Company Summary

| KCM Trade Review Summary in 10 Points | |

| Founded | 2016 |

| Registered Country/Region | Mauritius |

| Regulation | ASIC |

| Market Instruments | Forex, Precious Metals, Energy CFDs, Indices, Stock CFDS (Shares) |

| Demo Account | Available |

| Leverage | 1:400 |

| Spread | 1.2 pips ( MT5 Low Spread Account) |

| 1.6 pips ( MT4 Standard Account ) | |

| Trading Platforms | MT4/MT5 |

| Minimum Deposit | $1,000 |

| Customer Support | Live chat, WhatsApp, Phone , Email |

What is KCM?

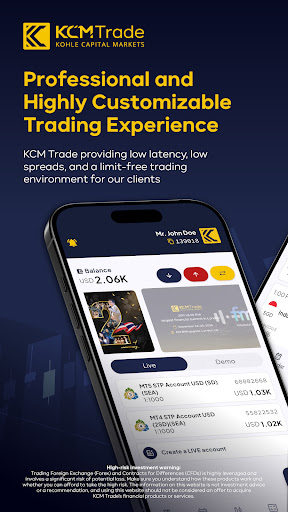

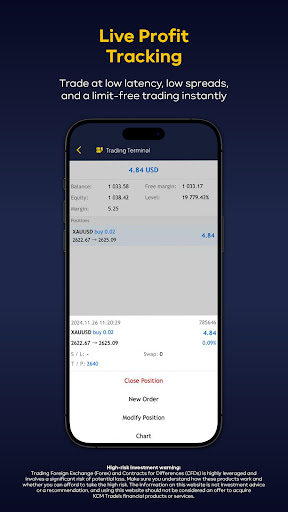

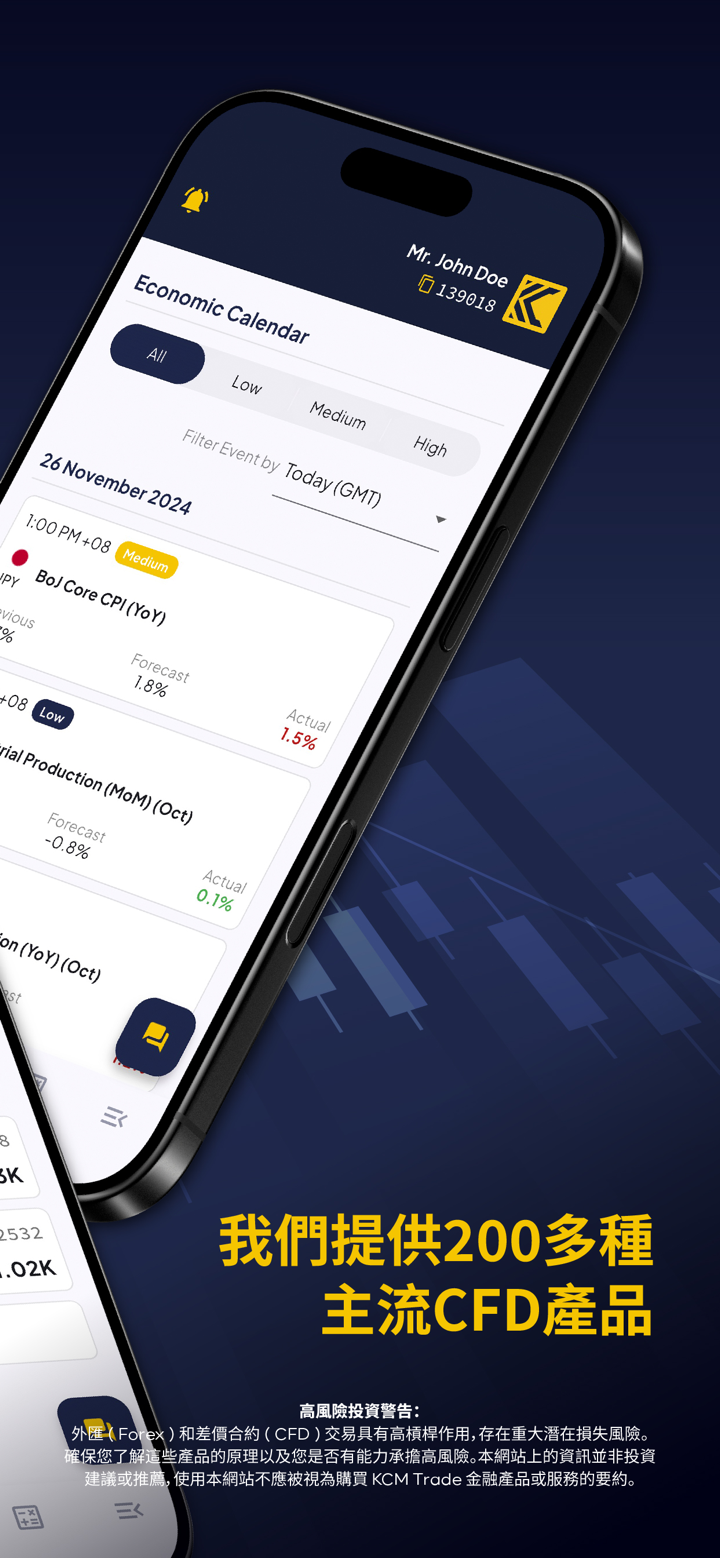

KCM Trade, a trademark of Kohle Capital Markets Limited, is a trading firm that provides online brokerage services including forex, metals, energies, indices, and Stock CFDS (Shares). The firm operates with low spreads, fast order execution, and multi-level market depth. Additionally, KCM Trade allows traders to use a variety of trading strategies, including hedging and Expert Advisors (EAs).

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

| |

|

Is KCM Trade Legit?

Based on the information available, KCM Trade appears to be a reliable and trustworthy broker. It holds Australia Securities & Investment Commission (ASIC, No. 489437) license and has received positive reviews from many customers.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

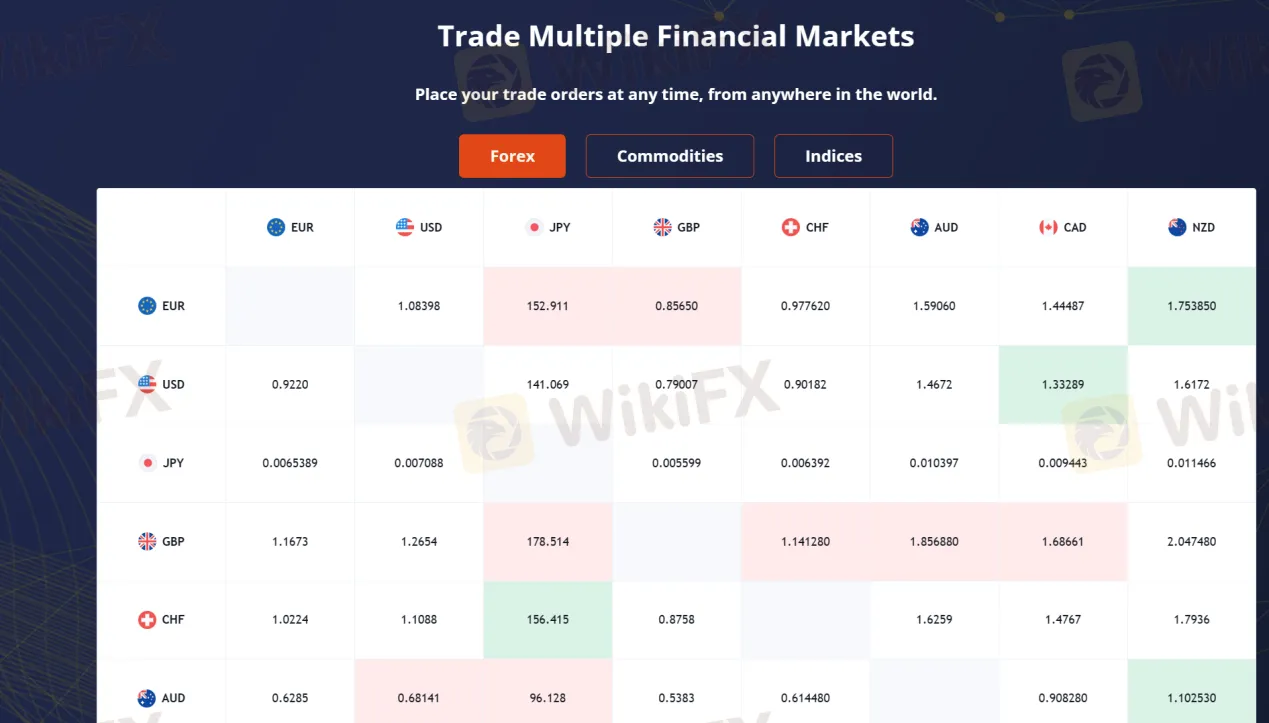

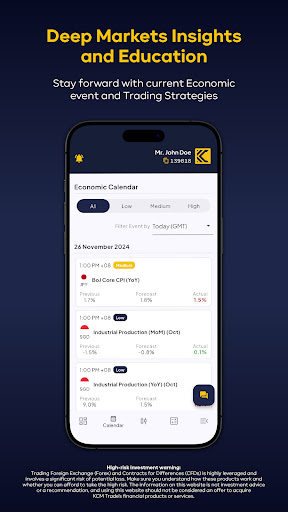

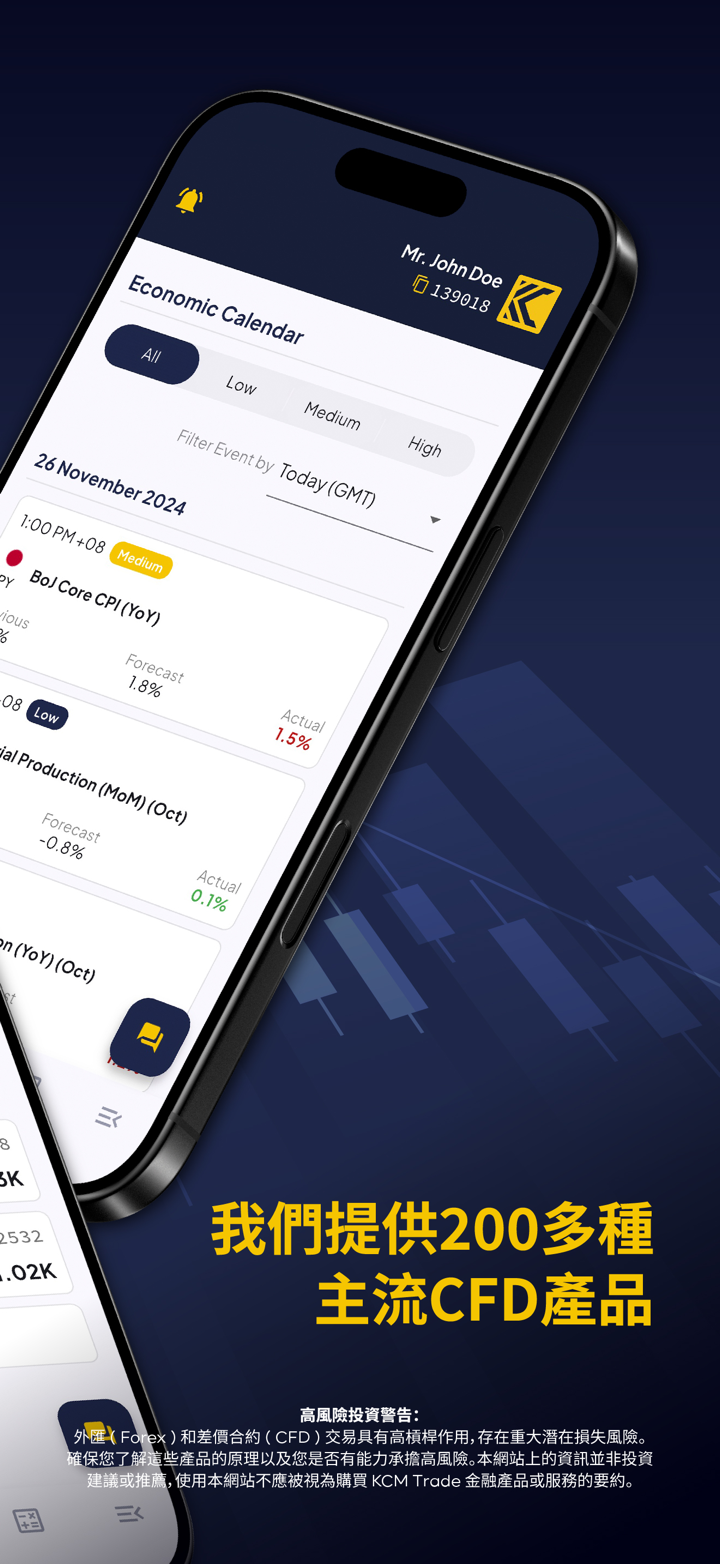

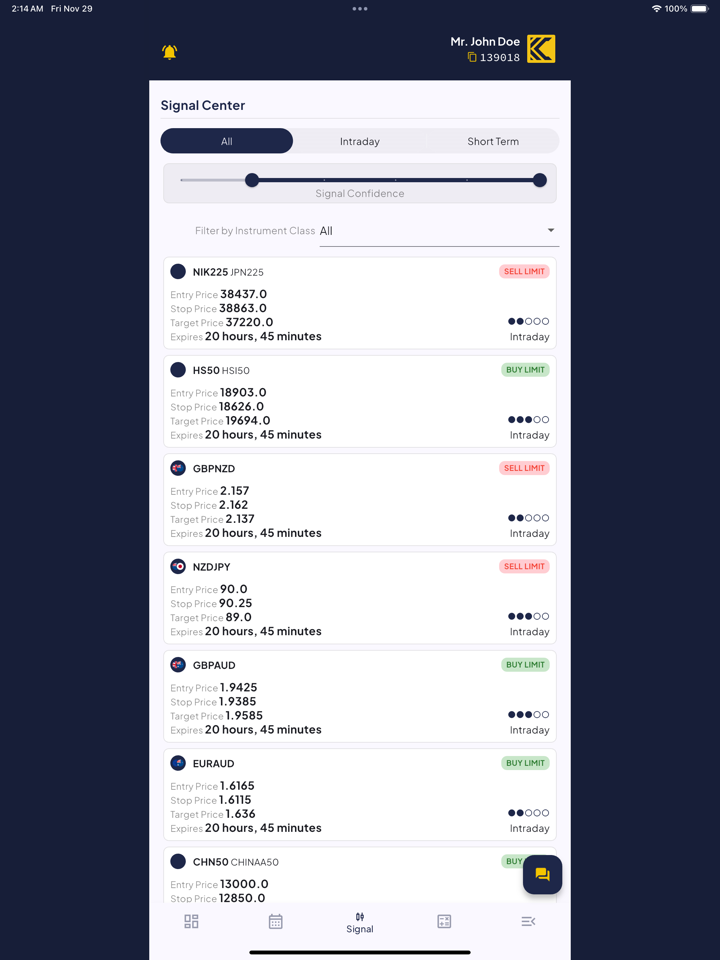

Market Instruments

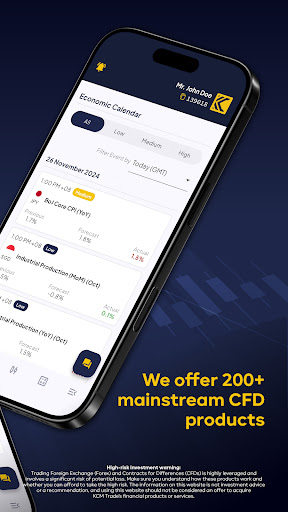

The Market Instruments of KCM Trade include Forex, Precious Metals, Energy CFDs, Indices, Stock CFDS (Shares).

For Forex, it can trade 40+ foreign exchange currency pairs on the global financial market and it supports ultra-low spreads and fast order execution.

For Precious Metals, it trades precious metals like gold and silver provides multiple trading opportunities daily. It benefits from low spreads and fast order execution.

For Energy CFDs, the high volatility of petroleum products provides a great range of price fluctuations. Register now and trade the world's lead commodities. And Trade Brent crude oil and WTI crude oil to make your trading portfolio more diversified.

For Indices, the CFD products of global stock market indices in America, Europe, and Asia. The rise or fall of an index is usually closely linked to the country's economic performance.

For Stock / Shares CFD, buy and sell, it is your choice. And investment products cover technology, energy, medical and other international companies.

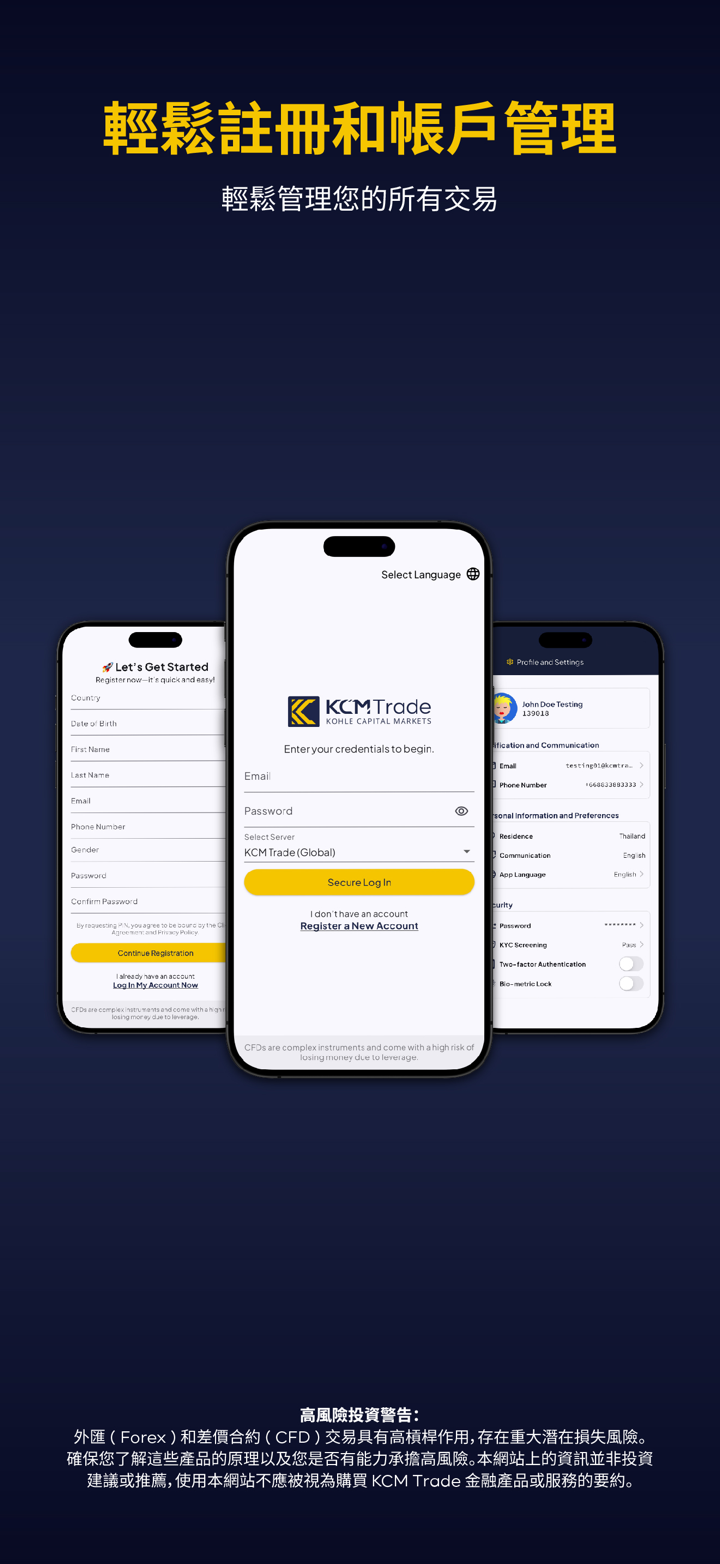

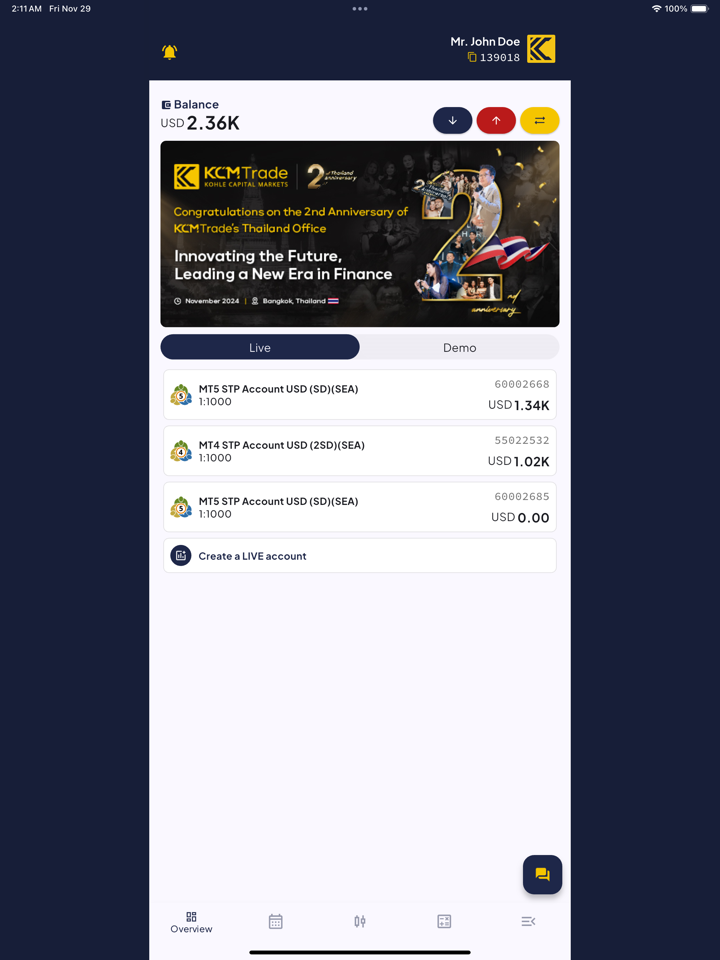

Account Types

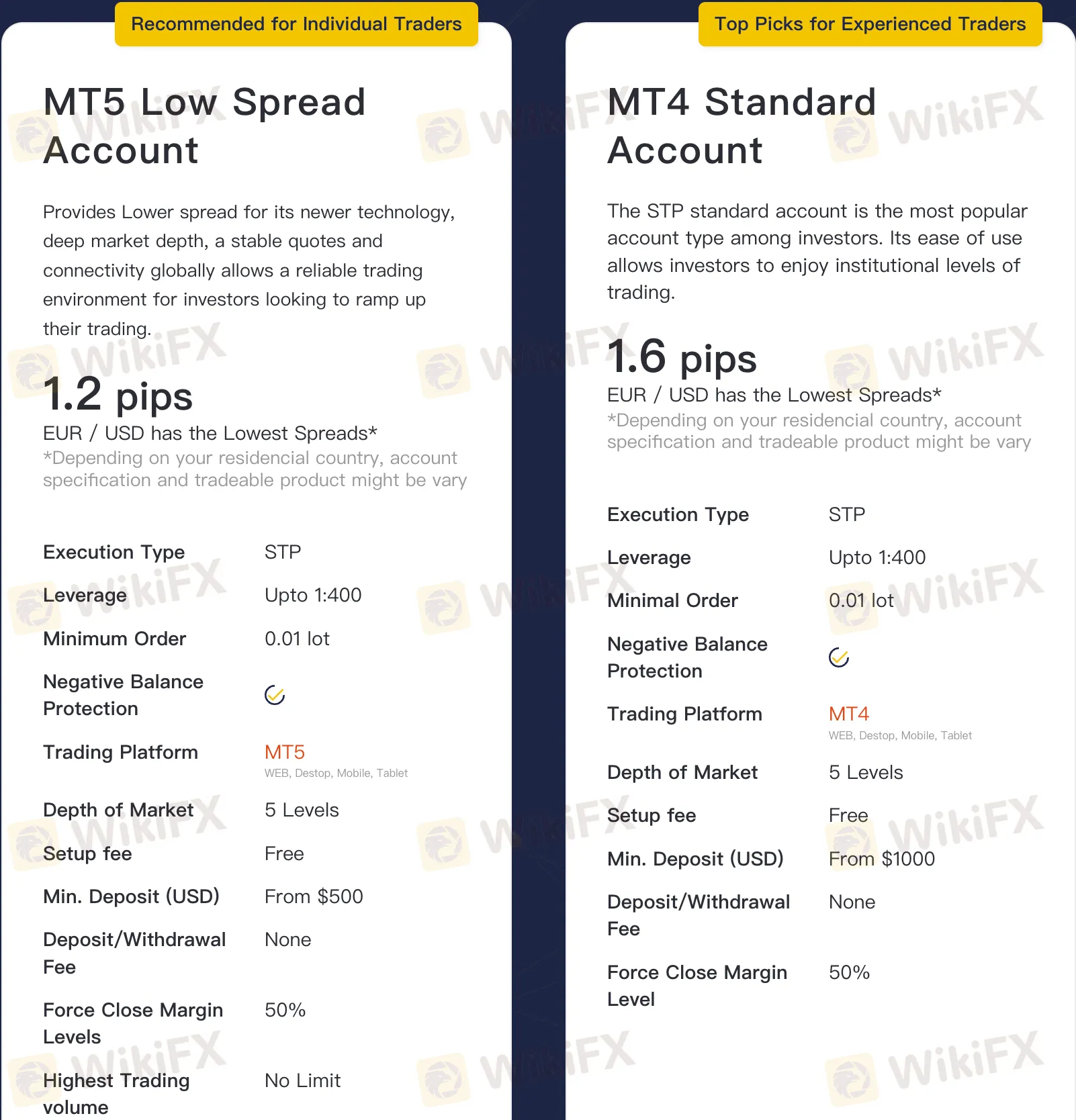

MT5 Low Spread Account (Recommended for Individual Traders)

Provides Lower spread for its newer technology, deep market depth, a stable quotes and connectivity globally allows a reliable trading environment for investors looking to ramp up their trading.

| Trading Features | Details |

| EUR / USD has the Lowest Spreads | 1.2 pips |

| Execution Type | STP |

| Leverage | Up to 1:400 |

| Minimum Order | 0.01 lot |

| Negative Balance Protection | Yes |

| Trading Platform | MT5 |

| Available Platforms | Web, Desktop, Mobile, Tablet |

| Depth of Market | 5 Levels |

| Setup Fee | Free |

| Minimum Deposit | $500 |

| Deposit/Withdrawal Fee | None |

| Force Close Margin Levels | 50% |

MT4 Standard Account (Top Picks for Individual Traders)

The MT4 standard account is the most popular account type among investors. Its ease of use allows investors to enjoy institutional levels of trading.

| Trading Features | Details |

| EUR / USD has the Lowest Spreads | 1.6 pips |

| Execution Type | STP |

| Leverage | Up to 1:400 |

| Minimal Order | 0.01 lot |

| Negative Balance Protection | Yes |

| Trading Platform | MT4 |

| Available Platforms | Web, Desktop, Mobile, Tablet |

| Depth of Market | 5 Levels |

| Setup Fee | Free |

| Minimum Deposit | $1,000 |

| Deposit/Withdrawal Fee | None |

| Force Close Margin Level | 50% |

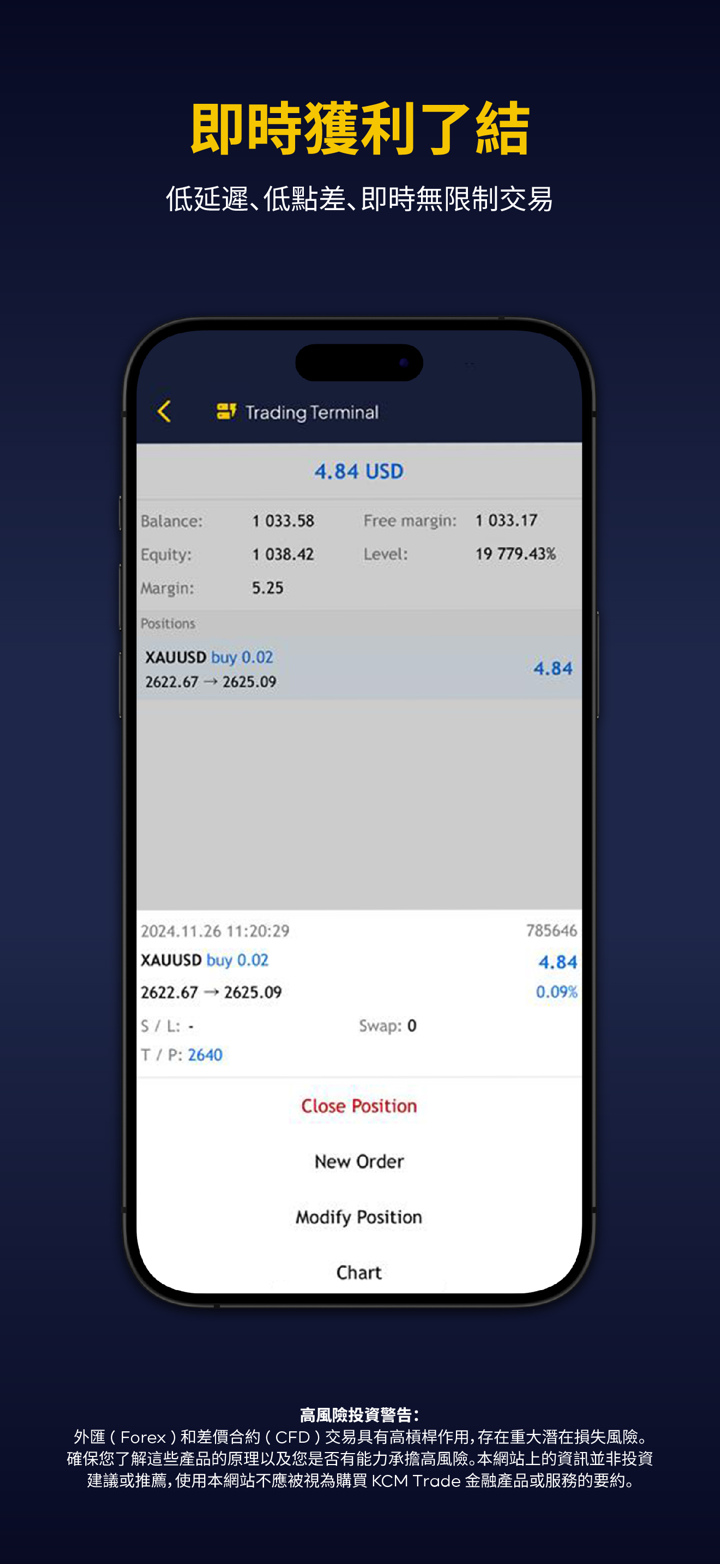

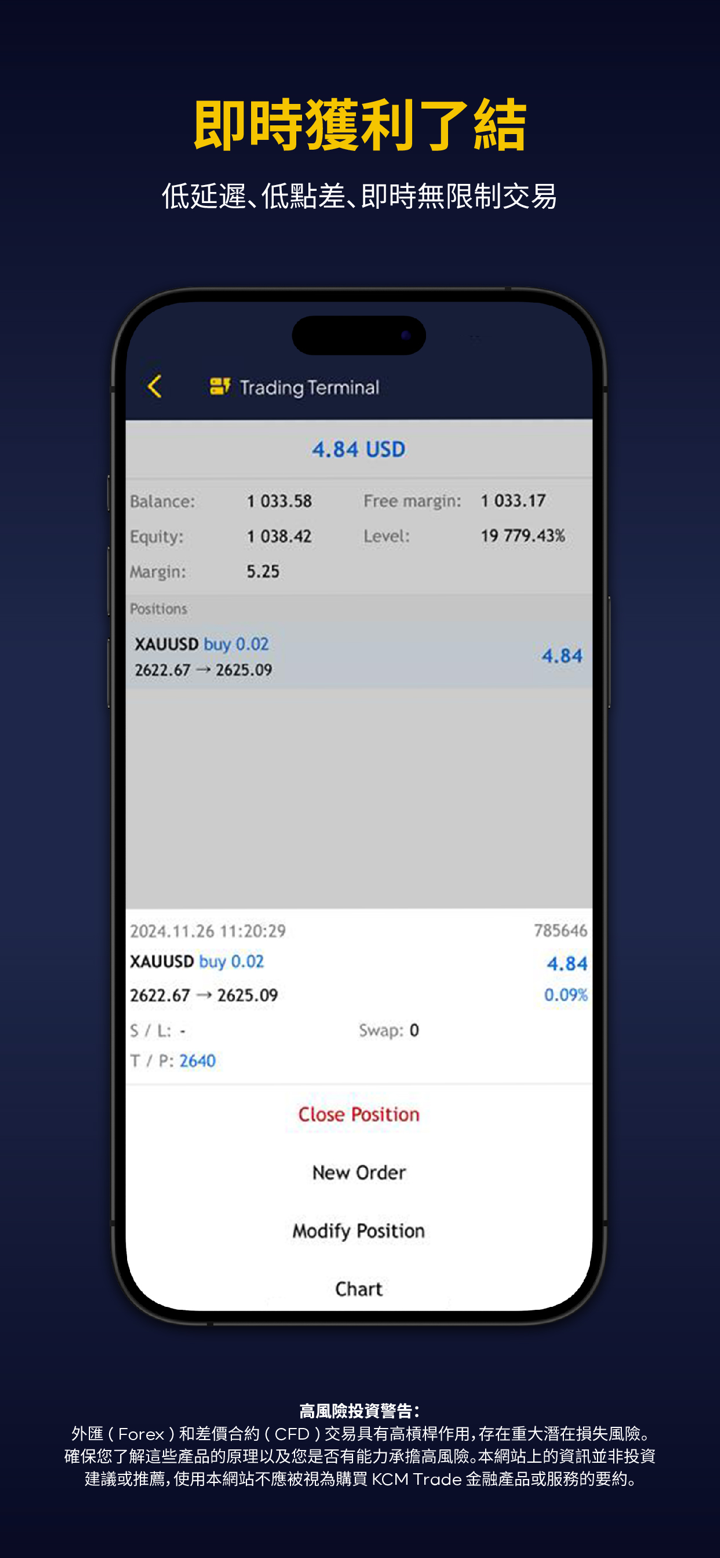

Leverage

KCM Trade offers leverage of up to 1:400, which is a relatively high leverage level in the forex trading industry. Leverage is a feature that allows traders to control positions that are larger than their account balance, enabling them to potentially magnify gains with a smaller initial investment.

While higher leverage can be desirable for some traders, it is important to keep in mind that it also means increased risk. Higher leverage magnifies potential losses as well, and traders can quickly lose more than their initial investment if they are not careful with risk management. The use of leverage requires a good understanding of the market and trading strategies to avoid significant losses, especially in volatile market conditions.

Spreads & Commissions

KCM Trade offers two types of trading accounts, MT5 Low spread Account and MT4 Standard Account.

The MT5 Low Spread Account boasts spreads 1.2 pips on the EUR/USD. Besides, the MT4 Standard Account offers spreads on the EUR/USD, starting from 1.6 pips.

In terms of commissions, KCM Trade does not provide detailed information on this front. It is possible that the company charges commissions on certain types of trading accounts or for certain assets, so traders should be sure to confirm any potential fees with KCM Trade.

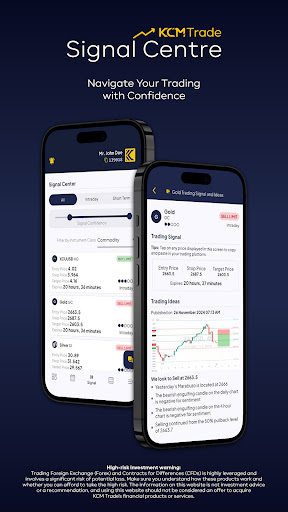

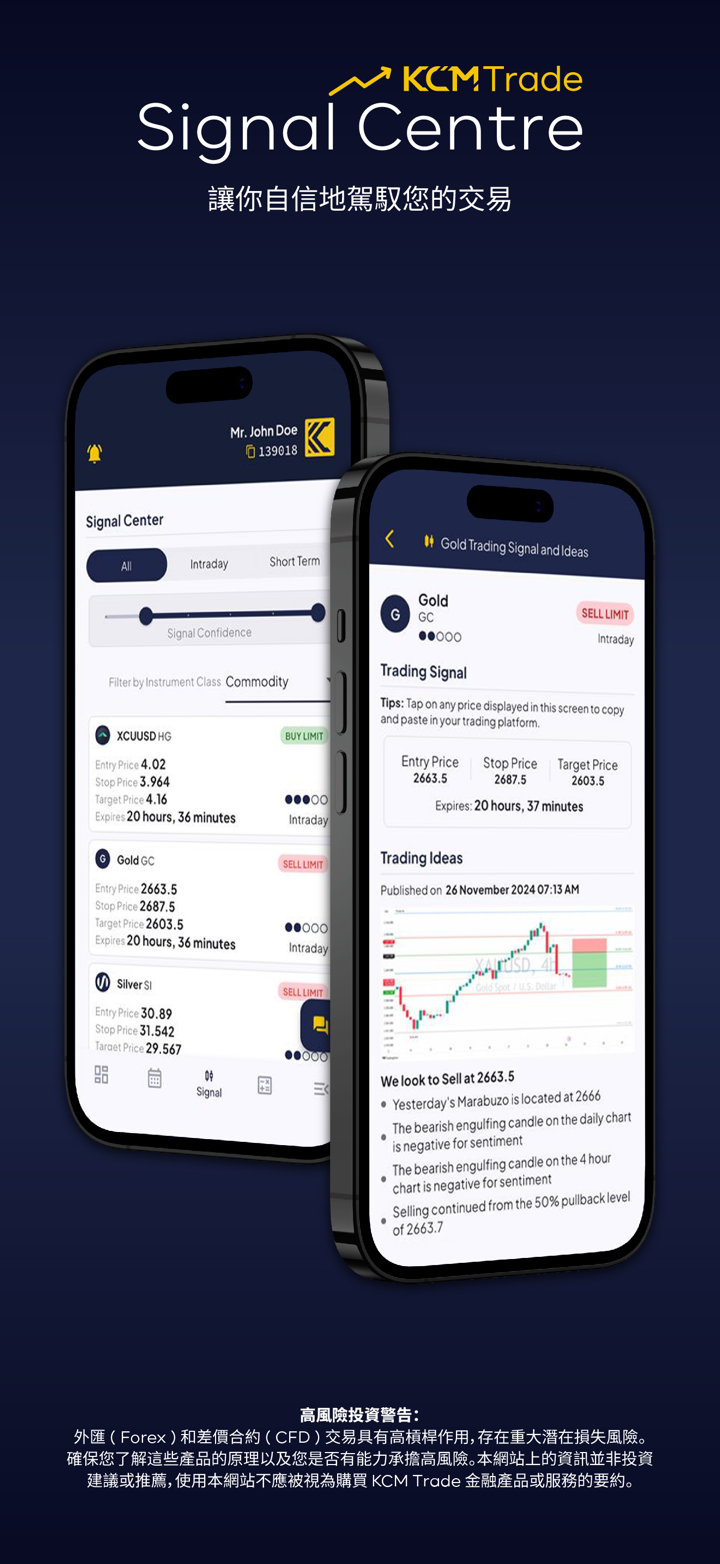

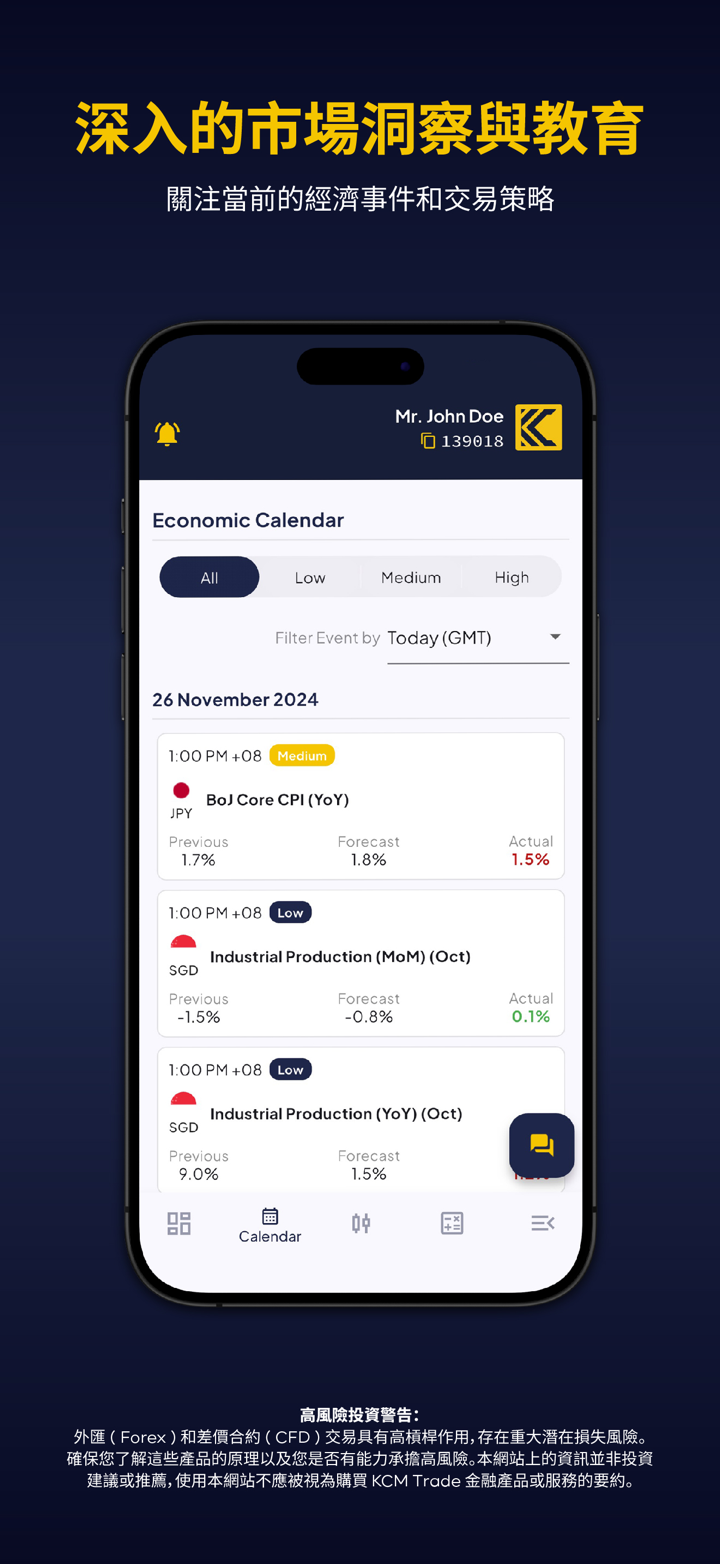

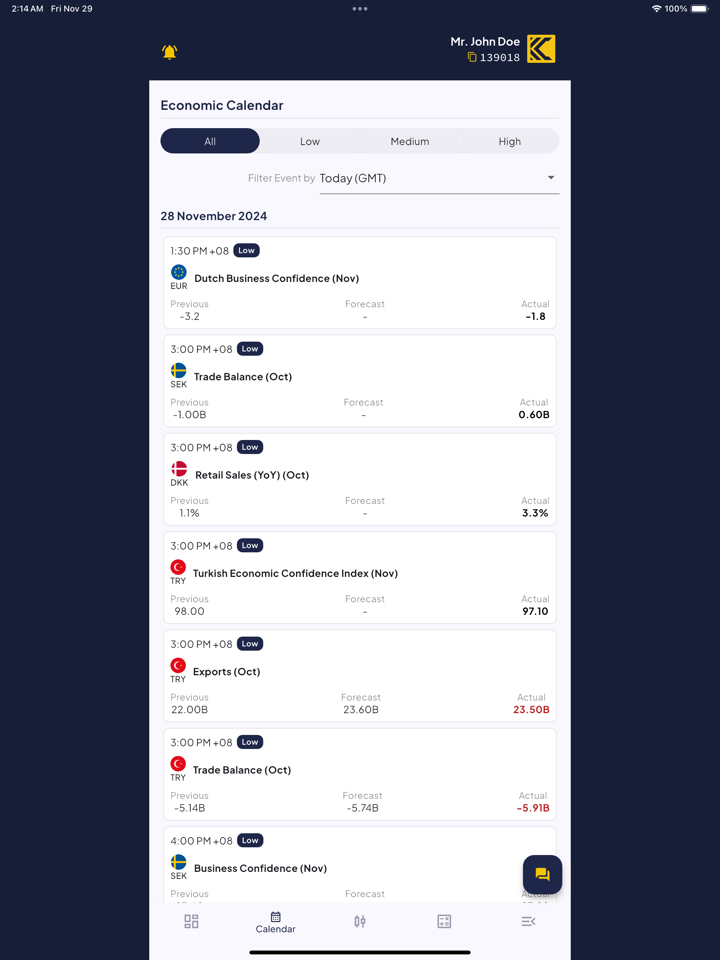

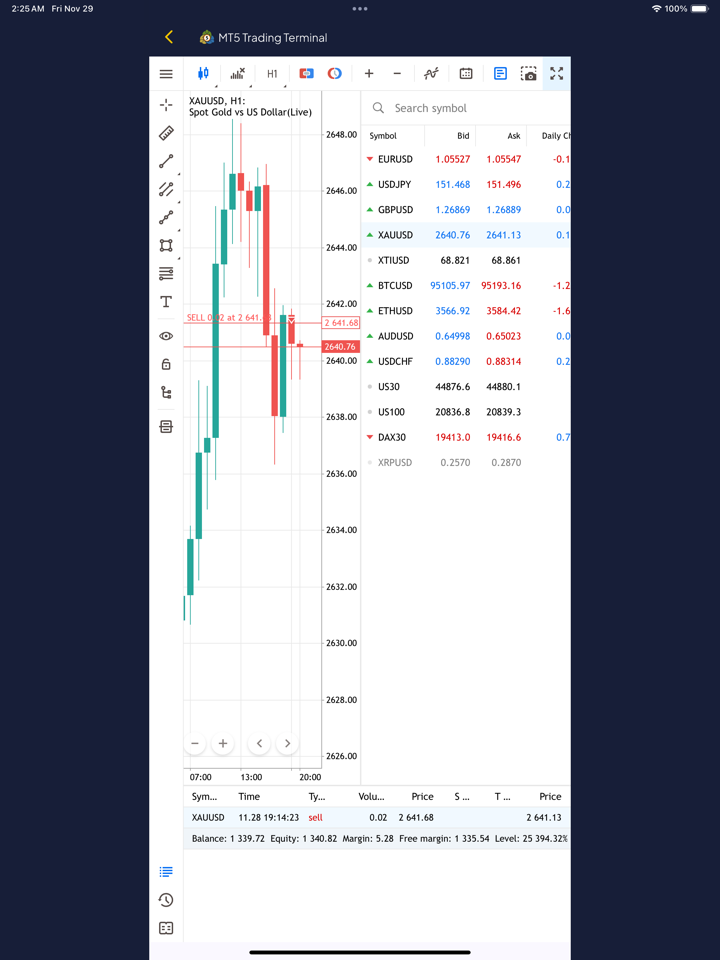

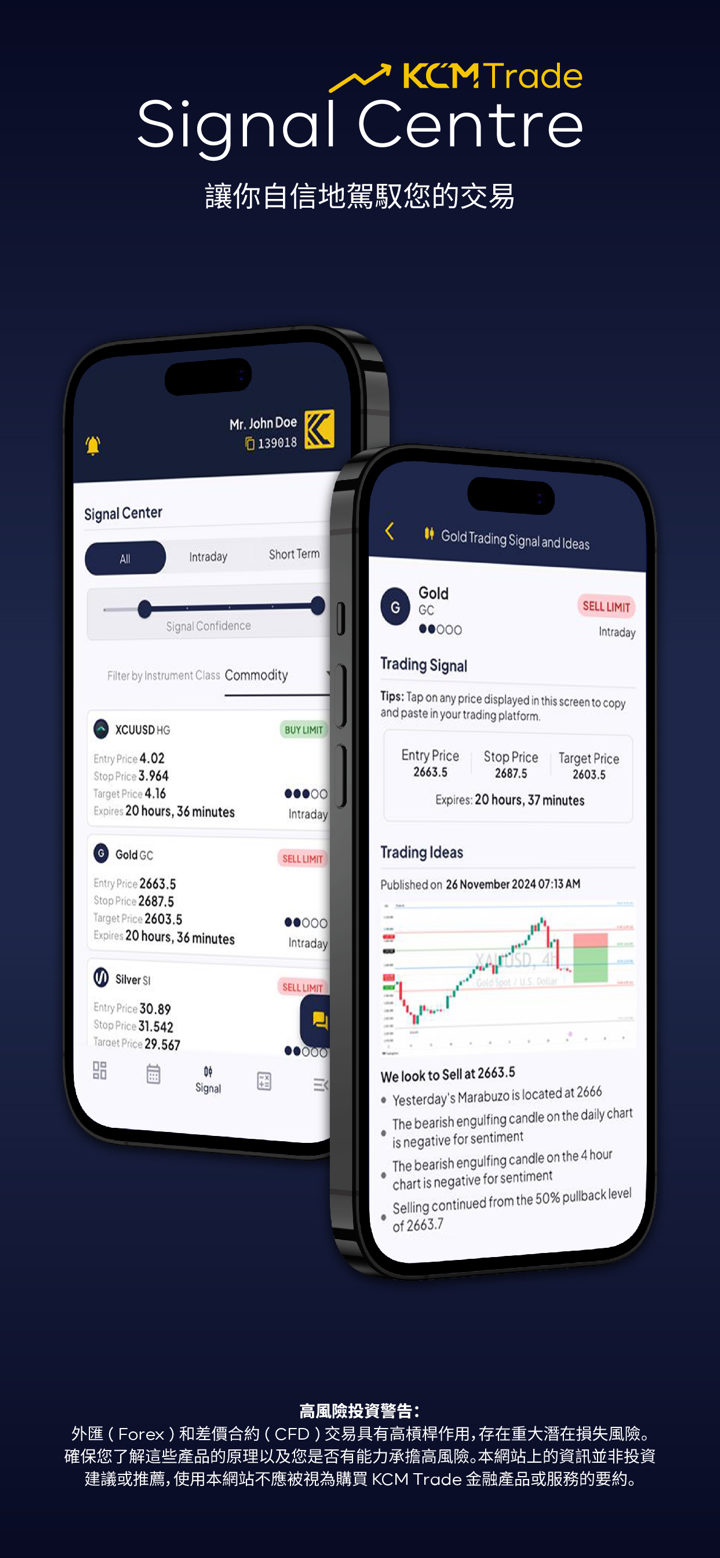

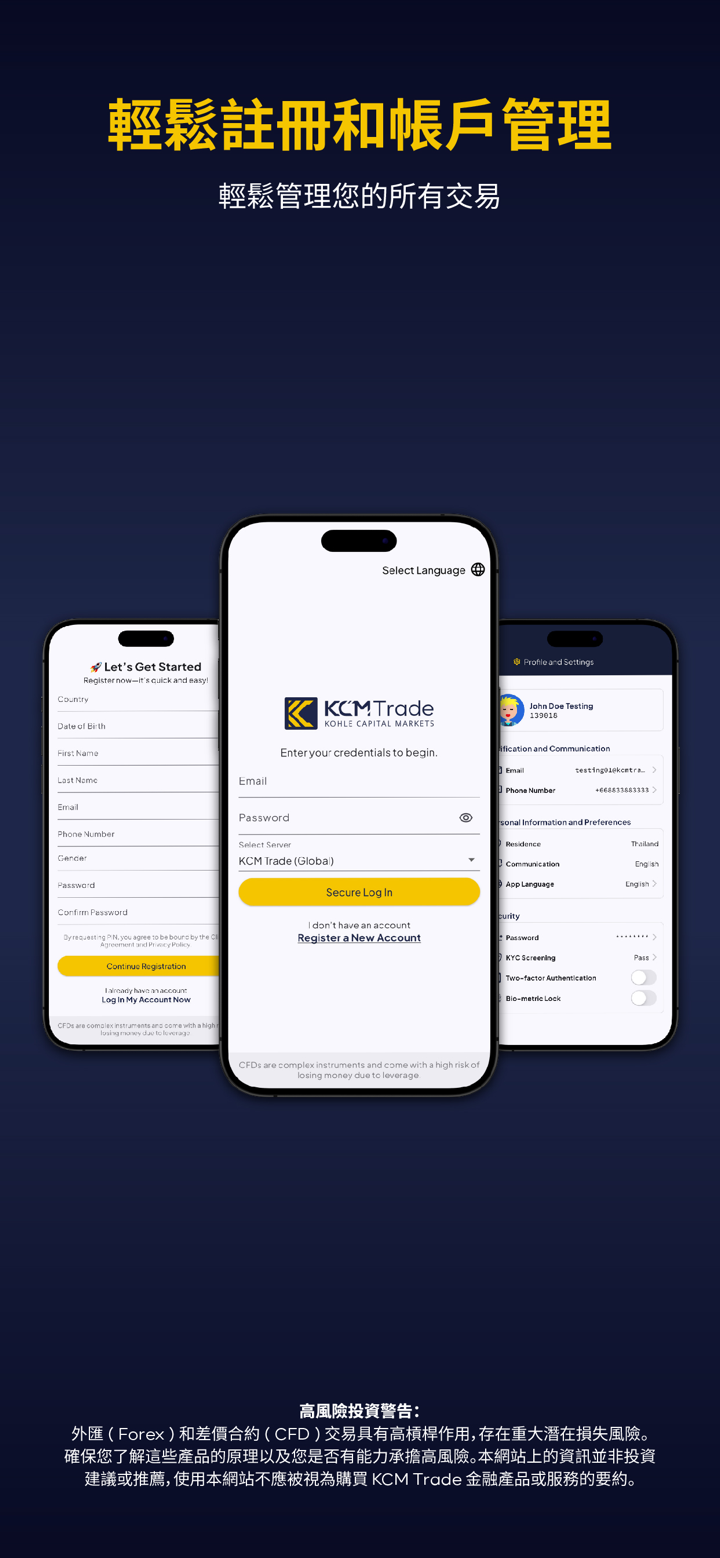

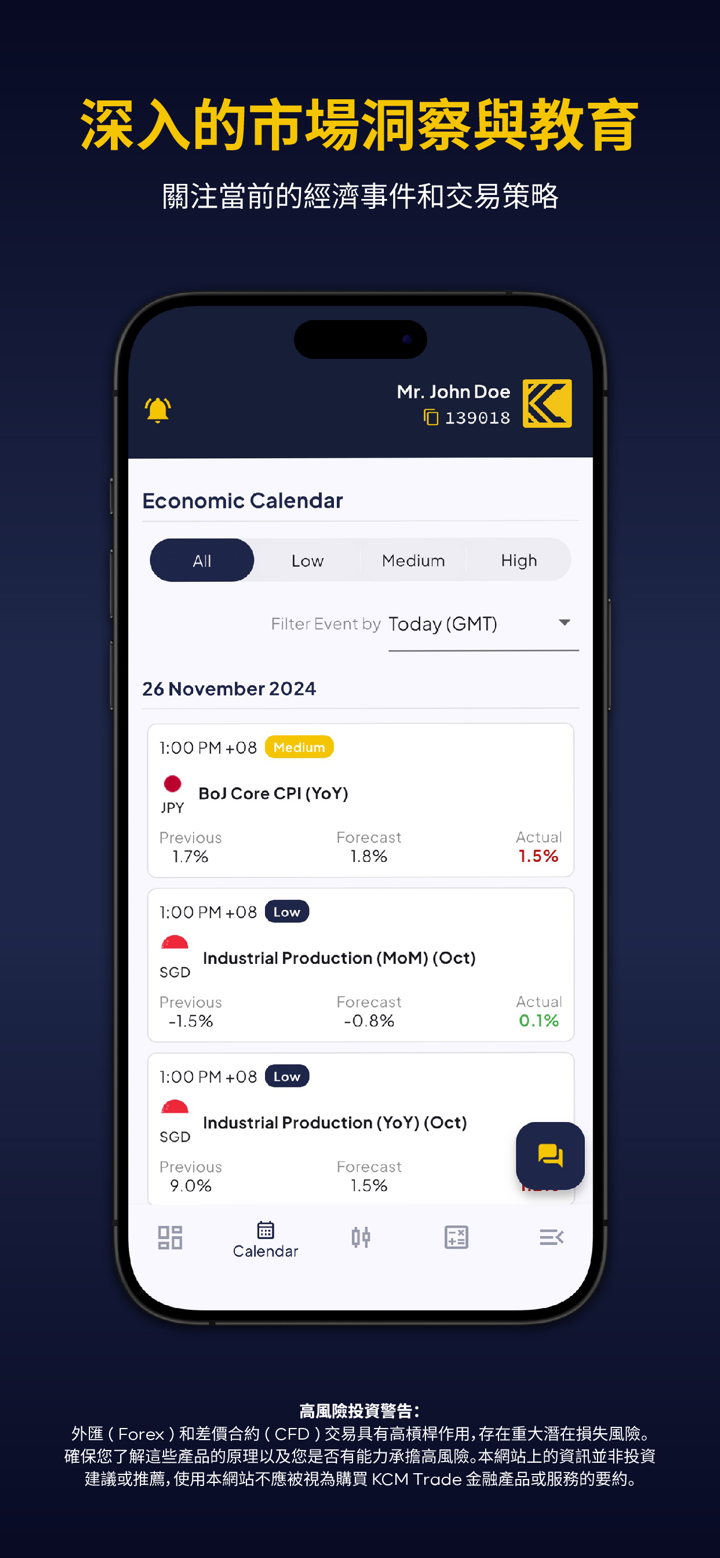

Trading Platforms

KCM Trade offers both MT4 and MT5.

MT4

You can register through WEB, desktop, mobile and tablet.

MT4 (MetaTrader 4) is a popular electronic trading platform that is widely used by forex traders around the world. It was developed by MetaQuotes Software and has been in existence since 2005. MT4 provides traders with access to a range of critical features, including real-time market data, advanced charting tools, and the ability to execute trades in real-time. MT4 also offers algorithmic trading through custom indicators and expert advisors.

MT5

You can register through WEB, desktop, mobile and tablet.

MT5 (MetaTrader 5) is a forex and CFD trading platform developed by MetaQuotes Software, following the success of its predecessor, MT4. Its release in 2010 was intended to improve upon the trading experience offered by MT4 and provide additional features and greater flexibility.

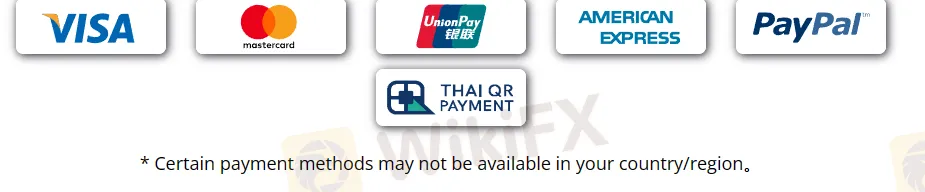

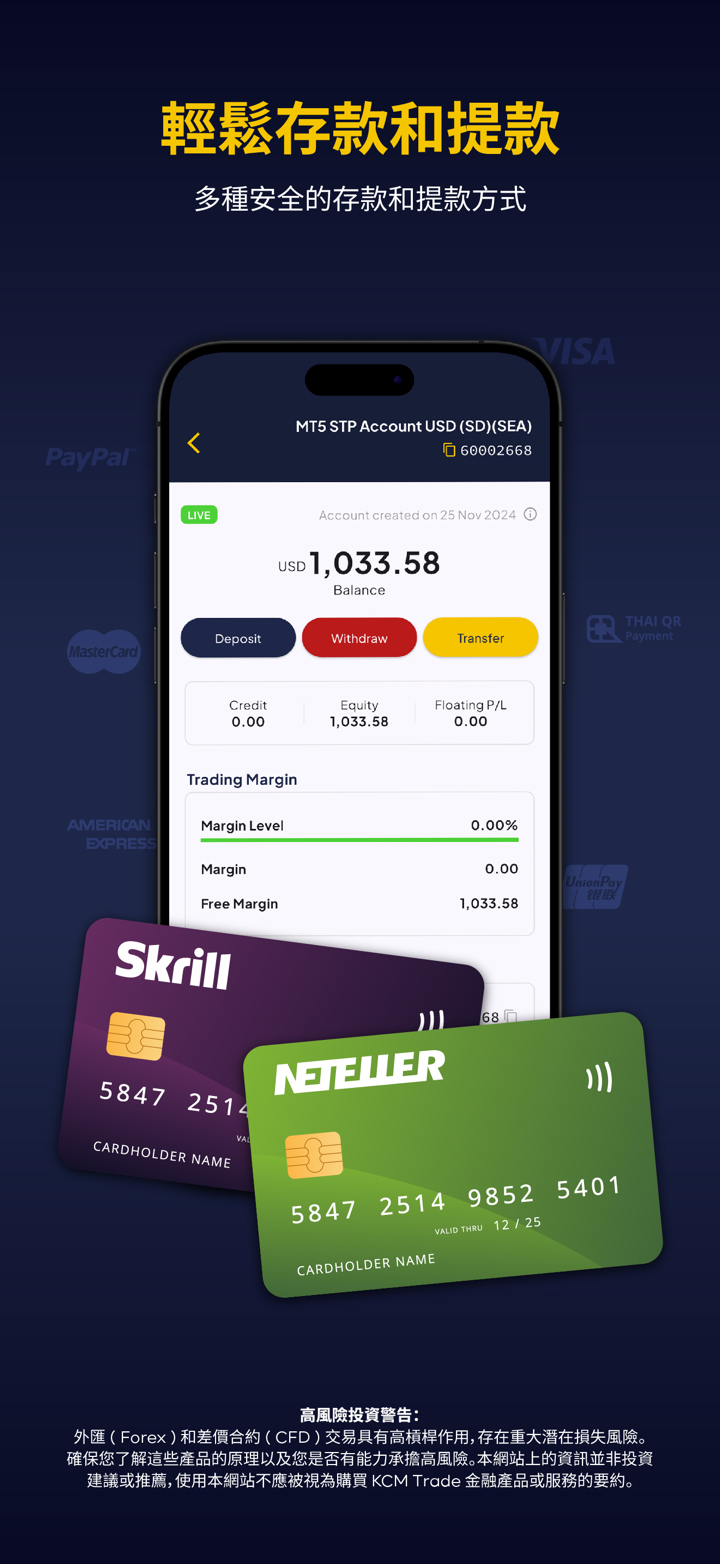

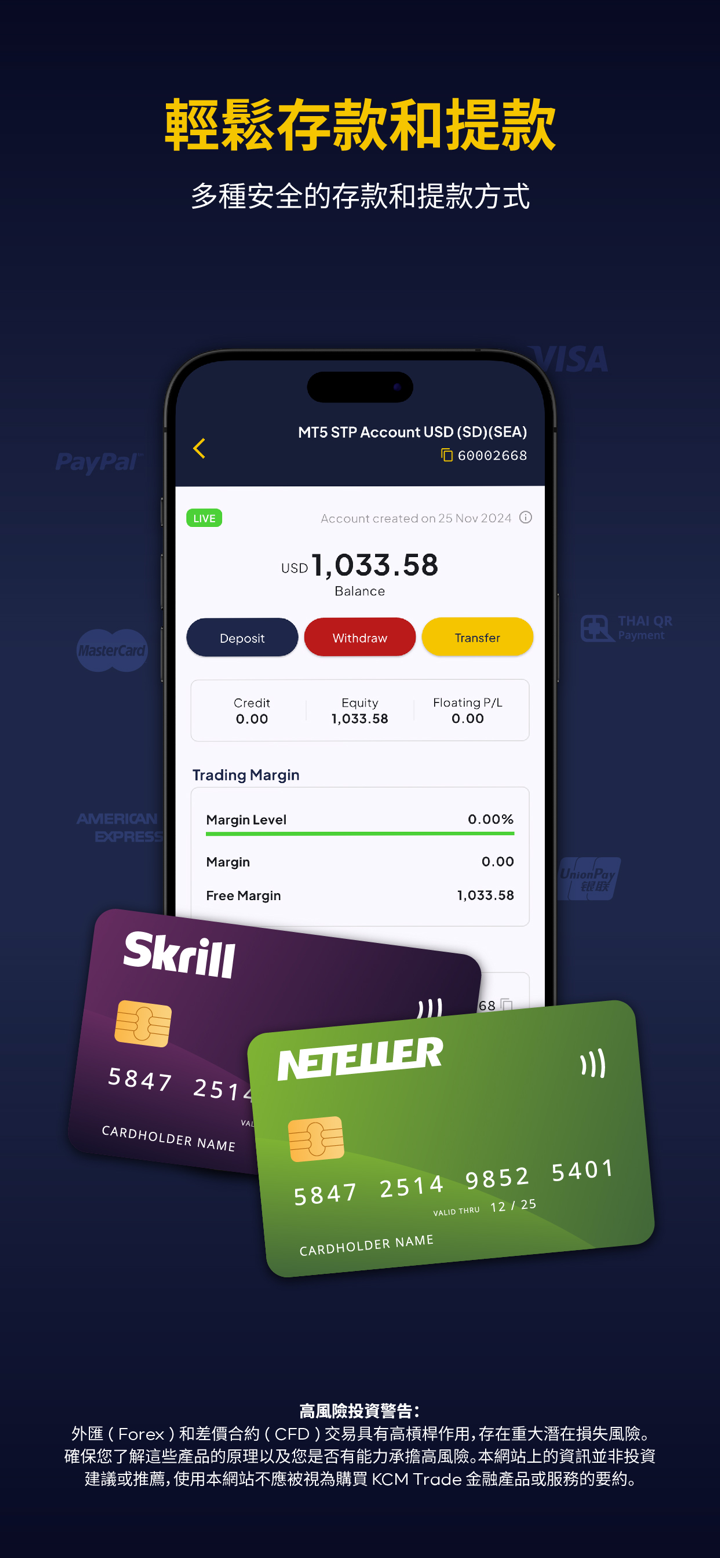

Deposits & Withdrawals

KCM Trade accepts deposits via multiple payment methods including VISA, Mastercard, UnionPay, AMERICAN EXPRESS, PayPal and THAI QR PAYMENT.

The minimum deposit requirement depends on the payment method chosen, with bank wire transfers requiring a minimum deposit of $500, while credit/debit card and e-wallet deposits have a minimum requirement of $250. Additionally, there may be deposit fees charged by the payment provider.

Processing times for deposits and withdrawals at KCM Trade vary depending on the payment method used. Bank wire transfers can take up to 7 business days for processing, while credit/debit card and e-wallet withdrawals are typically completed within 1 to 3 business days.

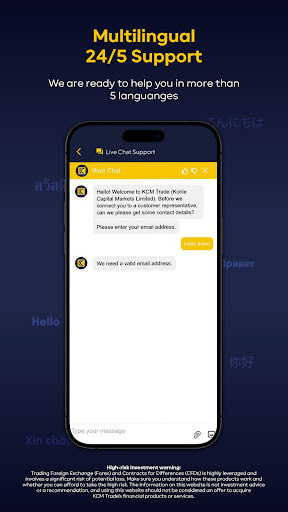

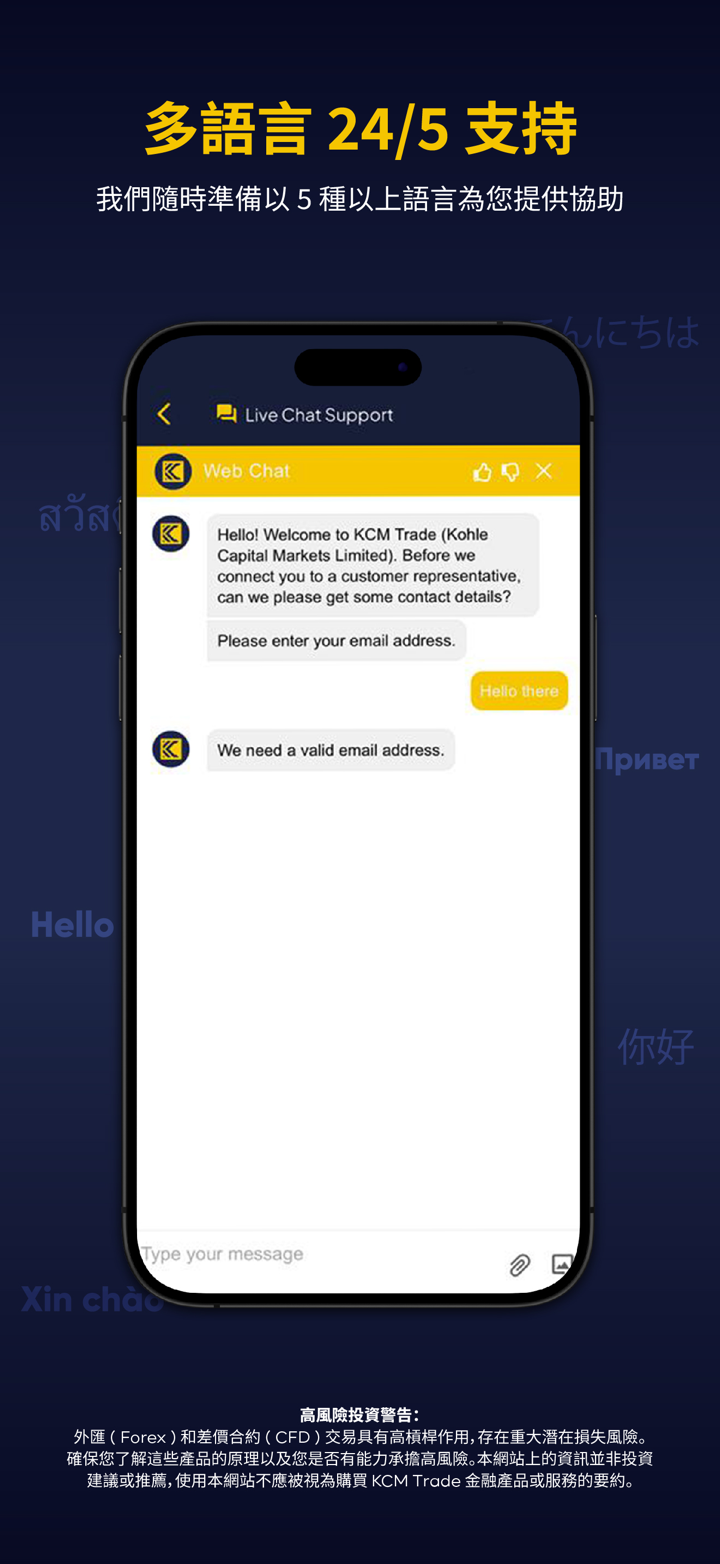

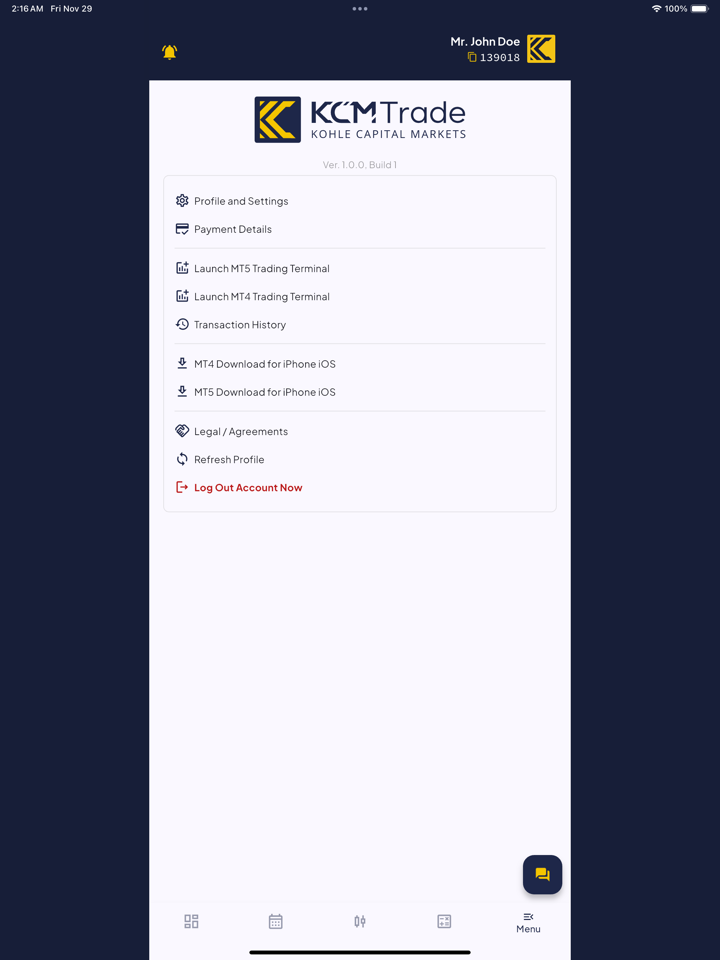

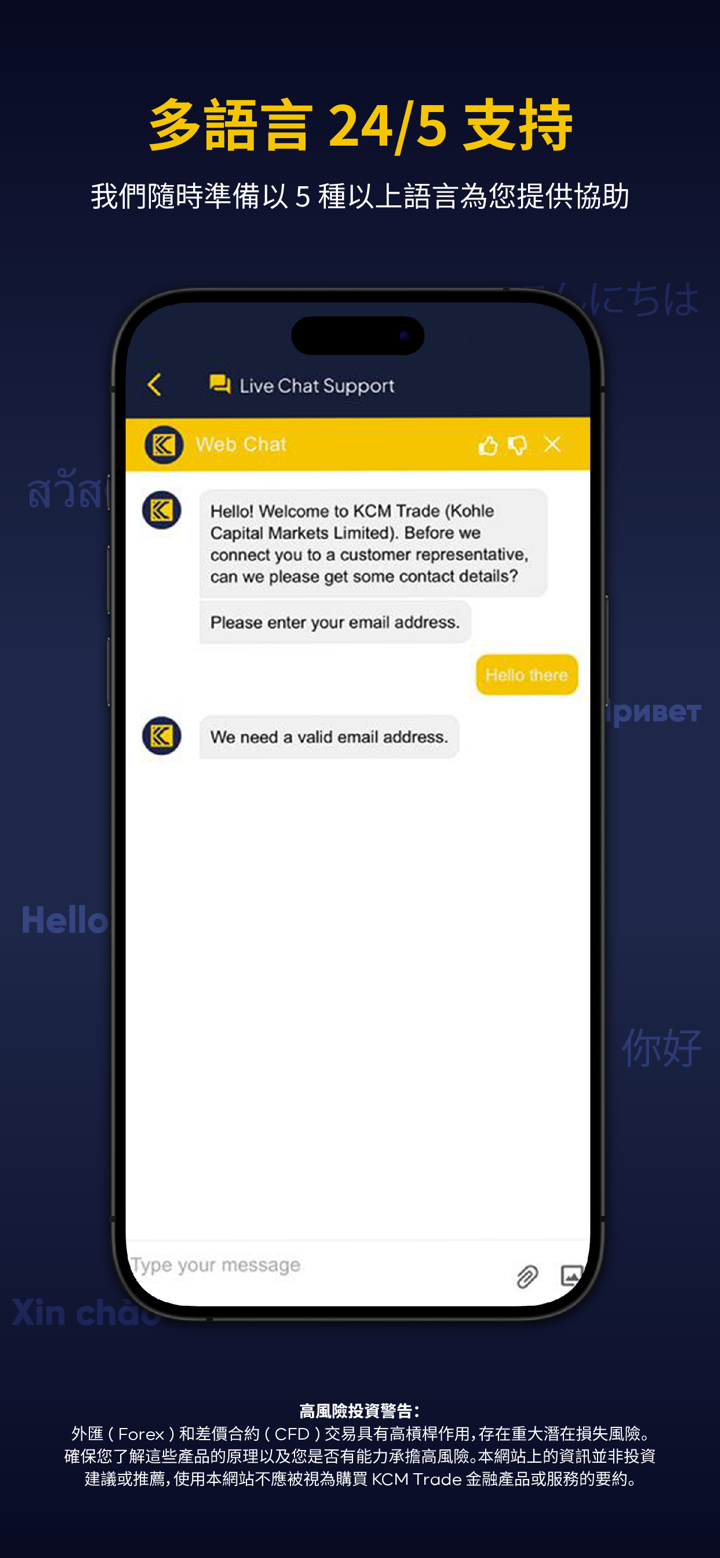

Customer Service

KCM Trade accepts many customer services such as live chat, WhatsApp, phone(+230 5297 0961), email (CS@kcmtrade.com ), and social media such as Facebook, YouTube and LinkedIn.

