France Mulls Splitting Off Coronavirus Debt to Stagger Costs

Abstract:LISTEN TO ARTICLE 1:31 SHARE THIS ARTICLE ShareTweetPostEmailFrench Finance Minister Bruno Le Mair

French Finance Minister Bruno Le Maire proposed splitting off the debt piled up as a result of emergency spending to tackle the coronavirus and spreading out repayments over years.

In a speech on Monday, he said the extra debt from the Covid crisis would be separated from the pre-existing public debt that stood at close to 100% of economic output at the start of the year. The debt strategy would be similar to CADES, a vehicle France created in the 1990s to repay social security debt.

“This Covid debt, we will pay it back,” Le Maire said. “We will pay it back with economic growth, not with taxes. We will pay it back by confining it and separating it from the 100 points of initial debt.”

Like many countries, France has had to stretch its budget to get the economy through the pandemic and the enforced restrictions on activity in recent months. Its debt ratio is forecast to top 121% of GDP this year after it increased spending on health care and pumped money into programs to protect jobs and businesses.

Le Maire said the state would put an another 500 million euros ($560 million) in an emergency fund to help the smallest companies and the self-employed.

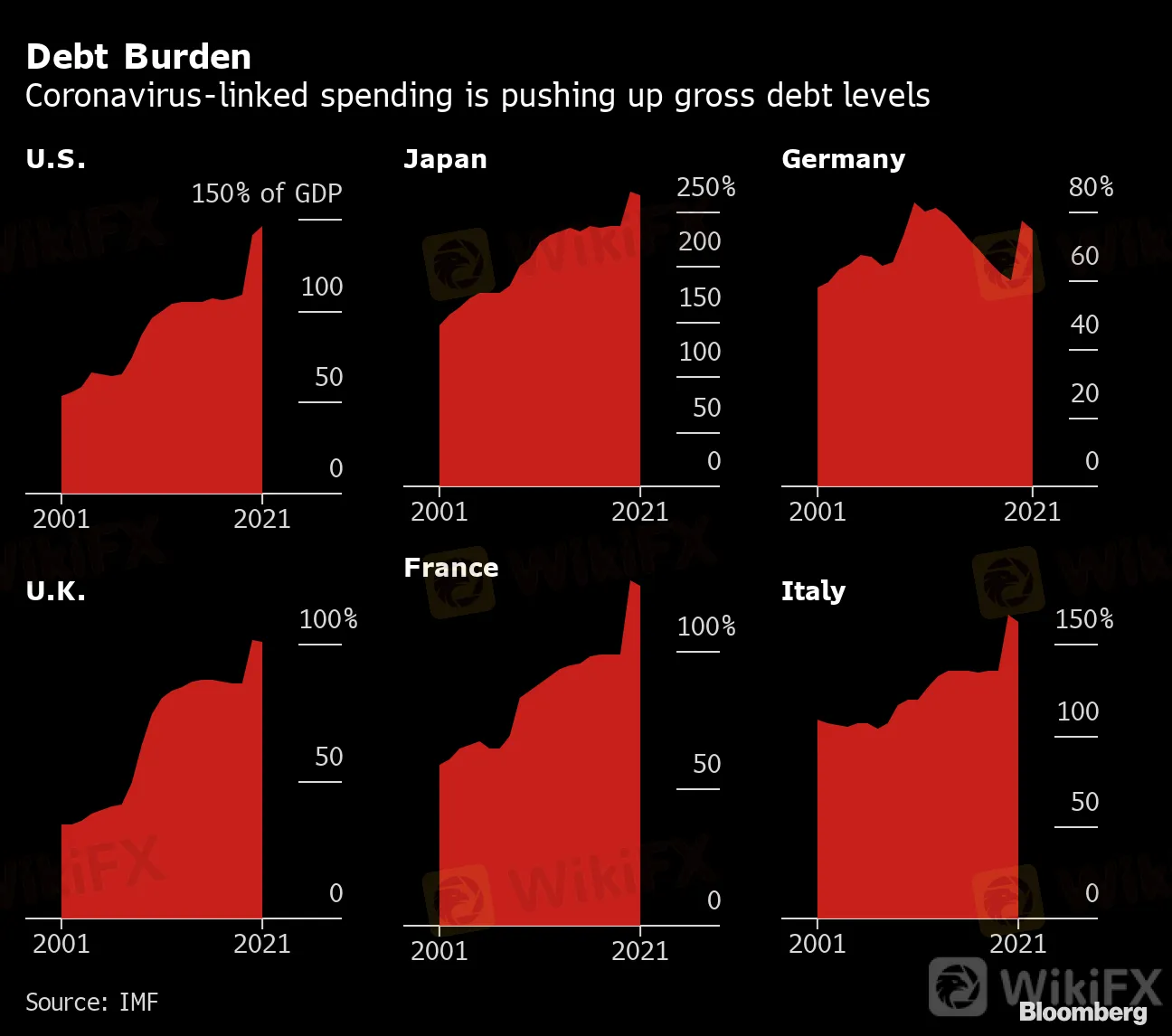

Debt Burden

Coronavirus-linked spending is pushing up gross debt levels

Source: IMF

Given the scale of the economic hit, and with the recovery likely to be slow, many governments have indicated they wont rush to implement dramatic fiscal policies such as spending cuts in the near term to reduce debt.

In the U.K., Chancellor of the Exchequer Rishi Sunak has been asked by members of the ruling Conservative Party to take his time to pay off debt, because moving too aggressively could choke off growth.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CFI Collaborates with TradingView for Enhanced Trading Experience

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator