Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is BDSWISS?

BDSwiss is an offshore-regulated forex and CFD broker that was established in 2012 and is registered in Seychelles. The broker offers a range of trading instruments across multiple asset classes, including forex, commodities, shares, indices, and cryptocurrencies.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

BDSWISS offers a wide range of trading instruments across multiple asset classes, making it a versatile platform for traders. The absence of deposit and withdrawal fees is a definite advantage for those who prioritize low-cost trading. Additionally, the broker's extensive educational resources can be beneficial for novice traders who want to improve their trading skills.

However, some traders may find the offshore Seychelles Financial Services Authority (FSA) license to be a drawback. Overall, BDSWISS appears to be a reliable broker with several advantages for traders, but it's important to consider the potential drawbacks before deciding to trade with them.

Note that this table is not exhaustive and there may be additional pros and cons to consider.

BDSWISS Alternative Brokers

There are many alternative brokers to BDSWISS depending on the specific needs and preferences of the trader. Some popular options include:

FxPro - A reputable broker with a variety of trading platforms and competitive pricing.

Trade Nation - A user-friendly broker with a focus on education and customer satisfaction.

Go Markets - A reliable broker with competitive spreads and a range of trading instruments.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is BDSWISS Safe or Scam?

These measures help to ensure that BDSWISS provides a safe and secure trading environment for its clients.

Our Conclusion on BDSWISS Reliability:

Based on the information provided, BDSWISS appears to be a reliable and reputable online broker. It is offshore regulated by Seychelles Financial Services Authority (FSA), offers negative balance protection and segregates client funds. However, it is important to note that all trading carries risks, and clients should always do their own research and take appropriate precautions.

Market Instruments

BDSwiss offers 250+ trading instruments across various asset classes, providing traders with numerous options for diversification. Forex traders can access over 50 currency pairs, including major, minor, and exotic pairs. The platform also offers CFD trading on precious metals such as gold, silver, and platinum, as well as energy products like crude oil and natural gas. Additionally, traders can choose from a range of popular stock CFDs, including shares of leading companies in the US, Europe, and Asia. BDSwiss also provides access to a range of global stock indices, such as the S&P 500, FTSE 100, DAX 30, and Nikkei 225. Finally, the platform offers trading on popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Accounts

Demo Account: BDSWISS provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: BDSWISS offers a total of 3 account types: Classic, VIP, and Raw. The minimum deposit to open an account is $10, $500 and $500 respectively. The threshold to open an account at BDSWISS is quite low. However, we should also realize that too little capital not only reduces losses, but also reduces profitability. Therefore, you may find it “unexciting” or unprofitable. In addition, accounts with smaller initial deposits tend to have poorer trading conditions.

Leverage

BDSWISS offers a maximum leverage of up to 1:500 for all account types, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Spreads & Commissions

BDSwiss offers variable spreads and commissions based on the type of trading account. Classic accounts have a minimum spread of 1.5 pips with no commission, while VIP accounts have a lower minimum spread of 1.1 pips and are also commission-free. Raw accounts, on the other hand, offer raw spreads starting from 0.0 pips but have to pay a commission of $5 per traded lot. Overall, BDSwiss' spreads and commissions are competitive compared to other brokers in the market. It's essential to note that spreads can fluctuate depending on market volatility, trading volumes, and other market conditions.

It is commendable that in the trading instruments interface, BDSWISS provides a detailed table showing the spreads, swaps, commissions and pip value of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

As for the trading platform, BDSWISS provides its clients with many options. There are public platforms such as MT4 and MT5 that have served many clients worldwide, also BDSWISS's own platforms - BDSwiss Mobile APP, BDSwiss WebTrader. If you didn't want to spend time familiarizing yourself with a new platform, you could choose MT5 and MT4. But BDSWISS's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

Overall, BDSWISS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

Note: It's worth mentioning that brokers may offer additional trading platforms or withdraw some trading platforms over time.

Trading Tools

BDSWISS provides a range of trading tools to help its clients in their trading activities.

The economic calendar allows traders to keep track of important upcoming events that can affect the markets.

The VPS service provides fast and reliable connection to BDSWISS servers for traders who use automated trading strategies.

The Trade Companion is a trading assistant that provides users with insights and trading signals.

The Trends Analysis tool helps traders to identify trends and make better trading decisions.

Trading Central provides technical analysis and market insights.

The Autochartist tool analyzes charts and helps traders to identify trading opportunities.

Trading Alerts notify users of important market events.

The Currency Heatmap tool allows traders to see the relative strength of different currencies.

Finally, the Trading Calculators help traders to manage their risk and calculate their potential profits and losses.

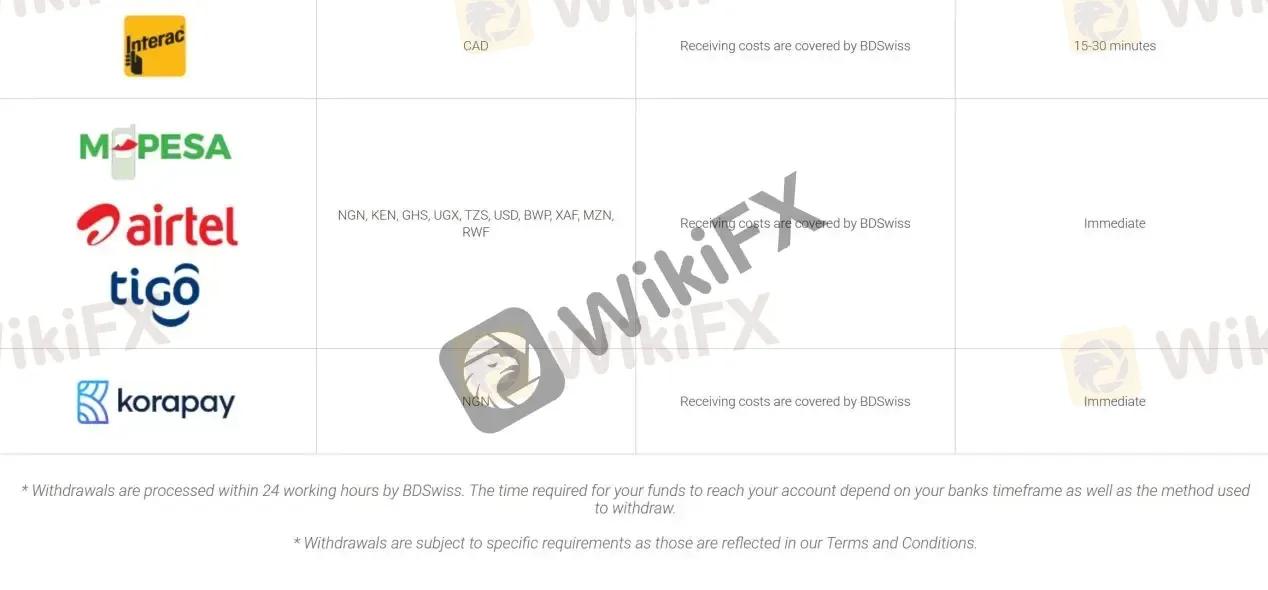

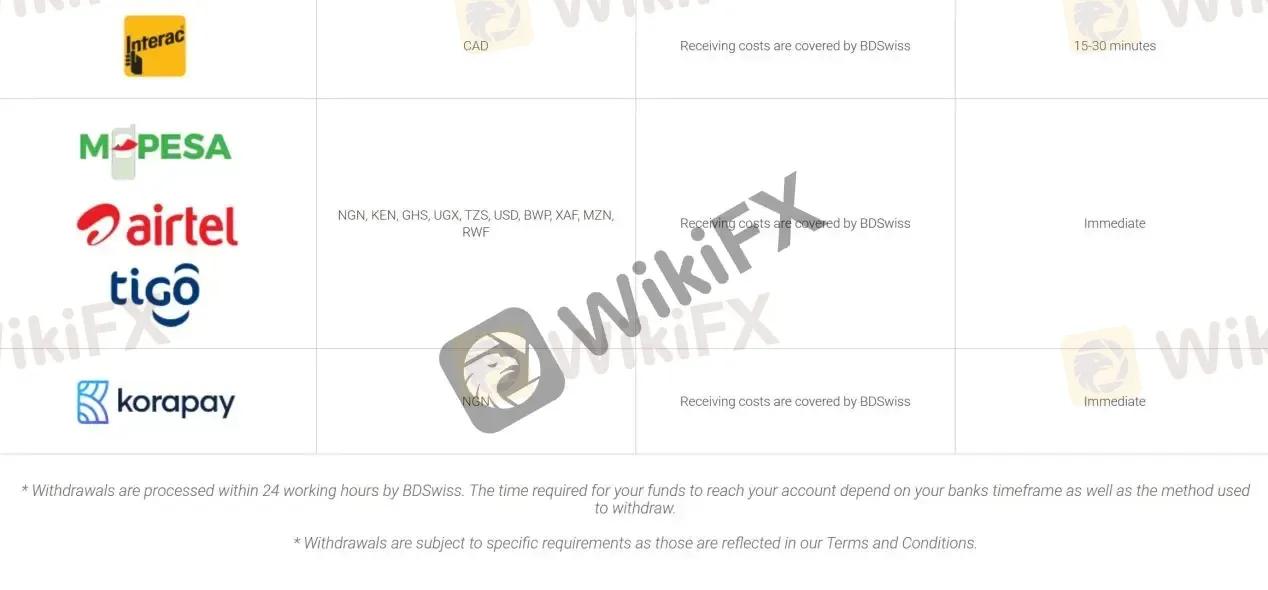

Deposits & Withdrawals

BDSWISS offers a wide range of deposit and withdrawal options, including Visa, MasterCard, Skrill, Neteller, Bank Wire, Pay Retailers, cryptocurrencies, AstroPay, Globepay, MPESA, airtel tiGo, korapay, and more.

The broker does not charge any fees for deposits or withdrawals via credit card, while for bank wire withdrawals equal to or less than €100, BDSwiss will charge a €10 flat fee.

BDSWISS minimum deposit vs other brokers

Most deposits are processed instantly. For withdrawals, BDSWISS strives to process most requests within 24 hours, although the processing time may vary depending on the payment method used and the verification requirements. Overall, BDSWISS offers convenient and cost-effective deposit and withdrawal options for its clients.

BDSWISS Money Withdrawal

To withdraw funds from BDSWISS, you need to follow these steps:

Step 1: Log in to your BDSWISS account

Step 2: Click on the “Withdrawal” option in the main menu.

Step 3: Select your preferred withdrawal method from the available options.

Step 4: Enter the amount you want to withdraw and provide any additional information requested.

Step 5: Click on the “Submit” button to process the withdrawal request.

Fees

BDSWISS charges overnight fees on all positions that are held open overnight, and the rates depend on the instrument being traded. The broker also charges a currency conversion fee for deposits made in a currency different from the account currency. Moreover, if no trading activity occurs for over 90 days, a monthly fee of $30 will be deducted from your account balance, until the account balance is 0. This charges covers the maintenance/administration expenses of such inactive accounts. It is important for traders to keep these fees in mind when planning their trading activities, as they can impact the overall profitability of their trades.

See the fee comparison table below:

Customer Service

Note: These pros and cons are based on our research and analysis of BDSWISS' customer service. Your personal experience may vary.

Overall, BDSWISS' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Education

BDSWISS provides a range of educational resources to assist traders in improving their trading knowledge and skills. They offer a variety of educational materials, including Forex eBooks, LIVE Education, Forex Basic Lessons, Forex Glossary, Educational Videos, and Seminars.

Their Forex eBooks cover various topics, such as trading psychology, technical analysis, and risk management, to help traders develop a well-rounded understanding of the Forex market.

They also provide live education through webinars, which are hosted by industry experts, and interactive training sessions.

The Forex Basic Lessons are designed to help beginner traders learn the basics of Forex trading.

Additionally, they offer educational videos that cover different aspects of trading, and traders can attend in-person seminars held in different locations globally.

User Exposure on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

All in all, BDSWISS offers a diverse range of trading instruments with competitive spreads and commissions on different account types. The broker provides a variety of deposit and withdrawal options with no fees charged, and fast processing times. BDSWISS also offers various educational resources and trading tools to enhance clients trading experience. However, is offshore regulated by Seychelles Financial Services Authority (FSA) and there are some negative reviews from their clients saying that they have met severe slippage and unable to withdraw. Every trader should be cautious before trading or investing with a broker.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX