Company Summary

Company Summary

Company Profile

Note: WeTrades official site - https://www.wetradefx.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Information |

| Registered Country/Region | United Kingdom |

| Found | 2015 |

| Regulation | unregulated |

| Market Instrument | forex, indices, energies, precious metals |

| Account Type | STP, VIP, ECN and Affiliate |

| Demo Account | N/A |

| Maximum Leverage | 1:1000 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MT4 |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | USDT, bank wire transfers |

WeTrade, a trading name of WeTrade International Limited, is a forex broker founded in 2015 and based in London, UK.

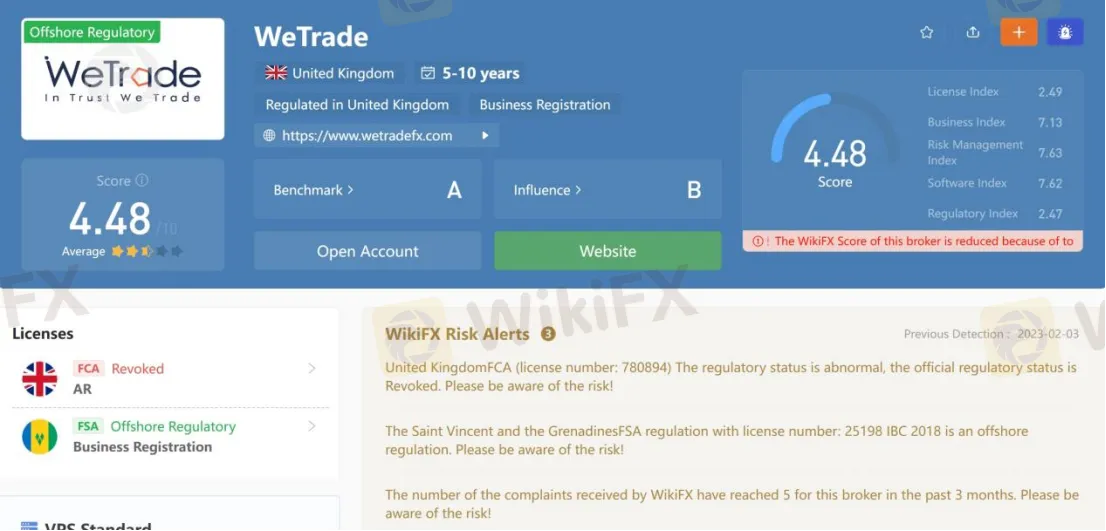

As for regulation, WeTrade holds a revoked (United Kingdom) Financial Conduct Authority license and an offshore regulated (Saint Vincent and the Grenadines) Financial Services Authority license. That is why its regulatory status on WikiFX is listed as “Offshore Regulatory” and receives a relatively low score of 4.48/10. Please be aware of the risk.

Note: The screenshot date is February 3, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

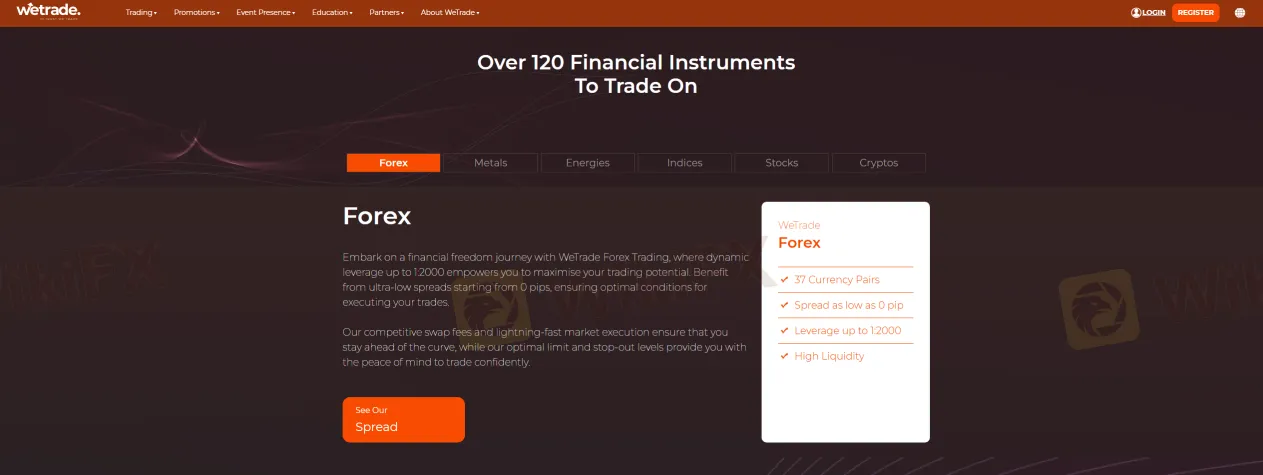

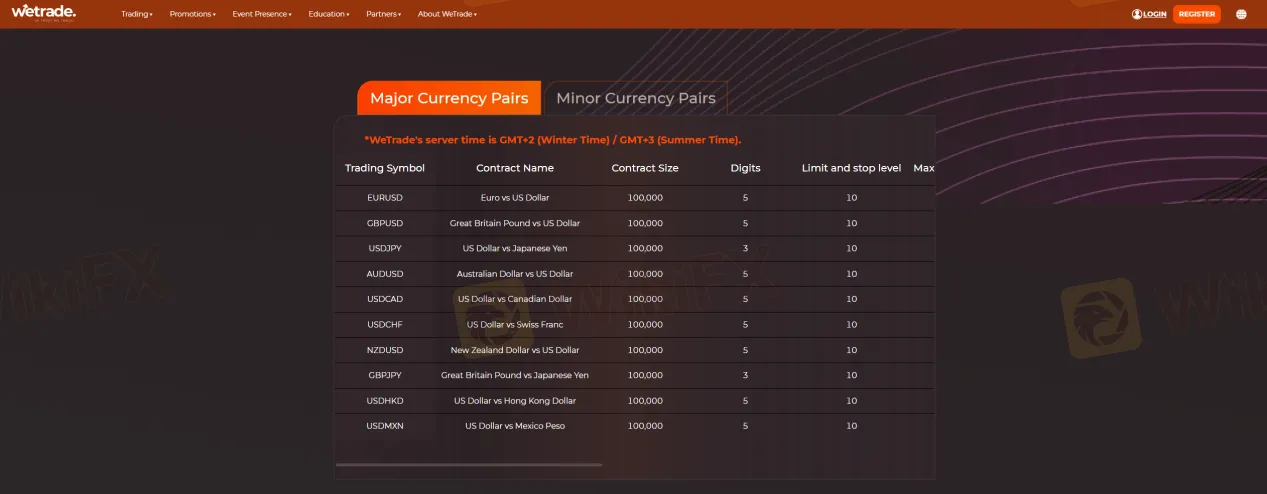

Market Instruments

The company offers a wide range of trading products, including forex, indices, energies, precious metals, four trading categories in total, and more than 60 kinds of trading products.

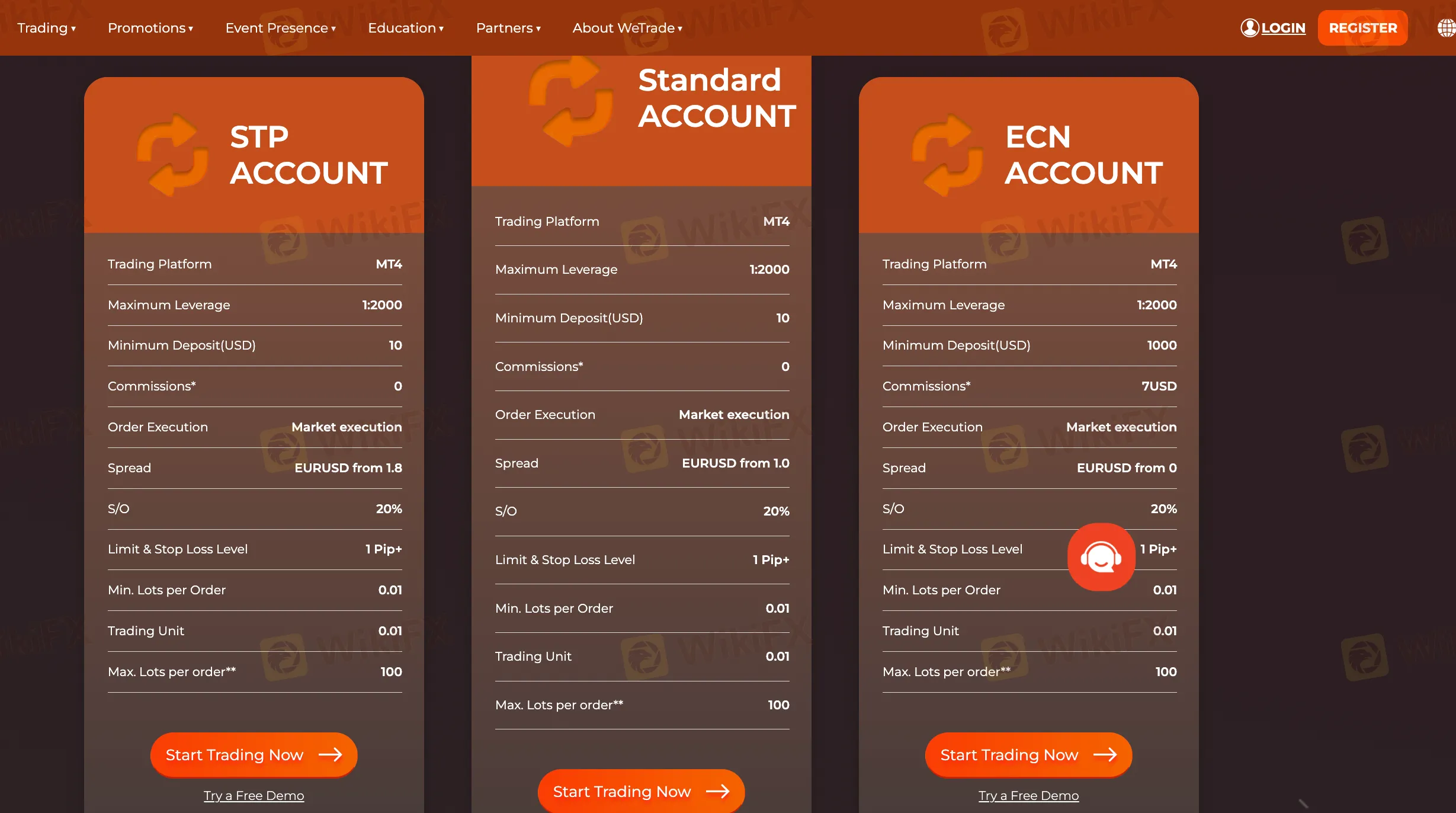

Account Types

WeTrade has set up four types of accounts for investors with various investment needs and strategies, including the STP (minimum deposit of $100), VIP (minimum deposit of $1000), ECN (minimum deposit of $3000), and Affiliate accounts (minimum deposit of $100).

Leverage

When it comes to trading leverage, the maximum leverage is up to 1:1000 for Forex trading, which sounds incredibly high. Inexperienced traders are advised not to use such high trading leverage in case of fund losses.

Spreads

Spreads vary depending on the different account types chosen. The minimum spread for the STP account is 1.8 pips for EUR/USD, with no trading commission. The minimum spread for the VIP account is 1.0 pips for EURUSD, with no trading commission. The minimum spread for the ECN account is 0, charging a commission of 7 USD per lot. The minimum spread for the Affiliate account is 2.3 pips for EURUSD, requiring no trading commission.

Trading Platform

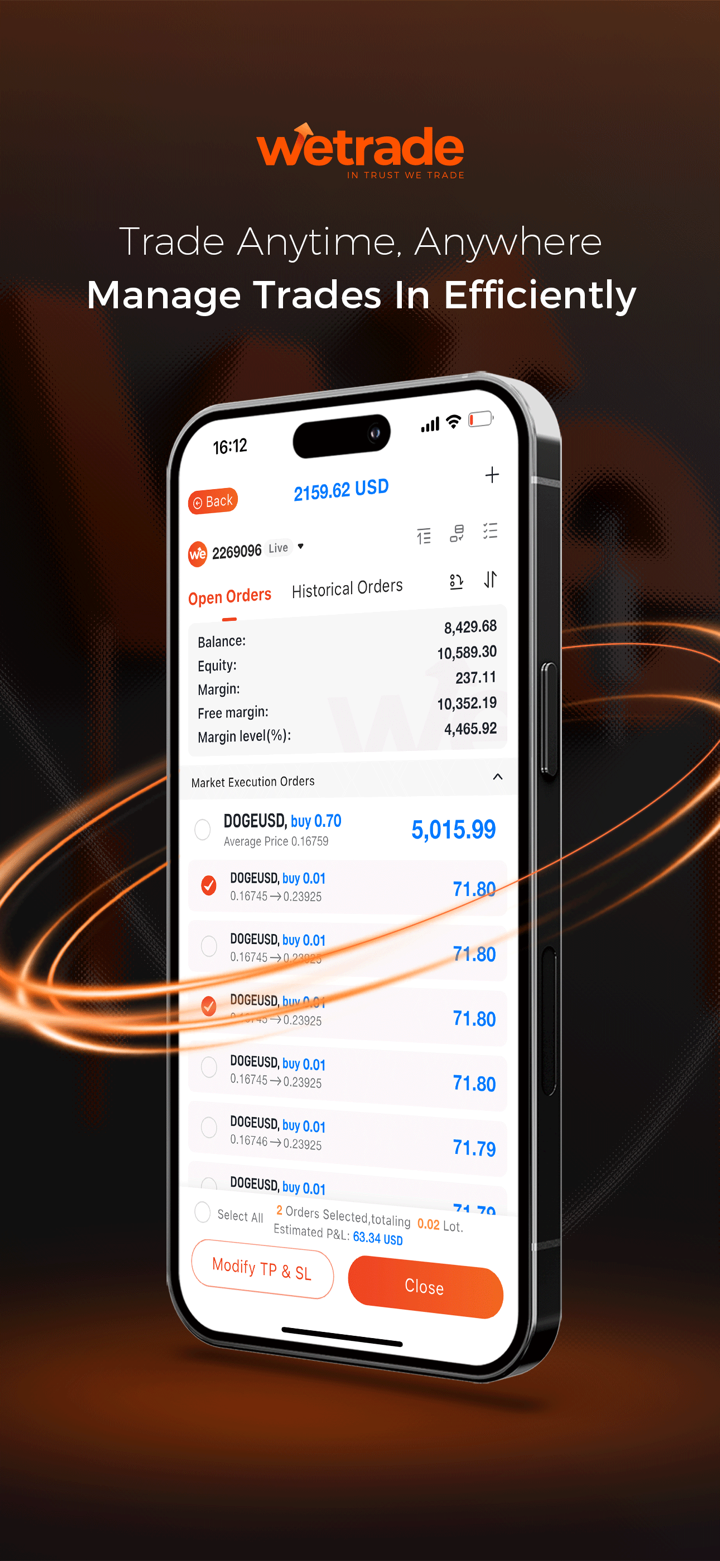

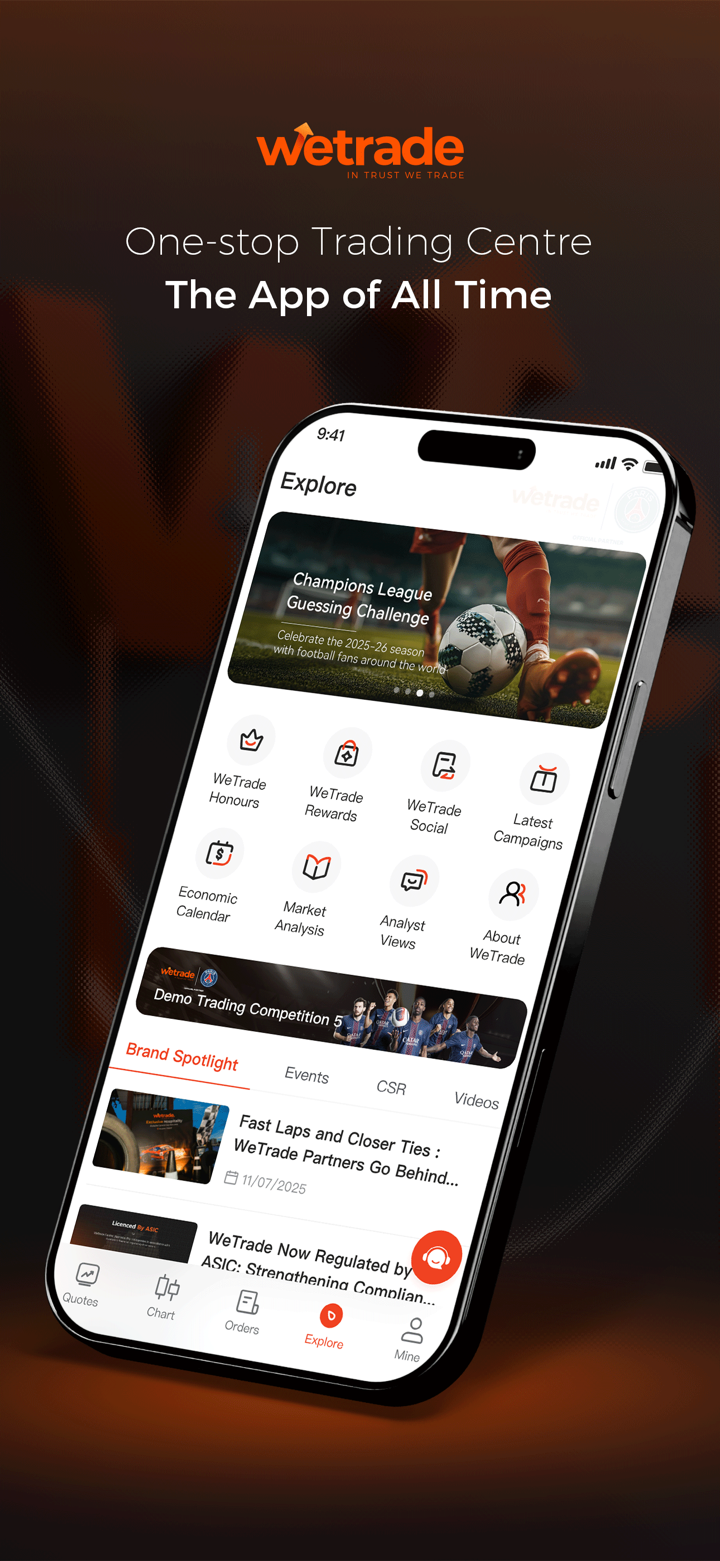

WeTrade offers its clients the advanced and popular MT4 trading platform, MAM and Multi-Account Management Tool (MAM). MT4 comes with robust charting and data analysis functions, available for PC, iOS, and Android versions. The MAM and multi-account management tools are two types of multi-account management systems that allow traders to trade for multiple accounts simultaneously.

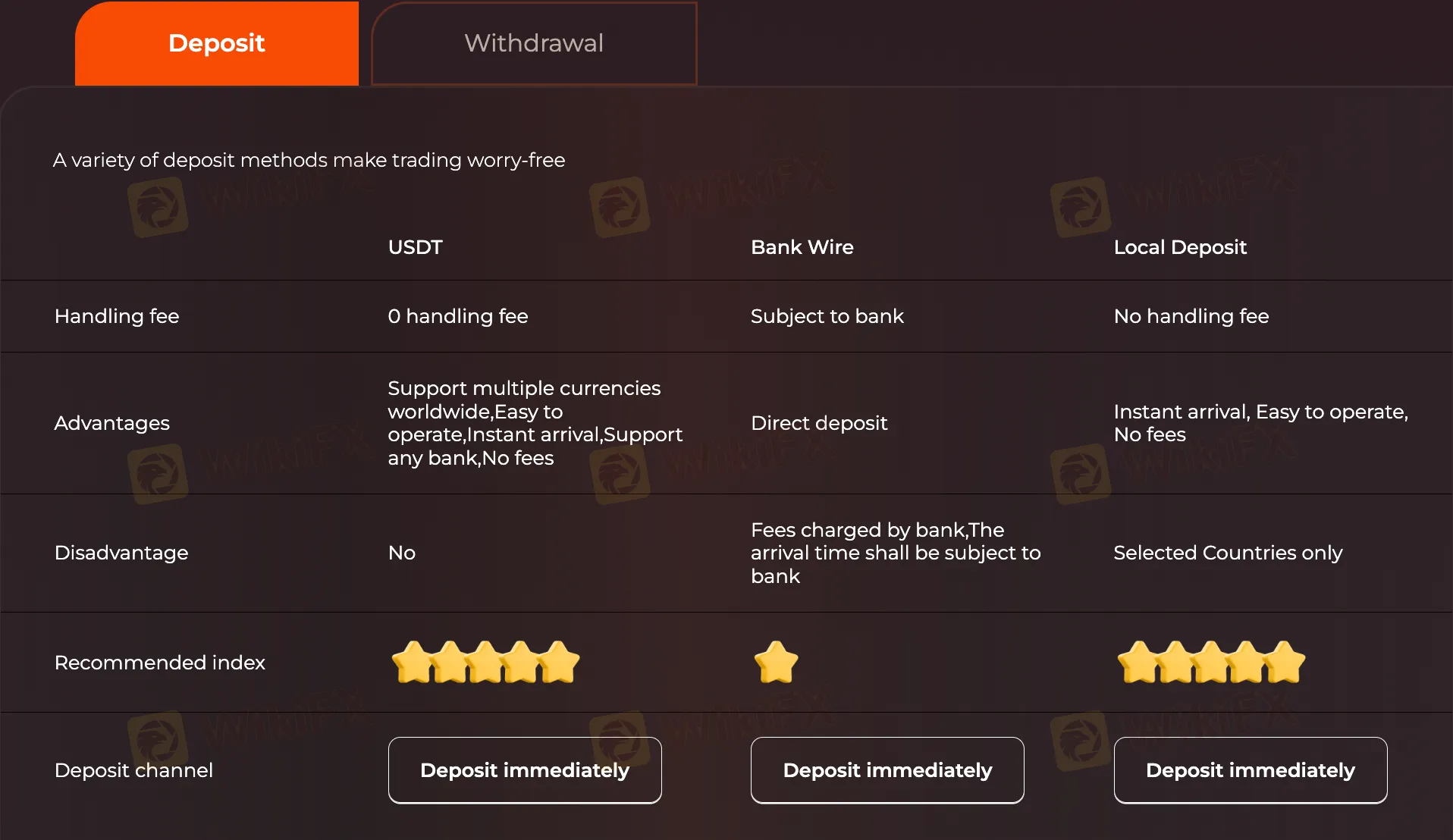

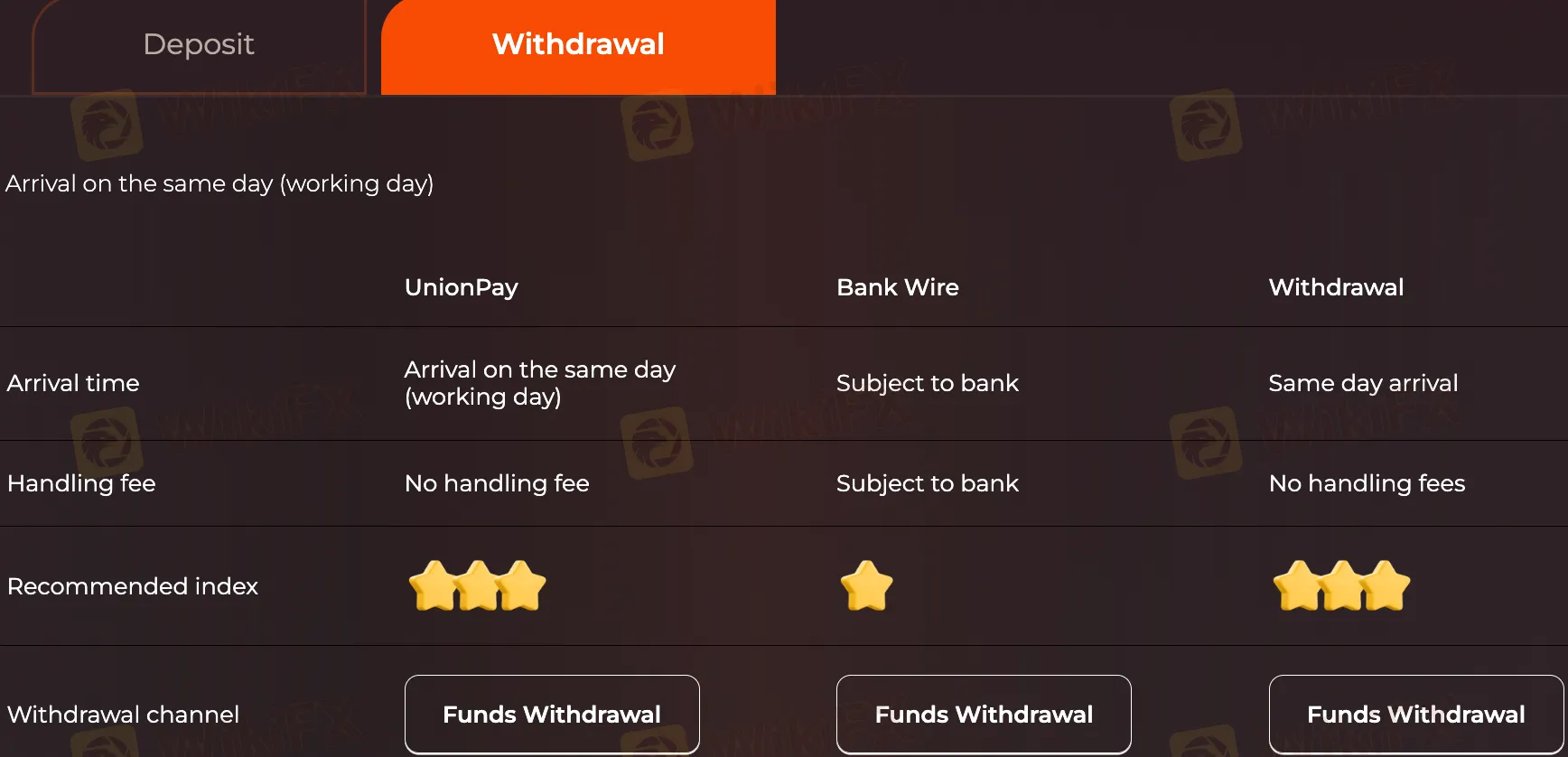

Deposit & Withdrawal

Deposit methods support USDT, wire transfer, no commission for USDT deposit, support any bank, and instant payment. For wire transfers, the bank will charge a fee, and the time of arrival is subject to the bank. Withdrawal methods are CUP and wire transfer. The bank will charge a fee for wire transfers, and the time of arrival will be determined by the bank.

Customer Support

The WeTrade customer support team can be contacted through email: globalsupport@wetradefx.com, chinasupport@wetrade.net, support@wetradefx.com. You can also follow this broker on social networks such as WeChat: wolovewetrade, Facebook, and YouTube.

Pros & Cons

| Pros | Cons |

| • Wide range of trading assets and account types | • No regulation |

| • MT4 supported | • Website inaccessible |

| • Limited funding options |

Frequently Asked Questions (FAQs)

| Q 1: | Is WeTrade regulated? |

| A 1: | No. WeTrade holds a revoked (United Kingdom) Financial Conduct Authority license and an offshore regulated (Saint Vincent and the Grenadines) Financial Services Authority license. |

| Q 2: | Does WeTrade offer the industry-standard MT4 & MT5? |

| A 2: | Yes. WeTrade supports MT4. |

| Q 3: | What is the minimum deposit for WeTrade? |

| A 3: | The minimum initial deposit to open an account is $100. |

| Q 4: | Is WeTrade a good broker for beginners? |

| A 4: | No. WeTrade is not a good choice for beginners. Though it advertises very well, it lacks legitimate regulations. |