Company Summary

| Opoforex Review Summary | |

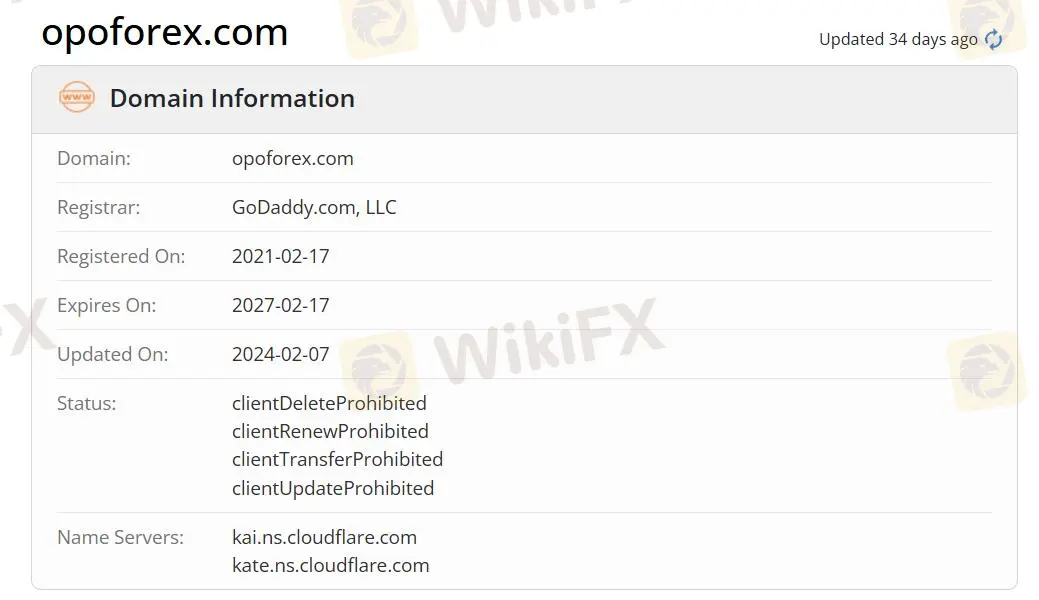

| Founded | 2021-02-17 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex/Commodities/Stocks/Cryptocurrencies/Metals/Indices |

| Demo Account | ❌ |

| Leverage | Up to 1:2000 |

| Spread | From 0 pip |

| Trading Platform | MT4/MT5/cTrader/TradingView(iOS/Android/Windows/macOS) |

| Min Deposit | $100 |

| Customer Support | Phone: +35724267200 |

| Email: Support@Opoforex.com | |

| Twitter/Facebook/Instagram/LinkedIn/Telegram | |

| Live chat | |

Opoforex Information

Opoforex is a broker. The tradable instruments with a maximum leverage of 1:2000 include forex, commodities, stocks, cryptocurrencies, metals, and indices. The broker also provides four accounts for MetaTrader and provides three accounts for CTrader. The minimum spread is from 0 pip and the minimum deposit is $100. Opoforex is still risky due to its unregulated status and high leverage.

Pros and Cons

| Pros | Cons |

| Various tradable instruments | Unregulated |

| MT4/MT5 available | High max leverage |

| Spread from 0 pip | |

| Swap free |

Is Opoforex Legit?

Opoforex is not regulated, making it less safe than regulated brokers.

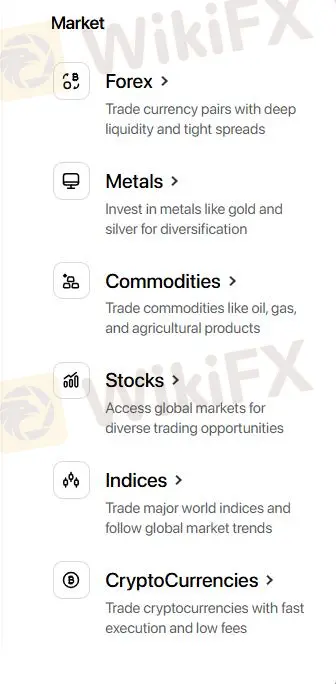

What Can I Trade on Opoforex?

Opoforex offers over 300 trading instruments, including forex, commodities, stocks, cryptocurrencies, metals, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

Opoforex has four account types for MetaTrader: Standard, Ecn Pro, ECN, Social Trade, and Prop. Traders who want low spreads can choose an ECN Pro account, while those with a small budget can open standard and ECN accounts. It also has three account types for Ctrader: ECN, ECNPLUS, and Copy. Traders who want low spreads can choose an ECNPLUS account, and those with a sufficient budget can also open an ECNPLUS account.

| Account Type(Metatrader) | Standard | Ecn Pro | ECN | Social Trade | Prop |

| Minimum Deposit | $100 | $5000 | $100 | $200(standard)/5000(pro) | $1000 |

| Commission | No | $4 | $6 | - | - |

| Spread | From 1.8 pip | From 0 pip | From 0.8 pip | - | - |

| Leverage | Up to 1:2000 | Up to 1:2000 | Up to 1:2000 | - | - |

| Swap free | ✔ | ✔ | ✔ | - | - |

| Account Type(Ctrader) | ECN | ECNPLUS | Copy |

| Minimum Deposit | $200 | $5000 | $200 |

| Commission | $6 | $4 | No |

| Spread | From 1 pip | From 0 pip | From 2.2 pip |

| Leverage | Up to 1:2000 | Up to 1:500 | Up to 1:500 |

| Swap free | ✔ | ✔ | ✔ |

Opoforex Fees

The spread is from 0 pip. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:2000 meaning that profits and losses are magnified 2000 times.

Trading Platform

Opoforex cooperates with the authoritative MT4 and MT5 trading platforms and the propriety cTrader and TradingView trading platforms, which are available on iOS, Android, Windows, and macOS. Junior traders prefer MT4 over MT5. MT4 and MT5 provide various trading strategies and implement EA systems.

Traders with rich experience are more suitable for using MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | iOS/Android/Windows/macOS | Junior traders |

| MT5 | ✔ | iOS/Android/Windows/macOS | Experienced traders |

| cTrader | ✔ | iOS/Android/Windows/macOS | - |

| TradingView | ✔ | iOS/Android/Windows/macOS | - |

Deposit and Withdrawal

The minimum deposit is $100. Opoforex accepts USDT(TRC20), Cryptocurrencies, Advcash, and Perfectmoney for deposit and withdrawal. The deposit processing times are instant and the withdrawal processing times are 24 hours, associated fees are charged.

| PSP Method | Min Deposit Amount | Max Deposit Amount | Processing Time | Fees |

| USDT (TRC20) | $1 | Unlimited | Instant | - |

| Cryptocurrencies | $15 | Unlimited | Instant | - |

| Top Change | $1 | Unlimited | Instant | 2.5% |

| Advcash | $1 | Unlimited | Instant | - |

| Perfectmoney | $1 | Unlimited | Instant | - |

| PSP Method | Min Deposit Amount | Max Deposit Amount | Processing Time | Fees |

| USDT (TRC20) | $1 | Unlimited | 24H | 3-5$ |

| Cryptocurrencies | $10 | Unlimited | 24H | 3-5$ |

| Advcash | $1 | Unlimited | 24H | 2% |

| Perfectmoney | $1 | $10000000 | 24H | - |