No data

Do you want to know which is the better broker between CPT Markets and FXGiants ?

In the table below, you can compare the features of CPT Markets , FXGiants side by side to determine the best fit for your needs.

EURUSD: 0.2

XAUUSD: 0.1

Long: -6.49

Short: 1.94

Long: -21.31

Short: 11.33

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of cpt-markets, fxgiants lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| CPT Markets | Basic Information |

| Registered Country/Region | Belize |

| Founded in | 2016 |

| Regulation | FCA (UK), FSC (Belize) |

| Minimum Deposit | $500 |

| Demo Account | Yes |

| Tradable Assets | Forex, Metals, Energy, Indices, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, WebTrader, Mobile App |

| Spreads | From 0.0 pips |

| Commission | $3 per lot |

| Leverage | Up to 1:1000 |

| Deposit Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets |

| Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets |

| Education | Trading Academy, Webinars, Trading Tools |

| Customer Support | Phone, Email, Live Chat |

CPT Markets is a global financial brokerage firm that offers a variety of financial instruments for trading. Founded in 2016, the broker is headquartered in London, UK, and is regulated by the Financial Conduct Authority (FCA) and the International Financial Services Commission (IFSC). CPT Markets provides its clients with access to a range of trading platforms, including the popular MetaTrader 4 (MT4) platform, as well as a variety of educational resources and trading tools. The broker also offers competitive spreads and leverage, with the ability to trade on a range of asset classes, including forex, commodities, indices, and cryptocurrencies. However, CPT Markets does not offer its services to residents of the United States, Canada, and some other jurisdictions.

CPT Markets is a legit broker and it has two entities regulated in their own jurisdictions:

CPT Markets is the trading name used by CPT Markets Limited, registered in Belize, regulated by the Belize International Financial Services Commission, license number: No. IFSC000314/351.

CPT Markets UK is the trading name used by CPT Markets UK Limited. The company's registered office is located in Wales, England, with registration number 6707165, authorized and managed by the UK Financial Conduct Authority (FCA), number 606110. CPT Markets UK Limited is an associated company of CPT Markets Limited.

When evaluating a potential broker to trade with, it's important to consider both the advantages and disadvantages. This can help you make an informed decision on whether a broker like CPT Markets is suitable for your trading needs. In this section, we will provide an overview of the pros and cons of trading with CPT Markets, including aspects such as trading conditions, account types, customer support, and more. By the end of this section, you should have a better understanding of what CPT Markets has to offer and whether it aligns with your trading goals and preferences.

| Pros | Cons |

| Wide selection of trading instruments | Limited range of tradable instruments |

| Multiple account types to suit various traders | No proprietary trading platform |

| Competitive spreads and commissions | Limited educational resources |

| Multiple deposit and withdrawal options | Limited research and analysis tools |

| Negative balance protection and client fund safety | Limited customer support options outside of Asia |

| Access to popular trading platforms such as MT4 | Limited social trading options |

CPT Markets offers a range of financial instruments across different markets, including forex, indices, commodities, and cryptocurrencies. The broker's asset selection is designed to provide traders with diversified trading opportunities and a chance to profit from market volatility. With over 60 currency pairs, major indices such as the S&P 500 and Nasdaq 100, popular commodities like gold, silver, and crude oil, as well as cryptocurrencies like Bitcoin and Ethereum, CPT Markets has a range of assets to suit different trading styles and strategies. In this way, traders have access to a broad range of markets to trade, making it easier to find potential opportunities in various markets.

| Pros | Cons |

| Diverse range of assets including forex, commodities, indices, and cryptocurrencies | Limited selection of stocks compared to some other brokers |

| Competitive spreads and low commissions | No option to trade futures |

| No option to trade options | |

| Limited information about some of the available assets | |

| No access to bonds or other fixed-income assets |

CPT Markets (Belize) offers three types of trading accounts: Standard, Platinum, and ECN. Each account comes with a minimum deposit requirement of $500.

The Standard account is designed for beginner traders who want to start trading with a small investment. This account offers fixed spreads and allows trading in all available instruments. It also comes with the option to use a swap-free account for those who want to trade according to Shariah law.

The Platinum account is aimed at more experienced traders who require access to a wider range of trading tools and services. This account offers variable spreads and allows trading in all available instruments. It also comes with a personal account manager, free VPS hosting, and priority withdrawal processing.

The ECN account is designed for advanced traders who require faster execution speeds and the ability to trade with no dealing desk intervention. This account offers raw spreads, which means that traders can access the tightest spreads available in the market. It also allows trading in all available instruments and comes with the option to use a swap-free account for those who want to trade according to Shariah law. Additionally, the ECN account offers free VPS hosting and priority withdrawal processing.

| Pros | Cons |

| Multiple account types to choose from | High minimum deposit requirement of $500 |

| Competitive spreads on all account types | No 24/7 customer support |

| Access to various trading instruments | No bonuses or promotions offered |

| Advanced trading platforms offered | |

| Negative balance protection | |

| Demo Accounts Available |

CPT Markets offers demo accounts to its clients, which can be used to practice trading without risking real money. The validity period of the CPT Markets demo account is 30 days, after which the account will expire. It's not possible to extend the demo account's validity period, but clients can open a new demo account once the previous one expires. Each client is allowed to have multiple demo accounts to test different trading strategies or to use them for educational purposes.

To initiate the account opening process with CPT Markets, interested individuals may visit the broker's official website and click on the “Open Account” button.

This will redirect them to the account registration page where they will be required to fill out the necessary personal and contact information, as well as financial details and other relevant documents.

After completing the online registration form, the account will then be subject to review and approval by CPT Markets. Once the account has been verified and activated, clients may then proceed to fund their trading account with the required minimum deposit and start trading various financial instruments offered by the broker.

CPT Markets (Belize) offers a maximum leverage of up to 1:1000, which is considered to be high. However, it's worth noting that the actual leverage offered to traders may vary depending on their account equity.

For example, traders with a lower account balance may have a lower leverage ratio, while those with a higher account balance may be able to access higher leverage ratios. This is because higher leverage ratios can increase the risk of losses, and brokers must take steps to ensure that traders have enough margin to cover potential losses.

You can request a change to the leverage of your trading account by logging into the CPT Markets Client Portal, clicking on “Accounts” section, selecting the relevant account number, and clicking on the “double arrow - leverage change” icon, selecting the suitable leverage from the options.

While CPT Markets (UK) offers trading leverage up to 1:30 in accordance with the regulations set by the Financial Conduct Authority (FCA). One of the regulations set by the FCA is the maximum allowable leverage that can be offered to retail clients, which is currently set at 1:30 for forex trading. This is intended to protect retail clients from incurring large losses due to excessive leverage.

CPT Markets offers variable spreads, which means that the spread can widen or narrow based on market conditions. The broker also charges commissions on some of its account types.

The spreads on CPT Markets' forex pairs start from 0.0 pips, with an average spread of 0.2 pips on the EUR/USD pair. The broker also offers competitive spreads on other major currency pairs, such as GBP/USD, USD/JPY, and AUD/USD.

For indices, the spread on the UK 100 index starts from 0.8 points, while the spread on the US 500 index starts from 0.5 points. For commodities, the spread on gold starts from 0.3 pips, while the spread on silver starts from 0.02 pips.

In terms of commissions, CPT Markets charges $4 per lot for its ECN account, while the Standard and Platinum accounts have no commission charges.

Below is a table comparing the spreads of CPT Markets on EUR/USD, Crude Oil, and Gold with those of FP Markets and AvaTrade:

| Broker | EUR/USD Spread | Crude Oil Spread | Gold Spread |

| CPT Markets | 0.3 pips | 3.5 cents | 20 cents |

| FP Markets | 0.1 pips | 3 cents | 25 cents |

| AvaTrade | 0.9 pips | 3 cents | 35 cents |

In addition to trading costs, CPT Markets also charges non-trading fees that clients should be aware of. These fees include fees for deposits, withdrawals, account inactivity, and other administrative fees that may apply.

CPT Markets does not charge fees for deposits and withdrawals, and clients can make unlimited free-of-charge withdrawals per month. However, it should be noted that some payment providers may charge their own fees for transactions, which is beyond the control of the broker.

Inactivity fees may be charged to clients who have not made any trades or account activity for a period of 90 days or more. The fee for this inactivity is $50 per month, which will be deducted from the client's account balance. However, if there is no available balance in the account, no fee will be charged.

Other administrative fees that may apply include fees for account closure, wire transfers, and chargebacks. These fees vary depending on the specific circumstances and are listed in the broker's terms and conditions

Besides, CPT Markets also charge swap fees. Swap fees are charges incurred for holding a position overnight, also known as an overnight financing fee. The amount of the swap fee depends on the instrument being traded and the direction of the position (long or short).

CPT Markets gives its clients access to two excellent choices of trading platforms, the advanced MT4 and MT5. CPT Markets offers the popular MetaTrader 4 (MT4) trading platform, which is available for download on desktop and mobile devices. MT4 is a well-established platform in the industry, offering advanced charting tools, technical analysis indicators, and the ability to execute trades directly from the platform. Additionally, CPT Markets also provides a web-based platform, which can be accessed through a web browser without the need for any downloads. The web platform offers similar features to the desktop platform, including charting tools and order execution.

