No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FXPRIMUS and Santander ?

In the table below, you can compare the features of FXPRIMUS , Santander side by side to determine the best fit for your needs.

EURUSD: -0.9

XAUUSD: --

Long: -7.5

Short: 1.38

Long: -41.09

Short: 18.55

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxprimus, santander lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| FXPRIMUS Review Summary in 10 Points | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Market Instruments | Forex, Metals, Energies, Equities, Indices, Futures and CFD Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | From 0 pips |

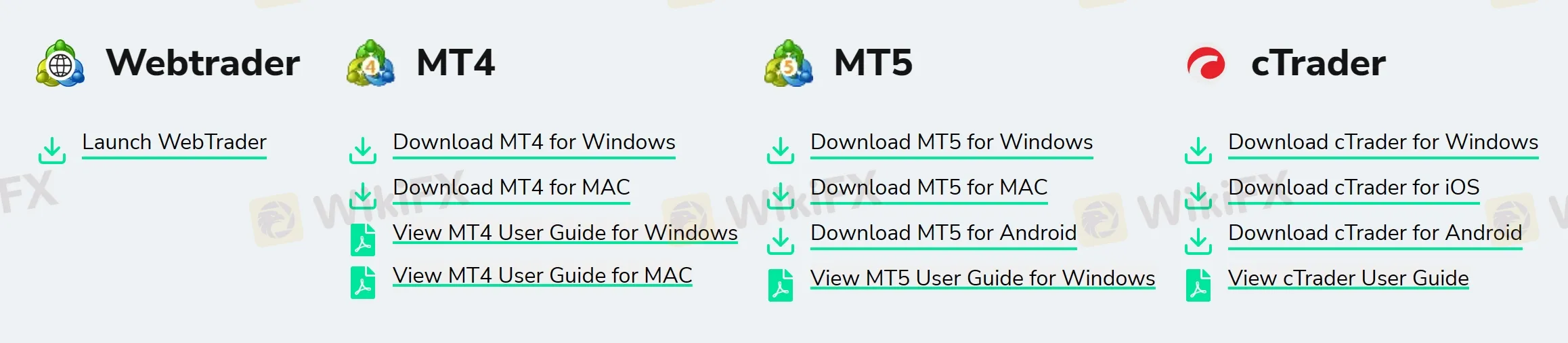

| Trading Platforms | MT4, MT5, cTrader, WebTrader |

| Minimum deposit | $15 |

| Customer Support | 24/5 live chat, email |

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on a range of financial instruments including Forex, Metals, Energies, Equities, and Indices, different account types with varying minimum deposits and leverages, and multiple trading platform choices of MT4, MT5, cTrader, and WebTrader.

| Pros | Cons |

| • Regulated by CYSEC | • Clients from Australia, Belgium, Iran, Japan, North Korea and USA are not accepted |

| • High-level protection measures for clients | • Higher minimum deposit for certain account types |

| • Wide range of market instruments | • Limited copy trading availability |

| • Low minimum deposit | |

| • No deposit or withdrawal fees | |

| • Competitive spreads and commissions | |

| • Various deposit and withdrawal methods | |

| • Strong customer service support | |

| • Comprehensive trading tools and educational resources |

Overall, FXPRIMUS appears to be a legitimate and reliable broker with strong regulatory oversight and high-level protection measures. They offer a wide range of trading instruments and account types, as well as various trading platforms and educational resources.

There are many alternative brokers to FXPRIMUS depending on the specific needs and preferences of the trader. Some popular options include:

FXCM - a well-established broker with a good reputation and comprehensive trading tools;

FxPro - offers competitive pricing and advanced trading platforms;

Exness - has a user-friendly platform and low minimum deposits.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

FXPRIMUS is a legitimate online broker that is regulated by the Cyprus Securities and Exchange Commission (CySEC). It is also a member of the Investor Compensation Fund (ICF) in Cyprus, which provides protection to clients in the event of the company's insolvency. Overall, FXPRIMUS appears to be a reputable broker.

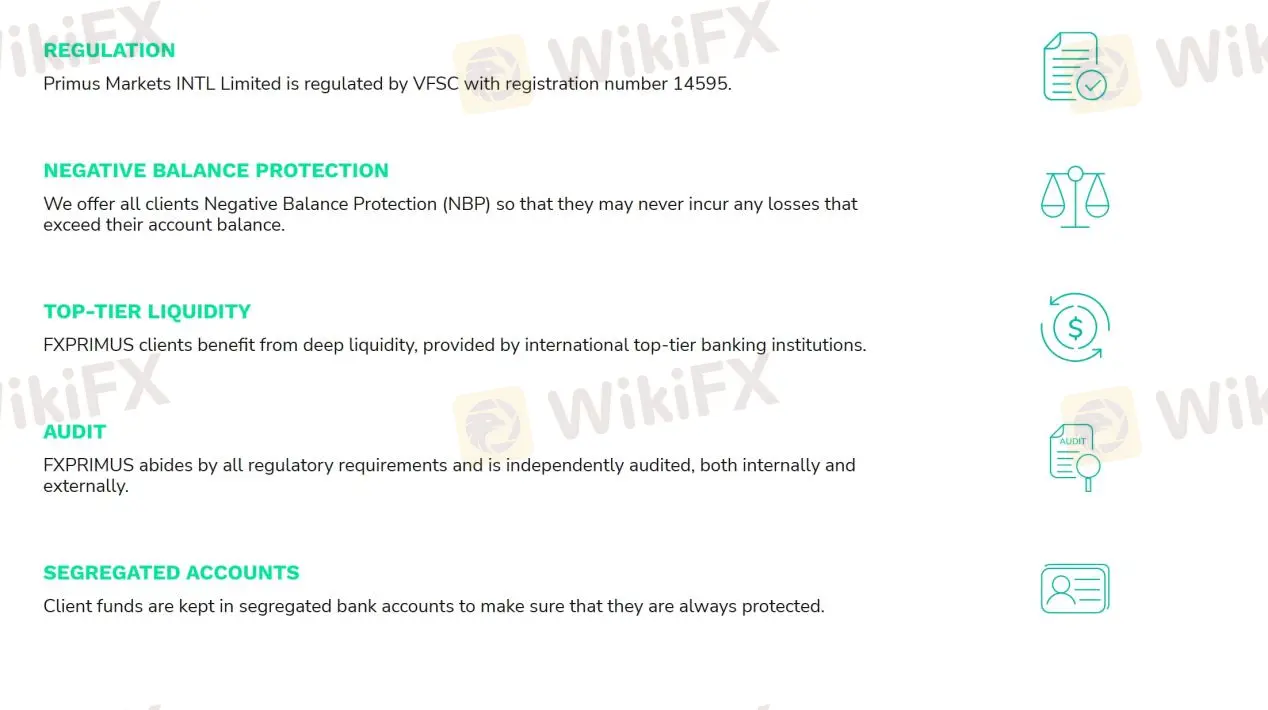

FXPRIMUS places a strong emphasis on client protection measures. It offers Negative Balance Protection, which means that clients will never lose more than their account balance. Additionally, FXPRIMUS uses top-tier liquidity providers, ensuring fast and reliable execution of trades. The broker's funds are audited by a third-party auditor to ensure transparency, and client funds are held in segregated accounts, separate from the broker's operating funds. These measures help to ensure that FXPRIMUS clients are protected from financial fraud and malpractice.

Based on the information provided, FXPRIMUS appears to have strong protection measures in place for their clients, including regulation by CYSEC, negative balance protection, top-tier liquidity, and audit and segregated accounts. These measures provide a level of assurance that FXPRIMUS is committed to the security of its clients' funds. Therefore, it can be concluded that FXPRIMUS is a trustworthy broker for traders.

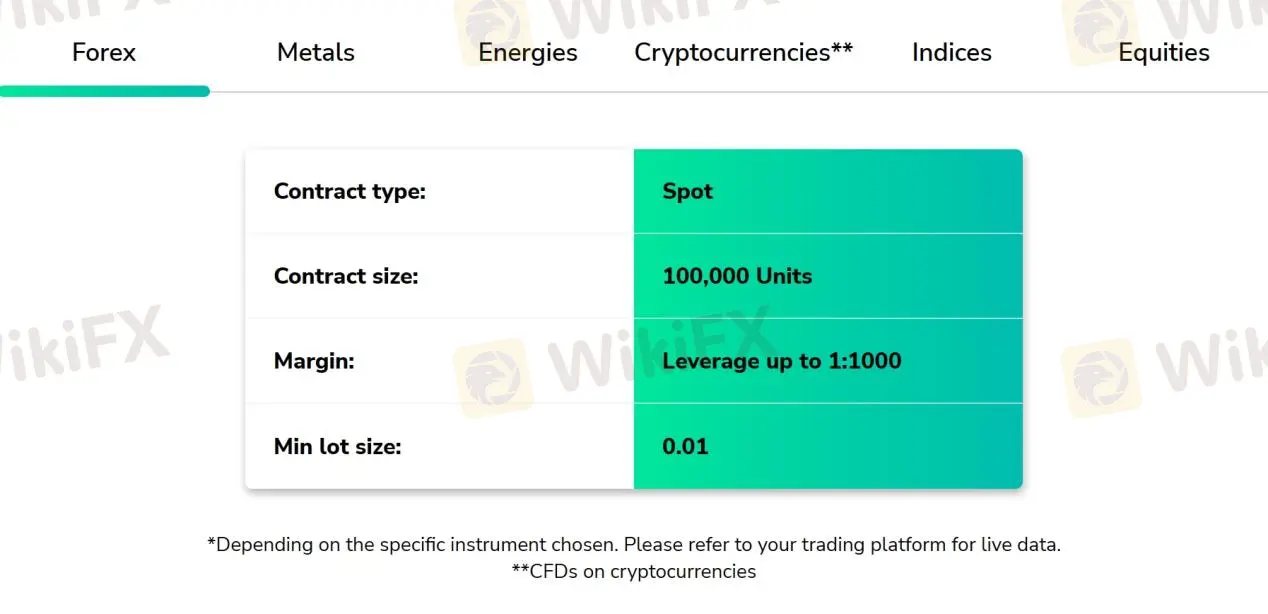

FXPRIMUS offers a diverse range of market instruments for its clients to trade. In addition to forex pairs, clients can also trade metals such as gold and silver, as well as energies such as oil and natural gas. The broker also offers equities, indices, futures, and CFD cryptocurrencies. With such a wide range of market instruments available, clients can diversify their trading portfolios and take advantage of different market opportunities.

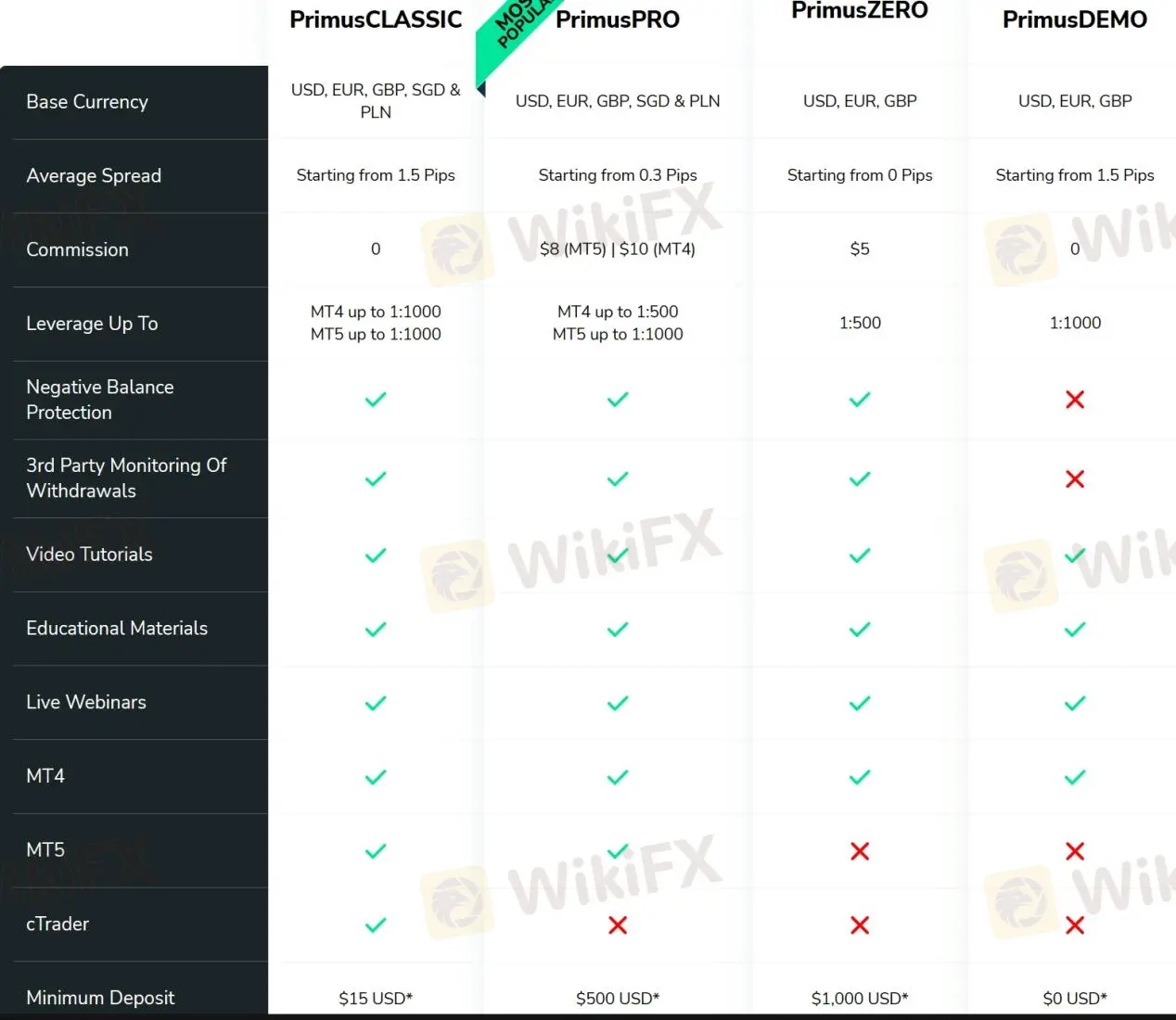

FXPRIMUS offers three account types, Primus Classic, Primus Pro, and Primus Zero, with minimum deposits ranging from $15 to $1,000. Primus Classic accounts are the most accessible with a low minimum deposit requirement of $15, while Primus Pro and Primus Zero accounts require higher minimum deposits of $500 and $1,000, respectively. Copy trading is only available for Primus Classic accounts. FXPRIMUS also offers demo accounts for traders to practice their strategies before committing to a live account.

FXPRIMUS provides varying leverage options depending on the account type and trading platform. For instance, for the Primus Classic account, clients can enjoy up to 1:1000 leverage. On the other hand, for the Primus Pro account, leverage is up to 1:500 on the MT4 platform and up to 1:1000 on the MT5 platform. For the Primus Zero account, the maximum leverage offered is up to 1:500. It is essential to note that high leverage levels carry a higher risk of potential losses, and traders should exercise caution when using high leverage levels.

FXPRIMUS offers competitive spreads and commissions across its account types. The spreads for the Primus Classic account start from 1.5 pips with no commission, which is suitable for beginners who are looking for a commission-free trading experience. For the Primus Pro account, the spreads are variable and start from as low as 0.3 pips, but the commissions are higher at $8 on the MT5 and $10 on the MT4. For experienced traders who prefer tighter spreads, the Primus Zero account offers spread from 0 pips with a commission of $5, making it suitable for high-frequency trading strategies.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXPRIMUS | From 0.0 pips | No commission on Primus Classic |

| FXCM | From 0.2 pips | No commission on Standard |

| FxPro | From 0.0 pips | From $4.5 on cTrader |

| Exness | From 0.3 pips | No commission on Standard |

Note: Spreads can vary depending on market conditions and volatility.

FXPRIMUS offers a range of popular trading platforms to cater to the needs of different types of traders. The platform options include the widely used MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and WebTrader.

The MT4 and MT5 platforms are popular among traders due to their user-friendly interface, advanced charting capabilities, and customizable indicators.

The cTrader platform is preferred by traders who seek a more transparent trading environment with direct market access (DMA) and Level II pricing.

The WebTrader platform is a web-based platform that allows traders to access their accounts from any device with an internet connection, without the need to download or install any software.

Overall, FXPRIMUS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| FXPRIMUS | MT4, MT5, cTrader, WebTrader |

| FXCM | Trading Station, MT4 |

| FxPro | MT4, MT5, cTrader |

| Exness | MT4, MT5, WebTerminal |

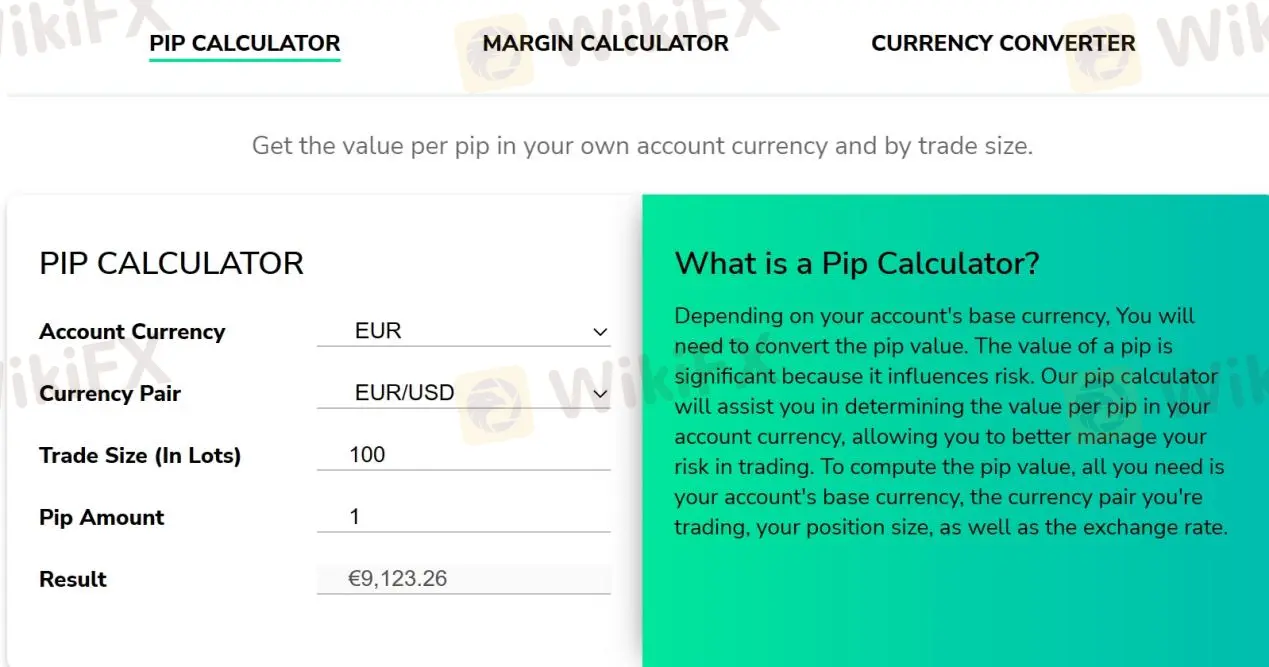

Trading tools

FXPRIMUS offers a variety of trading tools to assist its clients. The pip calculator helps traders calculate the value of a pip for a given currency pair and position size. The margin calculator allows traders to calculate the margin required to open and hold a position. The currency converter helps traders convert one currency to another at current exchange rates.

In addition, FXPRIMUS provides a market calendar that shows the schedule of economic events and their expected impact on the market, which can help traders make informed trading decisions. These tools can be accessed through the FXPRIMUS website or the trading platforms.

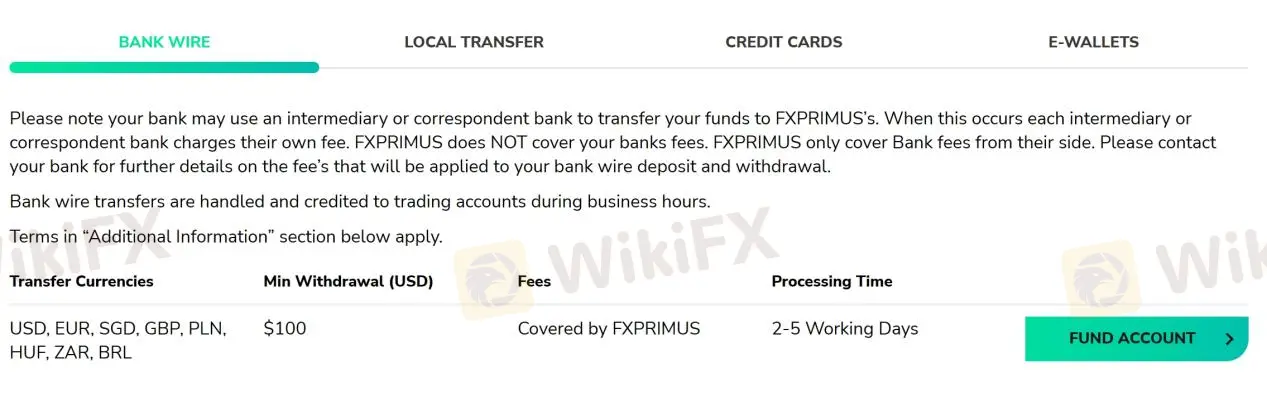

FXPRIMUS offers various deposit and withdrawal methods, including Bank Wire, Local Transfer, Credit Cards, and e-Wallets.

The minimum deposit is relatively low at $15. There are no deposit or withdrawal fees charged by FXPRIMUS, but your payment provider may charge a fee. However, it is worth noting that the minimum withdrawal amount is $100, which may be higher than some traders would prefer.

| FXPRIMUS | Most other | |

| Minimum Deposit | $15 | $100 |

The processing time for withdrawals varies depending on the payment method chosen, with Bank Wire taking 2-5 working days, Local Transfer taking 1-5 working days, and Credit Cards and e-Wallets taking up to 5 minutes.

To withdraw funds from FXPRIMUS, you can follow these steps:

Step 1: Log in to your FXPRIMUS account and click on the “Withdrawals” option in the main menu.

Step 2: Select the payment method you want to use for the withdrawal.

Step 3: Enter the amount you want to withdraw and click on the “Submit” button.

Step 4: Follow the instructions provided by the payment method you selected to complete the withdrawal process.

FXPRIMUS does not charge any deposit or withdrawal fees; however, payment provider fees may apply.

The broker charges an inactivity fee of $10 per month for accounts that have been inactive for 180 days or more. This fee is charged to cover the costs of maintaining the account and providing access to trading services, educational resources, and customer support. However, the inactivity fee can be avoided by simply logging into the trading account at least once every 180 days. It's important to note that the inactivity fee is only charged on the balance of the account and not on the deposited amount.

It also charges swap fees for holding positions overnight, and these fees vary depending on the instrument being traded.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXPRIMUS | Free | Free | $10 per month after 180 consecutive days of inactivity |

| FXCM | Free | Free | $50 per year after 12 months of inactivity |

| FxPro | Free | Free | $0 after 12 months of inactivity |

| Exness | Free | Varies by payment method | No |

It is important to note that fees and charges are subject to change, and clients should refer to the brokers websites for up-to-date information.

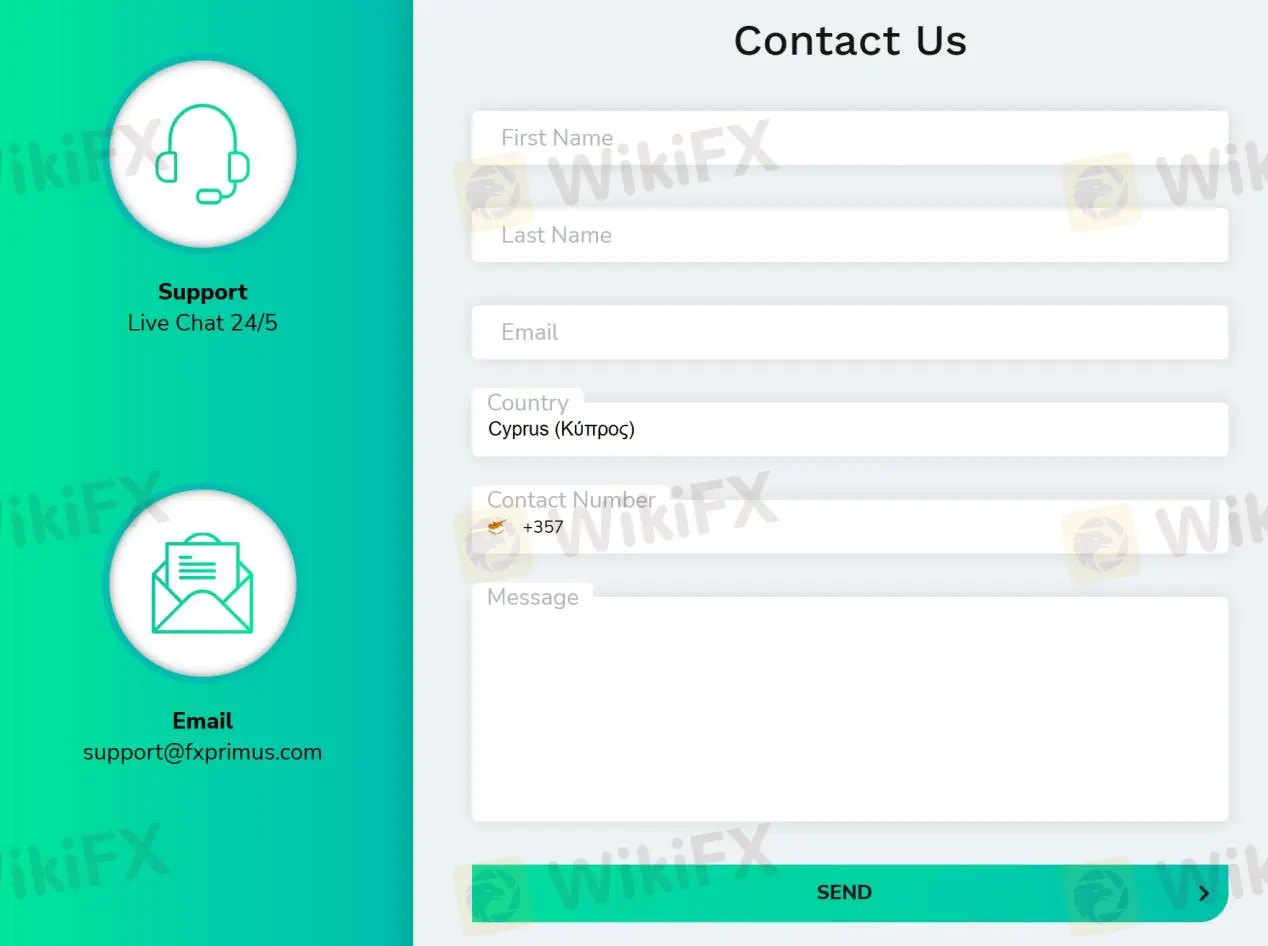

FXPRIMUS customer service offers various channels for clients to reach out for support. Clients can access 24/5 live chat, email, and online messaging to get in touch with customer support representatives. In addition, the broker provides support via messaging apps such as Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram. This allows clients to contact customer support representatives in a convenient and accessible way.

Furthermore, FXPRIMUS has a presence on social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay up-to-date with the latest news and updates from the broker.

| Pros | Cons |

| • 24/5 live chat | • No phone support |

| • Multiple language support for live chat and email | • No support on Weekends |

| • Active on social media channels for customer engagement | • Live chat can be slow to respond during busy periods |

Note: These pros and cons are subjective and may vary depending on the individual's experience with FXPRIMUS' customer service.

FXPRIMUS offers a variety of educational resources for traders of all levels. These resources include video tutorials, educational materials, live webinars, and articles.

The video tutorials cover a range of topics, from basic concepts such as trading terminology and chart analysis to more advanced topics such as risk management and trading strategies.

The educational materials include e-books, trading guides, and other resources to help traders improve their skills and knowledge.

The live webinars are led by experienced traders and cover a variety of topics, including market analysis, trading psychology, and risk management.

The articles on FXPRIMUS' website cover current market news and analysis, trading strategies, and other relevant topics.

In conclusion, FXPRIMUS is a regulated and reliable broker that offers a range of account types with competitive spreads and commissions. The broker provides a variety of trading platforms and trading tools to enhance clients' trading experience. Additionally, the broker offers excellent customer service and educational resources to support traders.

| Q 1: | Is FXPRIMUS regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At FXPRIMUS, are there any regional restrictions for traders? |

| A 2: | Yes. FXPRIMUS does not offer its services to residents of certain countries/jurisdictions including, but not limited to, Australia, Belgium, Iran, Japan, North Korea and USA. |

| Q 3: | Does FXPRIMUS offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does FXPRIMUS offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4, MT5, cTrader, and WebTrader. |

| Q 5: | What is the minimum deposit for FXPRIMUS? |

| A 5: | The minimum initial deposit to open an account is $15. |

| Q 6: | Is FXPRIMUS a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Company Name | Santander UK Plc |

| Regulatory Status | Regulated by the Financial Conduct Authority (FCA) with License No. 106054 |

| License Type | Market Making (MM) |

| Effective Date | December 1, 2001 |

| License Type | No Sharing |

| Website | Santander UK Plc |

| Email Address | customerservices@santander.co.uk |

| Address | 2 Triton Square, Regent's Place, London NW1 3AN, UNITED KINGDOM |

| Phone Number | 448003897000 |

| Products and Services | Current Accounts, Mortgages, Credit Cards, Savings and ISAs, Investments, Insurance, Personal Loans |

| Customer Support | Telephone (1-877-768-2265), Live Chat, ATM/Branch Locator |

| Customer Support Hours | Mon - Sat, 8 a.m. to 8 p.m. EST |

| International Calls | Local number for customers outside the United States: 1-401-824-3400 |

Santander UK is a large retail and commercial bank based in the UK and a wholly-owned subsidiary of the major global bank Banco Santander. It is registered in England and Wales, authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. It manages its affairs autonomously, with its own local management team, responsible solely for its performance. It has its origins in three constituent companies—Abbey National, Alliance & Leicester and Bradford & Bingley—all former mutual building societies. It is one of the leading personal financial services companies in the United Kingdom, and one of the largest providers of mortgages and savings in the United Kingdom.

Santander UK Plc is a regulated institution under the jurisdiction of the United Kingdom's Financial Conduct Authority (FCA) with License No. 106054. It holds a Market Making (MM) license type and has been regulated since December 1, 2001. The institution operates with the license type of “No Sharing.” You can contact them via email at customerservices@santander.co.uk and find more information on their website: https://www.santander.co.uk/. The regulatory status does not specify an expiry date, and Santander UK Plc is located at 2 Triton Square, Regent's Place, London NW1 3AN, UNITED KINGDOM, with a phone number of 448003897000. Certified documents related to their regulatory status are not provided in the information provided.

Santander offers a wide range of financial products and services to cater to diverse customer needs. However, it's essential to consider both the advantages and disadvantages when evaluating their offerings.

Pros:

Comprehensive Product Range: Santander provides a diverse selection of banking, investment, insurance, and borrowing options, allowing customers to find suitable solutions for their financial goals.

Accessible Customer Support: Customers can easily reach Santander's support through telephone, live chat, or the ATM/Branch Locator. The extended hours of operation and accessibility options accommodate various needs.

Regulated Institution: Santander is regulated by the UK's Financial Conduct Authority (FCA), providing customers with confidence in their financial stability and adherence to industry standards.

Cons:

Monthly Fees: Some of Santander's current accounts come with monthly fees, which may not be ideal for individuals seeking fee-free options.

Complexity: With numerous products and services, navigating Santander's offerings can be overwhelming for some customers who may prefer simpler banking solutions.

Eligibility Criteria: Eligibility criteria apply to certain products, such as personal loans, which may limit access to individuals who do not meet specific income or credit requirements.

Here is a table summarizing the pros and cons of Santander:

| Pros | Cons |

|

|

|

|

|

|

The Santander UKs segments include Retail Banking, Corporate & Commercial Banking and Corporate & Investment Banking. The Retail Banking segment offers a range of products and financial services to individuals and small businesses, through a network of branches and automated teller machines (ATMs), as well as through telephony, digital, mobile and intermediary channels. The Corporate & Commercial Banking segment offers a range of products and financial services include loans, bank accounts, deposits, treasury services, trade and asset finance for small medium enterprises (SME) and corporate customers. The Corporate & Investment Banking segment serves corporate clients and financial institutions.

Here's a summary of their products:

Current Accounts:

Santander Edge Up Current Account:

Earn cashback on selected household bills, supermarket, and travel costs.

Earn interest on credit balances up to £25,000.

Requires funding the account with £1,500 each month and setting up 2 active Direct Debits.

No charges for using the debit card outside the UK.

£5 monthly fee.

Santander Edge Current Account:

Earn cashback on selected household bills at supermarkets and travel spend.

Access to an optional savings account with exclusive rates.

Requires funding the account with £500 each month and setting up 2 active Direct Debits.

No charges for using the debit card outside the UK.

£3 monthly fee.

Everyday Current Account:

Simple and straightforward account with no monthly fee.

1|2|3 Student Current Account:

Free 16-25 railcard for four years.

Interest-free overdraft of £1,500 for the first 3 years of studies.

Requires regular deposits of at least £500 every 4 months.

1|2|3 Mini Current Account:

Designed to help children and young people learn money management.

Offers interest on balances at certain thresholds.

Choice of contactless debit card or cash card.

Basic Current Account:

Suitable for those with poor credit history or newcomers to the UK.

Mortgages:

Services for first-time buyers, home movers, and those looking to remortgage.

Options for changing lenders, borrowing more money, and managing existing mortgages.

Later life mortgages for individuals aged 55 or over.

Partnership with ufurnish.com for home furnishing experiences.

Credit Cards:

Range of credit cards for various needs, including:

All in One Credit Card

Long Term Balance Transfer Credit Card

Everyday No Balance Transfer Fee Credit Card

Santander World Elite™ Mastercard®

Savings and ISAs:

Savings and ISAs for different goals, including:

Easy Access Saver

Regular Saver

Santander Edge Saver

Easy Access ISA

Fixed Rate ISAs

Fixed Term Bonds

Junior ISA

Inheritance ISA

Investments:

Investment options with cashback incentives.

Investment Hub for online advice and fund selection.

Investment advice and resources available.

Insurance:

Home insurance, including contents insurance for renters.

Life insurance, including critical illness cover.

Health insurance.

Mortgage life insurance.

Family and lifestyle insurance.

Over 50s Life Insurance.

Car insurance, including electric vehicle insurance.

Travel insurance.

Business insurance and landlord insurance.

Personal Loan:

Personal loans with fixed interest rates.

Loan amounts from £1,000 to £25,000.

Flexible repayment terms.

Loan eligibility criteria apply.

Santander provides a comprehensive range of financial products and services to cater to their customers' banking, investment, insurance, and borrowing needs.

Six digit account sort codes are used in the range between 09-00-xx to 09-19-xx. Sort codes for accounts formerly held by Alliance & Leicester use the range 09-01-31 to 09-01-36.

In October 2011, Moody's downgraded the credit rating of twelve financial firms in the United Kingdom, including Santander UK, blaming financial weakness. In June 2012, Moody rated Santander UK as being in a more financially healthy position than its parent company, Banco Santander.

In November 2009, Santander launched the first current account in the United Kingdom without fees (including unauthorised overdrafts) for its current and future mortgage customers. In January 2010, the bank began waiving fees for customers using Santander's automated teller machines in Spain, which traditionally would incur fees for transactions in a foreign currency.

Santander's Corporate and Commercial Banking division operates from a number of regional business banking centres across the United Kingdom. Less than 1% of Santander UK's business is held abroad.

Santander has frequently been rated the worst bank for customer service in the United Kingdom, although by July 2011 had sought to improve, notably by returning call centre operations to the United Kingdom from India. Its '123' product range was ranked third best in the United Kingdom in 2013, and in a moneysavingexpert.com poll in February 2014, customers ranked their satisfaction higher than with any of other main high street banks.

Santander's customer support offers several ways to contact them and obtain assistance:

Telephone Support:

Customers can reach a Customer Service Center Advisor at 1-877-768-2265.

Hours of operation are from 8 a.m. to 8 p.m. EST, Monday to Saturday.

For customers with hearing/speech impairments, there is a dedicated relay service at 7-1-1.

International Calls:

For customers calling from outside the United States, there is a local number: 1-401-824-3400.

Live Chat:

Customers can use the live chat feature on the Santander website to get real-time assistance with their inquiries or problems.

ATM/Branch Locator:

For information on ATM and branch locations as well as their hours of operation, customers can use the ATM/Branch Locator on the Santander website.

Santander's customer support is accessible through various channels, including phone, chat, and online resources, ensuring that customers have multiple options to address their banking needs and inquiries. The telephone support hours are accommodating, and they provide accessibility options for customers with hearing or speech impairments.

Santander UK Plc is a regulated financial institution under the United Kingdom's Financial Conduct Authority (FCA) with License No. 106054. They offer a diverse range of financial products and services, including current accounts, mortgages, credit cards, savings and ISAs, investments, insurance, and personal loans. Santander provides accessible customer support through telephone, live chat, and an ATM/Branch Locator, ensuring customers have various ways to seek assistance with their financial needs. Their customer service hours are from 8 a.m. to 8 p.m. EST, Monday to Saturday. Santander's comprehensive product offerings aim to meet a wide array of customer banking and financial requirements.

Q: What types of current accounts does Santander offer?

A: Santander offers various current account options, including the Santander Edge Up, Santander Edge, Everyday Current Account, and specialized accounts for students and children.

Q: How can I contact Santander's customer support?

A: You can reach Santander's customer support by calling 1-877-768-2265 for general inquiries. For international calls, dial 1-401-824-3400. Alternatively, you can use the live chat feature on their website.

Q: Are there fees associated with Santander's current accounts?

A: Some current accounts may have monthly fees, such as £5 for the Santander Edge Up Current Account and £3 for the Santander Edge Current Account. The Everyday Current Account, however, has no monthly fee.

Q: What types of insurance does Santander offer?

A: Santander provides a range of insurance options, including home insurance, life insurance, health insurance, car insurance, and travel insurance, catering to various coverage needs.

Q: Can I apply for a personal loan from Santander?

A: Yes, Santander offers personal loans with fixed interest rates. You can apply for loan amounts ranging from £1,000 to £25,000, with flexible repayment terms. Eligibility criteria apply, and you can typically get a decision within 5 minutes.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxprimus and santander are, we first considered common fees for standard accounts. On fxprimus, the average spread for the EUR/USD currency pair is from 0 Pips pips, while on santander the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxprimus is regulated by CYSEC,FSCA,VFSC. santander is regulated by FCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxprimus provides trading platform including PrimusZERO,PrimusCLASSIC,PrimusCENT,PrimusPRO and trading variety including --. santander provides trading platform including -- and trading variety including --.