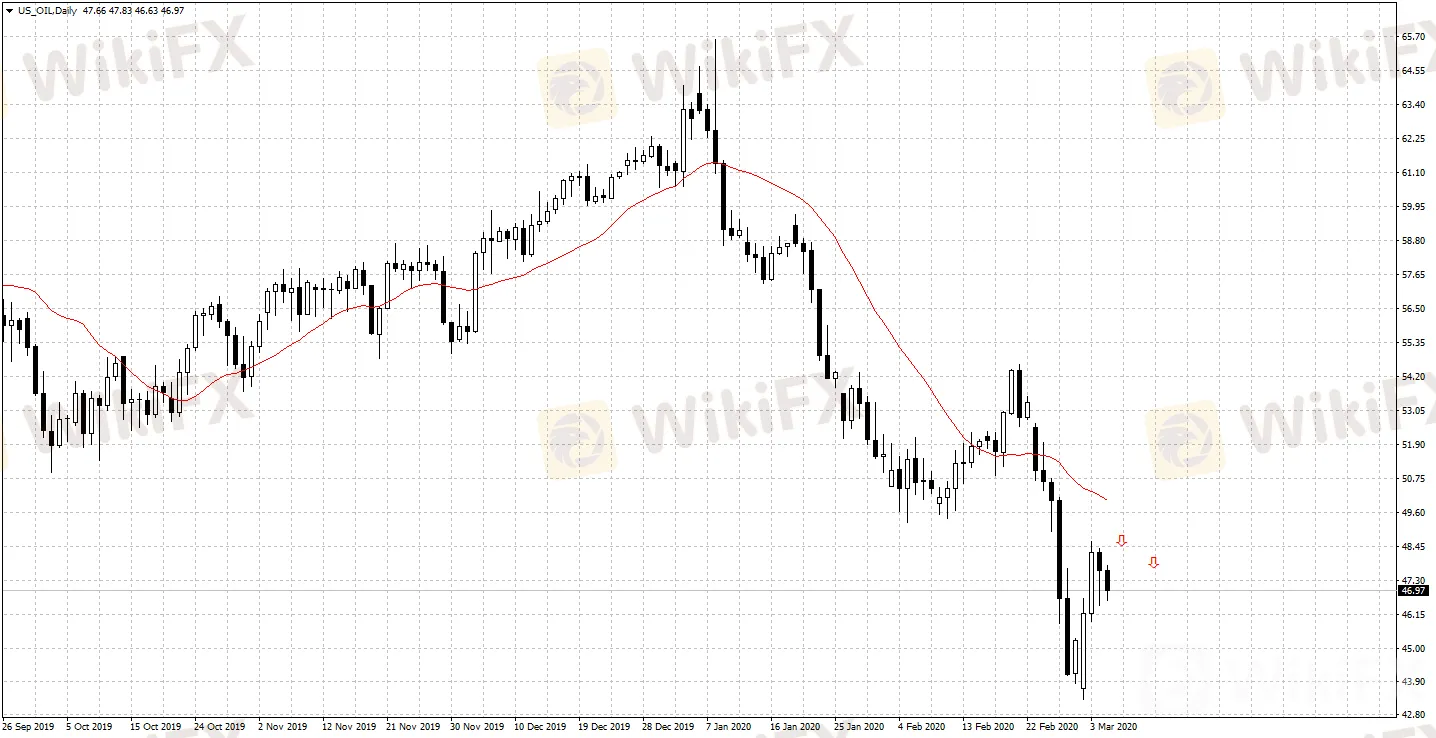

Crude Oil Demand May See Largest Quarterly Decline in History

Abstract:Due to the rapid-evolving public health emergency around the globe, the daily demand for crude oil will decrease by 3.8 million barrels year-on-year. Prior to this, Goldman Sachs had been the first among Wall Street's major investment banks to predict a sharp decline in crude oil consumption this quarter. The unprecedented drop of demand came as a sudden shock.

Due to the rapid-evolving public health emergency around the globe, the daily demand for crude oil will decrease by 3.8 million barrels year-on-year. Prior to this, Goldman Sachs had been the first among Wall Street's major investment banks to predict a sharp decline in crude oil consumption this quarter. The unprecedented drop of demand came as a sudden shock.

Such a huge shock on crude oil demand also highlights the challenge facing OPEC and its allies, who will meet in Vienna to discuss how to boost oil price that have fallen by more than 20% in the year. Saudi Arabia proposed to reduce daily output by as much as 1.5 million barrels, while Russia intended to maintain the current scale of production cut until the end of June. The last record decline of global oil demand was in 2009, when daily demand fell by 3.6 million barrels.

Goldman Sachs estimates daily crude oil demand will decline by 150,000 barrels this quarter, while energy FGE, a consulting firm from the energy industry, expected daily oil demand to drop 220,000 barrels.

In light of OPEC's past production reductions under the impact of falling demand, the reverse of the oil price slump will still depend on the support of macroeconomic situation. The current situation is obviously not very optimistic. We expect the decline of global crude oil demand this quarter to reach a record level.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Futures: Extra gains likely in the short-term

Crude Oil Futures: Extra gains likely in the short-term

Crude Oil May Rebound As Inventory Surges

This Tuesday (June 9th), Saudi announced it will stop cutting oil production beyond OPEC+ agreement, which sent WTI from above US$39 down to US$ 37.07. However, with the surge of crude inventory, oil prices are expected to rebound further.

China could be the biggest loser from the Saudi Arabia oil attack

An expert told Business Insider that China has been the largest buyer of Saudi oil since 2009 and could be most impacted by a halt to oil exports.

Crude Oil Prices Boosted, EUR/USD Suffers Ahead of ECB - US Market Open

Crude Oil Prices Boosted, EUR/USD Suffers Ahead of ECB - US Market Open

WikiFX Broker

Latest News

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

DESPITE A SHARP FALL IN FX, FOOD COSTS CONTINUE TO RISE.

Complaint against Capitalix

Binance Elevates Dubai's Crypto Status with Full VASP License

Webull Canada Unveils Desktop Trading Platform

MetroTrade Now NFA Member & CFTC Introducing Broker

Alert: Beware Of Unlicensed Scam Trading Broker ProMarkets

Currency Calculator