What is T4Trade?

T4Trade is a brokerage firm headquartered in Seychelles, established in 2022. It is regulated by the Financial Services Authority (FSC), ensuring compliance with industry standards. The company offers a comprehensive range of tradable assets, including Forex, Precious Metals, Indices, Commodities, and Futures, catering to the diverse investment preferences of traders.

Traders on T4Trade can select from various account types, namely Cent, Standard, Premium, and Privilege, designed to meet different trading requirements and strategies. The Privilege account, for instance, boasts competitive spreads starting from 1.1 pips.

T4Trade provides access to popular trading platforms such as MetaTrader 4 (MT4), MT4 Webtrader, T4Trade Mobile App, and T4Trade Web App. These platforms are renowned for their advanced features, intuitive interfaces, and extensive tools and indicators, empowering traders with the necessary resources to execute their strategies effectively.

Lastly, T4Trade equips traders with a range of educational resources. These include informative news updates, comprehensive economic calendars, insightful blogs, instructive videos, engaging webinars, enriching eBooks.

Here is the home page of this brokers official site:

Is T4Trade Legit or a Scam?

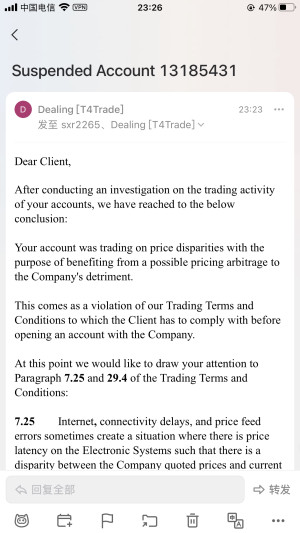

T4Trade is regulated and authorized by an offshore regulatory authority, The Seychelles Financial Services Authority, under license number SD029. While the Seychelles Financial Services Authority is an offshore regulatory authority, it still provides a level of oversight and protection for traders. Nonetheless, traders should evaluate the regulatory status of any broker they are considering working with and carefully consider the risks involved.

Pros and Cons of T4Trade

T4Trade boasts several enticing benefits for traders, including an extensive selection of tradable assets, generous leverage options of up to 1:1000, a multitude of trading platforms to choose from, and a diverse range of account options. Additionally, T4Trade provides valuable educational resources to support traders in their journey. However, it is important to consider a few potential drawbacks. Firstly, T4Trade operates under offshore regulation, which might raise concerns regarding regulatory oversight. Furthermore, customer support channels are somewhat limited, and there is a lack of specific information about the availability of a demo account. Additionally, it is worth noting that customer support is not provided around the clock, and the spreads offered by T4Trade are relatively higher compared to some competitors.

Market Instruments

T4Trade offers a diverse range of trading options across six asset classes:

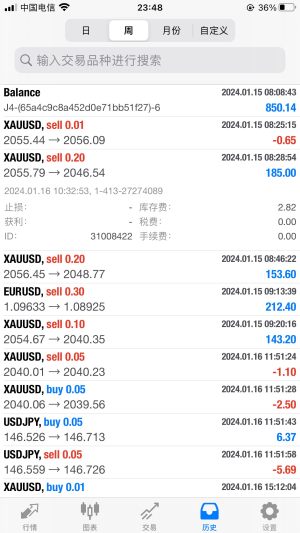

Forex: T4Trade features over 50 currency pairs, including major and minor currencies, available on the MetaTrader 4 (MT4) platform. These pairs offer high liquidity and tight spreads, appealing to both novice and experienced traders.

Precious Metals: The platform includes trading in valuable metals such as gold, silver, and copper, known for their stability and portfolio diversification benefits.

Indices: Traders can speculate on the performance of more than 20 global stock market indices like the S&P 500, FTSE 100, and Nikkei 225.

Commodities: Available commodities include oil, natural gas, and agricultural products. These markets are influenced by factors like supply and demand dynamics, geopolitical events, and weather conditions.

Futures: T4Trade allows futures trading on various assets including commodities, indices, and forex pairs. This enables traders to hedge their portfolios and manage risks effectively.

Shares: The broker also facilitates share trading, providing opportunities to invest in the stock market which requires careful consideration of investment goals and risk tolerance.

T4Trade Live and Cent Accounts

T4Trade offers four distinct account types designed to cater to a variety of trader needs and preferences: Live accounts can be categorized into fixed and floating types based on the spread options available.

The Cent account operates similarly to the Live accounts, with the primary distinction being that dollars are denominated in cents. For instance, a deposit of $100 is converted and credited as 10,000 cents in the Cent account. Trading on the Cent account is an excellent option for beginners looking to enter the trading world.

Live accounts:

Standard Account:

Average Spread: 1.8

Flexible Leverage: Up to 1:1000

Base Currency: Options include USD, EUR, and GBP.

Minimum Lot Size: 0.01

Commission: No commission is charged on trades.

Premium Account:

Average Spread: 1.6

Flexible Leverage: Up to 1:1000

Base Currency: Options include USD, EUR, and GBP.

Minimum Lot Size: 0.01

Commission: No commission is charged on trades.

Privilege Account:

Average Spread: 1.1, offering more competitive pricing.

Flexible Leverage: Up to 1:1000

Base Currency: Options include USD, EUR, and GBP.

Minimum Lot Size: 0.01

Commission: No commission is charged on trades.

Cent Account (Standard):

This account is particularly tailored for entry-level traders or those looking to trade with smaller amounts.

Average Spread: 1.8

Flexible Leverage: Up to 1:1000

Base Currency: USC (US Cent), making it accessible for micro trading.

Minimum Lot Size: 0.01

Commission: No commission is charged on trades.

How to open an account?

Opening an account with T4Trade is a straightforward process that can be completed online in just a few easy steps.

The first step is to visit T4Trade's website and select the “Trade Now or Sign up” option. This will take you to the account registration page, where you will be asked to provide some basic personal information such as your name, email address, and phone number.

Once you have provided this information, you will be asked to provide some additional information such as your address, date of birth, and trading experience. After filling in detailed information, you need to choose an account type that suits your trading needs and preferences. T4Trade offers a variety of account types, from standard accounts to premium accounts.

Once your account has been approved, you can fund your account using one of the many payment options available.

In summary, opening an account with T4Trade is a simple and straightforward process that can be completed online in just a few easy steps. By providing some basic information and selecting an account type that suits your trading goals and preferences, you can start trading the markets with confidence and ease.

Leverage

T4Trade offers flexible leverage options for its clients, with the maximum trading leverage up to 1:1000. This means that a trader can potentially control a larger position with a smaller amount of capital, allowing for greater potential profits but also higher risks.

While high leverage can increase potential profits, it is important for traders to carefully consider the risks and ensure that they have a solid risk management plan in place. It is also crucial to note that leverage may vary depending on the chosen account type and the financial instrument being traded.

T4Trade's range of account types provides a variety of leverage options to suit the needs of different traders. The standard account, for example, offers flexible leverage up to 1:1000, while the premium and privilege accounts offer even higher leverage options.

Spreads & Commissions

T4Trade provides traders with four different account types to choose from: Standard, Premium, Privilege, and Cent. In the case of T4Trade, there is no commission charged for any of the four trading account types. This means that traders do not have to pay extra for opening or closing a position; they only have to worry about the spread.

T4Trade offers its traders a diverse range of account types to cater to varying trading needs and preferences. The spread for the Standard account is 1.8 pips, which is same as the cent account's offering. The Premium account offers a slightly lower spread of 1.6 pips. Advanced traders may opt for the Privilege account, which boasts a spread as low as 1.1 pips, making it an attractive choice for those looking to execute large volume trades. As for the Cent account, as we mentioned before, it offers the same spread as the Standard account, but with the added benefit of being designed for traders who want to start trading with a smaller capital. It's essential to note that these spreads may vary depending on market conditions and other factors. Therefore, traders need to consider their trading needs and preferences carefully before selecting an account type.

T4Trade offers both live floating and live fixed spreads for trading on its platform, with detailed information provided on the website.

The fixed spreads are applicable under normal trading conditions during the day trading session. However, during more volatile night trading sessions, fixed spreads may be wider than those displayed below.

It's important to note that during the midnight session (11pm-2am, GMT+2), T4Trade changes the live fixed spreads to live floating spreads. This is because of the increased market volatility during this time, which requires a more flexible approach to pricing. The live floating spreads offered by T4Trade are variable and change according to market conditions and liquidity. Traders can view the spreads for each instrument in the trading platform under the market watch section, helping them to make informed trading decisions.

Trading Platform

T4Trade offers a range of trading platform options that cater to different trading needs. The popular MetaTrader 4 (MT4) software is available for traders who prefer a desktop platform. MT4 provides advanced charting, technical analysis tools, and customizable indicators to help traders make informed trading decisions.

For traders who prefer a more mobile trading experience, T4Trade provides a mobile trader app that allows them to access market information and trade from anywhere. T4Trade also offers a web-based trading platform, the T4Trade webtrader app, which provides easy access to the platform from any device with an internet connection.

The user-friendly interface and customizable features of T4Trade's trading platforms make it easier for traders to focus on their trading strategies and analysis. Overall, T4Trade's trading platform is a reliable and efficient option for traders looking for a range of trading options and advanced technical analysis tools.

Here's a comparison table showing T4Trade's trading platform options with other brokers:

Non-Trading Fees

In addition to trading fees, T4Trade also charges non-trading fees. These fees are associated with services that are not directly related to trading activities.

Some of the non-trading fees charged by T4Trade include deposit and withdrawal fees. These fees may vary depending on the payment method used by the trader. For example, deposit fees may be charged for credit card deposits, while withdrawal fees may be charged for bank wire transfers.

Another non-trading fee charged by T4Trade is the inactivity fee. This fee is applied for accounts that have been inactive for a prolonged period of time. The duration of inactivity and the corresponding fee may vary depending on the trader's account type.

Additionally, T4Trade may charge fees for currency conversion. This fee may be applied if a trader is depositing or withdrawing funds in a currency that is different from their trading account currency.

Bonuses

T4Trade claims to offer the 100% Bonus, the 40% Bonus and the 20% Bonus. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators.

Customer Support

Traders can reach the T4Trade support team through email or a contact form, which is available on the website. The support team is available to answer questions and provide assistance with any issues that traders may encounter while using the platform.

Educational Resources

T4Trade provides a range of educational resources to help traders improve their knowledge and skills. The T4Trade Academy offers a series of educational resources, including webinars, eBooks, podcasts, and video on demand. The Academy covers a wide range of topics, from fundamental analysis to trading psychology, providing traders with the tools they need to make informed trading decisions.

T4Trade also offers Live TV, which is a live news, analysis, and expert opinion service that gives traders up-to-date information on market events. Live TV helps traders stay informed about the latest developments in the financial world, helping them to respond quickly to market trends.

Conclusion

In conclusion, T4Trade offers several appealing features that can benefit traders in their financial endeavors. The broker provides a wide range of tradable assets, high leverage options, multiple trading platforms, and various account types to cater to different trading preferences. However, there are certain aspects that warrant consideration. T4Trade operates under offshore regulation, which may raise questions about the level of regulatory oversight. The customer support channels are somewhat limited, and specific details regarding the demo account are not provided. Furthermore, the absence of 24/7 customer support and the presence of relatively higher spreads could be potential drawbacks for traders.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX