Company Summary

| RBC Securities Review Summary | |

| Founded | 1995 |

| Registered Country/Region | United States |

| Regulation | CIRO |

| Services | Investment management, Wealth planning, Banking and borrowing and Trust and estate services |

| Demo Account | ❌ |

| Trading Platform | / |

| Min Deposit | / |

| Customer Support | Email: contactus@dib.ae |

| Phone: 1-800-769-2511; 1-833-654-2566; 1-800-769-2531; 1-800-769-2560 | |

Founded in 1995, RBC Securities is a wealth management company based in the United States. It offers financial services including investment management, wealth planning, banking and borrowing and trust and estate services.

Pros and Cons

| Pros | Cons |

| Comprehensive financial services | Lack of detailed info on fees |

| Long history of operation | |

| Regulated by CIRO |

Is RBC Securities Legit?

RBC Securities is regulated by the Canadian Investment Regulatory Organization (CIRO). It holds a license for Market Making (MM) and the specific license number is unreleased.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Canadian Investment Regulatory Organization (CIRO) | RBC Dominion Securities Inc. | Market Making (MM) | Unreleased | Regulated |

Services

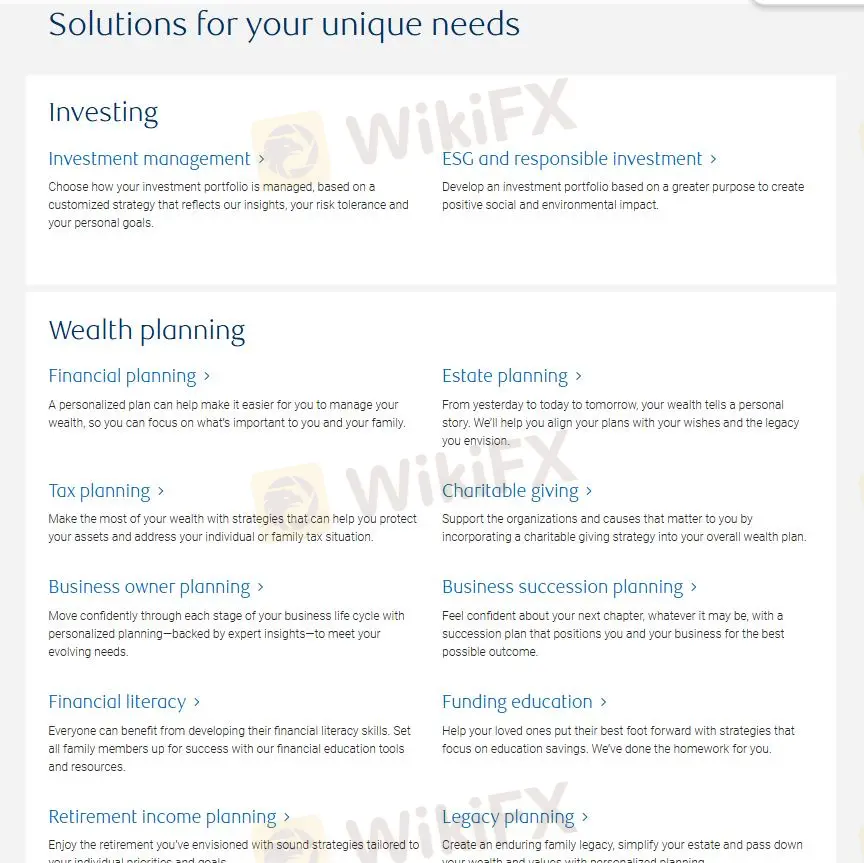

RBC Securities offers four kinds of service to address diverse financial needs:

Investment: Investment management and ESG and responsible investment

Wealth planning: Financial planning, Estate planning, Tax planning, Charitable giving, Business owner planning...

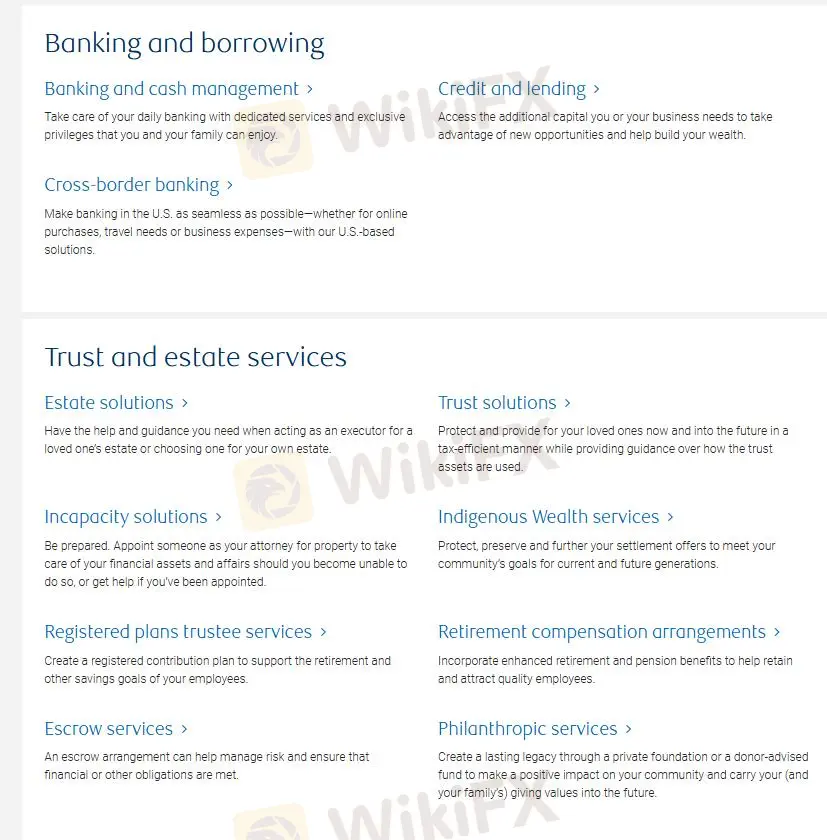

Banking and borrowing: Banking and cash management, Credit and lending and Cross-border banking

Trust and estate services: Estate solutions, Trust solutions, Incapacity solutions, Indigenous Wealth services, Registered plans trustee services, Retirement compensation arrangements, Escrow services, Philanthropic services.

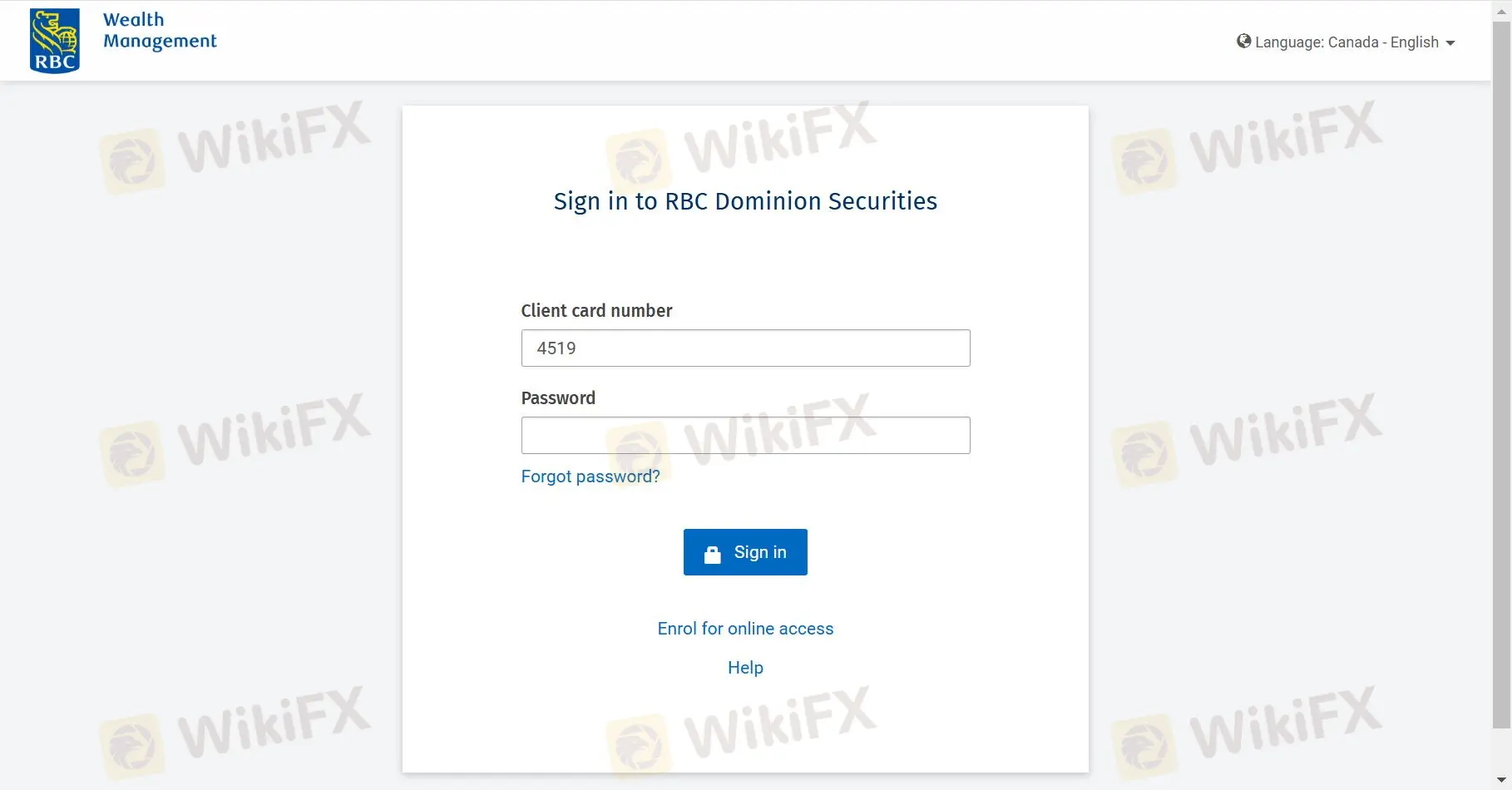

How to Open an Account on RBC Securities?

At RBC Securities, you can choose four types of accounts: RBC Dominion Securities Online, RBC PH&N Investment Counsel Online, RBC Royal Trust Online, and RBC Online Banking.

To open an account, you need to follow these steps:

- Look for the “Sign up” button on the homepage and click on it

- Select the account type based on your investment needs

- Provide your personal information including card number

- Set a password

- Submit your application by clicking the “sign in” button.