Company Summary

| Palm GlobalReview Summary | |

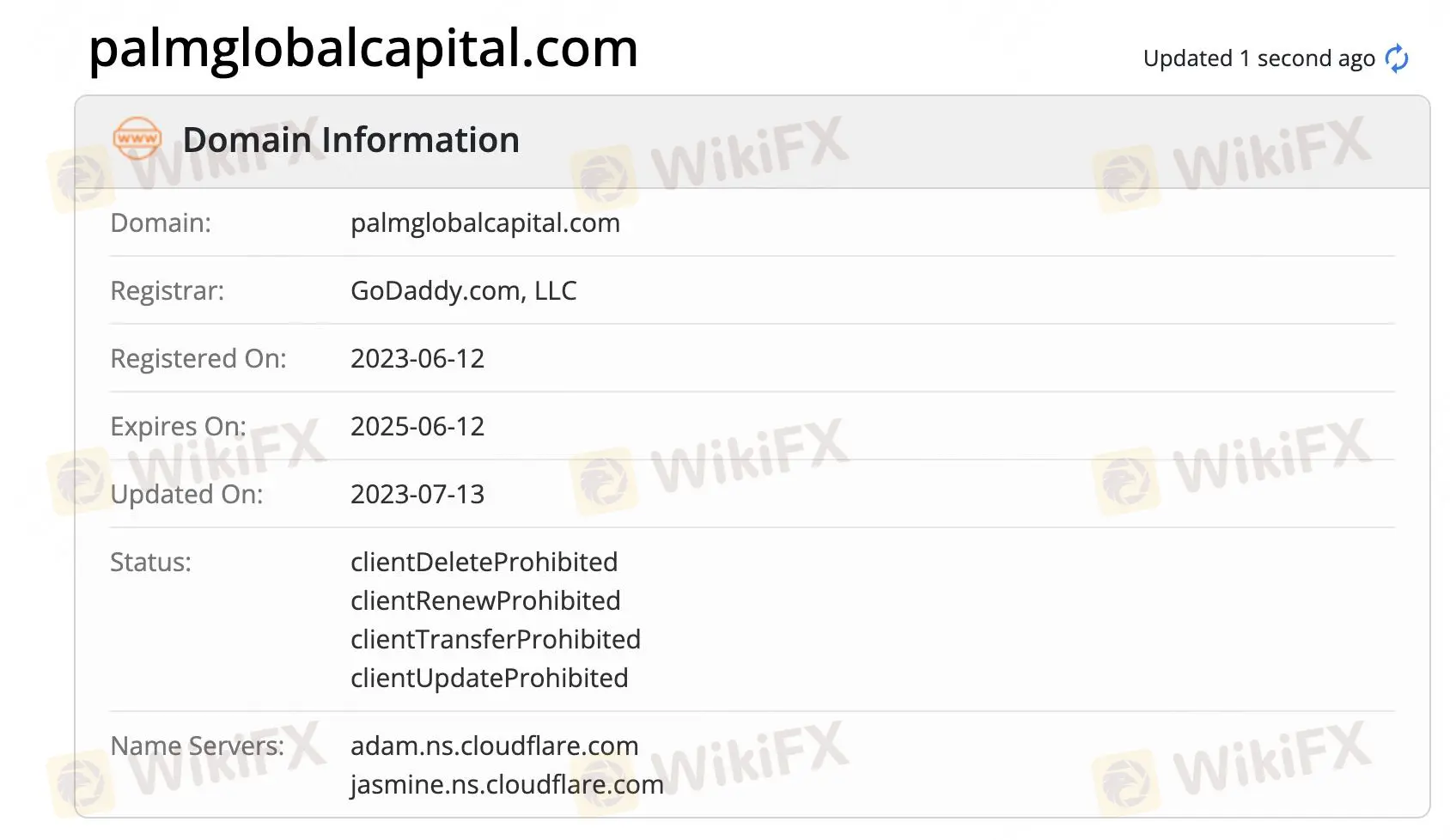

| Founded | 2023 |

| Registered Country/Region | Bahamas |

| Regulation | Offshore regulation |

| Market Instruments | Over 40 currency pairs, commodities and precious metals |

| Demo Account | ✔ |

| Leverage | Up to 1:200 |

| Spread | Starting from 0.17 pips |

| Trading Platform | MetaTrader 4 |

| Min Deposit | $100 |

| Customer Support | Phone: +44 203 1502654 |

| Email: info@palmglobalcapital.com | |

| Physical Address: Trinity Place Annex Corner Frederick and Shirley Streets, Nassau, Bahamas Palm Global Capital Ltd. | |

Palm Global Information

Palm Global Ltd is a global forex and CFD broker, authorised and regulated by the Securities Commission of the Bahamas, license number SIA-F191. Founded by an experienced and dedicated team of online finance professionals.

Pros and Cons

| Pros | Cons |

| Diversified trading products | Offshore regulation |

| Support MT4 | |

| Various accounts | |

| No hidden costs |

Is Palm Global Legit?

It is clear that Palm Global is offshore regulated by the Securities Commission of the Bahamas, license number SIA-F191.

What Can I Trade on Palm Global?

Palm Global offers traders the opportunity to trade a wide range of markets, including over 40 currency pairs, commodities and precious metals.

Account Types

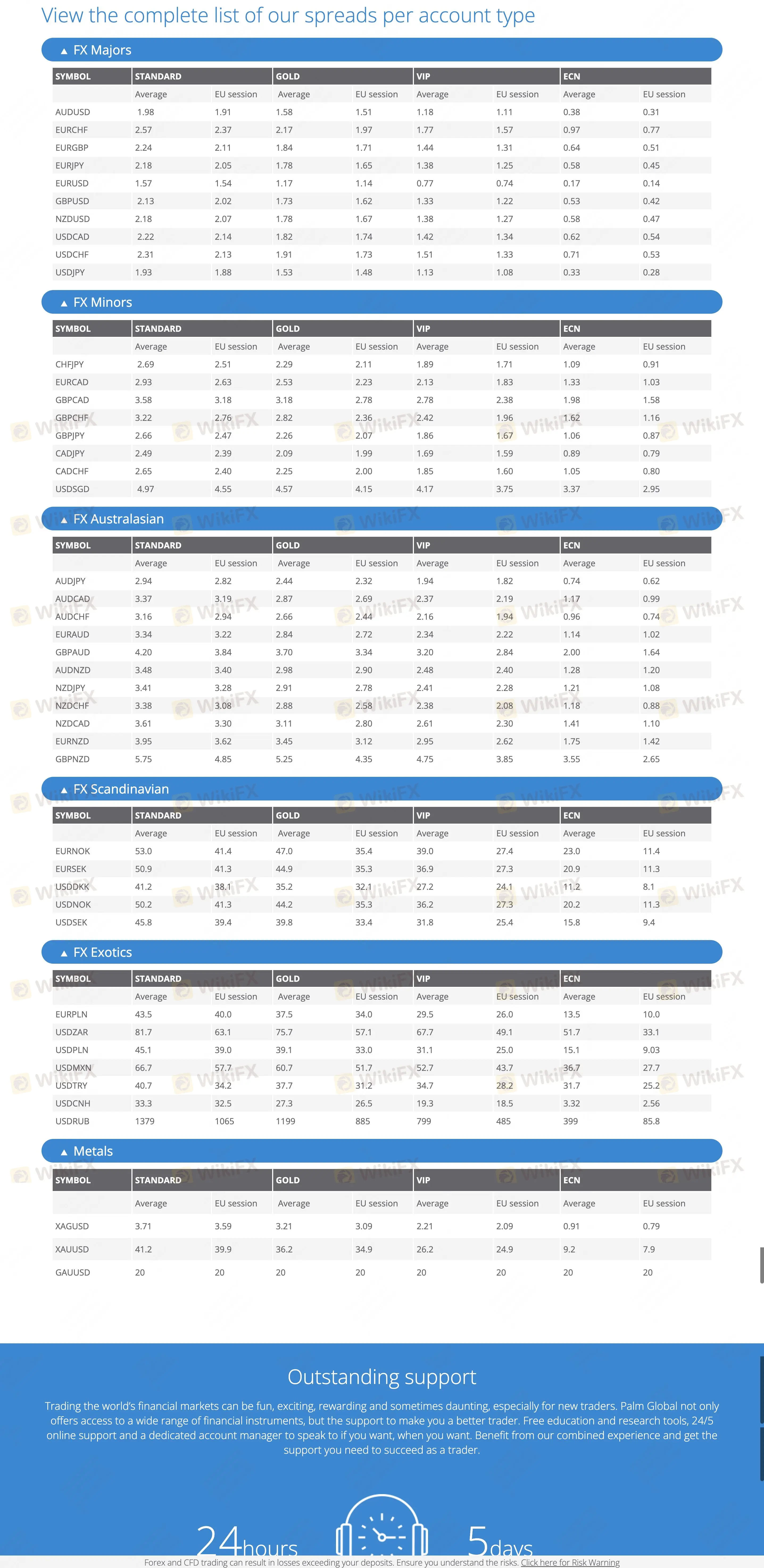

Palm Global offers a total of 5 different types of accounts to traders - Standard accounts, Gold accounts, VIP accounts , ECN accounts and demo accounts.

