Score

Pandora Finance

China|2-5 years|

China|2-5 years| https://www.pandorafxco.com/En.html

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Hong Kong

Hong KongContact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+17743029807

Other ways of contact

Broker Information

More

Pandora Finance Co., Limited

Pandora Finance

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Pandora Finance also viewed..

XM

STARTRADER

GTC

MiTRADE

Pandora Finance · Company Summary

Note: PANDORA FINANCEs official site - https://www.pandorafxco.com/En.html is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| PANDORA FINANCE Review Summary in 10 Points | |

| Founded | 2-5 years |

| Registered Country/Region | China |

| Regulation | Not regulated |

| Market Instruments | Forex, CFDs |

| Demo Account | Yes |

| Leverage | Up to 1:1000 on demo account |

| EUR/USD Spread | Over 1.0 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | Info not disclosed |

| Customer Support | Phone, Email |

What is PANDORA FINANCE?

PANDORA FINANCE is a global brokerage firm based in China. It is a global brokerage company that offers Forex and CFDs as market instruments to traders. However, it is important to note PANDORA FINANCE is currently not regulated by any recognized financial authorities which raises concerns when trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Demo account available | • Not regulated |

| • Wide range of trading instruments across multiple asset classes | • Lack of transparency |

| • MT5 trading platforms | • Many negative reviews from their clients |

| • Website unfunctional |

PANDORA FINANCE Alternative Brokers

There are many alternative brokers to PANDORA FINANCE depending on the specific needs and preferences of the trader. Some popular options include:

Valutrades- Valutrades offers a reliable and user-friendly trading experience, with a range of account types and competitive trading conditions to suit different traders' needs.

Global Prime- Global Prime offers high leverage and competitive spreads. Global Prime is also regulated by ASIC, FCA, and CySEC.

Plus500- Plus500 stands out for its intuitive platform, extensive range of tradable assets, and commission-free trading, making it an attractive option for traders looking for a user-friendly and cost-effective trading experience.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is PANDORA FINANCE Safe or Scam?

When considering the safety of a brokerage like PANDORA FINANCE or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: It is not regulated by any major financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Total 7 pieces of exposures on WikiFX of scam, fraud and unable to withdraw within 3 months are serious red flags that cannot be overlooked, immediate attention and caution in any financial dealings with this broker is suggested when traders consider trading.

Ultimately, the decision of whether or not to trade with PANDORA FINANCE is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

PANDORA FINANCE offers Forex and Contracts for Difference (CFDs) as market instruments.

As a Forex broker, PANDORA FINANCE empowers clients to participate in the vast foreign exchange market, facilitating the buying, selling, exchanging, and speculating of various currency pairs. In addition, the platform provides access to CFDs, allowing traders to engage in leveraged trading on a diverse array of assets, including stocks, indices, commodities, and cryptocurrencies, without needing to own the underlying assets.

Accounts

PANDORA FINANCE provides potential traders with a demo account, offering them an opportunity to practice and explore the platform's features without risking real money. However, concerning their live account options, the brokerage does not openly disclose specific details. Instead, traders are encouraged to directly consult with their representatives to inquire about the available live account options, trading conditions, leverage, and other essential aspects. While this approach may allow for personalized guidance, it raises concerns about transparency. Traders seeking to make informed decisions might find it challenging to evaluate the brokerage fully without comprehensive information on live account offerings. It is crucial for prospective clients to communicate directly with PANDORA FINANCE and ensure they obtain all necessary details before committing to live trading activities.

Leverage

PANDORA FINANCE offers a leverage of 1:1000 for their demo accounts, allowing traders to experience higher buying power and potentially larger gains or losses in a risk-free environment. However, the brokerage does not disclose the specific leverages available for their live accounts. Instead, traders are encouraged to directly consult with the broker to inquire about the leverage options and associated trading conditions. While this approach may allow for a more personalized discussion and tailored trading experience, it also raises concerns about transparency. As such, it is essential for traders to thoroughly communicate with PANDORA FINANCE and ensure a comprehensive understanding of leverage terms before engaging in live trading activities.

Spreads & Commissions

Its said PANDORA FINANCE offers a spread starting from over 1 pip for their trading services. However, the brokerage does not provide further information on spread variations or potential commissions that traders might incur during their transactions. Therefore, traders are advised to directly consult with PANDORA FINANCE representatives to obtain a comprehensive understanding of the spread structure and any associated charges. While this personalized approach could allow for tailored solutions, it raises concerns regarding transparency. Traders may find it challenging to assess the true cost of trading without clear and readily available information on spreads and commissions. To make well-informed decisions, it is crucial for prospective clients to engage in open communication with PANDORA FINANCE and gain clarity on all aspects of their trading costs before initiating any financial commitments.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| PANDORA FINANCE | From over 1 | Not disclosed |

| Valutrades | From 0.1 | No commissions |

| Global Prime | From 0.1 | Variable (depending on account) |

| Plus500 | From 0.5 | No commissions |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Trading Platforms

PANDORA FINANCE provides their clients with access to the popular MetaTrader 5 (MT5) trading platform. MT5 is a robust and versatile trading software widely used in the financial industry, offering advanced features and tools for trading various financial instruments. With MT5, traders can access real-time market data, execute trades, analyze charts, utilize technical indicators, and implement automated trading strategies through Expert Advisors (EAs). The platform's user-friendly interface and multi-asset capabilities cater to the diverse needs of traders, including those interested in Forex, stocks, commodities, indices, and cryptocurrencies.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| PANDORA FINANCE | Web-based platform |

| Valutrades | MT4/5, ValuTrader |

| Global Prime | cTrader, MT5, MT5 |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

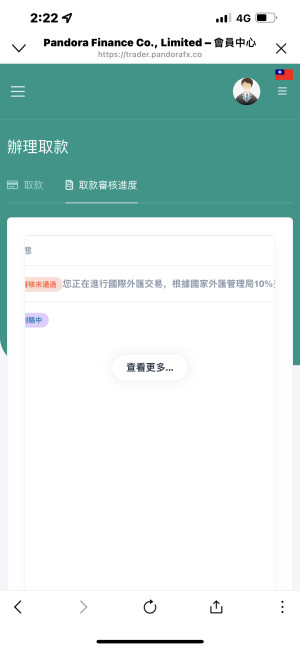

Deposits & Withdrawals

Comprehensive information regarding PANDORA FINANCEs deposit and withdrawal processes is not available on Internet. However, it is worth noting that many brokers in the financial industry commonly offer various payment methods to facilitate these transactions. These options often include bank wire transfers and credit/debit cards, providing secure means for clients to deposit and withdraw funds. Additionally, e-payment systems such as Skrill, Neteller, and PayPal are frequently integrated into brokers' platforms, offering traders increased convenience and flexibility in managing their financial activities. Given the limited information available on the website, potential traders are strongly advised to directly consult with PandoraFX's representatives to obtain clear and accurate details about their specific deposit and withdrawal options, ensuring a well-informed decision-making process before engaging in any financial commitments with the broker.

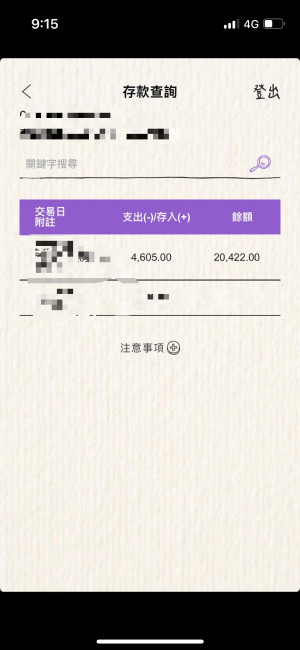

User Exposure on WikiFX

Encountering a total of 7 pieces of exposures on WikiFX, all related to scam, fraud, and difficulties in withdrawing funds, these serve as an alarming signal that cannot be ignored when considering this particular broker. These serious red flags are indicative of potential risks and malpractices within the company's operations. Traders and investors must exercise extreme caution and conduct thorough due diligence before engaging with the broker. The documented instances of scams and withdrawal issues on WikiFX raise significant concerns about the broker's reliability and credibility. It is essential for individuals to prioritize their financial security and seek out brokers with transparent and trustworthy track records to safeguard their investments and avoid potential pitfalls. If you find such fraudulent brokers or have been a victim of one as well, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

PANDORA FINANCE provides multiple customer service options to assist its clients in different areas. Customers can reach out to PANDORA FINANCE through various channels to address their queries and concerns as below:

Phone: +17743029807.

Email: cs@pandorafxco.com.

Conclusion

According to available information, PANDORA FINANCE is a non-regulated China -based brokerage firm. While the firm offers Forex and CFDs as market instruments, it is important to consider certain factors such as lack of regulations and 7 reports of scams, fraud and unable to withdraw within 3 months that raises concerns. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from PANDORA FINANCE before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is PANDORA FINANCE regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does PANDORA FINANCE offer the industry leading MT4 & MT5? |

| A 2: | Yes, it offers MT5 platform |

| Q 3: | Is PANDORA FINANCE a good broker for beginners? |

| A3: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of the lack of transparency and too many exposures on WikiFX within 3 months. |

| Q 4: | Does PANDORA FINANCE offer demo accounts? |

| A 4: | Yes. |

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now