Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is ActivTrades?

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated by the Financial Conduct Authority (FCA) and offers a range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

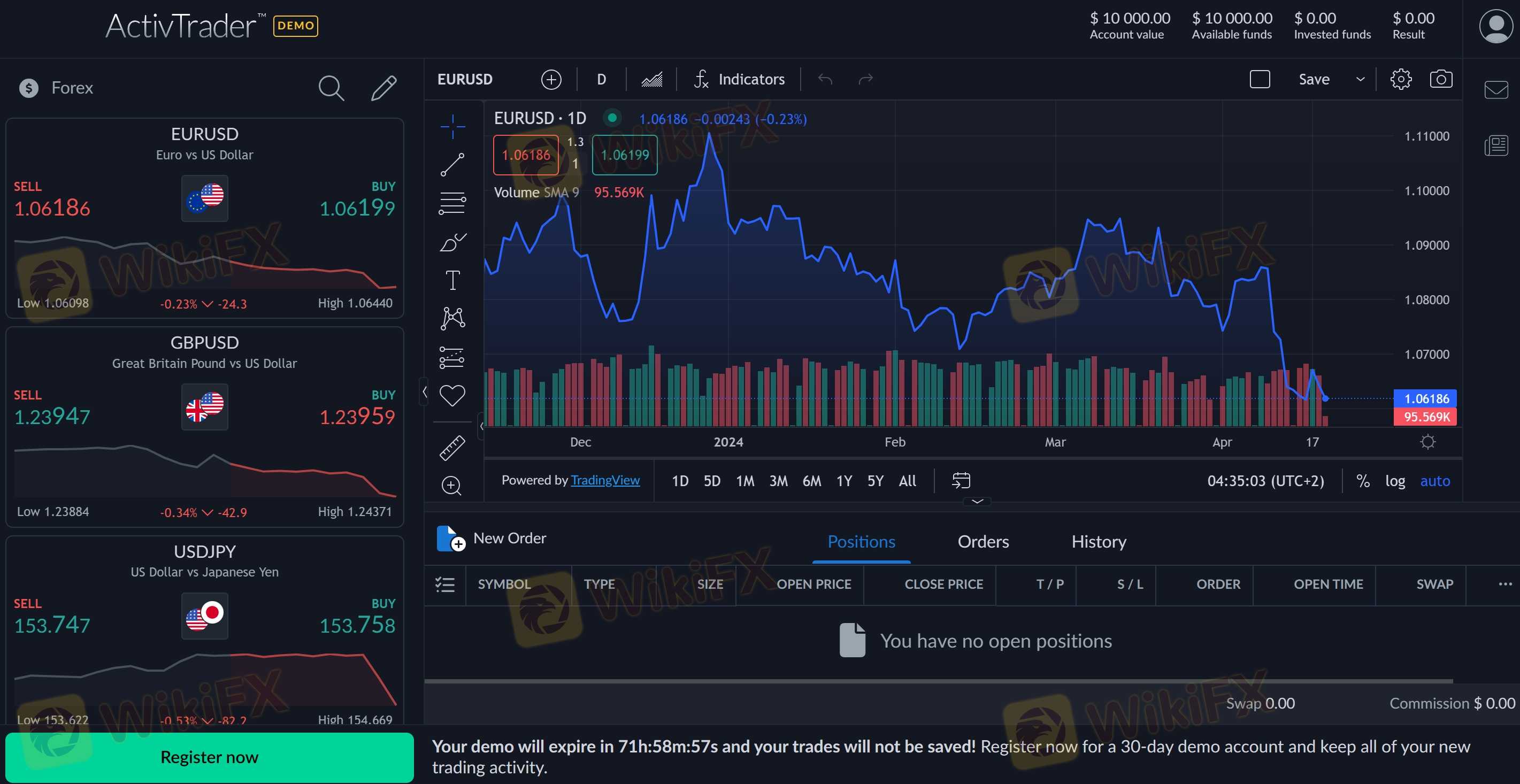

ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader. The broker aims to provide its clients with a safe and transparent trading environment, offering segregated accounts, negative balance protection, and a range of educational resources.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability. It's important for potential clients to carefully consider their trading needs and preferences before choosing ActivTrades as their broker.

ActivTrades Alternative Brokers

There are many alternative brokers to ActivTrades depending on the specific needs and preferences of the trader. Some popular options include:

Darwinex - a regulated broker that offers unique social trading features, with a focus on transparency and competitive pricing.

Dukascopy - a Swiss-based broker that provides excellent trading technology, including a proprietary trading platform, but it has high account minimums and limited product offerings.

Hantec Markets - a UK-based broker that offers a user-friendly trading platform and competitive pricing, but its educational resources are limited compared to some other brokers.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is ActivTrades Safe or Scam?

ActivTrades is a regulated broker by the Financial Conduct Authority (FCA) and and has been in operation for several years, which are positive aspects in terms of its reliability and security. The fact that they offer segregated accounts and negative balance protection adds an extra layer of protection for its clients. However, negative reviews from clients suggest that there may be issues with their trading platform.

Based on the information available, ActivTrades appears to be a reliable and trustworthy broker. However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Market Instruments

At ActivTrades, you can trade over 1,000 different CFD instruments across 7 asset classes, including forex, shares, indices, ETFs, commodities, bonds, and spread betting. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

Accounts

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

Overall, ActivTrades' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

Note: Some brokers may offer additional trading platforms or versions, but this table includes the most commonly used ones.

Trading Tools

In addition to the robust platform itself, a plethora of utility extensions is available to further develop trading functionalities and automation features, as well as to provide decision-making and signaling instruments. The term “indicators” can refer to a wide variety of tools, from those used for making decisions to those used for trading.

Deposits & Withdrawals

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

ActivTrades minimum deposit vs other brokers

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

See the deposit & withdrawal fee comparison table below:

Note: Fees and charges are subject to change. This table is only for informational purposes and may not reflect the latest fee structure of the brokers mentioned. It is recommended to always check with the brokers directly for the latest fees and charges.

Customer Service

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

Overall, ActivTrades' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Note: These pros and cons are subjective and may vary depending on the individual's experience with ActivTrades' customer service.

Education

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

User Exposure on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX