Score

Cowtrading Wealth Ltd

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.cowtradingvip.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Cowtrading Wealth Ltd

Cowtrading Wealth Ltd

United Kingdom

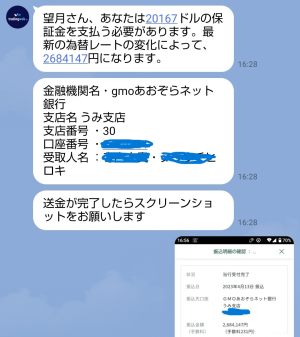

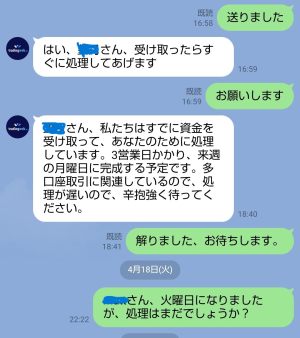

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

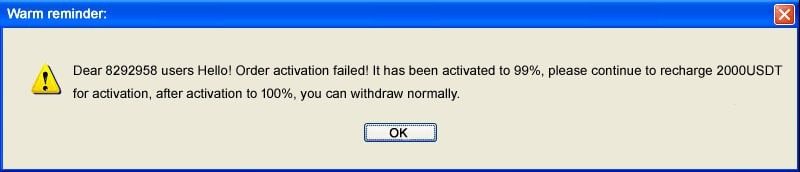

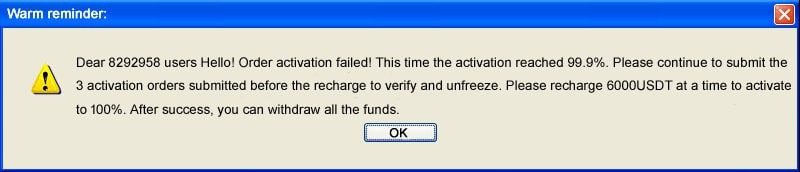

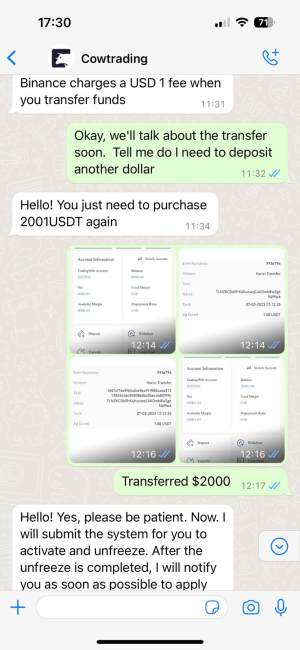

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

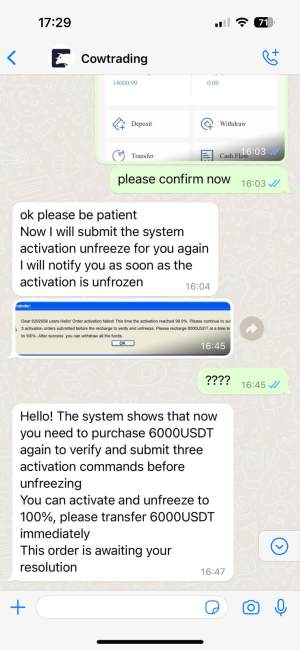

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The United StatesNFA regulation (license number: 0552353) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Cowtrading Wealth Ltd also viewed..

XM

Decode Global

VT Markets

IC Markets

Cowtrading Wealth Ltd · Company Summary

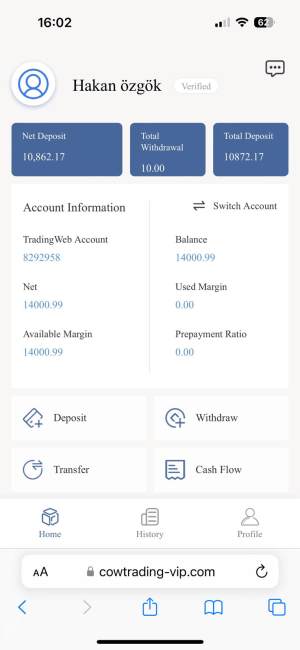

| Cowtrading Wealth | Basic Information |

| Company Name | Cowtrading Wealth |

| Founded | 2022 |

| Headquarters | United Kingdom |

| Regulations | Not regulated (Suspicious Clone) |

| Tradable Assets | Forex, Indices, Commodities |

| Account Types | Standard Account, Professional Account |

| Minimum Deposit | $100 |

| Maximum Leverage | 500:1 |

| Spreads | Competitive for forex trading |

| Commission | No commissions |

| Deposit Methods | Not specified |

| Trading Platforms | AppGlobalEasy |

| Customer Support | Email support@fxcowltd.com |

| Education Resources | Not specified |

| Bonus Offerings | “Introduce a Broker” program for commission-based bonuses |

Overview of Cowtrading Wealth

Cowtrading Wealth is an online trading platform based in the United Kingdom that provides access to Forex, Indices, and Commodities trading. They offer two types of trading accounts, namely the Standard Account and the Professional Account, catering to different trading preferences and experience levels. Traders can access the markets through the user-friendly AppGlobalEasy platform, which offers real-time charts, news events, and analytical tools.

While Cowtrading Wealth boasts competitive spreads and a maximum leverage of 500:1, it's important to note that the platform is not regulated by recognized financial authorities. This lack of regulation raises concerns about the credibility and safety of the platform. Additionally, limited transparency regarding important aspects such as deposit methods and education resources is another drawback. Customer support is available via email, but its availability and responsiveness may be questionable. The platform also lacks educational resources to help traders enhance their knowledge and skills.

Overall, while Cowtrading Wealth offers trading opportunities in multiple markets with its diverse range of instruments, caution is advised due to the lack of regulation and limited transparency. Traders should conduct thorough research and consider their risk tolerance before engaging with this platform.

Is Cowtrading Wealth Legit?

Cowtrading Wealth is not regulated or may have questionable regulation claims. The statement warns that the broker currently lacks valid regulation and suggests being cautious due to the associated risks. Additionally, it mentions suspicions about the broker's claimed United States NFA (National Futures Association) regulation licenses, indicating that they might be cloned or fraudulent. These warnings indicate the importance of exercising caution and conducting thorough research before engaging with Cowtrading Wealth.

Pros and Cons

Cowtrading Wealth has several notable drawbacks. Firstly, it lacks regulation from recognized financial authorities, raising concerns about its credibility. There are suspicions of cloning, indicating potential fraudulent behavior. The platform also lacks transparency, providing limited information on important aspects such as deposit methods and education resources. Customer support may be unreliable, and the platform lacks educational materials for traders. These factors highlight the need for caution when dealing with Cowtrading Wealth.

| Pros | Cons |

| None | Lack of Regulation: Cowtrading Wealth is not regulated by any recognized financial authority. |

| Cloning Suspicions: Cowtrading Wealth has been flagged as a suspicious clone, indicating that it may be impersonating a legitimate broker or using misleading information. | |

| Limited Transparency: The platform does not provide detailed information about important aspects such as deposit methods, education resources, and trading terms. | |

| Limited Customer Support: While Cowtrading Wealth offers customer support via email, the availability and responsiveness of their support team may be questionable. | |

| Lack of Educational Resources: The platform does not provide specific details about educational resources or materials to help traders enhance their knowledge and skills. |

Trading Instruments

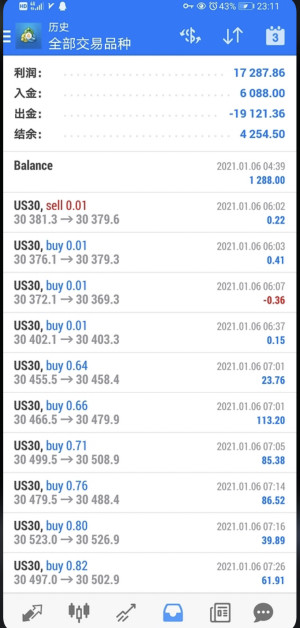

Cowtrading Wealth offers a diverse range of trading instruments, including Forex trading, Index trading, and Commodity trading.

Forex trading allows traders to take advantage of margin trading with competitive spreads. It involves buying more currency pairs using leverage, which can amplify gains or losses. Cowtrading Wealth accepts orders of all sizes and offers leverage ranging from 1:25 to 1:400. Traders can run multiple positions, use various order types, and benefit from transparency and no slippage under normal market conditions.

Index trading enables traders to monitor and profit from global stock market movements by trading Index CFDs. These CFDs track major stock market indices like the Dow Jones and S&P 500, allowing traders to take positions based on their overall market view. Index CFDs provide simplicity, affordability, and the ability to short an index for profitable trades in a falling market or as a hedge against an existing stock portfolio.

Commodity trading offers a cost-effective way to participate in the global commodity markets. Traders can diversify their portfolios and protect against inflation by including commodities. Commodities are subject to price volatility due to supply and demand factors. By having commodities in their portfolio, traders can improve risk-adjusted returns and potentially benefit from rising markets while protecting against heavy losses.

These trading instruments provided by Cowtrading Wealth aim to cater to different investment strategies and goals. Traders can leverage their positions, monitor stock market movements, and participate in the commodity markets to enhance trading opportunities and manage risk effectively.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | CFDs | Crypto | Stocks | Commodities | ETFs | Options | Indices |

| Cowtrading Wealth | Yes | Yes | No | No | Yes | No | No | Yes |

| Capital Bear | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Quadcode Markets | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Deriv | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Account Types

Cowtrading Wealth offers two types of trading accounts to meet the varying needs of traders: the Standard Account and the Professional Account.

The Standard Account requires a minimum deposit of $100 USD and provides a maximum leverage of 500:1. Traders using this account type can execute trades with a default maximum per click of 100 lots. The point spread type is set to float, meaning the spreads can vary based on market conditions. The Standard Account allows trading in spot forex, indices, and commodities. Traders can access the account through the AppGlobalEasy, Web, and Mobile platforms. Multiple currency options, including AUD, USD, GBP, EUR, and SGD, are available for account holders. The minimum transaction size is 0.01 lots, and there are no commissions charged for trades. A margin call is triggered when the account's equity falls to 50% of the required margin.

The Professional Account requires a minimum deposit of $300 USD and offers a maximum leverage of 500:1. The default maximum per click for trades is also set at 100 lots. Like the Standard Account, the point spread type is float, allowing spreads to fluctuate with market conditions. The Professional Account supports trading in spot forex, indices, and commodities. Traders can access the account through the AppGlobalEasy, Web, and Mobile platforms. Similar to the Standard Account, multiple currency options are available for account holders. The minimum transaction size is 0.01 lots, and no commissions are charged for trades. The margin call level for the Professional Account is set at 50%.

These account types are designed to accommodate traders with different levels of experience and trading preferences. By offering flexible leverage, tradable instruments, and platform options, Cowtrading Wealth aims to provide a trading environment that suits individual traders' needs.

How to Open an Account?

To open an account with Cowtrading Wealth, follow these steps:

Visit the Cowtrading Wealth website. Look for the “REGISTER ACCOUNT” or “LOGIN” button on the homepage and click on it.

2. Sign up on websites registration page.

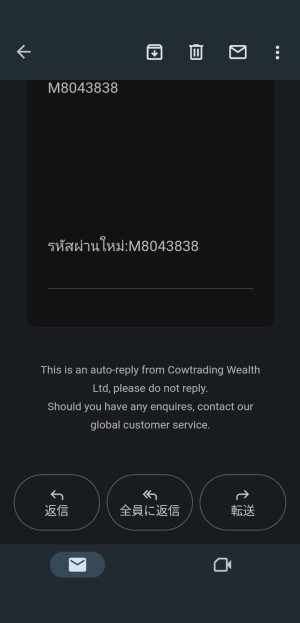

3. Receive your personal account login from an automated email

4.Log in

5.Proceed to deposit funds to your account

6.Download the platform and start trading

Leverage

Cowtrading Wealth offers leverage options for traders. The Standard Account and the Professional Account provide a maximum leverage of 500:1. Leverage allows traders to control larger positions with a smaller amount of capital. Traders can take advantage of margin trading and amplify gains (or losses) without divesting existing investments. It is important to understand the risks associated with leverage and use it wisely. Cowtrading Wealth accepts orders of all sizes and offers leverage ranging from 1:25 to 1:400, depending on the specific trading instruments.

Traders can run multiple positions, use various order types, and benefit from transparency and no slippage under normal market conditions.It's worth mentioning that leverage is a tool that can be used strategically, but it requires careful risk management and understanding of the potential consequences. Traders should assess their risk tolerance and trading strategies before utilizing leverage in their trades.

Here is a comparison table of maximum leverage offered by different brokers:

| Cowtrading Wealth | Capital Bear | Quadcode Markets | Deriv | |

| Maximum Leverage | 1:500 | 1:5 | 1:30 | 1:1000 |

Spreads and Commissions

Cowtrading Wealth offers spreads that are favorable for forex trading, allowing traders to benefit from market opportunities. They strive to provide narrow spreads, minimizing the difference between the bid and ask prices, which can help reduce trading costs for traders.

When it comes to index CFD trading, Cowtrading Wealth does not charge additional commissions or fees. This means that traders can access various global exchanges and take advantage of trading opportunities without incurring extra costs.

By focusing on providing favorable spreads and eliminating additional charges, Cowtrading Wealth aims to offer cost-efficient trading options for their clients.

Deposit & Withdraw Methods

[Describe (briefly) the Deposit & Withdraw Methods of * (in paragraphs) ]

The details regarding deposit and withdrawal options are not specified in the available information. It's recommended to contact Cowtrading Wealth directly or visit their website for accurate and up-to-date information on deposit and withdrawal methods.

Cowtrading Wealth offers two types of trading accounts: the Standard Account and the Professional Account. For the Standard Account, the minimum deposit required is $100 USD. This account is suitable for traders who prefer to start with a smaller initial investment. On the other hand, the Professional Account requires a minimum deposit of $300 USD, which indicates that it caters to more experienced traders or those who are willing to commit a higher amount of capital.

Trading Platforms

[Describe (briefly) the Trading Platforms of Cowtrading Wealth (in paragraphs) ]

Cowtrading Wealth offers the AppGlobalEasy trading platform, which provides traders with access to various markets, including FX, index, and CFDS, all through a single account and platform. With AppGlobalEasy, traders can enjoy a comprehensive trading experience with features such as real-time charts, real-time news events, and a range of analytical tools.

One notable feature of AppGlobalEasy is its support for algorithmic trading, allowing traders to seamlessly utilize trading bots directly on their chosen charts. The platform also offers access to trading signals, AppGlobalEasy marketplaces, and a global community of peer traders, enhancing the trading experience and facilitating interaction among traders.

Furthermore, the AppGlobalEasy trading platform provides a real-time interactive chart with 30 different technical indicators, 33 analysis objects, and nine time horizons. Traders can customize their charting preferences and choose from multiple chart types to suit their trading strategies.

It is important to note that AppGlobalEasy is not compatible with MacOS versions beyond Mojave (10.14) and will not work with the MacOS Catalina update (10.15).

Customer Service

Cowtrading Wealth values customer satisfaction and provides a dedicated customer service team to assist traders. If you have any inquiries, concerns, or need assistance, you can reach out to the customer service team via email at support@fxcowltd.com.

The customer service team is available during regular business hours from Monday to Friday, from 9:30 in the morning until 6:30 in the afternoon. However, please note that the customer service department is closed on Saturdays and Sundays.

Trading Tools

Cowtrading Wealth provides traders with a useful trading tool known as the economic calendar. This calendar offers valuable information about upcoming economic events that can impact the financial markets, such as interest rate decisions, GDP releases, and employment reports. Traders can utilize this tool to stay updated on the schedule and expected outcomes of these events, enabling them to anticipate market volatility and adjust their trading strategies accordingly. The economic calendar is designed to be user-friendly and comprehensive, allowing traders to filter events based on their relevance to specific markets or instruments. By utilizing the economic calendar, traders can make more informed trading decisions based on market expectations and historical data analysis.

Bonus

Cowtrading Wealth offers a bonus program called “Introduce a Broker” for individuals or companies who refer new clients to open real trading accounts with them. As an introducing broker, you can earn high commissions in real-time whenever your recommended clients close trades. There is no limit to the number of transactions clients can make, providing unlimited earning potential. Cowtrading Wealth values transparency and provides a personal portal to track important details such as visitors, registrations, and customer transactions. They also offer a dedicated Account Manager and prompt support for any inquiries.

Conclusion

In conclusion, Cowtrading Wealth offers online trading services in Forex, Indices, and Commodities markets through its Standard and Professional accounts. However, the platform has several disadvantages, including the lack of regulation, suspicions of cloning, limited transparency, questionable customer support, and a lack of educational resources. These drawbacks raise concerns about the platform's credibility and reliability. Traders should exercise caution and thoroughly evaluate the risks before considering Cowtrading Wealth as a trading option.

FAQs

Q: Is Cowtrading Wealth a regulated platform?

A: No, Cowtrading Wealth is not regulated by any recognized financial authority, which raises concerns about its credibility and the level of protection it provides to traders.

Q: What trading instruments are available on Cowtrading Wealth?

A: Cowtrading Wealth offers trading in Forex, Indices, and Commodities markets, allowing traders to access a variety of investment opportunities in these asset classes.

Q: How can I contact the customer support team at Cowtrading Wealth?

A: You can reach out to Cowtrading Wealth's customer support team via email at support@fxcowltd.com. However, the availability and responsiveness of their support team may be questionable.

Q: What is the minimum deposit required to open an account with Cowtrading Wealth?

A: The minimum deposit required to open an account with Cowtrading Wealth is $100 USD for the Standard Account and $300 USD for the Professional Account.

Q: What trading platform does Cowtrading Wealth offer?

A: Cowtrading Wealth offers the AppGlobalEasy trading platform, which provides access to various markets, real-time charts, news events, analytical tools, and supports algorithmic trading.

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now