简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

XM 、FXTM 交易商比较(前端未翻译)

Do you want to know which is the better broker between XM and FXTM ?

在下表中,您可以并排比较 XM 、 FXTM 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

EURUSD: -0.8

XAUUSD: -8

Long: -7.2

Short: 1.83

Long: -77.76

Short: 8.07

EURUSD: 0.4

XAUUSD: -8.1

Long: -8.55

Short: 1.84

Long: -59.98

Short: 23.22

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of xm, fxtm lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

xm

| Quick XM Review Summary | |

| Founded | 2009 |

| Registered | Cyprus |

| Regulation | CySEC, DFSA, FSC (Belize) |

| Market instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices |

| Demo Account | ✅ (30 days) |

| Account Type | Standard, Ultra Low, Shares |

| Min Deposit | $5 |

| Max leverage | 1:1000 |

| Spread | From 0.8 pips |

| Trading Platform | MT4/5, XM App |

| Copy Trading | ✅ |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets(May vary depending on the country of registration) |

| Customer Support | Emails, Live Chats, Telegram, and Telephone |

| Tel:+357 25029933 | |

| Regional Restrictions | The United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran |

| Bonus | 20% deposit bonus up to $2,000(No bonus offered under the entity regulated by CySEC in Europe) |

Disclaimer: The XM Group operates globally under various entities. Products, services, and features listed in this page vary between XM entities. For further information, please visit the XM website.

XM General Information

XM is a group of regulated companies, headquartered in Cyprus. The entities of the XM Group are regulated by several internationally renowned financial authorities, including CySEC, DFSA, and FSC (Belize). It offers 1,400+ tradable instruments, including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices via the MT4, MT5 and the XM App.

Pros and Cons of XM

Pros:

- 1,400+ financial instruments to choose from

- Popular platforms - MT4 and MT5

- Demo account available to practice

- Rich educational resources such as market analysis, economic calendars and courses

- Live chat support

Cons:

- The $10,000 minimum deposit for the Shares account may be prohibitive for some traders

- Commissions are applied to the Shares account

- No bonus offered under the entity regulated by CySEC in Europe

Is XM Legit?

Regulation is a key dimension to consider when choosing a forex broker, as it offers some protection to the client in terms of security of funds, transparency and fairness of operations. XM is a Belize-registered company and regulated by several major regulatory bodies, including CySEC, DFSA, and FSC (Belize).

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| CYSEC | Regulated | Trading Point of Financial Instruments Ltd | Market Making (MM) | 120/10 |

| DFSA | Regulated | Trading Point MENA Limited | Retail Forex License | F003484 |

| FSC | Offshore Regulated | XM Global Limited | Retail Forex License | 000261/397 |

Multi-entity regulation provides greater customer protection, as it means that the broker is subject to multiple sets of regulations and standards. In addition, this can enhance the broker's reputation in the industry.

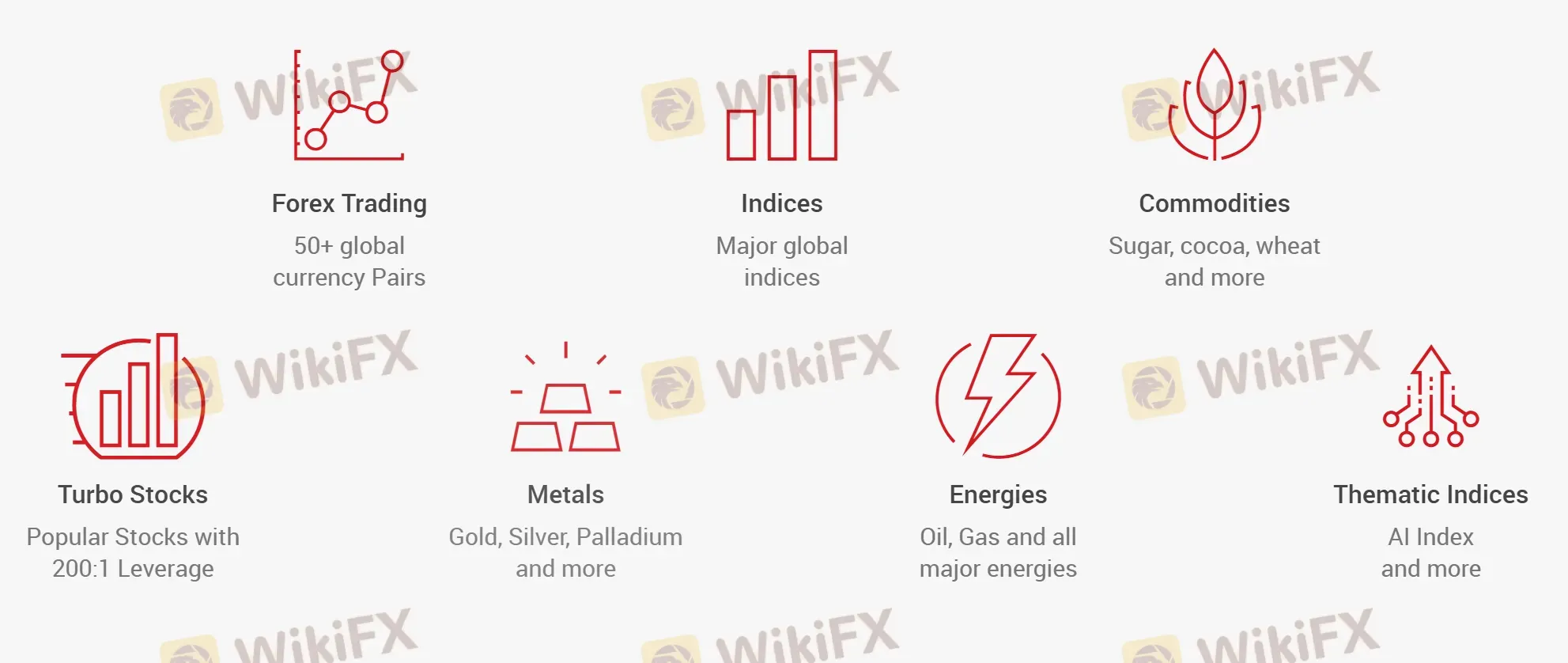

Market Instruments

XM offers its traders a wide variety of over 1,400 financial instruments, including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and ematic indices. This variety allows traders to diversify their portfolios and take advantage of different markets to implement different trading strategies.

| Asset Class | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Precious metals | ✔ |

| Shares | ✔ |

| Turbo stocks | ✔ |

| Equity indices | ✔ |

| Energies | ✔ |

| Thematic indices | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Traders also have the flexibility to choose from a wide range of financial instruments and select the ones that best suit their trading preferences and objectives. However, for some new or inexperienced traders, the variety of financial instruments can be overwhelming, and some instruments may have limited liquidity, which can make trading them difficult.

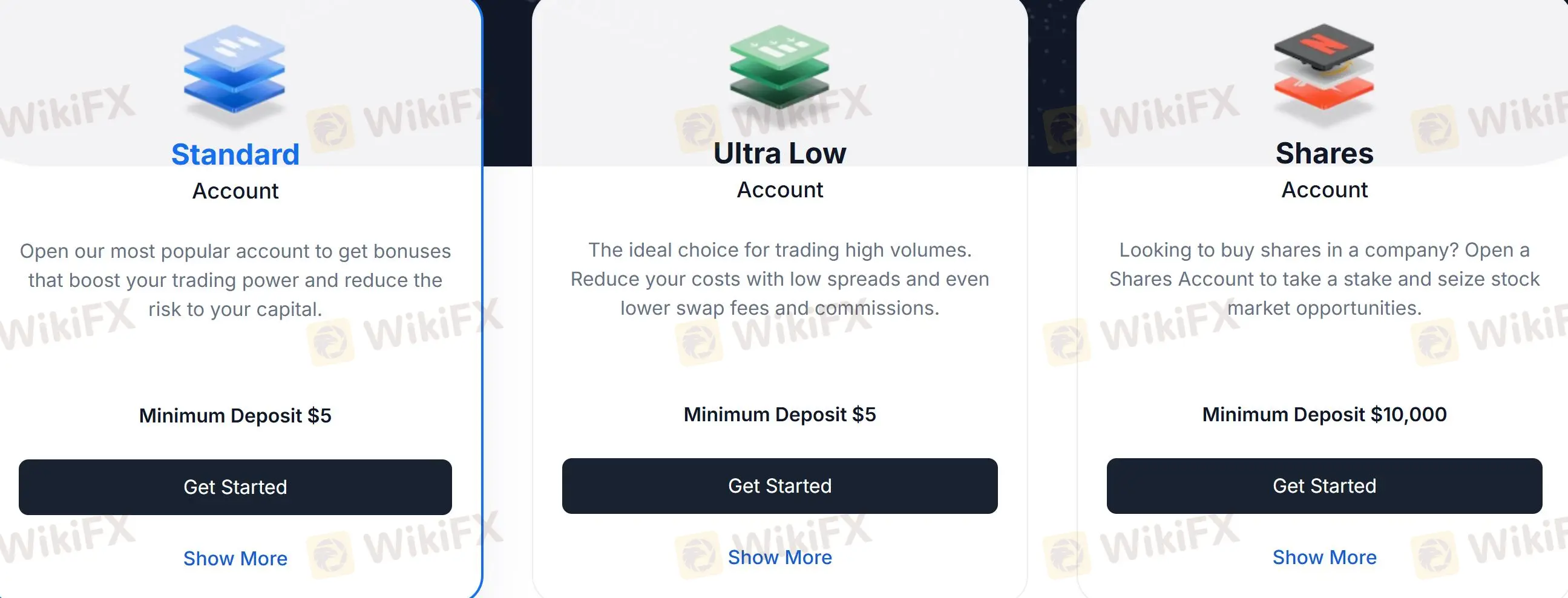

Trading Accounts

XM offers four types of trading accounts targeting different investment levels. The Standard and Ultra Low accounts have only $5 minimum deposit and no commissions are charged. The Shares account has a minimum deposit of $10,000 and a commission is charged. No leverage is offered on the Shares account, which means investors must invest the full amount of their trade. In general, XM offers account options for different investment levels.

The XM demo account is an excellent tool for novice traders or those who wish to test new trading strategies without risking their capital. The demo account comes with a virtual trading platform that replicates live trading conditions and can be accessed from any device. Traders can practice their trading skills and familiarize themselves with the financial instruments available at XM without having to risk their money.

How to Open an Account with XM?

XM, is a broker, which has an account opening with a minimum deposit of $5. Below are the steps to follow for opening an XM Broker account:

Step 1: Register

Click on ‘Get Started’. Enter your personal details and check your email for verification.

Step 2: Upload Documents

Complete your Personal Details, Financial Information and Investor Details to complete registration.

Step 3: Fund and Choose Platform

Upload your Proof of Identity and Proof of Address to complete verification.

Leverage

Leverage is an important tool in Forex trading that allows traders to have greater exposure to the market with limited capital. At XM, the maximum leverage offered is 1:1000, which means that for every $1 of capital, the trader can control up to $1000 in the market. This can be attractive to traders looking to maximize their profits with less capital.

Spreads and Commissions

In terms of spreads and commissions, XM offers low spreads on the first two commission-free accounts. However, during periods of high volatility, spreads may be higher.

Trading Platform

XM offers its clients a flexible selection of trading platforms, including the popular MT4 platform and its successor, MT5.In addition, the company has also developed its own custom trading platform - XM App for those looking for something different.

All platforms offer a wide variety of technical indicators, analysis tools and customization possibilities. Beginners may also find the MT4 and MT5 learning curve steep, although the customization possibilities and variety of analysis tools may make it worth the effort.

XM also offers a series of instructional videos, such as this one from its YouTube channel, on how to open an account using MT4.

Copy Trading

XM also offers popular copy trading solutions. This solution is particularly beneficial for beginners and less experienced traders who seek to leverage the expertise of successful investors. Through this platform, users can replicate the trades of seasoned professionals, benefiting from their market insights and strategies.

This approach allows novice traders to participate in the markets more confidently while simultaneously learning from the decisions of experienced traders. XM's copy trading feature thus serves as both a learning tool and a means for less experienced individuals to potentially improve their trading outcomes.

Deposit and Withdrawal: Methods and Fees

For all other account types, the minimum is $5.Most account types support currencies like USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR, while the Shares account can be only deposit in USD. XM support various payment methods, including credit and debit cards, bank transfers, e-wallets, and many more.

Promotions

XM provides a tiered deposit bonus structure. New depositors can benefit from a 20% bonus on deposits up to $2,000.

For those seeking a competitive edge, XM hosts both demo and real account trading competitions. These contests offer participants the chance to win substantial cash prizes without any entry fee. Open to traders of all experience levels, these competitions provide an excellent platform to test strategies, gauge performance against peers, and potentially earn rewards.

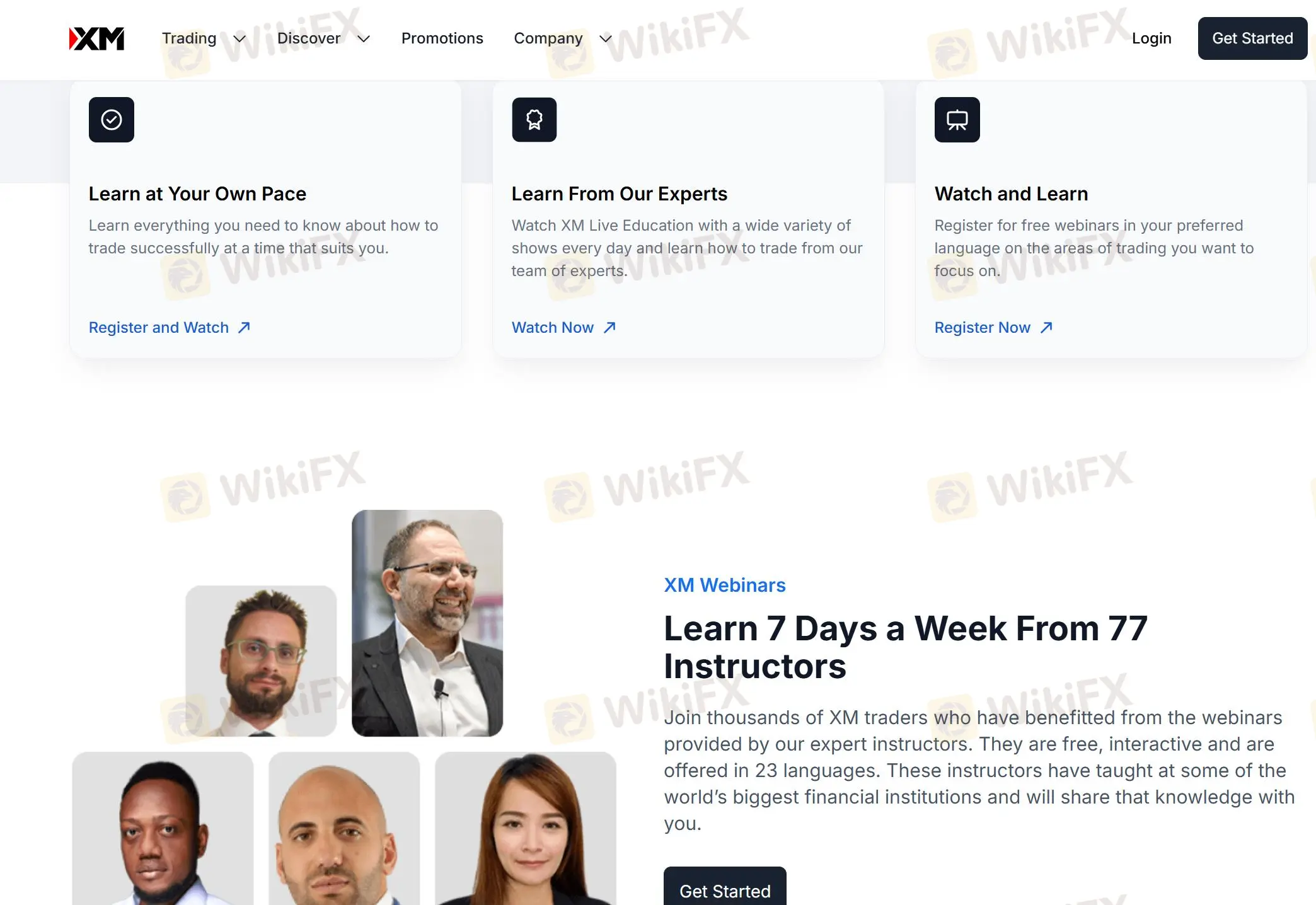

XM Educational Resources

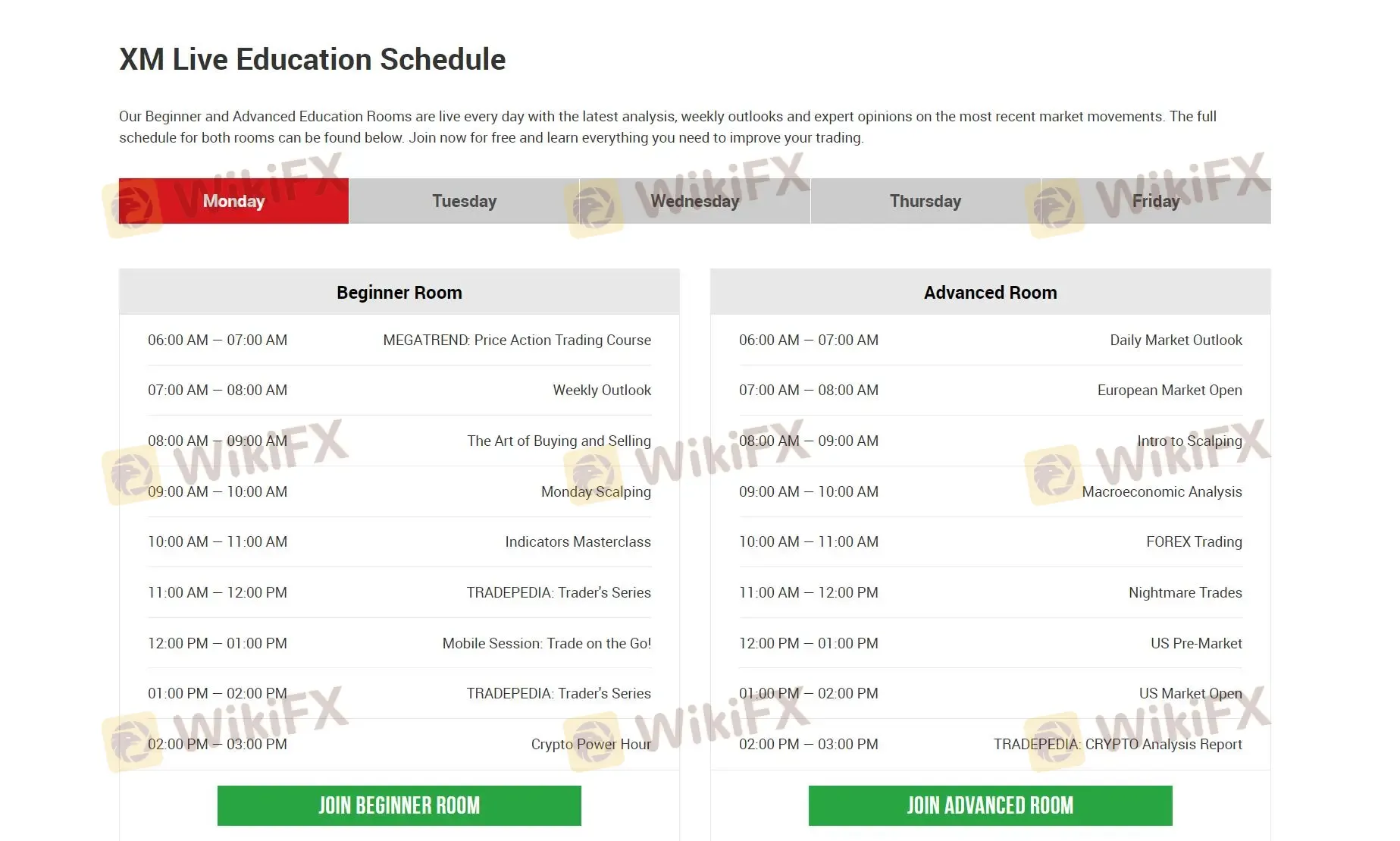

XM offers a comprehensive suite of research and educational resources designed to support traders at all levels.

The Learning Center at XM is structured to cater to various learning preferences. XM Live and Live Education sessions offer real-time interaction with experts, complemented by a regularly updated schedule of events. For self-paced learning, traders can access a library of Educational Videos, Forex & CFDs Webinars, and Platform Tutorials. These resources cover a wide range of topics, from basic concepts to advanced trading strategies.

To round out their offerings, XM provides a selection of practical tools to assist in day-to-day trading activities. This includes a set of Trading Tools, integration with MQL5 for custom indicators and expert advisors, and Forex Calculators for quick and accurate trade planning.

Conclusion

Overall, XM is a well-regulated and secure company that offers a wide range of financial instruments and a good variety of accounts. Its focus on customer education and multilingual support is also a big plus. Disadvantages include floating spreads that can be higher than the competition. Overall, XM is a good choice for those looking for a regulated broker with a wide range of products and customer support services.

Frequently Asked Questions (FAQs)

Is XM legit?

Yes, XM is regulated by multiple agencies such as CySEC, DFSA, and FSC (Belize).

What is the minimum deposit required to open an XM account?

The minimum deposit required for the first two accounts (Standard account and Ultra Low account) is $5, while for the Shares account it is $10,000.

What trading platforms does XM offer?

XM offers the most popular trading platforms in the industry: MT4 and MT5, as well as its own mobile application.

What is the maximum leverage offered by XM?

The maximum leverage offered by XM is 1:1000.

Does XM offer a demo account?

Yes, XM offers a 30-day demo account for clients to practice without risking their own money.

fxtm

| Quick FXTM Review Summary | |

| Founded | 2011 |

| Registered Country | United Kingdom |

| Regulation | FCA, FSC (Offshore) |

| Trading Instruments | Forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs |

| Demo Account | ✅ |

| Account Type | Advantage, Advantage Plus, Advantage Stocks |

| Min Deposit | $/€/£/₦200 |

| Leverage | Up to 1:3000 |

| Spread | Close to zero on major FX pairs |

| Trading Platform | MT4, MT5, mobile trading |

| Payment Method | Credit/debit cards, e-wallets, bank wire transfers and local payment solutions |

| Deposit Fee | €/£/$3 or ₦ 2,500 fee for any deposit under €/£/$30 or ₦25,000 |

| Customer Support | 24/5 live chat, contact form |

| Tel: +44 20 3734 1025 | |

| Regional Restrictions | The USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic People's Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar, Russia and India |

FXTM Information

FXTM (Forex Time), established in 2011, is a globally recognized forex and CFD broker regulated by both the Financial Services Commission (FSC) of Mauritius and the Financial Conduct Authority (FCA) in the UK. The company serves over 2 million clients across 150 countries, offering services in 18 languages. FXTM provides a diverse range of trading instruments including forex, metals, commodities, stocks, indices, cryptocurrencies, and various CFD products. The platform is known for its cost-effective trading solutions with competitive variable spreads that can reach as low as 0 pips. Traders can access the market through its user-friendly MT4 and MT5 trading platforms, available on desktop, web, and mobile devices, enabling convenient trading anytime and anywhere.

FXTM Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

| |

| |

| |

| |

|

Is FXTM Legit?

FXTM operates under a strong regulatory frame, and it has several entities that are regulated in different jurisdictions:

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| FCA | Exinity UK Ltd | Straight Through Processing (STP) | 777911 | Regulated |

| FSC | EXINITY LIMITED | Retail Forex License | C113012295 | Offshore regulated |

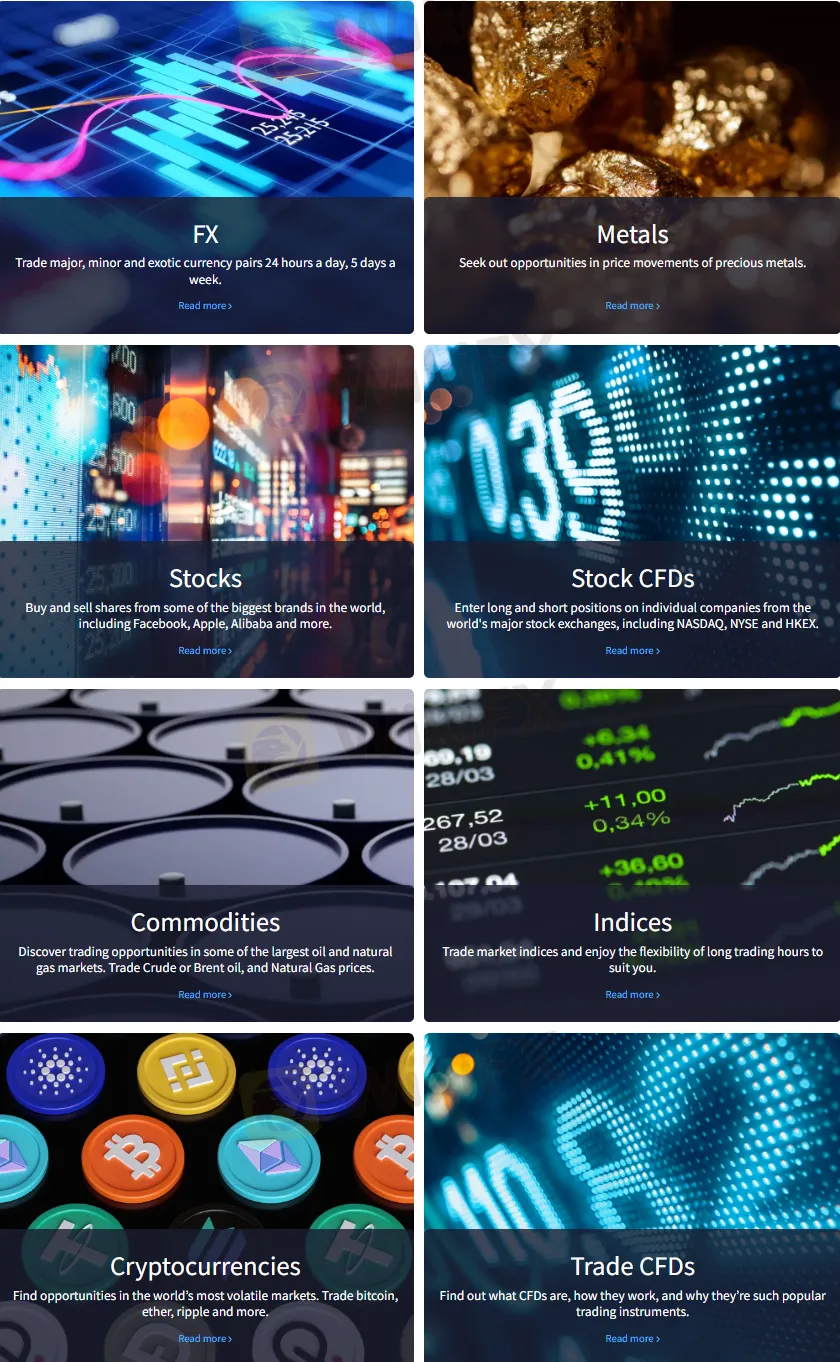

Market Instruments

FXTM offers over varioustradable instruments, covering forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs. However, this broker does not currently support trading on futures, options, and ETFs.

| Tradable Assets | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| CFDs | ✔ |

| Futures | ✔ |

| Options | ✔ |

| ETFs | ✔ |

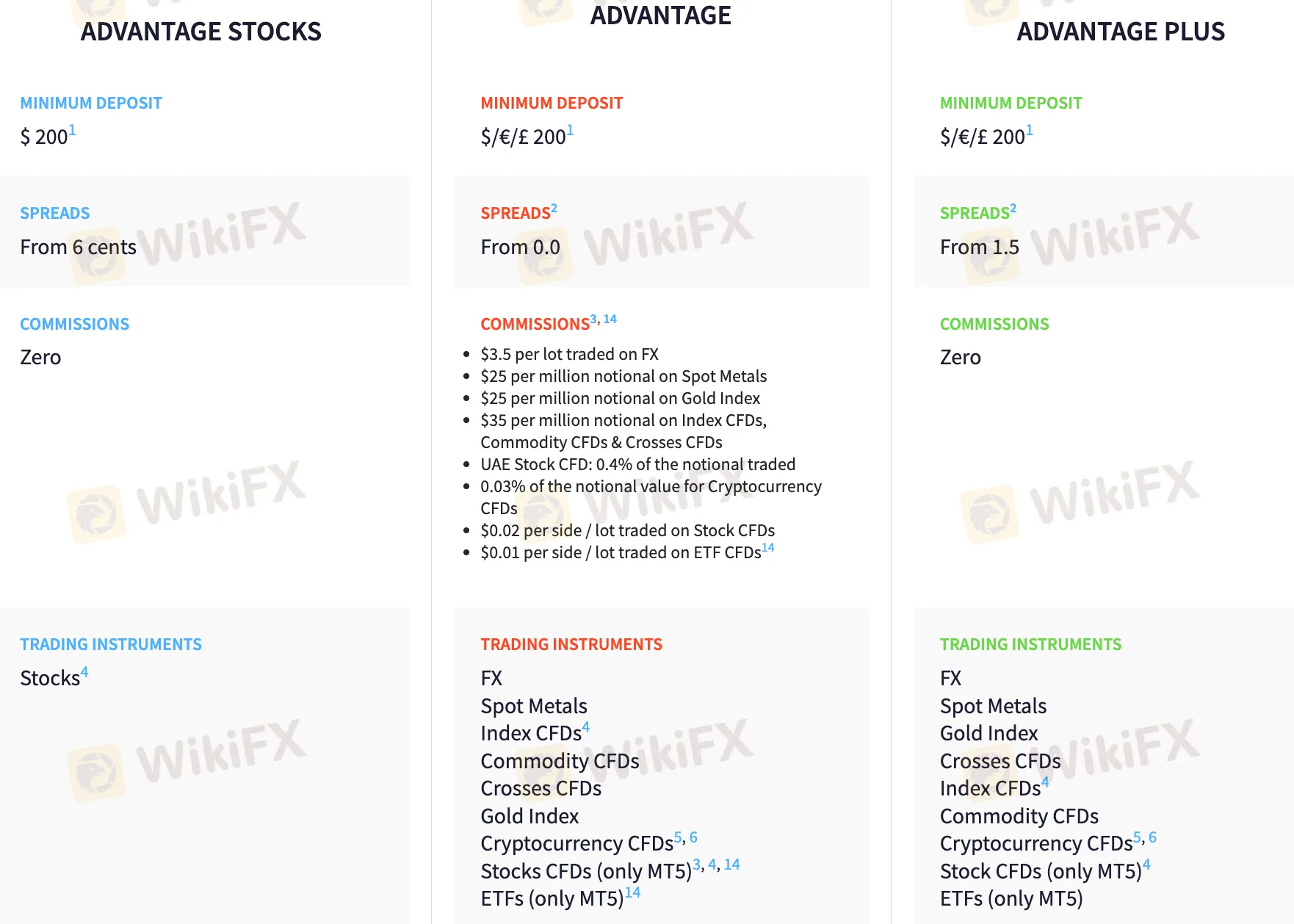

Account Type

FXTM offers three different types of trading accounts, which are the Advantage account, the Advantage Plus, and the Advantage Stocksaccount. All accounts require a minimum deposit requirement of 200. Each account type has its own unique features and benefits, such as different spreads, commissions, and trading instruments.

Demo Account

FXTM offers demo accounts for all its account types. These demo accounts allow traders to test their trading strategies in a risk-free environment using virtual funds. Demo accounts are also useful for new traders who want to learn how to trade before committing real money to live trading.

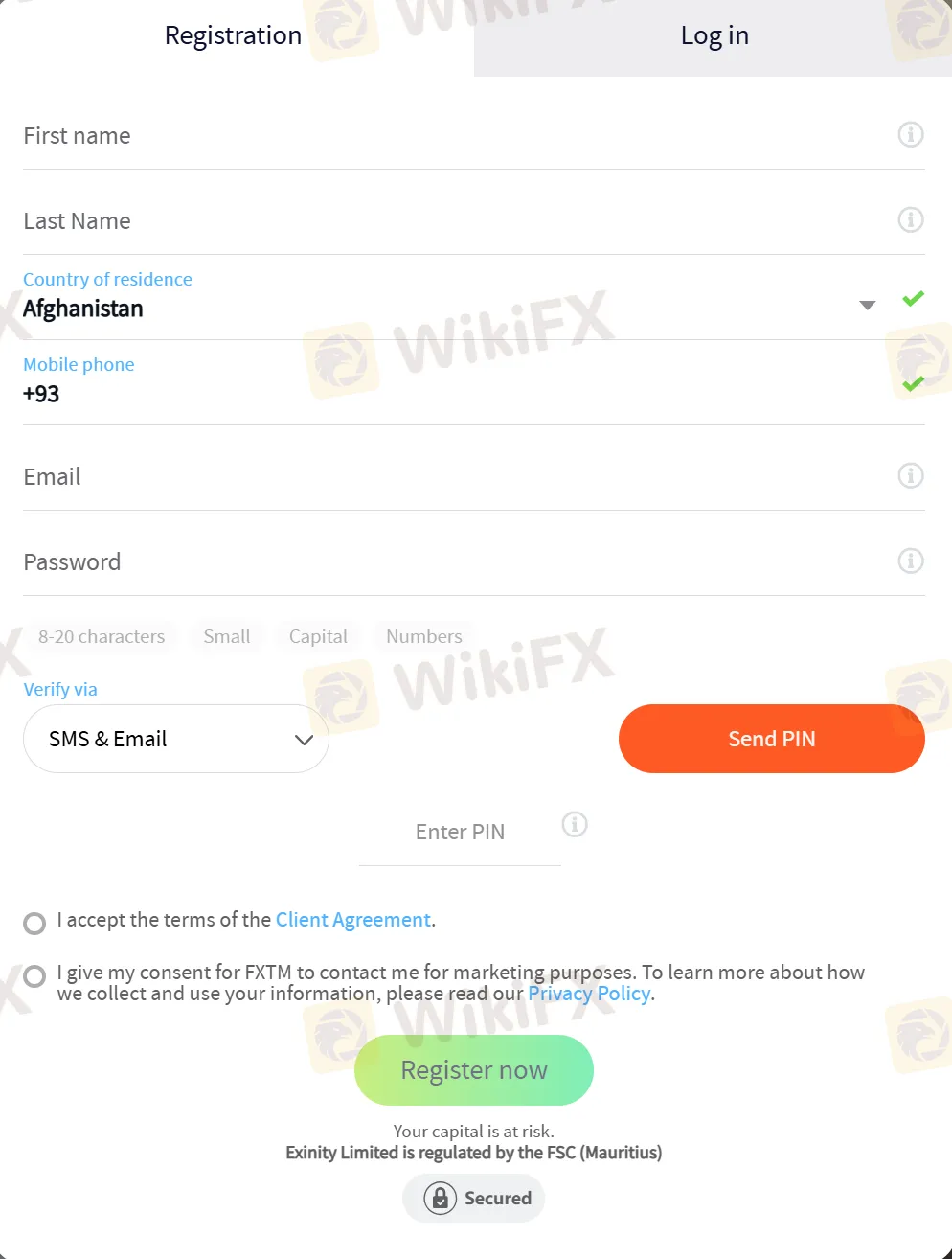

How to Open an Account?

- To open an account with FXTM, you first need to visit their website and click on the “OPEN ACCOUNT” button on the top right-hand corner of the page.

- This will take you to the account registration page where you will need to fill out some basic personal information like your name, email address, and phone number.

- Next, you will be asked to choose the type of account you want to open. FXTM offers three main account types - Advantage, Advantage Plus, Advantage Stocks, each with its own features and benefits. You will also need to select the base currency of your account and agree to the terms and conditions of the broker.

- Once you have selected your account type and base currency, you will be prompted to provide some additional personal information like your date of birth, occupation, and address. You will also need to answer a few questions about your trading experience and investment goals.

- After you have completed the registration process, you will need to verify your account by providing some additional documents like a copy of your ID or passport and a proof of address like a utility bill or bank statement.

- Finally, once your account is verified, you can then make your first deposit and start trading.

Leverage

FXTM offers leverage of up to 1:3000. It's recommended to use leverage wisely and only trade with funds you can afford to lose.

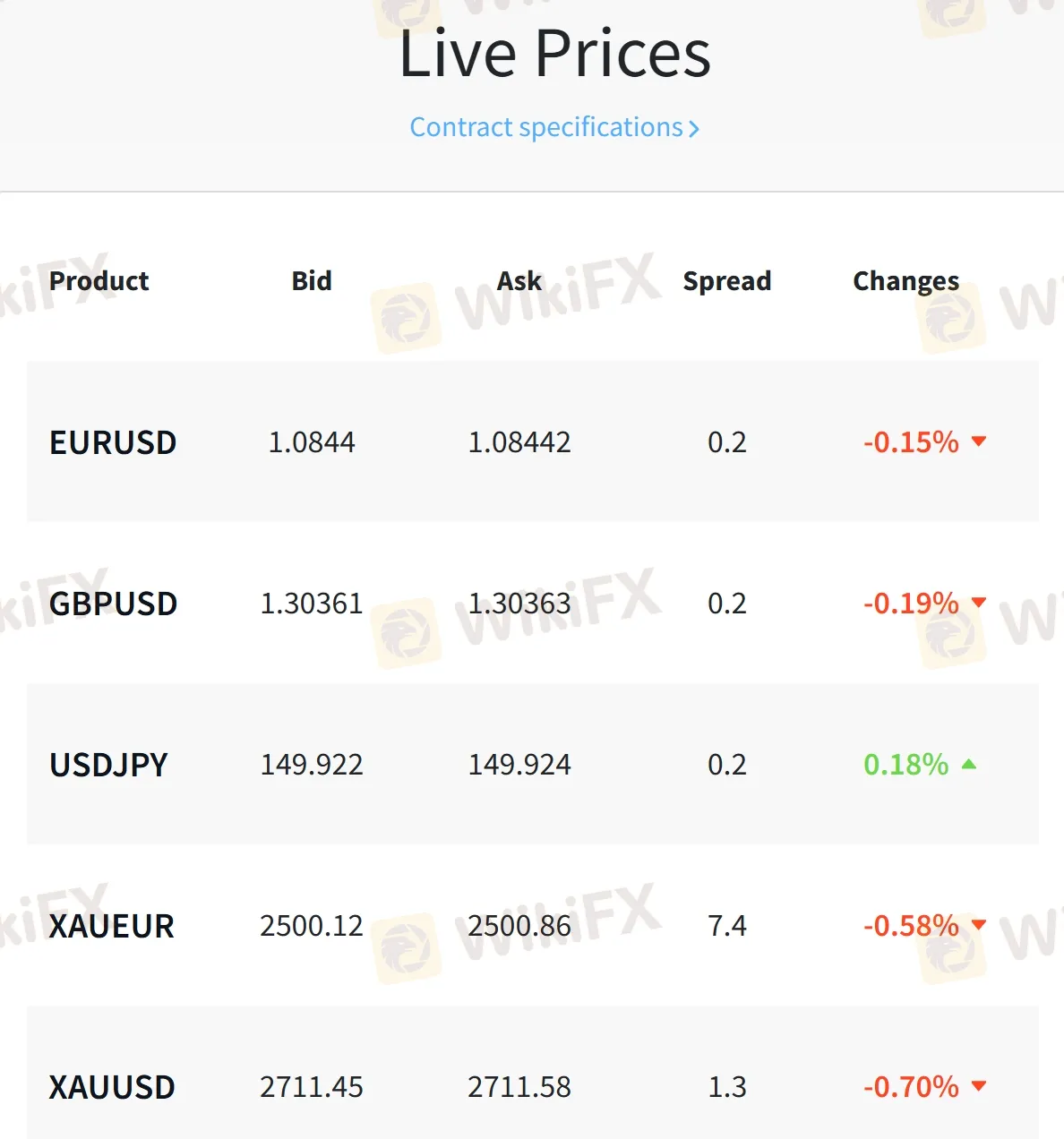

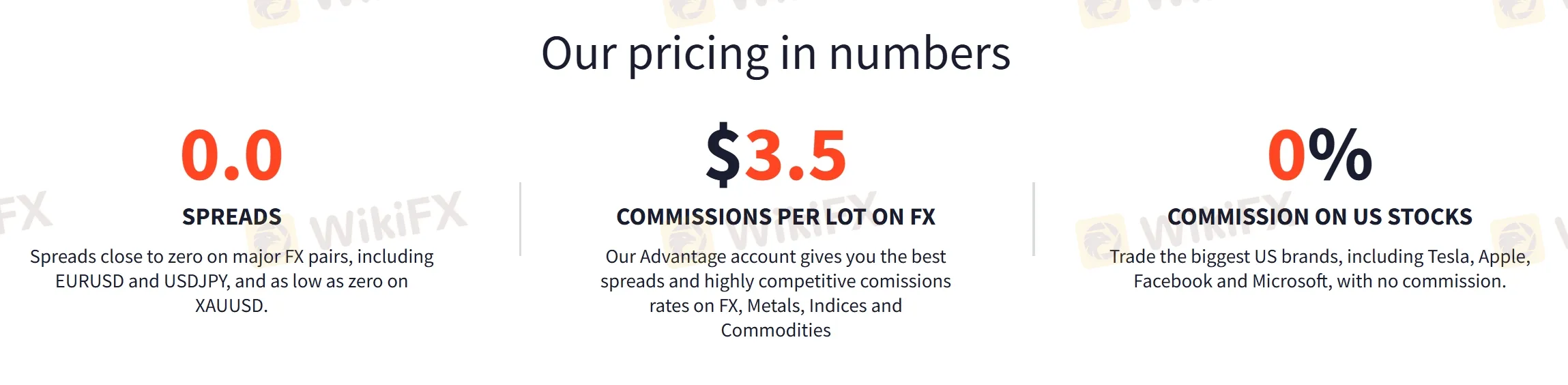

Spread and Commission

For the Advantage account, the spreads start from 0.0 pips, and $3.5 per lot traded on FX is charged. For the Advantage Plus account, the spreads start from 1.5 pips, but no commission. For the Advantage Stocks account, the spreads start from 6 cents, but no commission.

The spreads offered by FXTM are typically lower than those offered by many other brokers in the industry, particularly on the Advantage account. The Advantage Plus account, however, has slightly higher spreads, which is to be expected due to no commissions.

| Account Type | Spread | Commission |

| Advantage | From 0.0 pips | $3.5 per lot traded on FX |

| Advantage Plus | From 1.5 pips | ❌ |

| Advantage Stocks | From 6 cents | ❌ |

Trading Platform

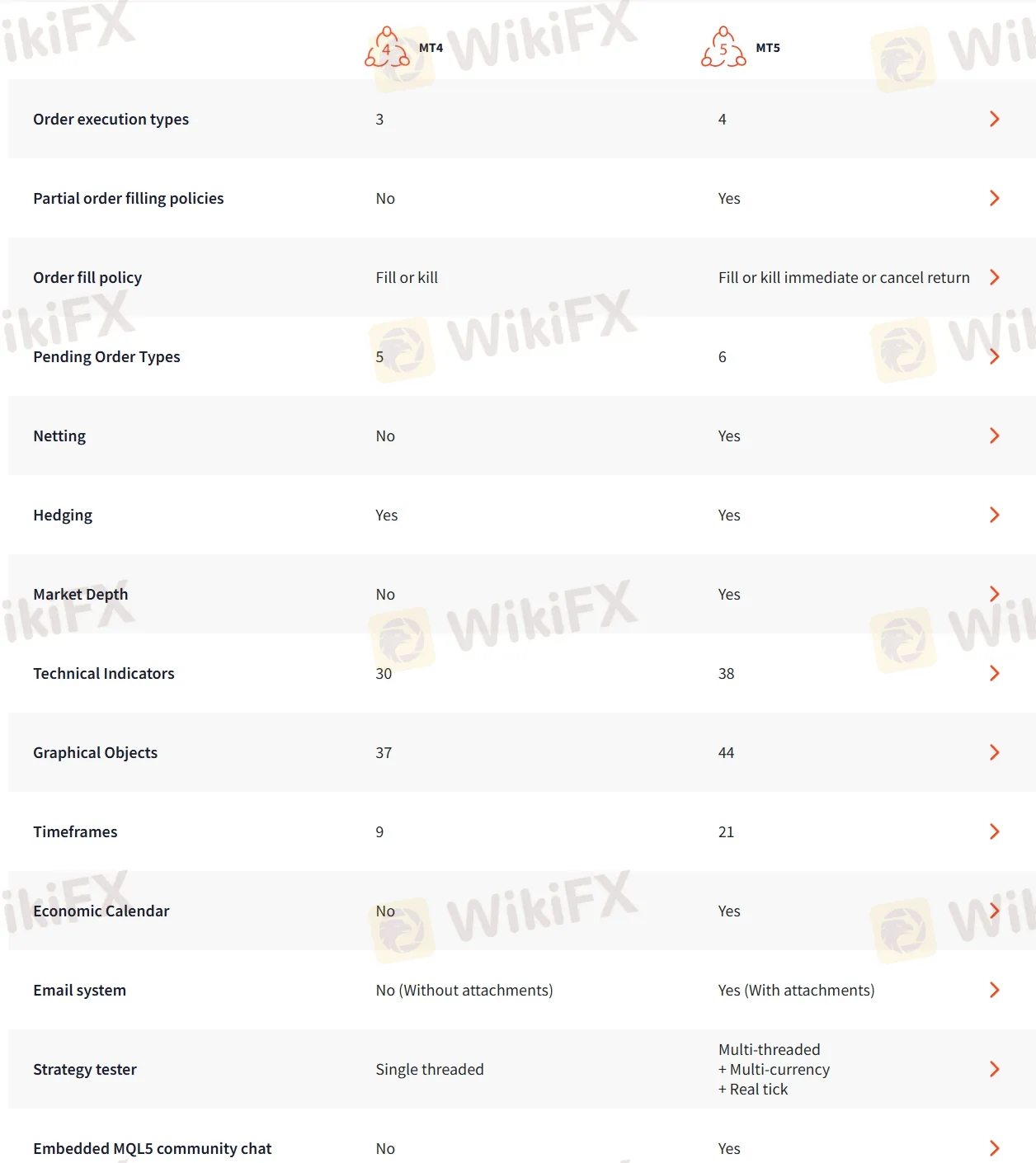

FXTM offers three chocies of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as their proprietary mobile trading app.

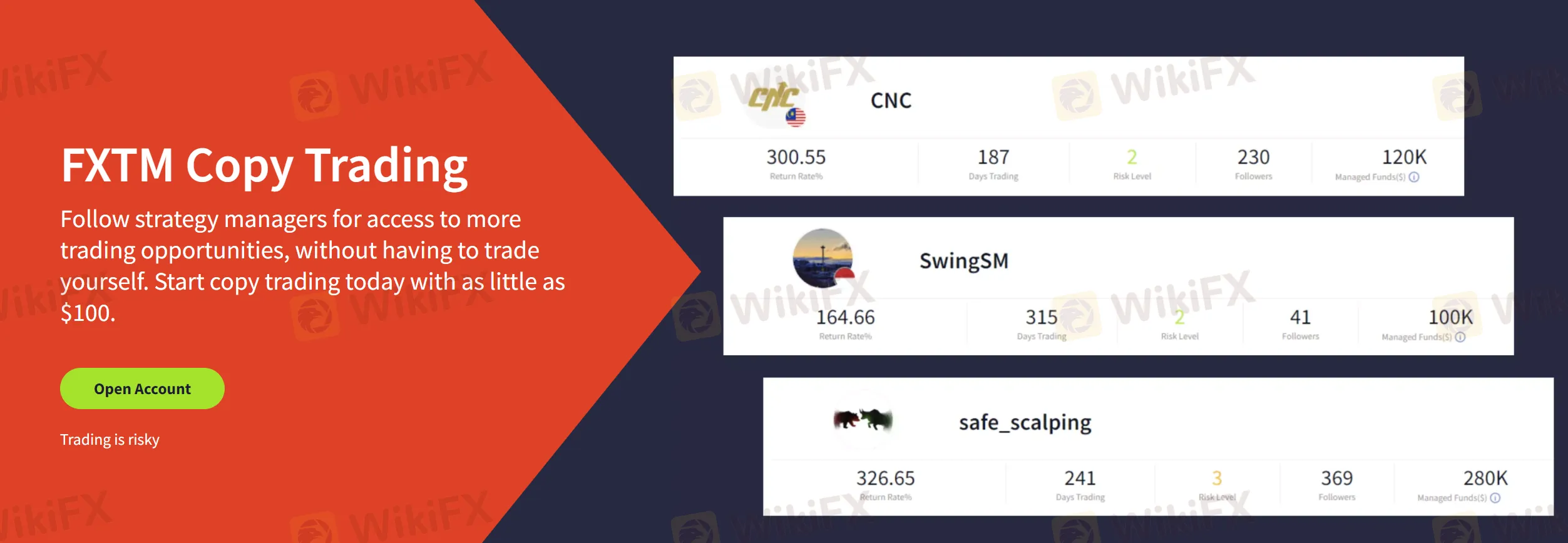

FXTM Copy Trading

FXTM Invest is an advanced copy trading feature offered by FXTM, designed to make trading accessible to investors of all experience levels. With a low entry threshold of just $100, this platform allows users to automatically replicate the trades of experienced Strategy Managers. FXTM Invest stands out for its attractive pricing model, offering zero spreads on major FX pairs and a performance-based fee structure where investors only pay when their chosen Strategy Manager generates profits.

The process of getting started with FXTM Invest is streamlined into five simple steps: signing up or logging in to MyFXTM, selecting a Strategy Manager, opening an Invest account, making a deposit, and then watching as the system automatically copies your chosen manager's trades. This user-friendly approach, combined with the ability to maintain full control over your funds, makes FXTM Invest an appealing option for those looking to tap into the forex market with the guidance of seasoned professionals.

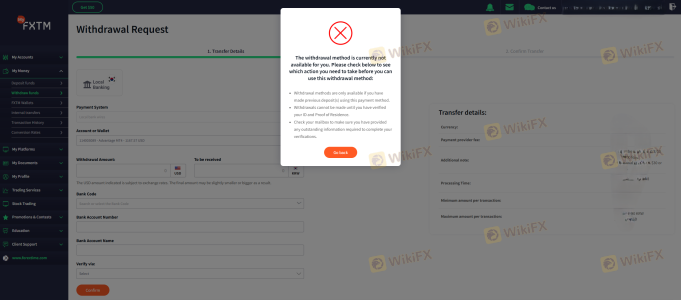

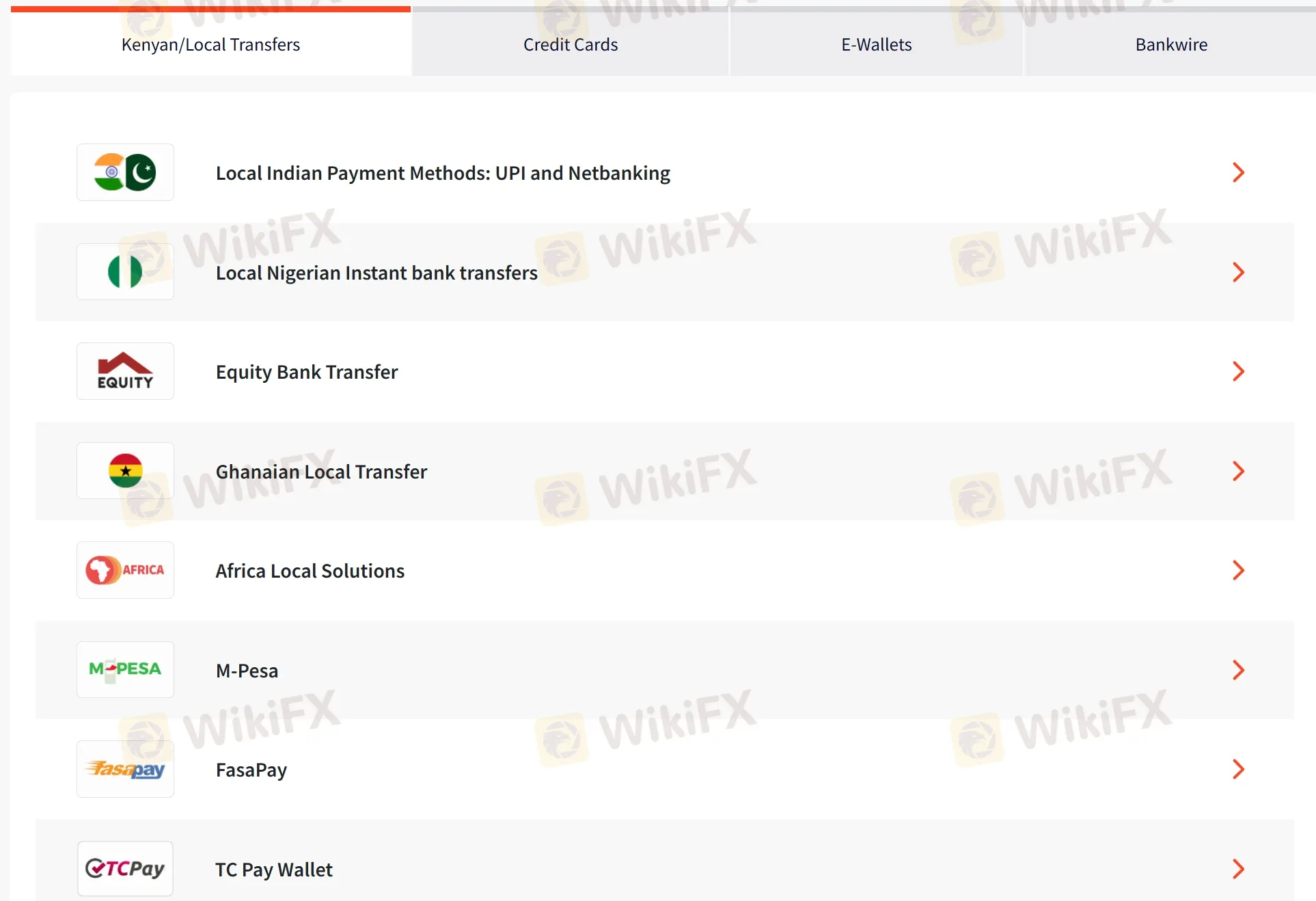

Deposit and Withdrawal

FXTM offers a variety of deposit and withdrawal options for its clients. Traders can deposit funds into their trading account using Kenyan/local transfers (local Indian payment methods: UPI and Netbanking, local Nigerian instant bank transfers, equity bank transfer, Ghanaian local transfer, Africa local solutions, M-Pesa, FasaPay, TC Pay Wallet), credit cards (Visa, MasterCard, Maestro, Google Pay), e-wallets (GlobePay, Skrill PayRedeem, Perfect Money, Neteller), and bank wire transfer.

FXTM charges €/£/$3 or ₦ 2,500 fee for any deposit under €/£/$30 or ₦25,000.

Educational Resources

FXTM offers various free educational resources including glossary, market analysis and guides.

Besides, their educational resoucres are friendly both for beginners and professionals.

For example, trading basics are suitable for beginners who want to learn some basics, while advanced guides are more suitable for traders who are experienced.