Besides, CPT Markets also offers the MetaTrader 5 (MT5) trading platform to its clients. With MT5, traders can access a range of order types, including market orders, limit orders, stop orders, and trailing stops. The platform also supports hedging, allowing traders to open multiple positions in the same market in different directions. In addition to the desktop version, CPT Markets also offers a mobile version of the MT5 platform, allowing traders to access the markets from anywhere with an internet connection. The mobile app is available for both iOS and Android devices and offers many of the same features as the desktop version.

| Broker | Platform | Desktop | Web | Mobile | Automated Trading |

| CPT Markets | MetaTrader 4 | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 5 | ✔ | ✔ | ✔ | ✔ | |

| cTrader | ❌ | ❌ | ❌ | ❌ | |

| FXCM | Trading Station | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 4 | ✔ | ✔ | ✔ | ✔ | |

| NinjaTrader | ✔ | ❌ | ✔ | ✔ | |

| FP Markets | MetaTrader 4 | ✔ | ✔ | ✔ | ✔ |

| MetaTrader 5 | ✔ | ✔ | ✔ | ✔ | |

| WebTrader | ❌ | ✔ | ✔ | ✔ | |

| IRESS | ✔ | ❌ | ✔ | ✔ |

CPT Markets offers a variety of deposit and withdrawal methods for its clients, including bank wire transfer, credit/debit card, and online payment systems. The broker does not charge any fees for deposits, but third-party fees may apply depending on the payment method used. Withdrawals are generally processed within one business day, but it may take up to five business days for funds to appear in the client's account, depending on the withdrawal method.

Clients can make deposits and withdrawals in multiple currencies, including USD, EUR, GBP, AUD, and CAD. However, it's worth noting that there may be some currency conversion fees charged by the payment provider. In terms of minimum deposit requirements, CPT Markets requires a minimum deposit of $500 for all account types, which is higher than the industry standard.

| Pros | Cons |

| Multiple deposit and withdrawal options | Some methods may incur fees or minimum transaction amounts |

| No deposit or withdrawal fees for most methods | Withdrawals can take up to 3 business days to process |

| Option to use local bank transfer in some regions | Limited availability of some methods in certain regions |

| Withdrawal options are more limited than deposit options | |

| Currency conversion fees may apply for some methods |

CPT Markets has set the minimum deposit amount at $500, which is relatively higher than the industry average. This may be a consideration for some traders who are just starting out or have limited funds available for trading.

Below is a table comparing the minimum deposit requirements of CPT Markets, IC Markets, and FP Markets:

| Broker | Minimum Deposit |

| CPT Markets | $500 |

| IC Markets | $200 |

| FP Markets | $100 |

CPT Markets offers customer support to clients via various channels. Clients can reach out to the broker's customer service team through phone, email, live chat, and social media platforms such as Facebook and Twitter. The broker also provides a comprehensive FAQ section on its website that covers a wide range of topics related to trading and account management.

CPT Markets' customer service team is available 24/5 to assist clients with any questions or issues they may have. The broker has a multilingual support team that can assist clients in different languages, including English, Chinese, Spanish, and Arabic.

CPT Markets offers a variety of educational resources to help traders improve their skills and knowledge of the financial markets. These resources include:

Webinars: CPT Markets offers regular webinars covering a range of topics, from trading strategies and market analysis to risk management and trading psychology.

Video Tutorials: CPT Markets provides a range of video tutorials covering different aspects of trading, including technical analysis, fundamental analysis, and trading psychology.

eBooks: CPT Markets offers a range of eBooks covering various topics related to trading, including forex trading, stock trading, and commodity trading.

Economic Calendar: CPT Markets provides an economic calendar that displays upcoming economic events and their potential impact on the financial markets.

Market Analysis: CPT Markets provides daily market analysis, including technical analysis, fundamental analysis, and market news.

Trading Tools: CPT Markets offers a range of trading tools, including trading calculators, economic indicators, and a margin calculator.

CPT Markets is a regulated broker that offers a range of trading instruments on multiple trading platforms. The broker's competitive spreads and flexible leverage options make it an attractive option for traders. Additionally, CPT Markets provides a wide range of educational resources, including webinars, trading courses, and market analysis, to help traders improve their skills and make informed trading decisions.

However, CPT Markets does have some drawbacks. The minimum deposit requirement of $500 is higher than industry standards, and the broker charges higher than average non-trading fees. Customer support options are limited, with no phone support available. Finally, while the broker offers a variety of deposit and withdrawal options, some users have reported slow processing times for withdrawals.

Overall, CPT Markets may be a suitable choice for experienced traders who value competitive pricing and a variety of educational resources. However, potential users should weigh the pros and cons carefully and conduct their own research before opening an account with the broker.

Q: Is CPT Markets regulated?

A: Yes, CPT Markets is regulated by the Financial Conduct Authority (FCA) in the UK and the International Financial Services Commission (IFSC) in Belize.

Q: What is the minimum deposit requirement for CPT Markets?

A: The minimum deposit requirement for CPT Markets is $500.

Q: What trading platforms are available with CPT Markets?

A: CPT Markets offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as the CPT Markets Mobile App.

Q: Does CPT Markets offer a demo account?

A: Yes, CPT Markets offers a demo account that is valid for 90 days. Multiple demo accounts can be opened.

Q: What is the maximum leverage offered by CPT Markets?

A: CPT Markets offers leverage up to 1:1000, but the actual leverage offered varies depending on the account equity.

| FXGiants | Basic Information |

| Registered Country/Region | Bermuda |

| Regulations | N/A |

| Tradable Assets | Forex, Metals, Indices, Commodities, Futures, Shares |

| Account Types | Live Floating Spread Account, Live Fixed Spread Account, Live Zero Fixed Spread Account, STP/ECN No Commission Account, STP/ECN Zero Spread Account, STP/ECN Absolute Zero Account |

| Minimum Deposit | N/A |

| Maximum Leverage | 1000:1 |

| Minimum spread | from 0.0 pips |

| Deposit & Withdrawal | VISA, Wire Transfer, and BTC |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Phone, Email, Live chat, |

| Education Resources | Blog |

FXGiants is an international online broker that offers retail and institutional traders across the globe access to trade over 200+ instruments from multiple asset-classes including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies & CFDs.

FXGiants, registered in Bermuda, operates as an unregulated broker. While it offers a diverse range of market instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares, investors should approach the platform with caution due to the lack of regulatory oversight. The maximum leverage ranges from 200:1 to 1000:1, providing traders with flexibility but also exposing them to higher risks. Spreads and commissions vary across different account types, with options such as fixed spreads, zero spreads, and variable spreads. The absence of regulation raises concerns about investor protection and transparency. Additionally, limited deposit options, the absence of a demo account, and unclear minimum deposit requirements can be considered disadvantages. However, FXGiants offers robust trading platforms, including MetaTrader 4 and PMAM, along with VPS hosting services for enhanced performance. The customer support team is responsive and available via phone, email, and live chat. Traders can access educational resources through the company's blog, although the offerings may be limited. In summary, FXGiants provides a wide range of trading options but requires careful consideration of the associated risks and limitations.

No, FXGiants, registered in Bermuda, operates without holding any licenses and is not subject to regulatory oversight from any governing bodies. As a result, investors should approach the platform with caution and carefully assess the risks involved. The absence of regulatory supervision means that there are no guarantees regarding the platform's compliance with industry standards and customer protection measures. It is advisable for investors to conduct thorough due diligence, seek professional advice, and consider alternative regulated options to ensure the security of their investments.

FXGiants offers a range of advantages and disadvantages for traders. One of the key advantages is the availability of diverse market instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares, allowing traders to diversify their portfolios. FXGiants also offers multiple account types, providing flexibility for traders to choose the one that aligns with their preferences. Additionally, FXGiants provides high leverage up to 1000:1. However, a significant drawback is the lack of regulation, which raises concerns about investor protection. The limited deposit options and the absence of a demo account for practice trading are also notable disadvantages. Moreover, the unclear minimum deposit requirement and limited educational resources may hinder comprehensive learning. Traders should carefully consider these factors before engaging with FXGiants.

| Pros | Cons |

| None | Lack of Regulation |

| Limited Deposit Options | |

| Lack of Demo Account | |

| Unclear Minimum Deposit Requirement | |

| Limited Educational Resources |

Forex: FXGiants offers a wide range of currency pairs for trading in the Forex market. Forex, also known as foreign exchange, involves the buying and selling of currencies. Traders can speculate on the price movements of major, minor, and exotic currency pairs, taking advantage of the volatility and liquidity of the Forex market.

Metals: FXGiants allows trading in precious metals like gold, silver, platinum, and palladium. These metals are considered as safe-haven assets and are often used as a hedge against inflation or economic uncertainty. Traders can take positions on the price movements of these metals, benefiting from both rising and falling markets.

Indices: FXGiants provides access to a variety of global stock indices, such as the S&P 500, FTSE 100, DAX 30, and Nikkei 225. Stock indices represent a basket of stocks from a specific exchange or sector and are used to gauge the overall performance of a market. Traders can speculate on the direction of these indices, capitalizing on market trends and economic indicators.

Commodities: FXGiants offers trading opportunities in popular commodities like oil, natural gas, and agricultural products. Commodity markets involve the buying and selling of physical goods, including energy products, metals, and agricultural produce. Traders can take advantage of price fluctuations in these markets, driven by factors such as supply and demand dynamics, geopolitical events, and weather conditions.

Futures: FXGiants allows trading in futures contracts, which are agreements to buy or sell an underlying asset at a predetermined price and date in the future. Futures cover a wide range of assets, including commodities, stock indices, and currencies. Traders can speculate on the future price movements of these assets, taking advantage of leverage and the ability to profit in both rising and falling markets.

Shares: FXGiants provides access to trading shares of major companies listed on global stock exchanges. Share trading allows investors to take ownership in a company and participate in its growth and profitability. Traders can speculate on the price movements of individual stocks, leveraging fundamental and technical analysis to make informed trading decisions.

These market instruments offered by FXGiants provide traders with a diverse range of opportunities to capitalize on price movements across various financial markets, catering to different trading strategies and risk preferences.

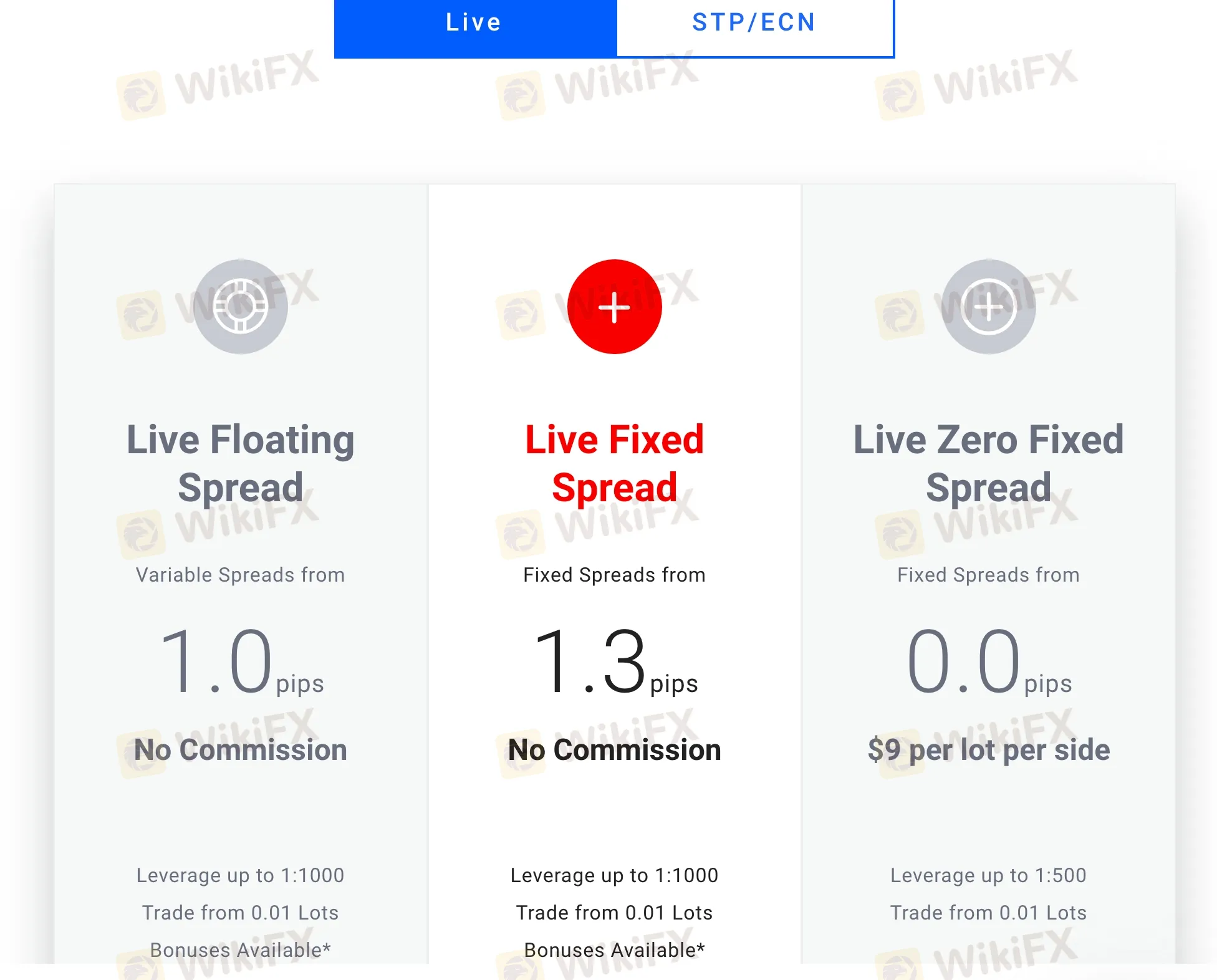

FXGiants offers a range of account types to cater to different trading preferences and strategies. Here are the details of the six account types:

Live Floating Spread Account: This account features variable spreads starting from 1.0 pips, with no commissions charged per trade. Traders can benefit from a maximum leverage of 1000:1, allowing for greater trading flexibility and potential.

Live Fixed Spread Account: With this account, traders enjoy fixed spreads starting from 1.3 pips, and there are no commissions per trade. Similar to the Live Floating Spread Account, the maximum leverage is set at 1000:1.

Live Zero Fixed Spread Account: This account type offers zero fixed spreads. Instead, traders are charged a commission of $9 per lot traded. The maximum leverage for this account is set at 500:1.

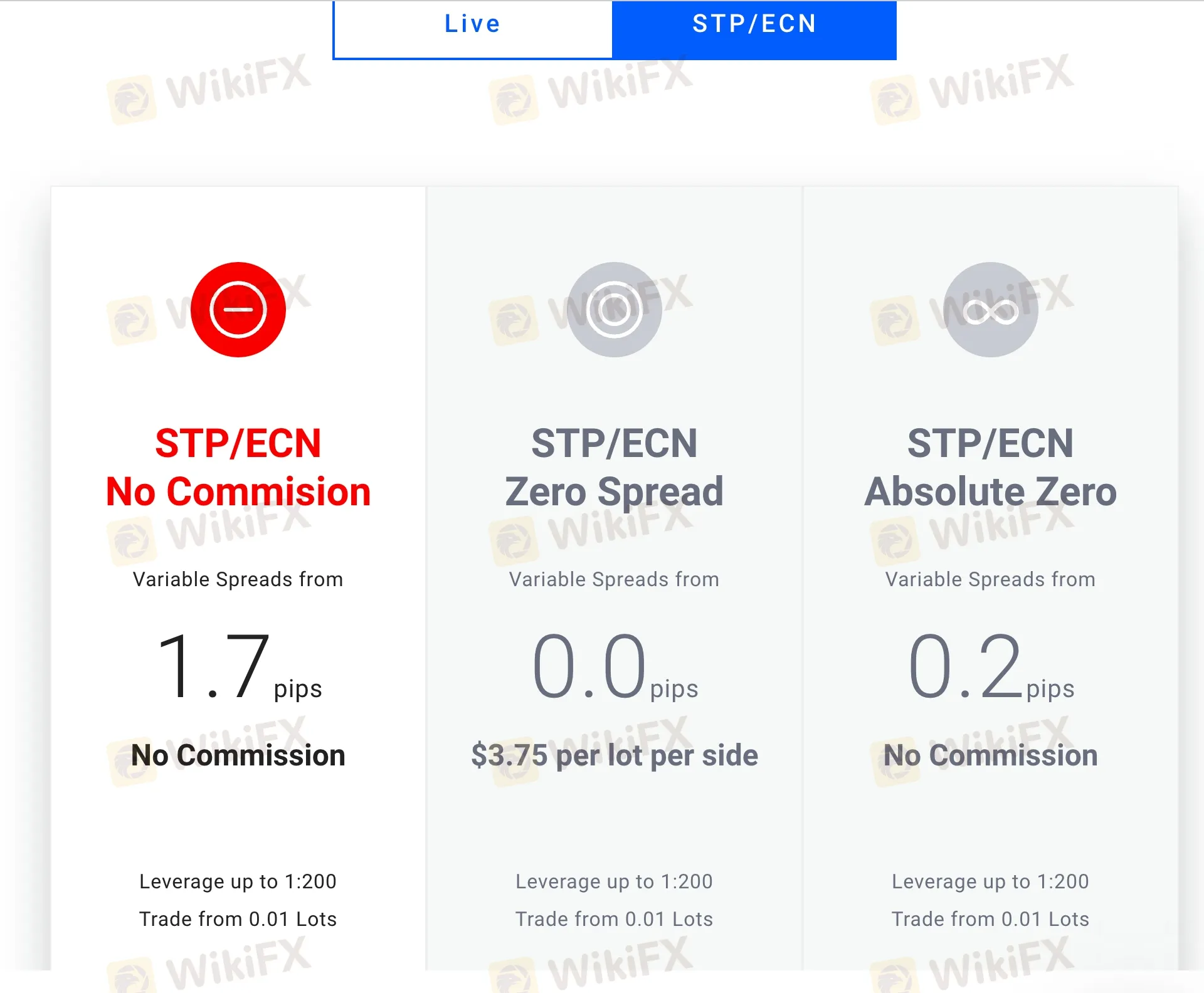

STP/ECN No Commission Account: Designed for traders who prefer straight-through processing (STP) and electronic communication network (ECN) execution, this account provides variable spreads starting from 1.7 pips without any commissions. The maximum leverage is set at 200:1.

STP/ECN Zero Spread Account: Traders opting for this account enjoy zero spreads, meaning there is no markup on the raw interbank spreads. However, a commission of $3.75 per lot is charged. The maximum leverage for this account type is 200:1.

STP/ECN Absolute Zero Account: This account features extremely low spreads starting from 0.2 pips, with no commissions charged per trade. Traders can leverage up to 200:1 in this account type.

These various account types offered by FXGiants allow traders to choose the one that aligns with their trading style, risk tolerance, and specific requirements, ensuring a customized trading experience.

Here are the steps involved in the account opening process with FXGiants:

Registration: Visit the FXGiants website and click on the “Open Account” or “Register” button. Fill in the required personal information such as name, email address, phone number, and country of residence.

Verification: After submitting your registration details, you will need to complete the verification process. This typically involves providing identification documents such as a valid passport or driver's license and proof of address, such as a utility bill or bank statement. FXGiants may require additional documents based on regulatory requirements.

Account Type Selection: Choose the type of trading account that suits your trading preferences and needs. FXGiants typically offers different account types, such as Standard, Premium, or VIP, each with varying features and trading conditions. Select the account type that aligns with your trading goals.

Deposit Funds: Once your account is verified, you can proceed to deposit funds into your trading account. FXGiants offers various deposit methods such as credit/debit card, wire transfer, or online payment systems. Choose the preferred method and follow the instructions to deposit the desired amount.

Start Trading: After successfully depositing funds, you can log in to your FXGiants trading account using the provided credentials. Download the trading platform (such as MetaTrader 4) or access the web-based platform. You are now ready to start trading by selecting financial instruments and executing trades.

It's worth noting that the specific steps and requirements may vary slightly based on your location and regulatory guidelines. FXGiants typically provides clear instructions and guidance throughout the account opening process to ensure a smooth and hassle-free experience for their clients.

When it comes to trading leverage, the maximum leverage offered by FXGiant is super high, reaching up to 1:1000. Generous leverage is not necessarily a good thing,e especially offered by unregulated brokers, so traders should take extra care to use it.

FXGiants offers varying spreads and commissions across different account types, providing traders with flexibility and choice. Here are the details:

Live Floating Spread Account: This account features spreads starting from 1.0 pip with no commissions charged per trade. Traders can benefit from floating spreads while enjoying commission-free trading.

Live Fixed Spread Account: With this account, traders can take advantage of fixed spreads starting from 1.3 pips without any commissions. The absence of commissions ensures transparent trading costs.

Live Zero Fixed Spread Account: This account type offers traders the benefit of zero fixed spreads, meaning there is no markup on the raw interbank spreads. However, a commission of $9 per lot is charged for each trade.

STP/ECN No Commission Account: Traders who opt for this account type enjoy variable spreads starting from 1.7 pips without any commissions. This account offers direct market access with no additional commission charges.

STP/ECN Zero Spread Account: With this account, traders benefit from zero spreads, while a commission of $3.75 per lot is charged. This ensures traders have access to raw interbank spreads with low-cost trading.

STP/ECN Absolute Zero Account: This account features incredibly low spreads starting from 0.2 pips with no additional commission charges.

FXGiants' diverse account types allow traders to choose the spreads and commissions structure that aligns with their trading style and preferences, providing flexibility and transparency in trading costs.

FXGiants offers a robust trading platform that caters to the needs of traders. The platform primarily supports MetaTrader 4 (MT4), a widely acclaimed and popular trading platform in the industry. MT4 provides a comprehensive set of tools and features for traders to execute trades, perform technical analysis, and access real-time market data. It offers a user-friendly interface, customizable charts, and a wide range of technical indicators for advanced analysis.

In addition to MT4, FXGiants also provides the PMAM (Percentage Allocation Management Module) platform. This platform allows traders to easily manage multiple forex investment portfolios. With PMAM, traders can allocate and distribute funds among different trading accounts, monitor performance, and efficiently manage their investment strategies.

FXGiants also offers VPS hosting services. By connecting their trading accounts to FXGiants' free MT4 VPS (Virtual Private Server), traders can benefit from enhanced trading performance, reduced latency, and uninterrupted trading even during power outages or Internet disruptions. VPS hosting ensures that traders can fully utilize the potential of their trading strategies without worrying about technical issues.

Overall, FXGiants' trading platforms, including MetaTrader 4 and PMAM, coupled with their VPS hosting service, provide traders with advanced tools, convenience, and reliability to optimize their trading experience.

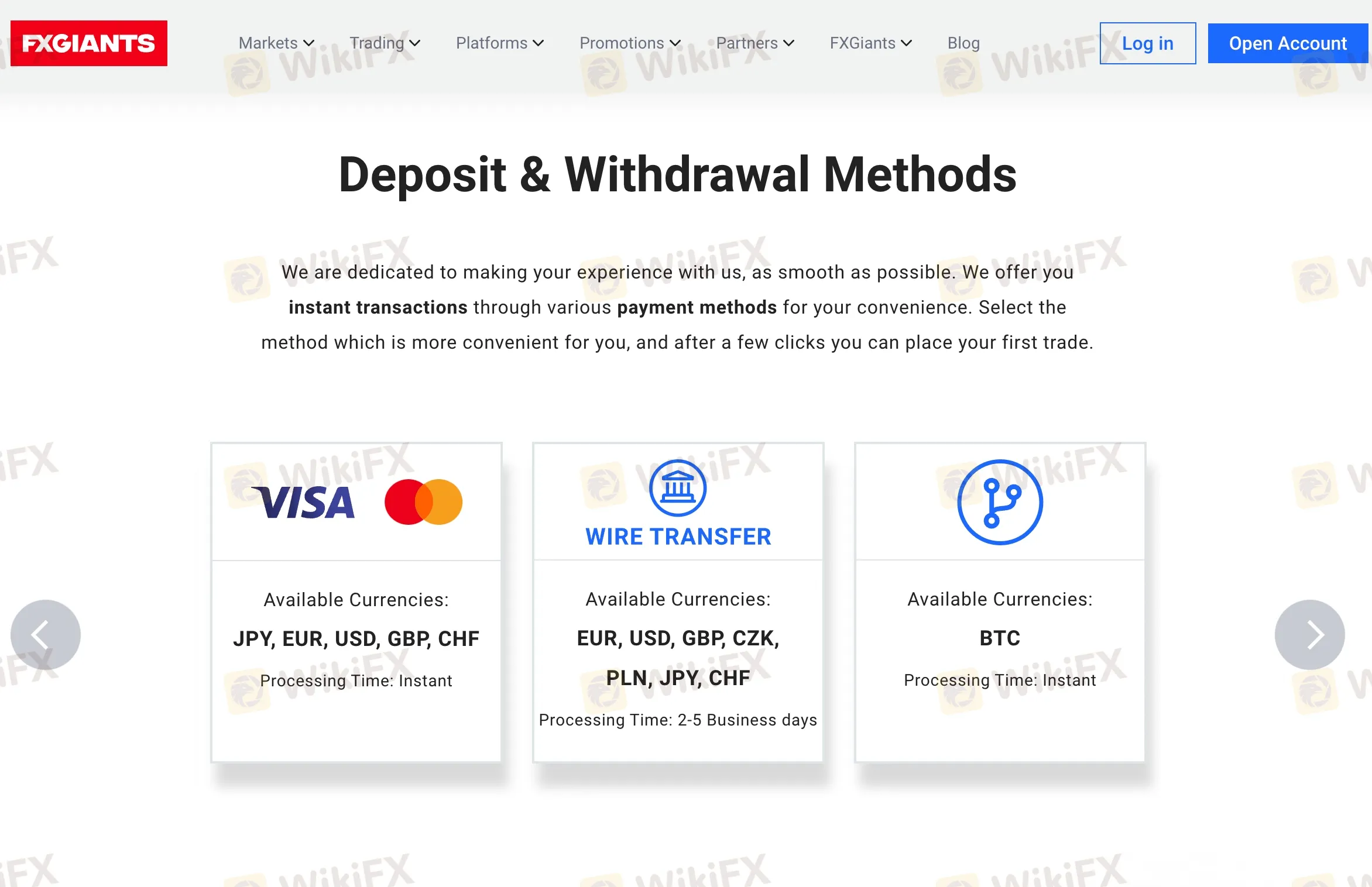

FXGiants offers convenient options for depositing and withdrawing funds. Clients can choose from various methods, including VISA, Wire Transfer, and BTC. VISA provides a quick and easy way to transfer funds using a credit or debit card. Wire Transfer allows for direct bank-to-bank transactions. Additionally, FXGiants supports BTC, enabling cryptocurrency enthusiasts to deposit and withdraw funds using Bitcoin. While FXGiants' official website does not specify the minimum deposit amount, clients can contact their customer support for more information.

FXGiants provides excellent customer support to assist traders in every possible way. Their dedicated staff is available 24/5, ensuring prompt assistance during trading hours. Clients can reach out to FXGiants' customer support through various channels. Alternatively, clients can reach out via email, allowing them to provide detailed information and receive a timely response. Additionally, FXGiants offers a convenient live chat feature on their website, enabling real-time communication with a support agent for quick resolutions to any issues.

FXGiants offers educational resources to help traders gain knowledge about the financial markets. While their official website primarily provides a blog for accessing trading market information, it serves as a valuable resource for traders to stay informed about market trends, analysis, and insights. Traders can leverage these resources to enhance their understanding of the markets and make informed trading decisions. While FXGiants' educational offerings may be primarily focused on their blog, the availability of valuable market information can still contribute to traders' learning and development.

In summary, FXGiants is an unregulated broker registered in Bermuda. It offers a wide range of market instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares. The platform provides multiple account types with varying spreads, commissions, and leverage options. FXGiants' trading platforms, including MetaTrader 4 and PMAM, offer advanced tools and features for traders. However, the lack of regulation raises concerns about investor protection. The limited deposit options, absence of a demo account, and unclear minimum deposit requirement are notable drawbacks. The customer support is responsive, and educational resources are available through the company's blog. Traders should carefully consider the risks and limitations associated with FXGiants before engaging with the platform.

Q: Is FXGiants a regulated broker?

A: No, FXGiants is not a regulated broker.

Q: What trading instruments are available at FXGiants?

A:FXGiants offers a wide range of trading instruments, including Forex, Metals, Indices, Commodities, Futures, Shares

Q: Does FXGiants offer a demo account?

A: No, FXGiants does offer a demo account.

Q: What payment methods does FXGiants accept?

A: FXGiants accepts three kinds of payment methods, including VISA, Wire Transfer, and BTC

Q: What trading platforms does FXGiants offer?

A:FXGiants offers trading platform MetaTrader 4

Q: What is the minimum deposit required to open an account withFXGiants?

A: The minimum deposit required to open an account withFXGiants is $100 for all account types.

Q: Does FXGiants offer any bonuses or promotions?

A: Yes, FXGiants offers bonuses or promotions and the information is provided on their website.

Q: What is the maximum leverage offered by FXGiants?

A: The maximum leverage offered by FXGiants is 1:1000.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive cpt-markets and fxgiants are, we first considered common fees for standard accounts. On cpt-markets, the average spread for the EUR/USD currency pair is From 0.9 pips, while on fxgiants the spread is from 0.2 .

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

cpt-markets is regulated by FCA,FSC,FSCA. fxgiants is regulated by FCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

cpt-markets provides trading platform including STANDARD ACCOUNTS and trading variety including --. fxgiants provides trading platform including STP/ECN Absolute Zero,STP/ECN Zero Spread,STP/ECN No Commision,Live Zero Fixed Spread,Live Fixed Spread,Live Floating Spread and trading variety including --.