Company Summary

| Broker Name | XS |

| Registered Country | Seychelles |

| Founded Year | 1-2 years |

| Company Name | XS Ltd |

| Regulation | Regulated in Seychelles |

| Minimum Deposit | US $200 (or equivalent denomination) |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Trading Platforms | MT4, MT5, XS Web Trader, XS Trader Mobile App |

| Tradable Assets | Currencies, Shares, Indices, Metals, Energy, Commodities, Crypto |

| Account Types | ELITE (RAW), STANDARD, CLASSIC, PLUS |

| Customer Support | 24/7 support via call back, live chat, email, social media |

| Payment Methods | Bank transfers, Visa & MasterCard, Skrill, Neteller, Klarna, Giropay |

What is XS?

XS is a multi-licensed financial services provider headquartered in Seychelles, operating under differing regulatory oversight depending on jurisdiction. In Seychelles, XS LTD holds a Retail Forex License from the Financial Services Authority. For Australian clients, XS PRIME LTD falls under the Australia Securities & Investment Commission's purview. However, XS Markets Ltd, licensed in Cyprus, has raised regulatory “Suspicious Clone” flags.

XS offers varrious popular tradable instruments spanning forex currency pairs, equities, indices, precious metals, energies, agricultural commodities, and cryptocurrencies. Clients can select from account types like ELITE (RAW), STANDARD, CLASSIC, and PLUS - each tailored with specific spreads, commissions, leverage, and order capabilities.

The trading platforms supported include the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their user-friendly design and robust technical analysis tools. XS also provides a web-based platform and mobile app for on-the-go trading access.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is XS Legit?

| Regulatory Agency | Current Status | License Type | Regulated By | License No. |

|---|---|---|---|---|

| Australia Securities & Investment Commission | Regulated | Institution Forex License (STP) | Australia | 374409 |

| The Seychelles Financial Services Authority | Offshore Regulated | Retail Forex License | Seychelles | SD089 |

| Cyprus Securities and Exchange Commission | Suspicious Clone | Straight Through Processing (STP) | Cyprus | 412/22 |

Market Instruments

- Currencies: XS offers a range of currency pairs for trading, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs like AUD/CAD and USD/SGD.

- Shares: XS provides access to trading shares of various companies from around the world. Examples include Apple Inc. (AAPL), Microsoft Corporation (MSFT), and Amazon.com Inc. (AMZN).

- Indices: The platform allows trading on a variety of global stock market indices such as the S&P 500, Dow Jones Industrial Average, and FTSE 100.

- Metals: Trading opportunities in precious metals like gold and silver are available, providing exposure to fluctuations in their market prices.

- Energy: XS offers trading options in energy commodities like crude oil and natural gas, enabling participation in the price movements of these resources.

- Commodities: Apart from metals and energy, XS extends its offerings to other commodities like agricultural products, including wheat, corn, and soybeans.

- Crypto: The platform includes a selection of cryptocurrencies for trading, such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), allowing investors to speculate on the value of these digital assets.

Account Types

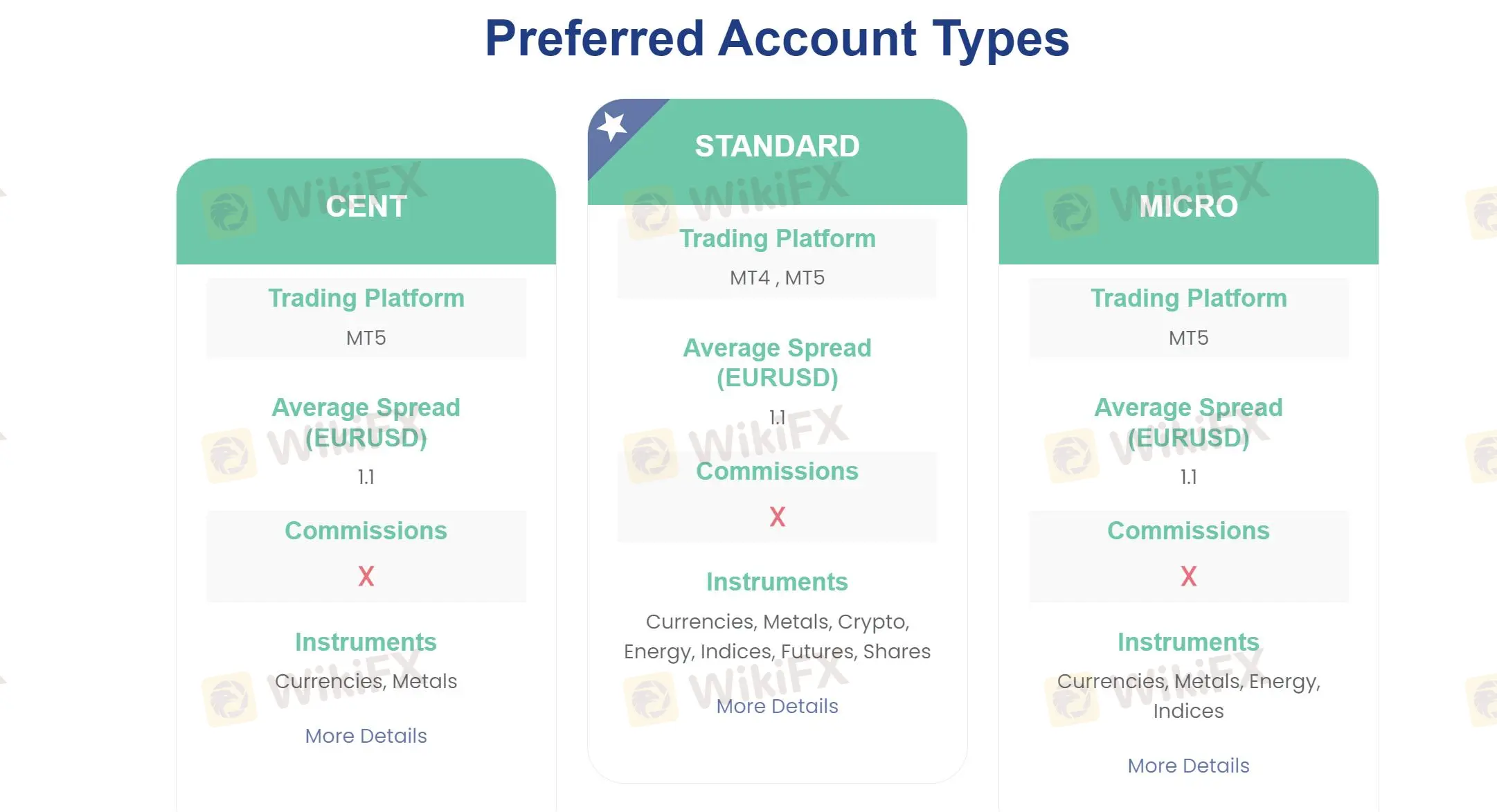

Preferred Account Types:

Cent Account: This MT5-based account provides access to currencies and metals with an average EUR/USD spread of 1.1 pips and no commissions.

Micro Account: Designed for MT5 users, this account focuses on currencies, metals, energies, and indices with an average EUR/USD spread of 1.1 pips and no commissions.

Standard Account: Available on both MT4 and MT5, this account offers a wide range of instruments including currencies, metals, cryptocurrencies, energies, indices, futures, and shares. The average EUR/USD spread is 1.1 pips with no commissions.

Professional Account Types:

Elite Account: Traders can access currencies, metals, cryptocurrencies, energies, indices, and futures on MT4 or MT5. This account features tight average EUR/USD spreads of 0.1 pips, but with a $3 commission per side.

Pro Account: This MT4 and MT5 account provides a comprehensive offering of currencies, metals, cryptocurrencies, energies, indices, futures, and shares. The average EUR/USD spread is 0.7 pips with no commissions.

VIP Account: Exclusive to the MT5 platform, this account offers a diverse range of instruments with an average EUR/USD spread of 0.1 pips and commissions.

Partner Special Account Types:

Extra Account: Available on MT4 and MT5, this account gives access to currencies, metals, cryptocurrencies, energies, indices, and futures with an average EUR/USD spread of 2.1 pips and no commissions.

Classic Account: Designed for MT4 and MT5 users, this account offers currencies, metals, cryptocurrencies, energies, indices, and futures with an average EUR/USD spread of 1.6 pips and no commissions.

How to Open an Account?

