Understanding forex regulation in South Africa|Influencer Forex Analysis•Langa Ntuli

Abstract:At least in the last five years, South Africa has witnessed an astounding increase in the number of forex traders and those interested in learning to trade forex. Gradually, as a result, more international brokers are seeing the potential for acquiring the FSCA license and offer their services to South Africans. This interest is partly due to some of the restrictions other nations (like those in Europe) enforced on brokers with concerns of leverage.

At least in the last five years, South Africa has witnessed an astounding increase in the number of forex traders and those interested in learning to trade forex. Gradually, as a result, more international brokers are seeing the potential for acquiring the FSCA license and offer their services to South Africans. This interest is partly due to some of the restrictions other nations (like those in Europe) enforced on brokers with concerns of leverage.

Fortunately, at the moment, very few restrictions with the products they can offer exist here. Due to the lack of trust that most South African-born brokers have, most clients have been heavily looking towards genuinely FSCA-approved brokers, whether originally from here or abroad. Its useful to understand what the benefits of the FSCA and other basic regulations are.

Primary benefits of regulated brokers

The FSCA (Financial Sector Conduct Authority) is South Africas primary regulatory body for financial firms, including forex brokers. There are two primary advantages that the FSCA provides for forex traders:

(a) Ensuring we are dealing with reputable brokers.

(b) Preventing money laundering.

(a)

A broker with an FSCA license has proven to their customers they‘ve adhered to all the necessary financial laws, ensuring the unlikelihood of malpractice or scams taking place with client funds. With this license, they cement a trustworthy reputation where clients feel secure their deposited money is in safe hands. Furthermore, clients are reassured there won’t be any issues with withdrawals as well, provided theyve met the requirements stipulated in prior agreements.

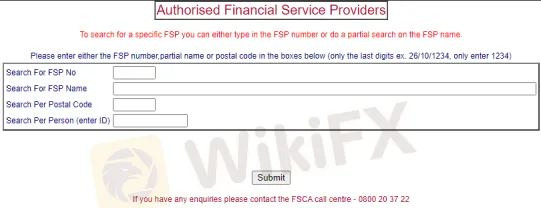

Luckily, clients can check the curret regulatory status of an FSCA-regulated broker here using their FSP number:

https://www.fsca.co.za/Fais/Search_FSP.htm

The FSCA also publishes regular media releases that warn the public of any recent fraudulent behavior of companies or individuals that may have lost their licenses or claimed to be licensed by them.

Though not directly related, another thing worth noting is the popularity of so-called money managers or traders who promise set returns through an investment programme. Most of these operations turn out to be scams. Any person trading other peoples funds must also be licensed by the FSCA.

(b)

The second benefit is to prevent money laundering. Over the last few years, financial organizations globally have religiously followed the KYC (Know Your Customer) guidelines. South Africas KYC aligns with The Financial Intelligence Centre Act 38 of 2001. In simple terms, a regulated broker has to follow KYC, whereby the client provides personal identification documents to ensure only they have full control of their trading account.

Laws around forex taxation

The forex markets are interbank markets based in foreign destinations. However, taxation laws still apply according to the South African Revenue Service (SARS). Even though trading with a local broker technically means your funds remain domestically, any profits above a certain threshold are liable to taxation as these come through as bank wire transfers. SARS class profits from forex under income tax, which traders should declare on an annual basis. Traders can get more detailed information in this regard by contacting SARS directly.

Conclusion

This article provides all the basics around regulation in South Africa and how the laws exist to safeguard the interest of clients and also ensuring companies always act in good faith.

【About the author】

Mr. Ntuli is a retail trader and writer in forex. He has been

engaged in the forex markets for many years. He also has knowledge about

many other financial markets, namely stocks, indices, and

cryptocurrencies. For the past year, he has then transitioned to writing

content on various forex-related topics for different clients ranging

from broker reviews, trading strategies, indicators to educational

information about the markets.

WikiFX, a third-party forex broker inquiry platform, has collected

the information of 21,000+ forex brokers, 30 regulators, and helped

victims recover over 300,000,000.00 USD. WikiFX App provides functions

like forex brokers inquiry, calender, forex news express, calculator and

other trading tools to help you get trading done with ease.

Forex brokers inquiry: in order to create a safe forex trading

environment, WikiFX offers you two methods of checking the compliance of

forex brokers, online checking and offline investigation report. WikiFX

has an independent inspection team, conducting on-spot visit to brokers

offices to identify they are trustworthy or not.

Forex calender: the financial events which may affect forex trading

Forex news express: providing you the latest info anytime and anywhere

Forex forum: tons of posts by WikiFX users, containing technical

analysis, industry discussion, fraud brokers exposure; Users can

exchange their thoughts here freely.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

22 things you need to know as a Beginner in the Forex Market| Influencer Forex Analysis•Bola Akinya

Forex trading has caused large losses to many inexperienced and undisciplined traders over the years. You need not be one of the losers. Here are twenty forex trading tips that you can use to avoid disasters and maximize your potential in the currency exchange market.

Two Concerns Non-Negligible After Thanksgiving| Influencer Forex Analysis•Jasper Lo

It is reported that the US Food and Drug Administration has scheduled a meeting of its Vaccines and Related Biological Products Advisory Committee on Dec. 10 to discuss the request for emergency use authorization of a Covid-19 vaccine from Pfizer. If nothing else, an approval would immediately allow the first Americans to get a vaccine on Dec. 11.

Inevitable Flaws Hidden in Demo Account

There are some disadvantages of virtual accounts during forex trading. If these drawbacks are ignored by traders, they may experience unexpected losses even in real trading.

Trading at the Right Time

The most obvious difference between the forex market and other trading markets is the constant trading hours and the unconstrained trading places. Trading at the right time helps generate a great profit.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

WikiFX Global Supervisors Gathering! Participate to win cash prizes!

Are Prop Firms Worth the Hype?

Currency Calculator