简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US jobless claims preview: Economists expect another week of decline - Business Insider

Abstract:"If the current rate of decline continues, claims will dip below 1M in the second or—more likely—third week of June," said economist Ian Shepherdson.

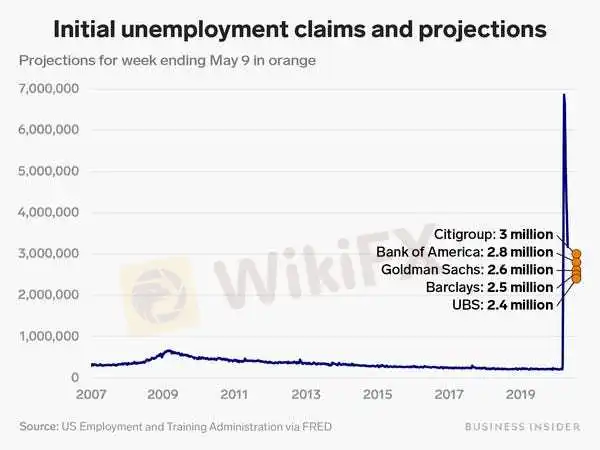

The median economist forecast for jobless claims in the week ending May 9 is 2.5 million, according to Bloomberg data.If Thursday's report from the Labor Department is near the estimate, it will mark another consecutive week of declining claims. It will also mean that more than 35 million Americans have been laid off in just eight weeks. “While there are glimmers of hope as a reopening tentatively gets underway, the damage wreaked on the economy will take a long time to repair,” said James Knightley, chief international economist at ING. Visit Business Insider's homepage for more stories. Economists expect that the number of Americans filing for unemployment fell again last week, yet remained elevated at a high level as coronavirus-induced layoffs continue.

The median economist estimate for jobless claims in the week ending May 9 is 2.5 million, according to Bloomberg data. If Thursday's report is near estimates, it will be an improvement from the previous week, when 3.2 million Americans filed for unemployment, according to the Labor Department.It would also mean that in eight weeks, more than 35 million Americans will have lost jobs amid the economic fallout caused by the coronavirus pandemic.

Business Insider/Andy Kiersz

Read more: MORGAN STANLEY: Buy these 20 stocks built to profit from a mounting inflation comeback that will alter the investing landscape

While dwindling weekly jobless claims are a step in the right direction, economists still point out that millions of Americans filing for unemployment benefits each week is unprecedented. Even in the worst week of the great recession, only 665,000 people filed a claim for unemployment. “If the current rate of decline continues, claims will dip below 1M in the second or—more likely—third week of June,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a note last week, adding that the level would still be above the worst week of the Great Recession.Continued high unemployment doesn't bode well for the US economic recovery. On Friday, the April jobs report showed that the US lost a record 20.5 million jobs during the month, and that the unemployment rate spiked to 14.7%, the highest since the Great Depression.Economists expect that report underestimated the true economic pain of sweeping lockdowns to contain the coronavirus pandemic, and that there still may be worse to come for the US economy even as some states start to reopen.

“While there are glimmers of hope as a reopening tentatively gets underway, the damage wreaked on the economy will take a long time to repair,” said James Knightley, chief international economist at ING. He continued: “Given ongoing social distancing for several more months, lingering consumer caution and the legacy of nearly 40 million jobs lost, we see little prospect of a V-shaped recovery. Even with additional fiscal support, the lost economic output may not be recouped until early 2023.”

Loading

Something is loading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

2021 World Economic Outlook

The IMF projects that the global economy will shrink by 4.4% in 2020, followed by a 5.2% rebound in 2021, supporting a V-shaped recovery.

Will Indian Economy Go Short?

According to the latest data of the Reserve Bank of India (RBI), the country's forex reserves have surged $11,938 million to a fresh all-time high of $534,568 million for the week ended July 31.

Fed survey: The poorest Americans are being hit hardest by job loss - Business Insider

"This reversal of economic fortune has caused a level of pain that is hard to capture in words," said Fed Chair Jerome Powell.

12 people who seemingly predicted the coronavirus pandemic - Business Insider

Bill Gates warned Donald Trump before he took office of the dangers of a pandemic — and urged him to prioritize the US' preparedness efforts.

WikiFX Broker

Latest News

FCA bans and fines James Lewis £120,300 for putting investors at risk

BSP Approves Coins.ph to Launch Peso Stablecoin

Exploring Swing Trading vs Scalping: A Strategy Comparison

Oppenheimer & Co. Fined $500K for Supervision Lapses

Scope Markets Boosts UAE Offer with 23 New Dubai Stocks CFDs

Robinhood to Fight SEC Over Crypto Business in Court

FCA Warns Against CryptosMarket

FCA Warns Against SolidusMarkets

Don’t Miss This Great Opportunity! Take Quiz and Win Prizes

FTX will pay out 118% to 98% of its creditors

Currency Calculator