Company Summary

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| Blue Ocean Review Summary | |

| Registered Country/Region | Malaysia |

| Regulation | No regulation |

| Market Instruments | forex, stocks, indices, precious metals, energies, commodities, cryptocurrencies |

| Leverage | 1:5000 |

| EUR/USD Spread | 1.5 pips (Std) |

| Trading Platforms | MT5 & cTrader |

| Minimum Deposit | $100 |

| Customer Support | email, 24/5 live chat, telephone |

What is Blue Ocean?

Blue Ocean is an unregualted brokerage firm that offers a variety of trading instruments across different asset classes, including forex, stocks, indices, precious metals, energies, commodities, and cryptocurrencies. They provide access to popular trading platforms like MetaTrader 5 (MT5) and cTrader, allowing clients to trade with ease and flexibility. Blue Ocean offers different types of accounts, including Classic and Premium accounts, with varying minimum deposit requirements and leverage options. They provide customer support through live chat, telephone, and email, as well as an educational platform to assist clients in enhancing their trading knowledge and skills.

Pros & Cons

| Pros | Cons |

| • Diverse Trading Instruments | • Lack of Regulation |

| • Popular Trading Platforms | • Withdrawal fees charged |

| • Educational Resources | |

| • No commission |

Blue Ocean Alternative Brokers

There are many alternative brokers to Blue Ocean depending on the specific needs and preferences of the trader. Some popular options include:

Ally Invest - A reputable broker providing competitive pricing, a robust trading platform, and valuable educational resources, making it a strong choice for self-directed investors.

Merrill Edge - A trusted broker backed by Bank of America, offering a seamless integration with banking services, making it convenient for clients looking for a combined investment and banking experience.

TradeStation - A feature-rich broker with advanced charting tools, algorithmic trading capabilities, and a wide range of tradable instruments, ideal for experienced traders and those seeking sophisticated trading technology.

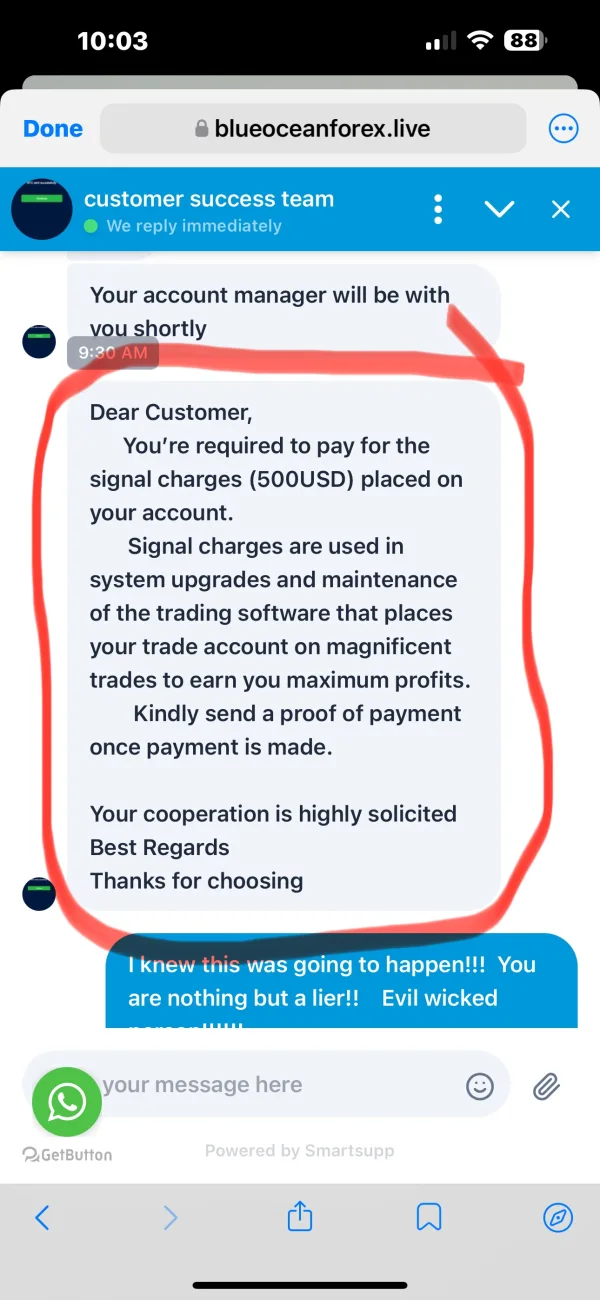

Is Blue Ocean Safe or Scam?

Based on the information provided, the lack of valid regulation for Blue Ocean raises concerns about the safety and legitimacy of the brokerage firm. Regulation plays a crucial role in overseeing and ensuring the fair and secure operation of financial institutions. The absence of regulation means that Blue Ocean is not subject to the oversight and compliance requirements imposed by regulatory authorities. It is important to conduct further research, seek independent advice, and consider alternative options before making any decisions related to Blue Ocean or entrusting them with your funds. It is essential to prioritize the safety of your investments and work with reputable and regulated brokers that have a track record of reliability, transparency, and client protection.

Market Instruments

Blue Ocean is a brokerage firm that offers a wide range of trading instruments across various asset classes. Here's a brief summary of the market instruments provided by Blue Ocean:

Forex: Blue Ocean allows trading in the foreign exchange market, where currencies are bought and sold. Traders can speculate on the price movements of major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY, among others.

Stocks: Blue Ocean provides access to trading stocks, which represent ownership in publicly traded companies. Traders can buy and sell shares of various companies listed on major stock exchanges, enabling them to profit from price fluctuations or earn dividends.

Indices: Blue Ocean offers trading in stock market indices, which represent a basket of stocks from a specific market or sector. Traders can speculate on the overall performance of an index, such as the S&P 500 or the FTSE 100, without needing to trade individual stocks.

Precious Metals: Blue Ocean allows trading in precious metals like gold, silver, platinum, and palladium. Traders can speculate on the price movements of these metals, which are considered as safe-haven assets and are often influenced by economic factors and investor sentiment.

Energies: Blue Ocean provides trading opportunities in energy markets, including crude oil and natural gas. Traders can speculate on the price fluctuations of these commodities, influenced by factors such as supply and demand dynamics, geopolitical events, and weather conditions.

Commodities: Blue Ocean allows trading in a variety of commodities, such as agricultural products (wheat, corn, soybeans), industrial metals (copper, aluminum, nickel), and other natural resources. Traders can take positions based on their expectations of price movements in these markets.

Cryptocurrencies: Blue Ocean offers trading in digital currencies like Bitcoin, Ethereum, Litecoin, and others. Traders can speculate on the price movements of these cryptocurrencies, which are known for their volatility and are influenced by factors such as market demand, regulatory developments, and technological advancements.

Accounts

Blue Ocean offers two types of accounts to cater to different trading preferences and investment levels: the Classic account and the Premium account. The Classic account requires a minimum deposit of $100. This makes it accessible to traders who are starting with a smaller capital. The Premium account has a higher minimum deposit requirement of $5000. This account type is designed for more experienced or high-net-worth traders who can afford a larger capital. Traders should review the account details provided by Blue Ocean to have a comprehensive understanding of the features and conditions associated with each account type before making a decision.

| Account Type | Minimum Deposit |

| Classic | $100 |

| Premium | $5,000 |

Leverage

| Types of Accounts | Maximum Leverage |

| Classic | 1:5000 |

| Premium | 1:500 |

Blue Ocean offers leverage options to enhance trading opportunities for both its Classic and Premium account holders. For Classic accounts, Blue Ocean provides a maximum leverage of 1:5000. This means that for every dollar in the trader's account, they can potentially control a position worth up to 5000 times that amount. On the other hand, for Premium accounts, Blue Ocean offers a maximum leverage of 1:500. It's important to remember that while leverage can magnify profits, it also amplifies potential losses. Higher leverage levels carry increased risk, as even small market fluctuations can have a significant impact on account balances. Traders should exercise caution, implement proper risk management strategies, and have a thorough understanding of leverage before utilizing it in their trading activities.

Spreads & Commissions

Blue Ocean provides competitive spreads for both its Classic and Premium accounts. The spread is the difference between the bid and ask prices of a trading instrument and represents the cost of executing a trade. For Classic accounts, Blue Ocean offers spreads starting from 1.5 pips. This means that the difference between the buy and sell price of a currency pair or other financial instrument could be as low as 1.5 pips. For Premium accounts, the spreads start from 1.0 pips, offering potentially tighter pricing compared to the Classic account. Lower spreads can be advantageous for traders as they reduce the cost of trading and potentially increase profitability.

In addition, Blue Ocean has a commission-free model for all types of accounts. This means that traders using both Classic and Premium accounts do not have to pay any additional commission charges on their trades. The absence of commissions can be beneficial for traders as it eliminates a direct cost associated with each trade and allows them to focus on the spreads and market conditions when evaluating their trading costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Blue Ocean | 1.5 (Std) | $0 |

| Ally Invest | From 0.3 | No commission |

| Merrill Edge | From 1.2 | No commission |

| TradeStation | From 0.2 | Commission-based: $0.005 per share |

Trading Platforms

Blue Ocean offers its clients two popular and widely used trading platforms: MetaTrader 5 (MT5) and cTrader. Both MT5 and cTrader offer mobile applications, allowing traders to access their accounts and trade on-the-go using their smartphones or tablets. These platforms provide a range of features to enhance the trading experience and cater to the diverse needs of Blue Ocean's clients. It's important to note that the specific functionalities and features of the trading platforms may vary depending on the version, customization options, and additional tools provided by Blue Ocean. Traders should refer to the platform documentation and explore the features offered by Blue Ocean to have a comprehensive understanding of the trading platforms available to them.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Blue Ocean | MetaTrader 5 (MT5) and cTrader |

| Ally Invest | Ally Invest Live |

| Merrill Edge | Merrill Edge MarketPro |

| TradeStation | TradeStation Platform |

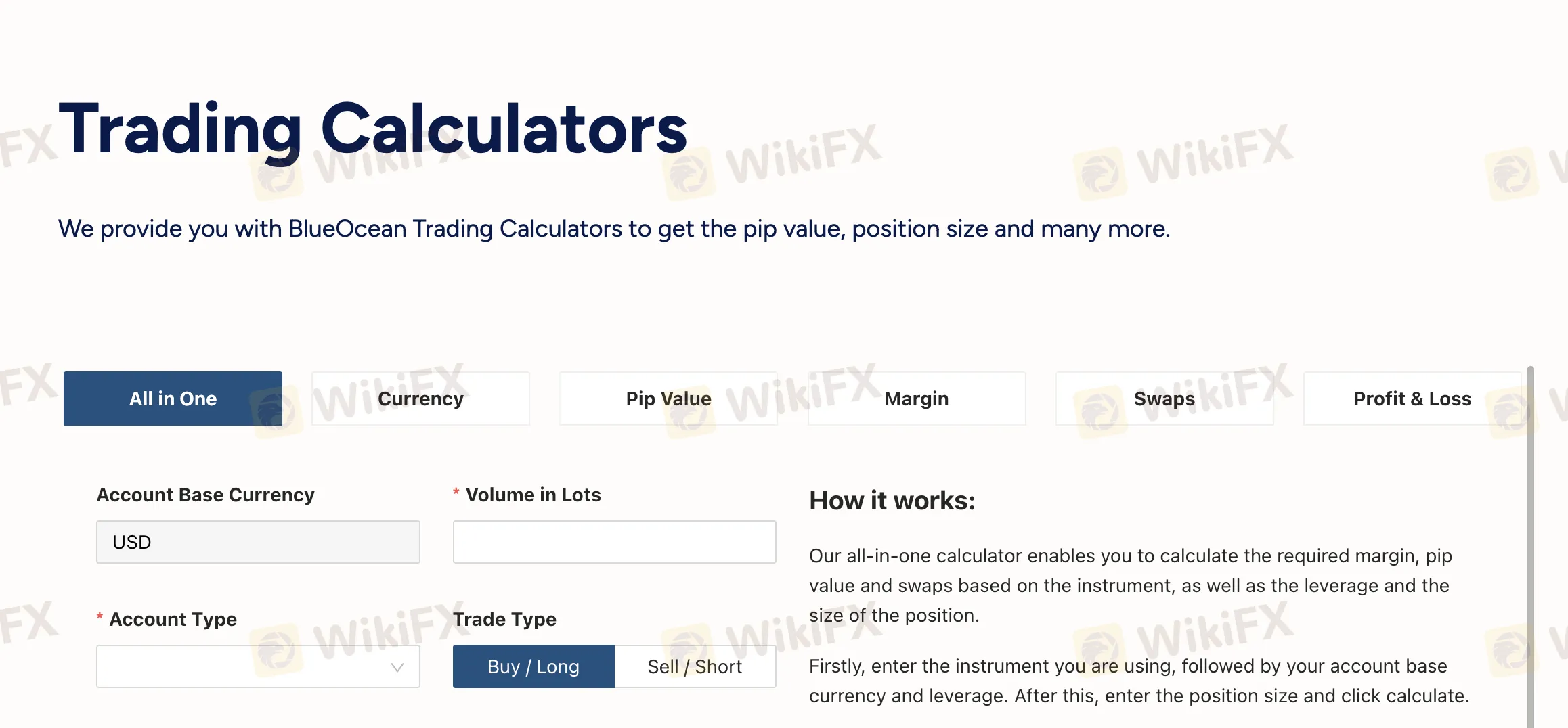

Trading Tools

Blue Ocean provides its clients with exclusive technical indicators that can be used to analyze price charts and identify potential trading opportunities. These indicators are designed to assist traders in making informed decisions based on market trends, patterns, and other technical analysis methods. These tools can help traders with their technical analysis and provide insights into market dynamics.

Trading calculators are available from Blue Ocean to help traders with a variety of computations linked to their transactions. These calculators may be used to figure out margin needs, position sizes, pip values, and prospective gains or losses. Trading calculators are useful tools for risk management and position size that help traders decide on their trades more intelligently.

