Company Summary

| Brilliant Global Review Summary | |

| Founded | 2015 |

| Registered Country/Region | China |

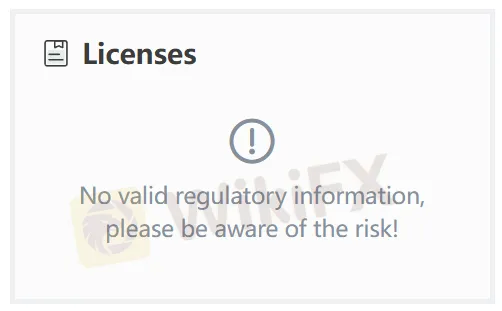

| Regulation | No Regulation |

| Market Instruments | Metals (Gold & SIlver) |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | Live chat, QQ |

Brilliant Global Information

Brilliant Global is a trading platform founded in 2015, registered in China. It specializes in trading metals, specifically gold and silver. The platform offers a demo account for practice trading and operates on the MT5 trading platform. This platform is currently operating without regulation.

Pros and Cons

| Pros | Cons |

| MT5 supported | No regulation |

| Demo accounts available | Limited choice of market instruments |

| Live chat support | Withdrawal fees charged |

Is Brilliant Global Legit?

No. Being an unregulated trading platform, Brilliant Global can not provide the security of your investment.

What Can I Trade on Brilliant Global?

Brilliant Global is primarily offering trading in metals, gold and silver, in particular.

| Trading Asset | Available |

| metals | ✔ |

| forex | ❌ |

| commodities | ❌ |

| indices | ❌ |

| stocks | ❌ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Trading Platform

Brilliant Global claims to offer MT5 (MetaTrader 5), which is a popular multi-asset trading platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | Desktop, Mobile, Web | Beginners |

Deposit and Withdrawal

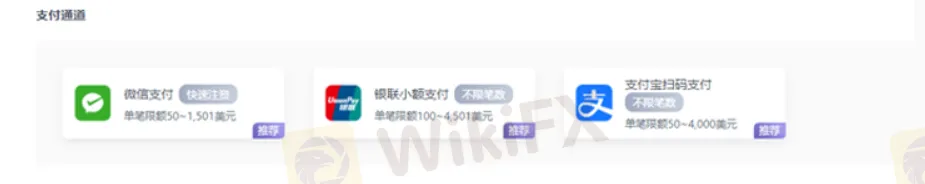

Traders are allowed to deposit through WeChat, PayPal, and AliPay and withdraw through Bank Transfer.

Withdrawal Options

| Withdrawal Options | Processing Time |

| Bank from the Chinese mainland | Within 24 hours |

| Bank outside of Chinese mainland | The next business |

Withdrawal Fees

- If you apply for a single withdrawal of US$50 or more, you can enjoy a small withdrawal fee waiver (the full amount of the remittance fee will be borne by the company). Therefore, free.

- If you apply for a single withdrawal of less than $50, the company will charge a flat withdrawal fee of $3.

- A 6% withdrawal fee will be charged on each transaction if the following two conditions are met: The number of trading lots is less than 1/2500 of the deposited amount, and no trades were opened or closed after the last deposit.