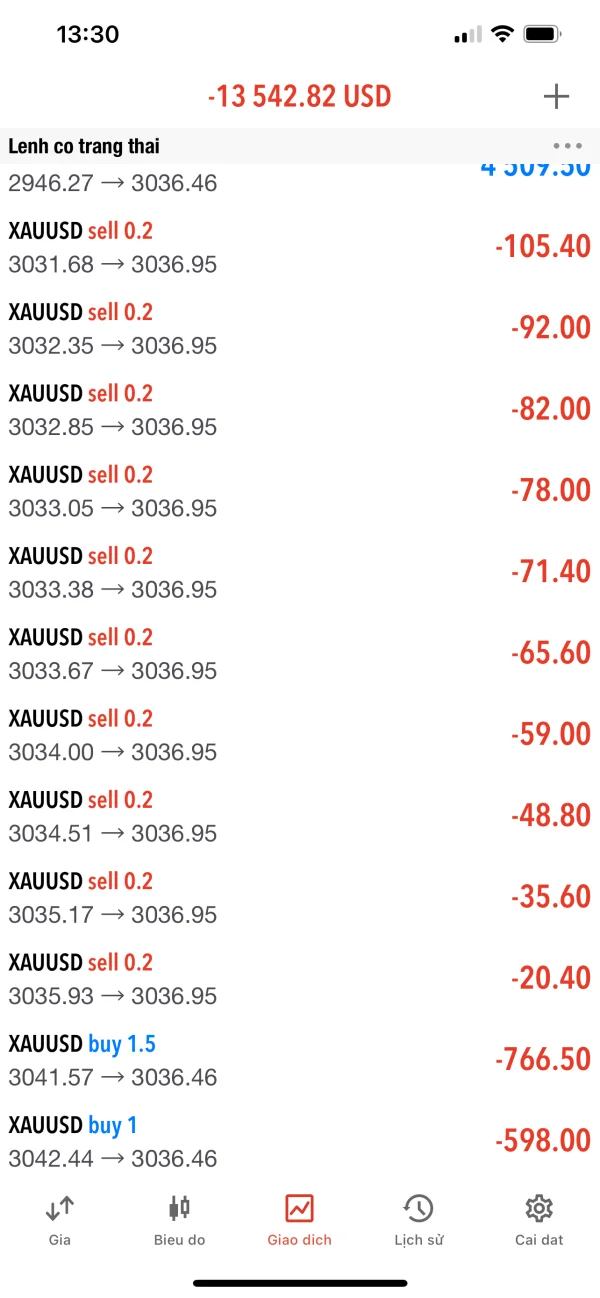

FX3337314102

Singapore

Everyone, steer clear of this platform. Even though I changed my password, their staff still intervened in my account, leading to a crash. Today, as the gold prices surged like a storm, they kept selling gold, causing my account to burn out.

Exposure

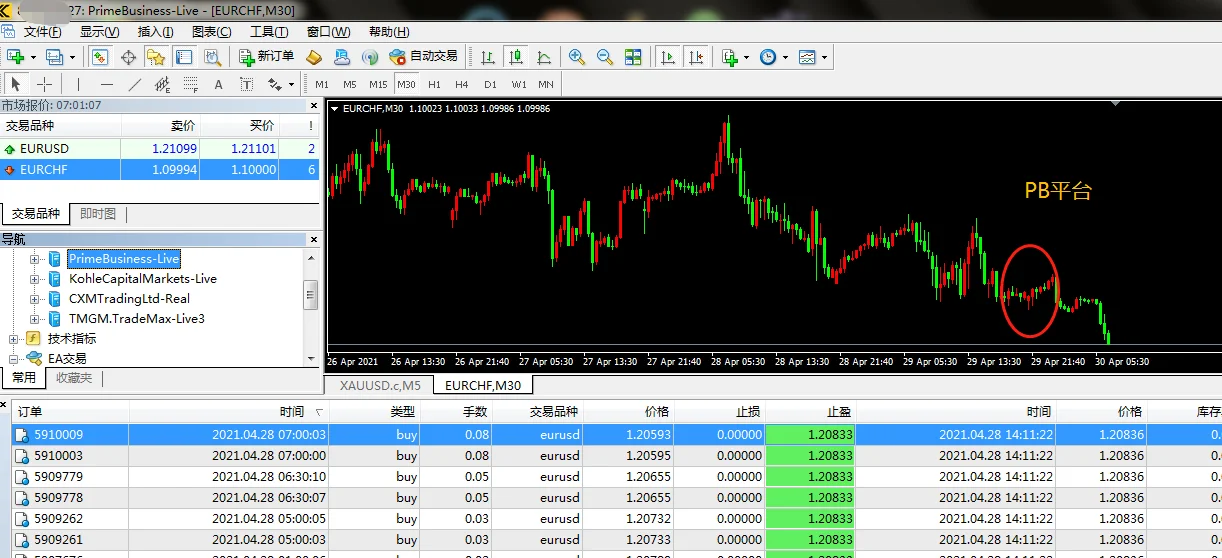

泄露电话告你侵犯隐S

Japan

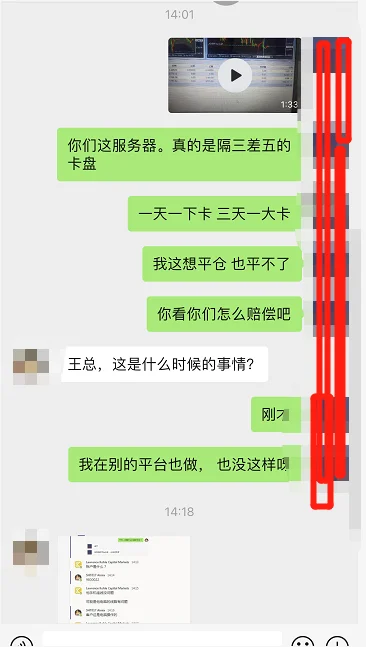

The KCM server really lags. It is also doing it on other platforms, and it chucks without moving, unable to close the position and open the position. After contacting the sales, the platform obviously shirked its responsibilities. I am not sure if there is any problem with the network. My other platform accounts are normal. Originally, the position was closed with a floating loss of 568, but now gold has risen (Orui fell), and the floating loss is nearly 800, which is a loss of 200 US dollars. [d83d][de21]I can’t put on the video here, otherwise everyone can take a look at what it means: You can’t close a position, you can’t open a position, and you can’t watch a loss [d83d][de21]

Exposure

peayuth

Thailand

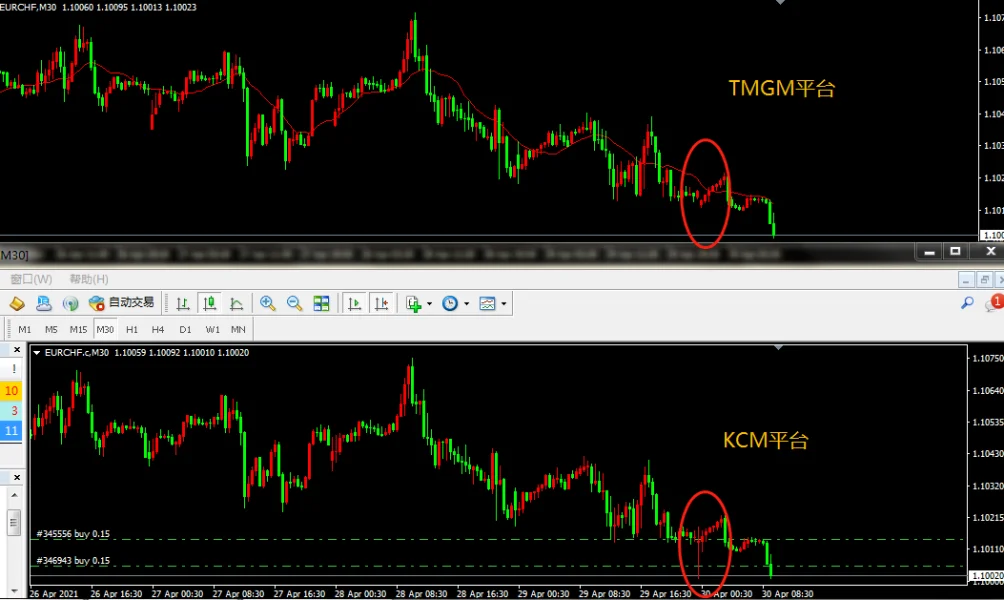

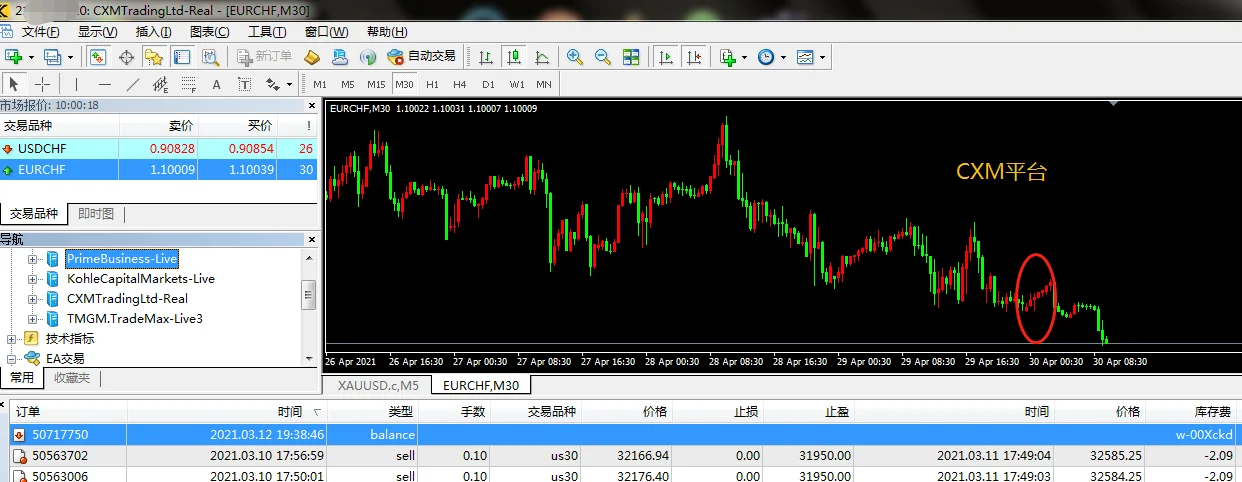

The charts on this platform were different from others.

Exposure

lucy6820

South Korea

Dear 44018931 user, according to the international tax law, 27% of your personal income tax will be charged for personal profits exceeding USD 10,000. Your personal profit in the account is USD 27,935.1, and the personal income tax you need to pay is USD 7,542.4. The financial department notifies you: Your account44018931 has not yet paid personal income tax, and you need to pay personal income tax successfully before you can handle withdrawals! Now our financial department will register and report for you. Please complete your personal tax payment within 7 working days, that is, before 24:00 on August 4, 2023! Overdue will charge three percent of your account profit per 24 hours, i.e. $838, as a fund custody fee! Please complete it as soon as possible so as not to cause inconvenience to you in handling payment!

Exposure