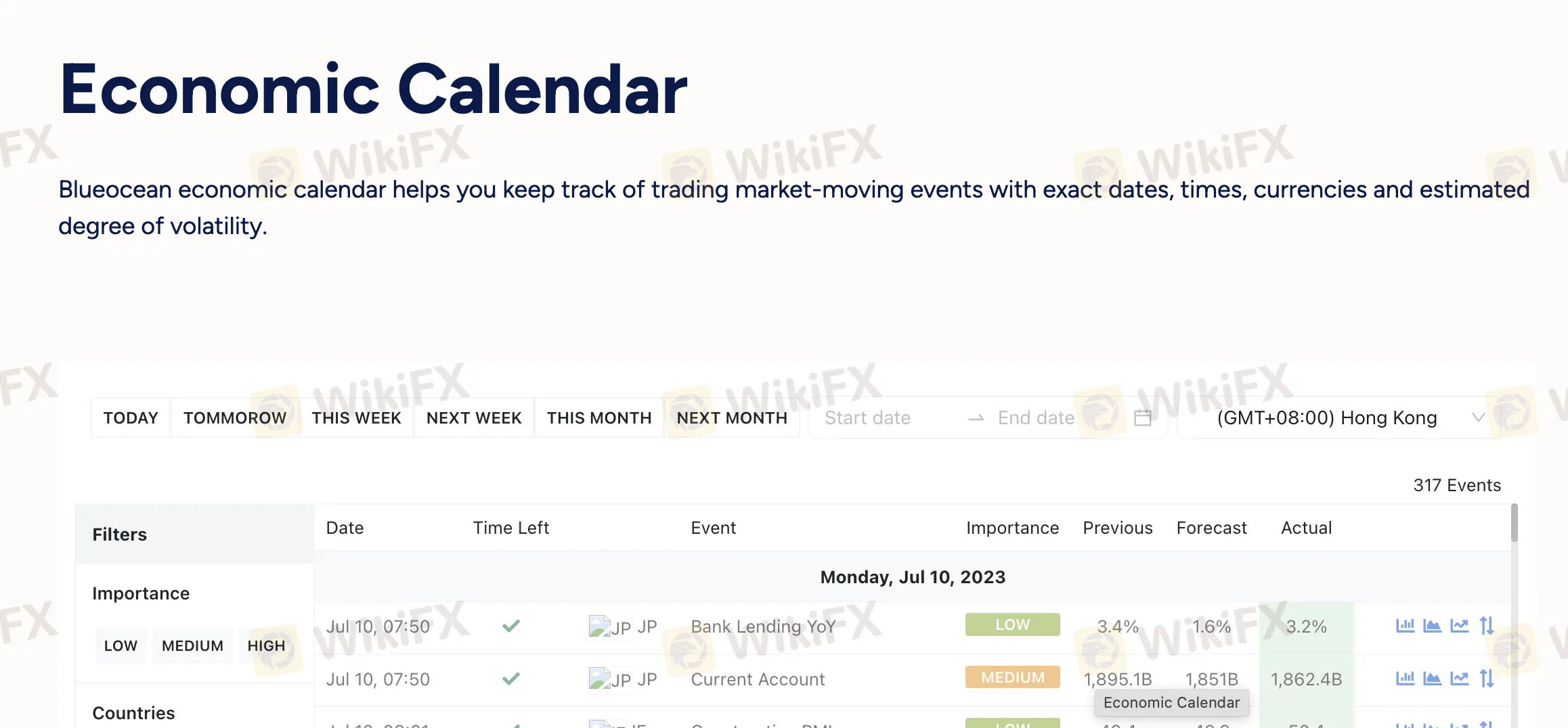

Additionally, Blue Ocean offers an economic calendar that highlights significant news releases, economic events, and important global indicators. The economic calendar aids traders in keeping up with forthcoming developments that can have an effect on the financial markets. Traders may better comprehend market volatility and make knowledgeable trading decisions based on the anticipated impact of these events by keeping track of economic releases.

Furthermore, Blue Ocean provides a trading widget so that customers may get important market data and statistics straight from their website or other platforms. Real-time quotations, market news, economic statistics, and other pertinent information are frequently provided by the widget for traders to use in their trading activity. The widget provides easy access to crucial market data and may be adjusted to suit personal tastes.

Deposits & Withdrawals

Blue Ocean offers its clients a range of convenient deposit and withdrawal options to facilitate funding and accessing their trading accounts. Clients can choose from various payment methods, including CashSphere, 9Pay, Bitcoin, Ethereum, Tether, FPX, and Asian Banks, among others.

The minimum deposit requirement at Blue Ocean is 100 USD, EUR, GBP, NZ.

| Blue Ocean | Most other | |

| Minimum Deposit | $100 | $100 |

For 9Pay withdrawals, Blue Ocean applies a 1% withdrawal fee. This means that when clients choose to withdraw funds from their trading accounts using the 9Pay payment system, a fee of 1% of the withdrawn amount will be charged. The withdrawal fee helps cover the processing and transaction costs associated with the transfer of funds through the 9Pay payment system.

In the case of Tether (USDT) withdrawals, Blue Ocean charges a withdrawal fee of 1% plus USDT.TRC2010. This means that when clients withdraw funds in Tether (USDT) from their trading accounts, they will incur a fee consisting of 1% of the withdrawn amount as well as an additional charge in the form of USDT.TRC2010. The inclusion of USDT.TRC2010 in the withdrawal fee is specific to the Tether network's TRC2010 standard, which may be required for processing Tether withdrawals on the blockchain.

Customer Service

Blue Ocean offers customer service options to assist clients with their inquiries, support needs, and account-related concerns.

Customers may communicate with customer service agents in real-time with Blue Ocean's live chat support service, which is available 24/7. Customers may ask questions, request assistance, and get timely answers to their issues via the live chat tool.

Blue Ocean provides telephone support for clients through the phone number +6037727099.

Clients can also contact Blue Ocean's customer service team through email by sending their inquiries or concerns tosupport@blueoceanfin.com.

Blue Ocean's customer service location is specified as Room 12, 12/F, Block B, Cheung Wah Industrial Building, 10-12 Shipyard Lane, Quarry Bay, Hong Kong.

Education

Blue Ocean offers an educational platform that aims to provide valuable resources and knowledge to its clients. The educational platform covers various topics related to trading and investing, and it is designed to enhance clients' understanding of the financial markets. Here are some key components of Blue Ocean's educational offerings:

Basic Articles: Foundational Concepts and Essential Information About Trading and Investing are covered in Blue Ocean's Basic Articles. These articles are appropriate for those who are new to the field of finance and are looking to gain a firm grasp of the fundamentals.

Product Articles: The instructional platform of Blue Ocean comprises product articles that go in-depth on particular trading tools and asset classes provided by the brokerage house.

Terms Articles: Blue Ocean offers terms articles that provide explanations and definitions of key trading terminologies. These articles help clients develop a comprehensive understanding of industry-specific terms, allowing them to navigate the trading landscape with more confidence and clarity.

Trading Articles: The educational platform of Blue Ocean includes trading articles that cover different trading strategies, techniques, and approaches. These articles provide insights into various trading styles, risk management practices, and market analysis methods.

Fundamentals Articles: Blue Ocean's educational resources cover fundamental analysis, which involves evaluating economic indicators, news events, and geopolitical factors that impact the financial markets. These articles help clients understand how economic data, news releases, and other fundamental factors influence asset prices and market trends.

Technical Articles: Blue Ocean's educational platform also includes technical analysis articles. These articles explore chart patterns, technical indicators, and other tools used to analyze historical price data and identify potential trading opportunities. Technical analysis articles provide clients with insights into the art of interpreting charts and patterns to make informed trading decisions.

Conclusion

In conclusion, while Blue Ocean offers a diverse range of trading instruments, access to popular platforms, and customer support channels, there are important factors that raise concerns about the safety and legitimacy of the brokerage firm. The absence of valid regulation, indicate potential risks associated with engaging with Blue Ocean. Clients are advised to exercise caution, conduct thorough research, and consider regulated and reputable alternatives that prioritize client safety and offer a transparent trading environment. Protecting one's investment and ensuring a trustworthy trading experience should always be a priority when choosing a brokerage firm.

Frequently Asked Questions (FAQs)

Q1: What trading instruments does Blue Ocean offer?

A1: Blue Ocean offers a variety of trading instruments across different asset classes, including forex, stocks, indices, precious metals, energies, commodities, and cryptocurrencies.

Q2: Which trading platforms are available at Blue Ocean?

A2: Blue Ocean provides access to MetaTrader 5 (MT5) and cTrader, two popular and widely used trading platforms.

Q3: Are there different types of accounts offered by Blue Ocean?

A3: Yes, Blue Ocean offers different types of accounts, including Classic and Premium accounts, each with its own minimum deposit requirements and potential benefits.