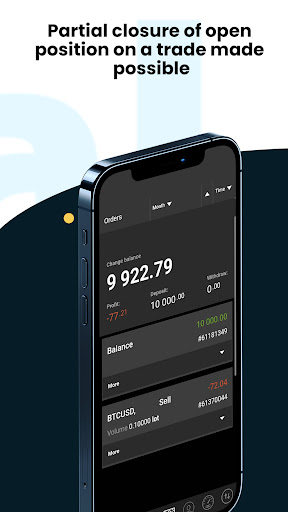

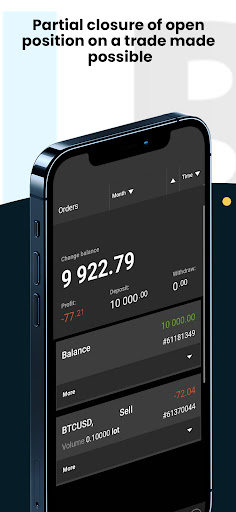

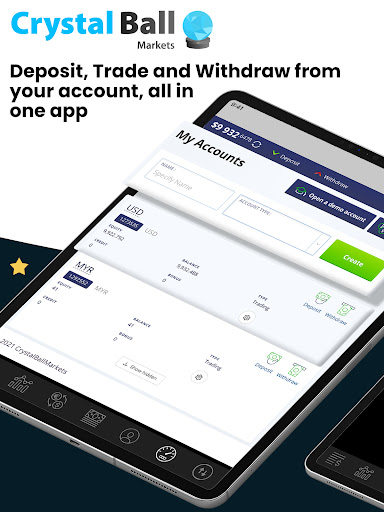

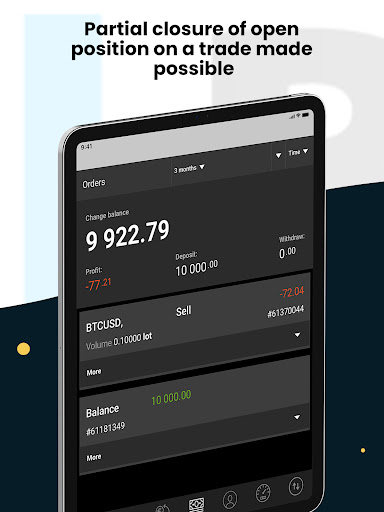

