No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Swissquote and Vipotor ?

In the table below, you can compare the features of Swissquote , Vipotor side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of swissquote, vipotor lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Swissquote | Basic Information |

| Founded in | 1996 |

| Headquarters | Gland, Switzerland |

| Regulation | FINMA, FCA, MFSA, SFC |

| Tradable Instruments | Forex, Stocks, Options, Futures, CFDs, ETFs |

| Account Types | Standard, Premium |

| Minimum Initial Deposit | $1,000 |

| Maximum Leverage | 1:100 |

| Commission | Depends on the account type and instrument traded |

| Spreads | Variable, starting from 0.6 pips |

| Trading Assets | Currencies, Stocks, Bonds, Options, Futures, and Funds |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Phone, Email, Live Chat |

| Educational Resources | Webinars, Tutorials, Market Analysis, News |

| Additional Features | Swiss DOTS (Structured Products), Robo-Advisory |

Swissquote is a leading online forex and financial trading broker headquartered in Switzerland. It was established in 1996 and has since grown to become a popular choice among traders worldwide. The broker offers a wide range of financial instruments to trade, including forex, stocks, indices, commodities, bonds, and cryptocurrencies.

Swissquote offers several account types, including Standard, Premium, Prime, and Professional, to cater to different trader needs. The minimum deposit for a Standard account is $1,000, which is relatively high compared to some other brokers. However, the broker's range of account types and trading conditions may appeal to professional traders who require higher leverage and tighter spreads.

Swissquote provides its clients with access to several trading platforms, including MetaTrader 4 and 5, Advanced Trader, and their proprietary platform, Swissquote EDGE. The broker's platforms are user-friendly, feature-rich, and offer advanced trading tools and charting capabilities.

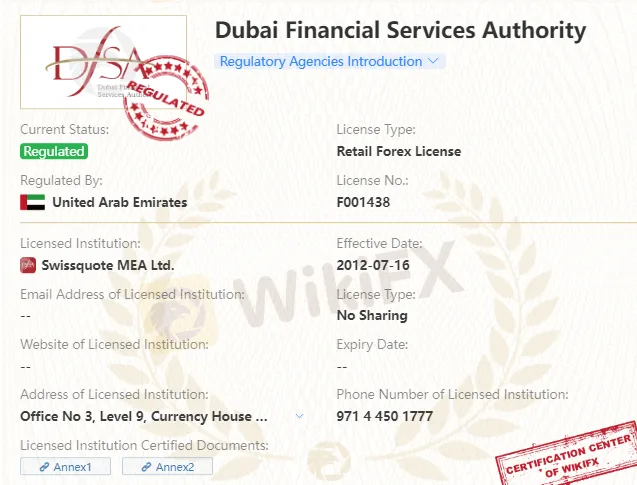

Yes, Swissquote is a legitimate broker with four entities under respective jurisdictions:

Swissquote Bank Ltd, which is based in Switzerland, is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Swissquote Ltd, which is based in the United Kingdom, is regulated by the Financial Conduct Authority (FCA).

Swissquote MEA Ltd, which is based in Dubai, is regulated by the Dubai Financial Services Authority (DFSA).

SWISSQUOTE FINANCIAL SERVICES (MALTA) LTD, is regulated by the Malta Financial Services Authority (MFSA).

These regulatory authorities ensure that Swissquote adheres to strict standards in terms of financial stability, transparency, and investor protection.

Swissquote is areputable and regulated broker, offering an array of financial instruments and account types for traders to choose from. As with any broker, there are advantages and disadvantages to consider. In the following table, we present a summary of the key pros and cons of trading with Swissquote. Swissquote undoubtedly offers a comprehensive range of trading instruments and state-of-the-art trading platforms that are designed to cater to the diverse trading needs of both novice and experienced traders. However, despite its many strengths, it falls short in terms of customer support, as it does not provide round-the-clock assistance, which can be a major drawback for traders who require immediate assistance during off-hours or in emergency situations. Whether you are a beginner or an experienced trader, this information can help you make an informed decision about whether Swissquote is the right broker for you.

| Pros | Cons |

| Regulated by reputable authorities including FINMA and FCA | Relatively high trading fees compared to other brokers |

| Wide range of trading instruments including forex, stocks, ETFs, bonds, and cryptocurrencies | Limited education and research resources |

| Competitive spreads and commissions | Inactivity fee charged after 24 months of inactivity |

| Demo Account Available | No 24/7 customer support |

| Various account types with different features to suit different trading needs | High minimum deposit requirement |

| Availability of advanced trading platforms including MT4, MT5, and Advanced Trader | Limited customer support options outside of business hours |

| Efficient and reliable customer support during business hours | No US clients accepted |

Swissquote offers a wide range of market instruments for trading, including over 130 currency pairs, commodities, stock indices, shares, bonds, and cryptocurrencies. As a well-established Swiss broker, Swissquote is able to offer trading on several Swiss-specific instruments, such as the Swiss Market Index (SMI) and the Swissquote Group Holding Ltd. (SQN) stock, as well as access to other global exchanges such as the NYSE, NASDAQ, and LSE. With such a broad range of market instruments, traders of different experience levels can find suitable trading options that align with their trading strategies and investment goals.

Swissquote offers a range of account types to cater to the varying needs and preferences of its clients. The primary account types available are the Premium Account, Prime Account, Elite Account and Professional Account. Each account type comes with distinct features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads. The Premium Account requires a minimum deposit of 1,000 CHF or equivalent, while the Prime Accounts require a higher minimum deposit of 5,000 CHF or equivalent. The Elite and Professional accounts ask for the highest minimum deposit of 10,0000 CHF or equivalent.

The Standard Account provides clients with access to a wide range of financial instruments, including forex, CFDs, stocks, options, futures, and bonds. The Premium Account, on the other hand, is designed for high-volume traders and offers lower spreads and commissions, as well as personalized service. The Prime Account is designed for institutional clients and provides them with a dedicated account manager, as well as access to exclusive liquidity and pricing.

Moreover, Swissquote also offers an Islamic Account, which is compliant with Sharia law and is available to clients who follow the Islamic faith.

Swissquote offers a free demo account for clients to practice trading strategies and test out the broker's trading platforms without risking any real funds. The demo account provides users with virtual funds to trade on the same live markets as the actual trading accounts. The account comes with real-time pricing and charting tools, allowing traders to simulate trading conditions as closely as possible. This is an excellent opportunity for traders to get familiar with the broker's platforms and trading environment before committing any real money. Moreover, the demo account is ideal for both novice and experienced traders who want to try new trading strategies or test their current trading strategies without incurring any financial risk.

Overall, demo accounts are a valuable resource for any trader who wishes to sharpen their skills and become more proficient in their trading activities.

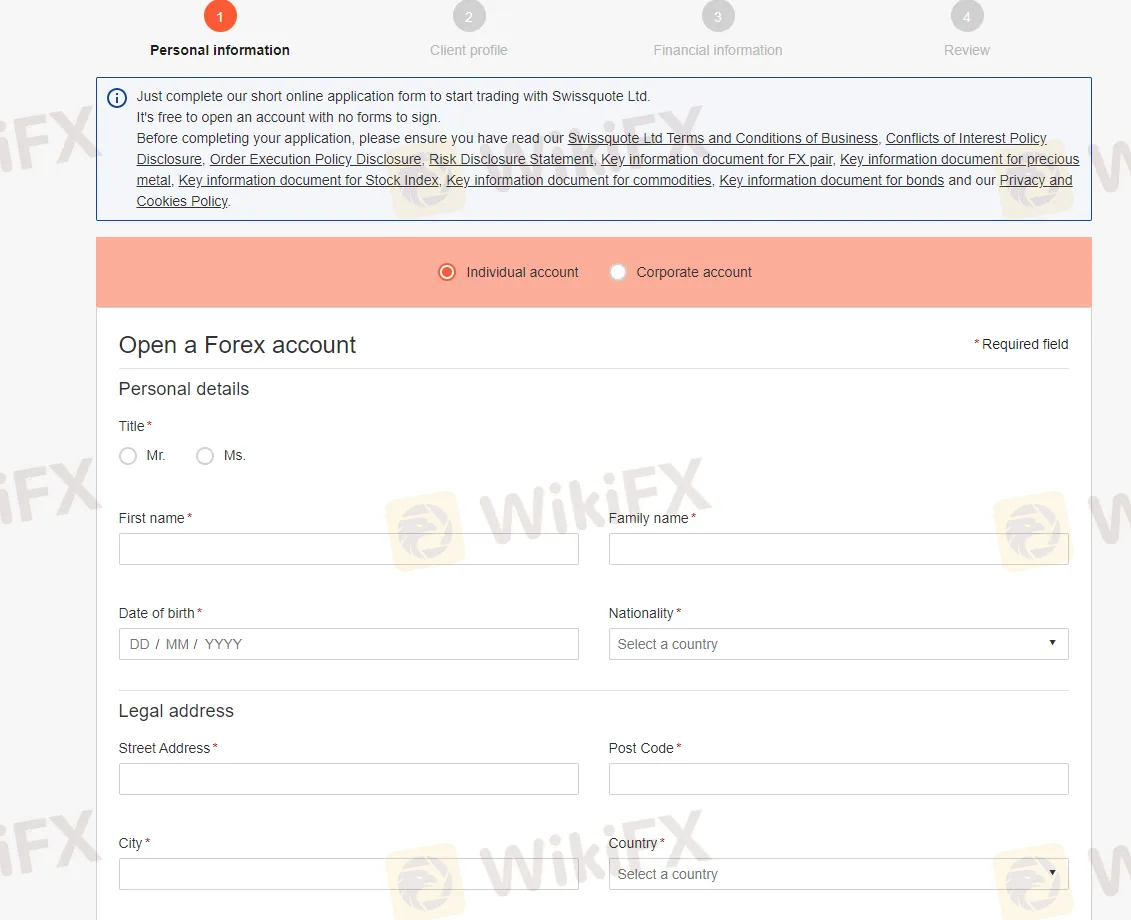

Visit the Swissquote website and click on the “Open your Account” button.

Provide personal information, such as name, email, and phone number, along with a valid identification document, such as a passport or driver's license.

After the account is created and verified, the next step is to select the desired account type and deposit funds, such as Premium, Prime or Elite accounts.

Agree to the terms and conditions and submit your application.

Swissquote offers several convenient deposit methods, including bank transfer, credit/debit card, and online payment services. Once the account is funded, traders can access the trading platforms, begin analyzing the markets, and placing trades on a variety of financial instruments.

Swissquote offers variable leverage levels depending on the financial instrument and the account type. For forex trading, the maximum leverage available is typically 1:30 for retail clients and up to 1:100 for professional clients who meet certain criteria. For CFD trading on indices, commodities, and cryptocurrencies, the maximum leverage ranges from 1:10 to 1:5, depending on the underlying asset.

Always keep in mind that high leverage can significantly increase the potential gains, but it can also magnify the losses, so it's important to use it with caution and always keep in mind the risks involved.

Swissquote offers competitive spreads and commissions to its clients. The exact costs depend on the type of account and the trading instrument being traded. The Premium Account has variable spreads, with the EUR/USD spread starting from 1.3 pips, while the Prime Account offers spreads starting from 0.6 pips. The Elite Account offers spreads as low as 0.0 pips, but it requires a higher minimum deposit and trading volume. The professional accounts provide spreads from 0.0 pips too.

In terms of commissions, the Premium Account and Prime Account charge zero commission. The Elite Account and the Professional Account charge a commission of EUR2.5 per side per lot traded. Overall, Swissquote is often seen as competitive in terms of spreads and commissions when compared to other major brokers.

Below is a comparison table illustrating the spreads of EUR/USD, UK100, Gold, and Silver offered by Swissquote and three other brokers - FXTM, XM, and Plus500:

| Broker | EUR/USD Spread | UK100 Spread | Gold Spread | Silver Spread |

| Swissquote | 1.3 | 1 | 0.25 | 0.03 |

| FXTM | 1.5 | 1.2 | 0.35 | 0.03 |

| XM | 1.6 | 1 | 0.35 | 0.03 |

| Plus500 | 0.6 | 1 | 0.37 | 0.03 |

Non-trading fees are fees that Swissquote charges its clients for services that are not directly related to trading activities. Swissquote has a relatively low level of non-trading fees compared to other brokers. Swissquote does not charge deposit fees, but it charges withdrawal fees, which depend on the method used. Swissquote also charges an inactivity fee of CHF 50 per quarter if no trades have been made during the last six months. This fee is lower than the industry average, which is around $15 per month.

Besides, Swissquote also charges overnight swap fees, also known as rollover fees or financing fees, on positions that are held overnight. The amount of the fee depends on the currency pair, the size of the position, and the prevailing interest rates in the respective countries.