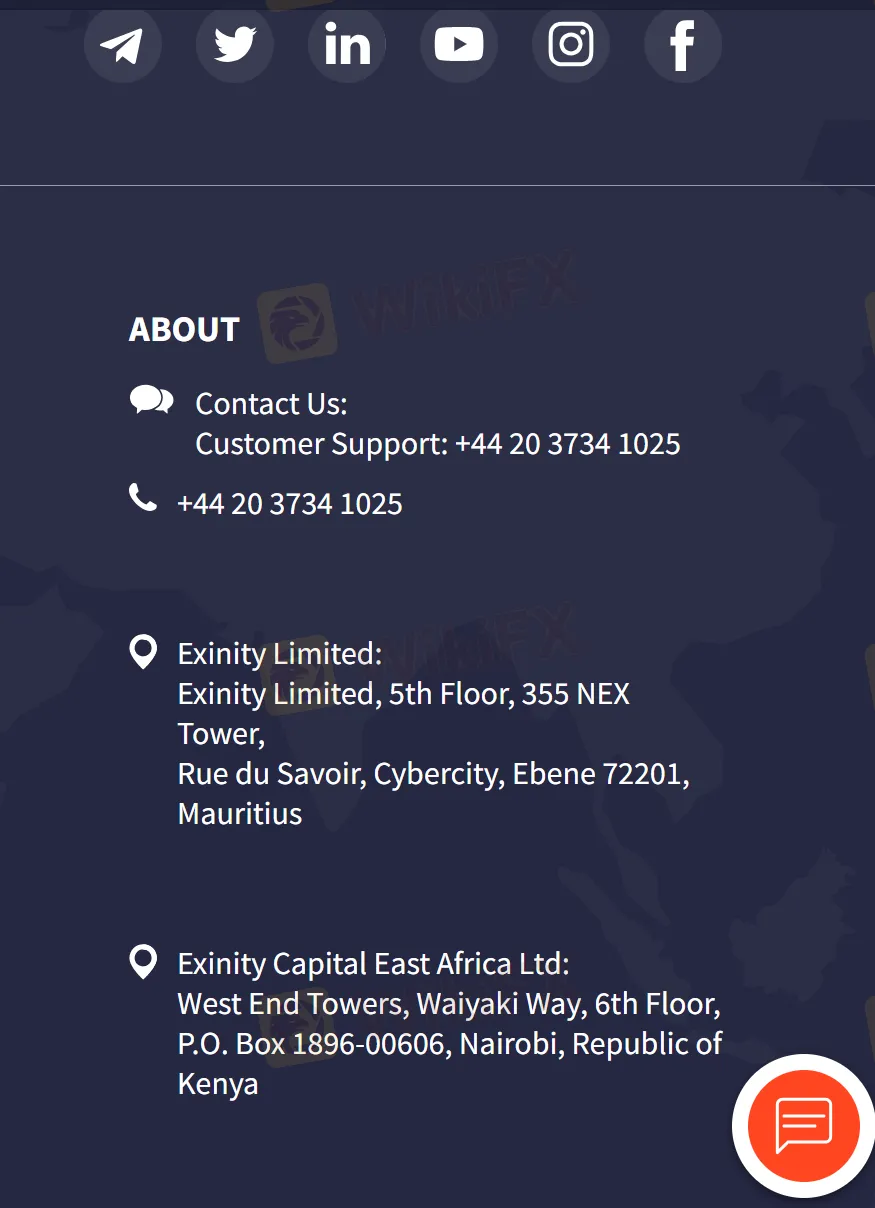

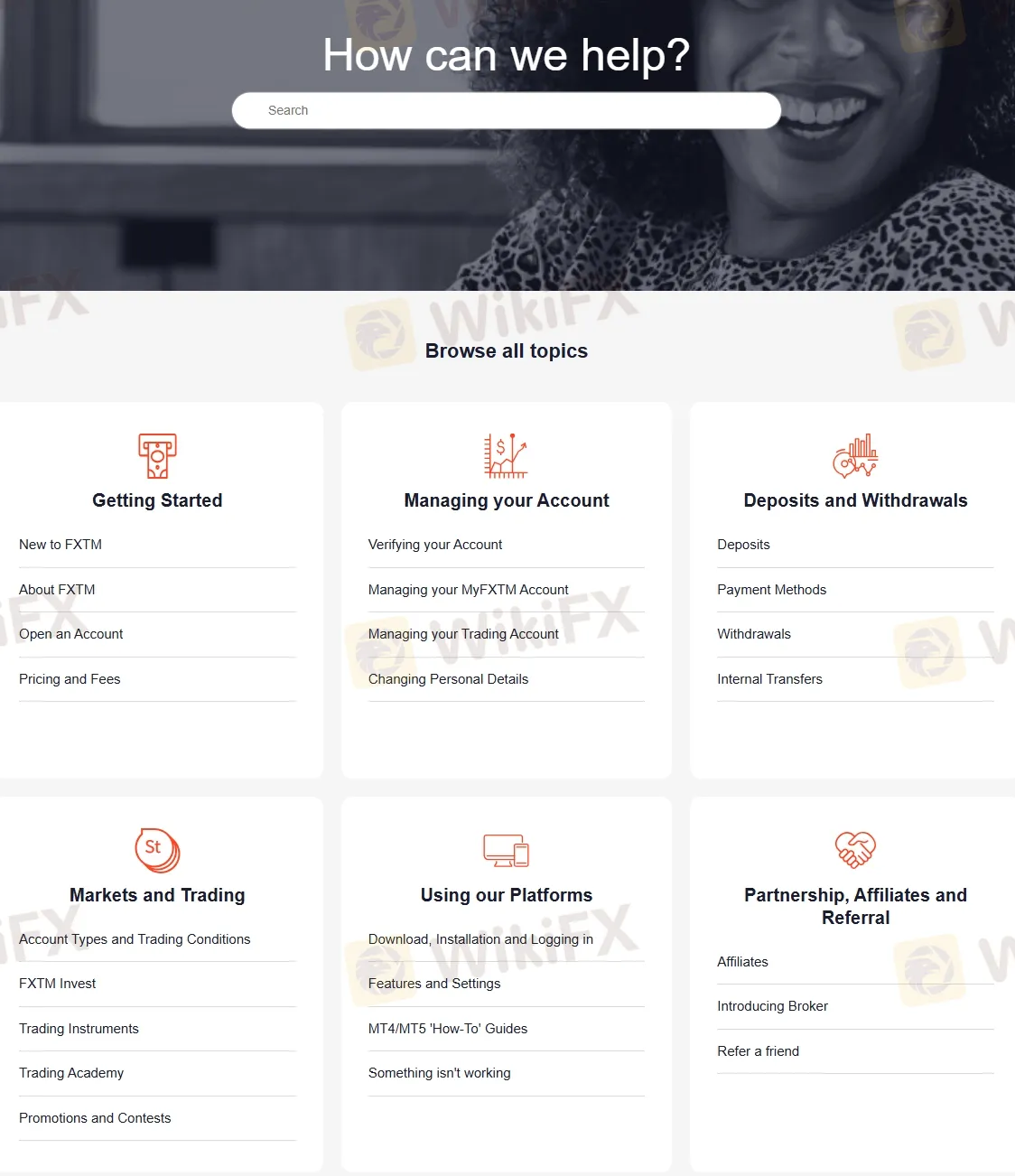

Customer Support

FXTM is known for providing excellent customer support to its clients, including live chat, contact form and phone. The customer support team is available 24/5 and is multilingual, which means clients can communicate with them in their preferred language.

Here are their headquarters and other office locations.

| Headquarter | Headquarter Address | 5th Floor, NEX Tower, Rue du Savoir, Cybercity 72201 |

| City | Ebene | |

| Country | Mauritius | |

| Other offices# | City/ies | Mauritius, Dubai, London, Hong Kong, Lagos, Limassol |

FXTM also provides an extensive Help Center section on their website that covers various topics, such as account opening, deposit and withdrawal methods, trading platforms, and more. This section is helpful for clients who prefer to find answers to their questions without contacting the support team.

Conclusion

To sum up, FXTM is a well-regulated and respected forex broker with a wide range of market instruments, competitive trading conditions, and user-friendly trading platforms. FXTM's customer support is also responsive and helpful, and their free educational resources are very useful for both novice and experienced traders.

FAQs

Is FXTM legit?

Yes, FXTM is regulated by FCA and FSC (Offshore).

What trading instruments are available on FXTM?

FXTM offers a range of trading instruments including forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs.

What is the minimum deposit required to open an account on FXTM?

$/€/£/₦200

What trading platforms are available on FXTM?

FXTM offers three chocies of trading platforms including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as mobile trading.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Are the transaction costs and expenses of xm, fxtm lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive xm and fxtm are, we first considered common fees for standard accounts. On xm, the average spread for the EUR/USD currency pair is Depends on the stock exchange pips, while on fxtm the spread is From 1.5.

Which broker between xm, fxtm is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

xm is regulated by ASIC,CYSEC,DFSA,FSC. fxtm is regulated by FCA,FSCA,CMA,FSC.

Which broker between xm, fxtm provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

xm provides trading platform including Stock,Micro,Standard,Ultra Low Spread Standard & Micro and trading variety including Currency pairs (major, minor and exotic), stock CFDs, CFDs on cryptocurrencies, commodities, turbo stocks, precious metals, thematic indices, equity indices and energies. fxtm provides trading platform including ADVANTAGE PLUS,ADVANTAGE and trading variety including forex, commodities, metals, indices, etf cfds, stock cfds, cash equities, cryptos.