Company Summary

| Quick City Index Review Summary | |

| Founded | 1983 |

| Registered Country/Area | United Kingdom |

| Regulation | FCA |

| Tradable Assets | 13,500+, indices, shares, forex, gold/silver, commodities, futures, bonds, options, interest rates, thematic indices |

| Demo Account | ✅ (£10,000 in virtual funds for 12 weeks) |

| Account Types | Standard, MT4 |

| Min Deposit | $0 |

| Leverage | Up to 1:500 for clients outside the UK and Australia |

| EUR/USD Spread | Floating around 1.3 pips |

| Trading Platforms | Mobile trading app, WebTrader, TradingView, MT4 (web, desktop, mobile) |

| Payment Methods | Visa, MasterCard, Maestro and Electron, Bank transfer |

| Deposit Fee | ❌ |

| Withdrawal Fee | ❌ |

| Inactivity Fee | £12 charged if inactive for 12 months or more |

| Customer Support | 24/5 |

City Index Information

City Index, a trading name of StoneX Financial Ltd, is allegedly a global Spread Betting, FX and CFD provider established in the United Kingdom in 1983, offering 13,500+ markets with variable spreads from 0.5 points on the Mobile trading app, WebTrader, TradingView and MT4 trading platforms, as well as a choice of two different account types and 24/5 customer support service.

Pros and Cons

| Pros | Cons |

| Regulated by FCA (Financial Conduct Authority) | Limited contact options |

| Wide range of tradable assets | |

| Demo accounts available | |

| MT4 platform | |

| Advanced trading tools and features | |

| No minimum deposit requirement | |

| No fees for deposits and withdrawals |

Is City Index Legit?

Yes. City Index is regulated by Financial Conduct Authority (FCA).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | StoneX Financial Ltd | Market Making(MM) | 446717 |

Market Instruments

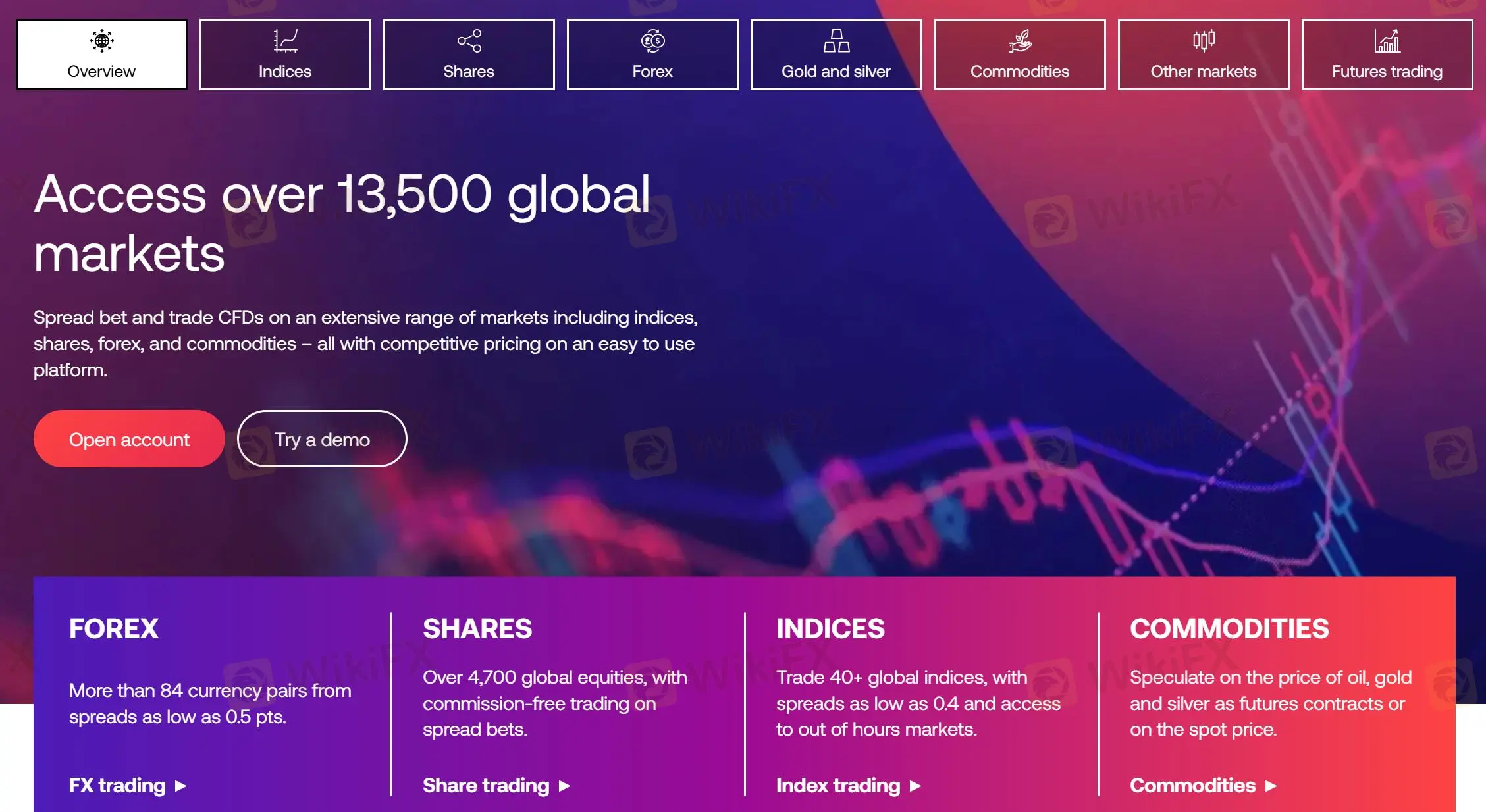

City Index advertises that it offers spread betting, forex and CFD trading and it can give access to 13,500+ markets including indices, shares, forex, gold/silver, commodities, futures, bonds, options, interest rates, and thematic indices.

| Asset Class | Supported |

| Indices | ✔ |

| Shares | ✔ |

| Forex | ✔ |

| Gold/Silver | ✔ |

| Commodities | ✔ |

| Futures | ✔ |

| Bonds | ✔ |

| Options | ✔ |

| Interest Rates | ✔ |

| Thematic Indices | ✔ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

Account Types/Fees

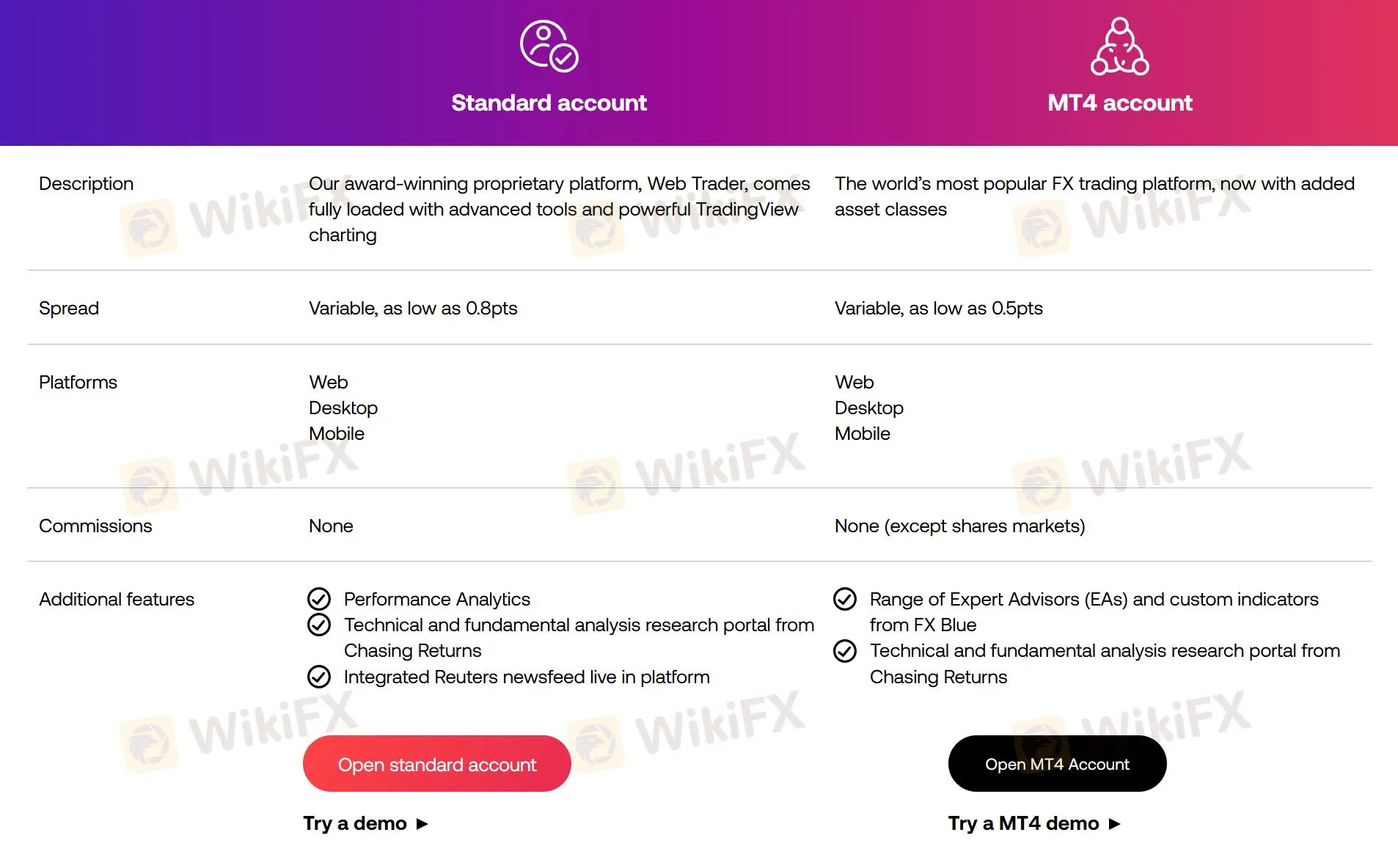

City Index offers two account types, Standard and MT4. Both are available for demo accounts.

| Account Type | Spread | Commission |

| Standard | From 0.8 points | From 0.5 points |

| MT4 | ❌ | ❌ (except shares) |

How to Open an Account?

To open an account with City Index, you can follow these steps:

Step 1: Click “Open account” button on City Index's homepage.

Step 2: Now you need to fill in your email address. Additionally, there is an option to subscribe to receive news, product updates, and offers via email. You can choose whether you'd like to receive these emails or not.

Step 3: After entering your email address and making your email preferences selection, you will need to confirm your agreement to the City Index Privacy Policy and the possibility of being contacted about your application.

Step 4: The next steps typically involve providing personal details, such as your name, address, and additional information about yourself, as requested on the application form.

Step 5: Complete the application form by filling in all the required fields with accurate information.

Step 6: Review the information you have provided to ensure its accuracy and completeness.

Step 7: Once you are satisfied with the details you have entered, click on the “Complete Application” button or a similar option to submit your application.

Leverage

The maximum leverage provided by City Index is as high as 1:500 (for clients outside the UK and Australia). It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

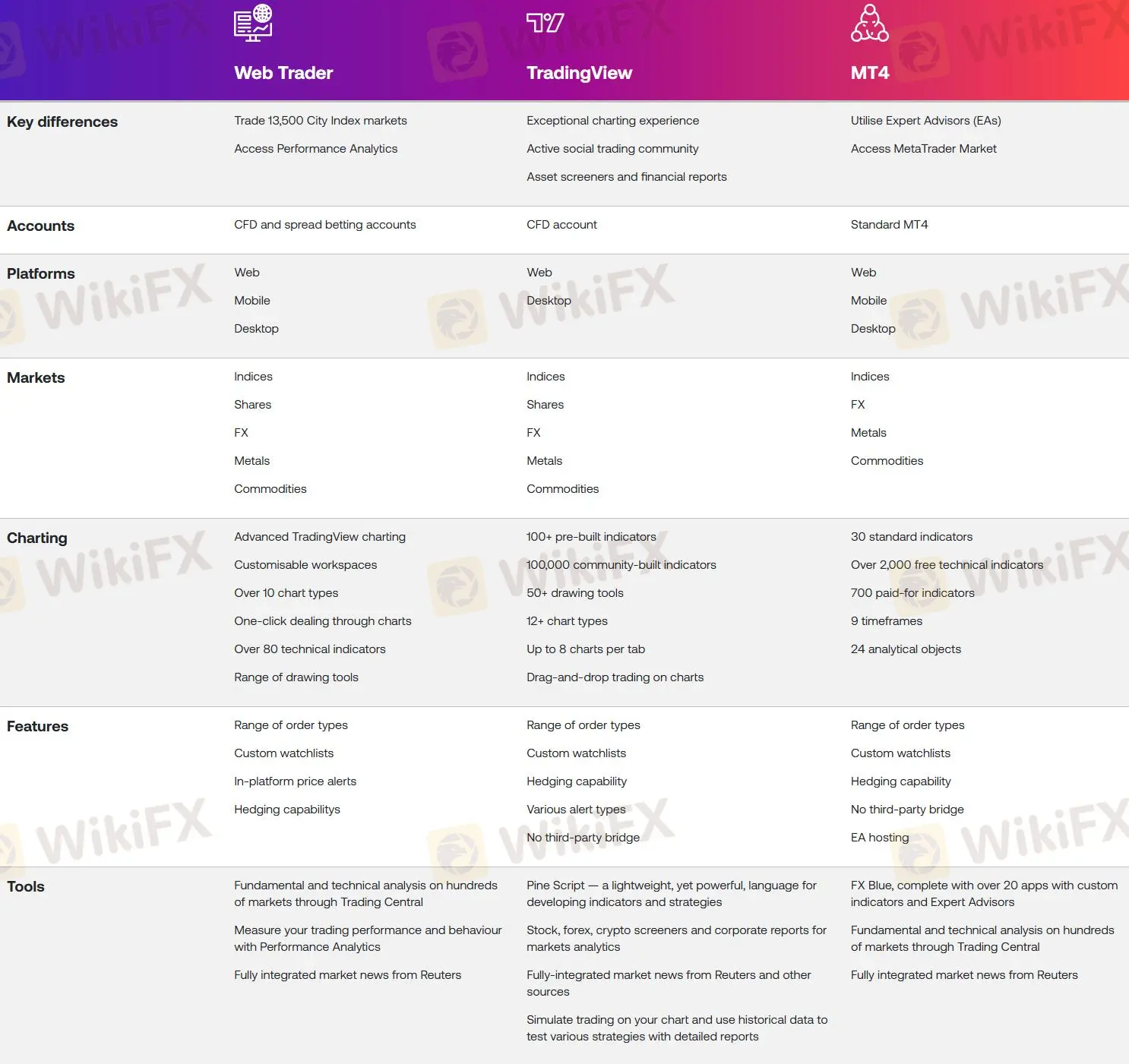

Trading Platforms

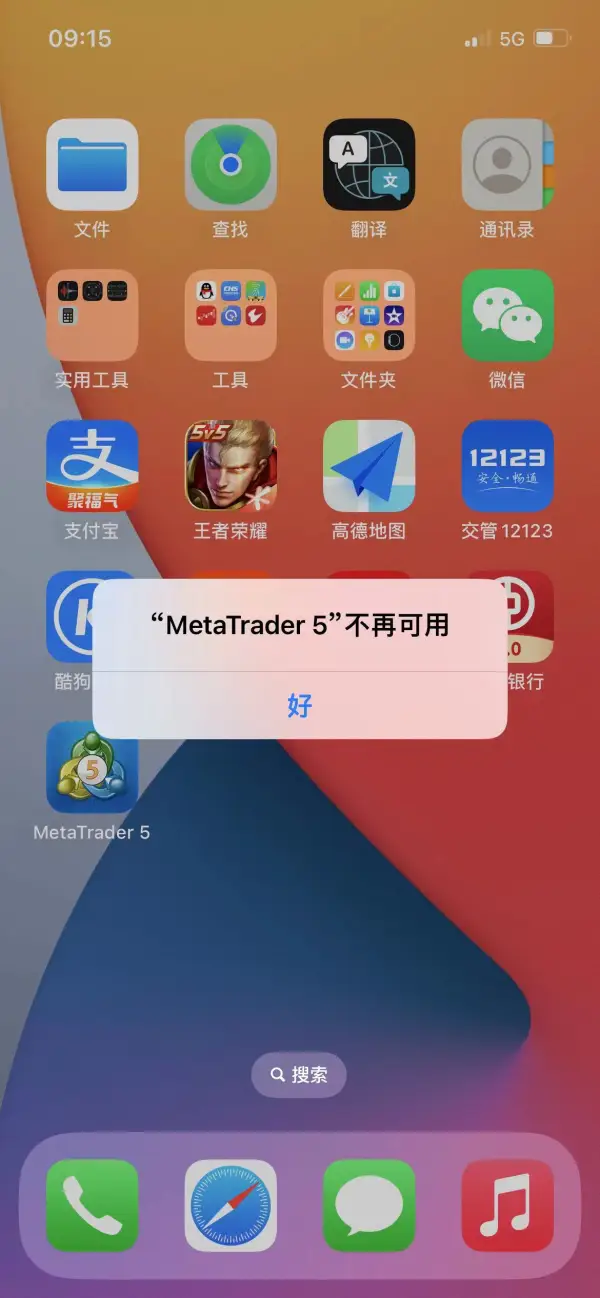

Platforms available for trading at City Index are the Mobile trading app and WebTrader, as well as the world's most advanced and popularly-used MetaTrader4 and TradingView.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile trading app | ✔ | Mobile | / |

| WebTrader | ✔ | Web, Mobile, Desktop | / |

| TradingView | ✔ | Web, Desktop | / |

| MT4 | ✔ | Web, Mobile, Desktop | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

City Index accepts payments via Visa, MasterCard, Maestro and Electron, and Bank transfer.

No fees charged for deposits and withdrawals.

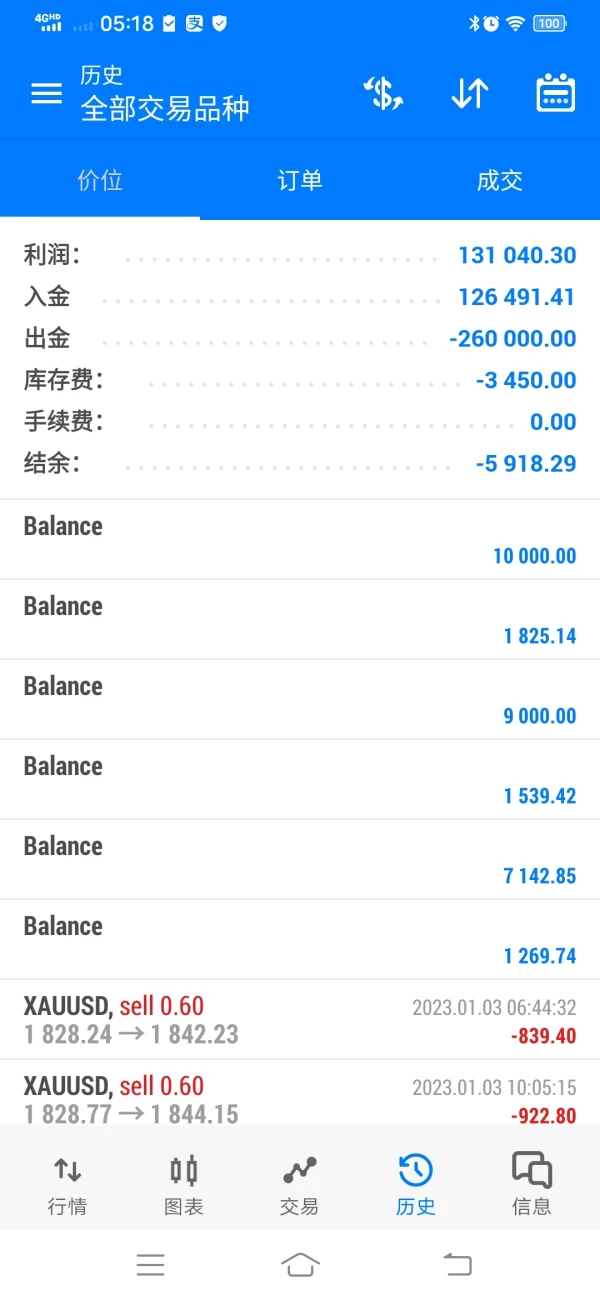

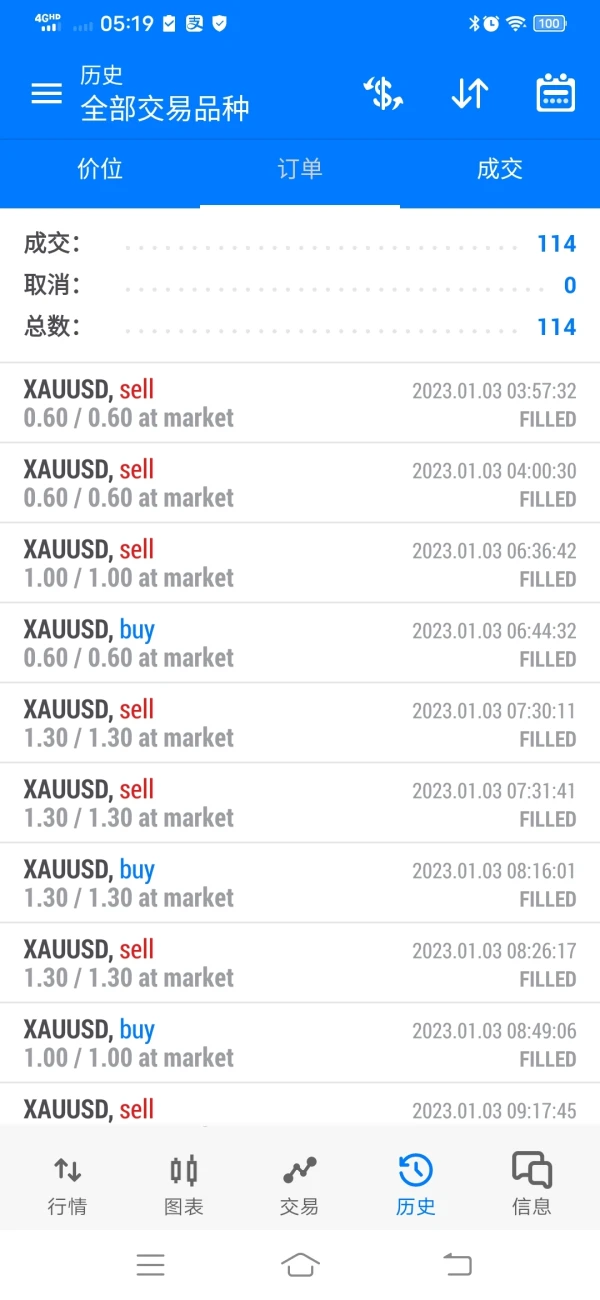

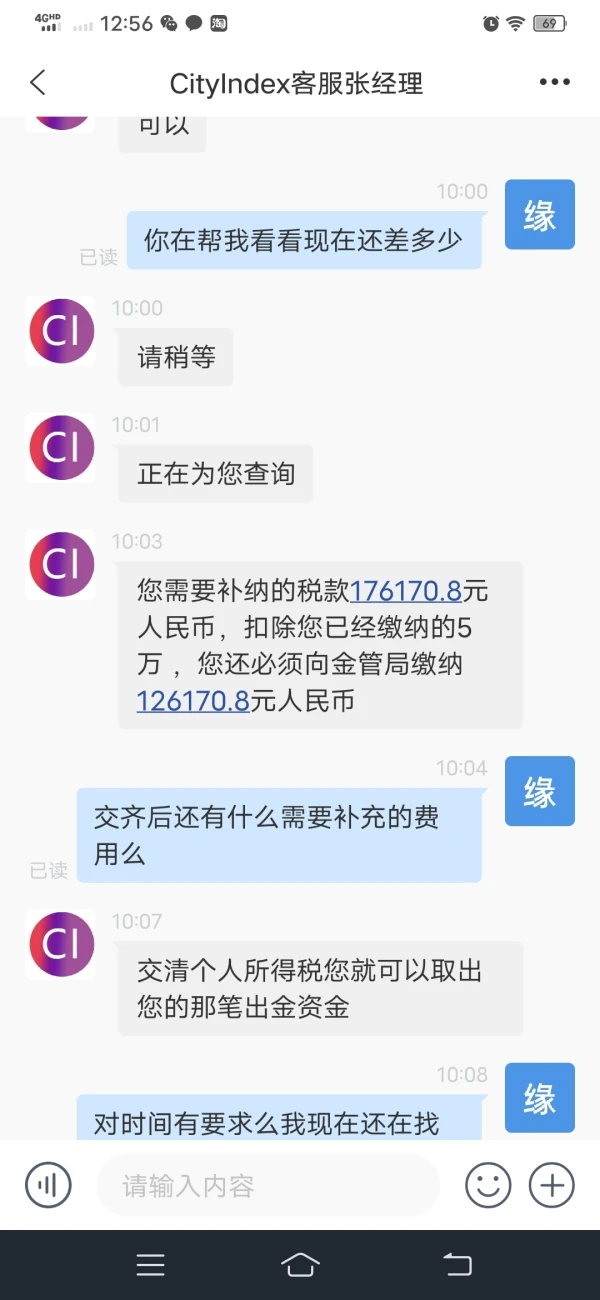

卡卡7238

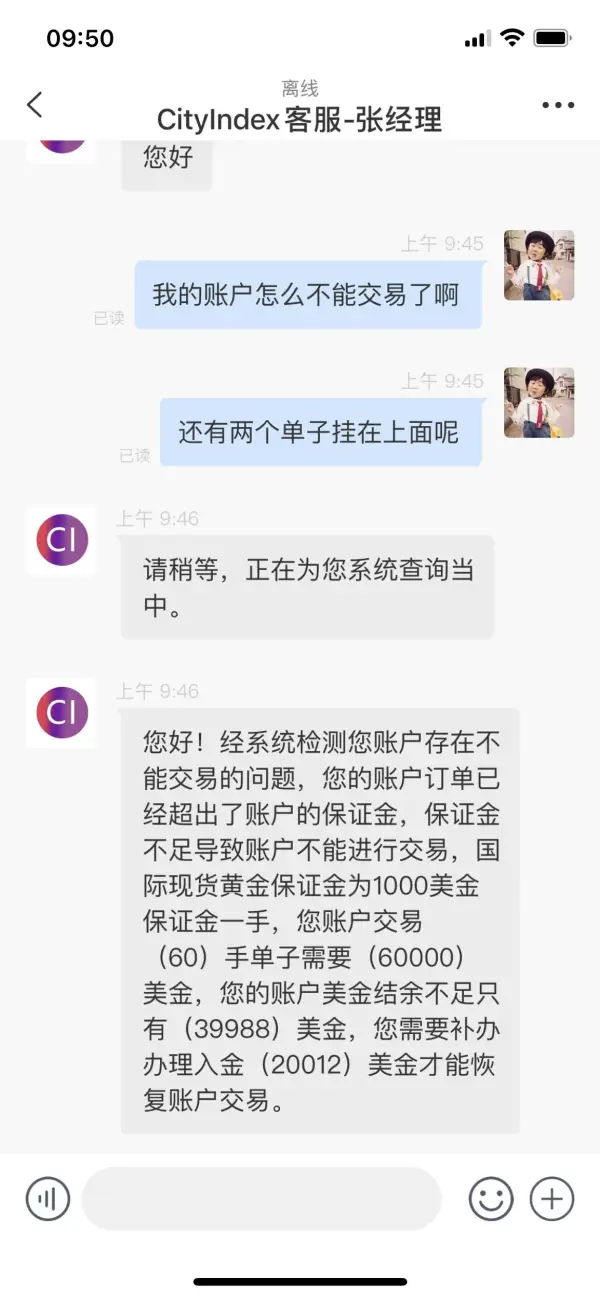

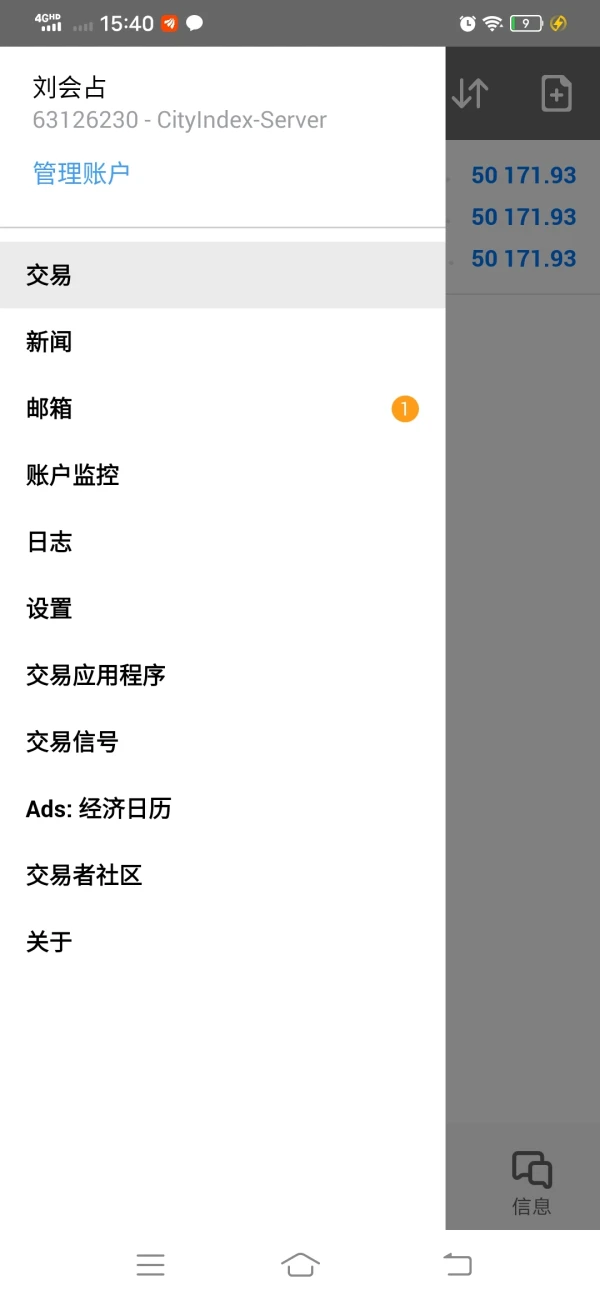

Hong Kong

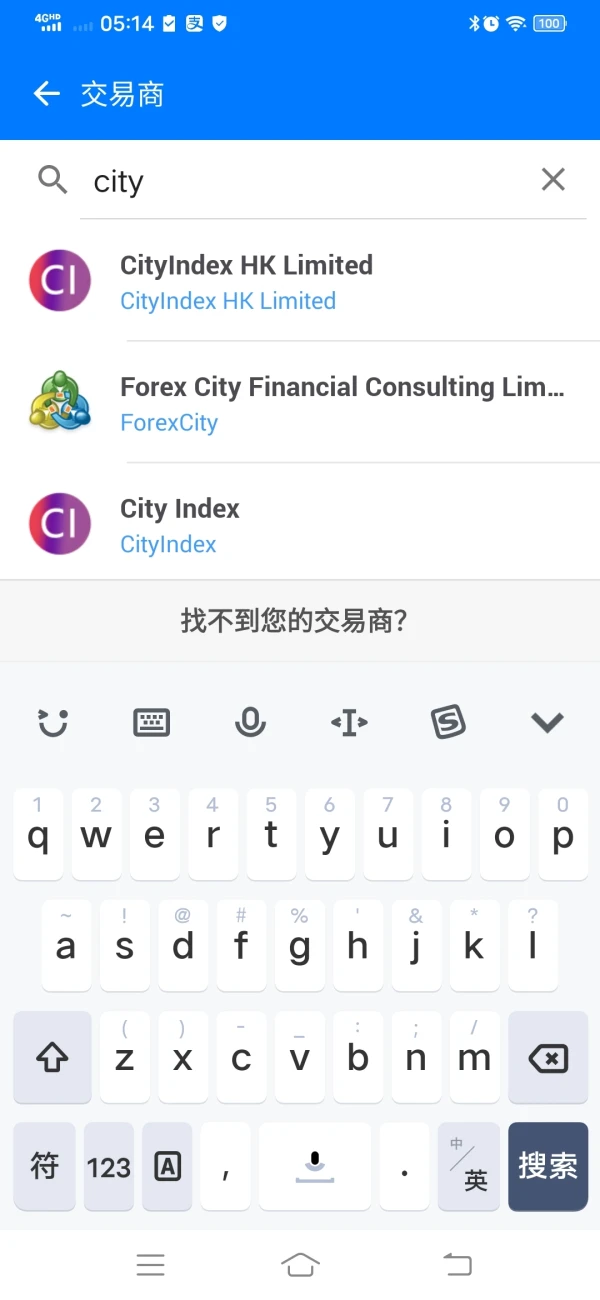

I am not fair, the justice of God will not allow me to follow the teacher to play gold investment in the middle of this year, resulting in the investment of more than 800,000 can not get out of the gold, when I was induced to join the teacher called Chen Ming, Zhang Hongye, through I have been tracking and my criminal investigation friends investigation, they continue to cheat, the aliases used are Wang Tianshun, Liu Zhenhua, the current platform is stolen from the regular international market City index's fake platform, the official website is https://1671435251000.citynice.me/ The people involved in the scam are master No. Xu Hao (real name Zeng Xinghao), assistant No. Lin Ziyi (real name Chen Xiaomei), business number. After heavy police investigation, they cheat the process is as follows: the boss named (real name Lin Jian), he invested money, let the following people cheat, first through the shake fast with the business number to find add fish, guide the fish with the new chat software [listen to chat], and then through the business number, meet Wang Tianshun, Wang Tianshun will be invited into the group after a simple chat with the fish, the group get good two or three days after the start of the lecture, invited his During the period to send gifts on behalf of the teacher to launch the assistant number Lin Ziyi (real name Chen Xiaomei), the follow-up has been to start brainwashing, marketing process, the group will suddenly appear a master, powerful investment, successful career people Xu Hao (real name Zeng Xinghao) often send red packets, slowly Wang Tianshun will begin to slowly guide everyone to do gold, his friend Liu Zhen Sheng will also begin to cooperate with the fish who took the class together The company's business is to provide a wide range of products and services to its customers, including the following: the company's products and services, the company's products and services, the company's products and services, and the company's services. The last will be this expert Xu Hao (real name Zeng Xinghao) to get the fish gold account, help the fish to operate gold, make money to earn a lot, and then began to hedge lock, do not give the fish to close their own positions, said only to fill the money to close the position to withdraw, after the money will say that you need to pay the certification gold, because the account detection to others to operate, off-site login, need to be certified is my own, and have to pay money, after the payment will also say involved in money laundering and so on. A series of steps just won't let the fish finally out of gold, until the fish no money. I have experienced this nightmare, many friends to investigate their fraudulent investors real name (real name Lin Jian) home (Fujian Putian), the planner real name (real name Zeng Xinghao) home (Sichuan Guang'an), important co-conspirators real name (real name Chen Xiaomei) family (Fujian Quanzhou) The gold platform called City index, theft of other platforms Platform official website: https:// 1671435251000.citynice.me/ live platform: https://e37421393.at.baijiayun.com/web/room/quickenter?code=jwbkma&user_name=%E7%94%A8%E6%88%B77769 The following is the real identity information of their main participants in the scam, including the teachers where they lecture. I hope that if the people involved in their fraudulent platform can see this message in time to hang a horse, of course, if you remember to save this message after being cheated, we join together to make the police pay more attention to this matter, at present I am also using legal means to apply for assistance, but very slow, this process is very torturous, I hope more friends to join in, together so that this group of evil people can be brought to justice, do not let If the legal means is not feasible, I will eventually take other means, I will always track this group of criminals, no longer let them cheat!

