Dovish ECB Meeting Minutes to Rattle EURUSD Rate Rebound

Abstract:Fresh developments coming out of the Euro area may rattle the recent rebound in EURUSD if the ECB shows a greater willingness to implement more non-standard measures.

EUR/USD Rate Talking Points

EURUSD extends the rebound from the weekly-low (1.1193) as the Federal Reserve prepares US household and businesses for lower interest rates, but fresh developments coming out of the Euro area may rattle the recent advance in the exchange rate as the European Central Bank (ECB) endorses a dovish forward guidance for monetary policy.

Dovish ECB Meeting Minutes to Rattle EURUSD Rate Rebound

EURUSD may continue to retrace the decline from the June-high (1.1412) as fresh comments from Federal Reserve Chairman Jerome Powell indicate the central bank will adjust monetary policy at the next interest rate decision on July 31 as “uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.”

At the same time, the European Central Bank (ECB) may take a similar approach to insulate the monetary union even though the Governing Council prepares to launch another round of Targeted Long-Term Refinance Operations (TLTRO) in September as the central bank struggles to achieve its one and only mandate for price stability.

Recent remarks from ECB board member Philip Lane suggest the central bank will endorse a dovish forward guidance at the next meeting on July 25 as “substantial accommodation is still required,” and it seems as though the Governing Council will continue to push monetary policy into unchartered territory as Mr. Lane insists that the central bank has a “variety of tools” to shore up the monetary union.

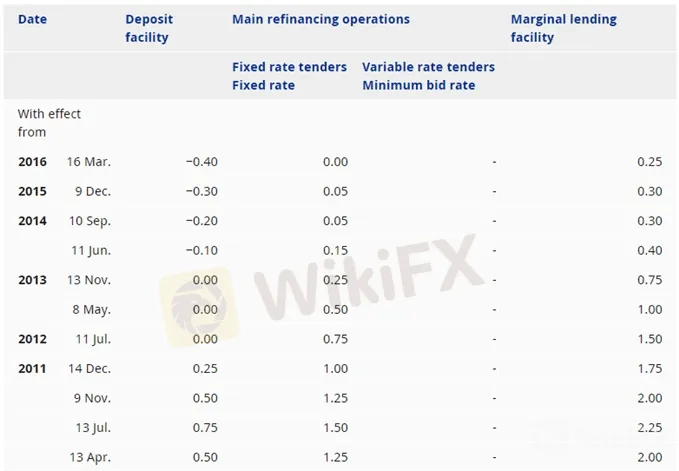

In turn, the account of the ECBs June meeting may highlight a greater willingness to implement more non-standard measures, and the Euro stands at risk of facing a more bearish fate over the coming days if the Governing Council shows a greater willingness to implement a negative interest rate policy (NIRP) for the Main Refinance Rate, its flagship benchmark for borrowing costs.

With that said, speculation for lower interest rates in Europe may rattle the recent rebound in EURUSD, but more of the same from the Governing Council may keep the exchange rate afloat as the Federal Open Market Committee (FOMC) comes under pressure to reverse the four hikes from 2018.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

Keep in mind, the broader outlook for EURUSD is no longer tilted to the downside as both price and the Relative Strength Index (RSI) break out of the bearish formations from earlier this year.

In turn, EURUSD stands at risk for a larger correction as it breaks out of the range-bound price action from May following the failed attempt to test the 1.1000 (78.6% expansion) handle.

The pullback from the June-high (1.1412) appears to have finally stalled around the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) region, with the RSI highlighting a similar dynamic as the oscillator continues to track the bullish formation from earlier this year.

A break/close back above the 1.1270 (50% expansion) to 1.1290 (61.8% expansion) zone raises the risk for a move towards 1.1340 (38.2% expansion), with the next topside hurdle coming in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion) followed by the 1.1510 (38.2% expansion) to 1.1520 (23.6% expansion) area.

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

EURUSD Rate Rebound Unravels as Attention Turns to ECB Meeting

EURUSD gives back the rebound from earlier this month, with the Euro at risk of exhibiting a more bearish behavior as the ECB is expected to deliver a rate cut.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator