Vantage Markets from Australia | Is It Trustworthy?

Abstract:In today's article, WikiFX will take you on an in-depth review of Vantage Markets, an established broker from Australia.

WikiFX is a global forex broker regulatory query platform that has investigated and reviewed over 40,000 brokers while collaborating closely with more than 30 national regulators. To learn more about the security and credibility of your chosen brokers, visit www.wikifx.com or download our free app from either Google Play or App Store.

Vantage Markets or Vantage (www.vantagemarkets.com) is a brokerage firm based in Sydney, Australia, established in 2009.

The firm offers transparent trading, a leading market platform, speed of execution, various technology solutions, low spreads and starting capital.

Most importantly, Vantage is a highly regulated broker that operates under the surveillance of three established financial authority bodies.

Today, Vantage operates in 172 countries, with more than 30 offices and 1,000 staff members that serves over 50,000 active trading clients worldwide.

Over the years, Vantage has expanded its CFD offerings, which now includes up to 400 instruments such as foreign exchange, global indices, energy, precious metals, commodities, ETFs, equity CFDs, and bonds.

Vantage does not provide services to residents of certain jurisdictions such as Canada, China, Romania, Singapore, the United States, and jurisdictions on the FATF and EU/UN sanctions lists.

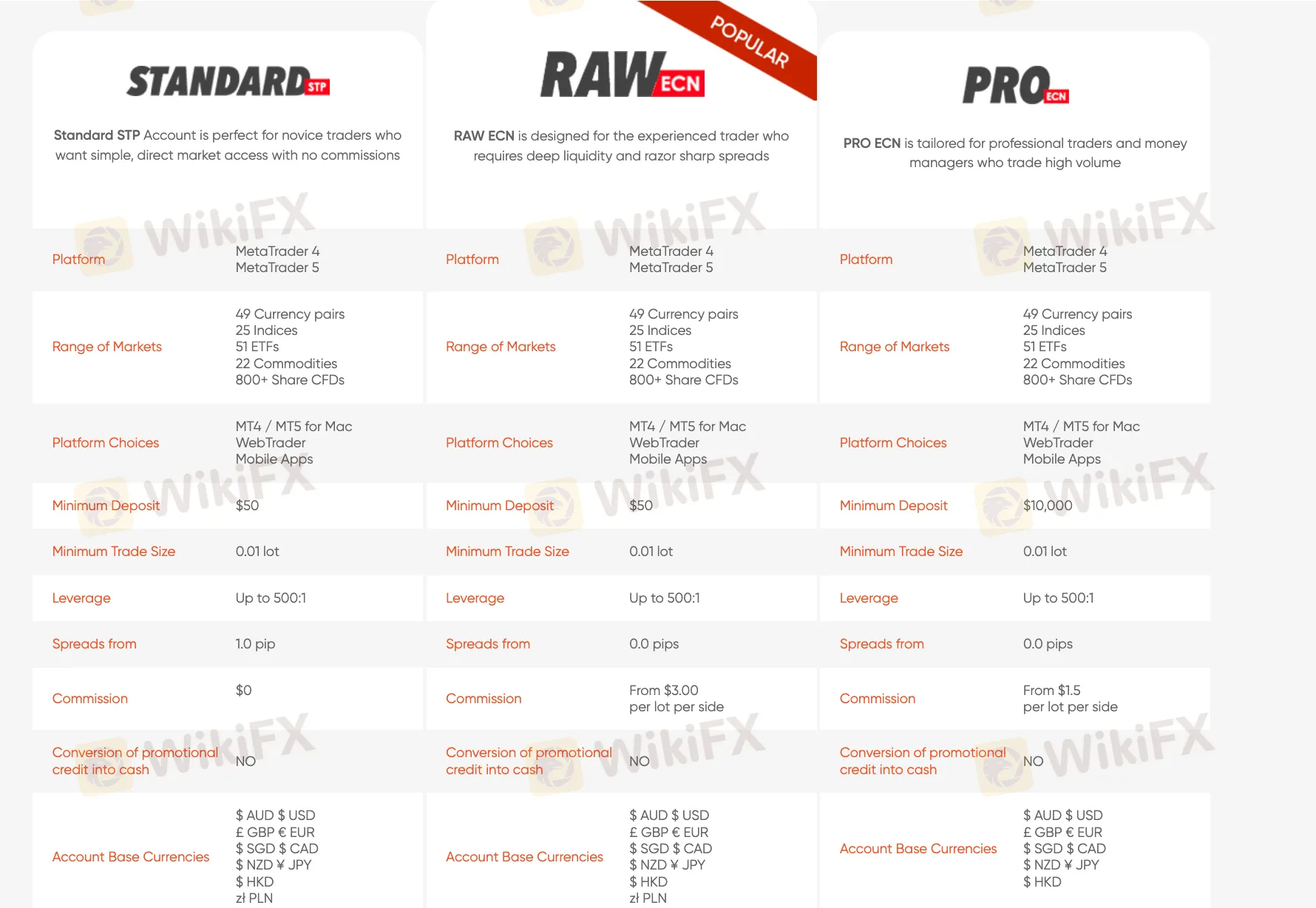

Types of accounts:

Vantage offers 3 different types of trading accounts, and the highest level of leverage is up to x500:

- Standard STP Standard Account: The minimum spread is 1.4 pips.

- Raw ECN account: The minimum spread is 0 pip.

- Pro ECN Pro account: The minimum spread is 0 pip.

Deposit and Withdrawal Methods:

Vantage offers its clients a variety of deposit and withdrawal methods, including bank remittances, credit/debit cards (Visa, Master, M, AstroPay), e-Wallet (Neteller, Skrill, fasapay), UnionPay, etc.

Vantage allows clients to deposit funds in the following base currencies: Australian Dollar, US Dollar, Euro Dollar, British Pound Sterling, New Zealand Dollar, Singapore Dollar, Japanese Yen, and Canadian Dollar.

Vantage does not charge commissions or handling fees involved in the deposit or withdrawal processes. However, the user should solely bear any transaction fees or commissions charged by a third-party payment system provider.

Trading Platforms:

Vantage offers a variety of trading platforms:

- Vantage App: This is Vantage's specially curated mobile app, a complete and easy-to-use trading and investment platform for both iOS and Android users.

- Vantage ProTrader Platform: Powered by TradingView, the Vantage ProTrader platform provides all clients access to hundreds of the most popular indicators, over 50 technical drawing tools and a comprehensive set of tools that allow clients to perform in-depth market analysis, including the most popular trading systems and strategies. When trading on the Vantage ProTrader platform, users can unlock a set of technical indicators and oscillators.

- MT4 trading platform (PC, mobile, web): This is the most common trading platform within the industry. By using the Vantage MT4 trading platform, traders can take advantage of the global forex market, achieve a steady and continuous increase in trade execution speed, and obtain transparent quotes for a variety of trading products.

- MT5 Trading Platform (PC, Mobile, Web): Users trading on Vantage's MT5 platform can activate all EA and trading signals, as well as use the hedge position feature.

WikiFX also evaluated the trading environment of Vantage in various aspects, and the results are shown below:

Customer Service:

Vantage offers several channels for clients to contact them at any time. Languages supported include English, Simplified Chinese, Vietnamese, Korean and more.

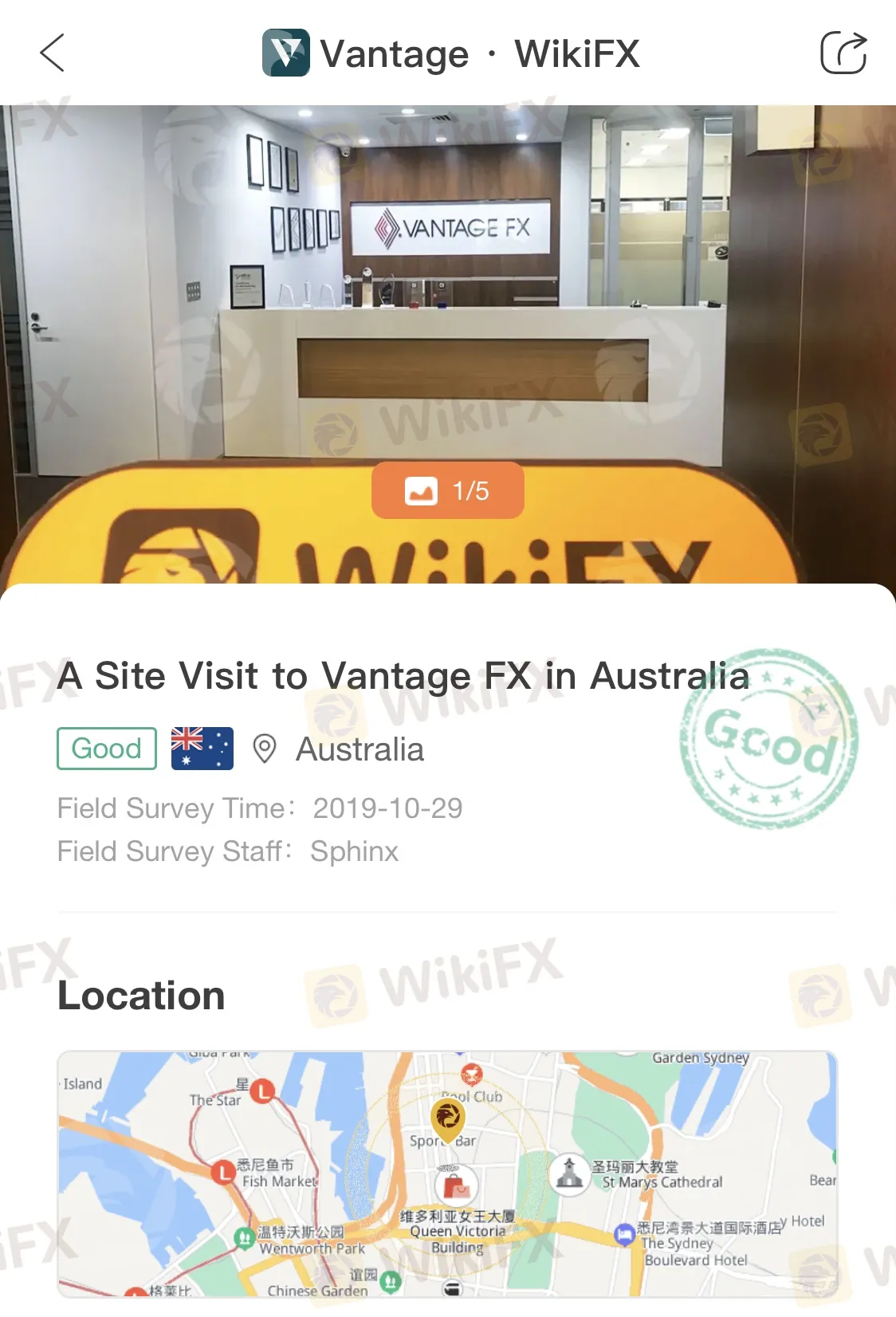

Field Survey:

WikiFX also paid a visit to the business premise of Vantage in Australia and found that it is indeed legitimate.

Considering that Vantage is highly regulated and has been established for a long period of time, but also the low spread offerings and low account opening requirement, WikiFX believes that this broker is trustworthy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CySEC withdraws license of Forex broker AAA Trade

CySEC Revokes CIF Authorization of Forex Broker AAA Trade

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Oroku Edge, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Webull Canada Unveils Desktop Trading Platform

Webull Canada launches a desktop trading platform with advanced tools for more informed decisions. The platform offers customizable features for all levels of traders.

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Finalto launches a regulated ODP liquidity solution in South Africa, promising compliance and peace of mind amid tighter regulations.

WikiFX Broker

Latest News

India's Forex Rules Shake-Up Stuns Traders and Markets

Finalto Elevates OTC Trading With FSCA-Approved Liquidity

Ringgit Weakens Amidst Battling Global Economic Turmoil

WikiFX Broker Assessment Series | Oroku Edge: Is It Trustworthy?

CySEC withdraws license of Forex broker AAA Trade

Maunto Review: Imp. Things to Know!!

Hong Kong Authorizes Spot Bitcoin & Ether ETFs

Iran's Strike on Israel Sends Shockwaves: Gold Soars, Oil in Flux

"Worst Customer Support Ever" User Complaint

Webull Canada Unveils Desktop Trading Platform

Currency Calculator