EUR/USD Forex Market Trading Strategies: Breakout Mode

Abstract:EUR/USD Forex Market Trading Strategies: Breakout Mode

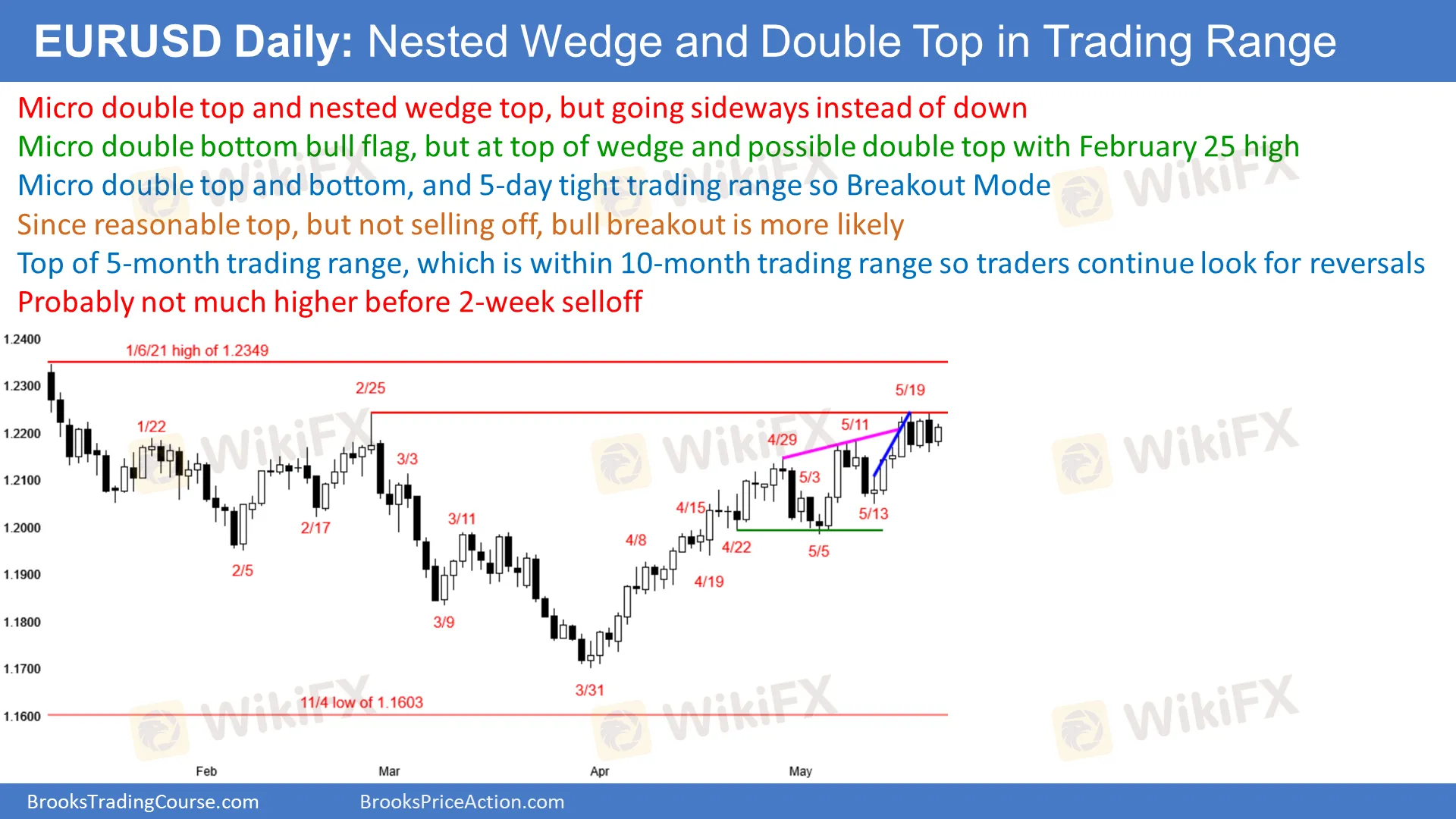

Friday was an outside down bar for EUR/USD. It formed a micro double top with Wednesdays high.

The rally up until May 19 was a nested wedge, with Friday sending a sell signal bar for the nested wedge and double top with the Feb. 25 high. Whenever there is a credible sell setup, and the market does not go down, it will probably go up.

We're in a 5-day tight trading range, so it's Breakout Mode.

Friday closed above Thursday's low, so there's a low probability a sell setup will occur; there may be more buyers than sellers.

So far, today is a bull inside day. There is a micro double bottom in the 5-day tight trading range and if today continues to be a bull day, it will be a buy signal bar for tomorrow, especially if today closes near its high. EUR/USD has been in a strong bull trend since the March low, so a reversal down will probably be minor. There might be a 2-week sideways to down pullback, but a bear trend is not likely this week.

EUR/USD might test down to the 1.20 Big Round Number, since it is also around the 50% pullback, and at the bottom of wedge.

Bulls want a breakout above the January high, which is at the top of the 2-year trading range. Most trading range breakouts fail, so we'll probably see sellers above or around the January high.

The 4-day tight trading range reduces the chance of big move up or down today.

EUR/USD forex daily chart

EUR/USD Daily Chart

Overnight EUR/USD forex trading on the 5-minute chartEUR/USD sold off sharply several hours ago, but reversed up just as sharply.

Bulls were prevented today from trading below yesterdays low, which would have triggered a daily sell signal.

Reversal up was strong enough to make a bear trend unlikely today.

Trading was sideways for 2 hours in the top half of the 5-day tight trading range.

Today will probably be a trading range day, and stay within the 5-day tight trading range.

If today breaks above Fridays high and the top of the range, the breakout will probably not be big. Therefore, today will probably not be a big bull day.

Since sideways to up is likely, day traders will scalp in both directions.

Trend day up or down is unlikely, but if there is a series of strong trend bars, traders will switch to swing trading.

The bulls want today to close nears its high, which would increase the chance of a breakout above the Feb. 25 high tomorrow.

The bears would like today to be a 2nd consecutive bear day, but the odds favor a bull day today. The bears instead will try to get today to close below the midpoint of the range, to continue the 5-day tight trading range and reduce the chance of a bull breakout.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

Explore Easy Trading Online - Discover the World’s Leading Forex Trading Platform

Easy Trading Online Broker Proud to be a trusted Forex trading platform. Fulfilling all the mentioned criteria, we provide: A trading platform that is easy to use and understand. Advanced market analysis tools To help you keep track of market changes and make effective trading decisions. Competitive trading fees It will help you save on your expenses. Professional customer support team Always available to advise when in doubt 24/7.

WikiFX Broker

Latest News

Start Winning Now! Here's How You Build a Winning Trading System

BaFin Warns Against Unlicensed FX Brokers in April

PH SEC to Set Cryptocurrency Rules in 2024

Man Arrested for Rs 68L Fraud Using Bogus Trading App

FOREX TODAY: AS THE NEW WEEK BEGINS, THE MARKET IS FEELING BETTER

ON FOREX WINDOW, $1.7 BILLION WAS EXCHANGED IN A SINGLE WEEK.

Japan's FSA Alerts on Rising in Investment Cold Call Frauds

ED Freezes ₹5 Crore in Raids on Ponzi Scheme Mastermind

Clone entity – Stern

CONSOB Orders Blackout of Five Illegal Finance Sites

Currency Calculator