Company Summary

| XGLOBAL Review Summary in 10 Points | |

| Founded | 2012 |

| Registered Country/Region | Vanuatu |

| Regulation | Offshore regulated by VFSC |

| Market Instruments | Forex, Precious metals, Equity indices, Commodities, Shares, Cryptocurrency CFDs |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT5, MAM MULTI-TRADER |

| Minimum Deposit | USD 100 |

| Customer Support | Phone, Address, Email, Contact us form, Social media, FAQ |

What is XGLOBAL?

XGLOBAL is a global brokerage firm based in Vanuatu. Founded in 2012, it provides traders with access to market instruments including Forex, Precious metals, Equity indices, Commodities, Shares, Cryptocurrency CFDs. It is currently offshore regulated by VFSC (Vanuatu Financial Services Commission) regulation under License No. 15062.

In this forthcoming article, we will conduct a comprehensive analysis of this broker, examining its attributes from multiple angles, and present you with clear and structured information. If this topic piques your interest, we invite you to continue reading. Towards the conclusion of the article, we will also offer a concise summary for a quick overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| • Multiple customer support channels | • Commissions charged |

| • Wide range of trading instruments across multiple asset classes | • Offshore regulated by VFSC |

| • Various account types to suit different trading needs | |

| • MT5 trading platform | |

| • Multiple account funding and withdrawal options | |

| • Demo account available |

XGLOBAL Alternative Brokers

There are many alternative brokers to XGLOBAL depending on the specific needs and preferences of the trader. Some popular options include:

IC Markets: IC Markets is a reputable choice for traders, known for its competitive spreads, diverse trading instruments, and advanced technology infrastructure.

Pepperstone: Pepperstone offers a user-friendly platform, zero commissions, and a range of trading tools, making it suitable for both beginners and experienced traders.

AvaTrade: AvaTrade stands out for its extensive range of assets, educational resources, and innovative trading platforms, making it a versatile option for traders of all levels.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is XGLOBAL Safe or Scam?

When considering the safety of a brokerage like XGLOBAL or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

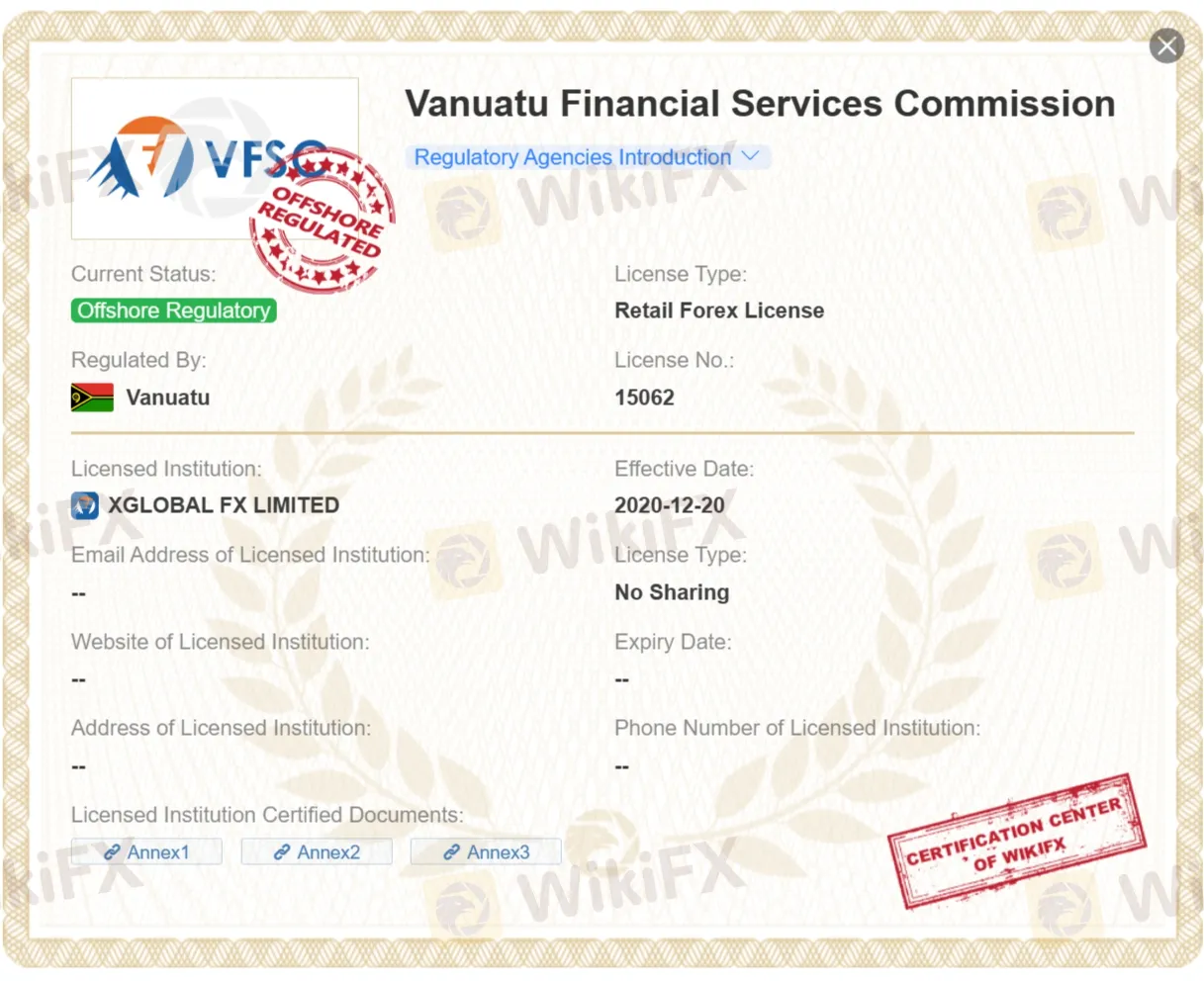

Regulatory sight: It is offshore regulated by VFSC (Vanuatu Financial Services Commission, License No.: 15062), which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the company. Look for reviews on reputable websites and forums.

Security measures: XGLOBAL underscores its dedication to client security by implementing various measures, such as segregated accounts, margin calls, stop-outs for risk management, and negative balance protection to avert account deficits. The strict adherence to a privacy policy ensures the protection of personal information, aligning with data protection regulations to foster increased trust and confidentiality.

In the end, the choice of whether to engage in trading with XGLOBAL is a matter of personal judgment. It is essential to thoughtfully evaluate the associated risks and potential benefits before reaching a decision.

Market Instruments

XGLOBAL offers a comprehensive range of market instruments, designed to cater to diverse trading preferences:

Forex: Traders can access the dynamic world of foreign exchange, engaging in currency pair trading and capitalizing on exchange rate fluctuations.

Precious Metals: Investing in safe-haven assets like gold and silver provides a secure and tangible means of portfolio diversification and wealth preservation.

Equity Indices: Speculating on broader market movements allows traders to take positions on global indices, mirroring the performance of various stock markets.

Commodities: A range of commodities, from agricultural products to energy resources, provides opportunities for traders to participate in the commodity market's inherent volatility.

Shares: Trading individual company stocks enables investors to directly engage with some of the world's most prominent corporations.

Cryptocurrency CFDs: With the ability to speculate on the price movements of cryptocurrencies like Bitcoin and Ethereum without owning the underlying asset, traders can participate in the exciting and rapidly evolving world of digital currencies.

Account Types

XGLOBAL offers a demo account, allowing traders to familiarize themselves with the platform and gain hands-on experience in a risk-free environment. Traders can utilize the demo account to explore different trading instruments, practice executing trades, and analyze market conditions.

Once traders feel confident and ready to transition to live trading, XGLOBAL offers a versatile range of live accounts designed to cater to various trading preferences, including XG RAW, XG ZERO, and XG ISLAMIC Accounts. With a consistent minimum deposit requirement of USD 100 or its equivalent in other currencies like EUR, GBP, or CHF, the platform ensures accessibility for all traders. These live accounts provide a diverse trading experience, accommodating both beginners and experienced traders, with a choice of base currencies that enhance flexibility and convenience.

Leverage

XGLOBAL brokerage provides traders with maximum leverages of up to 1:500. Leverage allows traders to control larger positions in the market with a smaller amount of invested capital. With a leverage ratio of 1:500, traders can amplify their trading potential by effectively multiplying their trading capital.

It's important to note that while leverage can increase potential profits, it also amplifies potential losses, as traders are exposed to higher market risk. Therefore, it is crucial for traders to exercise prudent risk management practices, carefully consider their trading strategies, and be aware of the potential implications of using leverage.

Spreads & Commissions

XGLOBAL offers a range of live accounts tailored to suit diverse trading preferences.

The XG RAW Account boasts tight spreads starting from just 0.2 pips, making it an attractive choice for traders seeking competitive pricing. With a commission of USD 3.75 per side, it provides a transparent fee structure.

The XG ZERO Account, on the other hand, features spreads starting from 1.0 pips with zero commissions, catering to those who prefer a no-commission trading environment.

For traders who require a swap-free option, the XG ISLAMIC Account offers spreads from 1.2 pips, ensuring compliance with Islamic finance principles.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| XGLOBAL | From 0.2 pips | Variable (depending on account) |

| IC Markets | From 0.0 pips | Variable (depending on account) |

| Pepperstone | 1.1 pips | No commissions |

| AvaTrade | From 0.9 pips | No commissions |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Trading Platforms

XGLOBAL provides a versatile trading experience with its support for the popular MetaTrader 5 (MT5) platform, accessible across various devices. Whether on Windows, macOS, iOS, or Android devices, traders can access MT5's advanced features, robust charting tools, and automated trading capabilities. This multi-platform accessibility ensures traders can stay connected and manage their portfolios seamlessly, regardless of their preferred device or operating system.

Additionally, XGLOBAL offers the MAM MULTI-TRADER option, allowing skilled traders and money managers to efficiently handle multiple accounts and execute trading strategies on behalf of their clients, adding an extra layer of flexibility to their trading services.

Overall, XGLOBALs trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| XGLOBAL | MT5, MAM MULTI-TRADER |

| IC Markets | MT4/MT5, cTrader |

| Pepperstone | TradingView, MT5, MT4, cTrader |

| AvaTrade | AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, DupliTrade |

Deposits & Withdrawals

Deposits

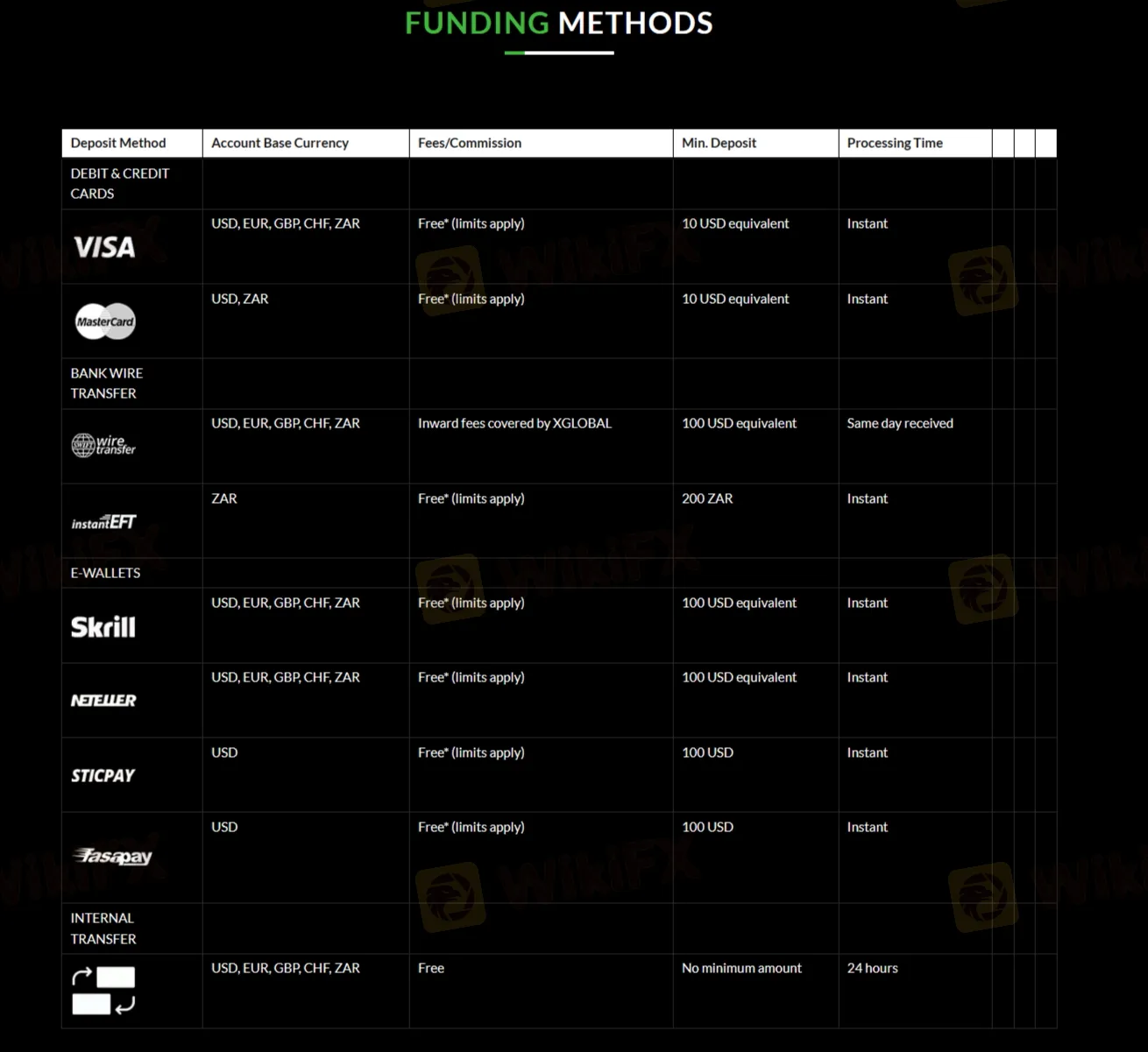

Debit & Credit Cards: Available in USD, EUR, GBP, CHF, and ZAR, deposits are free with certain limits applied, requiring a minimum of 10 USD equivalent. Transactions are processed instantly.

Bank Wire Transfer: For USD, EUR, GBP, CHF, and ZAR, XGLOBAL covers inward fees, and the minimum deposit is 100 USD equivalent, with same-day processing. For ZAR deposits via instantETF, there are no fees, but limits apply, minimum deposit is ZAR 200, and the processing is instant.

E-Wallets (Skrill, NETELLER, STICPAY, fasapay): Deposits in USD, EUR, GBP, CHF, and ZAR are free, with limits applied, and require a minimum of 100 USD equivalent. These transactions are processed instantly.

Internal Transfer: This option is free, with no minimum amount required, and it typically takes 24 hours to process for USD, EUR, GBP, CHF, and ZAR deposits.

Withdrawal:

