Company Summary

| Aspect | Information |

| Registered Country/Area | South Africa |

| Founded Year | Within 1 year |

| Company Name | Jura Investments (Pty) Ltd |

| Regulation | Financial Sector Conduct Authority (FSCA) |

| Minimum Deposit | $50 (Classic ECN and Trader ECN), $10,000 (Custom ECN) |

| Maximum Leverage | 1:500 |

| Spreads | Classic ECN: Starting from 0.9 pips<br>Trader ECN: Starting from 0.0 pips<br>Custom ECN: Starting from 0.0 pips (Customized commission) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, CFDs, Cryptocurrency CFDs, Stocks, Metals, Commodities |

| Account Types | Classic ECN, Trader ECN, Custom ECN |

| Demo Account | Available |

| Islamic Account | Not mentioned |

| Customer Support | Website messaging, Address, Social Media (Twitter, Instagram) |

| Payment Methods | Bank, Card, Bitcoin, Fiat currencies (EUR, GBP, USD, ZAR) |

| Educational Tools | Blogs, Mini-courses, Comprehensive Guides |

Overview of Mugan Markets

Mugan Markets, operated by Jura Investments (Pty) Ltd in South Africa, is a regulated trading platform authorized by the Financial Sector Conduct Authority under license number 51505. It offers a diverse array of trading instruments, including Forex, CFDs, Cryptocurrency CFDs, stocks, metals, and commodities. The platform's regulatory status ensures adherence to standards while providing traders opportunities to speculate on price movements without direct ownership of assets.

With a focus on diverse account options, Mugan Markets presents the Classic ECN, Trader ECN, and Custom ECN accounts. These accounts cater to different trading preferences, offering spreads starting from 0.9 pips for the Classic ECN account, spreads from 0.0 pips for the Trader ECN account, and customizable spreads for the Custom ECN account. Leverage of up to 1:500 is available across all accounts, allowing traders to amplify their positions.

The trading experience is facilitated through the MetaTrader 4 (MT4) platform, known for its stability and user-friendly interface. MT4 offers various trading tools, including Expert Advisors and technical analysis features, enabling traders to implement diverse strategies. Mugan Markets also provides educational resources through blogs and comprehensive guides, enhancing traders' knowledge and skills. The platform's regulated status, account options, and access to MT4 make Mugan Markets a versatile choice for speculative trading across multiple asset classes.

Pros and Cons

Mugan Markets presents several advantages and potential drawbacks for traders. On the positive side, the company operates under the regulation of the Financial Sector Conduct Authority, ensuring a level of oversight and compliance. Traders can choose from various account types and benefit from a demo account for practice. The platform also offers high leverage of up to 1:500, contributing to potential profitability. Additionally, low spreads starting from 0 pips and efficient transaction processes for deposits enhance the trading experience. However, there are some limitations such as incomplete information about available market instruments, a higher deposit requirement for the Custom ECN account, lack of a provided phone number, and restricted payment methods.

| Pros | Cons |

| Regulated by Financial Authority | Limited information on market instruments |

| Multiple Account Types Available | Custom ECN account requires high deposit |

| Demo account available | No detailed information on available instruments |

| Offers High Leverage, up to 1:500 | No phone number available |

| Low spreads from 0 pips | Limited payment methods |

| Swift Transactions for Deposits |

Is Mugan Markets Legit?

Mugan Markets is regulated by the Financial Sector Conduct Authority in South Africa under license number 51505, with JURA INVESTMENTS (PTY) LTD as the licensed institution. The effective date of this regulation is November 17, 2022. The institution's address is 47 BUCKINGHAM ESTATE, 26 LION ROAD, STERRREWAG, Pretoria 0181, and the phone number is 0823311840. While the specific regulatory details regarding the scope and nature of their financial services are not provided, the regulatory oversight by the Financial Sector Conduct Authority ensures that Mugan Markets operates within the regulatory framework defined by the authority.

Market Instruments

FOREX: Mugan Markets offers a variety of currency pairs for trading, allowing users to speculate on the exchange rate fluctuations between different global currencies. Examples of currency pairs include EUR/USD, GBP/JPY, and AUD/CAD.