| STANDARD | GOLD | VIP | ECN | |

| Minimum deposit | $100 | $ 1,000 | $ 5,000 | $ 10,000 |

| EURUSD spread (average 24hrs) | 1.57 | 1.17 | 0.77 | 0.17 |

| Commissions | No | No | No | Yes |

| Minimum trade size in lots | 0.01 | 0.01 | 0.01 | 0.01 |

| Maximum leverage* | 200:1 | 200:1 | 200:1 | 100:1 |

| Hedging allowed | Yes | Yes | Yes | Yes |

| EAs allowed | Yes | Yes | Yes | Yes |

Palm Global Fees

Palm Global claims to offer low spreads and split spreads overview by market and account type. The spread shown for indices and commodities is the in-hours spread, which is the minimum spread they quote for these symbols.

The EURUSD average spread for standard account is 1.57 pips. Gold account is 1.17 pips. For VIP account, it is 0.77 and ECN account is 0.17 pips.

Trading Platform

Aifactor's trading platform is MT4, which supports traders on the web and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, Mobile | Beginner |

| MT5 | ❌ |

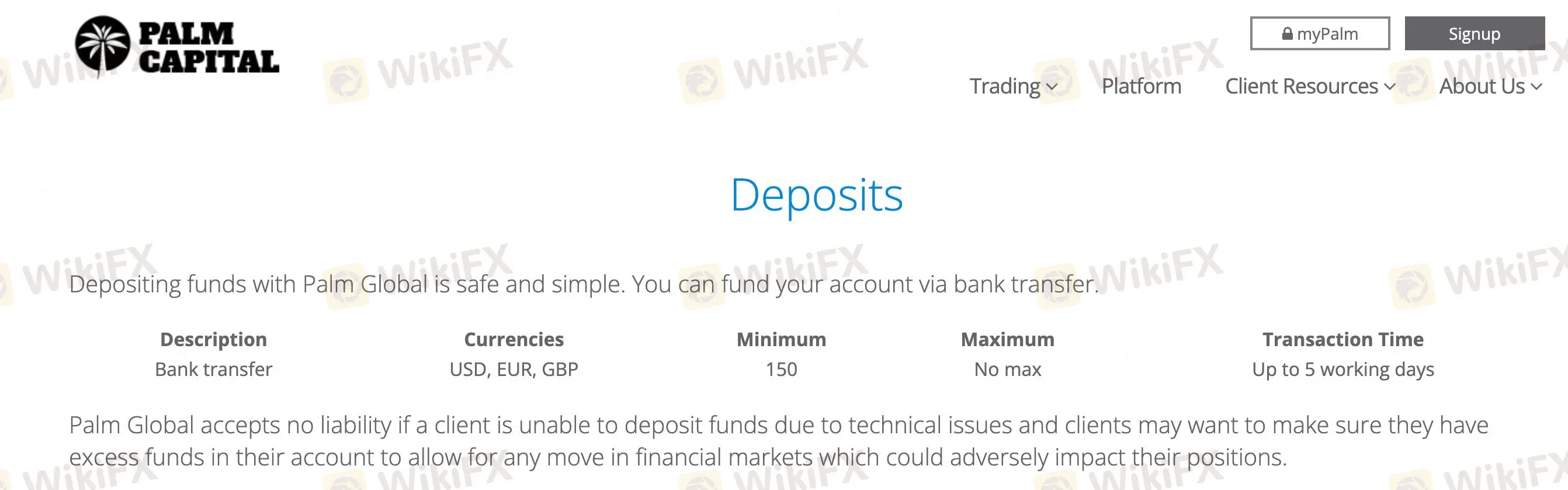

Deposit and Withdrawal

The broker supports four payment methods, including credit cards, wire transfers, and web money.

Deposit

| Description | Currencies | Minimum | Maximum | Transaction Time |

| Bank transfer | USD, EUR, GBP | 150 | No max | Up to 5 working days |

Withdrawal

| Description | Currencies | Minimum* | Transaction Time |

| Bank transfer | USD, EUR, GBP | 100 | Up to 5 working days |