Next stock market crash: Why a meltdown by year-end is on the table - Business Insider

Abstract:Investors face a bevy of imminent risks and should remain on high alert, according to RBC Capital Markets.

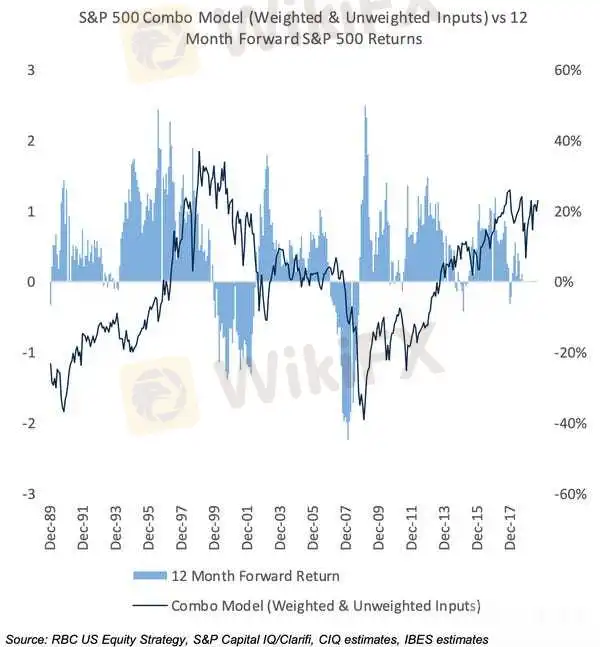

Investors should be on alert for another pullback in the stock market before Dec. 31 given the myriad of risks ahead, according to RBC Capital Markets. In addition, the stock market's valuation has recently taken “a clear turn for the worse” and is now well above its historical average. Click here for more BI Prime stories.You should brace for another pullback in the stock market before this year runs out, say equity strategists at RBC Capital Markets. The worst of it could take place at the tail-end of the year, similar to the Christmas Eve meltdown of 2018. It may also come sooner. But regardless of the timing, RBC Capital Markets sees compelling reasons why another investors should remain on standby for another pullback by Dec. 31. The team led by Lori Calvasina laid out their concerns in a recent note to clients. Their case is broadly threefold: history suggests a pullback is coming, there are risks aplenty for the market, and valuation is extremely stretched. Starting with the historical evidence, Calvasina notes that the rally in stocks since the market's low on Dec. 24 has been similar to the recoveries from three growth scares since the financial crisis: in 2010, 2011, and 2016. All of these market recoveries suffered between two and four sell-offs, ranging in severity from a 4% pullback to a 10% correction. There have been three such episodes so far in 2019, “suggesting that another would not be all that unusual,” Calvasina said. But these historical parallels don't lay out the full evidence. There is a bevy of risks — some already impacting markets and others on the horizon — that could serve as negative catalysts in the coming weeks. To name a few:Investors are already grappling with the global economic slowdown and the risk that it spreads to the US and causes a recession.Any economic data that shows cracks in consumer spending or the labor market would intensify this risk.The third-quarter earnings season — off to a strong start with the banks — is still pending releases from the all-important big-tech and consumer discretionary companies. There's anxiety concerning the 2020 elections, particularly as Sen. Elizabeth Warren leads the pack in the Democratic party.Read more: The world's most accurate economic forecaster sees a 'prolonged global slowdown' on the horizon — and warns it can only be narrowly avoidedMost metrics say stocks are overvaluedAll these potential catalysts are confronting a market that is overvalued by most major metrics.“S&P 500 valuations are still extremely stretched, taking a clear turn for the worse on forward P/E recently,” Calvasina said. The S&P 500 forward price-to-earnings ratio hit a new high relative to its global counterpart before the fourth-quarter sell-off in 2019. It is now 18.6 — a 1.8 standard deviation from the mean, above its long-term average, and higher than every other major region in the world, Calvasina said. To consolidate all the additional valuation gauges, RBC created an S&P 500 Combo Model which takes into account 17 different ones.“At 1.16 standard deviations as of October 16th, this gauge remained above average and was close to the peaks of the current cycle,” Calvasina said.She added that it was in a range historically associated with 12-month forward returns in the low single digits.

RBC Capital Markets

Calvasina further observed that the relative valuation between US stocks continue to look overvalued relative to the rest of the world.Ultimately, she is still bullish on the stock market. Her S&P 500 year-end target of 2,950 implies a roughly 18% gain for the year. She is overweight large-cap industrials, financials, utilities, and real estate. But she's also prepared for a lot of zigzagging on the way to that target — and is advising clients to buckle up too.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

February 23, 2024- US Stocks Hit Record Highs, Tech Sector Fuels Rally

Nvidia Soars, European Markets Gain, and Key Forex Trends

Market Resurgence: Stocks Rally, Cryptos Surge, and Forex Fluctuations - February 15, 2024 Update

Key Insights into Today's Market Dynamics and Profitable Trading Strategies

EBC Research Institute Hotspot Analysis | China Unleashes Major Moves, Stock Market Brews a Violent Reversal

The Chinese government has taken measures to boost the stock market, yet the market still faces challenges, and investors should proceed with caution.

Market Wrap: Stocks, Bonds, Commodities

U.S. Stocks Rebound, Yen Surges on BoJ Policy Hints

WikiFX Broker

Latest News

Blockchain: A Game-Changer in the Fight Against Fraud?

Unlicensed Broker QmmFx: Failed Withdrawals and Frustration

Crude Oil Prices Inch Up Despite Uncertainties in US Demand

FCA Exposed Two Major Red Flags

Capitalix Denies Withdrawals to Copy-Trading Clients

ED smashed a fake app with the help of Binance

ASIC Warns of New Bond and Deposit Scam

B2Prime Secured Seychelles License

Webull Launched Webull Lite

FOREX TODAY: AHEAD OF THIS WEEK'S MAJOR EVENTS, MARKET ACTIVITY SLOWS DOWN

Currency Calculator