CFDs: Contracts for Difference (CFDs) are available on various underlying assets such as stocks, indices, and commodities. Users can engage in CFD trading without owning the actual assets. Examples include Apple Inc. stock, S&P 500 index, and Brent Crude Oil.

CRYPTOCURRENCY CFDs: Traders can access the cryptocurrency market through CFDs, allowing them to speculate on the price movements of cryptocurrencies like Bitcoin, Ethereum, and Ripple, without owning the actual cryptocurrencies themselves.

STOCKS: Mugan Markets provides the opportunity to trade stocks from different global markets. Users can buy and sell shares of companies such as Amazon, Microsoft, and Google parent company Alphabet.

METALS: Precious metals like gold, silver, platinum, and palladium are available for trading on the platform. Traders can speculate on the price movements of these metals as part of their investment strategy.

COMMODITIES: The platform offers a range of commodities for trading, including agricultural products (such as corn, soybeans), energy commodities (like crude oil, natural gas), and industrial metals (such as copper, aluminum).

Pros and Cons

| Pros | Cons |

| Diverse range of trading options available | No specific information on available instruments |

| Opportunity to engage in global markets | Limited detail about market variety and depth |

| Access to cryptocurrency market through CFDs |

Account Types

CLASSIC ECN:

The Classic ECN account type offered by Mugan Markets features spreads starting from 0.9 pips. It provides a maximum leverage of 1:500 and a minimum lot size of 0.01. Account currencies available include USD, EUR, ZAR, GBP, BTC, NGN, GHS, and KES. This account type does not have any commission charges, making it suitable for traders looking for a straightforward fee structure. The account can be opened with a minimum deposit of $50.

TRADER ECN:

The Trader ECN account type boasts spreads starting from 0.0 pips, appealing to traders seeking low-cost trading. It offers a maximum leverage of 1:500 and a minimum lot size of 0.01. Account currencies available are USD, EUR, ZAR, GBP, NGN, GHS, and KES. This account type comes with a commission of $8 per side, adding a transparent cost for each trade. With a minimum deposit of $50, traders can begin trading on this account.

CUSTOM ECN:

Mugan Markets offers the Custom ECN account type, providing spreads starting from 0.0 pips. It features a maximum leverage of 1:500 and a minimum lot size of 0.01, similar to other account types. Account currencies accepted are USD, EUR, ZAR, and GBP. The commission for this account type is customized based on individual trading preferences. This account is tailored for traders with specific requirements. A higher minimum deposit of $10,000 is necessary to open a Custom ECN account.

Mugan Markets also offers a demo account option for traders who want to practice and familiarize themselves with the platform and trading strategies without risking real funds.

Pros and Cons

| Pros of Account Types | Cons of Account Types |

| Demo account available | Higher minimum deposit required for Custom ECN |

| Leverage up p 1:500 | Custom ECN account has customized commission |

| Low spreads from 0 pips | Limited information on demo account and its benefits |