Exposure

开心4443

Hong Kong

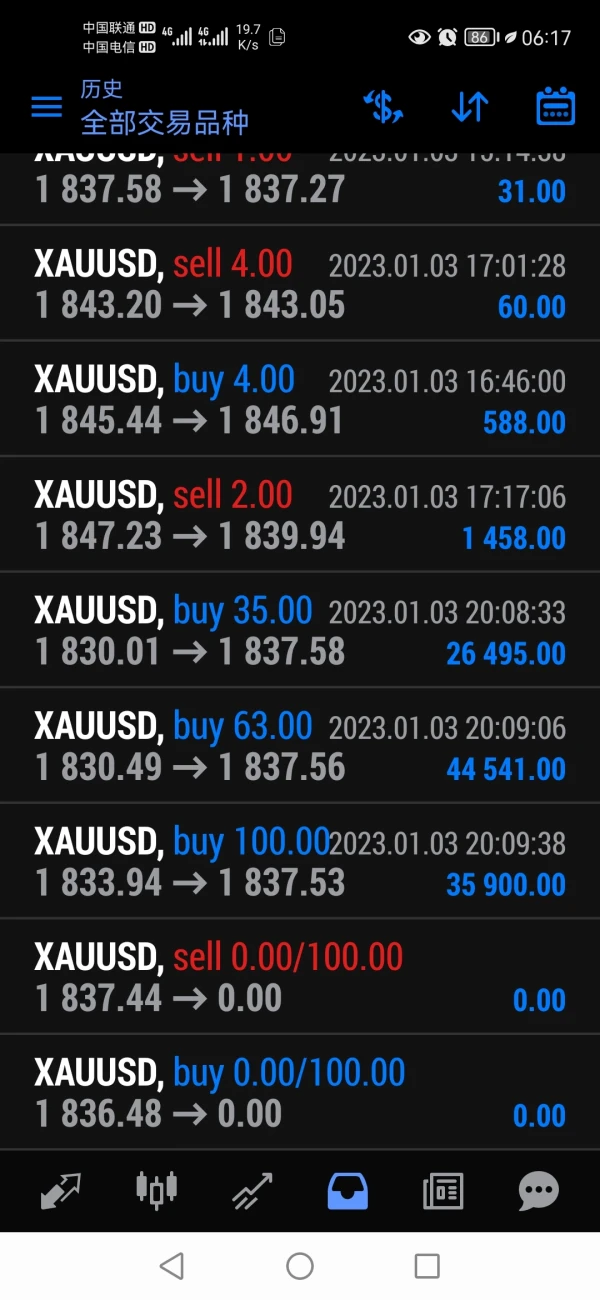

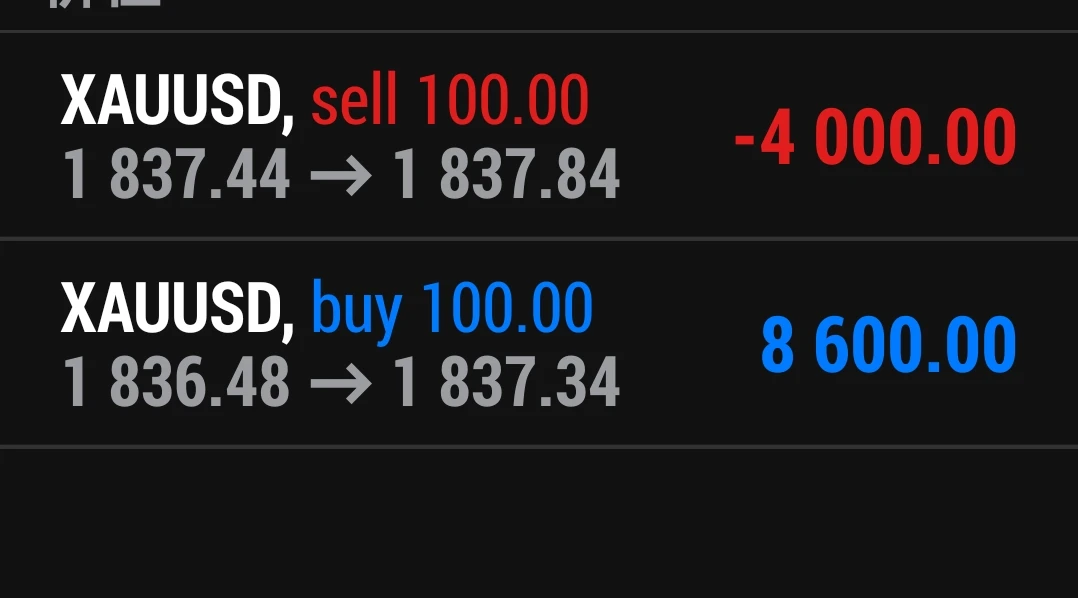

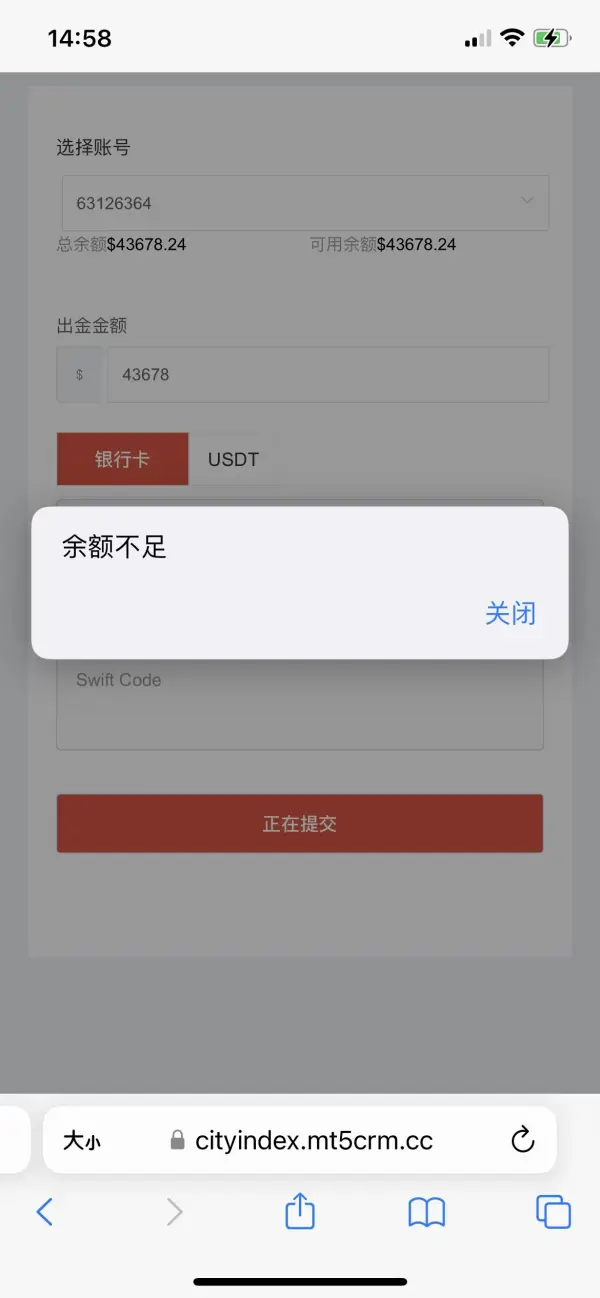

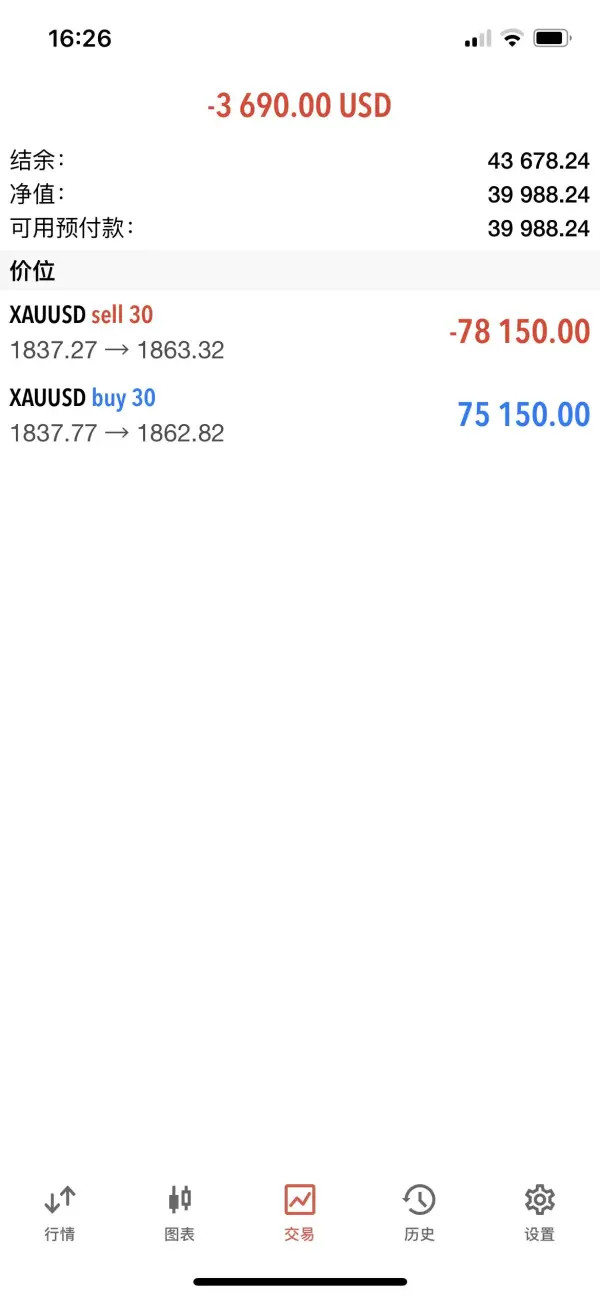

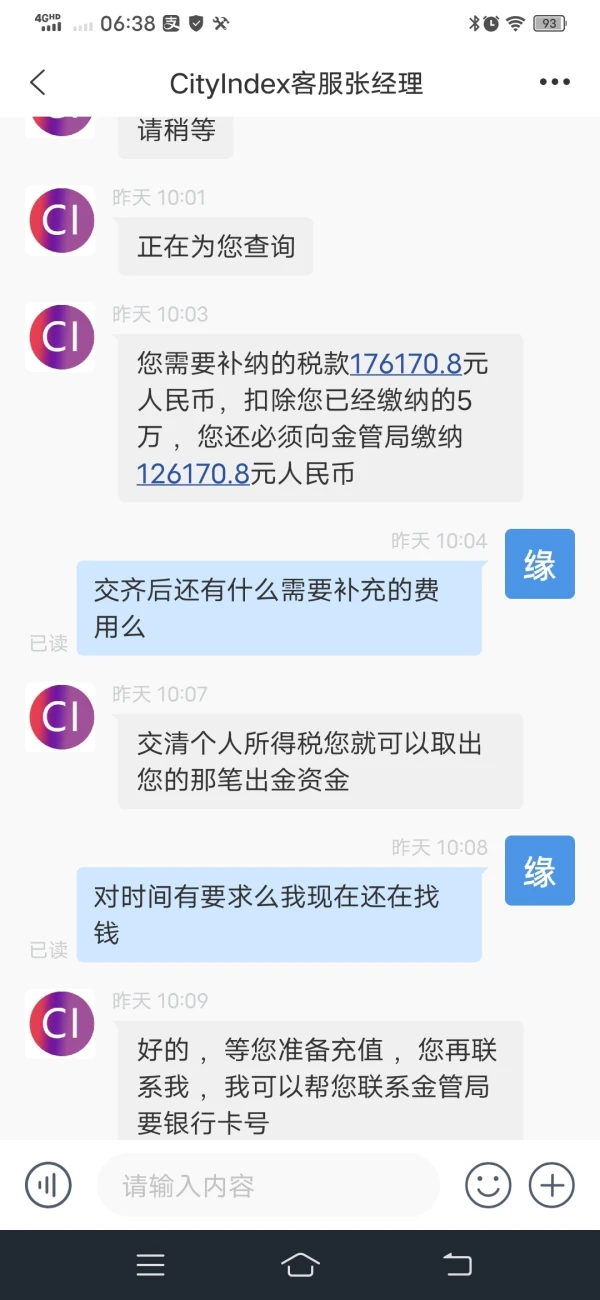

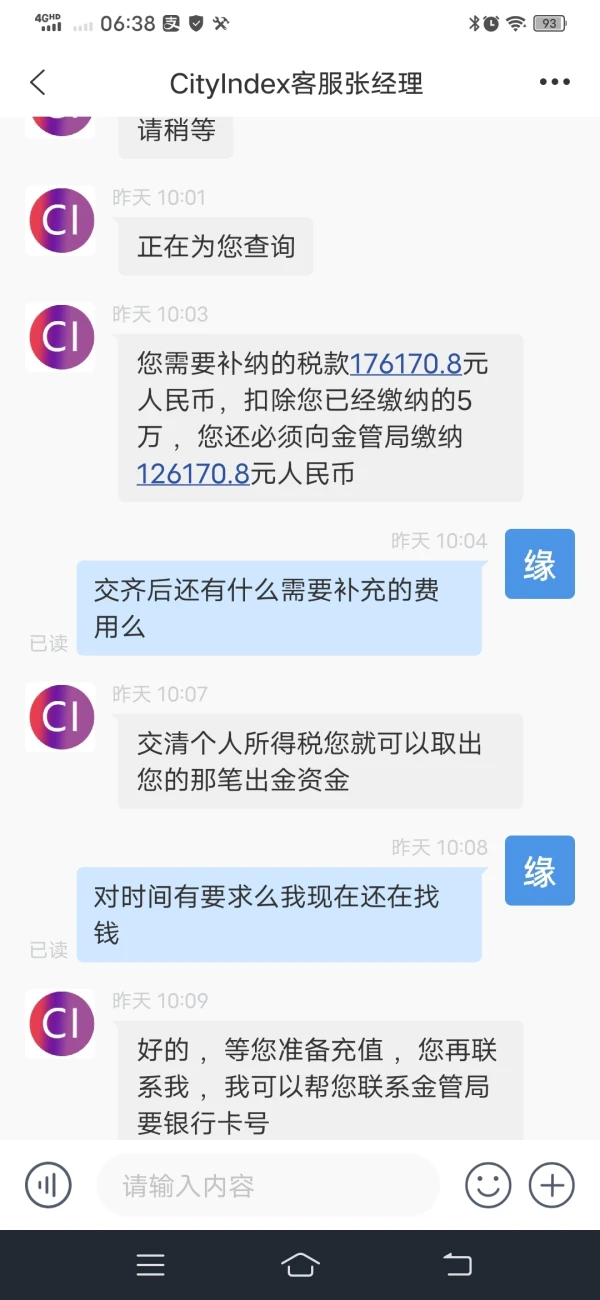

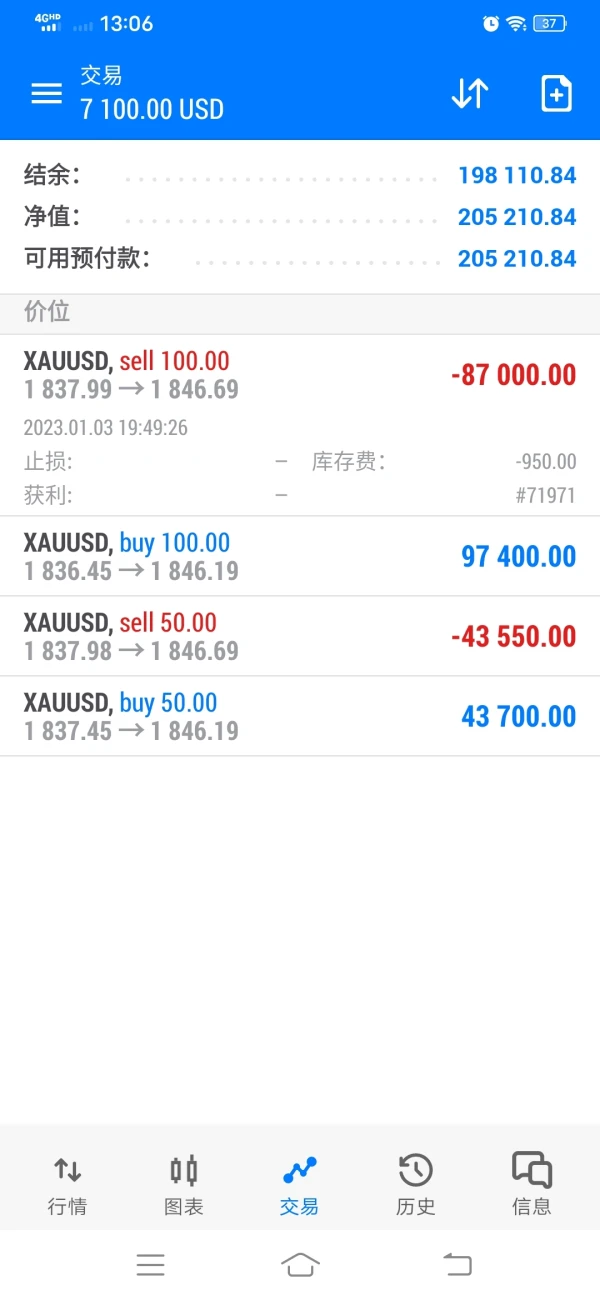

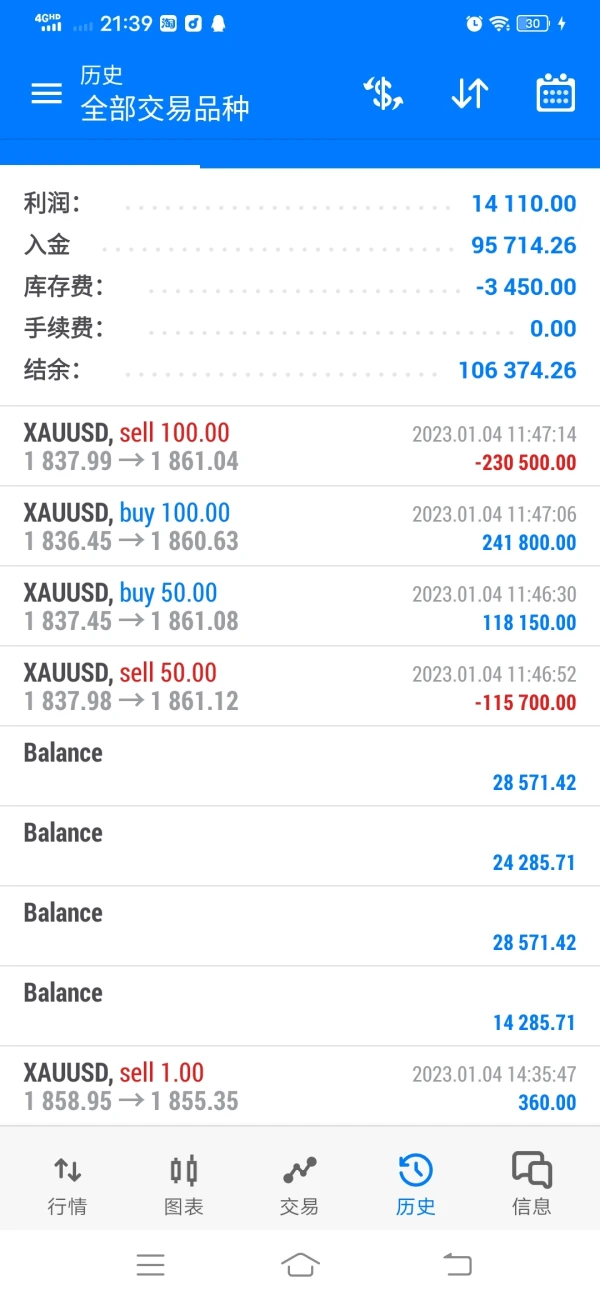

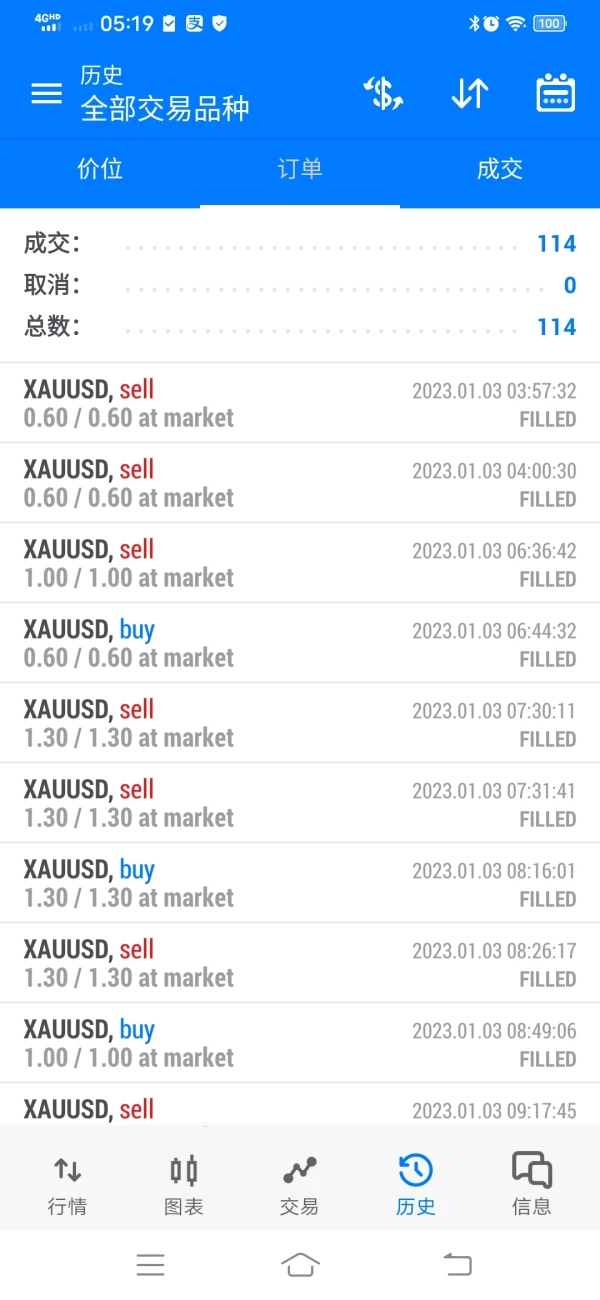

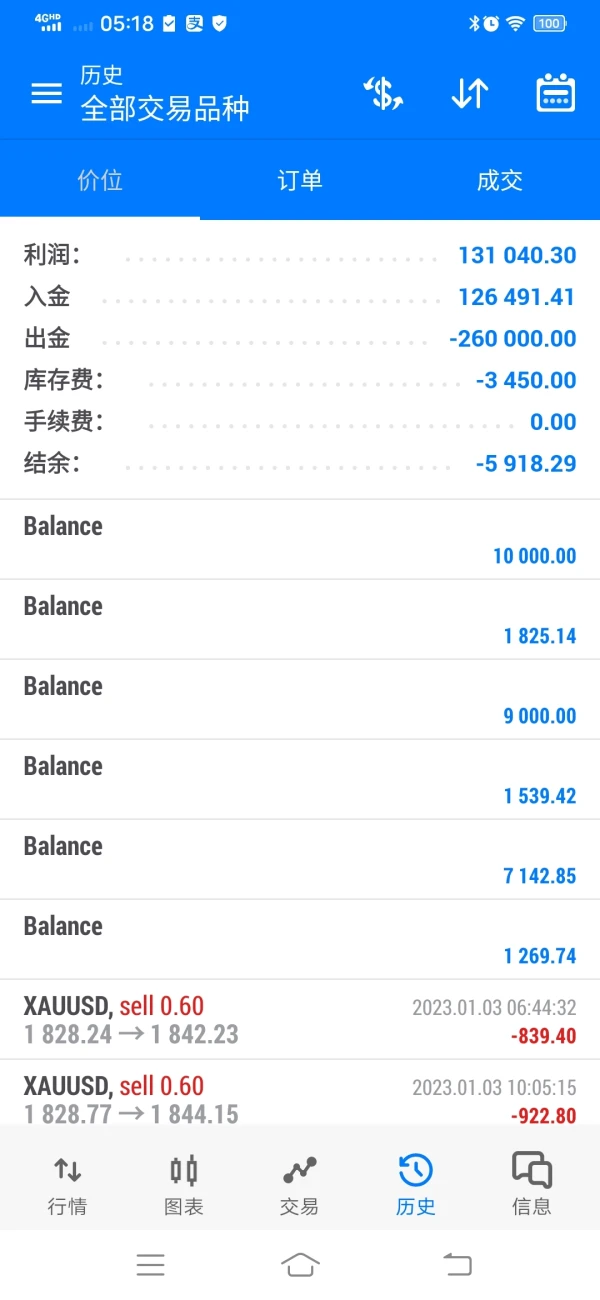

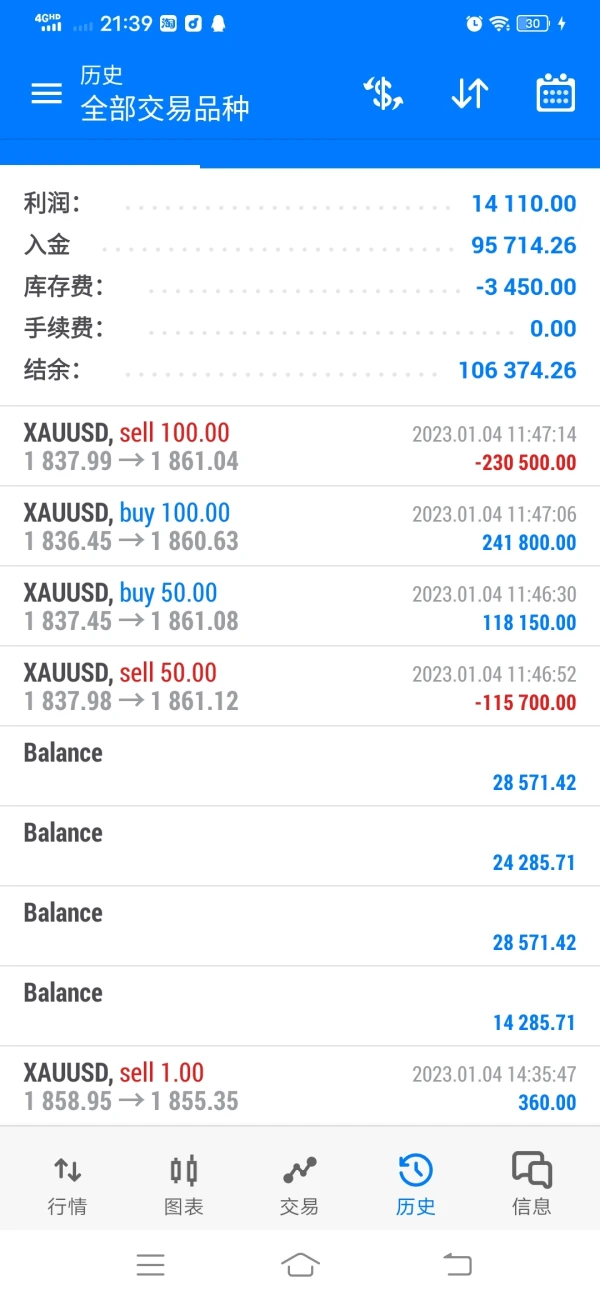

This platform should be a fake platform. I was planned to withdraw today, but they maliciously hedge and lock the postition, resulting inability of closing position for me. After hedging more than 180,000 yuan, I feel very helpless now. I closed my position last night, and was locked up by malicious hedging. I woke up and saw that I couldn’t close my position. I really need help . The bank card that gave them the transfer amount before has just been checked and has been canceled. I feel cheated.

