No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FXPRIMUS and Deriv ?

In the table below, you can compare the features of FXPRIMUS , Deriv side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: --

Long: -7.57

Short: 1.44

Long: -43.02

Short: 19.36

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxprimus, deriv lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| FXPRIMUS Review Summary in 10 Points | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Market Instruments | Forex, Metals, Energies, Equities, Indices, Futures and CFD Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | From 0 pips |

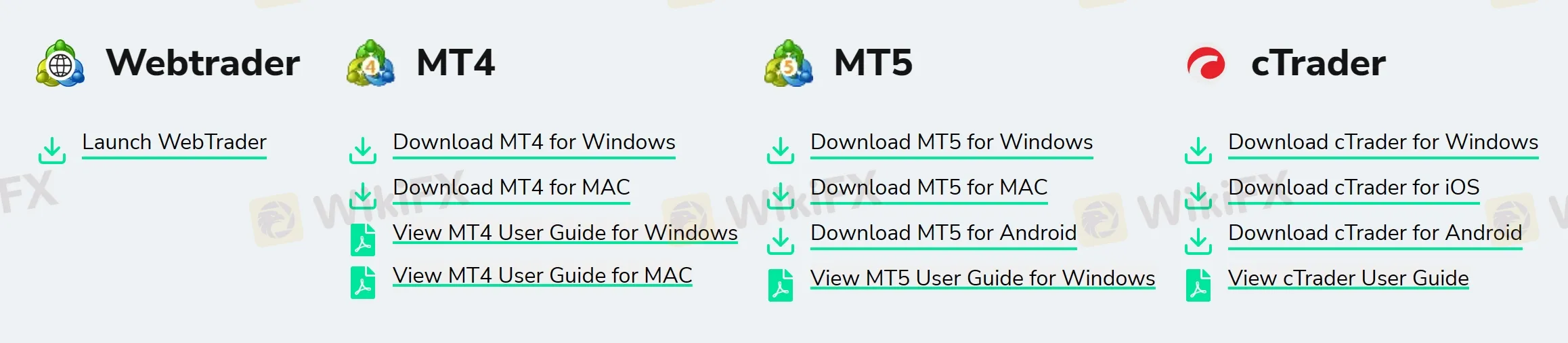

| Trading Platforms | MT4, MT5, cTrader, WebTrader |

| Minimum deposit | $15 |

| Customer Support | 24/5 live chat, email |

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on a range of financial instruments including Forex, Metals, Energies, Equities, and Indices, different account types with varying minimum deposits and leverages, and multiple trading platform choices of MT4, MT5, cTrader, and WebTrader.

| Pros | Cons |

| • Regulated by CYSEC | • Clients from Australia, Belgium, Iran, Japan, North Korea and USA are not accepted |

| • High-level protection measures for clients | • Higher minimum deposit for certain account types |

| • Wide range of market instruments | • Limited copy trading availability |

| • Low minimum deposit | |

| • No deposit or withdrawal fees | |

| • Competitive spreads and commissions | |

| • Various deposit and withdrawal methods | |

| • Strong customer service support | |

| • Comprehensive trading tools and educational resources |

Overall, FXPRIMUS appears to be a legitimate and reliable broker with strong regulatory oversight and high-level protection measures. They offer a wide range of trading instruments and account types, as well as various trading platforms and educational resources.

There are many alternative brokers to FXPRIMUS depending on the specific needs and preferences of the trader. Some popular options include:

FXCM - a well-established broker with a good reputation and comprehensive trading tools;

FxPro - offers competitive pricing and advanced trading platforms;

Exness - has a user-friendly platform and low minimum deposits.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

FXPRIMUS is a legitimate online broker that is regulated by the Cyprus Securities and Exchange Commission (CySEC). It is also a member of the Investor Compensation Fund (ICF) in Cyprus, which provides protection to clients in the event of the company's insolvency. Overall, FXPRIMUS appears to be a reputable broker.

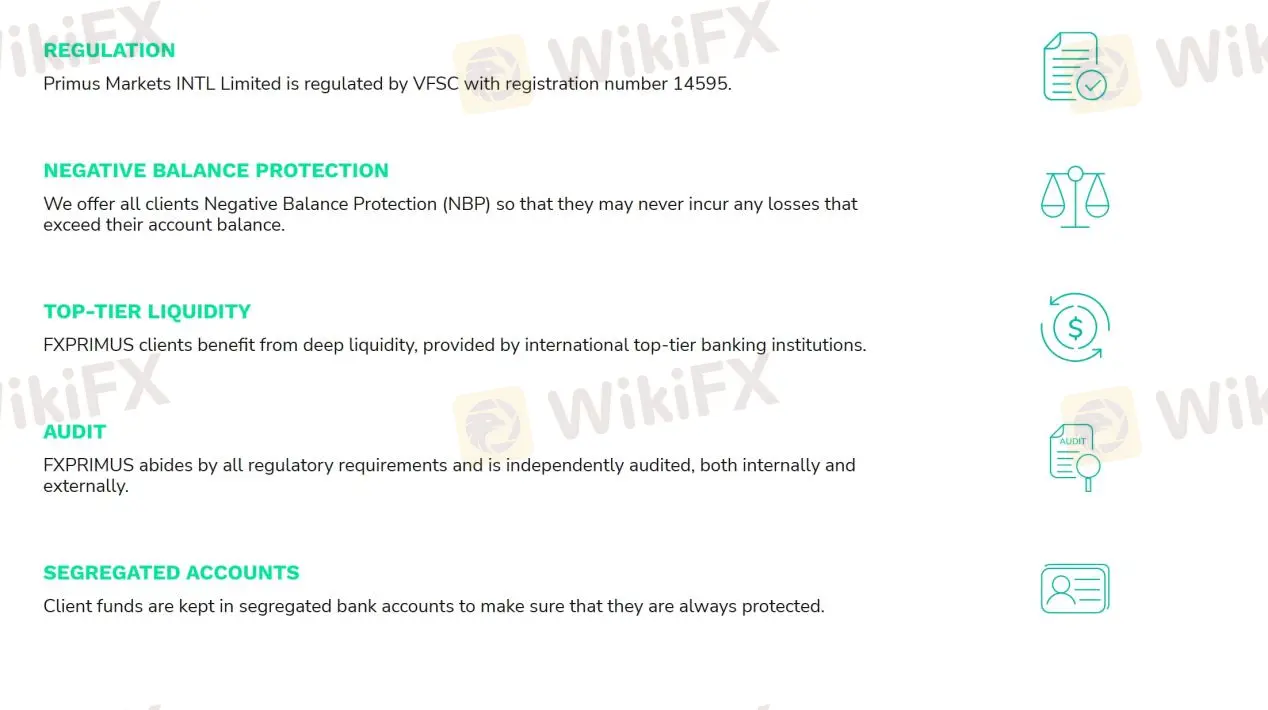

FXPRIMUS places a strong emphasis on client protection measures. It offers Negative Balance Protection, which means that clients will never lose more than their account balance. Additionally, FXPRIMUS uses top-tier liquidity providers, ensuring fast and reliable execution of trades. The broker's funds are audited by a third-party auditor to ensure transparency, and client funds are held in segregated accounts, separate from the broker's operating funds. These measures help to ensure that FXPRIMUS clients are protected from financial fraud and malpractice.

Based on the information provided, FXPRIMUS appears to have strong protection measures in place for their clients, including regulation by CYSEC, negative balance protection, top-tier liquidity, and audit and segregated accounts. These measures provide a level of assurance that FXPRIMUS is committed to the security of its clients' funds. Therefore, it can be concluded that FXPRIMUS is a trustworthy broker for traders.

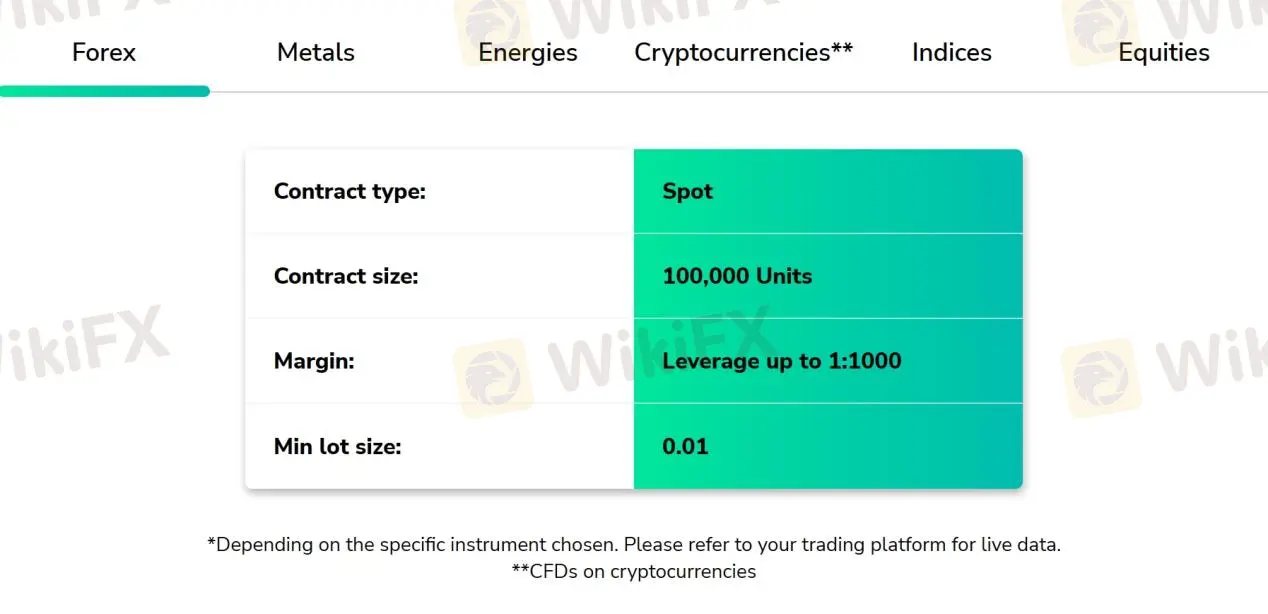

FXPRIMUS offers a diverse range of market instruments for its clients to trade. In addition to forex pairs, clients can also trade metals such as gold and silver, as well as energies such as oil and natural gas. The broker also offers equities, indices, futures, and CFD cryptocurrencies. With such a wide range of market instruments available, clients can diversify their trading portfolios and take advantage of different market opportunities.

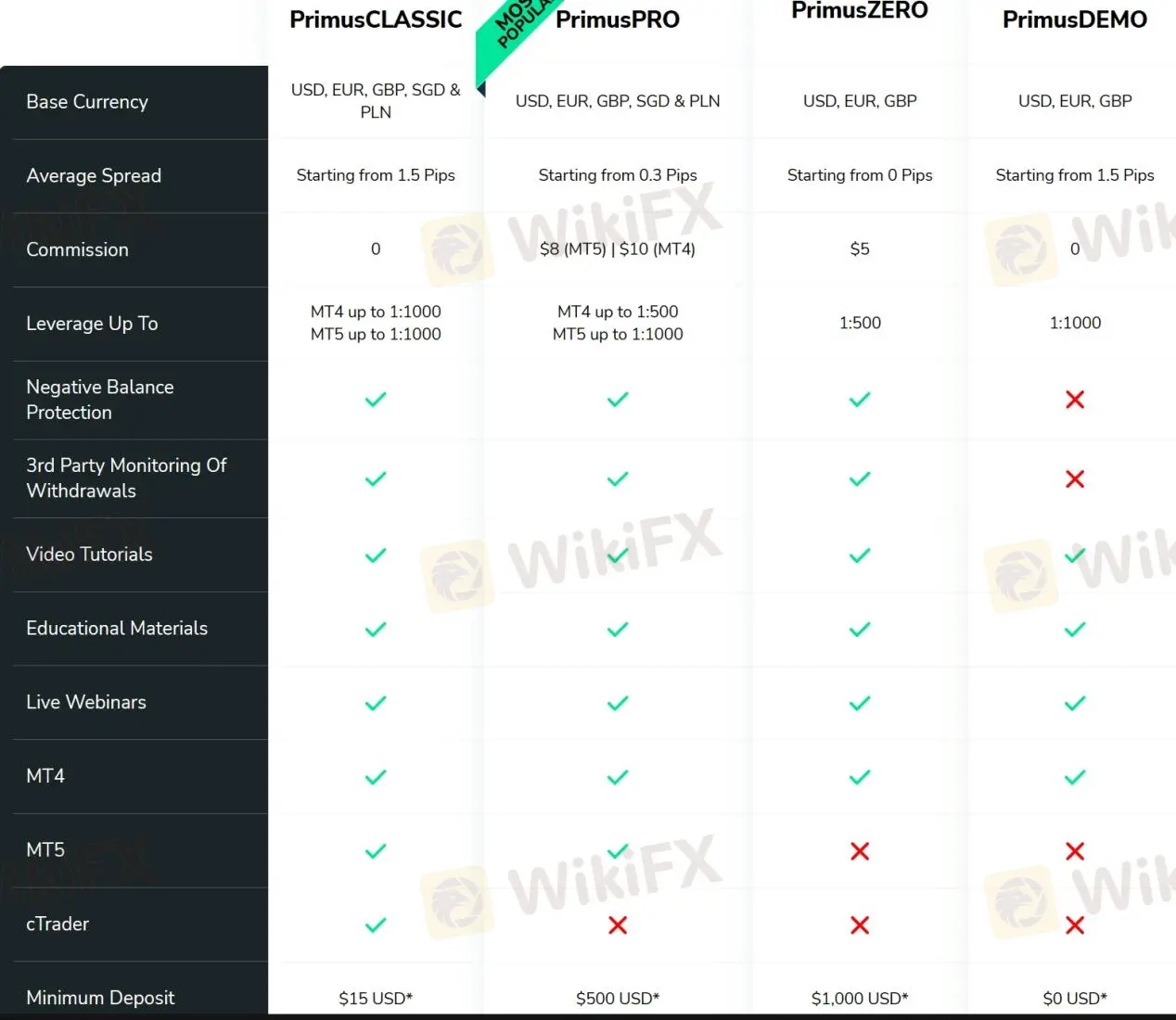

FXPRIMUS offers three account types, Primus Classic, Primus Pro, and Primus Zero, with minimum deposits ranging from $15 to $1,000. Primus Classic accounts are the most accessible with a low minimum deposit requirement of $15, while Primus Pro and Primus Zero accounts require higher minimum deposits of $500 and $1,000, respectively. Copy trading is only available for Primus Classic accounts. FXPRIMUS also offers demo accounts for traders to practice their strategies before committing to a live account.

FXPRIMUS provides varying leverage options depending on the account type and trading platform. For instance, for the Primus Classic account, clients can enjoy up to 1:1000 leverage. On the other hand, for the Primus Pro account, leverage is up to 1:500 on the MT4 platform and up to 1:1000 on the MT5 platform. For the Primus Zero account, the maximum leverage offered is up to 1:500. It is essential to note that high leverage levels carry a higher risk of potential losses, and traders should exercise caution when using high leverage levels.

FXPRIMUS offers competitive spreads and commissions across its account types. The spreads for the Primus Classic account start from 1.5 pips with no commission, which is suitable for beginners who are looking for a commission-free trading experience. For the Primus Pro account, the spreads are variable and start from as low as 0.3 pips, but the commissions are higher at $8 on the MT5 and $10 on the MT4. For experienced traders who prefer tighter spreads, the Primus Zero account offers spread from 0 pips with a commission of $5, making it suitable for high-frequency trading strategies.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXPRIMUS | From 0.0 pips | No commission on Primus Classic |

| FXCM | From 0.2 pips | No commission on Standard |

| FxPro | From 0.0 pips | From $4.5 on cTrader |

| Exness | From 0.3 pips | No commission on Standard |

Note: Spreads can vary depending on market conditions and volatility.

FXPRIMUS offers a range of popular trading platforms to cater to the needs of different types of traders. The platform options include the widely used MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and WebTrader.

The MT4 and MT5 platforms are popular among traders due to their user-friendly interface, advanced charting capabilities, and customizable indicators.

The cTrader platform is preferred by traders who seek a more transparent trading environment with direct market access (DMA) and Level II pricing.

The WebTrader platform is a web-based platform that allows traders to access their accounts from any device with an internet connection, without the need to download or install any software.

Overall, FXPRIMUS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| FXPRIMUS | MT4, MT5, cTrader, WebTrader |

| FXCM | Trading Station, MT4 |

| FxPro | MT4, MT5, cTrader |

| Exness | MT4, MT5, WebTerminal |

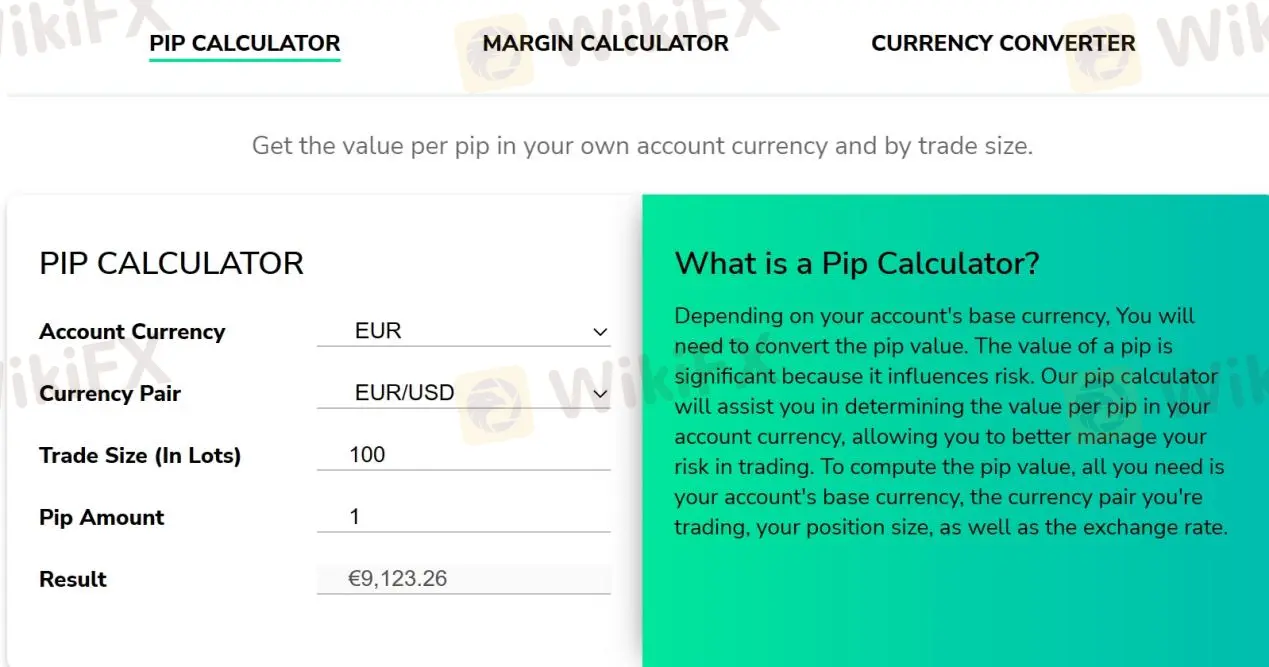

Trading tools

FXPRIMUS offers a variety of trading tools to assist its clients. The pip calculator helps traders calculate the value of a pip for a given currency pair and position size. The margin calculator allows traders to calculate the margin required to open and hold a position. The currency converter helps traders convert one currency to another at current exchange rates.

In addition, FXPRIMUS provides a market calendar that shows the schedule of economic events and their expected impact on the market, which can help traders make informed trading decisions. These tools can be accessed through the FXPRIMUS website or the trading platforms.

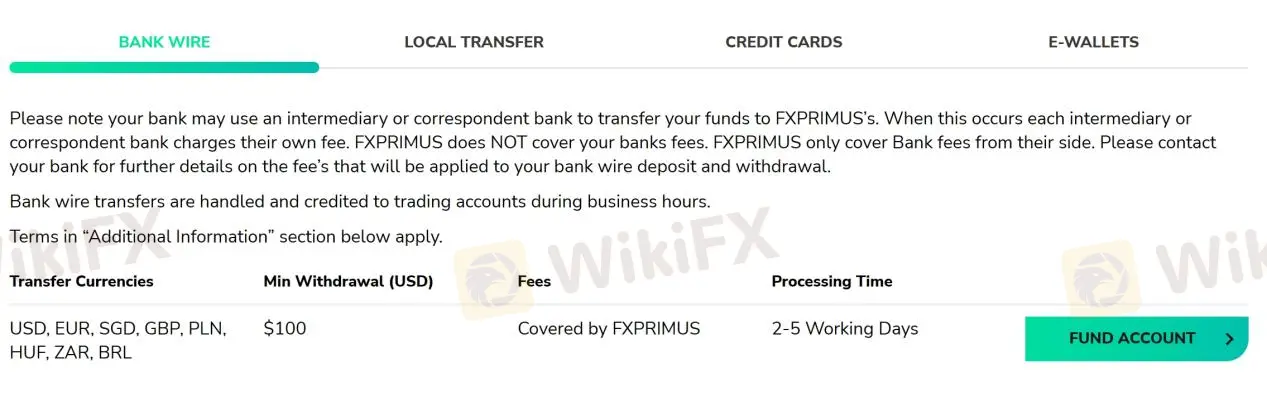

FXPRIMUS offers various deposit and withdrawal methods, including Bank Wire, Local Transfer, Credit Cards, and e-Wallets.

The minimum deposit is relatively low at $15. There are no deposit or withdrawal fees charged by FXPRIMUS, but your payment provider may charge a fee. However, it is worth noting that the minimum withdrawal amount is $100, which may be higher than some traders would prefer.

| FXPRIMUS | Most other | |

| Minimum Deposit | $15 | $100 |

The processing time for withdrawals varies depending on the payment method chosen, with Bank Wire taking 2-5 working days, Local Transfer taking 1-5 working days, and Credit Cards and e-Wallets taking up to 5 minutes.

To withdraw funds from FXPRIMUS, you can follow these steps:

Step 1: Log in to your FXPRIMUS account and click on the “Withdrawals” option in the main menu.

Step 2: Select the payment method you want to use for the withdrawal.

Step 3: Enter the amount you want to withdraw and click on the “Submit” button.

Step 4: Follow the instructions provided by the payment method you selected to complete the withdrawal process.

FXPRIMUS does not charge any deposit or withdrawal fees; however, payment provider fees may apply.

The broker charges an inactivity fee of $10 per month for accounts that have been inactive for 180 days or more. This fee is charged to cover the costs of maintaining the account and providing access to trading services, educational resources, and customer support. However, the inactivity fee can be avoided by simply logging into the trading account at least once every 180 days. It's important to note that the inactivity fee is only charged on the balance of the account and not on the deposited amount.

It also charges swap fees for holding positions overnight, and these fees vary depending on the instrument being traded.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXPRIMUS | Free | Free | $10 per month after 180 consecutive days of inactivity |

| FXCM | Free | Free | $50 per year after 12 months of inactivity |

| FxPro | Free | Free | $0 after 12 months of inactivity |

| Exness | Free | Varies by payment method | No |

It is important to note that fees and charges are subject to change, and clients should refer to the brokers websites for up-to-date information.