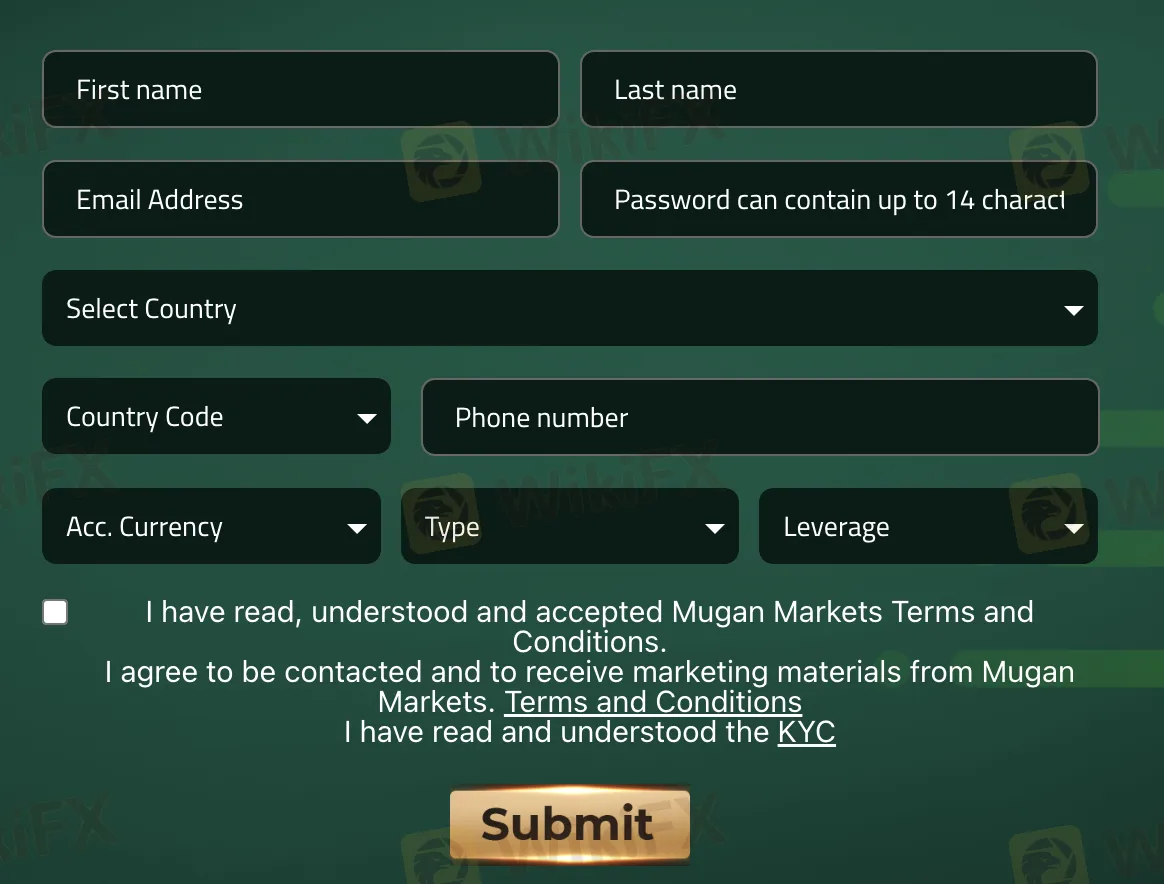

How to Open an Account

To open an account with Mugan Markets, whether it's a “Live Account” or a “Demo Account,” follow these steps:

Fill Information: Provide your first name, last name, email address, and create a password (up to 14 characters) for your account.

Select Country: Choose your country from the list provided.

Enter Phone Details: Input your country code and phone number.

Account Currency: Choose the desired account currency for your transactions.

Account Type: Select the type of account you wish to open.

Leverage: Specify the leverage level for your trading activities.

Agree to Terms: Confirm that you have read, understood, and accepted Mugan Markets' Terms and Conditions. You also have the option to agree to receive marketing materials from Mugan Markets.

KYC Acknowledgement: Confirm that you have read and understood the KYC (Know Your Customer) requirements.

Submission: Click the “Submit” button to complete the account opening process.

Leverage

Mugan Markets offers leverage of up to 1:500 for all its account types, allowing traders the potential to control positions up to 500 times the amount of their initial margin deposit.

Spreads & Commissions

Mugan Markets offers spreads starting from 0.9 pips on the Classic ECN account with no commission, while the Trader ECN account features spreads from 0.0 pips and a $8 per side commission. The Custom ECN account provides spreads from 0.0 pips with a personalized commission structure.

Minimum Deposit

Mugan Markets has minimum deposit requirements that range from $50 for Classic ECN and Trader ECN accounts to $10,000 for the Custom ECN account.

Deposit & Withdrawal

Mugan Markets offers swift transactions through both bank and card options. For seamless trading experiences, clients can use Bitcoin for deposits and withdrawals via the Mugan Markets Client Portal. Additionally, fiat currencies like EUR, GBP, USD, and ZAR are accepted for deposits and withdrawals, all of which are efficiently processed by the forex broker team, allowing traders to focus on market activities.

Pros and Cons

| Pros | Cons |

| Swift transactions through bank, card, and Bitcoin options | Limited types of payment methods |

| Acceptance of fiat currencies (EUR, GBP, USD, ZAR) | No specific information about processing times provided |

Trading Platforms

Mugan Markets offers the widely recognized trading platform, MT4 (MetaTrader 4), known for its stability and user familiarity. This platform facilitates easy trading for Forex, CFDs, Cryptocurrency CFDs, Stocks, Metals, and Commodities. Traders can enjoy fast execution with no slippage or re-quotes, choose leverage from 1:1 to 1:500, and benefit from features like full Expert Advisor functionality, technical analysis tools, hedging, scalping, and the ability to place orders as low as 0.01 lots. MT4's advantages include one-click trading, lightning-fast order execution, profiles, chart templates, and the ease of getting started with just four steps: signing up, depositing funds, downloading the platform, and commencing trading.

Pros and Cons

| Pros | Cons |

| Stable and Familiar MT4 Platform | No alternative platforms available |

| Multiple Asset Classes Supported | |

| Fast Execution with No Slippage or Re-quotes |

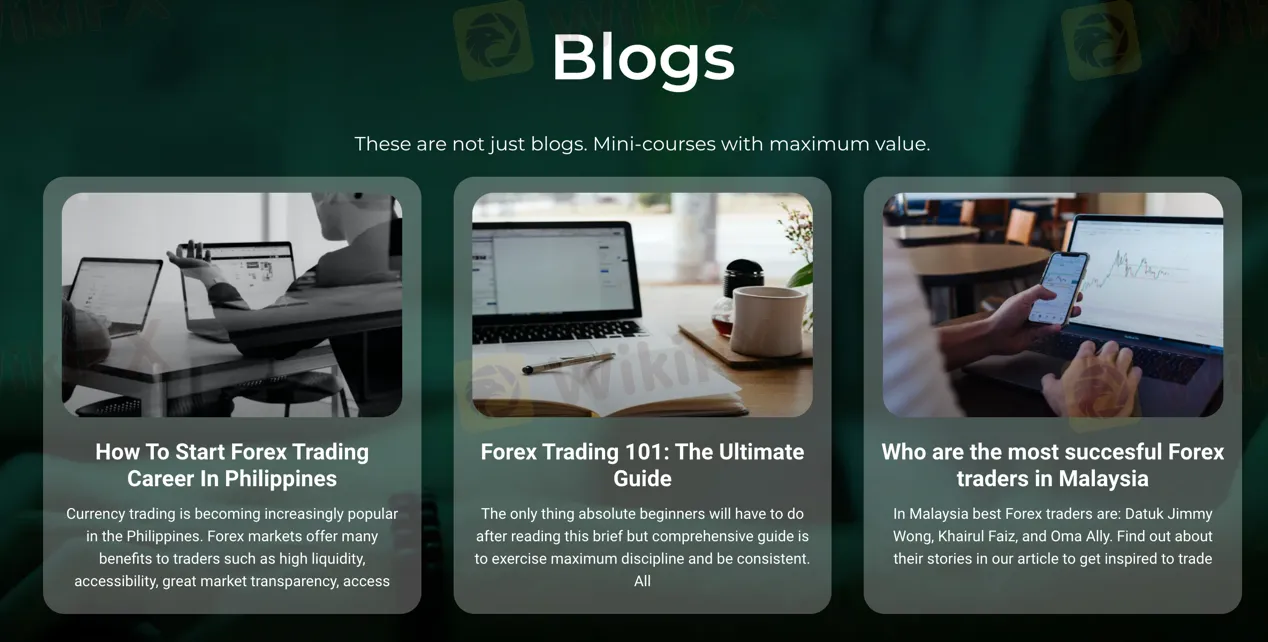

Educational Tools

Mugan Markets provides educational tools in the form of blogs that offer valuable insights. These blogs offer mini-courses that cover topics like starting a Forex trading career in the Philippines, with content such as benefits of Forex markets, high liquidity, and market transparency. Additionally, there are comprehensive guides, such as “Forex Trading 101: The Ultimate Guide,” which helps beginners understand trading basics and emphasizes discipline and consistency. The platform also features informative articles about successful Forex traders in Malaysia, including Datuk Jimmy Wong, Khairul Faiz, and Oma Ally, providing inspiration for aspiring traders.

Customer Support

CUSTOMER SUPPORT: Mugan Markets offers accessible customer support through their website, where traders can send messages with their inquiries. The company's address is 47 Buckingham Estate, 26 Lion St, Sterrewag, Gauteng 0181, South Africa. Social media presence includes Twitter (https://twitter.com/muganmarkets) and Instagram (https://instagram.com/muganmarkets) for updates and communication.

Conclusion

In conclusion, Mugan Markets, operated by JURA INVESTMENTS (PTY) LTD in South Africa, presents a trading platform for various market instruments, including FOREX, CFDs, cryptocurrency CFDs, stocks, metals, and commodities. Regulated by the Financial Sector Conduct Authority, Mugan Markets offers different account types with varying features, leverage up to 1:500, and spreads starting from 0.9 pips. The trading platform of choice is MT4, known for stability and ease of use. Educational tools such as blogs and guides are available to aid traders, and customer support is reachable through the website and social media channels. While Mugan Markets provides opportunities for diverse trading activities, traders should carefully evaluate their options before engaging due to potential risks associated with trading in financial markets.

FAQs

Q: Is Mugan Markets a legitimate company?

A: Yes, Mugan Markets is regulated by the Financial Sector Conduct Authority in South Africa (license number 51505) under JURA INVESTMENTS (PTY) LTD.

Q: What trading instruments does Mugan Markets offer?

A: Mugan Markets provides trading options including FOREX, CFDs, CRYPTOCURRENCY CFDs, stocks, metals, and commodities.

Q: What are the account types available at Mugan Markets?

A: Mugan Markets offers CLASSIC ECN, TRADER ECN, and CUSTOM ECN account types with varying spreads, commissions, and minimum deposit requirements.

Q: What leverage does Mugan Markets offer?

A: Mugan Markets provides leverage of up to 1:500 across all account types, allowing traders to control larger positions.

Q: What are the deposit and withdrawal options at Mugan Markets?

A: Mugan Markets offers swift transactions through bank, card, and Bitcoin options. Fiat currencies like EUR, GBP, USD, and ZAR are also accepted.

Q: Which trading platform does Mugan Markets use?

A: Mugan Markets uses the MT4 (MetaTrader 4) trading platform, known for its stability, user-friendliness, and diverse trading options.

Q: What educational tools does Mugan Markets provide?

A: Mugan Markets offers informative blogs and guides on topics like starting a Forex trading career, trading basics, and profiles of successful traders.

Q: How can I contact customer support at Mugan Markets?

A: You can contact Mugan Markets' customer support through their website or find them on Twitter and Instagram for updates and communication.

Xukar

Italy

Mugan Markets has some of the tightest spreads I've seen, which is great for reducing trading costs. Plus, they offer a variety of account types to suit different traders' needs. Overall, I'm really satisfied with Mugan Markets' offerings.

Positive

Aiko. Ishikawa

Turkey

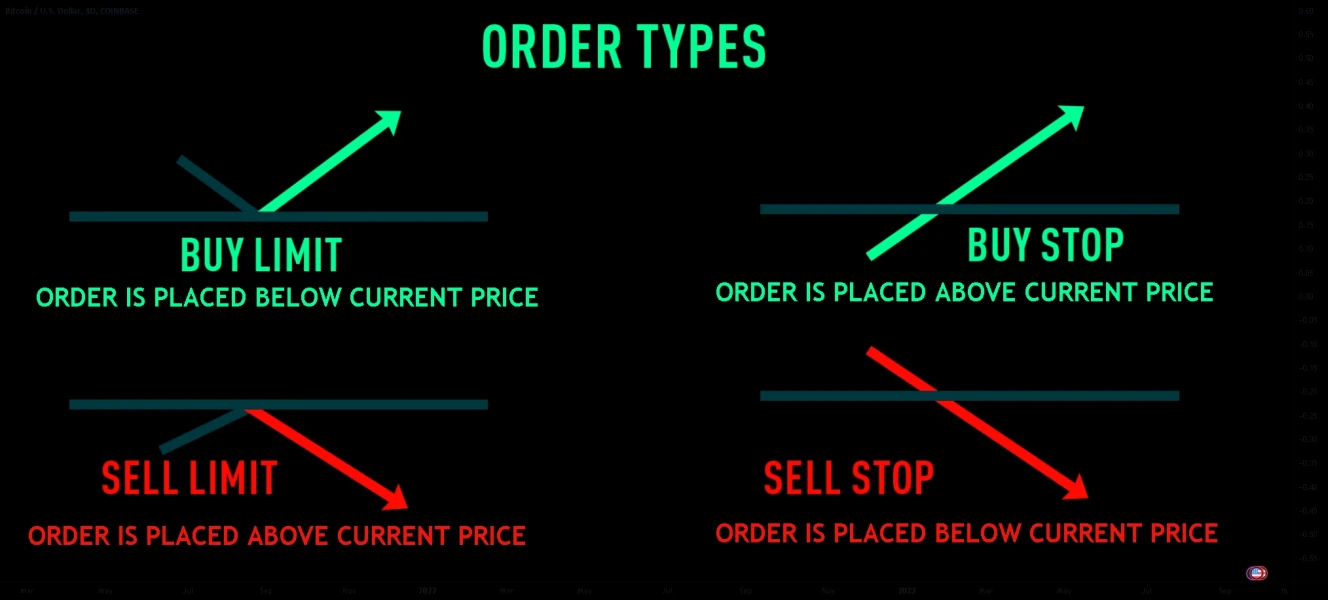

Various order types, which gives me more control over my trades. Great!!!

Positive

JackieSmith

Nigeria

In terms of order execution, Mugan Markets really shines. Trades are executed swiftly without any noticeable slippage, which gives you the peace of mind that you're getting the best available prices. It's fast and feels reliable. As for spreads and commissions, they are competitive in my view. While they aren't the very cheapest, they're certainly shell out for the level of service and platform performance in my opinion. One area that needs a bit of refinement is the account-opening procedure. I won’t lie, it was a tad complicated and took longer than I would have liked.

Positive

FX1524107455

Colombia

The Mugan Markets trading platform undoubtedly stands tall. It's steadfast in providing fast, real-time data updates and order execution. Take it from the day when the US Non-Farm Payroll report sent the market into a frenzy! Amidst exchanging seas, the platform held firm, promising secure order execution with zero slippage. A skipper can rely on it! A tad improvement with withdrawal speed would be the wind in their sails, but overall, it's been a pleasure sailing these trading seas with Mugan Markets.

Positive

David95223

Netherlands

Low spreads? my foot! It was a classic case of 'too good to be true.' In reality, the spreads turned out to be sky-high! What's worse? Their unstable trading platform. It felt like I was riding a roller coaster with unexpected twists, turns, and sudden stops! Be it in the middle of a profit-making trade or an anticipated market crash, the platform would conveniently crap out on me. You just can't trust these guys for a stable, reliable platform. I remember this one time when I was on the verge of a profitable transaction. I could almost smell the sweet scent of victory when - bam! - the app crashes! Just like that, my dreams of a successful deal fizzled out.

Neutral

BDSW

Nigeria

They lured me in with this so-called 'Custom ECN' account. Nice marketing move, eh? It's supposed to be some tailor-made, fancy styling of a trading account that lets you trade like a pro. I thought ‘why not take a crack at it,’ seeing as I don't mind spending a little to make a lot, right? But THEN, get this - the deposit requirement on that bad boy were through the roof! I mean, we're not all rolling in dough, mate! And you'd think with the high deposits and ridiculously unstable spreads 'someone' would have the courtesy to offer half decent customer service, right? Wrong again! The support team was about as helpful as a chocolate tea pot. I got more insight on trading conditions from reading brew leaves!

Neutral