Score

Optium Group

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.optiumgroup.com/#

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Broker Information

More

Optium Group

Optium Group

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

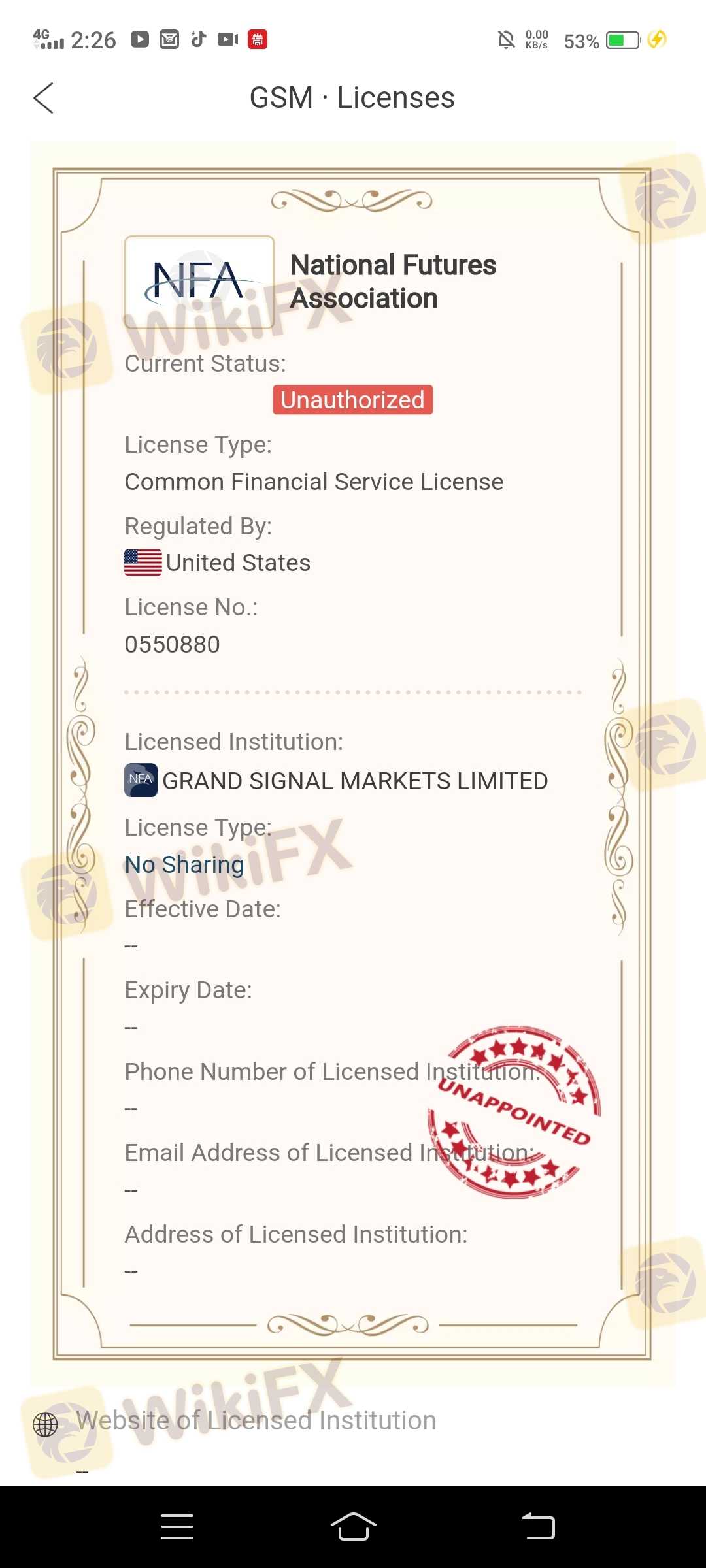

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The United StatesNFA regulation (license number: 0549736) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

Users who viewed Optium Group also viewed..

XM

GMI

FXCM

IC Markets

Exposure

3 pieces of exposure in totalOptium Group · Company Summary

| Aspect | Information |

| Company Name | Optium Group |

| Registered Country | United Kingdom |

| Founded Year | 1-2 years |

| Regulation | No License |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:300 |

| Minimum Spread | From 0.0 pips |

| Trading Platforms | Optium Group Web Trader (proprietary trading platform) |

| Tradable Assets | Forex, Stocks, Commodities, Indices, Cryptocurrency |

| Account Types | Starter, Pro, Advanced |

| Customer Support | Email, Phone |

| Deposit & Withdrawal | VISA, MasterCard, Maestro, Bitcoin, Wire Transfer |

Overview of Optium Group

Registered in United Kingdom, Optium Group is an online forex broker offering diversified range of trading instruments, including Forex, Stocks, Commodities, Indices, and Cryptocurrency through its in-house trading platform.

The minimum deposit required to start trading with Optium Group is $100, and the maximum leverage offered is 1:300. The minimum spread starts from 0.0 pips, providing potentially competitive trading conditions.

Optium Group offers a proprietary trading platform called Webtrader for executing trades. Traders can fund their accounts using various payment methods, including VISA, MasterCard, Maestro, Bitcoin, and Wire Transfer. Customer support is available via email and phone to assist traders with their inquiries and concerns.

Is Optium Group safe to trade with?

XBPrime does not have valid regulation, as verified through the available information. This lack of regulation poses a potential risk for traders. Additionally, the claim made by the broker regarding United States NFA regulation (license number: 0549736) is suspected to be a clone, further raising concerns about the broker's legitimacy.

Pros and Cons

Optium Group presents both advantages and disadvantages for traders. On the positive side, it offers a diverse range of trading instruments, competitive minimum deposit requirements, high leverage for potential profit amplification, a user-friendly proprietary trading platform, and multiple payment options. However, there are notable disadvantages, including the lack of valid regulation, unclear spreads and commission structures, the absence of industry-standard trading platforms like MT4 or MT5, limited contact channels for customer support, limited educational resources, and the possibility of withdrawal restrictions and undisclosed fees. Traders should carefully evaluate these factors and exercise caution when considering Optium Group as their trading platform of choice.

| Pros | Cons |

| Diverse range of trading instruments available | Lack of valid regulation |

| Competitive minimum deposit requirement | Suspected clone of United States NFA regulation |

| High leverage offering potential for amplified profits | Unclear spreads and commission structures |

| User-friendly proprietary trading platform | Lack of industry-standard trading platforms like MT4 or MT5 |

| Multiple payment options for deposit and withdrawal | Limited contact channels for customer support |

| Multilingual website for accessibility | Lack of educational resources |

Market Instruments

Optium Group offers traders access to a wide range of popular and mainstream financial markets. Traders can engage in trading activities across different asset classes, including Forex, Stocks, Indices, Digital Currencies, Commodities, Cryptocurrency, and Crude oil. This diverse selection of trading assets allows traders to explore various markets and potentially take advantage of different investment opportunities. Whether traders are interested in currency pairs, stocks, or commodities, Optium Group aims to provide a comprehensive trading experience across multiple financial instruments.

Account Types

Optium Group offers three tiered trading accounts to cater to both retail and professional traders: Starter, Pro, and Advanced accounts.

While the Starter account is tailored for beginners and novices, it may not be ideal for them due to the relatively high deposit requirement of €250. This deposit amount could potentially be challenging for traders who are just starting out and have limited capital.

On the other hand, the Pro and Advanced accounts are better suited for professional and advanced traders who are willing to make a higher commitment. The Pro account requires an initial deposit of €2,500, while the Advanced account demands a more substantial deposit of €25,000. These accounts provide additional features and benefits tailored to the needs and trading experience of more seasoned traders.

It is important for traders to carefully consider their level of expertise and financial capabilities when selecting the most suitable account type with Optium Group.

Spreads & Commissions

Optium Group offers different spreads and commission structures based on the type of trading account chosen. Interestingly, the Starter account claims to have no additional commissions and offers spreads starting from 0.0 pips, which is quite competitive.

On the other hand, both the Pro and Advanced accounts have a combination of spreads and commissions. The Pro account offers spreads from 0.1 pips, along with a commission of €13 per million traded. As for the Advanced account, it provides spreads starting from 1.5 pips, accompanied by a commission of €20.5 per million traded.

Traders should carefully consider the spread and commission structure associated with each account type when deciding which account aligns best with their trading preferences and strategies.

Leverage

Optium Group offers varying leverage levels depending on the trading instruments and specific trading accounts. Traders using the Optium Group platform have the opportunity to utilize leverage of up to 1:300, which is notably higher than the leverage ratios deemed appropriate by many regulators.

It is essential for traders to understand the implications of high leverage and the associated risks involved. While high leverage can potentially amplify profits, it also magnifies potential losses. Traders should exercise caution and carefully consider their risk tolerance and trading strategies before utilizing the maximum leverage offered by Optium Group. It is advisable to have a thorough understanding of leverage and its impact on trading activities to make informed decisions.

Trading Platform

Optium Group offers its investors the proprietary trading platform called Optium Group Web Trader, instead of the industry-leading MT4 or MT5 trading platforms. This platform is highlighted for its user-friendly interface, allowing traders to navigate and execute trades with ease.

It also offers high customization options, enabling traders to tailor their trading environment to suit their preferences and strategies. Additionally, the Optium Group Web Trader provides a wide range of advanced functions, enhancing the trading experience and providing traders with tools to analyze the markets and make informed decisions.

·

Payment Methods

Optium Group requires a minimum deposit of €250 for clients to start investing with them. They provide various payment options for deposit and withdrawal, including VISA, MasterCard, Maestro, Bitcoin, and Wire Transfer. These options offer flexibility and convenience for clients to fund their accounts or withdraw funds from their trading activities. By accepting multiple payment methods, Optium Group aims to accommodate the diverse needs and preferences of their clients.

Customer Support

Optium Group provides a multilingual website, allowing traders to access information and support in different languages. For inquiries or concerns, traders can contact Optium Group via email at sup@optiumgroup.org. The registered company address of Optium Group is located at Gracechurch St, London EC3V 0AG, UK. However, it is important to note that some direct contact channels, other than email and the registered address, may not be available. Traders should utilize the provided contact information to reach out to Optium Group for assistance or information regarding their accounts or trading activities.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

Conclusion

Optium Group offers a diverse range of trading instruments and a competitive minimum deposit requirement, along with high leverage that provides the potential for amplified profits. The proprietary trading platform is user-friendly, and multiple payment options are available for deposit and withdrawal. Additionally, the website is multilingual, enhancing accessibility for traders.

However, Optium Group lacks valid regulation, raises concerns about its legitimacy with suspected clone regulation claims, and has unclear spreads and commission structures. It also lacks industry-standard trading platforms like MT4 or MT5 and has limited contact channels for customer support. Traders are advised to exercise caution and conduct thorough research before engaging with Optium Group.

FAQs

Q: Is Optium Group regulated by any financial authority?

A: No, Optium Group does not possess a valid license from a regulatory authority.

Q: What is the minimum deposit required to start trading with Optium Group?

A: The minimum deposit required by Optium Group is $100.

Q: What is the maximum leverage offered by Optium Group?

A: Optium Group offers a maximum leverage of 1:300.

Q: What are the available trading platforms offered by Optium Group?

A: Optium Group provides a proprietary trading platform called Optium Group Web Trader, offering a user-friendly interface and advanced functionalities.

Q: What payment methods can be used for deposit and withdrawal with Optium Group?

A: Optium Group supports various payment methods, including VISA, MasterCard, Maestro, Bitcoin, and Wire Transfer.

Q: How can I contact Optium Group's customer support?

A: You can reach Optium Group's customer support team through email at sup@optiumgroup.org.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

11

CommentsWrite a review

2023-12-11 18:38

2023-12-11 18:38

2023-12-08 18:14

2023-12-08 18:14 2023-03-16 17:20

2023-03-16 17:20 2022-12-11 05:44

2022-12-11 05:44

2022-12-08 15:51

2022-12-08 15:51