Exposure

微量

Hong Kong

I don’t know what happened the night before yesterday, and there were two more hedging orders in my account. I woke up today and found that the account could no longer be closed. The customer service said that you must pay a deposit to close the position and withdraw the money. Originally, I was planning to withdraw money today, so I couldn’t withdraw the money, and I had to pay to close the position and withdraw the money. Hope the platform can help me get my money back.

Exposure

难忘青春

Hong Kong

After being induced by customer service to make a deposit, I was unable to withdraw money, and they even tricked me into depositing by various means. A total of less than 1 million was deposited, I hope the platform can help me to recover it

Exposure

难忘青春

Hong Kong

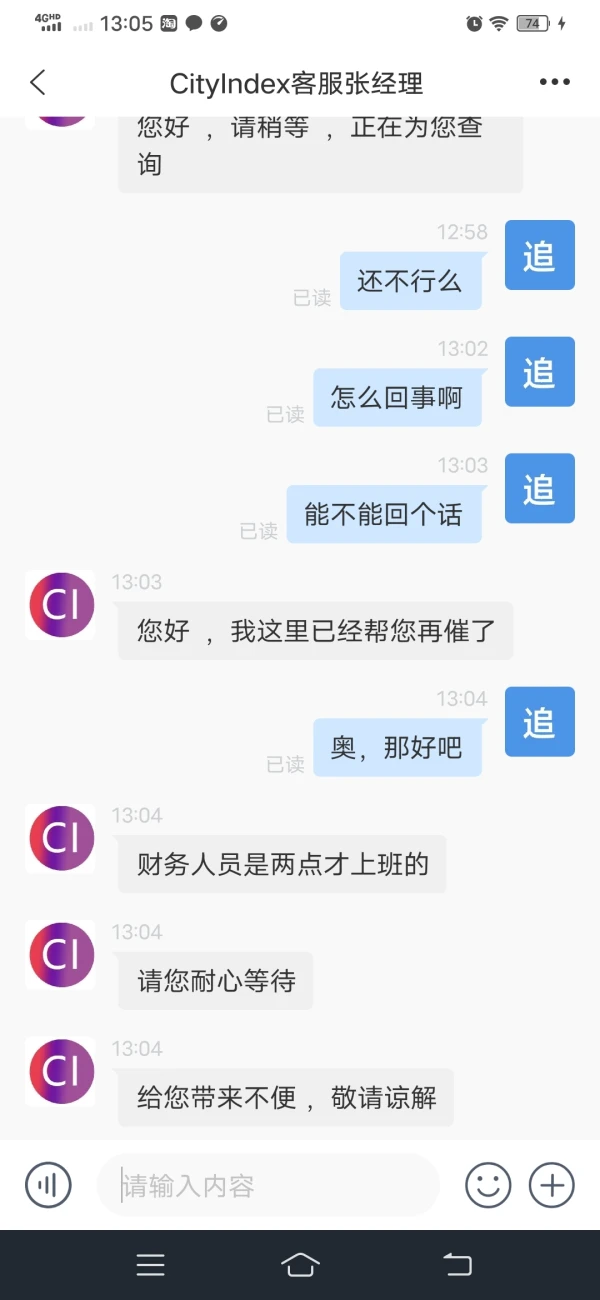

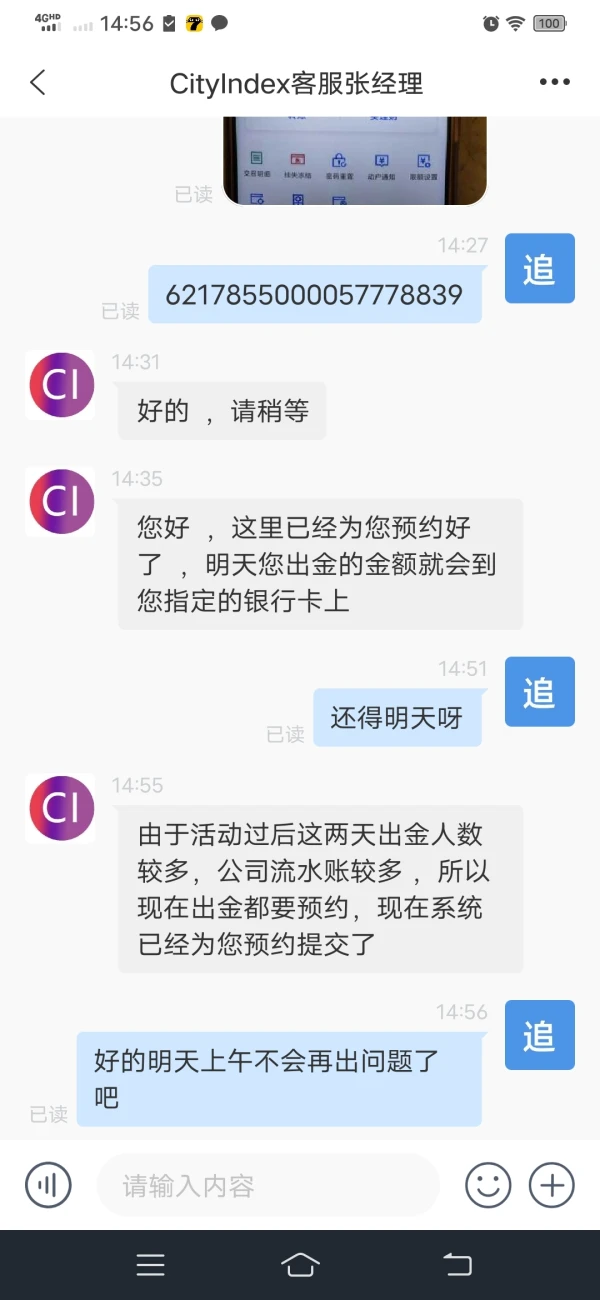

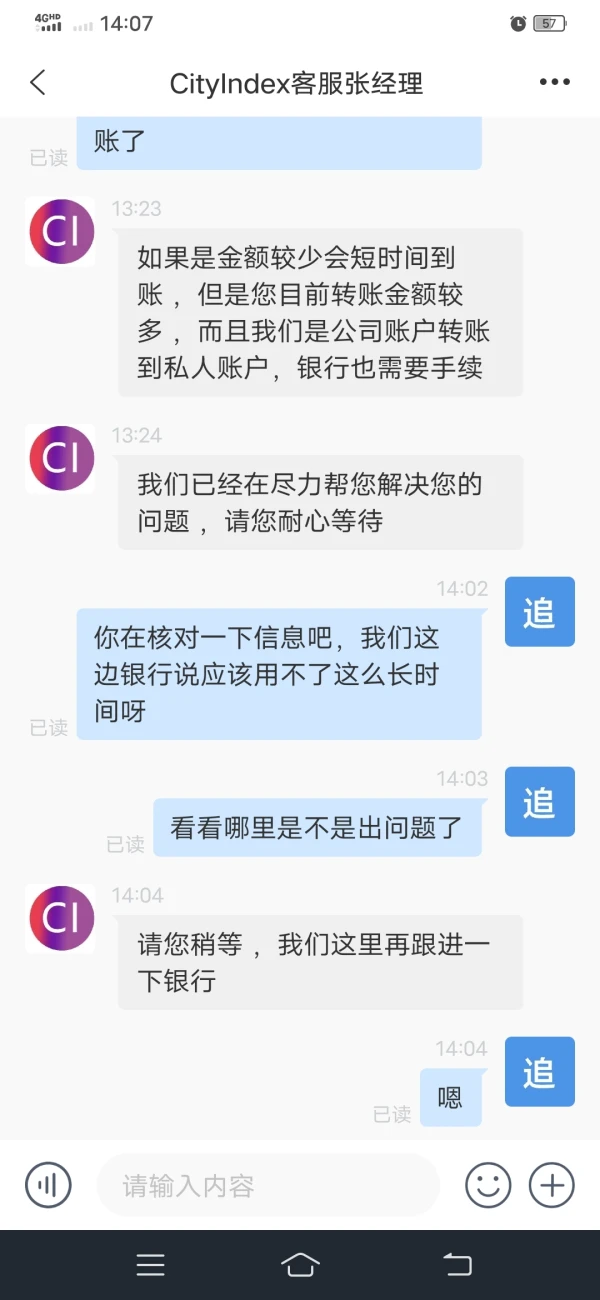

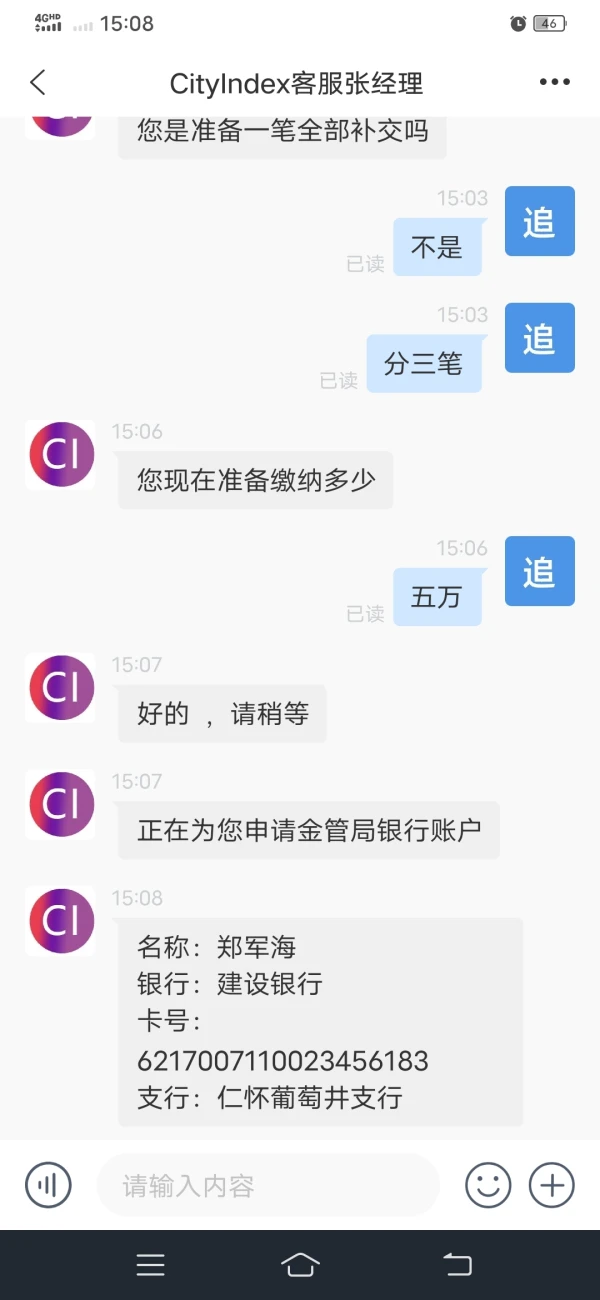

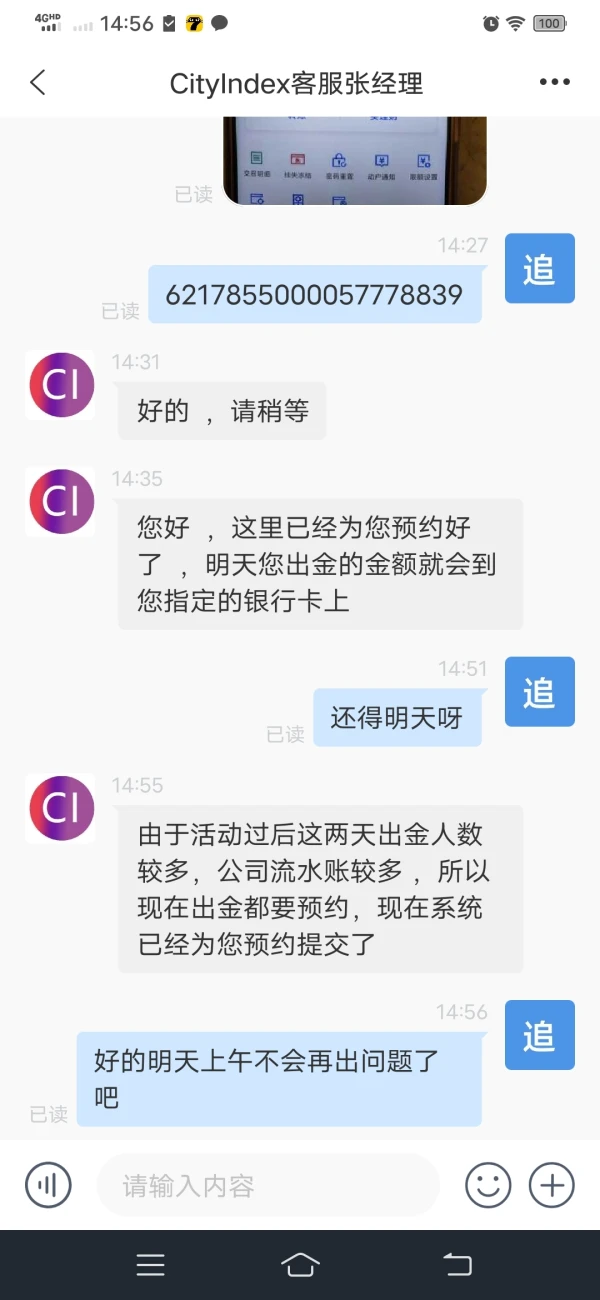

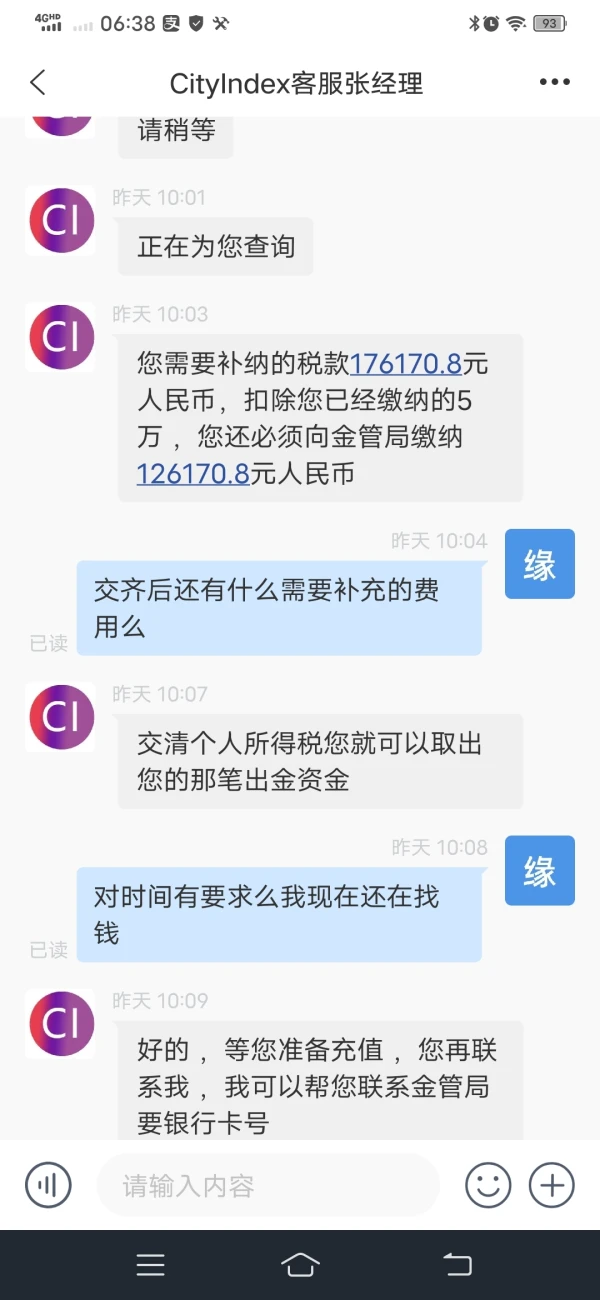

Around December 20, 2022, I entered the gold-trading platform through a friend and added a customer service manager called cityindrx who is the customer service manager, and started depositing through her. When withdrawing money, they deny the withdrawals by various reasons and deceving me to depopsit more. Since, I always want my money back, I got scammed more and more and cannot withdraw at the end.

Exposure

FX1238707102

Morocco

I found out about City Index recently. It seems to be a very experienced broker with a good reputation. I read some good reviews and decided to try a demo account here.

Positive

FX1205395544

Indonesia

I would give city index five stars without any hesitation. Yes, I have been trading with this broker for several years, and they don’t let me know all the time, amiable customer support, quick withdrawals. I recommend it to you guys.

Positive

难忘青春

Hong Kong

Starting from Christmas Eve and Christmas, they used the company’s festival as an excuse to charge gold and anti-gold. The four-day event time was close to New Year’s Day. The reason was that the spread was lowered, the recharge was anti-money, and other reasons. During the event, the funds in the account suddenly disappeared at the end of the event. The double said that the security deposit exceeds the limit and cannot be withdrawn, and the account is locked and needs to be recharged and unsealed. After recharging, the withdrawal is said to be too large and detained by the Hong Kong Monetary Authority. Individuals need to pay personal income tax to get into the account

Exposure

难忘青春

Hong Kong

The friends added through qq started to play stocks together for a long time, not to mention knowing a very good teacher who claimed to be Liu Zhenlin. He also invited another teacher who claimed to be Wang Shundong in the live broadcast room, and then built a group through a software called (listening and chatting). After a period of time, they said that the stock market is not good and let us speculate in gold. Because people in the group said that it is better to make money faster than stocks (in retrospect, it is all procrastination), so I got deeper and deeper and couldn’t extricate myself. I put myself and my side friends are suffering

Exposure

微量

Hong Kong

I don’t know what happened the night before yesterday, and there were two more hedging orders in my account. I woke up today and found that the account could no longer be closed. The customer service said that you must pay a deposit to close the position and withdraw the money. Originally, I was planning to withdraw money today, so I couldn’t withdraw the money, and I had to pay to close the position and withdraw the money. Hope the platform can help me get my money back.

Exposure

大聪明5243

Hong Kong

After inducing us to deposit and trade for a while, I figured out that I could not withdraw the money and they directly disabled my trading account. The customer service blocked me. File a case with the police,

Exposure

FX1147572742

Taiwan

This company was recommended by my friend and I, after looking at his website and wikifx interface, I think it is very good. I'm going to open a demo account now to try it out, and then consider a real account if the experience is good.

Positive

Wcnmdjpp

Hong Kong

City Index has more than 15 years’ experience in forex and it does has a regulated FCA license. No minimum deposit amount, high leverage up to 1:500, variable spreads from just 0.8 pips, no commission charged except stocks, mt4 is also offered! As i tested on their demo accounts, everything performs like they advertise. But their payment option is too limited to credit cards, bank transfers and PayPal, other popular e-payments such as Skrill and Neteller are excluded.

Positive

卡布奇诺80913

Hong Kong

I’ve been trading quite a while with City Index, and I am satisfied with the reliability functionalities of City Index’s trading platforms. Recently I just started using the city index app and it works perfectly which is good news because now I can go out and take a rest outdoor…

Positive

ONE I LOVE

Hong Kong

Spreads on its MT4 demo accounts seems attractive, however, it does not mean the same thing in a real-trading eenvironement. Unfortunately, swap-free accounts are not provided...

Positive

墨香

Hong Kong

I actually like the experience with Cityindex... It's nice! I'm still new and I'm learning... I don't take many risks, because my profits and my losses are now tiny,,, but I have learned a lot in trading. Thank you very much cityindex!

Positive