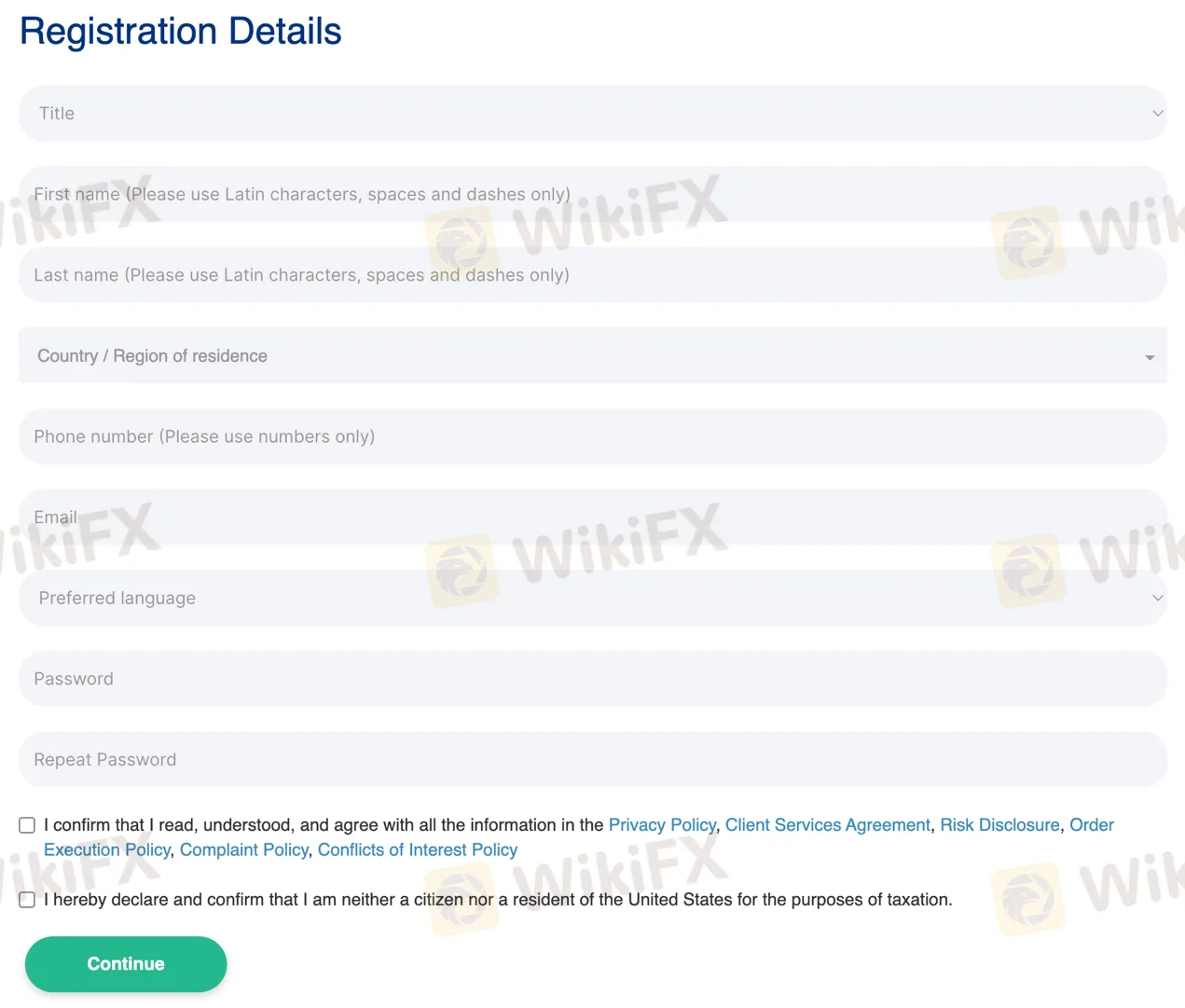

To open an account with XS, follow these steps:

- Click on the “JOIN XS NOW” button on the registration page.

- Provide your registration details:

- Title (e.g., Mr., Mrs., etc.)

- First name (using Latin characters, spaces, and dashes)

- Last name (using Latin characters, spaces, and dashes)

- Country / Region of residence

- Phone number (numbers only)

- Email address

- Select your preferred language.

- Create a password and repeat it for confirmation.

- Confirm your agreement to the terms and policies:

- Confirm that you have read, understood, and agree with the Privacy Policy, Client Services Agreement, Risk Disclosure, Order Execution Policy, Complaint Policy, and Conflicts of Interest Policy.

- Declare that you are neither a citizen nor a resident of the United States for tax purposes.

Leverage

XS offers leverages and commissions for diverse instruments: major, minor, and exotic FX pairs boast a leverage of 1:500; metals include 1:200 for gold, 1:100 for silver, and 1:50 for platinum and palladium. Energy instruments feature a leverage of 1:100, major indices offer 1:100, minor indices provide 1:50, commodities utilize 1:50, shares employ 1:50, and cryptocurrencies operate at 1:20 leverage.

Spreads & Commissions

XS provides multiple account types with specific spreads and commissions. The ELITE (RAW) Account features spreads from 0.0 pips with a $6 per lot commission, while the STANDARD Account offers spreads from 0.9 pips with no commission, the CLASSIC Account presents spreads starting at 1.4 pips without commission, and the PLUS Account provides spreads from 1.9 pips with no commission.

Minimum Deposit

The minimum deposit amount across various payment methods supported in all countries is US $200 (or equivalent denomination).

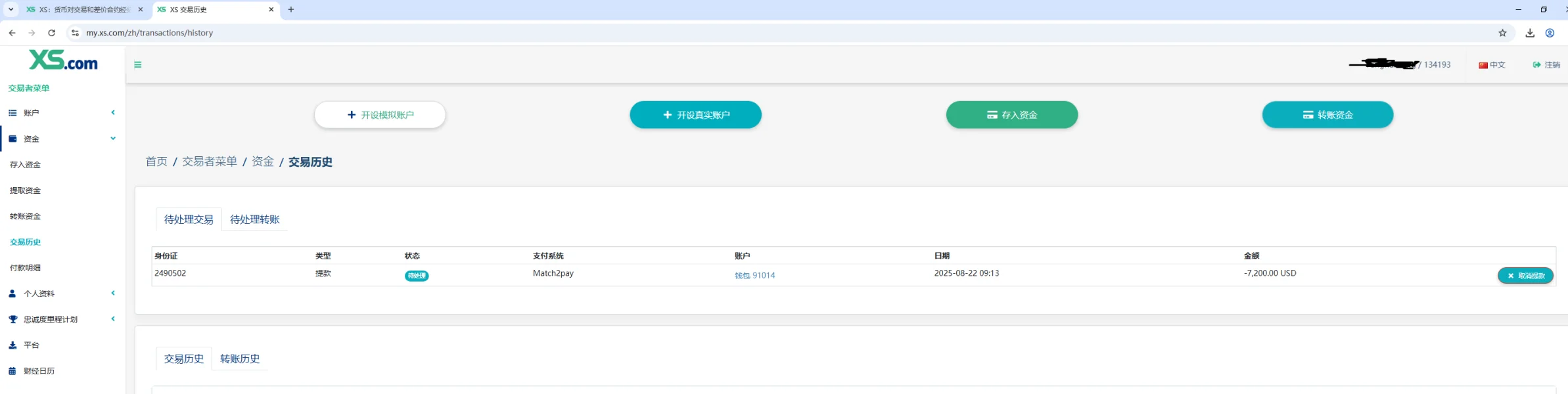

Deposit & Withdrawal

Deposits: XS offers multiple deposit options with varying minimum and maximum deposit amounts. Bank transfers require a minimum deposit of $200 with unlimited maximum, processing in 1-7 working days for EUR and USD. Visa & MasterCard deposits have a $50 minimum and $5,000 maximum, processing instantly for EUR and USD. Skrill and Neteller deposits, both with a $15 minimum, allow up to $15,000 or equivalent and process instantly for EUR and USD. Klarna deposits, also starting at $15, can go up to $5,000, processing within 1 business day for EUR, GBP, PLN, and CZK. Giropay deposits, starting at $15, are limited to $5,000, processing in up to 1 business day for EUR.

Withdrawals: For withdrawals, bank transfers require a minimum of $200 and have unlimited maximum withdrawals, processing in 1 business day for EUR, USD, and GBP. Visa & MasterCard withdrawals have a $50 minimum and a maximum of $5,000, processing instantly for the same currencies. Skrill withdrawals start at $50 and go up to $50,000 or equivalent, processing in 1 business day for EUR, USD, and GBP. Neteller withdrawals require a minimum of $50 and have a maximum of $2,500 or equivalent, processing instantly for EUR, USD, and GBP.

Trading Platforms

Metatrader 4 (MT4) Platform: XS offers the popular Metatrader 4 (MT4) platform, known for its user-friendly interface and automated trading features. With a wide range of technical indicators and trading tools, MT4 supports market analysis and trade execution. Traders can access real-time quotes, employ one-click trading, and build custom indicators and automated strategies. The platform's versatility and convenience make it suitable for traders of varying experience levels.

Metatrader 5 (MT5) Platform: XS introduces the MetaTrader 5 (MT5) platform, an advanced version of its predecessor with improved features. MT5 provides an expanded set of tools for technical analysis, including 90 indicators and charting options. Traders can place one-click trades, access embedded news, and utilize six types of pending orders. The platform's support for hedging positions, a diverse range of timeframes, and a VPS service enhances its versatility and utility for traders.

XS Web Trader Platform: The XS Web Trader platform offers clients a web-based trading solution accessible from any operating system. This platform eliminates the need for downloads and installations, allowing traders to access their accounts conveniently from web browsers. With real-time quotes, multiple chart types, and timeframes, XS Web Trader offers a reliable and user-friendly trading experience. Its compatibility across devices ensures traders can manage their activities seamlessly.

XS Trader Mobile App: XS provides traders with the XS Trader Mobile App for on-the-go trading. This mobile app allows users to access their accounts and trade from anywhere using advanced mobile technology. Traders can execute trades, manage accounts, and customize settings on the move. The app offers a range of features including reliable deposit and withdrawal methods, advanced charts, and multiple chart types and timeframes, making it a comprehensive solution for mobile trading.

PAMM Soultion

XS provides clients with advanced Percentage Allocation Money Management (PAMM) solutions, a powerful tool for diversifying portfolios. Their PAMM system integrates with the MetaTrader 5 platform, allowing you to either invest in accounts managed by experienced traders or take the helm yourself as a money manager.

Customer Support

XS provides around-the-clock customer support through various contact options. Clients can access assistance through a call back request form, live chat via the XS online trading platform, or by requesting a call back. For email inquiries, support is available at support@xs.com. Additionally, XS maintains a presence on Twitter, Instagram, and Facebook for additional communication channels.

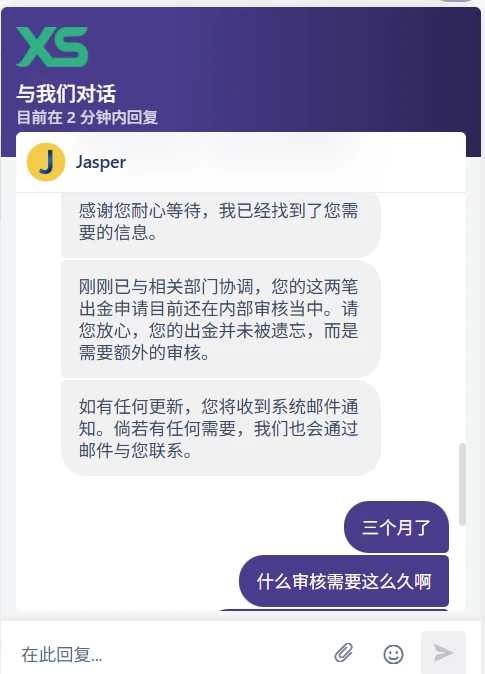

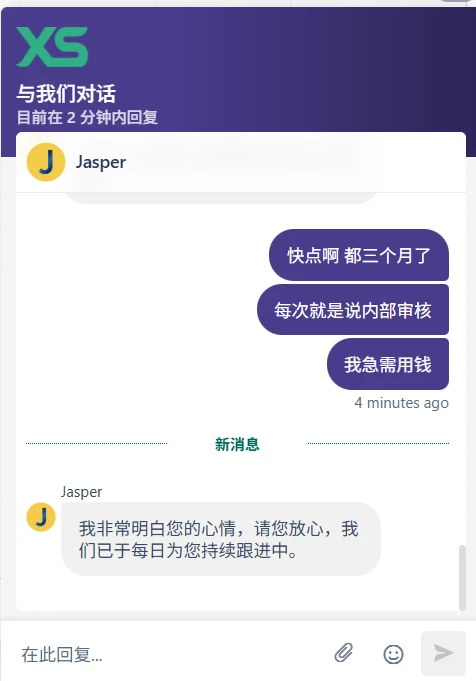

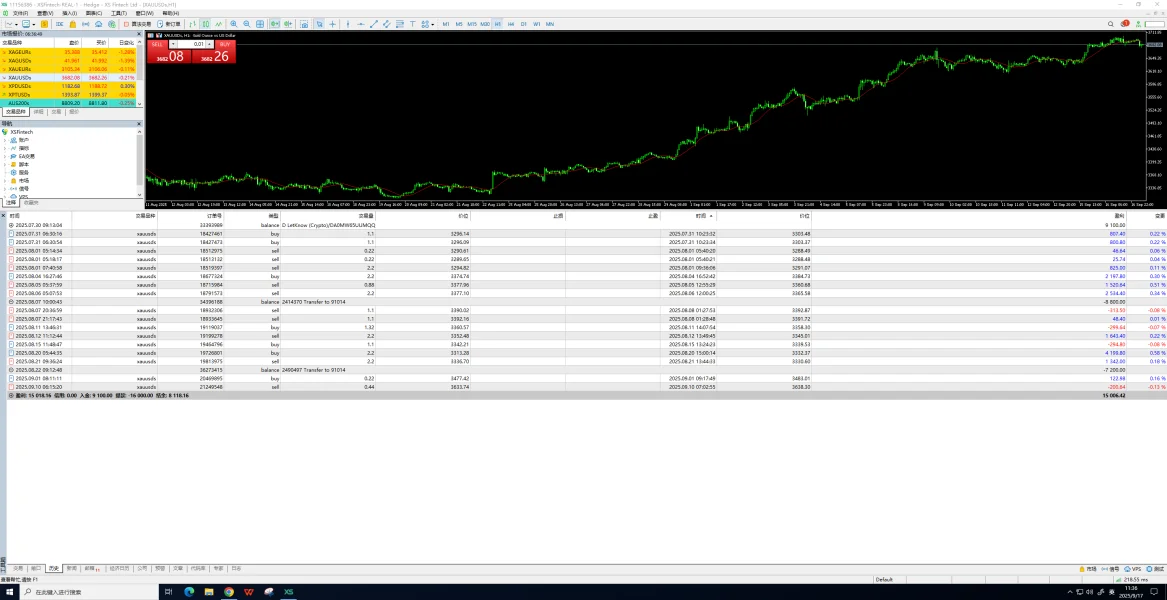

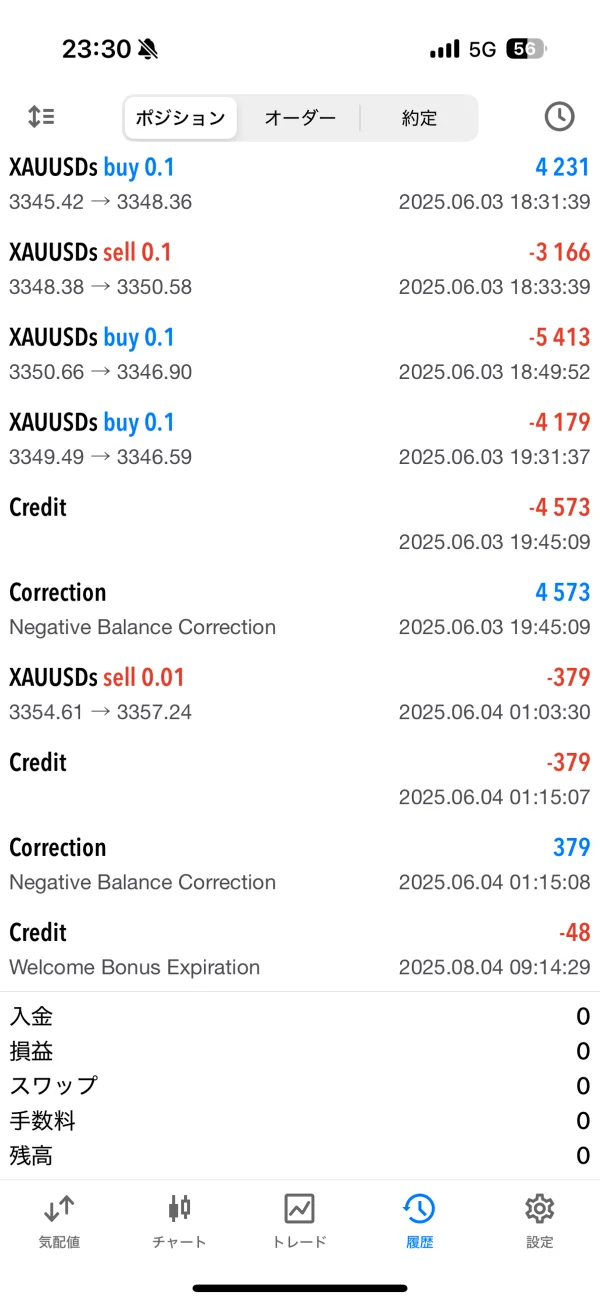

FX2542483264

Hong Kong

For over three months, they've refused to process my withdrawal. When I inquired, they claimed it was under internal review. My account was also suspended from trading. They requested a photo of me holding my ID, which I provided, yet they still won't release the funds.

Exposure

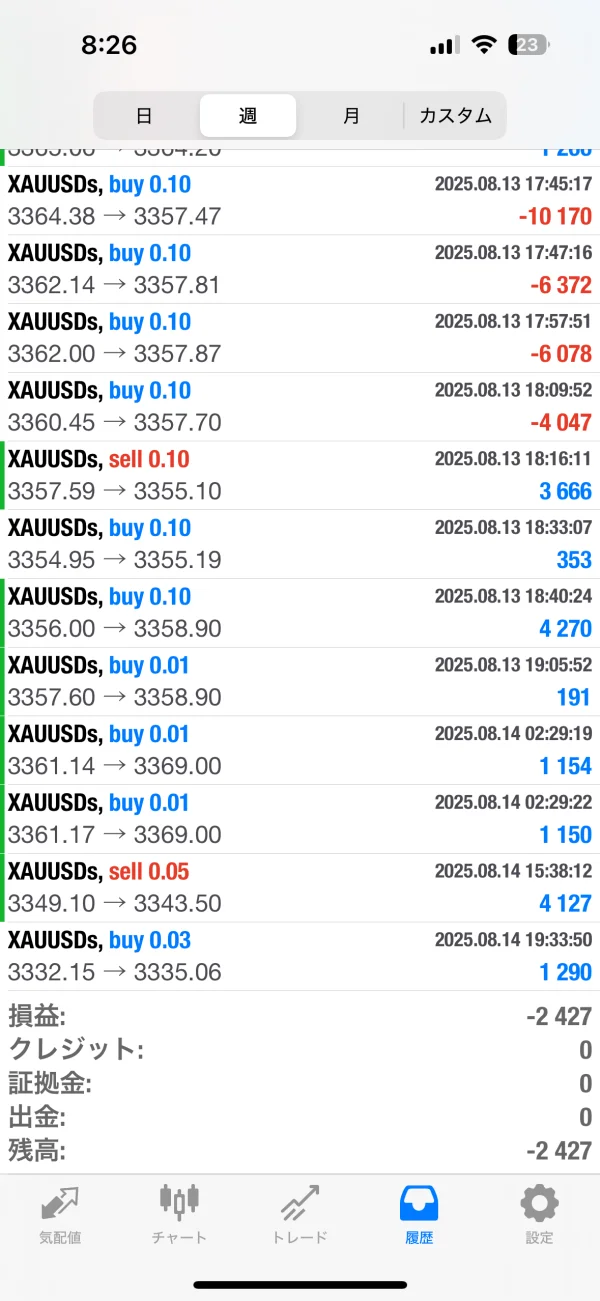

FX3065780982

Hong Kong

Withdrawal hasn't been processed for a month, many customers in the comment section can't withdraw, suspecting the platform is going to run off. Everyone, be careful and apply for withdrawal as soon as possible to avoid being scammed!

Exposure

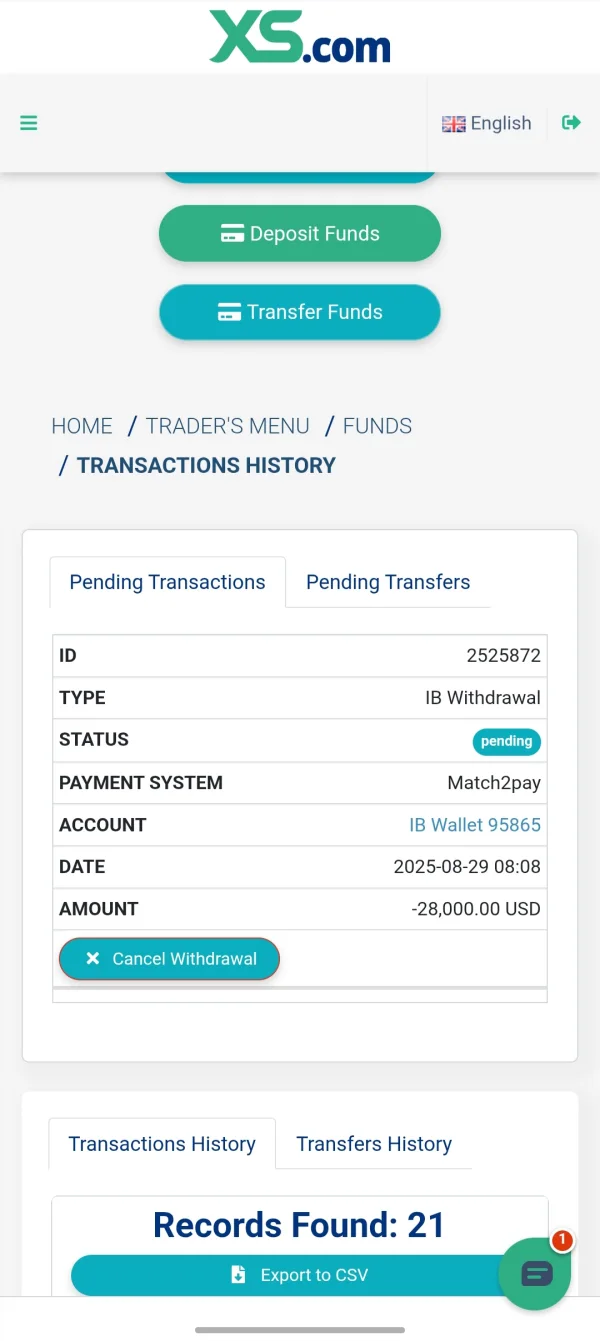

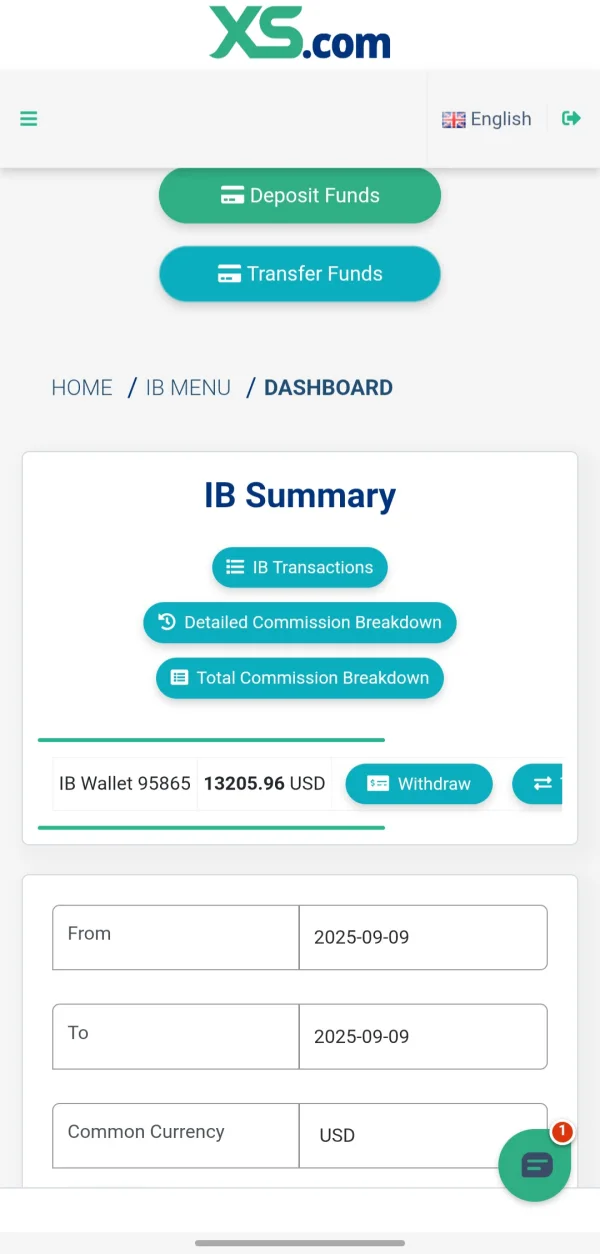

luna2001

Hong Kong

Small commissions are agreed to be withdrawn, but when the commission reaches a large amount, it cannot be withdrawn. I applied for a withdrawal of 28000USD, which has been reviewed for 14 days.Every time I ask the customer service, I answer that it is under review. They sent me a selfie verification email, saying that they could pass the audit after passing the verification. When I passed the selfie verification, they didn't abide by the agreement. Please agree to my withdrawal as soon as possible.

Exposure

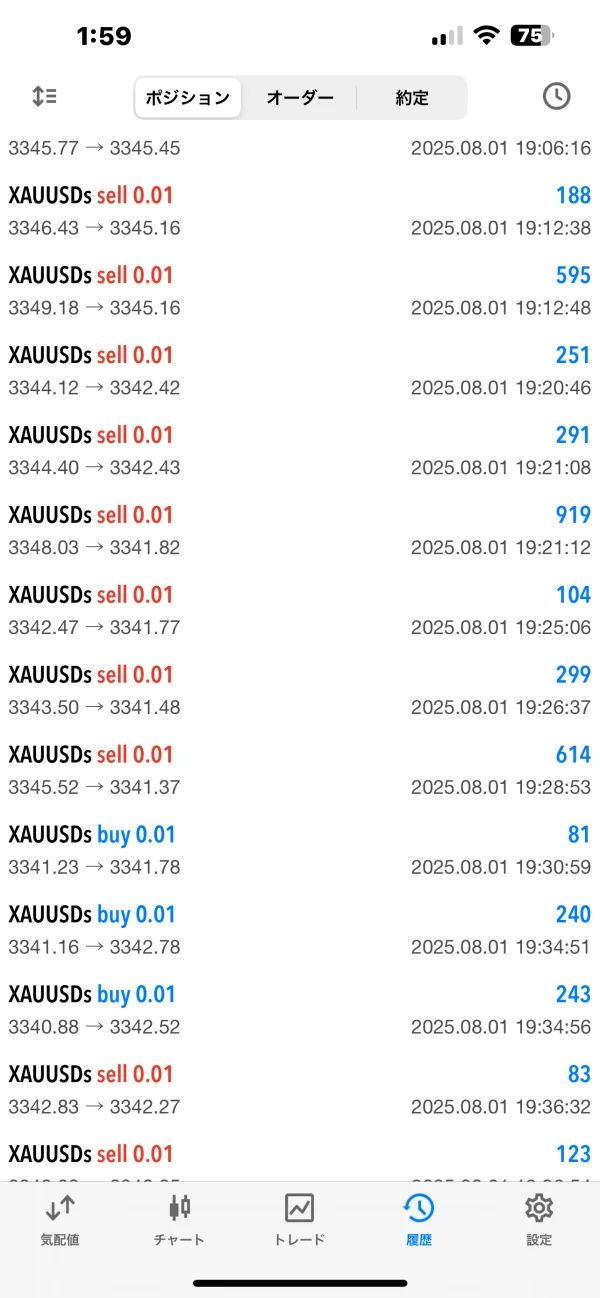

FX5137562772

Japan

The website operation has some slightly confusing aspects, but once you get used to it, you can use it without any problems. The trading environment features tight spreads and stable execution rates, allowing for secure trading. Leverage up to 200x.

Neutral

きのこまん

Japan

Agreements are good, deposits and withdrawals are also good. With high leverage and tight spreads, it's great for serious users. The live chat support is high-level, so you can feel secure when in trouble. They regularly hold trading competitions, which I enjoy participating in.

Positive

FX2792288409

Japan

Since everyone around me was using it, I gave it a try, but it was neither good nor bad. I don't think it's bad, though.

Positive

Pepe Silvera

Spain

I like how XS took a step forward when it comes to prices. Yes perhaps you don't see many promos here and flashy ads, but they have always been nice when it comes to sheer trading. For example on eur/usd it's london open already and it's just 0.6 pips, even lower than 0.7 they have promised for the pro account. and it's not for a split second, I see this very often, and I guess this is what you can call doing more than you promise!

Positive

muu-chan

Japan

Fast transactions, quick deposits High cashback rate

Positive

FX3495332462

Japan

This is the broker I personally recommend the most. CB is deposited directly into your wallet within about 10 minutes after trading. And the execution is seriously smooth. Deposit processing takes less than 30 minutes via bank transfer, and withdrawals take 1-2 business days. They also offer a welcome bonus of 5000.

Positive

FX7859323262

Japan

I think I received an account opening bonus and withdrew it.

Positive

FX7917327802

Japan

I mainly trade gold, and I think it's very good because the spreads are tight and there are no issues with execution or slippage. Also, the best part is that so far, there has never been a withdrawal rejection.

Positive

R Y

Japan

There's no room for complaint about the tight spreads and smooth withdrawals. They recently added a 5,000 yen account opening bonus, but what really shows their user-first approach is that they even granted it to existing account holders.

Positive

FX1825073414

Japan

This broker is gradually becoming more substantial, offering 2,000x leverage, a royalty program, tight spreads, and now even an account opening bonus. It might surpass Exness for those aiming not for ultra-high leverage but for decent leverage and long-term use. Withdrawals are also fast. If they ever remove leverage limits, I'd seriously consider switching completely 🤣

Neutral

FX3613021943

Japan

It hasn't reached the point of withdrawals yet, but according to other people's reviews, it seems to be quite highly rated.

Neutral

FX2678860915

Japan

This is my personal top recommended broker. First of all, there are no bonuses like those offered by other brokers. Currently, I believe they are offering a ¥5,000 credit bonus for new account openings. The best part is the same-day cashback you can receive. Additionally, even the standard account has quite tight spreads. If you have extra funds and engage in scalping, the pro account is recommended, but for those who don't scalp, the standard account with higher cashback is a better choice. Another great feature is the wallet function, which allows for quick fund transfers. This helps you trade with limited funds. Deposits are reflected within minutes, and withdrawals take about 1-2 days.

Positive

FX6908437982

Japan

The narrow spread makes trading easy. I also thought the deposit/withdrawal processing was fast.

Positive

FX6369975932

Japan

There are no flashy bonuses, but the spreads are tight and easy to use. However, I feel like the slippage has gotten worse recently.

Neutral

FX8823628920

Japan

I received a welcome bonus of 5000 yen! It was helpful that even those who already have an account were eligible. The spreads are also narrow.

Positive

FX2563990896

Japan

The spread was narrow and easy to use. Also, the execution speed was fast, and there was little slippage.

Positive

貴ちゃんねる

Japan

The inquiries to the operators are also very kind and polite. Deposits and withdrawals are fast and easy to use.

Positive

Chris Haung

Taiwan

Customer service responds quickly, with high completeness in explanations, stable platform execution, competitive gold spreads, sufficient product leverage flexibility, complete and valid regulatory licenses, and smooth and natural multilingual support

Positive

annlim831

Malaysia

XS offers MT4 and MT5 trading platforms and various deposit methods

Neutral

DANIEL6448

Brazil

I made 1400 usd in profit and when I asked for a withdrawal I received an email from the management team saying that I had committed abuse in the negotiations, and they threatened to debit 5% of the money I deposited, and withdraw the profits. I sent my source code for analysis, but so far it has not been resolved and they probably will not pay the profits.

Exposure