Swissquote offers a range of trading platforms suitable for both beginner and advanced traders. Its flagship platform is the Advanced Trader, which is a user-friendly and customizable platform that provides access to multiple markets and a wide range of trading tools. Additionally, the broker offers the popular MetaTrader 4 and 5 platforms, which are favored by many traders for their advanced charting capabilities and expert advisor features.

Swissquote Advanced Trader is a proprietary trading platform developed by Swissquote. It is a fully customizable platform designed to cater to the needs of professional traders. The platform offers advanced charting tools, a variety of technical indicators, and the ability to create and backtest trading strategies using the integrated programming language. Swissquote Advanced Trader also offers real-time news and market analysis to keep traders up-to-date with market events. The platform is available for desktop, web, and mobile devices.

Swissquote offers the popular MetaTrader 4 (MT4) trading platform to its clients, which is widely recognized in the industry for its reliability, speed, and advanced charting tools. MT4 is available for download on desktop, web, and mobile devices, allowing traders to access their accounts and manage their trades from anywhere at any time. Swissquote also offers a range of customized tools and indicators, allowing traders to personalize their trading experience on the platform. Additionally, Swissquote provides free access to Autochartist, a popular technical analysis tool that helps traders identify potential trading opportunities.

Swissquote offers the MetaTrader 5 (MT5) platform to its clients, which is the successor to the popular MT4 platform. MT5 has several advanced features such as improved charting capabilities, additional order types, and an economic calendar. Clients can also use MT5's algorithmic trading capabilities through the use of Expert Advisors (EAs) to automate their trading strategies. Swissquote's MT5 platform is available for desktop, web, and mobile devices, making it easily accessible for traders on the go.

Here is a table comparing the trading platforms offered by Swissquote, IG, and IC Markets:

| Trading Platform | Swissquote | IG Markets | IC Markets |

| MetaTrader 4 | √ | √ | √ |

| MetaTrader 5 | √ | √ | √ |

| Advanced Trader | √ | × | × |

| WebTrader | √ | √ | √ |

| Mobile App | √ | √ | √ |

Swissquote offers two primary deposit methods: wire transfer and debit card deposit. With wire transfer, clients can make deposits in various currencies, but the process may take longer, typically taking one to two business days to reflect on their account. On the other hand, debit card deposits are processed faster, typically within a few minutes, and they are available in CHF, EUR, GBP, EUR, AUD, JPY, PLN, CZK, HUF and USD.

Swissquote, a prominent brokerage firm in the financial market, has set its minimum deposit threshold at a noteworthy sum of CHF 1,000 or its equivalent in other currencies, which may be considered relatively high compared to other brokers in the industry.

Below is a comparison table depicting the minimum deposit prerequisites of Swissquote, Exness, and IG:

| Broker | Minimum Deposit |

| Swissquote | $1,000 |

| Exness | $1 |

| IG | $300 |

For withdrawals, Swissquote typically processes requests within one to two business days. Clients can withdraw funds using the same methods they used to deposit funds. However, it's important to note that some withdrawal methods may incur fees, so it's essential to check with the broker first before initiating a withdrawal request.

Swissquote offers customer support via various channels to ensure its clients receive timely and efficient assistance. Clients can reach Swissquote's customer support team via phone, email, and live chat, available during business hours. However, Swissquote's customer support is not available 24/7, which may be a disadvantage for clients who require immediate assistance outside of business hours. Nonetheless, the broker offers a comprehensive FAQ section on its website, which provides answers to some common questions, and clients can also seek assistance by submitting a ticket through the website. In addition, Swissquote offers support in several languages, including English, French, German, Italian, and Spanish, to cater to its global client base.

Swissquote offers a plethora of educational resources to help traders of all levels enhance their knowledge and skills. The broker provides various learning materials, including webinars, seminars, online courses, and e-books. Additionally, Swissquote offers market analysis and news to keep clients informed about the latest developments in the financial markets. This valuable information can help traders make informed decisions when executing their trades.

| Pros | Cons |

| Comprehensive educational material on various topics | No formal education program |

| Interactive webinars and seminars with industry experts | Limited language options for educational material |

| Wide range of market analysis tools and resources | No demo account for educational purposes |

| Access to Swissquote's research and analysis reports | Some educational material requires a paid subscription |

| Free educational material for all account holders | No personalized coaching or mentoring programs |

In conclusion, Swissquote is a well-established and highly regulated forex broker offering a wide range of trading instruments, advanced trading platforms, and competitive trading conditions. The broker has earned a strong reputation for its commitment to security, transparency, and innovation, which has made it a preferred choice for traders looking for a reliable and trustworthy trading partner. While the broker's high minimum deposit requirement may be a challenge for some traders, its educational resources and excellent customer support help to offset this disadvantage.

Q: Is Swissquote a regulated broker?

A: Yes, Swissquote is regulated by several financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA) and the Financial Conduct Authority (FCA) in the UK

Q: What trading platforms are offered by Swissquote?

A: Swissquote offers several trading platforms, including the MetaTrader 4 and 5 platforms, the Advanced Trader platform, and a mobile trading app.

Q: What is the minimum deposit required to open an account with Swissquote?

A: The minimum deposit required to open an account with Swissquote is $1000.

Q: Does Swissquote offer a demo account?

A: Yes, Swissquote offers a free demo account with virtual funds for traders to practice trading strategies.

Q: How can I deposit and withdraw funds from my Swissquote account?

A: You can deposit and withdraw funds from your Swissquote account using wire transfer or debit card.

| Aspect | Information |

| Company Name | VIPOTOR |

| Registered Country/Area | Malta |

| Founded Year | 2019 |

| Regulation | Unauthorized by NFA |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:100 |

| Spreads | Starting from 1.1 pips |

| Trading Platforms | MT4 |

| Tradable Assets | Forex exchange, forex exchange options, CFDs |

| Account Types | Standard, Premium, Prime account |

| Customer Support | English phone: +356 2778 1919, Email: services@Vipotor.com |

| Deposit & Withdrawal | Wire Transfer, Debit/Credit Cards, Skrill, Neteller |

| Educational Resources | Limited educational resources |

VIPOTOR, founded in Malta in 2019, is an online trading platform offering a diverse range of market instruments, including forex exchange, forex exchange options, and CFDs. The platform supports the popular MetaTrader 4 (MT4) trading platform, offering traders a user-friendly interface and comprehensive charting tools.

However, it's important to note that VIPOTOR is unauthorized by the National Futures Association (NFA) in the United States, raising concerns about regulatory oversight and user protection.

VIPOTOR is unauthorized by the regulatory authority, the National Futures Association (NFA), in the United States. It holds a Common Financial Service License with License No. 0538884 and operates under the name VIPOTOR WEALTH LTD. It's crucial to emphasize that VIPOTOR's regulatory status is“Unauthorized.”

Traders should exercise extreme caution and conduct comprehensive research before engaging in trading activities with unauthorized entities.

| Pros | Cons |

| Diverse range of market instruments | Unauthorized by the regulatory authority |

| Provides the popular MT4 trading platform | Lack of comprehensive educational resources |

| Offers various deposit methods | |

| Competitive spreads | |

| Leverage of up to 1:100 |

Pros:

Diverse Range of Market Instruments: The platform provides a variety of market instruments, such as forex exchange, forex exchange options, and CFDs. This broad range caters to different trading preferences and strategies.

MT4 Trading Platform: VIPOTOR supports the widely acclaimed MetaTrader 4 (MT4) trading platform. MT4 is known for its user-friendly interface, comprehensive charting tools, and technical analysis capabilities, making it a popular choice among traders.

Various Deposit Methods: VIPOTOR offers multiple deposit methods, including wire transfers, debit/credit cards, and e-wallets. This variety ensures convenience and flexibility for traders when funding their accounts.

Competitive Spreads: VIPOTOR provides competitive spreads, particularly on major currency pairs. Competitive spreads can help traders optimize their trading costs, potentially leading to more profitable trades.

Leverage of up to 1:100: The platform offers leverage of up to 1:100. Leverage allows traders to control larger positions with a relatively small amount of capital. This can amplify potential profits, but it also comes with increased risk.

Cons:

Unauthorized Regulatory Status: VIPOTOR lacks authorization from a reputable regulatory authority. This raises concerns about transparency, oversight, and user protection.

Lack of Comprehensive Educational Resources: VIPOTOR's educational resources are limited, which can be a drawback for traders seeking in-depth knowledge and skill development.

VIPOTOR provides its clients with a diverse range of trading assets across various categories, allowing traders to explore a wide array of investment opportunities:

Forex Exchange: VIPOTOR offers access to the foreign exchange market, commonly known as forex trading. Clients can trade major currency pairs like EUR/USD, GBP/USD, USD/JPY, and numerous exotic currency pairs.

Forex Exchange Options: In addition to spot forex trading, VIPOTOR provides clients with the opportunity to engage in forex exchange options trading.

Contract for Difference (CFD) Products: VIPOTOR also offers a range of CFD products, which include various assets such as indices, commodities, stocks, and cryptocurrencies. Traders can speculate on the price movements of these underlying assets without owning them physically.

VIPOTOR offers three distinct account types to accommodate traders of various experience levels and preferences.

Standard Account: This entry-level account provides traders with leverage of up to 1:100, allowing them to amplify their positions. The spread on major pairs is competitive at 1.7 pips, making it suitable for those who want cost-effective trading conditions. Additionally, there are no commissions associated with this account type, making it attractive for traders looking to keep trading costs low. The minimum deposit requirement for a Standard Account is $100, making it accessible to a wide range of traders. You can trade on this account using the popular MT4 trading platform.

Premium Account: With a minimum deposit of $500, the Premium Account offers the same leverage of up to 1:100 as the Standard Account. However, traders benefit from slightly tighter spreads, with major pairs having a spread of 1.4 pips.

Prime Account: For experienced traders and those looking for the tightest spreads and the highest leverage, the Prime Account is a suitable choice. It requires a minimum deposit of $5,000 and provides leverage of up to 1:100. The spreads are notably low, with major pairs having a spread of just 1.1 pips.

| Account Type | Standard | Premium | Prime |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 |

| Spread | 1.7 pips | 1.4 pips | 1.1 pips |

| Commission | None | None | None |

| Minimum Deposit | $100 | $500 | $5,000 |

| Trading Tool | MT4 | MT4 | MT4 |

| Customer Support | 24/7 | 24/7 | 24/7 |

Opening an account with VIPOTOR is a straightforward process. Here are the five steps to guide you through the procedure:

Visit the VIPOTOR Website: Start by visiting the official VIPOTOR website (https://www.Vipotor.com/).

Registration: You'll be prompted to provide your personal information, including your full name, email address, phone number, and country of residence. Make sure the information you provide is accurate and matches your official documents.

Account Type Selection: VIPOTOR offers multiple account types, such as Standard, Premium, and Prime. Select the account type that aligns with your trading needs and budget.

Identity Verification: To comply with regulatory requirements, VIPOTOR may require you to verify your identity. This often involves submitting a copy of your government-issued ID, passport, or other identification documents.

Fund Your Account: Once your account is approved, you can proceed to fund it. VIPOTOR typically accepts various deposit methods, such as wire transfer, debit/credit cards, and e-wallets like Skrill and Neteller.

Vipotor offers leverage up to 1:100 for futures and options contracts. Leverage allows you to control a larger position with a smaller amount of capital. However, leverage can also be risky, as it can amplify your losses as well as your profits.

| Account Type | Standard | Premium | Prime |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 |

VIPOTOR provides competitive spreads for traders across its account types. In the Standard account, the spread for major pairs is 1.7 pips, while the Premium account offers tighter spreads at 1.4 pips. For the Prime account, traders can benefit from even lower spreads starting at 1.1 pips. Notably, VIPOTOR does not charge any commissions, enhancing cost-effectiveness for its clients.

| Account Type | Standard | Premium | Prime |

| Spread | 1.7 pips | 1.4 pips | 1.1 pips |

| Commission | None | None | None |

VIPOTOR is a trading platform that provides its users with access to the popular MetaTrader 4 (MT4) trading platform, catering to the needs of both PC and mobile users on IOS and Android devices. Additionally, VIPOTOR offers an online trading portal that allows traders to engage in trading without the need for any downloads or installations.

MetaTrader 4 (MT4) Platform: One of the standout features of VIPOTOR is its support for the MT4 trading platform. MT4 is well-regarded in the trading community for its user-friendly interface, advanced charting tools, technical analysis capabilities, and a wide range of customizable indicators. This platform is favored by both novice and experienced traders alike for its reliability and comprehensive set of features.

Multi-Device Compatibility: VIPOTOR ensures accessibility for traders on various devices. Whether you prefer trading on your PC or on the go using your mobile device, VIPOTOR has you covered. The MT4 trading platform is available for PC users, while traders on IOS and Android devices can also enjoy seamless trading experiences.

Online Trading Portal: In addition to the downloadable MT4 platform, VIPOTOR provides an online trading portal. This portal offers traders a convenient way to access the markets without the hassle of software installations. Traders can simply log in to their accounts through a web browser and commence trading immediately. This feature is especially appealing to traders who value flexibility and quick access to the markets.

User-Friendly Approach: VIPOTOR's emphasis on the MT4 platform and an online trading portal reflects its user-friendly approach. The availability of multiple options allows traders to choose the method that best suits their preferences and trading styles. Whether you're a desktop enthusiast or prefer the convenience of mobile trading, VIPOTOR caters to your needs.

VIPOTOR offers a variety of payment methods to accommodate its clients' preferences. Traders can fund their accounts using common payment options widely supported by brokers, including Wire Transfer, Debit/Credit Cards, and popular e-wallets like Skrill and Neteller.

Wire Transfer: This traditional banking method allows for secure and direct transfers from your bank account to your VIPOTOR trading account. It is a reliable option for larger deposits, but processing times may vary depending on your bank and location.

Debit/Credit Cards: VIPOTOR accepts payments via major debit and credit cards, providing a convenient and widely-used option. Deposits made through cards are usually processed quickly, allowing traders to start trading promptly.

E-Wallets (Skrill and Neteller): E-wallets offer a swift and convenient way to deposit funds into your VIPOTOR account. Skrill and Neteller are popular choices among traders due to their ease of use and rapid transaction processing times.

The minimum deposit requirement varies based on the chosen account type, with the Standard account requiring a minimum deposit of $100, the Premium account at $500, and the Prime account at $5,000. Traders should ensure they meet the minimum deposit criteria for their selected account type before initiating the deposit process.

| Account Type | Standard | Premium | Prime |

| Minimum Deposit | $100 | $500 | $5,000 |

VIPOTOR offers responsive customer support to assist its clients with any inquiries or concerns. For direct communication, you can reach VIPOTOR's English-language customer support team at +356 2778 1919. Additionally, you can contact VIPOTOR via email at services@Vipotor.com for assistance and information. These multiple customer support channels ensure that clients have access to reliable assistance, enhancing their overall trading experience and addressing any issues promptly and effectively.

VIPOTOR lacks comprehensive educational resources. The platform does not provide an extensive collection of educational materials for traders seeking in-depth knowledge and skill development. While basic FAQs may address common queries, traders looking for a more robust educational experience may need to supplement their learning with external sources or educational platforms to enhance their trading expertise while using VIPOTOR as their trading platform. It's essential for traders to be aware of this limitation and take proactive steps to acquire the necessary knowledge and skills for successful trading.

In conclusion, VIPOTOR offers traders a diverse range of market instruments, featuring forex exchange, forex exchange options, and CFDs. With the support of the popular MetaTrader 4 (MT4) trading platform and various deposit methods, it caters to traders' diverse needs. Competitive spreads and leverage of up to 1:100 enhance trading opportunities.

However, it's crucial to consider the platform's unauthorized status by the National Futures Association (NFA) in the United States, which raises transparency and oversight concerns. Furthermore, the limited educational resources may require traders to seek additional learning sources. As with any trading platform, thorough research and caution are essential when considering VIPOTOR.

Q: Is VIPOTOR a regulated forex broker?

A: No, VIPOTOR is unauthorized by the regulatory authority, the National Futures Association (NFA), in the United States.

Q: What trading platforms are available on VIPOTOR?

A: VIPOTOR offers the MetaTrader 4 (MT4) trading platform for PC, IOS, and Android, along with an online trading portal.

Q: What is the minimum deposit required to open a VIPOTOR account?

A: The minimum deposit varies depending on the account type, starting from $100 for the Standard account, $500 for Premium, and $5,000 for Prime.

Q: Does VIPOTOR charge commissions on trades?

A: No, VIPOTOR does not charge commissions on trades. It primarily earns revenue through spreads.

Q: Are there educational resources available on VIPOTOR?

A: VIPOTOR's educational resources are limited, consisting mainly of basic FAQs. Traders seeking in-depth education may need to explore external sources.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive swissquote and vipotor are, we first considered common fees for standard accounts. On swissquote, the average spread for the EUR/USD currency pair is -- pips, while on vipotor the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

swissquote is regulated by FCA,MFSA,FINMA,DFSA. vipotor is regulated by ASIC,NFA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

swissquote provides trading platform including professional ,standard,prime,premium and trading variety including custom. vipotor provides trading platform including -- and trading variety including --.