User Reviews

Sort by content

- Sort by content

- Sort by time

User comment

1

CommentsWrite a review

2023-03-23 18:40

2023-03-23 18:40

Estonia|2-5 years|

Estonia|2-5 years| https://asian-trade.asia/

Website

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

More

Asian Trade

Asian Trade

Estonia

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Japan |

| Founded Year | 1-2 years |

| Company Name | Asian Trade |

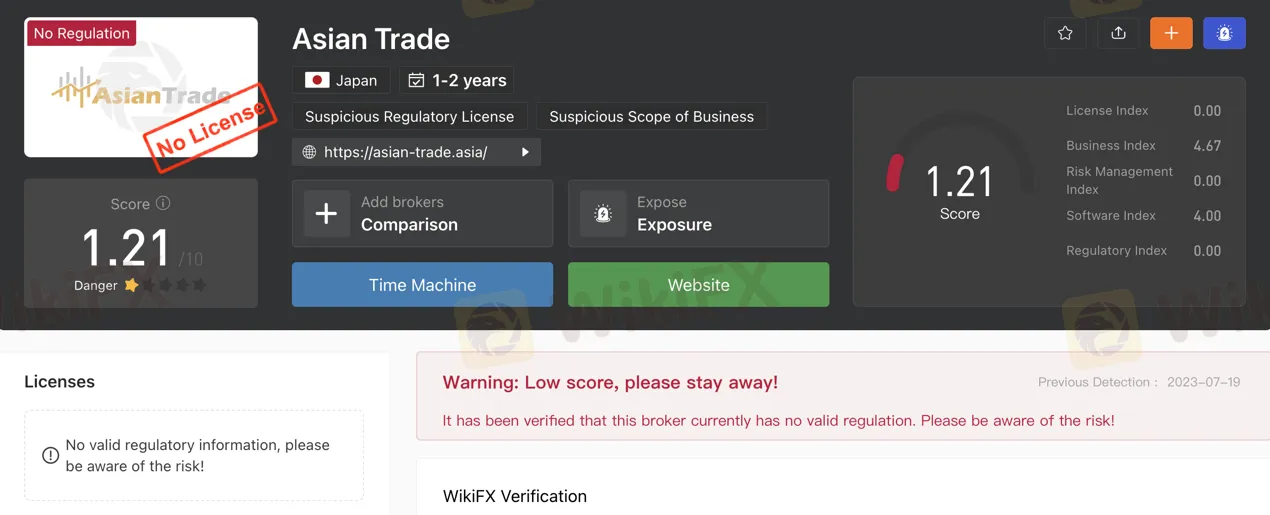

| Regulation | Lacks proper regulation |

| Minimum Deposit | 100 JPY |

| Maximum Leverage | 1:500 |

| Spreads | From no spreads |

| Trading Platforms | Asian Trade Fx platform available for Windows, MacOS, Android, iOS, WebTrader |

| Tradable Assets | FOREX, Metals, Indices, CFDs, Cryptocurrency |

| Account Types | Micro Account, Trader Account, ECN Account |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Email: support@asian-trade.info |

| Payment Methods | Bank transfers, cash, Bitcoin, Tether, Ethereum |

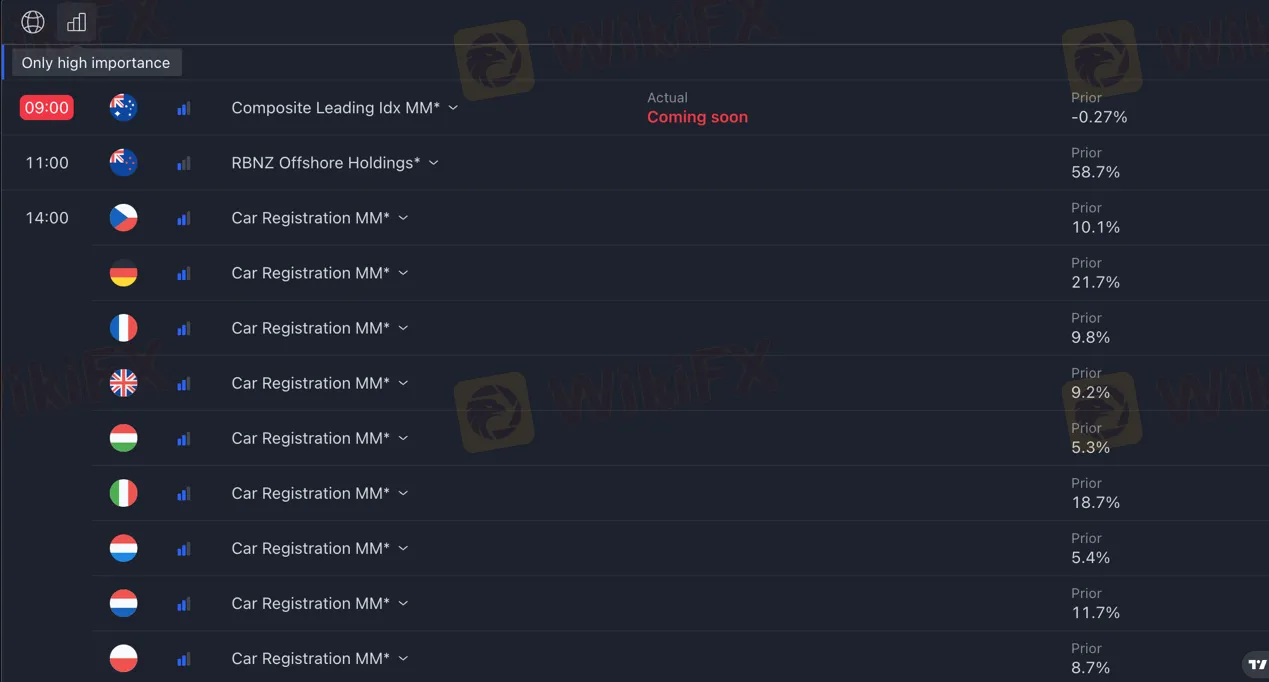

| Educational Tools | Economic Calendar |

The Asian trade market is a diverse marketplace offering trading opportunities across various instruments. However, it is important to note that the market operates without proper regulation, which poses significant risks for investors. Caution is advised when engaging in trading activities within this unregulated environment.

Asian Trade market provides a wide range of instruments for trading, including forex, metals, indices, CFDs, and cryptocurrencies. Forex trading involves major currency pairs such as EUR/JPY and JPY/GBP, while metals like gold and silver are actively traded. The market also offers indices like the Nikkei 225 and Hang Seng Index, as well as CFDs on commodities, stocks, and indices. Traders can also participate in cryptocurrency trading with popular digital currencies like Bitcoin and Ethereum.

Different types of accounts are available in the Asian Trade market, including the Micro Account, Trader Account, and ECN Account. Each account type has varying minimum deposit requirements and offers different trading conditions. The market provides leverage options of up to 1:500, and the spreads and commissions depend on the chosen account type. Additionally, there are multiple options for depositing and withdrawing funds, including bank transfers and cryptocurrencies.

Asian Trade offers a range of pros and cons for traders. On the positive side, it provides opportunities to trade cryptocurrencies, major currency pairs, precious metals, and various stock market indices. Traders can also engage in Contracts for Difference (CFDs) and benefit from high leverage of up to 1:500. The platform offers advanced trading platforms with charting and analytical tools, as well as a real-time Economic Calendar tool to stay informed about financial events. However, there are also notable drawbacks, including the lack of proper regulation, limited information on specific market instruments, account types, and features. The absence of a demo account, transparency issues with spreads and commissions, and insufficient information on deposit and withdrawal methods are also concerns. Additionally, there is unclear information about trading platforms and tools, customer support availability, and the lack of comprehensive FAQs and educational resources.

| Pros | Cons |

| Opportunities to trade cryptocurrencies. | Lack of proper regulation raises concerns and poses risks. |

| Opportunities to trade major currency pairs. | No information on specific market instruments |

| Access to trading precious metals. | Limited information on account types and features. |

| Availability of various stock market indices. | No demo account available |

| Option to trade Contracts for Difference (CFDs). | Lack of transparency regarding spreads and commissions. |

| Spreads from o | Limited information on deposit and withdrawal methods. |

| Different account types catering to new and experienced traders. | Unclear details on trading platforms and tools. |

| High leverage of up to 1:500. | Insufficient information on customer support availability and responsiveness. |

| Advanced trading platforms with charting and analytical tools. | Lack of comprehensive FAQs addressing key concerns. |

| Real-time Economic Calendar tool to stay informed about financial events. | Lack of educational resources |

The Asian trade lacks proper regulation, which has been confirmed by reputable sources. This raises significant concerns and poses a considerable risk to investors. It is crucial to exercise caution and be fully aware of the potential dangers associated with engaging in trading activities within this unregulated environment.

1. FOREX: The Asian trade offers a wide range of forex trading opportunities. Major currency pairs such as EUR/JPY, JPY/GBP, CHF/AUD, CAD/NZD, and CNY are actively traded. These currency pairs allow investors to speculate on the fluctuations in exchange rates between different economies. For example, traders can engage in EUR/JPY trades to capitalize on the performance of the Euro against the Japanese Yen or JPY/GBP trades to take advantage of the exchange rate movements between the Japanese Yen and British Pound.

2. METALS: Precious metals play a significant role in the Asian trade. Investors have the opportunity to trade metals like gold, silver, platinum, and palladium. These metals are considered safe-haven assets and are often influenced by geopolitical and economic factors. Traders can engage in gold trading, for instance, to benefit from the price movements of this precious metal in response to market conditions.

3. INDICES: The Asian trade offers a variety of indices representing different stock markets in the region. Popular indices include the Nikkei 225, Hang Seng Index, Shanghai Composite Index, and S&P/ASX 200. These indices allow investors to track and speculate on the performance of specific stock markets or sectors. Traders can take positions on the Nikkei 225, for example, to profit from changes in the overall Japanese stock market.

4. CFD's: Contracts for Difference (CFDs) are another instrument widely available in the Asian trade. CFDs allow traders to speculate on the price movements of various assets without actually owning them. In this market, traders can find CFDs on commodities, stocks, and indices. For instance, traders can engage in CFD trading on popular Asian stocks like Tencent Holdings, Samsung Electronics, or Alibaba Group.

5. CRYPTO CURRENCY: The Asian trade offers opportunities to trade cryptocurrencies. Popular digital currencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC) can be traded against major fiat currencies like USD, EUR, or JPY. Traders can take advantage of the price volatility in the crypto market, speculating on the price movements of these digital assets against traditional currencies.

| Pros | Cons |

| Opportunities to trade cryptocurrencies | Transparency issues with spreads and commissions |

| Availability of precious metals trading | Limited information on specific market instruments |

| Opportunity to trade various stock market indices | Unclear details on trading conditions |

| Availability of Contracts for Difference (CFDs) |

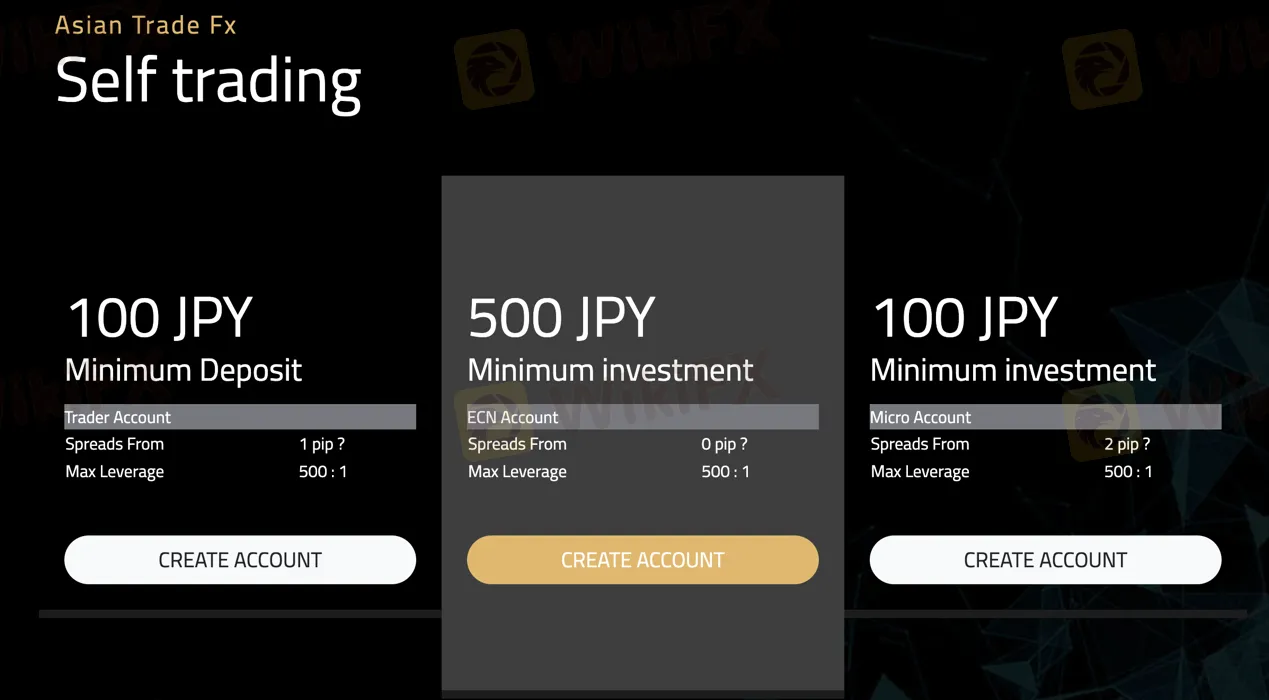

Micro Account: The Micro account offered by Asian Trade requires a minimum investment of 100 JPY. It features variable spreads starting from 2 pips and has no commissions. Traders can engage in trading activities involving currency pairs, major stock indices, oil, precious metals, and bonds. The account is designed to cater to both new and experienced traders, offering optimal trading conditions and fast order execution. It serves as an excellent entry point for individuals venturing into the world of trading.

Trader Account: Asian Trade also provides the Trader account option, which necessitates a minimum deposit of 100 JPY. Similar to the Micro account, it offers variable spreads, but starting from 1 pip. There are no commissions involved. Traders can participate in trading various instruments, including currency pairs, major stock indices, oil, precious metals, and bonds. The Trader account is suitable for both new and experienced traders, providing favorable trading conditions and fast order execution.

ECN Account: Asian Trade presents the ECN account, which requires a minimum deposit of 500 JPY. This account type offers unique features such as no spreads and no commissions. Traders can engage in trading activities involving currency pairs, major stock indices, oil, precious metals, and bonds. The ECN account is designed to cater to both new and experienced traders, providing optimal trading conditions and fast order execution.

| Pros | Cons |

| Micro Account offers optimal trading conditions | Lack of information on specific account features |

| Leverage up tp 1:500 | Limited details on account benefits and advantages |

| ECN Account offers unique features with no spreads or commissions | Demo account unavailable |

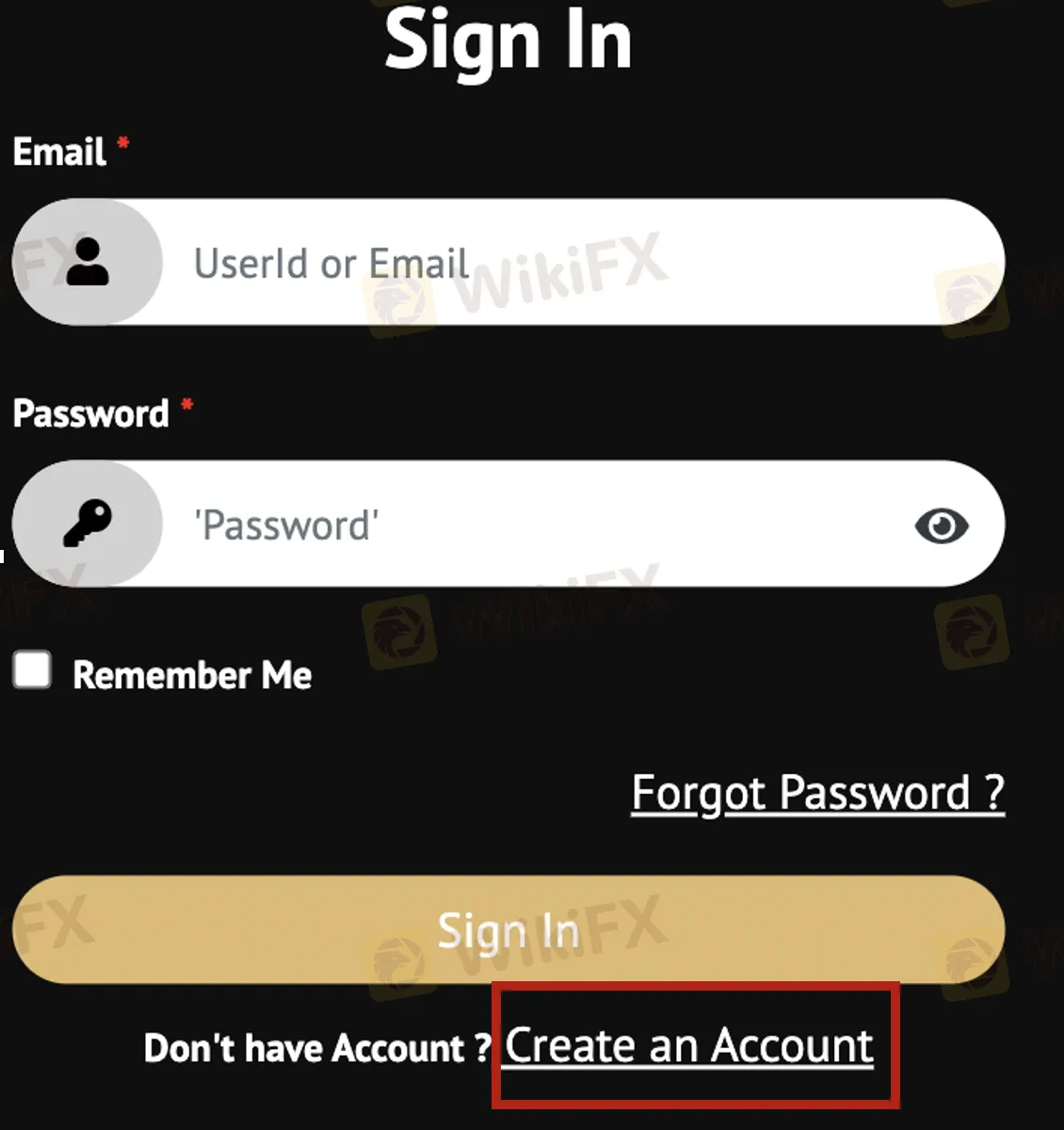

To open an account with Asian Trade, follow these steps:

Click on the “REGISTER” button.

Sign in by entering your email address or user ID and password. You can choose to enable the “Remember Me” option for convenience or click on “Forgot Password?” if needed.

If you don't have an account, click on “Create an Account.”

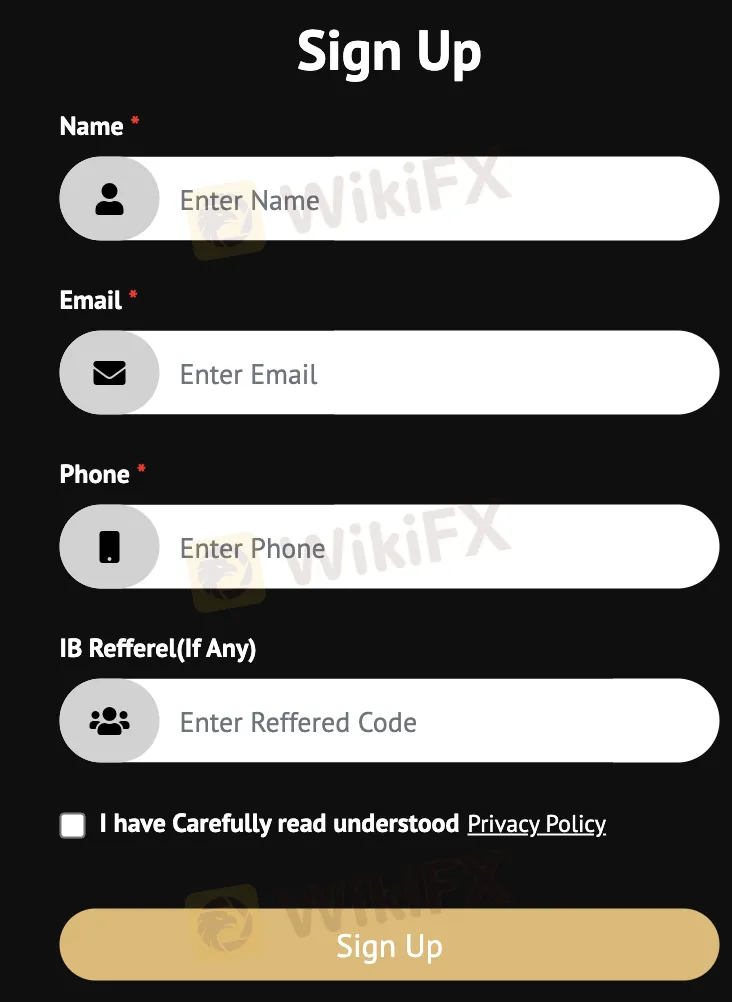

Fill in your name, email address, and phone number in the respective fields.

If you were referred by someone, enter their referral code in the “IB Referral (If Any)” field.

Confirm that you have read and understood the Privacy Policy.

Click on the “Sign Up” button to complete the account registration process.

Asian Trade offers a leverage of 1:500, allowing traders to amplify their trading positions up to 500 times the amount of their initial investment.

Asian Trade offers different spreads and commission structures depending on the type of trading account. The Micro account features variable spreads starting from 2 pips with no commissions. The Trader account offers variable spreads starting from 1 pip without any commissions. As for the ECN account, there are no spreads or commissions involved.

Asian Trade offers different account types with varying minimum deposit requirements. The Micro account requires a minimum deposit of 100 JPY, the Trader account also requires a minimum deposit of 100 JPY, and the ECN account has a higher minimum deposit of 500 JPY.

Asian Trade provides various options for depositing and withdrawing funds. If depositing through a bank, customers are required to provide the necessary details such as the bank name, IFSC code, branch name, and account number, as instructed by the support team. Alternatively, if depositing by cash, customers need to specify the deposited amount and the recipient's name. Similarly, for withdrawals, customers can choose between bank transfers by providing their own bank details or opting for cash withdrawals. The market also supports different payment methods, including Bitcoin, Tether, and Ethereum.

| Pros | Cons |

| Various options for depositing and withdrawing funds | Lack of information on deposit and withdrawal fees |

| Support for bank transfers and cash withdrawals | Limited details on specific requirements for each method |

| Acceptance of multiple payment methods, including cryptocurrencies | Insufficient information on processing times |

Asian Trade provides a range of trading platforms with advanced charting and analytical tools, sophisticated order management tools, and Expert Advisors. Traders can access these platforms from Windows, MacOS, Android, iOS, and WebTrader. The Asian Trade Fx trading platform allows users to trade the markets from any desktop, Android, or iOS device.

| Pros | Cons |

| Advanced charting and analytical tools | No MT4/5 provided |

| Sophisticated order management tools | Insufficient details on platform features and functionalities |

| Accessible platforms for Windows, MacOS, Android, iOS, WebTrader | Lack of transparency regarding platform stability and performance |

Asian Trade offers an Economic Calendar tool that provides real-time coverage of financial events and indicators worldwide. This tool is regularly updated with new data as it becomes available, allowing traders to stay informed about relevant economic events.

Asian Trade offers customer support through their office located at Vana turg 2, 10140 Tallinn, Estonia. Customers can contact them via email at support@asian-trade.info or connect with their support team through the same email address. Additionally, they have an Asian Trade Fx office in Japan.

In conclusion, Asian Trade presents both advantages and disadvantages. On the positive side, the market offers a diverse range of trading instruments, including forex, metals, indices, CFDs, and cryptocurrencies. It provides multiple account types with varying minimum deposit requirements and leverage options. The trading platforms offered by Asian Trade are accessible from various devices, and they provide advanced charting and analytical tools. Moreover, Asian Trade offers an Economic Calendar tool to keep traders informed about relevant economic events. However, it is important to note that the Asian trade market lacks proper regulation, posing risks to investors. Caution should be exercised when engaging in trading activities within this unregulated environment.

Q: Is Asian Trade a legitimate market?

A: Asian Trade lacks proper regulation, posing risks to investors.

Q: What market instruments are available in Asian Trade?

A: Asian Trade offers forex, metals, indices, CFDs, and cryptocurrencies.

Q: What account types are offered by Asian Trade?

A: Asian Trade provides Micro, Trader, and ECN accounts.

Q: What leverage does Asian Trade offer?

A: Asian Trade offers leverage of 1:500.

Q: What are the spreads and commissions in Asian Trade?

A: Spreads vary based on account type, and there are no commissions in some accounts.

Q: What is the minimum deposit required in Asian Trade?

A: Minimum deposits range from 100 JPY to 500 JPY, depending on the account type.

Q: How can I deposit and withdraw funds with Asian Trade?

A: Multiple options are available, including bank transfers and cryptocurrencies.

Q: What trading platforms are available in Asian Trade?

A: Asian Trade offers advanced trading platforms for various devices.

Q: What trading tools does Asian Trade provide?

A: Asian Trade offers an Economic Calendar tool for real-time financial event coverage.

Q: How can I contact customer support at Asian Trade?

A: Contact Asian Trade via email or visit their offices in Estonia and Japan.

Q: What should I consider when trading in Asian Trade?

A: Exercise caution due to the lack of regulation and potential risks involved.

Sort by content

User comment

1

CommentsWrite a review

2023-03-23 18:40

2023-03-23 18:40