XM 0001461138

Abstract:XM is a Forex and CFD broker based in Cyprus and regulated by several internationally renowned financial authorities, including ASIC, CYSEC, FSA, FSC and DFSA. It offers a wide variety of financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies, etc. Clients have access to several trading platforms, including MT4, MT5 and the XM mobile app, and can choose from four different account types. XM also offers a free demo account, educational resources and 24/7 customer support.

| Registered in | Cyprus |

| Regulatory status | ASIC, CYSEC, FSA, FSC and DFSA |

| Year(s) of incorporation | 10-15 years |

| Market instruments | Currency pairs, stocks, commodities, precious metals, energies, indices... |

| Minimum initial deposit | $5 |

| Maximum leverage | 1:1000 |

| Minimum spread | From 0.6 pips |

| Trading platform | MT5, MT4, own platform |

| Deposit and withdrawal methods | credit or debit card, Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay |

| Customer Service | Email/phone number/address/live chat |

| Fraud allegations | Not yet |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of XM

Pros:

Wide variety of financial instruments to operate.

It offers popular platforms such as MT4 and MT5, as well as its own APP.

Demo account available to practice before trading with real money.

It offers educational resources such as market analysis, economic calendars and courses.

24/7 customer service via live chat, email and telephone.

Cons:

The $10,000 minimum deposit for the stock account may be prohibitive for some traders.

Spreads on some accounts may be higher than those offered by other brokers.

Commissions are applied to the share account.

The maximum leverage of 1:1000 may increase risk for inexperienced traders.

Regulation in Cyprus may be less stringent than in other European countries.

What type of broker is XM?

| Dimension | Advantages | Disadvantages |

| Broker Model | XM offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' operations, XM has a potential conflict of interest that can lead to decisions that are not in the best interest of its clients. |

XM is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, XM acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of offering leverage. However, this also means that XM has a certain conflict of interest with its clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interest of their clients. It is important for traders to be aware of this dynamic when trading with XM or any other MM broker.

Regulation

Regulation is a key dimension to consider when choosing a forex broker, as it offers some protection to the client in terms of security of funds, transparency and fairness of operations. XM is a Cyprus registered company and regulated by several major regulatory bodies, including ASIC, CYSEC, FSA, FSC and DFSA.

ASIC is the Australian Financial Services Authority and is responsible for regulating the financial sector in Australia. CYSEC is the Cyprus Securities and Exchange Commission and is the financial regulatory authority in Cyprus. The FSA is the Financial Services Authority of the United Kingdom and regulates the financial sector in the United Kingdom. The FSC is the Financial Services Commission of Mauritius, which regulates the financial sector in Mauritius. The DFSA is the Dubai Financial Services Authority and is the financial regulatory authority in Dubai.

Multi-entity regulation provides greater customer protection, as it means that the broker is subject to multiple sets of regulations and standards. In addition, this can enhance the broker's reputation in the industry.

In summary, XM is a forex broker regulated by several entities, which provides clients with greater protection and transparency in their operations.

XM General Information

XM is a Forex and CFD broker based in Cyprus and regulated by several internationally renowned financial authorities, including ASIC, CYSEC, FSA, FSC and DFSA. It offers a wide variety of financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies, etc. Clients have access to several trading platforms, including MT4, MT5 and the XM mobile app, and can choose from four different account types. XM also offers a free demo account, educational resources and 24/7 customer support.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Wide range of financial instruments to choose from | It can be overwhelming for new or inexperienced traders. |

| Traders can diversify their portfolio | Some financial instruments may have limited liquidity |

| Opportunities to take advantage of different markets | Traders may need to perform additional analysis of the different markets and their influencing factors. |

| Greater flexibility to implement different strategies | Some traders may not be interested in certain financial instruments. |

XM offers its traders a wide variety of over 1000 financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies and more. This variety allows traders to diversify their portfolios and take advantage of different markets to implement different trading strategies. Traders also have the flexibility to choose from a wide range of financial instruments and select the ones that best suit their trading preferences and objectives. However, for some new or inexperienced traders, the variety of financial instruments can be overwhelming, and some instruments may have limited liquidity, which can make trading them difficult.

Spreads and commissions for trading with XM

| Advantages | Disadvantages |

| Low Spreads | Spreads can be higher during periods of high volatility |

| No commissions charged on the first three accounts | A commission is charged on the share account. |

| Highly leveraged accounts | Spreads may vary according to account type and time of day. |

In terms of spreads and commissions, XM offers low spreads on the first three commission-free accounts. However, during periods of high volatility, spreads may be higher. On the equity account, a commission is charged in addition to the spreads. The accounts offer high leverage, which means that investors can trade significantly more money than they have in their account. Spreads can vary by account type and time of day, so investors should keep an eye out for changes. In general, XM offers competitive spreads and account options to suit different investment levels.

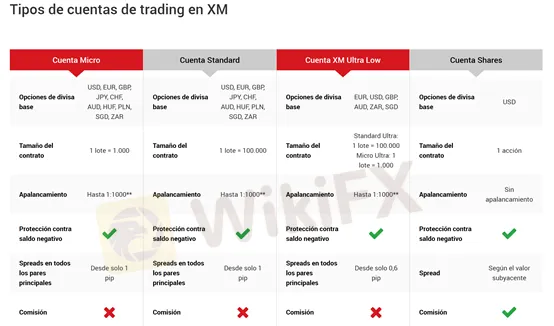

Trading accounts available at XM

| Advantages | Disadvantages |

| Low minimum deposit accounts | The share account has a high minimum deposit |

| Offers account options for different investment levels | A commission is charged on the share account. |

| No commissions charged on the first three accounts | There is no leverage in the share account. |

| High leverage on the first three accounts | The ultra low account has higher spreads than other accounts. |

XM offers a variety of account types to suit different investment levels. The micro, standard and ultra low accounts have no high minimum deposit and no commissions are charged. The ultra low account has higher spreads than the other accounts, but the goal is to offer even lower spreads than those offered in the micro and standard accounts. The stock account has a minimum deposit of $10,000 and a commission is charged. No leverage is offered on the share account, which means investors must invest the full amount of their trade. In general, XM offers account options for different investment levels.

The XM demo account is an excellent tool for novice traders or those who wish to test new trading strategies without risking their capital. The demo account comes with a virtual trading platform that replicates live trading conditions and can be accessed from any device. Traders can practice their trading skills and familiarize themselves with the financial instruments available at XM without having to risk their money. In addition, the XM demo account has no time restrictions, which means that traders can use it for as long as they need before they start trading with a live account. Overall, the XM demo account is a valuable tool for those who wish to improve their trading skills before getting involved in live trading.

Account Opening

XM, is a broker, which has an account opening with a minimum deposit of $5. The steps for account opening

How can you open an XM Broker account?

Currently, there are numerous online brokers on the market, where you can trade forex, CFDs. Each of them offers a variety of trading accounts, in a simple and fast way, where there are brokers that have an easier registration process. Below are the steps to follow for opening an XM Broker account:

a) Fill in your personal data and address in the online registration form.

b) Usually, you have to choose the leverage, to comply with regulatory bodies, in this broker does not meet the regulatory parameters. So be careful.

c) Upon completion, it is recommended to read, agree and accept the terms and conditions of the contract.

d) Sending documentation, there are brokers that request documentation, in this case, the company does not indicate the requirement of the same.

e) Proof of identity, you must send a scanned document proving your identity, e.g. passport, ID card or driver's license. Must be valid

f) Proof of Address: as to the veracity of the address, a scanned copy of the current utility bill verifying the address must be provided.

g) Make initial deposit: each Broker establishes its minimum deposit, for the opening of the trading account it offers.

h) Upon completion of the registration process, you have access to the client area with the Broker.

Operating platform offered by XM

| Advantages | Disadvantages |

| It offers the popular MT4 and MT5 platforms, which are widely used by traders around the world. | XM's proprietary trading platform may have fewer features than MT4 and MT5. |

| MT4 and MT5 offer extensive customization possibilities and a wealth of technical indicators and analysis tools. | The learning curve can be steep for beginners using MT4 and MT5. |

| The XM mobile app is easy to use and is available for both iOS and Android. | Users may have trouble switching from one platform to another if they are used to a particular one. |

XM offers its clients a selection of trading platforms, including the popular MT4 platform and its successor, MT5. In addition, the company has also developed its own custom trading platform for those looking for something different. Both platforms offer a wide variety of technical indicators, analysis tools and customization possibilities. XM's mobile app is also easy to use and is available on iOS and Android. However, for those who are comfortable with a particular platform, it may be difficult to switch to another platform. Beginners may also find the MT4 and MT5 learning curve steep, although the customization possibilities and variety of analysis tools may make it worth the effort. Overall, XM offers a solid selection of trading platforms to meet the needs of all traders.

XM also offers a series of instructional videos, such as this one from its YouTube channel, on how to open an account using MT4.

XM maximum leverage

| Advantages | Disadvantages |

| Enables operators to expand their investment capacity | Significantly increases the risk of loss |

| Possibility of obtaining higher profits with less capital | Requires greater knowledge and experience of the market |

| Allows diversification of the portfolio with larger positions | Lack of proper management can lead to large losses |

| Greater flexibility to operate different instruments | Increased exposure to the risk of market fluctuations |

Leverage is an important tool in Forex trading that allows traders to have greater exposure to the market with limited capital. At XM, the maximum leverage offered is 1:1000, which means that for every $1 of capital, the trader can control up to $1000 in the market. This can be attractive to traders looking to maximize their profits with less capital.

However, it is also important to note that high leverage carries a higher risk of loss. If the market moves against the trader's position, losses can be significant. That is why it is important for traders to have proper risk management and understand the risks associated with trading with leverage before trading XM.

Deposit and Withdrawal: methods and fees

In XM deposits and withdrawals are made from the user's site, and is functional on mobile devices can use mobile trading.

There are brokers that accept bank transfers and credit or debit card payments. Some brokers offer greater facilities by implementing the possibility of payment through electronic means of payment such as Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay, etc.

XM Education

| Advantages | Disadvantages |

| Wide variety of educational resources, including market analysis, economic calendars, signals and online courses. | Not all educational resources are available in all languages. |

| Offers trading tools and videos to help traders improve their skills. | The quality of educational resources may vary depending on the trader's level of experience. |

| Offers regular webinars and online seminars. | Some educational resources may not be up to date with the latest market developments. |

XM strives to provide a wide variety of educational resources to help their clients improve their trading skills. They offer a wide range of tools and resources, such as market analysis, economic calendars, signals and online courses. In addition, XM regularly offers webinars and online seminars, which are an excellent way to learn from experienced traders and gain a better understanding of the markets. However, not all educational resources are available in all languages and the quality of educational resources may vary depending on the trader's level of experience. In addition, some educational resources may not be up to date with the latest developments in the markets, so traders should be careful in selecting the resources they use. Overall, XM makes a solid effort to provide a variety of useful educational resources for its clients.

XM Customer Service

| Advantages | Disadvantages |

| Live chat available 24/7 | No toll-free number |

| Multilingual customer service | |

| Registered address provided on the website | No estimated response time is mentioned |

| E-mail available for inquiries | No fax support |

| International phone numbers available | No callback service available |

XM excels in its customer service by providing a live chat available 24 hours a day, which means that customers can get real-time help at any time. In addition, XM's website offers the company's registered address, which provides greater transparency and confidence to the customer. Multi-language customer support is also a significant advantage for international customers. In addition, XM provides an international e-mail address and phone numbers for support inquiries. However, a disadvantage is the lack of a toll-free number, as well as the lack of social media and fax support. In addition, there is no mention of an estimated response time for support inquiries and no callback service is offered.

Conclusion

Overall, XM is a well-regulated and secure company that offers a wide range of financial instruments and a good variety of accounts. Its focus on customer education and 24/7 multilingual support is also a big plus. Disadvantages include floating spreads that can be higher than the competition and the lack of a proprietary trading platform. Overall, XM is a good choice for those looking for a regulated broker with a wide range of products and customer support services.

Frequently asked questions about XM

Question: Is XM a regulated company?

Answer: Yes, XM is regulated by multiple agencies such as ASIC, CYSEC, FSA, FSC and DFSA.

Question: What are the account types offered by XM?

Answer: XM offers four account types: micro account, standard account, ultra low account and share account.

Question: What is the minimum deposit required to open an XM account?

Answer: The minimum deposit required for the first three accounts (micro account, standard account and ultra low account) is $5, while for the share account it is $10,000.

Question: What trading platforms does XM offer?

Answer: XM offers the most popular trading platforms in the industry: MT4 and MT5, as well as its own mobile application.

Question: What is the maximum leverage offered by XM?

Answer: The maximum leverage offered by XM is 1:1000.

Question: Does XM offer a demo account?

Answer: Yes, XM offers a demo account for clients to practice without risking their own money.

Question: What educational resources does XM offer?

Answer: XM offers a wide range of educational resources such as market analysis, economic calendars, trading signals, tools, videos, courses and webinars.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Now Allows 22-Hour Treasury Bond Trading

Interactive Brokers has expanded trading hours for US Treasury bonds, now allowing trading for 22 hours daily.

Are Prop Firms Worth the Hype?

Proprietary trading firms, commonly known as prop firms, have been gaining attention in the forex and cryptocurrency industry. These firms recruit traders to trade with their capital, offering potentially lucrative opportunities. However, the question arises: Are prop firms truly worth the hype?

CFI Collaborates with TradingView for Enhanced Trading Experience

CFI Financial Group integrates with TradingView, offering clients access to 4,000 trading instruments and a community of 50M+ traders, along with advanced charting tools for an improved trading journey.

WikiFX Global Supervisors Gathering! Participate to win cash prizes!

A major event is coming! The "WikiFX Global Supervisors Gathering" event has officially launched, and participants will have the chance to win USDT rewards!

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

WikiFX Global Supervisors Gathering! Participate to win cash prizes!

Are Prop Firms Worth the Hype?

Currency Calculator