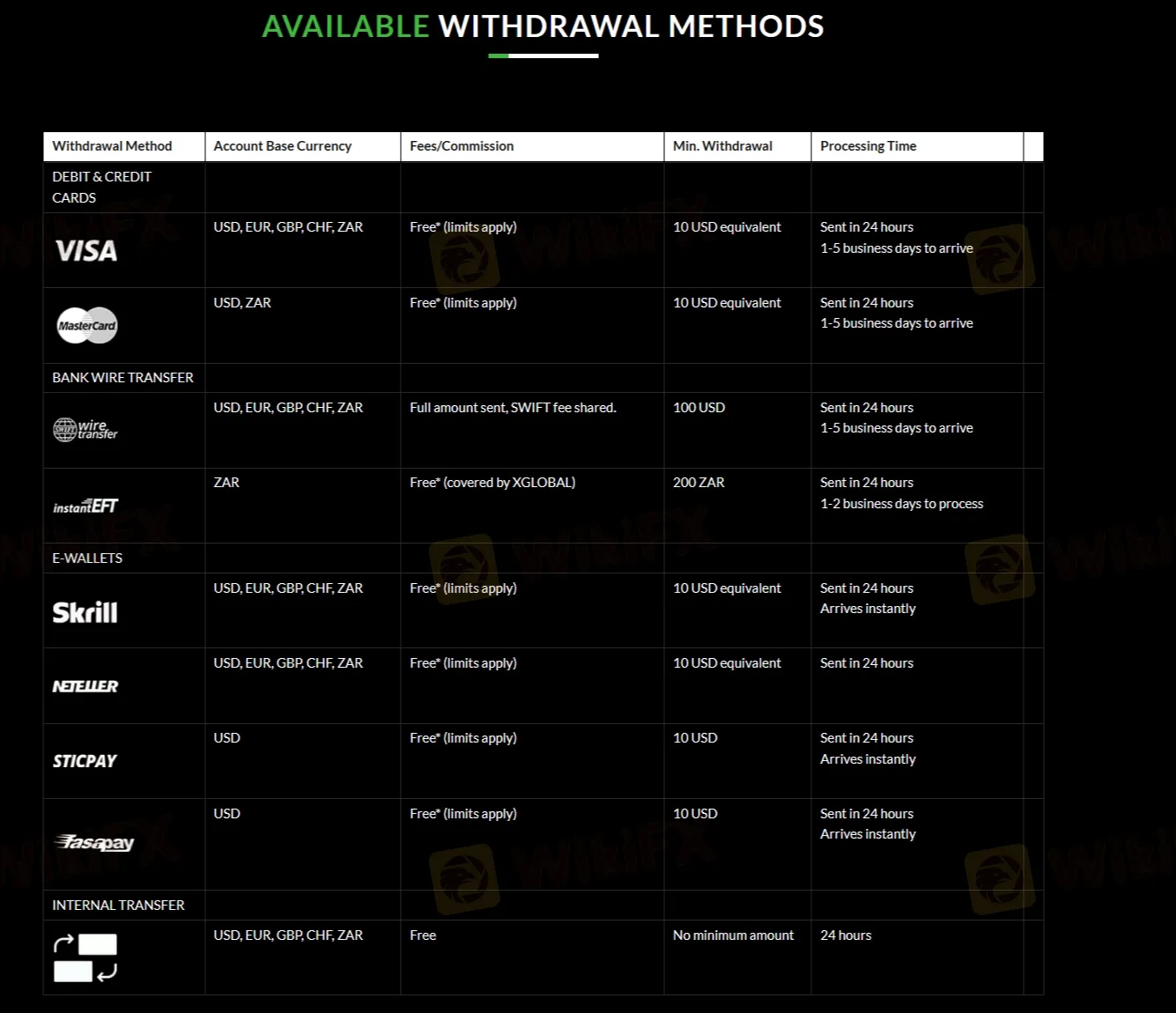

Debit & Credit Cards: Withdrawals in USD, EUR, GBP, CHF, and ZAR are free with certain limits applied, and a minimum withdrawal of 10 USD equivalent is required. Withdrawals are processed within 24 hours, with funds taking 1-5 business days to arrive.

Bank Wire Transfer: For withdrawals in USD, EUR, GBP, CHF, and ZAR, the full amount is sent, with SWIFT fees shared. The minimum withdrawal amount is 100 USD for wire transfer, and processing occurs within 24 hours. The funds typically arrive in 1-5 business days. For ZAR withdrawals via instandEFT, there are no fees as XGLOBAL covers them, and the minimum withdrawal amount is 200 ZAR. Processing takes 1-2 business days.

E-Wallets (Skrill, NETELLER, STICPAY, fasapay): Withdrawals in USD, EUR, GBP, CHF, and ZAR are free with limits applied, and a minimum withdrawal of 10 USD equivalent is required. These withdrawals are processed within 24 hours and arrive instantly.

Internal Transfer: This option is free, with no minimum withdrawal amount required, and processing typically takes 24 hours for withdrawals in USD, EUR, GBP, CHF, and ZAR.

Customer Service

XGLOBAL provides multiple customer service options to assist its clients. Customers can reach out to XGLOBAL through various channels to address their queries and concerns as below:

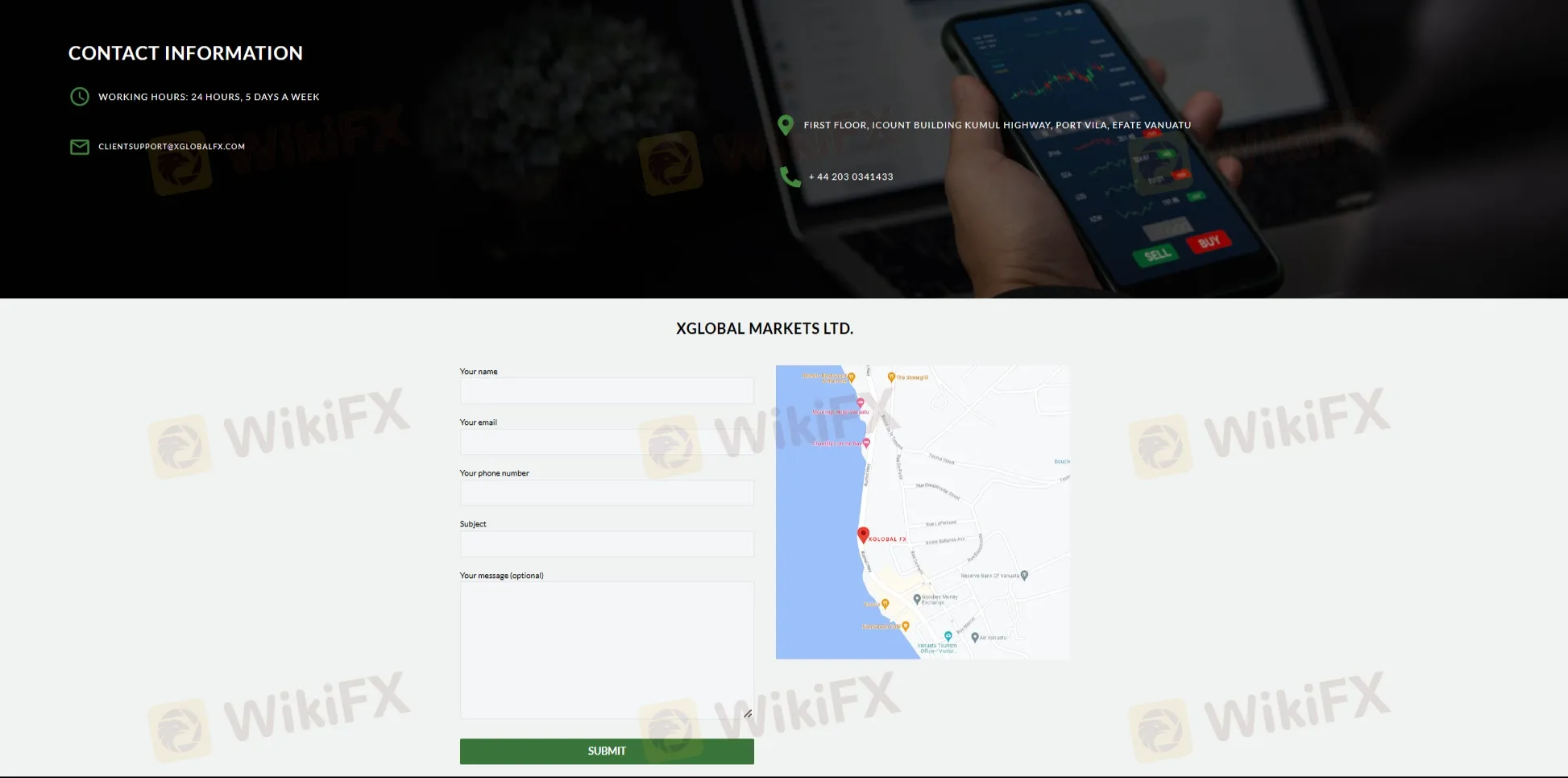

Phone: + 44 203 0341433.

Email:CLIENTSUPPORT@XGLOBALFX.COM.

Address: FIRST FLOOR, ICOUNT BUILDING KUMUL HIGHWAY, PORT VILA, EFATE VANUATU.

Moreover, traders can access real-time assistance by submitting inquiries via a convenient “Contact Us” form, or engage with the broker through social media platforms such as Facebook, Twitter and Linkedin.

Conclusion

According to available information, XGLOBAL is an offshore VFSC-regulated Vanuatu-based brokerage firm. It provides Forex, Precious metals, Equity indices, Commodities, Shares, Cryptocurrency CFDs as market instruments to traders. Even though this makes the broker appear reliable, it is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from XGLOBAL before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is XGLOBAL regulated? |

| A 1: | Yes. The broker is currently offshore regulated by VFSC (Vanuatu Financial Services Commission) regulation under License No.: 15062. |

| Q 2: | Does XGLOBAL offer the industry leading MT4 & MT5? |

| A 2: | Yes, it offers MT5 trading platform on Windows, MacOS, iOS and Android devices. |

| Q 3: | Is XGLOBAL a good broker for beginners? |

| A3: | No. It is not a good choice for beginners because it is offshore regulated by VFSC. |

| Q 4: | What is the minimum deposit for XGLOBAL? |

| A 4: | The minimum initial deposit to open an account is USD 100. |

| Q 5: | Does XGLOBAL offer demo accounts? |

| A 5: | Yes. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

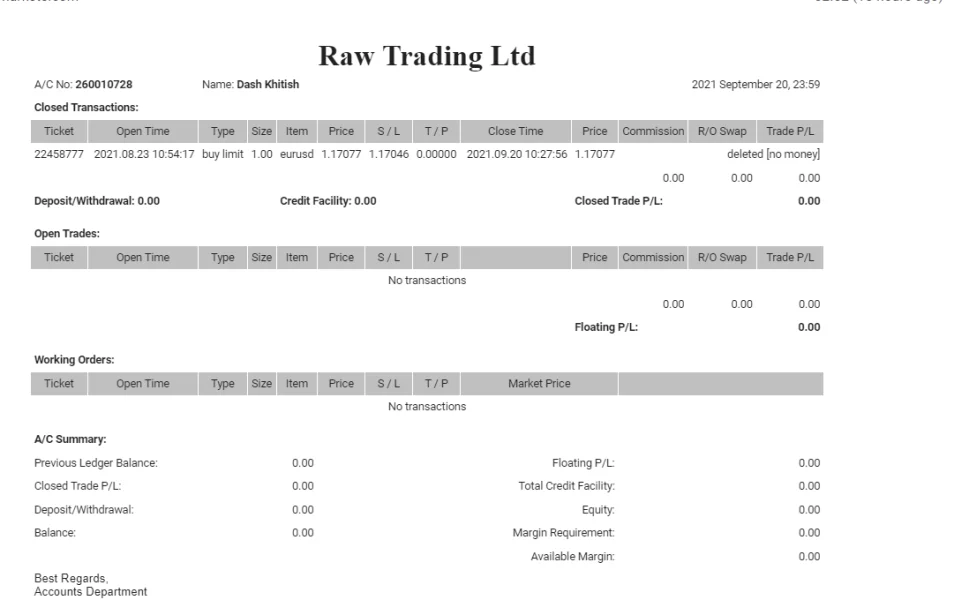

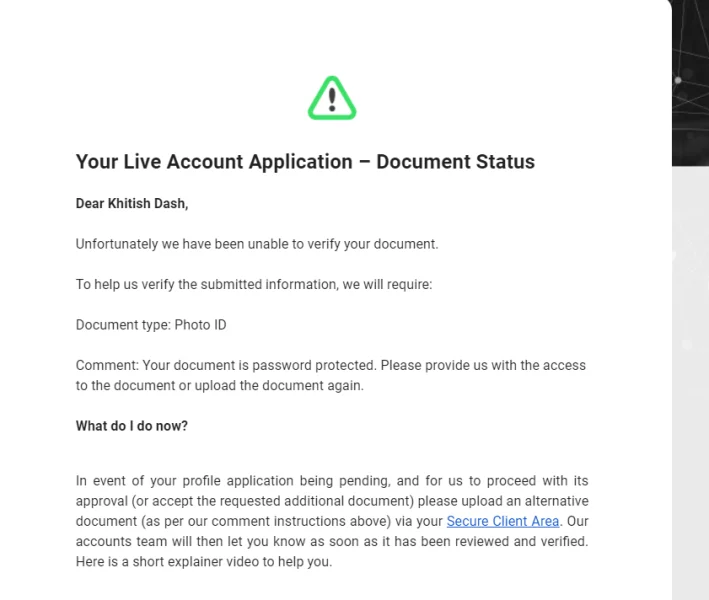

Khitish Dash20293

India

Hi I am Khitish Dash i deposited $500 to the X global markets but then i tried to withdraw my profits then they rejected my documents and then i given another documents will full verified still they rejected it again and again and finally they blocked my account and blocked my email.

Exposure

FX5944873722

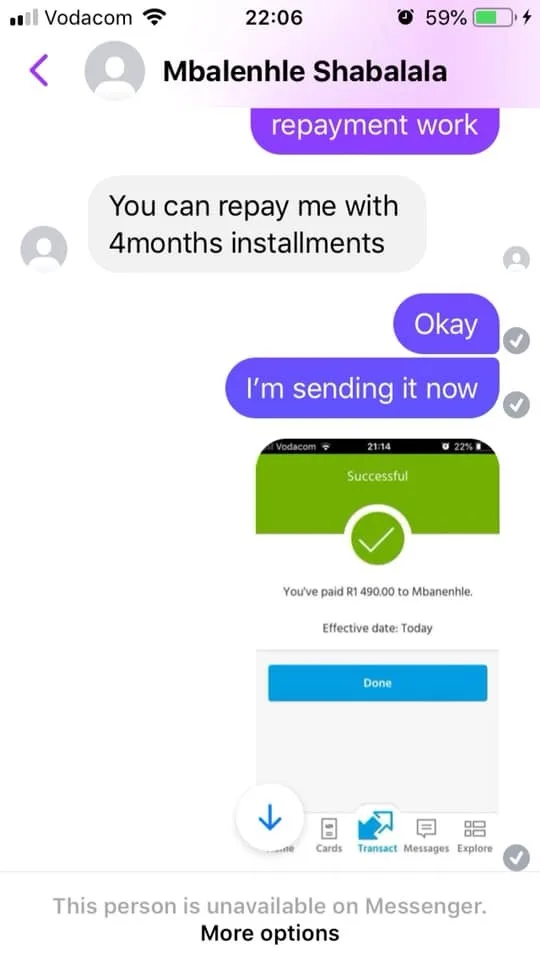

Malaysia

This person cheated me yesterday. I paid 1500 to them, but as soon as I transferred the money, they blocked me.

Exposure

大卫55675

Hong Kong

XLOGAL is a fantastic broker and I am an existing client. My only advice will be that widen your trading instruments, xglobal. Yes, I also want to try some other investment portfolios.

Neutral

FX1196563903

United States

The regulatory situation looks good, and it also provides the industry's famous MT4 and MT5 trading platforms, but the question is why did the website crash? Is anyone having the same problem as me?

Neutral

韩鑫

Ecuador

At first I planned to trade with XGLOBAL. My friend recommended the wikifx platform to me and said we can easily check whether a forex company is legitimate or not. I'm surprised to see so many negative comments about XGLOBAL here. For the safety of my money, I decided not to invest.

Neutral

Zom

Argentina

For me, trading costs are a bit high. The spreads are uncompetitive, and the commission, while not too high, is still a fee. The leverages are also not satisfactory. As a general rule, with an offshore license, this broker could have had higher leverage.

Neutral

FX1042716768

Tunisia

Both mt4 and mt5 are available at XGLOBAL, and they also support multiple deposit and withdrawal options. But the spread and commission fees are too high, I can’t accept 2 pips on EUR/USD pair.

Neutral

FX1028855272

Australia

Their superb trading environment and trading conditions on the practice account impress me a lot, I am ready to open a live account, and I’ve made a deposit of $200, I believe this platform won’t let me know, thanks Jacob who helped me complete my account registration. I recommend you to open a demo account first, if everything in the demo account reaches your expectation, you can open a live account then….

Positive