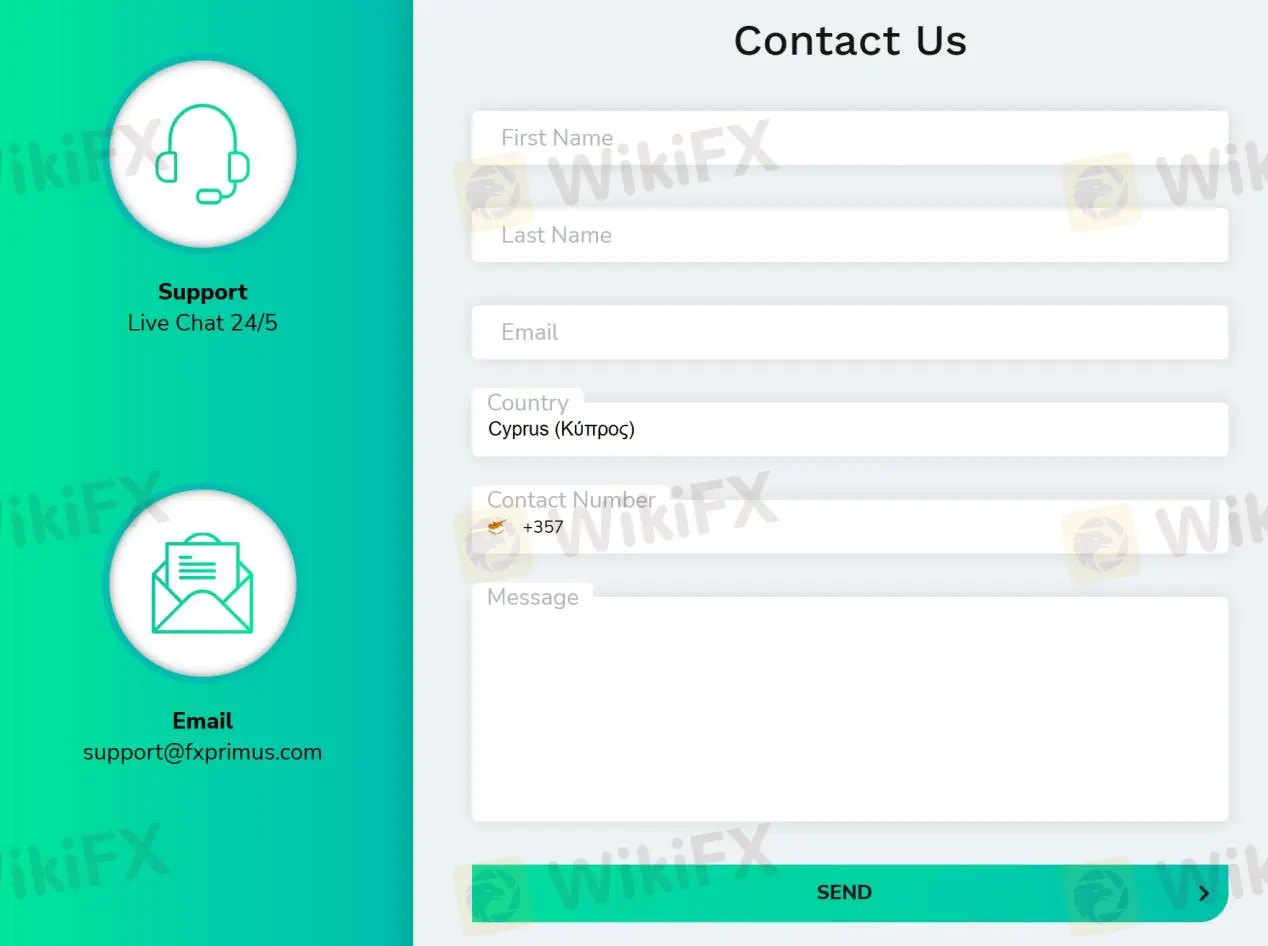

FXPRIMUS customer service offers various channels for clients to reach out for support. Clients can access 24/5 live chat, email, and online messaging to get in touch with customer support representatives. In addition, the broker provides support via messaging apps such as Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram. This allows clients to contact customer support representatives in a convenient and accessible way.

Furthermore, FXPRIMUS has a presence on social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay up-to-date with the latest news and updates from the broker.

| Pros | Cons |

| • 24/5 live chat | • No phone support |

| • Multiple language support for live chat and email | • No support on Weekends |

| • Active on social media channels for customer engagement | • Live chat can be slow to respond during busy periods |

Note: These pros and cons are subjective and may vary depending on the individual's experience with FXPRIMUS' customer service.

FXPRIMUS offers a variety of educational resources for traders of all levels. These resources include video tutorials, educational materials, live webinars, and articles.

The video tutorials cover a range of topics, from basic concepts such as trading terminology and chart analysis to more advanced topics such as risk management and trading strategies.

The educational materials include e-books, trading guides, and other resources to help traders improve their skills and knowledge.

The live webinars are led by experienced traders and cover a variety of topics, including market analysis, trading psychology, and risk management.

The articles on FXPRIMUS' website cover current market news and analysis, trading strategies, and other relevant topics.

In conclusion, FXPRIMUS is a regulated and reliable broker that offers a range of account types with competitive spreads and commissions. The broker provides a variety of trading platforms and trading tools to enhance clients' trading experience. Additionally, the broker offers excellent customer service and educational resources to support traders.

| Q 1: | Is FXPRIMUS regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At FXPRIMUS, are there any regional restrictions for traders? |

| A 2: | Yes. FXPRIMUS does not offer its services to residents of certain countries/jurisdictions including, but not limited to, Australia, Belgium, Iran, Japan, North Korea and USA. |

| Q 3: | Does FXPRIMUS offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does FXPRIMUS offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4, MT5, cTrader, and WebTrader. |

| Q 5: | What is the minimum deposit for FXPRIMUS? |

| A 5: | The minimum initial deposit to open an account is $15. |

| Q 6: | Is FXPRIMUS a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Deriv | Basic Information |

| Registered Country/Region | Malta |

| Founded in | Unknown |

| Regulation | No regulation (Fake and clone forex broker |

| Company Name | Deriv (FX) Ltd |

| Instruments | Forex, commodities, cryptocurrencies, synthetic indices, and more |

| Account types | Synthetic Account, Financial account, Financial STP Account |

| Demo Account | Available |

| Minimum deposit | $1 |

| Leverage | Unknown |

| Spreads & commissions | Unknown |

| Non-trading fees | No deposit or withdrawal fees, inactivity fees after 12 months |

| Trading platforms | DTrader, DBot, DMT5 |

| Mobile app | Available for Android and iOS |

| Education | Free educational resources and webinars |

| Customer support | 24/7 multilingual support via live chat, email, and phone |

There are two brokers named Deriv, which can cause confusion:

One company is registered in Malta and is commonly known as Deriv.com, with its company name: Binary.com. In 2013 Binary.com rebranded to Deriv. They are a legitimate online trading platform offering forex, commodities, cryptocurrencies, and more, with regulation from the Malta Financial Services Authority (MFSA) and other regulatory bodies.

The other company, also named Deriv (FX) Ltd, is suspected to be a clone or fake broker. There is limited information available about this company, and it is not clear whether they are regulated or offer legitimate trading services.

Please note that this Deriv is the trading name of Deriv (FX) Ltd, and this company is not regulated or authorized by any other regulatory authorities. More clearly, this broker is using another legit Deriv's url website to confuse people and it is a clone broker.

Trading with a cloned forex broker carries a high risk as these brokers are not authorized or regulated by any legitimate regulatory body. These cloned brokers often use the names, logos, and websites of established and reputable brokers to deceive traders into believing that they are dealing with a legitimate broker.

Cloned brokers often offer attractive trading conditions such as low spreads, high leverage, and bonuses to lure unsuspecting traders into depositing funds into their accounts. Once traders deposit their funds, they may find that it is impossible to withdraw their money or receive any support from the cloned broker.

Based on the available information, it has been reported that Deriv is a suspected clone broker, which means that it is not a legitimate or regulated financial entity. Therefore, it is highly recommended to avoid trading with this broker. It is important to trade with a regulated and reputable broker to ensure the safety of your funds and investments. In conclusion, as there are no pros to trading with an unregulated and potentially fraudulent broker, it is advisable to consider reputable alternatives.

| Pros | Cons |

| None | Cloned broker with unclear regulatory status |

| No negative balance protection | |

| Limited customer support options | |

| Limited educational resources | |

| No social or copy trading features |

Deriv offers a wide range of market instruments for traders to trade on, including forex currency pairs, commodities, cryptocurrencies, indices, and synthetic indices. Forex currency pairs include major, minor, and exotic pairs, while commodities include precious metals, energies, and agricultural products. Traders can also trade on popular indices such as the S&P 500, FTSE 100, and Nikkei 225. Deriv also offers trading on popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Additionally, traders can trade on synthetic indices, which are proprietary indices designed to simulate the behavior of real-world markets.

Deriv offers different account types to cater to the varying needs and preferences of traders.

Synthetic Account: This account provides access to synthetic markets, which are artificial markets that simulate real-world market conditions. It requires a minimum deposit of $1 and offers leverage of up to 1:1000.

Financial account: Deriv also provides a financial account, which is specifically designed for trading on financial instruments. This account offers a higher leverage of up to 1:1000, allowing traders to maximize their trading potential. Additionally, traders can access a wide range of financial instruments, including stocks, bonds, and commodities.

Financial STP Account: This account is designed for traders who prefer to trade with Straight Through Processing (STP) execution. It requires a minimum deposit of $100 and provides access to over 50 tradable assets, including forex, commodities, and cryptocurrencies. The account also offers leverage of up to 1:100.

Deriv offers a demo account for traders who want to practice trading without risking real money. The demo account is a simulation of the live trading environment, and it comes with $10,000 in virtual funds that can be used to place trades in a risk-free setting. The demo account allows traders to test the trading platform, try out different trading strategies, and get a feel for the market conditions before investing real money. The demo account is available for all account types, including financial account. It is a great way for new traders to learn how to trade and for experienced traders to test out new strategies.

Go to the Deriv website and click on “Create free demo account” or “Sign up for free” to create a demo or real account, respectively.

Fill in your personal information, such as your name, email address, and phone number.

Choose the account type that you want to open, such as a real or demo account.

Agree to the terms and conditions and submit your application.

Once your application is approved, you can fund your account and start trading.

Leverage is a critical component of trading that allows traders to control more significant positions in the market with a smaller amount of capital. Deriv offers various leverage options for traders, depending on the type of account and trading instrument. For forex trading, the maximum leverage offered is up to 1:1000 for professional clients and 1:30 for retail clients. For commodities, indices, and cryptocurrencies, the maximum leverage offered is up to 1:200 for professional clients and 1:5 for retail clients.

It's essential to understand the risks involved with leverage trading and how to use it properly to avoid significant losses. Deriv provides education and resources for traders to understand leverage and its impact on trading. Traders can also adjust their leverage levels according to their risk appetite and trading strategies. It's crucial to note that high leverage comes with high risks, and traders should exercise caution when using leverage in their trading activities.

The exact spreads and commissions vary depending on the account type and trading instrument. Here's a brief overview of the spreads and commissions offered by Deriv:

For forex trading, the spreads start from 0.5 pips for major currency pairs such as EUR/USD, GBP/USD, and USD/JPY. The spreads for minor and exotic currency pairs are slightly higher, ranging from 1.0 to 3.0 pips.

For commodities, the spreads start from as low as 0.01 pips for Gold and 0.03 pips for Silver. For other commodities such as Crude Oil and Natural Gas, the spreads range from 0.3 to 3.0 pips.

For indices trading, the spreads start from as low as 0.5 pips for major indices such as the US 500 and Germany 30. For other indices, the spreads range from 1.0 to 3.0 pips.

Deriv charges a commission of $1 for forex trading and $0.50 for commodities and indices trading. However, the commission is only applicable to certain account types such as the Financial and Synthetic Indices account types.

Deriv does not charge any deposit or withdrawal fees. However, there are some non-trading fees that clients need to be aware of. For instance, an inactivity fee of $5 per month is charged on accounts that have been inactive for more than 12 months. There is also a fee of $10 for each returned deposit or withdrawal, and a $25 fee for withdrawals to international bank accounts. Moreover, clients may incur additional fees for using certain payment methods such as credit cards or e-wallets. It is recommended that clients thoroughly review the fee schedule provided by Deriv before opening an account.

Deriv offers its clients a variety of trading platforms to choose from, each with its own unique features and advantages. The DTtrader platform is a browser-based platform that is user-friendly and easy to navigate, making it suitable for beginner traders. It offers a wide range of trading instruments, including forex, commodities, cryptocurrencies, and stocks. The platform also comes with a built-in economic calendar and technical analysis tools to help traders make informed trading decisions.

The Deriv platform is a comprehensive trading platform that is suitable for both beginner and experienced traders. It offers advanced charting tools, customizable layouts, and a wide range of technical indicators. The platform is available as a desktop, web, and mobile application, providing traders with access to the markets from anywhere in the world.