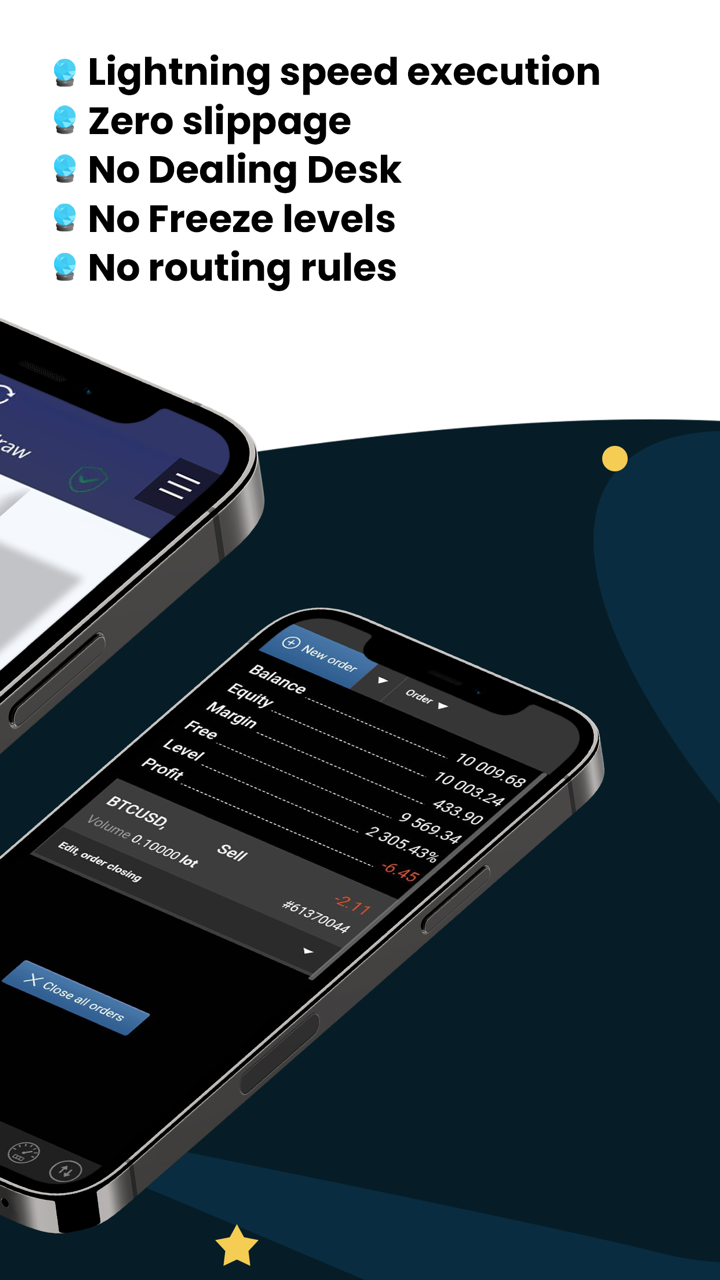

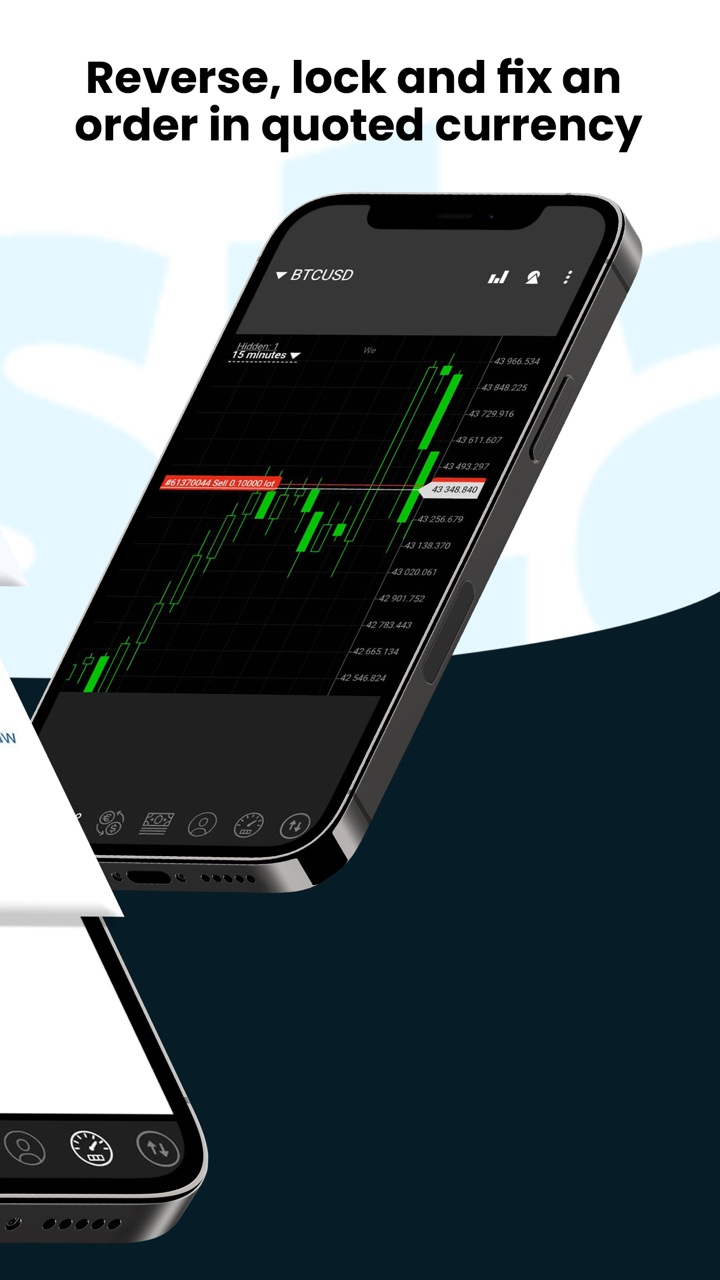

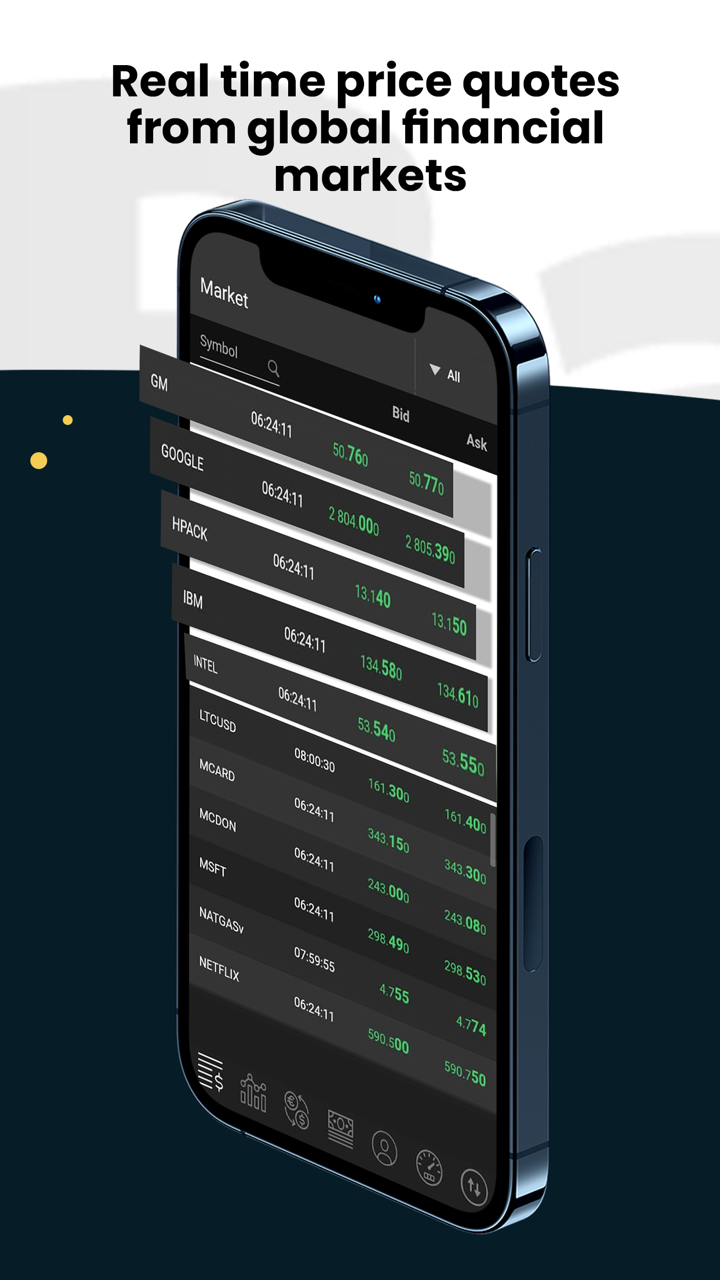

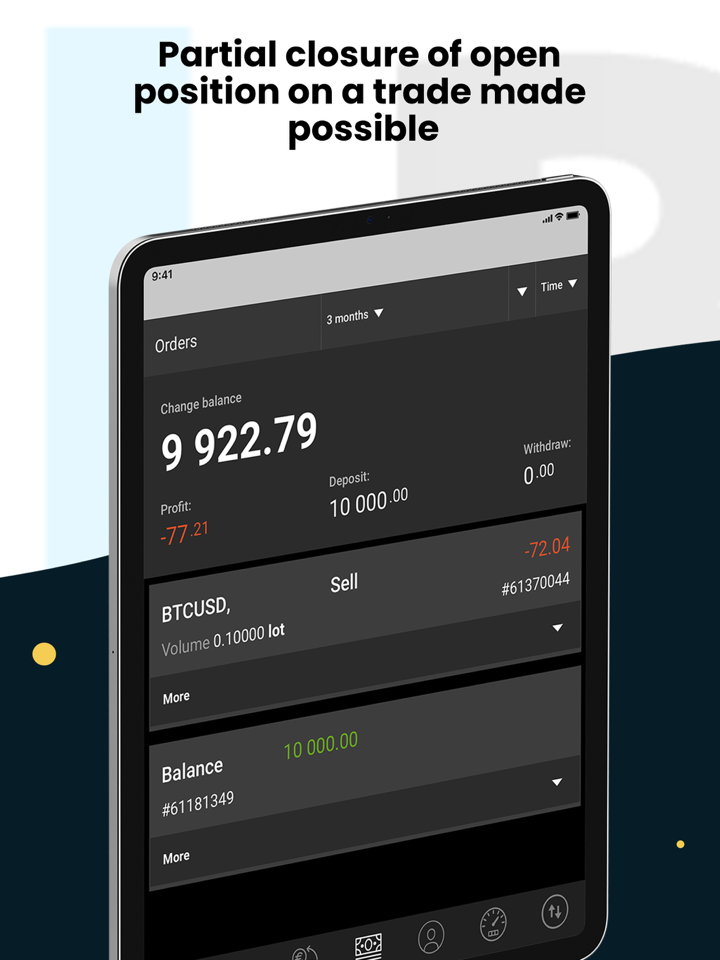

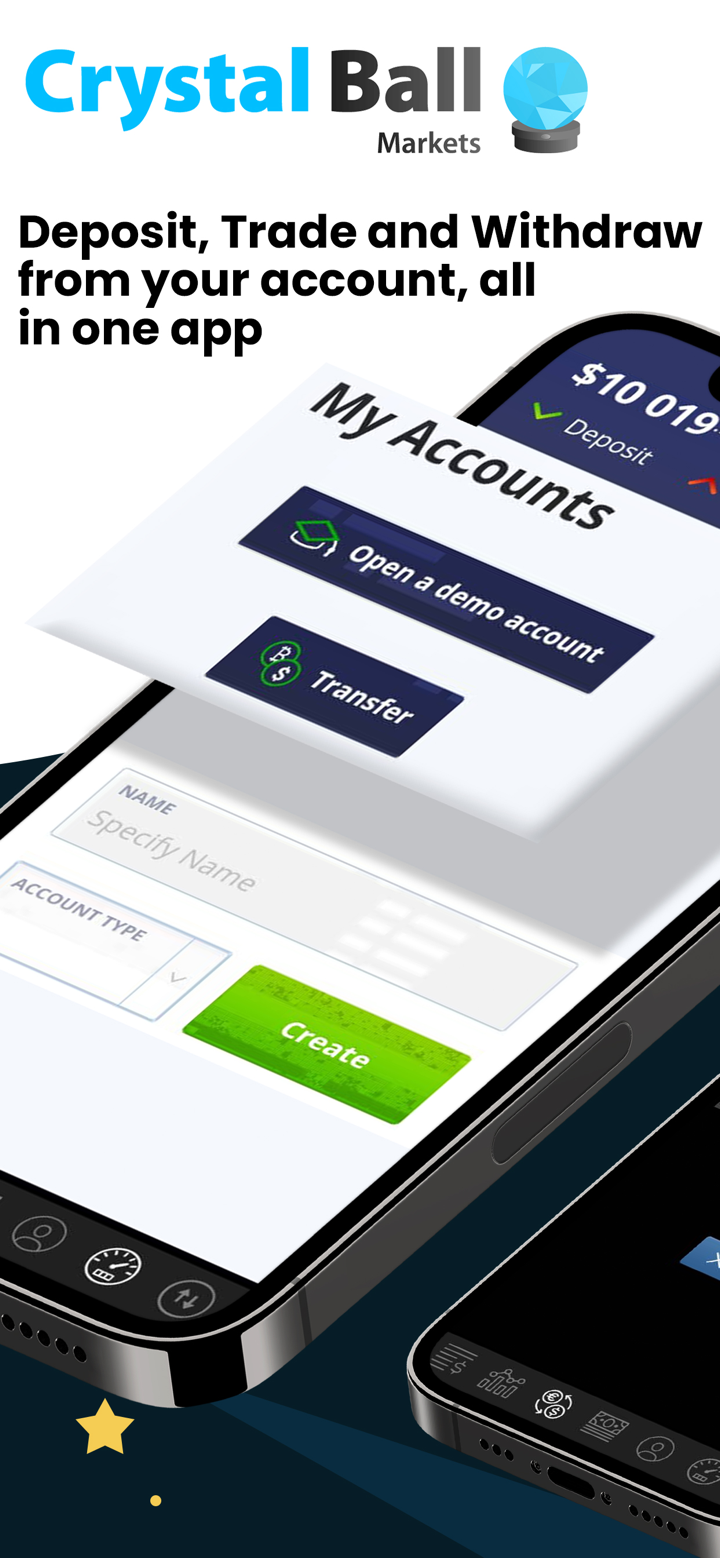

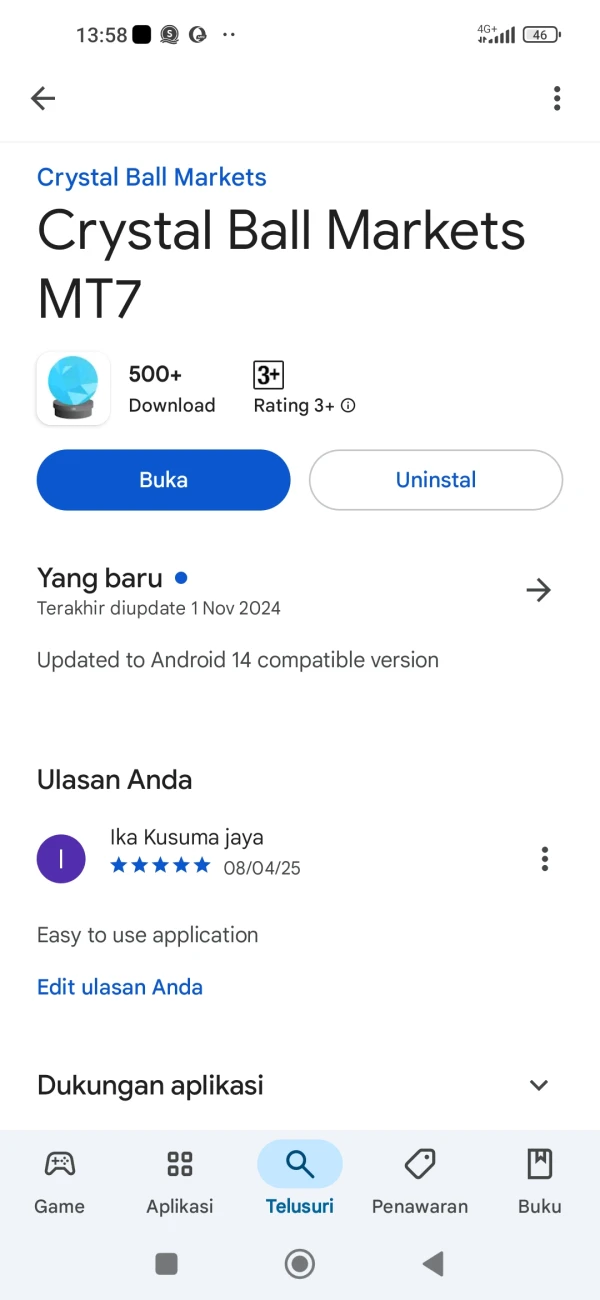

Trading Platform

Mobius Trader 7 (MT7) is the core trading platform of Crystal Ball Markets. Developed for web-based use, it requires no downloads and is compatible with PC, Mac, tablets, and mobile phones, enabling users to trade anytime, anywhere.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobius Trader 7 | ✔ | Web, mobile, Windows, Linux, and Mac | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

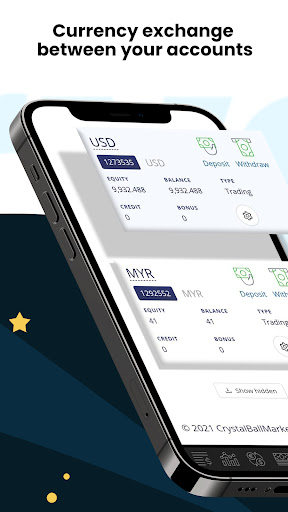

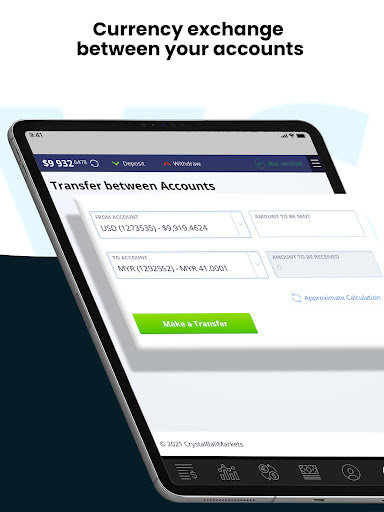

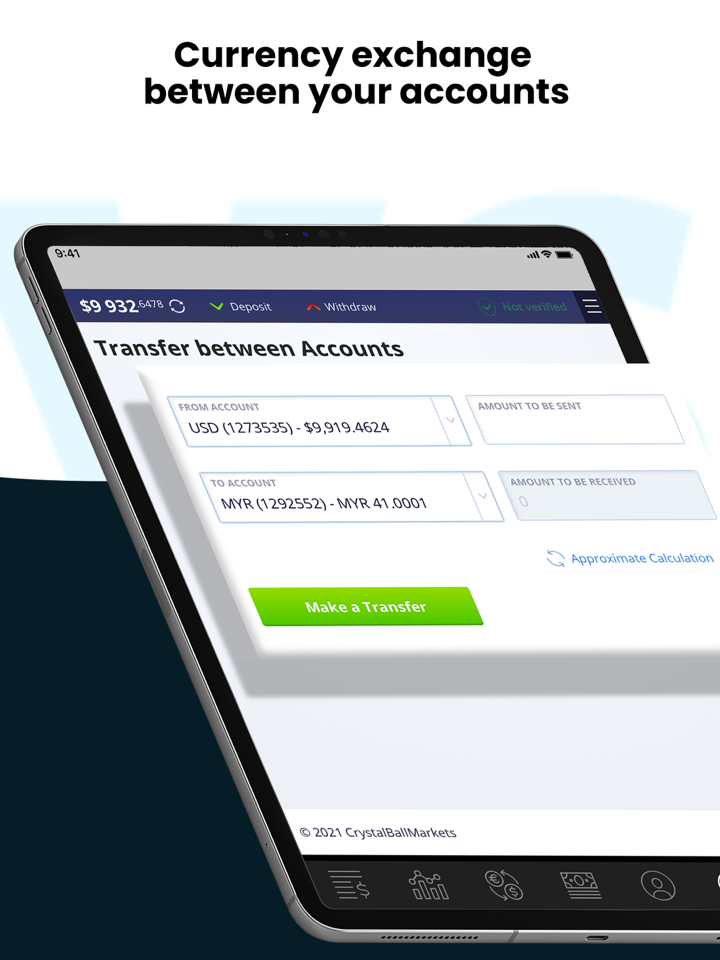

Deposit and Withdrawal

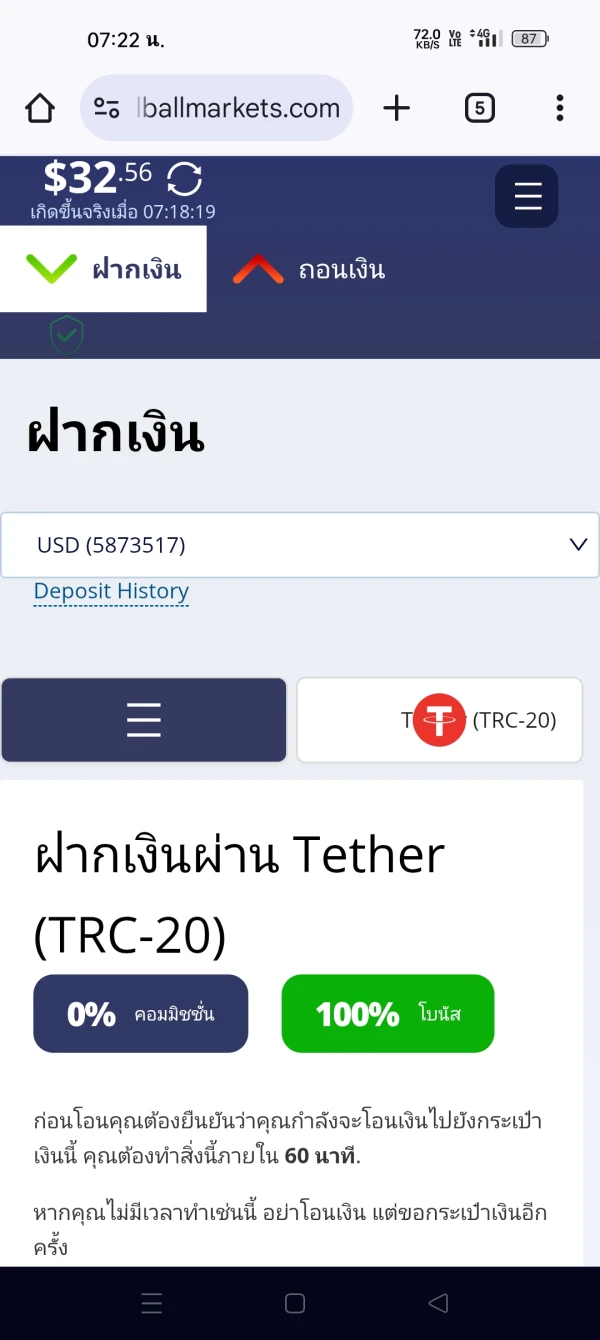

Deposits

The platform supports multiple deposit methods:

Instant availability: Visa, Mastercard, Perfect Money, and cryptocurrencies (after blockchain confirmation).

3-10 business days: Bank transfers. The platform does not charge deposit fees, but third-party institutions may impose charges.

Withdrawals

Within 24 hours: Perfect Money and cryptocurrencies.

3-10 business days: Visa, Mastercard, and bank transfers. Similarly, the platform does not charge withdrawal commissions, but third-party fees may apply.

| Payment Method | Currency | Commission | Deposit Processing Time | Withdrawal Processing Time |

| Visa | USD | None | Instant | 3-10 Business Days |

| Mastercard | USD | None | Instant | 3-10 Business Days |

| Perfect Money | USD | None | Instant | 24 hours |

| Bitcoin / Other Cryptos | BTC, USDT, BCH, LTC, DASH, XRP, ETH | None | Instant | 24 hours |

| Bank Wire Transfer | USD | None | 3-10 Business Days | 3-10 Business Days |

FX1400225535

Indonesia

Broker With very friendly service, fast deposits and withdrawals, improve further to become better and more trustworthy!!

Positive

FX1608984696

Yemen

What distinguishes Crystal Ball Markets is the funded accounts and paid services that give traders the opportunity to prove themselves without the need for huge capital. I liked the transparency in the terms and the ease of tracking profits. In addition, the extra services like paid signals and analyses really helped me make better decisions. A professional experience in every sense of the word.

Positive

FX2440505127

Nigeria

Crystallball market is one of those new broker with too good to be through offers that you just decided to sideline but, here's the trust I at first thought so but now am saying other wise Crystallball market doesn't have my trader but they have their own unique trading platform the Mobius trader which is as fluent a d fast as meta trader,for there trading account and leverage it's the same as every other standard broker.i.also love the fact that they offer prop firm services with great pricing,so overall it a Good broker

Positive

Zubb

Indonesia

Simple user interface, good broker for beginner, many promotion and funded account, good broker

Positive

Arm1518

Thailand

Being an excellent broker, great investment, plus free bonus giveaways. Thank you

Positive

FX3297683111

Saudi Arabia

They are growing better and better. Lets be a part of the team🌔

Positive

Ika kusuma jaya

Indonesia

Hopefully this broker is good and responds quickly to open positions.

Positive

行云ai流水

Malaysia

Great customer service! Chatting with them is rewarding! Just opened an account and hope to get off to a good start. Guys! Wish me success!

Positive

FX1067475175

Malaysia

I have been trading with Crystalball Markets for months, and I am very satisfied with it. They are an excellent broker providing me the best quality of service, attractive trading conditions, advanced trading platform… I would recommend this broke to your guys if you are looking for a new broker.

Positive