Company Summary

Note: Vantageoption's official website: http://vantageoption.com/ is currently inaccessible normally.

| Vantageoption Review Summary | |

| Founded | 2018 |

| Registered Country/Region | United Kingdom |

| Regulation | Not regulated |

| Market Instruments | Forex, indices, commodities, cryptocurrencies |

| Demo Account | ✅ |

| Leverage | / |

| Spread | From 0.0 pips |

| Trading Platform | Meta Trader 4, Meta Trader 5 |

| Min Deposit | $600 |

| Customer Support | Service time: 8:00 AM - 8:00 PM Monday - Sunday |

| Email: support@Vantageoption.com | |

| Physical Address: 67 Wellington Road North, Stockport, Cheshire, United Kingdom, SK4 2LP | |

Founded in 2018 and based in the United Kingdom, Vantageoption is a financial broker that offers four types with a minimum deposit of $600 for the most basic account. However, Vantageoption does not hold a legal regulatory license from official institutions.

Pros and Cons

| Pros | Cons |

| Multiple trading choices | No Legal regulation |

| Multiple trading accounts | Unavailable website |

| High minimum deposit | |

| Limited customer service channels |

Is Vantageoption Legit?

Vantageoption is not overseen by any major financial regulatory authority. Trading with an unregulated broker like Vantageoption may lead to risks concerning funds protection and assistance seeking, so you are advised to choose an officially regulated broker for your asset safety.

What Can I Trade on Vantageoption?

Vantageoption offers four types of market instrument: forex, indices, commodities, and cryptocurrencies. However, since it lacks legal regulation, trading these market instruments on Vantageoption poses a high risk of financial loss.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Mutual Fund | ❌ |

| Futures | ❌ |

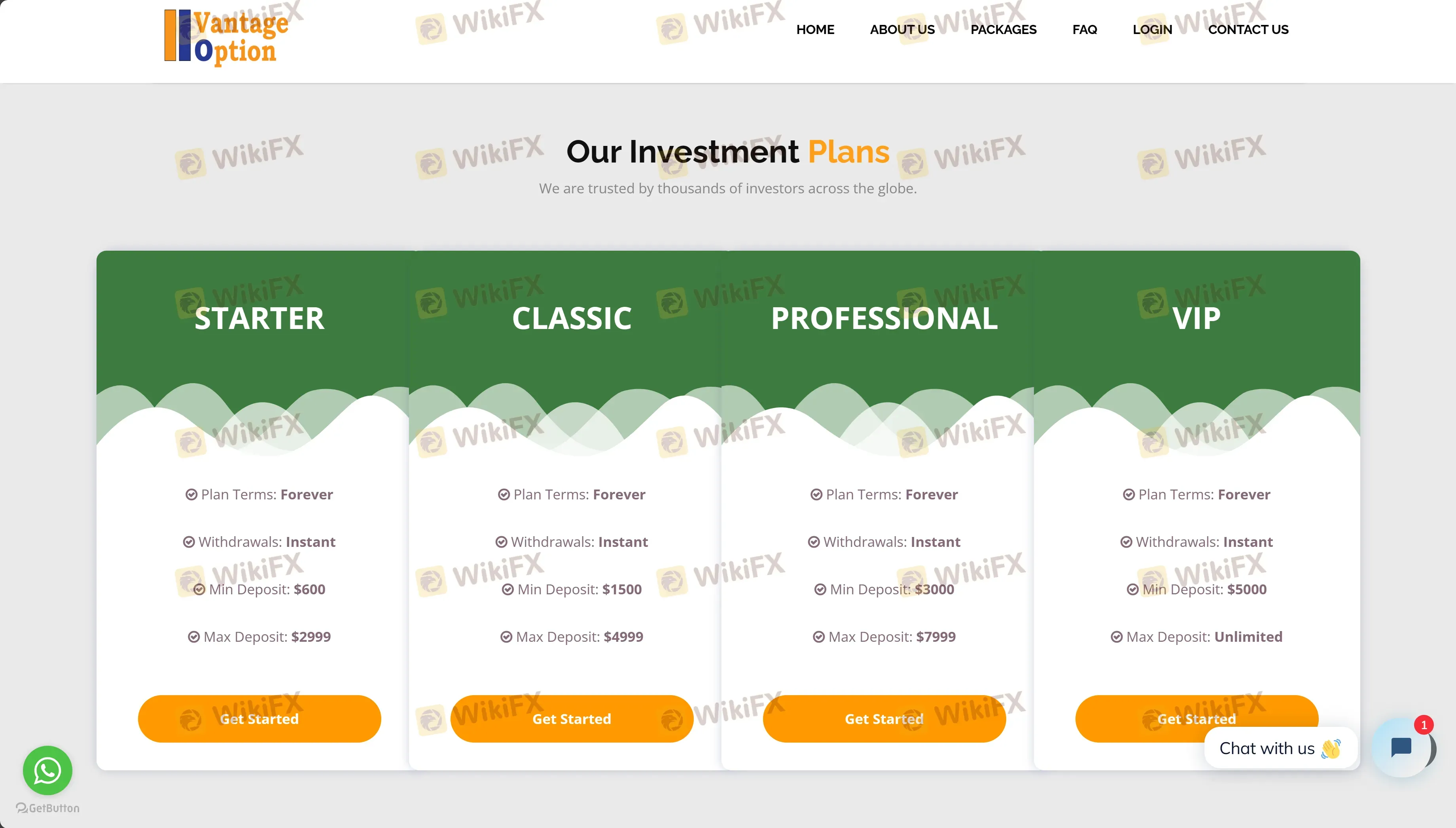

Account Type

Vantageoption offers four distinct account types, tailored to different levels of investment: the Starter, Classic, Professional, and VIP Account, with minimum deposits ranging from $600 to $5,000. The minimum deposit is quite high, so you'd better avoid depositing such a high amount into an unregulated broker.

| Account Type | Min Deposit |

| Starter | $600 |

| Classic | $1,500 |

| Professional | $3,000 |

| VIP | $5,000 |

Trading Platform

Vantageoption provides its traders with access to two of the most popular and widely used trading platforms in the industry: Meta Trader 4 (MT4) and Meta Trader 5 (MT5).

Meta Trader 4 (MT4): MT4 is renowned for its user-friendly interface, making it suitable for both beginners and experienced traders. It offers a range of features including advanced charting tools, a large library of technical indicators, and automated trading capabilities through Expert Advisors (EAs). MT4's robustness and customization options make it a favorite among Forex traders.

Meta Trader 5 (MT5): As the successor to MT4, MT5 provides all the features of its predecessor along with additional enhancements. These include more technical indicators, graphical tools, timeframes, and improved EA functionality. MT5 also supports trading in more market instruments compared to MT4, making it a better fit for traders who deal with multiple asset classes beyond just Forex.

Both platforms are known for their stability, comprehensive analytical tools, and automated trading capabilities.

Deposit & Withdrawal

Vantageoption supports common methods like bank transfers and credit/debit card transactions.