For traders who prefer automated trading strategies, Deriv offers the DBot platform. This platform allows traders to create and test their own trading bots using simple drag-and-drop tools. It also provides access to pre-built trading bots that have been developed by other traders.

Deriv offers a range of trading tools to help traders analyze the markets and manage their trades effectively. Some of the trading tools available on the platform include:

Swap calculator: This tool helps traders to calculate the swap fees incurred when holding positions overnight. It provides traders with the required swap rate and the amount of swap to be charged or credited to their accounts.

Margin calculator: The margin calculator is used to calculate the required margin for opening a new position based on the instrument traded, leverage, and trade size.

Pip calculator: This tool helps traders to calculate the value of a pip for a given currency pair, allowing them to estimate their potential profits or losses on a trade.

PNL for margin: The Profit and Loss calculator for margin is used to calculate the profit or loss of a trade based on the margin used. It takes into account the instrument traded, leverage, and trade size to provide an accurate estimate of the potential profit or loss on a trade.

Deriv offers various deposit and withdrawal methods for its clients, including bank wire transfers, credit/debit cards, e-wallets, and cryptocurrencies. The available payment options may vary depending on the client's country of residence.

For deposits, clients can use bank wire transfers, credit/debit cards (Visa, Mastercard, Maestro), and e-wallets (Neteller, Skrill, FasaPay, Jeton, Perfect Money, and Qiwi). Deposits made via e-wallets and credit/debit cards are usually processed instantly, while bank wire transfers may take a few business days to reflect in the trading account.

For withdrawals, clients can use bank wire transfers, e-wallets (Neteller, Skrill, FasaPay, Jeton, Perfect Money, and Qiwi), and cryptocurrencies (Bitcoin, Ethereum, Tether, and Litecoin). Withdrawals made via e-wallets and cryptocurrencies are usually processed within a few hours, while bank wire transfers may take up to 7 business days to reflect in the client's account.

It's important to note that some payment methods may have fees associated with them, and the processing time may also vary depending on the payment method and the client's country of residence. Deriv does not charge any fees for deposits and withdrawals, but clients may be subject to fees charged by the payment provider or the intermediary bank.

Deriv offers customer support through multiple channels, including live chat, email, and phone support. The customer support team is available 24/7 to assist traders with any questions or issues they may have. Additionally, Deriv has an extensive FAQ section on its website, which covers a wide range of topics, including account registration, deposits and withdrawals, trading platforms, and more.

One of the advantages of Deriv's customer support is its multilingual support team. The customer support team can assist traders in multiple languages, including English, Spanish, French, Portuguese, Chinese, and more. This allows traders from around the world to communicate effectively with the support team.

Another benefit of Deriv's customer support is its responsiveness. The live chat support team is typically available within seconds, and email and phone support requests are usually addressed within a few hours. Overall, Deriv's customer support is highly rated by traders, and the broker is committed to providing exceptional customer service.

However, one potential downside of Deriv's customer support is that it does not offer support through social media channels. Some traders may prefer to communicate through social media, and the lack of this option could be seen as a limitation.

Deriv offers various educational resources to help traders improve their knowledge and skills. Some of the educational resources offered by Deriv include:

Trading guides: Deriv provides detailed trading guides that cover various topics such as forex trading, digital options trading, and contracts for difference (CFDs).

Video tutorials: The broker also offers video tutorials on its website that cover a wide range of topics such as how to use the trading platforms, technical analysis, and trading strategies.

Webinars: Deriv conducts regular webinars that cover a variety of topics related to trading. These webinars are conducted by experienced traders and are designed to provide traders with valuable insights and tips.

Economic calendar: Deriv provides an economic calendar that displays important upcoming economic events and their impact on the financial markets.

Trading contests: The broker also conducts trading contests that provide traders with an opportunity to test their skills and win prizes.

Based on the information available, Deriv (FX) Ltd is a suspected fake clone broker. It is important for traders to be cautious when dealing with such brokers and to thoroughly research and verify the legitimacy of a broker before opening an account or depositing funds. It is always recommended to choose a regulated broker with a good reputation in the industry to ensure the safety of your investments.

Q: Is Deriv a regulated broker?

A: No, this Deriv is the trading name of Deriv (FX) Ltd, which is not regulated by any regulatory authority.

Q: What trading instruments does Deriv offer?

A: Deriv offers a range of trading instruments, including forex, commodities, cryptocurrencies, stock indices, and synthetic indices.

Q: What are synthetic indices on Deriv?

A: Synthetic indices on Deriv are proprietary financial instruments that simulate real-world market movements using algorithms. They are available for trading 24/7, unlike regular market indices that have trading hours.

Q: Does Deriv offer educational resources for traders?

A: Yes, Deriv offers a range of educational resources such as video tutorials, trading guides, webinars, and market analysis to help traders improve their skills and knowledge.

Q: Is customer support available on Deriv?

A: Yes, Deriv offers customer support via live chat, email, and phone in multiple languages.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxprimus and deriv are, we first considered common fees for standard accounts. On fxprimus, the average spread for the EUR/USD currency pair is from 0 Pips pips, while on deriv the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxprimus is regulated by CYSEC,FSCA,VFSC. deriv is regulated by MFSA,VFSC,FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxprimus provides trading platform including PrimusZERO,PrimusCLASSIC,PrimusCENT,PrimusPRO and trading variety including --. deriv provides trading platform including -- and trading variety including --.